AleaSoft, March 23, 2020. The European electricity demand fell across the European markets, especially in those that are in a regime of confinement due to the coronavirus: France, Italy and Spain. This caused the drop in prices in the markets. The declines were also seen in other markets such as electricity, CO2, Brent oil and TTF gas futures. In the case of gas, the decreases continued today when prices below €8/MWh were reached.

Photovoltaic and solar thermal energy production and wind energy production

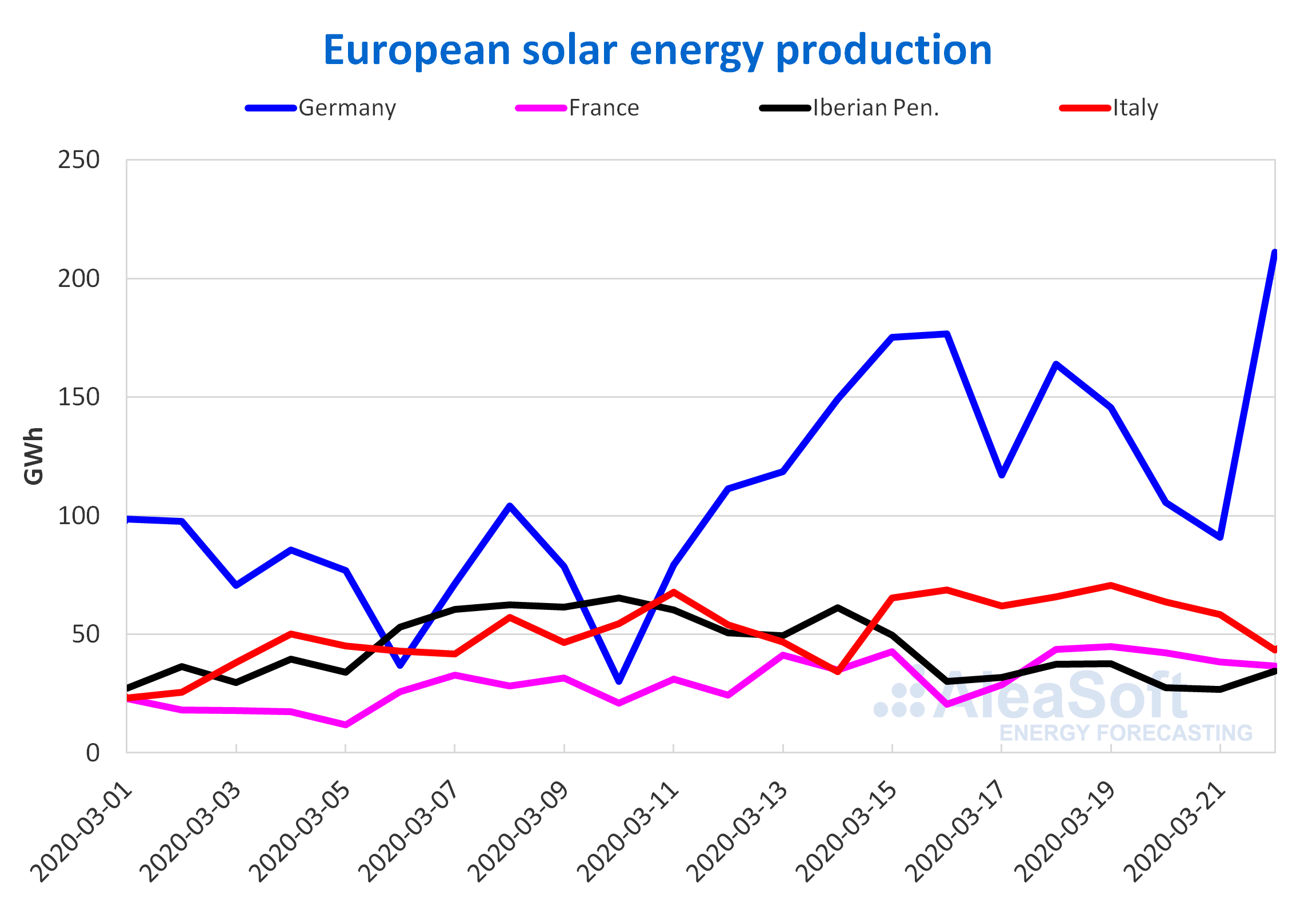

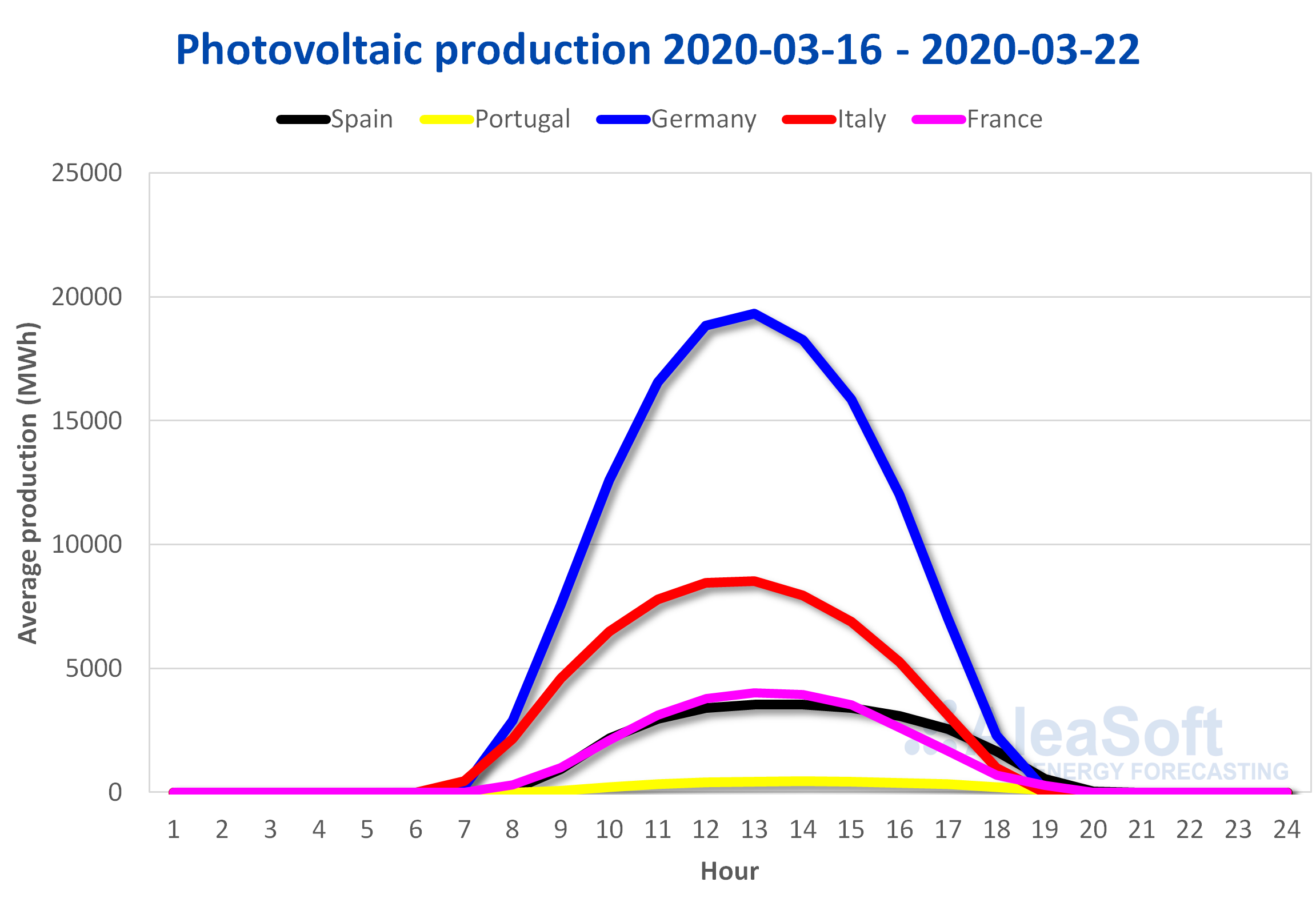

The solar energy production in Germany increased by 36% the week of Monday March 16 compared to the previous week, as expected at AleaSoft. In Italy there was also an increase in production with this technology of 17%. On the other hand, in Spain and Portugal the production fell by 44% and 27% respectively. For the current week, at AleaSoft, the solar energy production in Spain is expected to increase. On the contrary, the generation with this technology is expected to decrease in the Italian market.

During the elapsed 22 days of March, there was a 26% increase in solar energy production of the German market compared to the same days of last year. In the rest of the markets analysed by AleaSoft the variations during this month were between 1.7% of the Italian market and 8.7% of the Portuguese market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

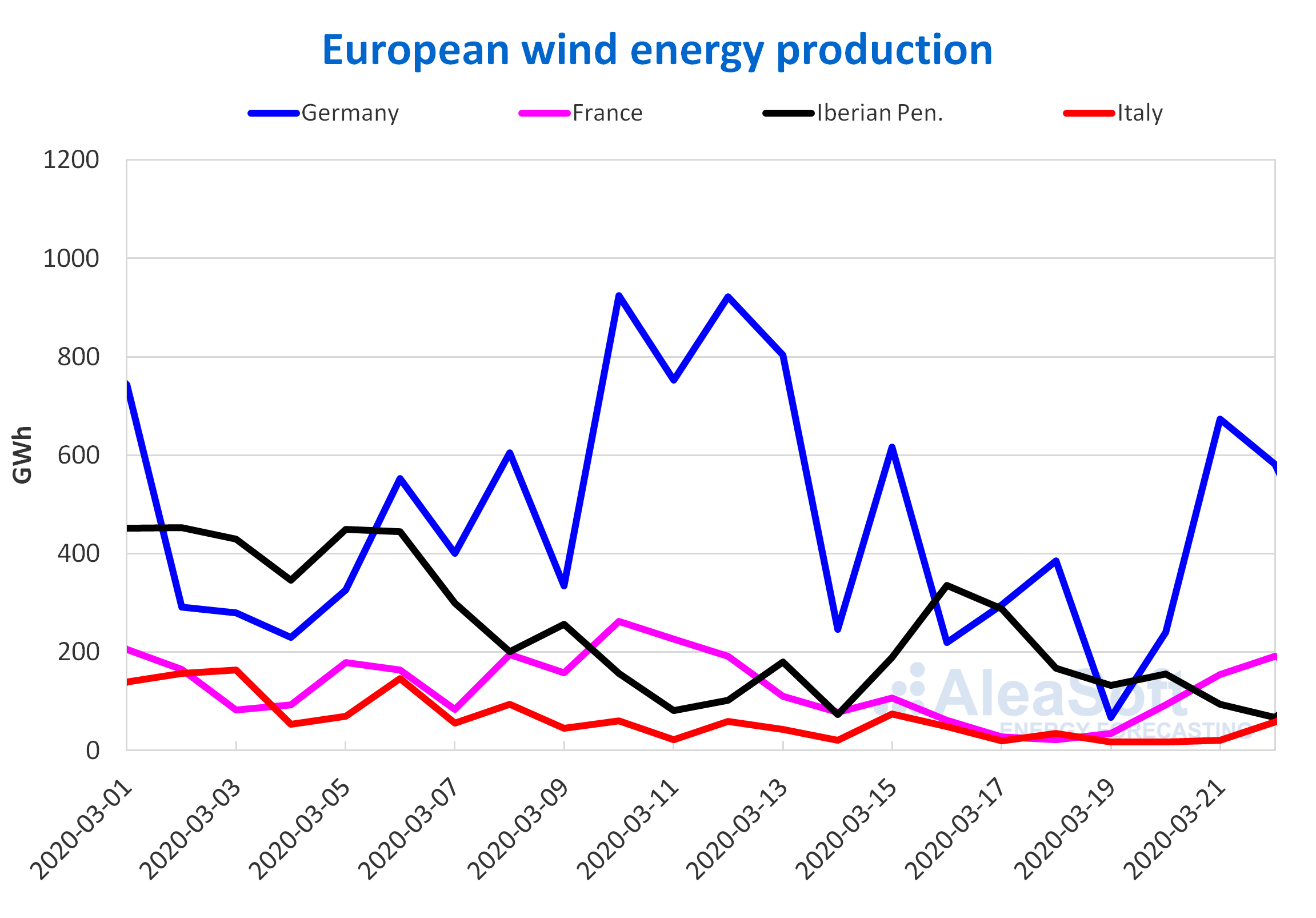

As forecast last week at AleaSoft, the wind energy production in Portugal and Spain increased by 72% and 10% respectively compared to the previous week. While in Germany and Italy it decreased by 46% and 34% respectively. For this week an increase in wind energy production of Italy is expected at AleaSoft. On the contrary, it is expected to decrease in the Iberian Peninsula.

Between March 1 and 22, the wind energy production fell by 23% and 22% in the German market and the Italian market compared to the same period of last year. On the contrary, in the Iberian Peninsula there was an increase in production with this technology of 31%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

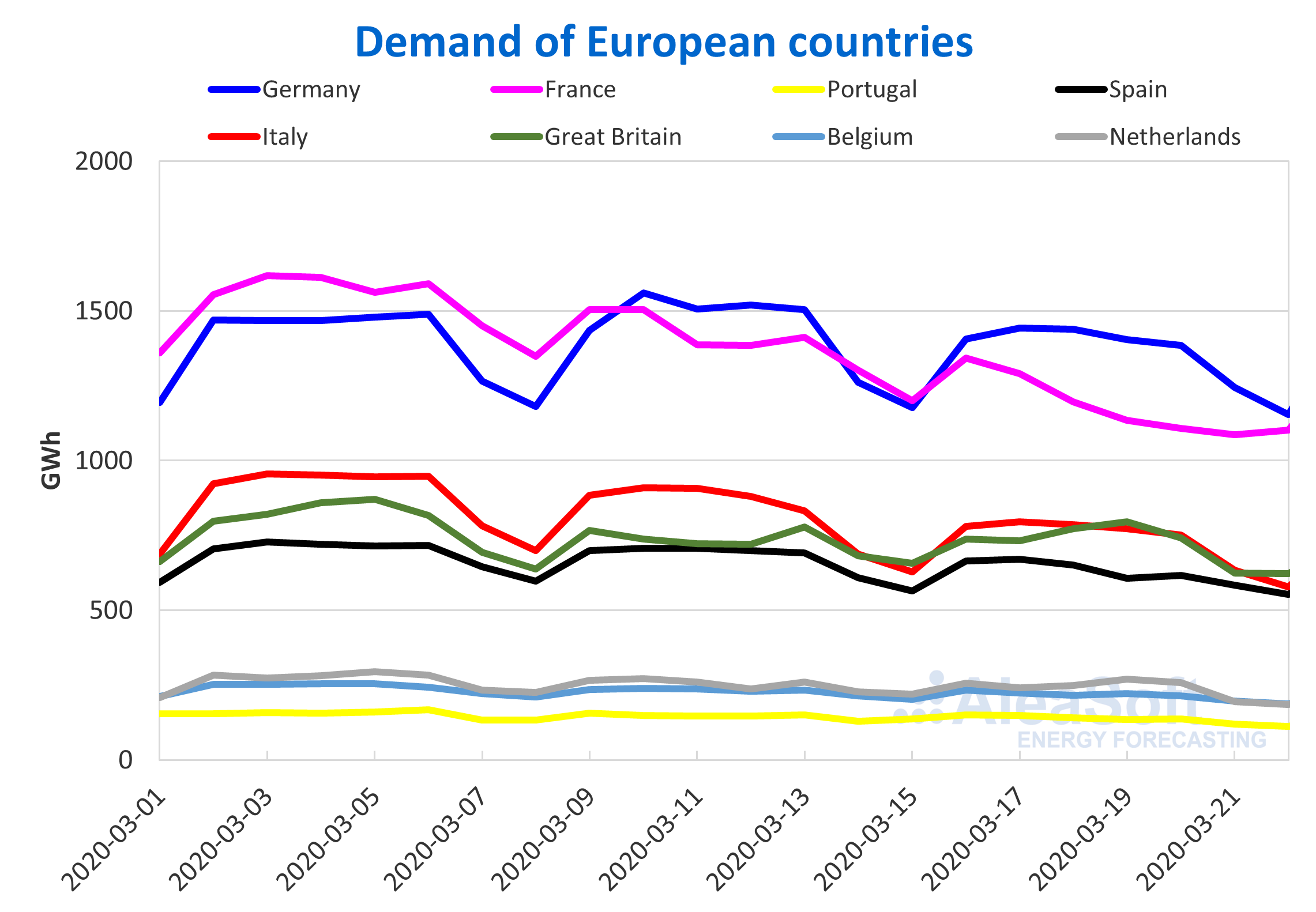

Electricity demand

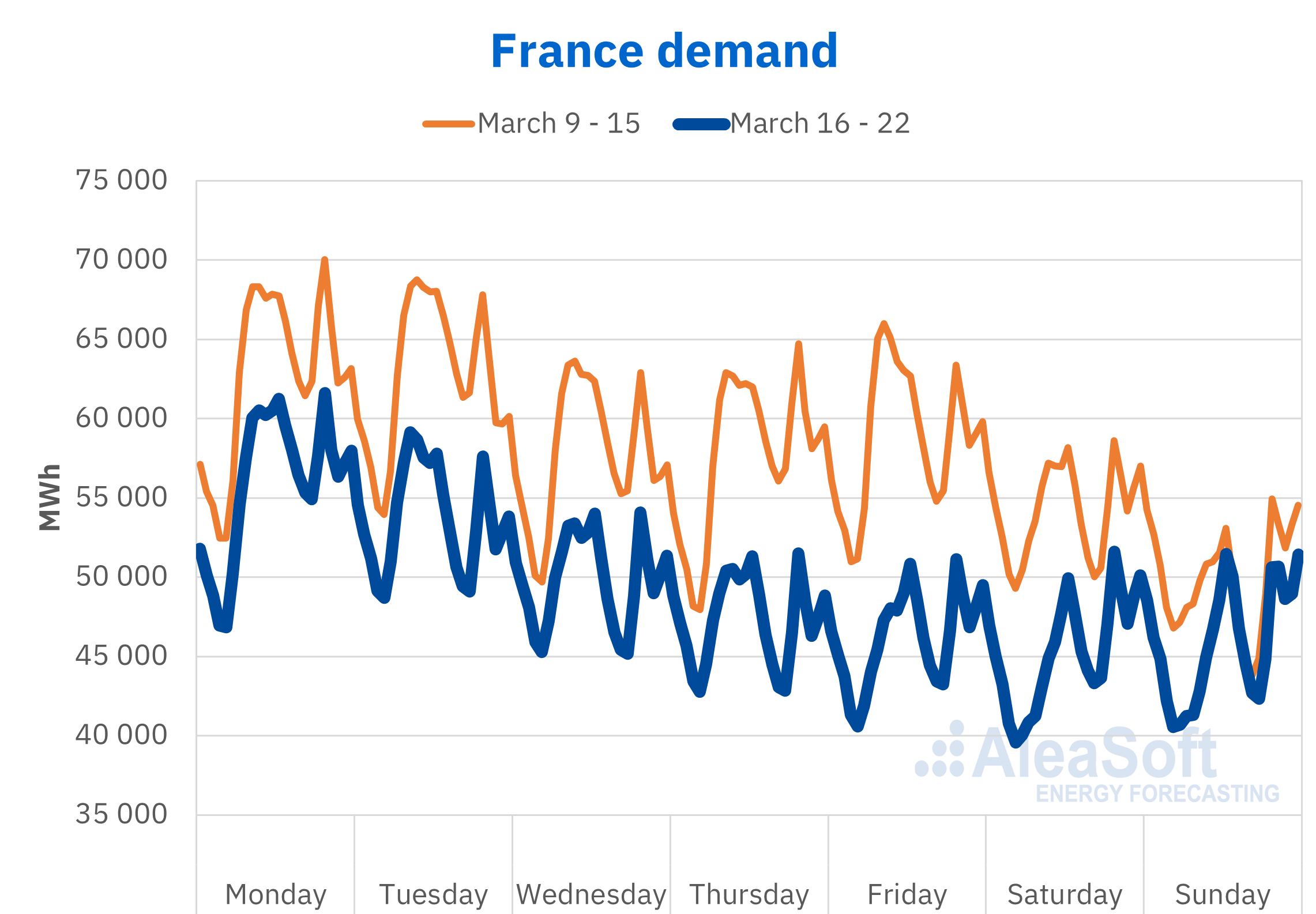

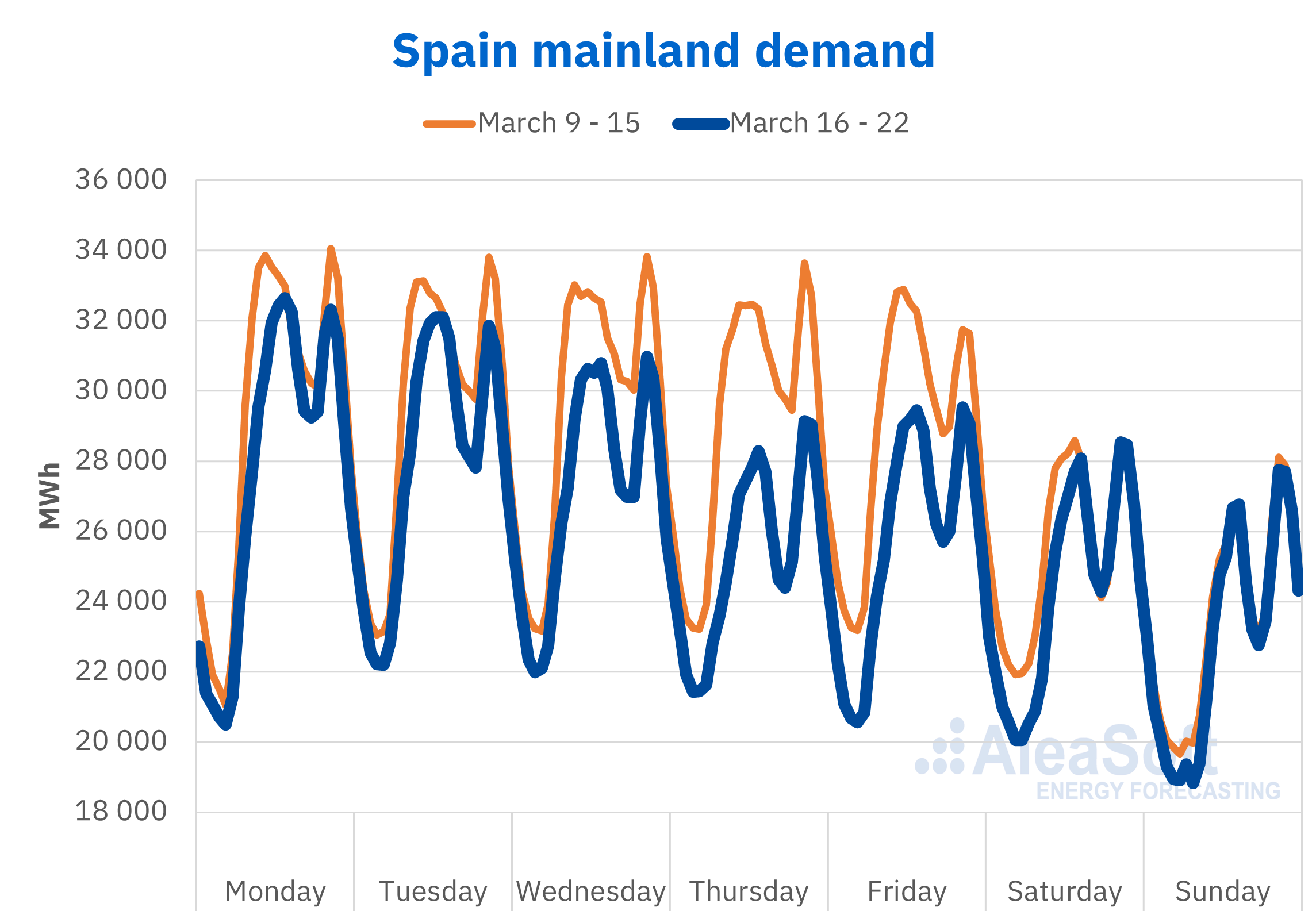

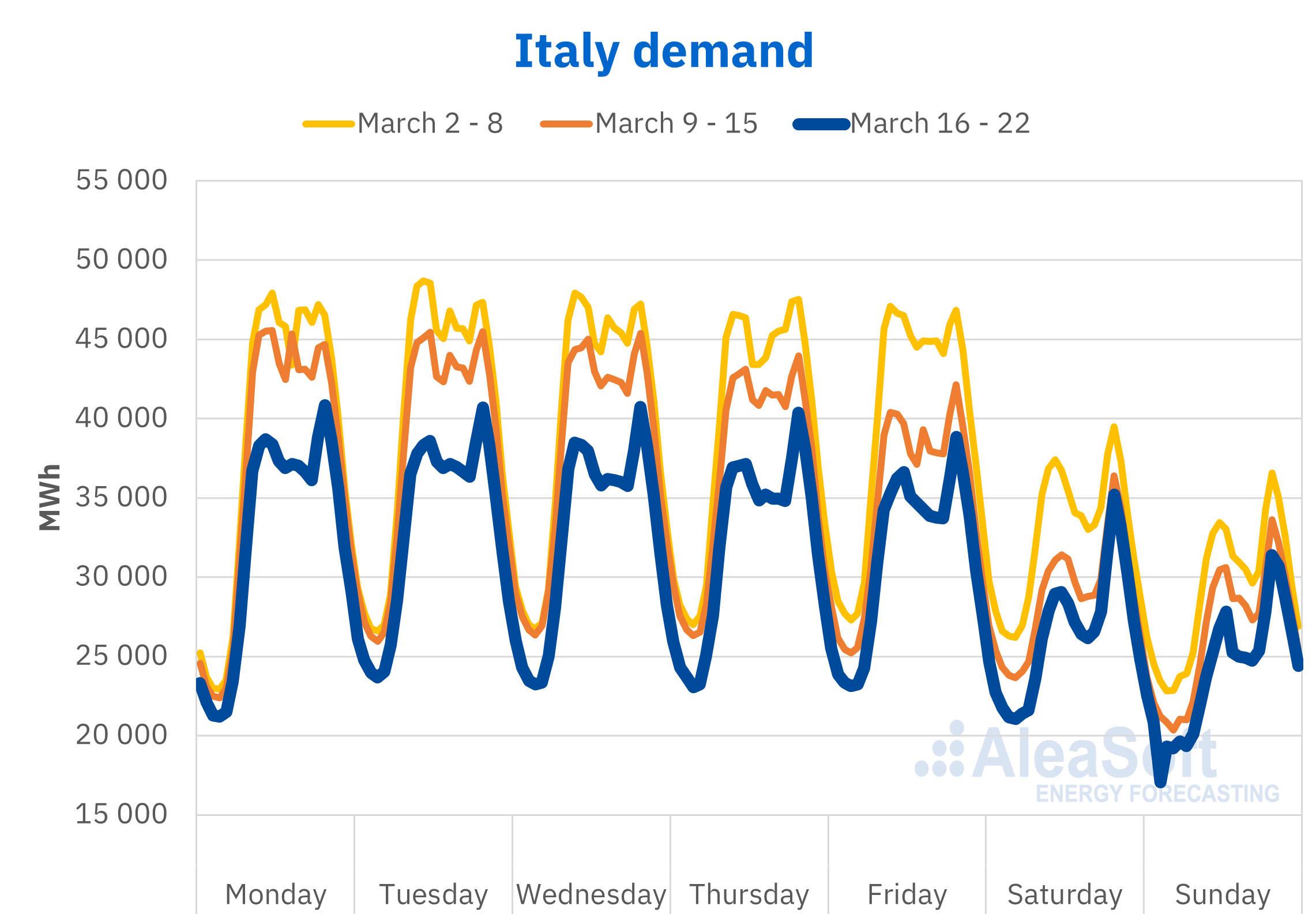

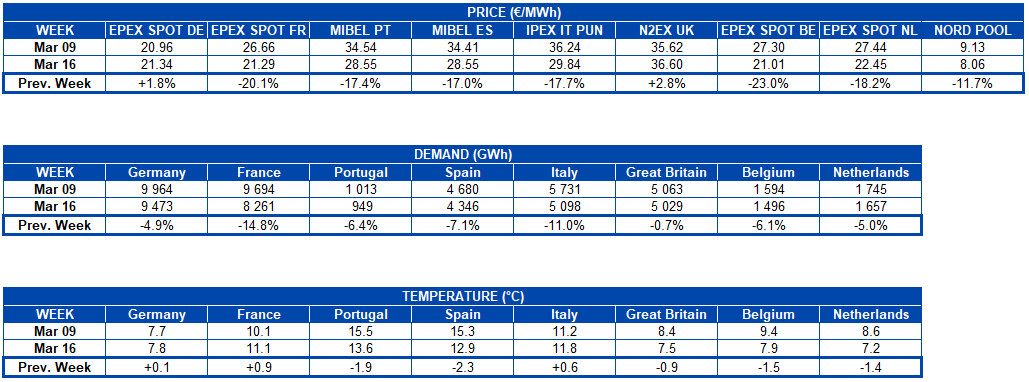

Last week there were widespread falls in electricity demand in all European countries. In some cases, this drop could be attributed in part to a slight increase in temperatures that were less cold, such as in Germany, France or Italy, but in the rest of the countries the temperatures fell between 0.9 °C and 2.3 °C. The most pronounced drops in demand were registered in France, 15%, Italy, 11%, and Spain, 7.1%, which are countries that are in a confinement regime as a result of the coronavirus pandemic.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

The entry into force of the confinement orders generated a similar pattern in the evolution of the electricity demand in these three countries, with a gradual decrease in demand with respect to the levels of previous weeks. But, in the case of France, the decline was much faster and more abrupt than in the case of Spain and Italy. The French government established containment measures that prohibit unnecessary movements from Tuesday 17 at noon. That same Tuesday the electricity demand began to fall and on Wednesday it was already below the demand of the previous Sunday. The hourly demand profile also evolved rapidly, and on Friday a Sunday or holiday profile could already be clearly seen.

Source: Prepared by AleaSoft using data from RTE.

Source: Prepared by AleaSoft using data from RTE.

In Spain, the drop in demand was much more gradual since the declaration of the state of alarm on Saturday, March 14. The drop in demand compared to the previous week started around 5% on Monday and Tuesday, and on Wednesday it escalated to 8%. Thursday was a holiday in some communities, so the reduction in demand reached 13%, while on Friday it fell by 11%. For the weekend, the falls were less since the alarm state was already in force the previous weekend.

The hourly profile of the demand also registered modifications in Spain. Over the past week, the morning demand peak was delayed by around three hours, while the evening peak schedule was maintained, indicating a clear shift from the industrial and commercial profile to a more domestic profile.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

Italy already completed its second week of confinement. The week of transition and gradual decrease in electricity demand was the week of March 9 to 15, while, in this last week of March 16 to 22, the demand remained more stable, also with a clearly more domestic hourly profile with a higher peak at night.

The intention of the Italian government is to tighten the conditions of confinement of the population and the cessation of all activity that is not essential, so that a further decrease in demand could be seen this week.

Source: Prepared by AleaSoft using data from TERNA.

Source: Prepared by AleaSoft using data from TERNA.

For this week, at AleaSoft, a steep drop in temperatures of between 1 °C and 5 °C in all European countries is forecasted, which may partially offset the drop in demand due to the stoppage of the economic activity. But without a doubt, this break in industrial and commercial activity will be what will mark the evolution of electricity demand in the coming weeks and months.

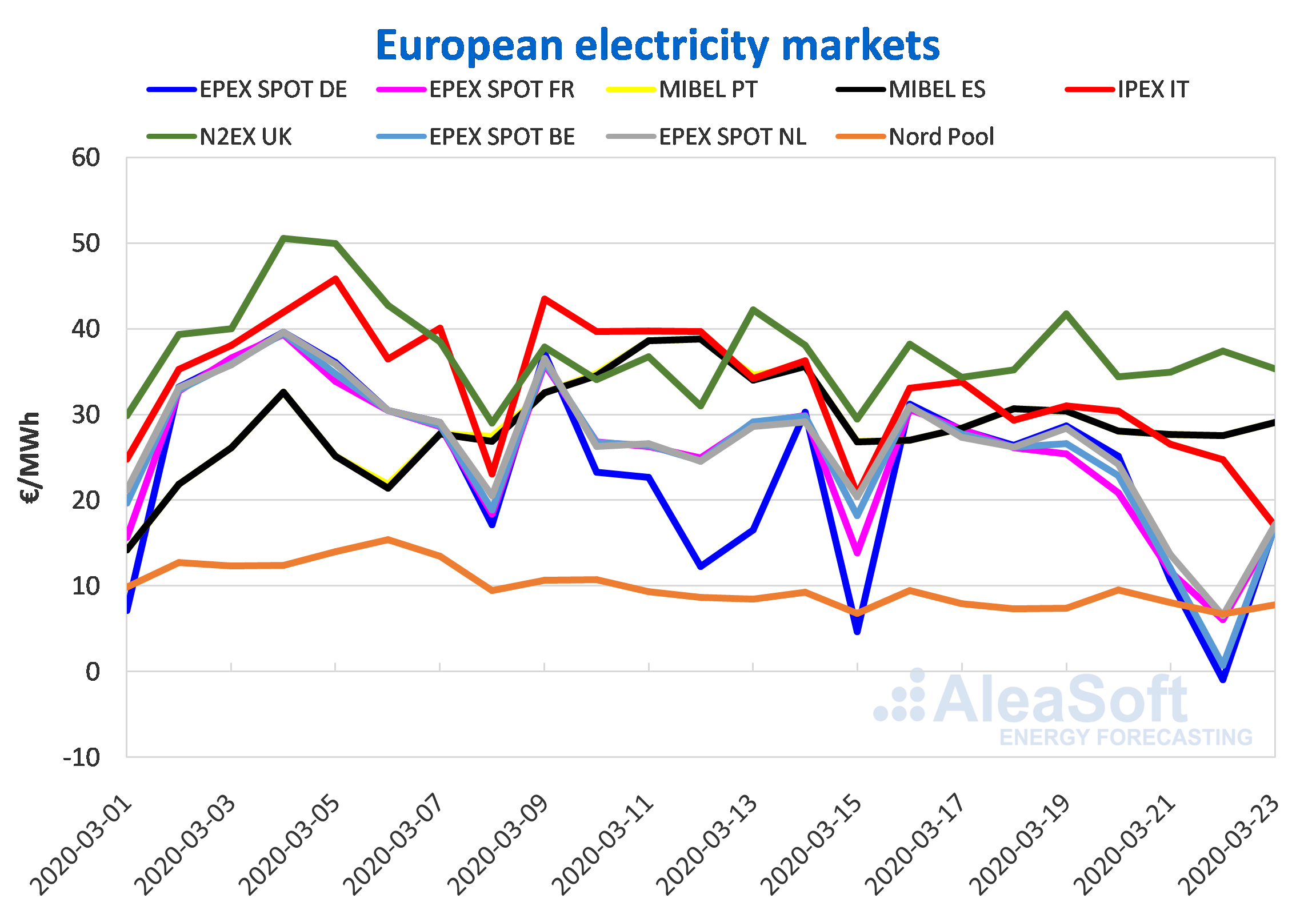

European electricity markets

In most of the European markets analysed by AleaSoft, the prices decreased last week compared to the week of March 9. The exceptions were the EPEX SPOT market of Germany and the N2EX market of Great Britain, although in both cases the increase was less than 3%. In the German market the increase was 1.8%. This despite presenting negative hours from 10 am to 4 pm (CET) this Sunday, March 22, averaging a negative price of €0.95/MWh for the day. In addition, at the hour 14 the lowest hourly price was reached, of €55.05/MWh, since that obtained at the hour 16 of Sunday, March 15. The British market, with an increase of 2.8%, was the market with the highest prices throughout the past week, remaining above €34/MWh and averaging a price of €36.60/MWh for the finished week.

On the other hand, in the EPEX SPOT markets of Belgium, France and the Netherlands the decreases were 23%, 20% and 18% respectively. Negative prices were also obtained in these markets for some of the hours of last Sunday, reaching averages of €0.70/MWh in the case of Belgium and around €6/MWh in the case of France and the Netherlands. The Nord Pool market of the Nordic countries, with a decrease of 12%, was the lowest priced market for most of last week, with the exception of Sunday, March 22, when it averaged a price of €6.73/MWh, the lowest in that market so far this year, but higher than the prices of the EPEX SPOT markets for that day.

Meanwhile, in the Italian IPEX market last week prices fell 18% compared to the previous week. Due to the low electricity demand derived from the containment measures taken in the country to combat the spread of SARS Cov 2, the prices in this market started the week with prices close to €34/MWh and were falling during the rest of the week until €24.77/MWh on Sunday.

The influence of the measures applied to combat the COVID 19 pandemic during the past week led to a decrease in the electricity demand in general in the markets of Europe, which in turn favoured the drop in prices in most of the electricity markets of the continent.

In the MIBEL market of Spain and Portugal, the drop in prices during the past week was 17% for both poles. With a 100% convergence in the hourly prices of both markets, the weekly average price was €28.55/MWh. Still, they were in the third position of the ranking of markets with the highest prices of the week on the continent. The low electricity demand during the past week due to the measures adopted by the Spanish government to fight against the expansion of the coronavirus, together with higher wind energy production, allowed the prices to fall, remaining below €30/MWh during most of the week.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

For this Monday, March 23, the prices decreased in most markets compared to Monday, March 16. The MIBEL market was the exception where, with a daily price of €29.04/MWh for both Spain and Portugal, it increased by 7.5% and positioned itself as the second market with the highest prices on the continent, below the British market with a daily price of €35.34/MWh. The EPEX SPOT markets were quite coupled for this day with prices close to €17/MWh. The Italian market, with a daily average price of €16.97/MWh and a variation of 49% compared to Monday, March 16, approached the EPEX SPOT group of markets. While the Nord Pool market with an average price of €7.82/MWh continues to be the market with the lowest prices for this Monday.

In general, at AleaSoft it is expected that the prices of the markets of the European continent will be less coupled during this week. In most markets the prices will remain stable for most of the week, falling at the end of the week due to lower demand. On the other hand, in the Italian IPEX market, the prices are expected to continue falling.

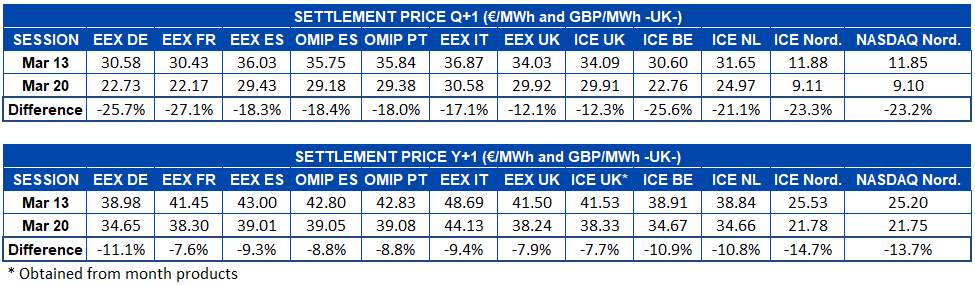

Electricity futures

The electricity futures prices for the second quarter of 2020 during the past week registered a sharp and general drop in all the European markets analysed at AleaSoft. The main factor driving prices in this way is the anticipation of low electricity demand due to the containment policies that European countries are implementing to curb the expansion of the coronavirus. The steepest decline was registered by the French EEX market, which between the settlement of Friday, March 13, and that of Friday, March 20, had a negative difference of more than €8/MWh, representing a variation of 27%. In percentage terms, all the decreases between the settlements of both weeks were above 12%.

In the case of the future for the calendar year 2021, there was also a general price drop during the past week. The scenario is practically the same. In this case, the greatest decrease in percentage terms was presented by the ICE market and the NASDAQ market of the Nordic countries, with decreases of 15% and 14% respectively. However, in absolute terms, it is the Italian EEX market that registered the greatest drop in prices between the settlements of the two weeks, with a reduction of €4.56/MWh.

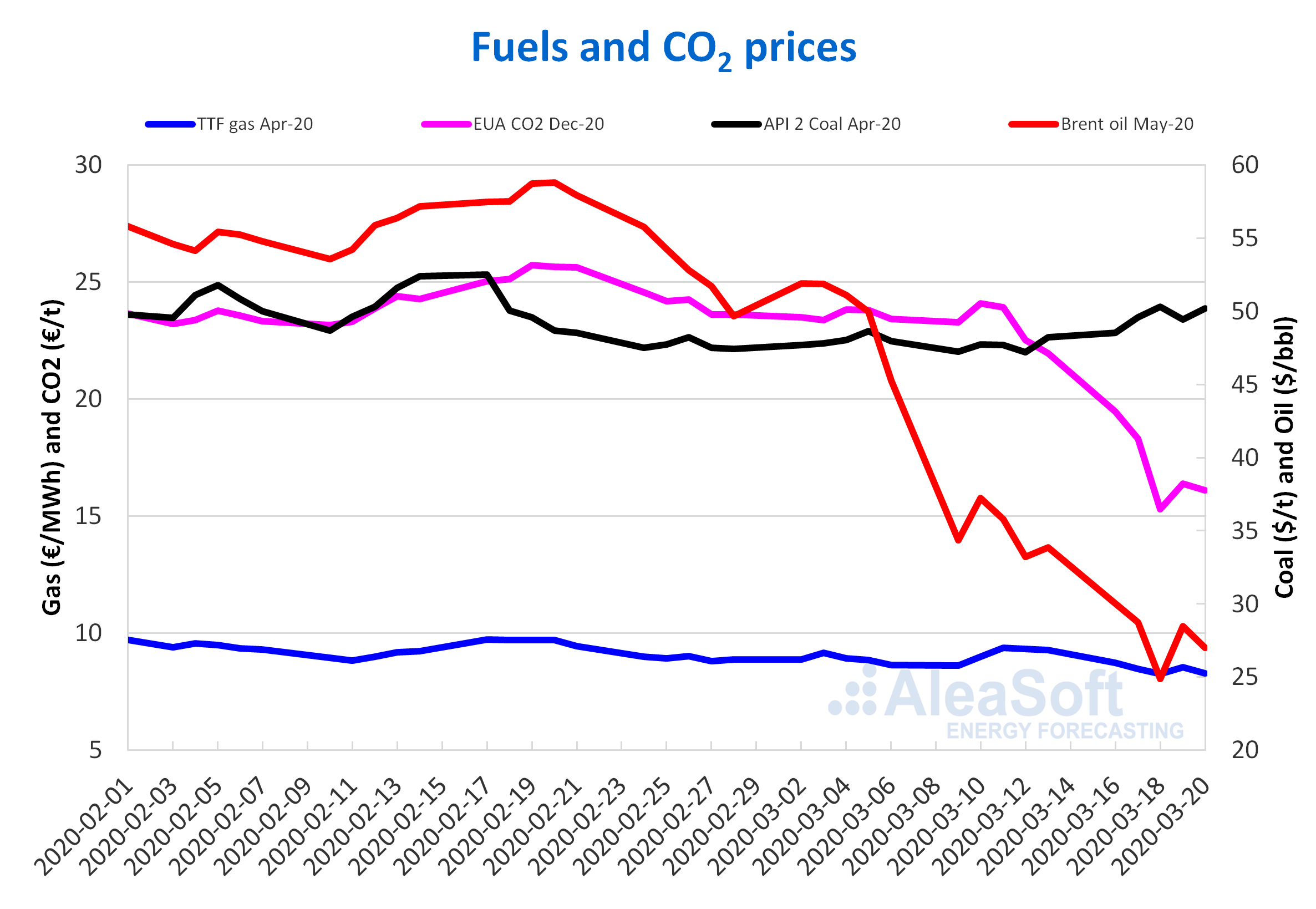

Brent, fuels and CO2

The Brent oil futures prices for the month of May 2020 in the ICE market began last week with declines until reaching a settlement price of $24.88/bbl on Wednesday, March 18, the lowest since those registered in April 2003. But on Thursday, March 19, there was a recovery of 14% compared to the previous day to $28.47/bbl. On Friday, March 20, the prices fell again, registering a settlement price of $26.98/bbl, 20% lower than that of Friday of the previous week.

The decline in demand due to the restrictions imposed in many countries to try to contain the expansion of the coronavirus and the fact that the current storage capacity is very low, forcing the producers to sell the extracted oil immediately, are affecting the Brent oil futures prices.

At a time when containment measures against the coronavirus pandemic tend to last over time and to be more restrictive in most countries, it is expected that oil prices will continue to decline.

However, last week talks between OPEC and US producers began with the aim of stopping the price war.

The TTF gas futures prices in the ICE market for the month of April 2020 last week remained below €9/MWh and fell almost every day, except on Thursday, March 19, when there was a recovery of 3.4% compared to the previous day. The lowest settlement price of the week, of €8.26/MWh, was registered on Wednesday, March 18. This price is 12% lower than that of the same day the previous week and the lowest in the last two years. It seems that the streak of low record prices will continue, since in today’s session prices below €8/MWh were registered.

Regarding TTF gas in the spot market, it started last week with an index price of €9.56/MWh for Monday, March 16. Subsequently, the prices fell to €8.36/MWh on Thursday, March 19, which was the lowest price of the week and since the beginning of September 2019. As of Friday, March 20, the prices settled at around €8.52/MWh. Today, Monday, March 23, the index price is €8.57/MWh.

On the other hand, the API 2 coal futures prices in the ICE market for the month of April 2020, last week had the opposite behaviour to that of oil and gas futures. In the case of coal, the prices rose almost all week, except Thursday, March 19, when they fell 1.7% compared to the previous day. The last week’s maximum settlement price, of $50.30/t, was that of Wednesday, March 18. This value is 5.5% higher than that of the Wednesday of the previous week and the highest since February 18.

This behaviour may be related to colder temperatures and increased demand in the Asian market, as well as to the fact that the producers are preventing the prices from falling below the cost prices.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, they started last week with the same downward trend as the previous week. A settlement price of €15.30/t was reached on Wednesday, March 18, 36% lower than that of Wednesday of the previous week. This value is the lowest of last week and since November 2018. On the other hand, on Thursday there was a recovery of 7.2% compared to the previous day. But, on Friday the price fell again by 1.8% until registering a settlement price of €16.11/t.

As the coronavirus spreads across Europe and the countries are increasingly taking more restrictive measures to try to contain it, this is expected to exert a downward influence on the emission rights futures prices.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: AleaSoft Energy Forecasting