AleaSoft, May 21, 2020. In the third week of May, the electricity markets prices recovered from those of the previous week as the wind energy production fell generally. However, for the time being, they are still below €30/MWh. For the weekend, the wind energy production is expected to rise, lowering the prices. The electricity demand fell due to the increase in temperatures, although in Italy and Spain it rose due to the de‑escalation. The TTF gas prices remain at historical lows, below €5/MWh.

Photovoltaic and solar thermal energy production and wind energy production

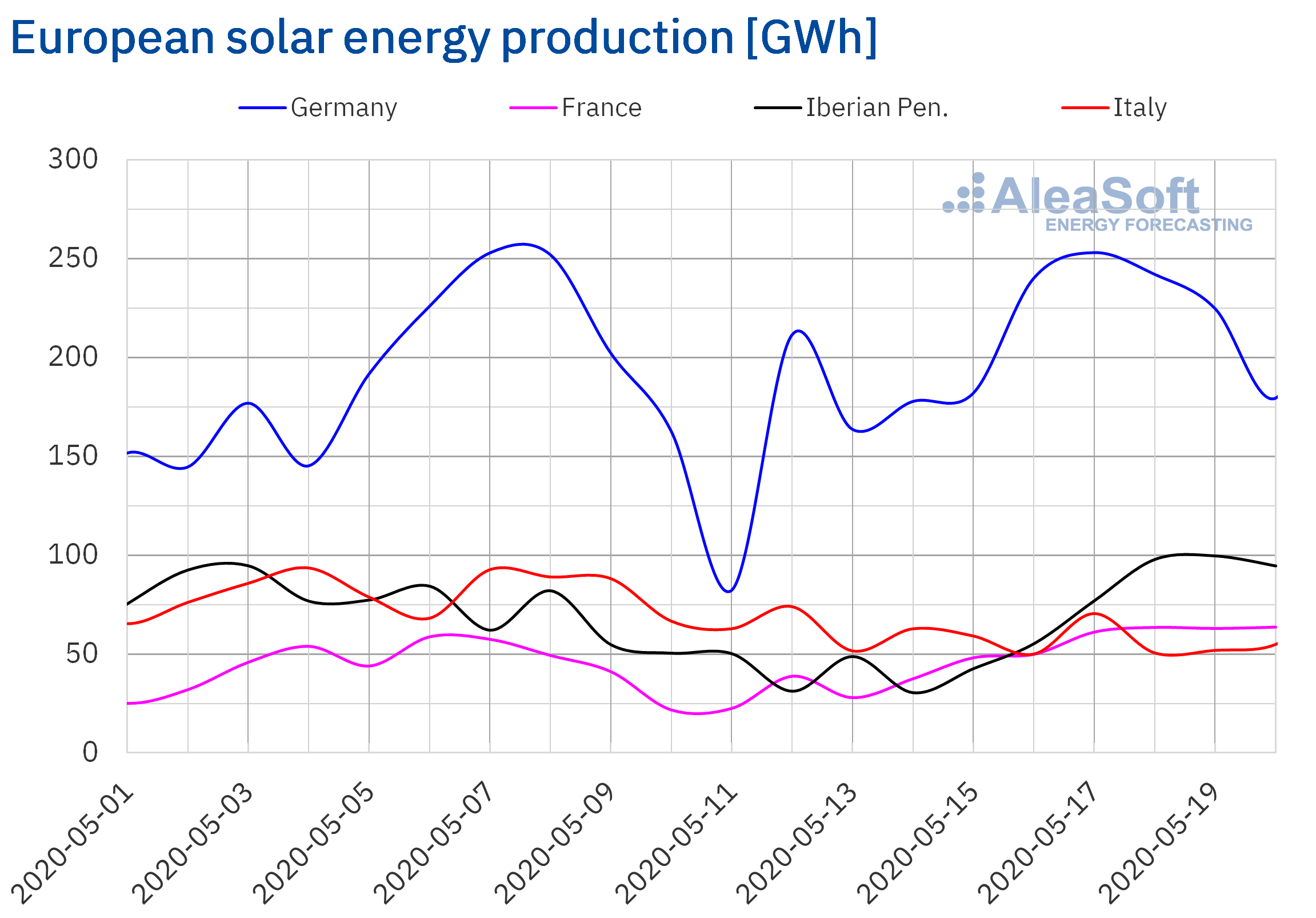

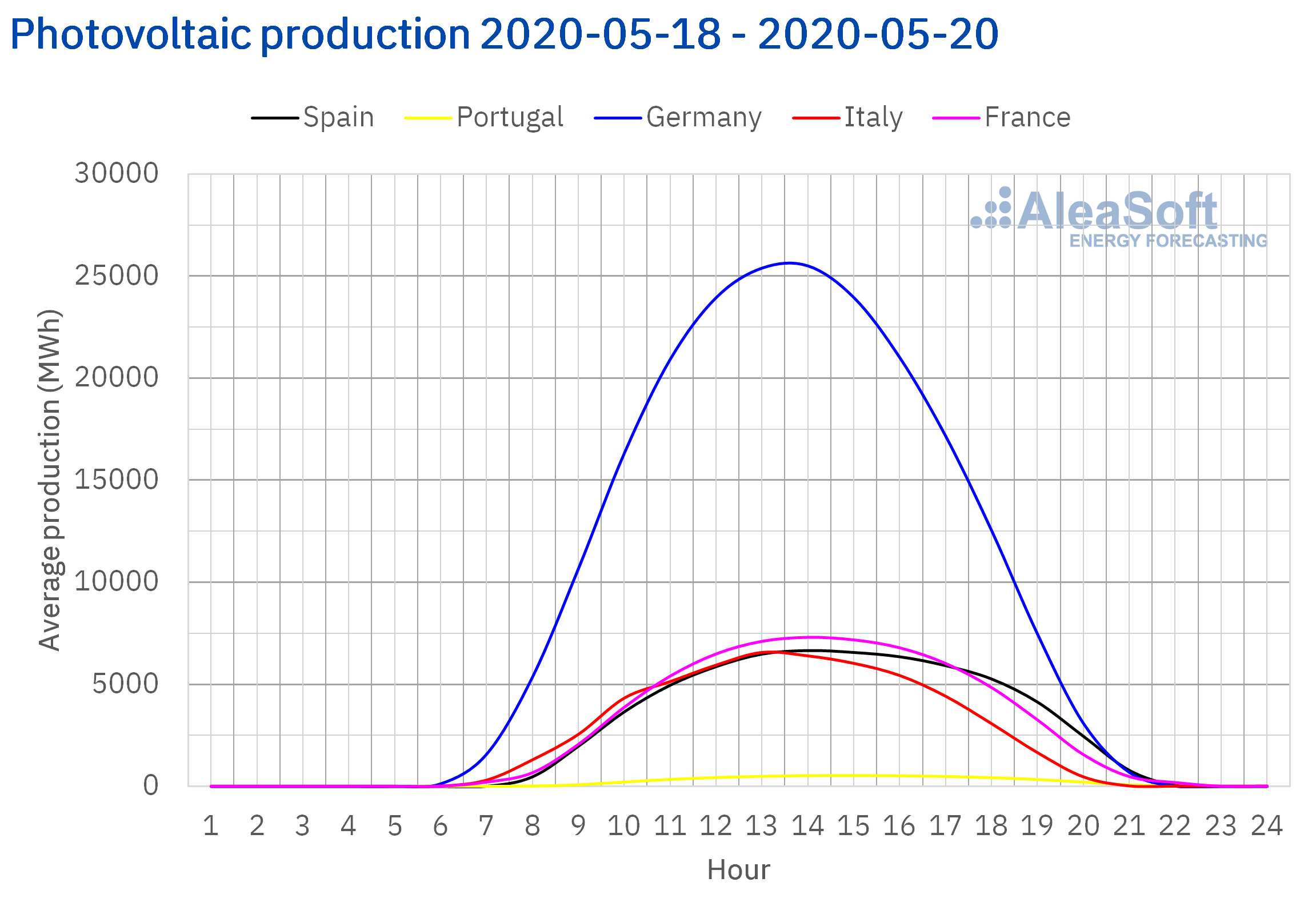

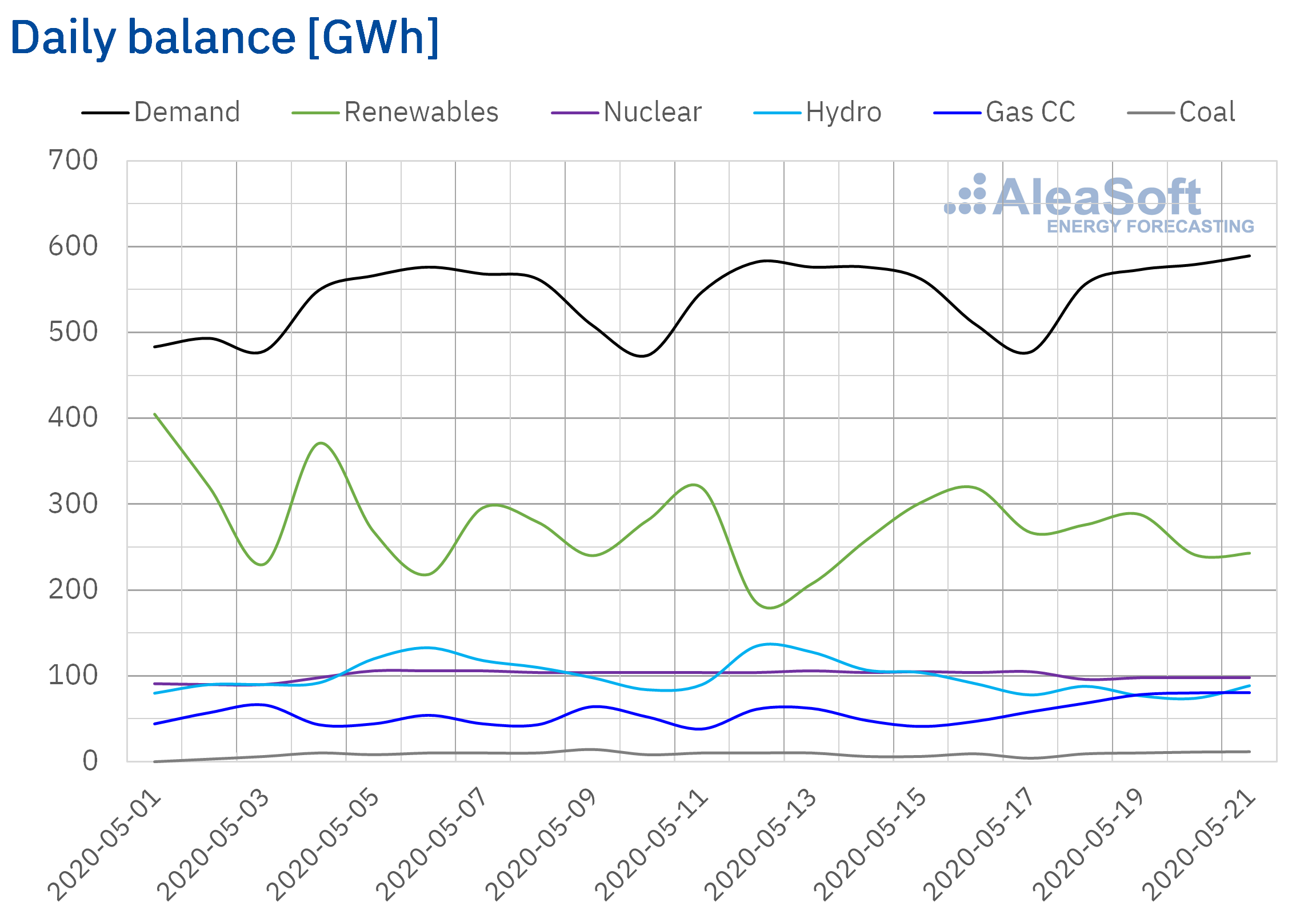

The solar energy production increased in most of the markets analysed at AleaSoft during the period from Monday, May 18, to Wednesday, May 20, compared to the average of the previous week. The greatest increase was registered in the Iberian Peninsula, which doubled the production. In France, it increased by 55% while in the German market the increase was 15%. On the contrary, in the Italian market the production with this technology was reduced by 15%.

During the first 20 days of May, the solar energy production was higher than that registered in the same period of 2019 in the main European markets. The greatest increase was in the Italian market, of 29%. Similarly, in the Iberian Peninsula the increase was 27%, while in the German market it increased by 20% and in the French by 13%.

At the end of the week, the analysis carried out at AleaSoft indicates that the production with this technology will increase in the German, Spanish and Italian markets compared to last week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

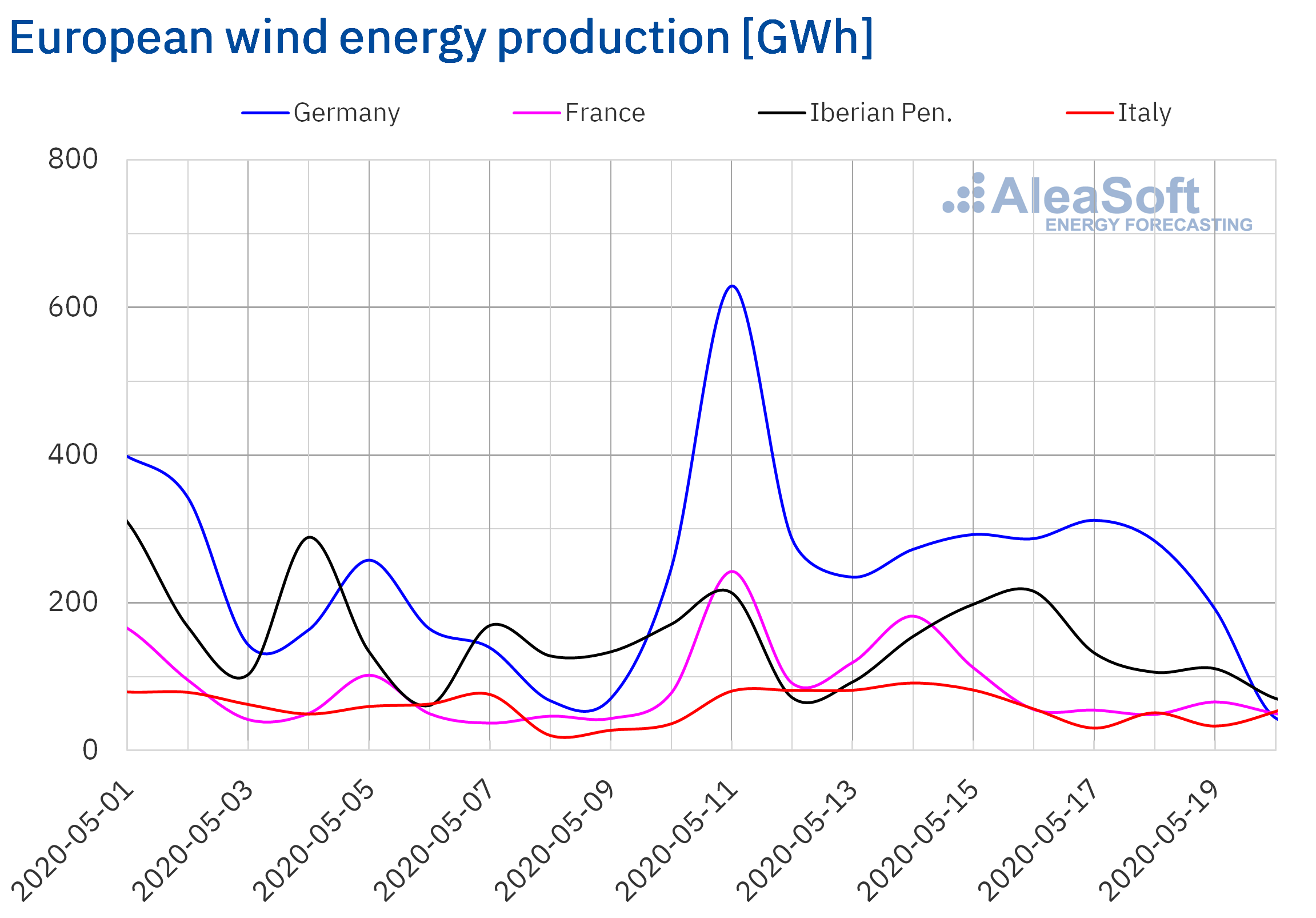

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

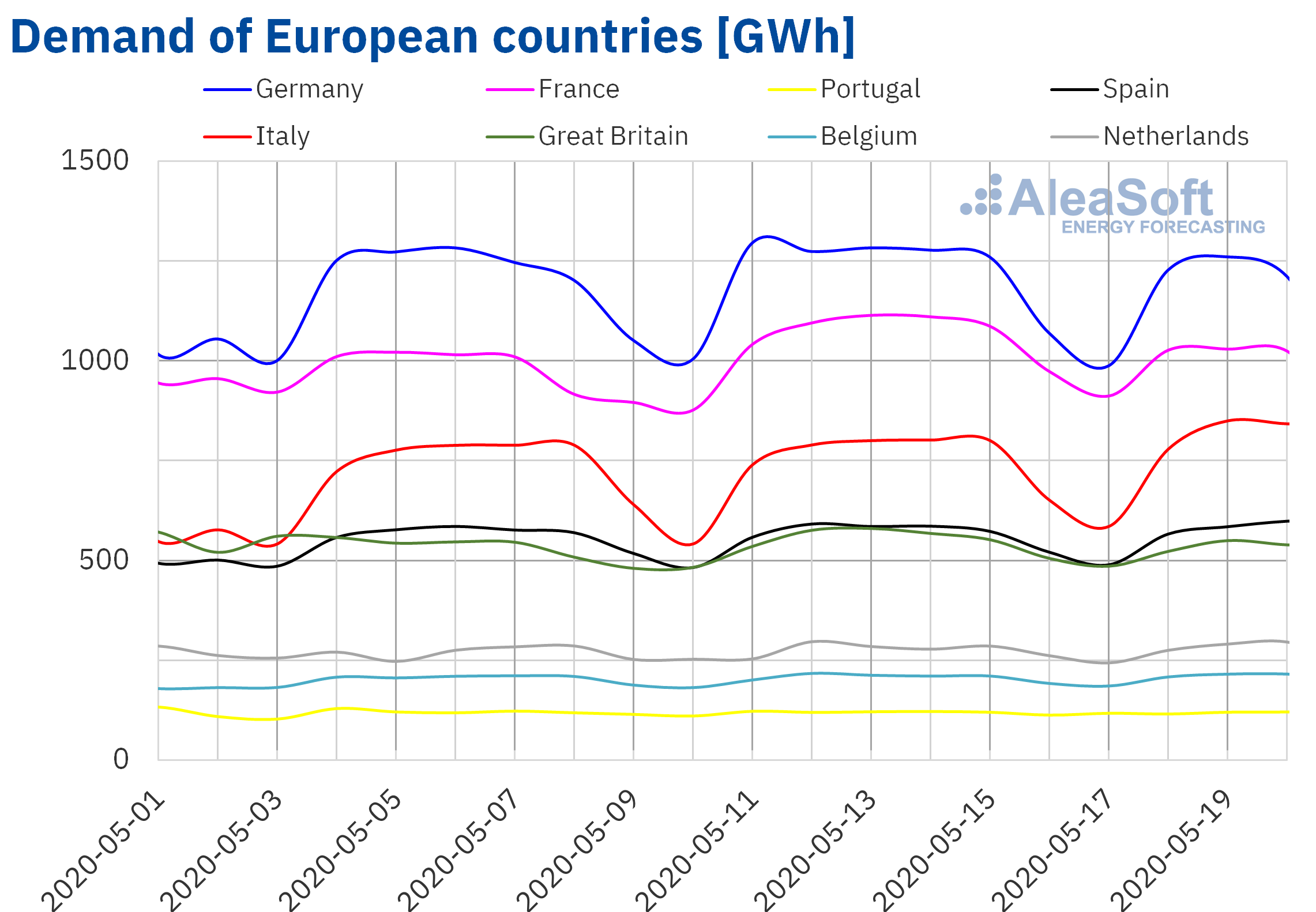

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

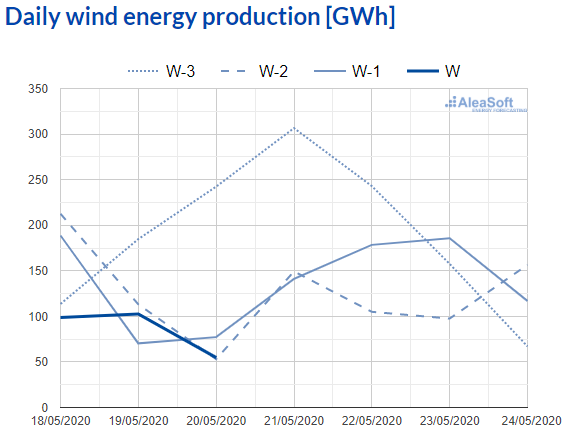

During the past three first days of this week, the average wind energy production was lower than that registered in the same period of the previous week in all the European markets analysed at AleaSoft. In the French market it decreased by 55%, while in the German it was 48% lower. In the Iberian Peninsula and in Italy it decreased by 38% and 37% respectively.

In the period from the first day of May to last Wednesday the 20th, the production with this technology was lower in the Iberian Peninsula and in Germany compared to the same period of 2019. The decrease of 39% in the Portuguese market stands out, while in Germany it fell 12%. In Italy, on the contrary, the production during this month was 13% higher, while in the French market it increased only 3.3%.

Although the production with this technology is expected to recover over the weekend, the AleaSoft‘s analysis indicates that the total wind energy production for the week will decrease in the main European markets compared to the week that ended on Sunday, May 17.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

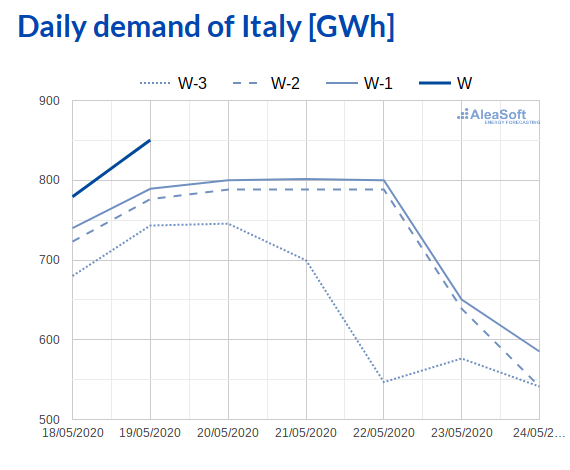

In the week of May 18, the electricity demand decreased from Monday to Wednesday in some markets of Europe compared to the same period of the week of May 11. The average temperatures were less cold compared to the first three days of last week, with increases of up to more than 8.0 °C in some cases, being the factor that most influenced these drops in demand. In Great Britain, the 8.1 °C increase in mean temperature contributed to the 4.7% decrease. The temperature changes were noticeable in France, where the 6.7 °C rise on average caused the most notable drop among the analysed markets, which was 5.3%. On the other hand, in Germany and Portugal the decreases were 4.0% and 1.9% respectively.

However, the measures for the de‑escalation of the confinement due to the COVID‑19 were protagonists of the increases in electricity demand in markets such as those of Spain and Belgium, which registered increases of 0.9% and 1.4% respectively. In the case of Italy, which leads the deconfinement in Europe, the opening of some shops and the increase in mobility this week favoured the recovery of 6.1% of the demand in the first three days.

The AleaSoft’s electricity demand observatories contain daily updated data where it is possible to visualise and analyse the behaviour of the demand in most markets of the European continent.

At AleaSoft, it is expected that at the end of this week the total demand will decrease compared to that of the week of May 11 due to the less cold temperatures, which will be subject to the advance of the de‑escalation in each region.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from Terna

Source: Prepared by AleaSoft using data from Terna

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The Mainland Spain’s electricity demand increased by 0.9% so far this week due to the increase in work activity and travel as part of the jump to the phase 1 in much of the country. For the same reason, at AleaSoft it is expected that at the end of this week of May 18 the demand will be higher than that of last week.

The average solar energy production in Mainland Spain, which includes the photovoltaic and solar thermal technologies, during the first three days of the third week of May increased by 108% compared to the average of the same days of last week. Similarly, during the first 20 days of May, the production increased by 28% compared to the same days of 2019. For this week, the analysis carried out at AleaSoft indicates that the production will increase compared to the total registered last week.

The average level of the wind energy production of the first three days of this week of May 18 decreased by 37%, compared to the last week’s average in Mainland Spain. In the year‑on‑year analysis, the wind energy production during the first 20 days of May was 20% lower. For this week, the analysis carried out at AleaSoft indicates that the production with this technology will end up being lower than that of the previous week.

Source: Prepared by AleaSoft using data from REE

Source: Prepared by AleaSoft using data from REE

The daily nuclear energy production between May 18 and 20 decreased from 105 GWh averaged over the same period of last week to around 97 GWh, due to the disconnection of the electricity grid of the Trillo Nuclear Power Plant to start the corresponding works for its recharge number 32 last May 18. The disconnection was planned for a longer than normal duration due to the actions that were taken to face the pandemic. In this way, the Trillo plant will remain shut down for 35 days and joins the stops of the unit 1 of the Almaraz Nuclear Power Plant and the unit 1 of the Ascó Nuclear Power Plant.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 16 041 GWh stored, according to data from the last Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge, which represents an increase of 176 GWh compared to the previous bulletin.

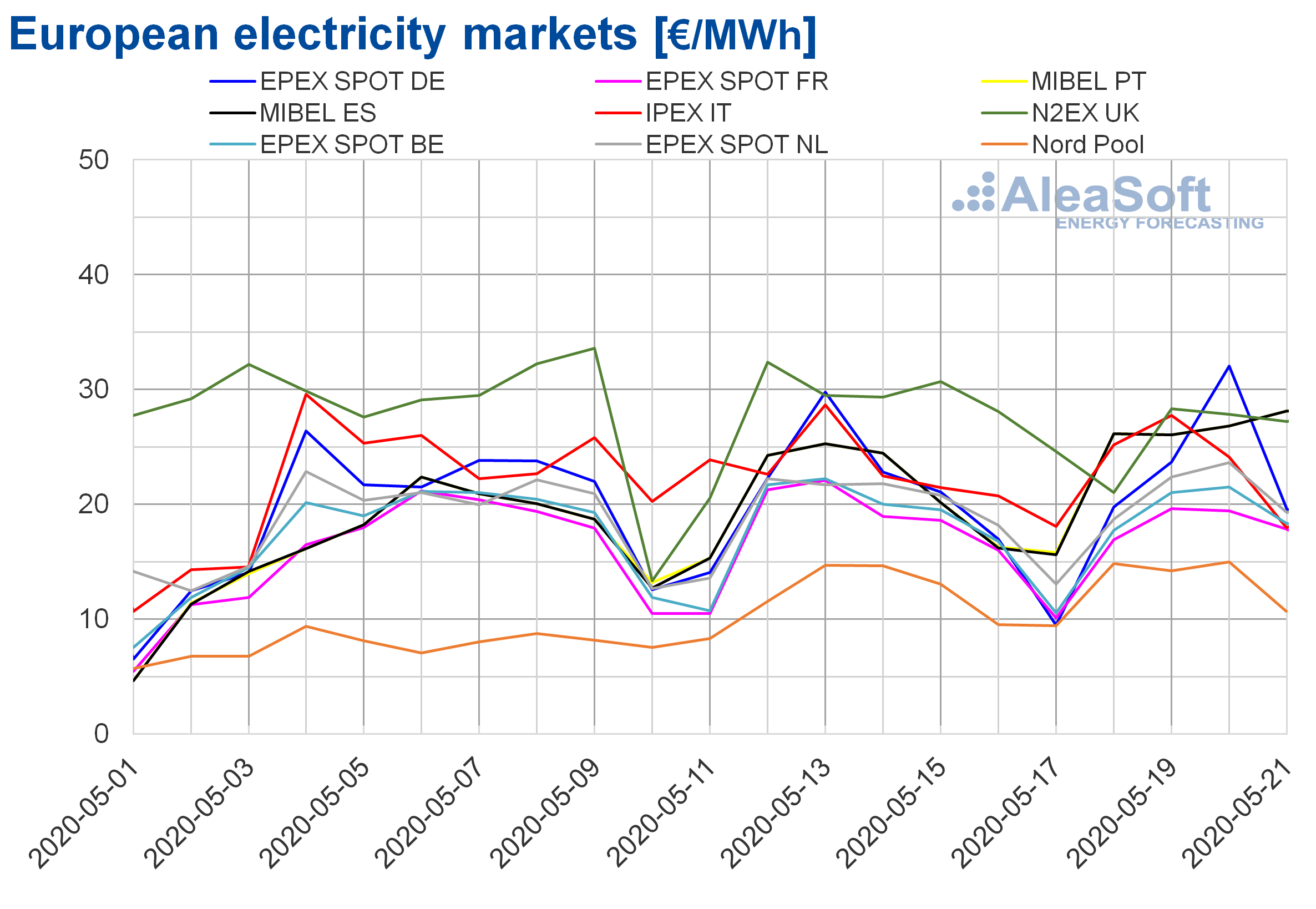

European electricity markets

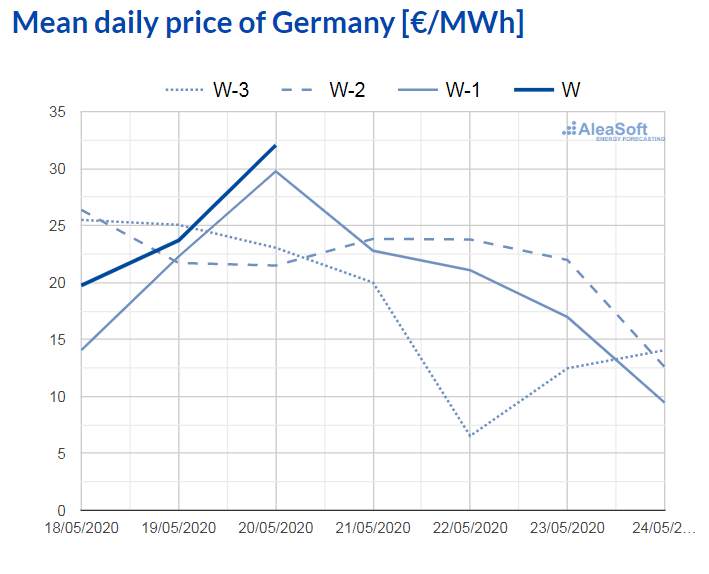

The first four days of the week of May 18, the prices increased in most European electricity markets compared to those of the same days of the previous week. The exceptions were the IPEX market of Italy and the N2EX market of Great Britain, with decreases of 2.7% and 6.6% respectively. On the other hand, the greatest price rise, of 20%, occurred in the MIBEL market of Spain and Portugal. While the smallest increase was that of the EPEX SPOT market of France, of 1.4%. In the rest of the markets, the price increases were between 5.2% of the EPEX SPOT market in Belgium and 11% of the Nord Pool market of the Nordic countries.

The prices continued with averages below €30/MWh during the first four days of this week of May 18. The market with the lowest average price in this period, of €13.67/MWh, was once again the Nord Pool market. While the market with the highest average, of €26.78/MWh, was the MIBEL market of Spain and Portugal, followed by the British market, with a price of €26.09/MWh. The rest of the markets had average prices between €18.45/MWh of France and €23.77/MWh of the German market.

On the other hand, in the first days of this week, the daily average prices were positive in all the analysed markets and also remained below €30/MWh. The only exception was the price of May 20 in the German market, of €32.05/MWh. This is the highest daily average price in the last two months in this market, and coincides with the day with the lowest wind energy production of the year so far, of 44 GWh.

Source: Prepared by AleaSoft using data from EPEX SPOT

Source: Prepared by AleaSoft using data from EPEX SPOT

The general decline in wind energy production in Europe favoured the price increases in the electricity markets in the first days of this week of May 18. But the decrease in demand in Great Britain allowed the decrease in prices in that market.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

For the weekend and the first days of next week, the AleaSoft‘s price forecasting indicates that the prices will decrease in the markets of Germany, Spain, Italy and Portugal as a result of the increases in renewable energy production in these countries.

Iberian market

The average price of the first four days of the week of May 18 increased by 20% in the MIBEL market of Spain and Portugal compared to the same days of the previous week. This was the largest increase in prices in the analysed European electricity markets for the period from May 18 to 21.

As a consequence of this price increase, from May 18 to 21 the average price was €26.78/MWh for both Spain and Portugal, which was the highest in the analysed European electricity markets.

The increase in prices in the MIBEL market is related to the decrease in hydroelectric and wind energy production in Spain and Portugal during the first days of the week.

The AleaSoft‘s price forecasting indicates that over the weekend and during the first days of the next week of May 25, the prices will decrease in the MIBEL market due to the increase in wind energy generation.

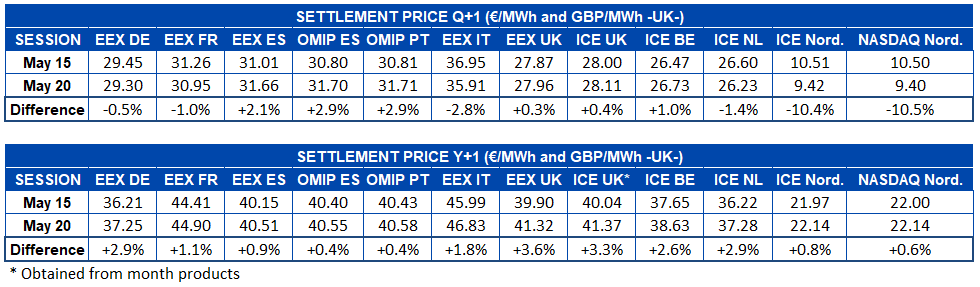

Electricity futures

The electricity futures prices for the product of the third quarter of 2020 behaved unevenly so far this week of May 18 in the European markets. On the one hand, in the EEX market of Germany and France, the ICE market of the Netherlands and the Nordic countries, and the NASDAQ market of the Nordic countries, the price registered drops of around 1%, except in the Nordic region, where it exceeds 10%. While on the other hand, the EEX market of Spain and Great Britain, the OMIP market of Spain and Portugal and the ICE market of Great Britain and Belgium registered increases of between 0.3% and 2.9%. This last increase was registered by the Iberian Peninsula in the OMIP market.

Regarding the electricity futures prices for 2021, so far this week there was a general rise. The increases range from 0.4% of the OMIP market of Spain and Portugal, to 3.6% of the EEX market of Great Britain.

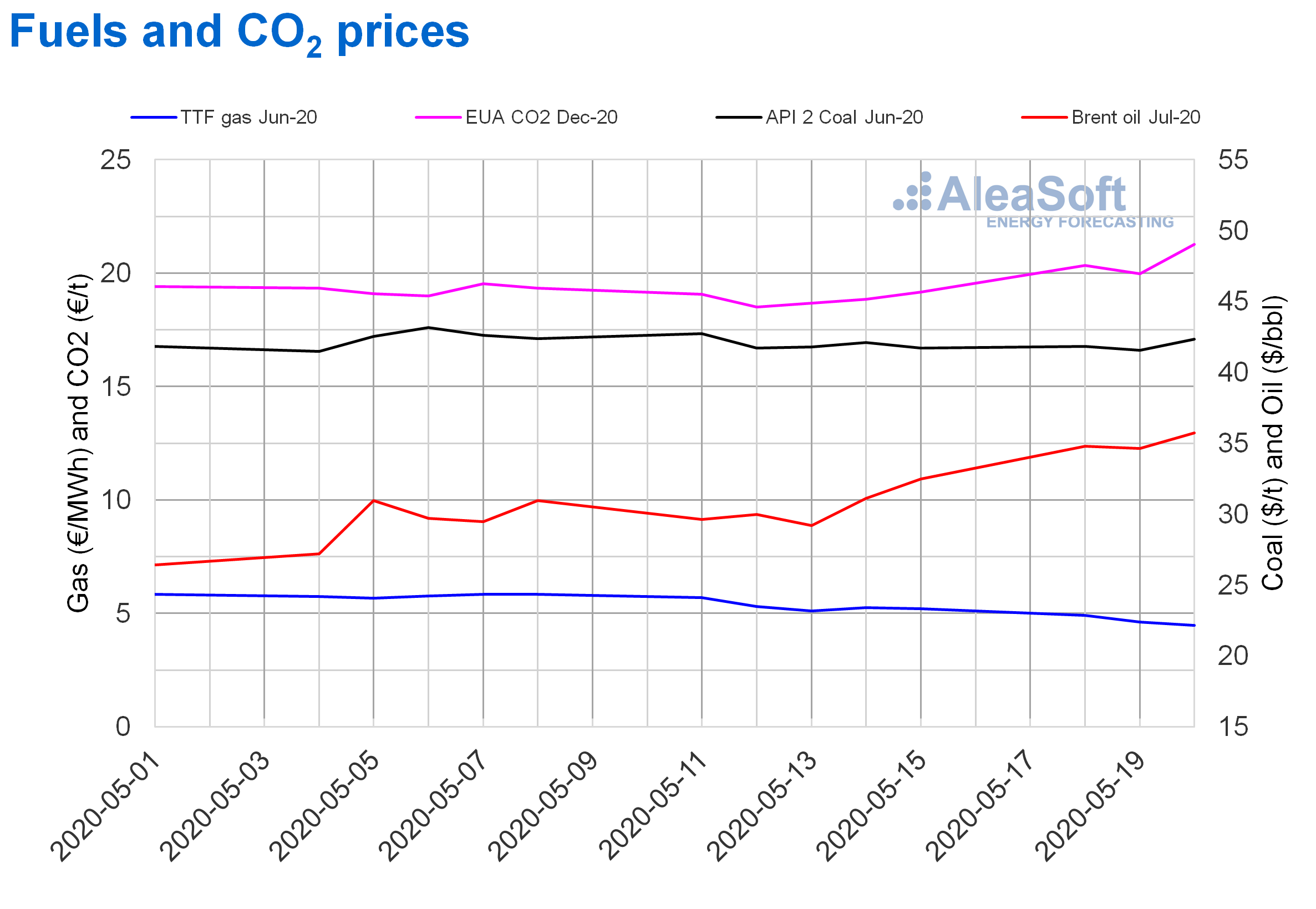

Brent, fuels and CO2

The settlement prices of the Brent oil futures for the month of July 2020 in the ICE market during the first days of this week of Monday, May 18, were at least 16% higher than those of the same days of the previous week. The maximum settlement price so far this week, of $35.75/bbl, was that of yesterday, May 20. This price was 22% higher than that of the previous Wednesday and the highest since the $36.77/bbl registered on March 13.

The cuts in production by the OPEC+ member countries and the progressive increase in demand as the restrictions imposed to curb the expansion of COVID‑19 lessen in many countries favoured this price increase. This trend could continue in the coming days, as long as there are no new outbreaks of the pandemic that slow down the recovery in demand.

The TTF gas futures prices in the ICE market for the month of June 2020 the first days of this week, from May 18 to 20, continued to decline. The registered settlement prices were lower than €5/MWh and around 13% lower than those of the same days of the previous week. On Wednesday, May 20, a settlement price of €4.46/MWh was reached, which was the lowest in the last two years.

Regarding the TTF gas prices in the spot market, on Monday, May 18, they reached an index price of €4.87/MWh, which was €0.07/MWh higher than that of the previous weekend. But, the following days the prices registered a downward trend. As a result of these declines, the index price for today, Thursday, May 21, is €4.17/MWh, the minimum value since at least October 2008. This price is 18% lower than that of the previous Thursday and a 68% lower than that of the same day of last year.

On the other hand, the API 2 coal futures prices in the ICE market for the month of June 2020, the first two days of the week of May 18, remained fairly stable around $41.70/t, with daily variations of less than 1%. On the other hand, on Wednesday, May 20, the increase compared to Tuesday was 1.9% and a settlement price of $42.35/t was reached, 1.3% higher than that of the same day of the previous week.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, the first days of the week of May 18 they were higher than those of the same days of the previous week. On Wednesday, May 20, the maximum settlement price so far this week, of €21.26/t, was reached. This price was 14% higher than that of the previous Wednesday and the highest since April 20. This rise was influenced by the absence of auctions scheduled for the next sessions and the evolution of the oil prices in recent days.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

The observatory of the energy markets available on the AleaSoft website continues to grow. The last enabled observatory is that of the SEM electricity market of Ireland. These observatories allow analysing the evolution of the main market variables with data that is updated daily. They include a comparative analysis of the hourly, daily and weekly data of the last three weeks.

The Webinar “Influence of coronavirus on electricity demand and the European electricity markets (II)” was held this Thursday, May 21, with great success of participation. In it, the behaviour of the energy markets during the COVID‑19 crisis was analysed. There was also talk about renewable energy projects financing during the health crisis stage, and the future prospects, especially in the economic crisis stage that will cause the pandemic. On June 25, a third part of the Webinar “Influence of coronavirus on electricity demand and the European electricity markets (III)” will be held, where the analysis of these topics will be updated.

Source: AleaSoft Energy Forecasting.