AleaSoft, June 18, 2020. In the third week of June, the European electricity markets prices continued to rise and most of them exceeded €30/MWh. The fall in wind energy production and in some cases the increase in demand are the main causes of the rise. The highest daily price was that of June 17 in the EPEX SPOT market of Germany, of €37.24/MWh, which is also the highest in this market since the beginning of March. The Nord Pool market is the only exception as it remains at prices around €5/MWh.

Photovoltaic and solar thermal energy production and wind energy production

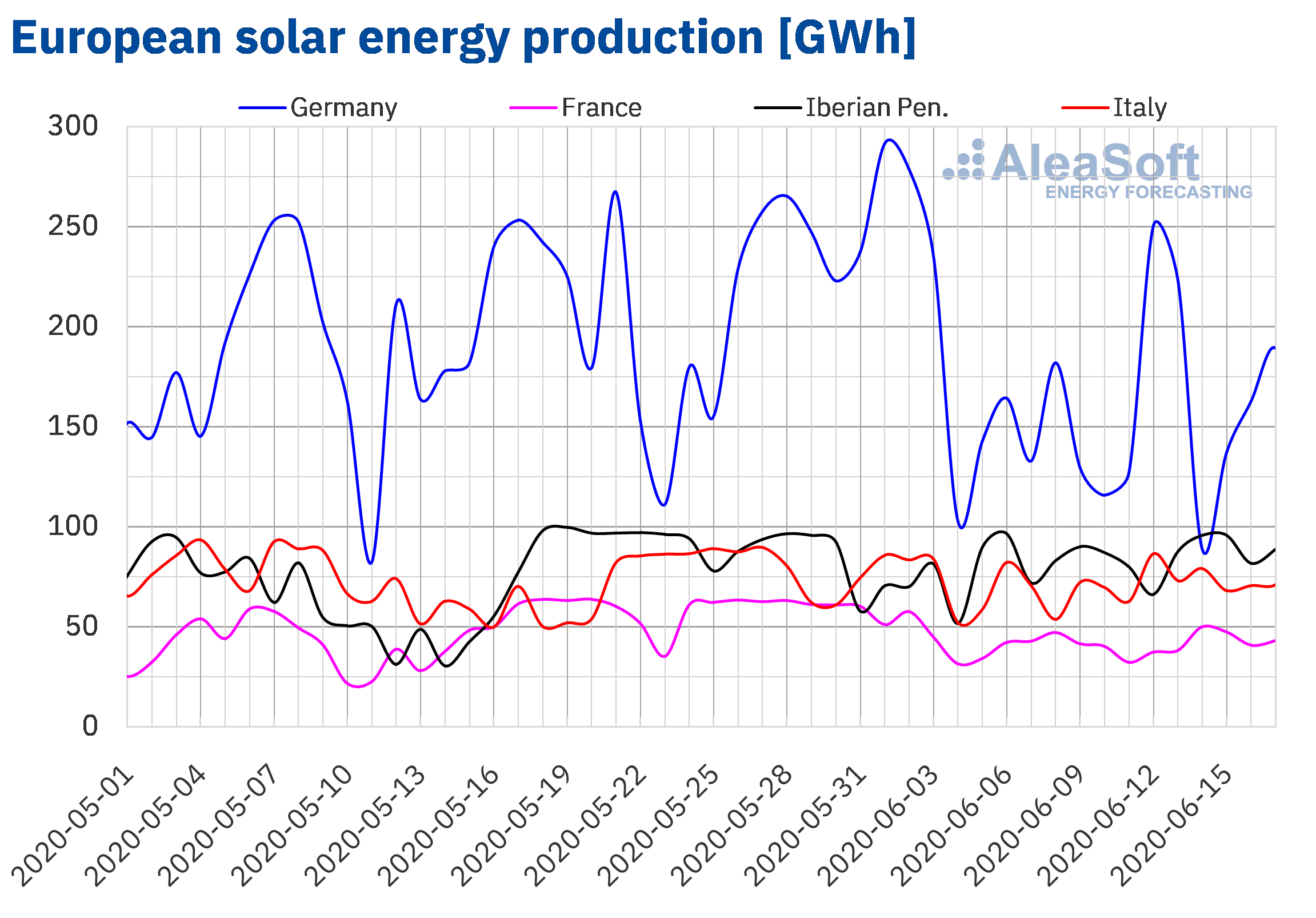

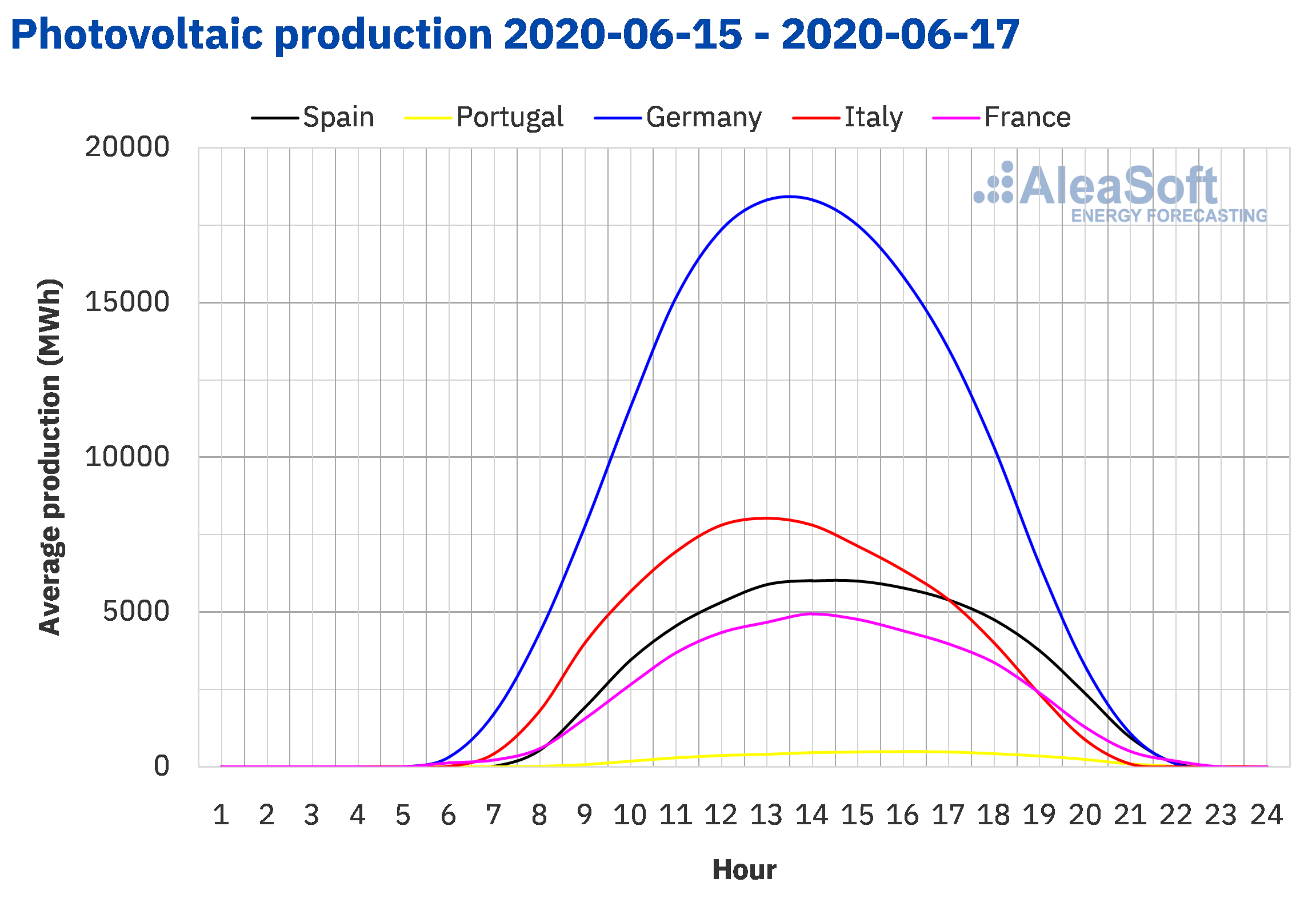

The solar energy production increased in most European markets between last Monday, June 15, and Wednesday, June 17, compared to the average of the previous week. In the French market it increased by 6.7%, while in the Iberian Peninsula and in Germany it increased by 5.4% and 2.3% respectively. Out of all the markets analysed at AleaSoft, the only one that registered a decrease in production during the first three days of this week was the Italian market, with a variation of ‑1.5%.

The production with this technology during the past 17 days of June was 33% higher in the Iberian Peninsula, compared to the same period of 2019. In contrast, in Germany it decreased by 14%, while in France and Italy the decrease was 2.9% and 1.5% respectively.

The analysis carried out at AleaSoft indicates that this trend will continue throughout the week and the production will be higher than that of last week in most markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

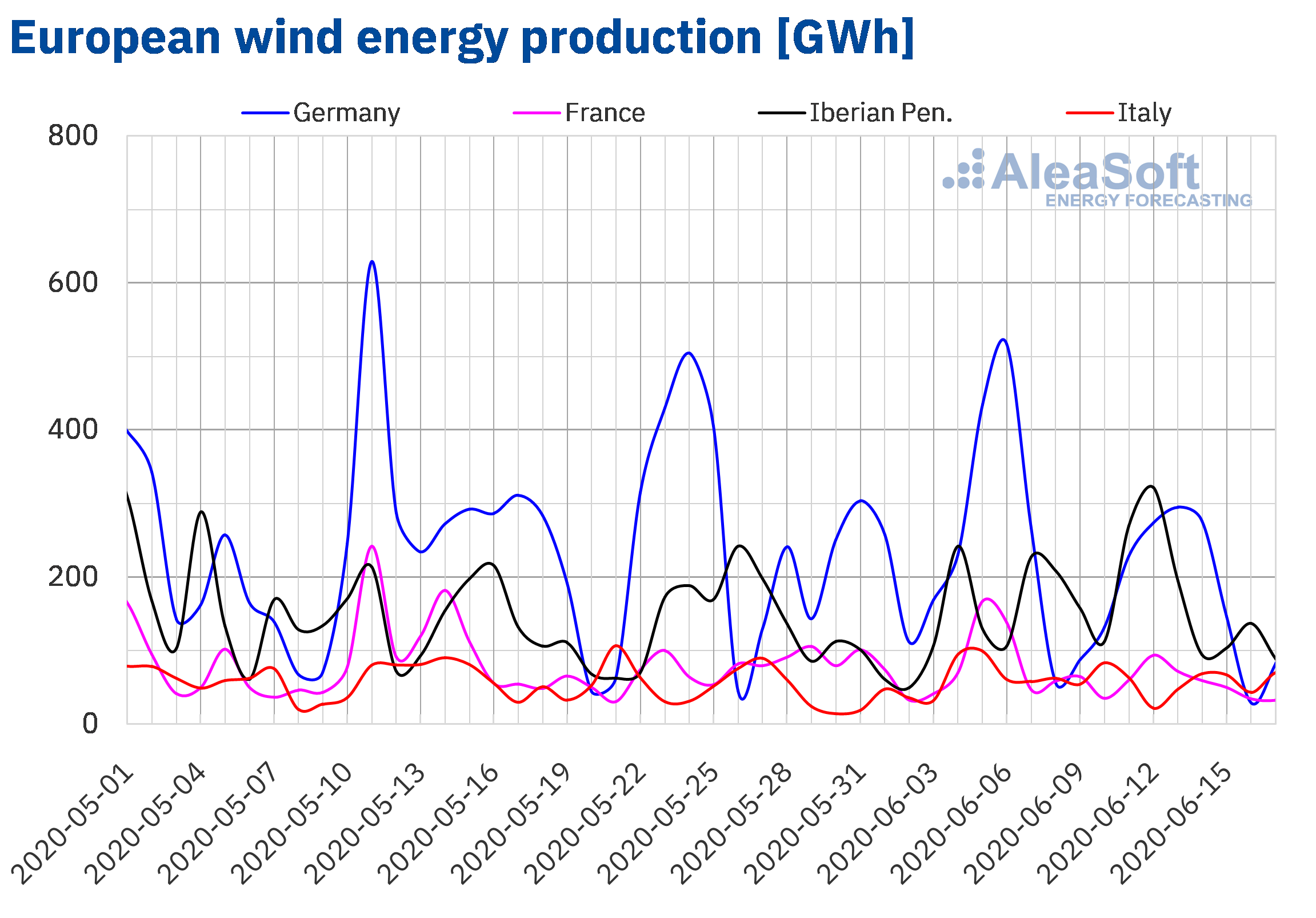

The average wind energy production between Monday and Wednesday of the week of June 15 presented a strong decrease compared to the average of the previous week in most of the markets analysed at AleaSoft. In the German market it decreased by 55% and in the French market by 38%, while in the Iberian Peninsula it was 43% lower. The exception was the Italian market, where the production increased by 5.2%.

In the first 17 days of June, the wind energy production was 10% lower than that registered in the same period of 2019 in the German market. On the contrary, in the Italian market it increased by 98% during this period, while in the Iberian Peninsula and France by 7.7% and 1.4% respectively.

At the end of the week, the AleaSoft‘s analysis indicates that the week’s total wind energy production will be lower than that of the previous week in the main European markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

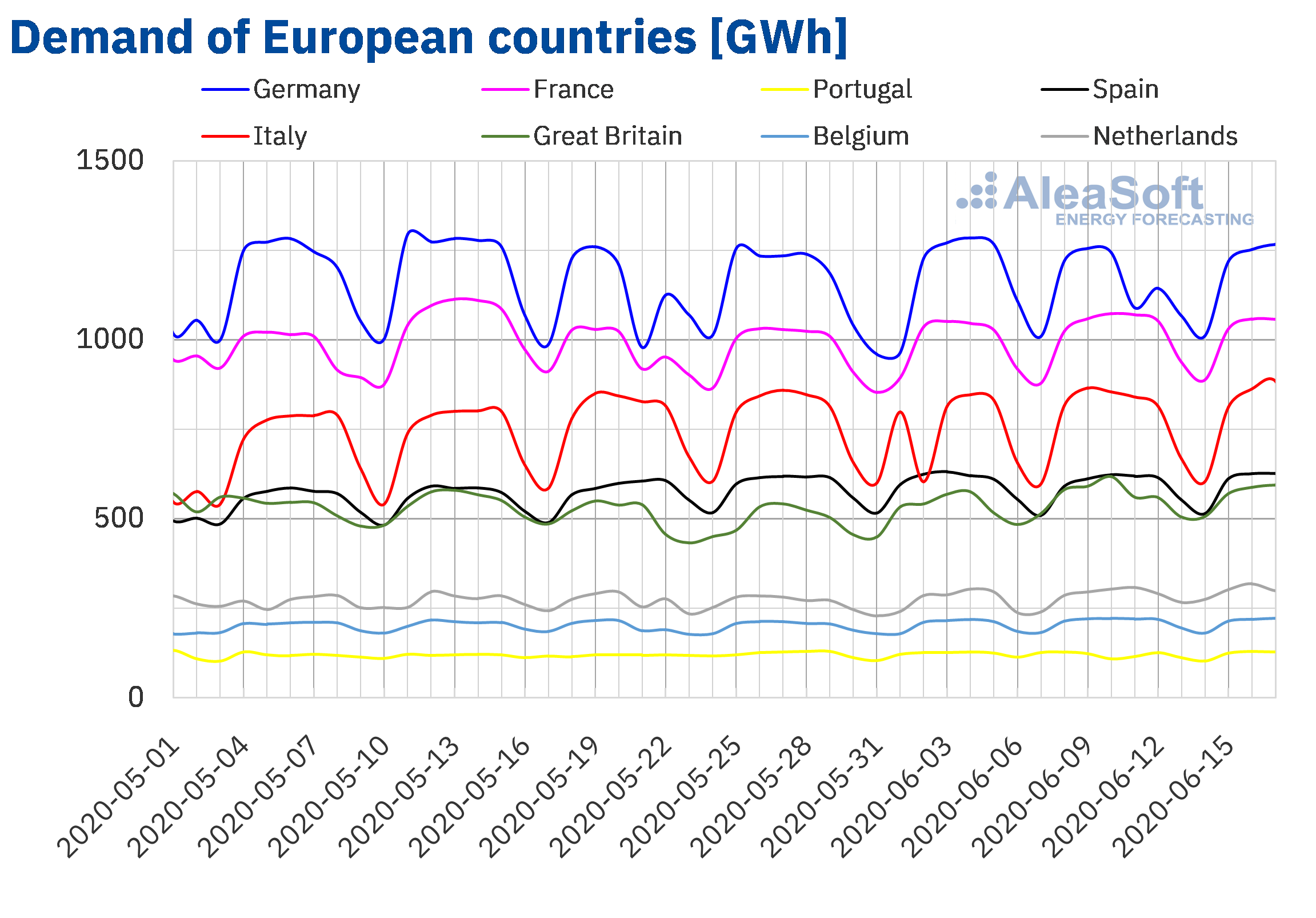

From Monday to Wednesday of the week of June 15, the electricity demand increased in a large part of the analysed markets compared to the same period of the previous week, although in some cases the growth was moderate. The restrictions to curb the spread of COVID‑19 were eased in some European countries since June 15, but the fact that the average temperatures were warmer in all examined markets contained the increase in demand. The smallest variations were registered in Germany, France, Italy and Belgium, all below 1%. Temperatures increased by 6.1 °C in the case of Belgium. In the Portuguese market, the demand rose 5.8%, mainly helped by the effect that the holiday of the Day of Portugal, Wednesday, June 10, had on demand the week before. In Spain and the Netherlands the increases were 2.1% and 3.8%. On the other hand, in Great Britain there was a drop of 2.1%.

For a more detailed analysis of the evolution of the demand, there are the electricity markets observatories on the AleaSoft website, with information of the different market variables.

The AleaSoft‘s electricity demand forecasting indicates that the total for the week will exceed that of the previous week in Germany, Portugal and Spain, while similar values will be maintained in the rest of the markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

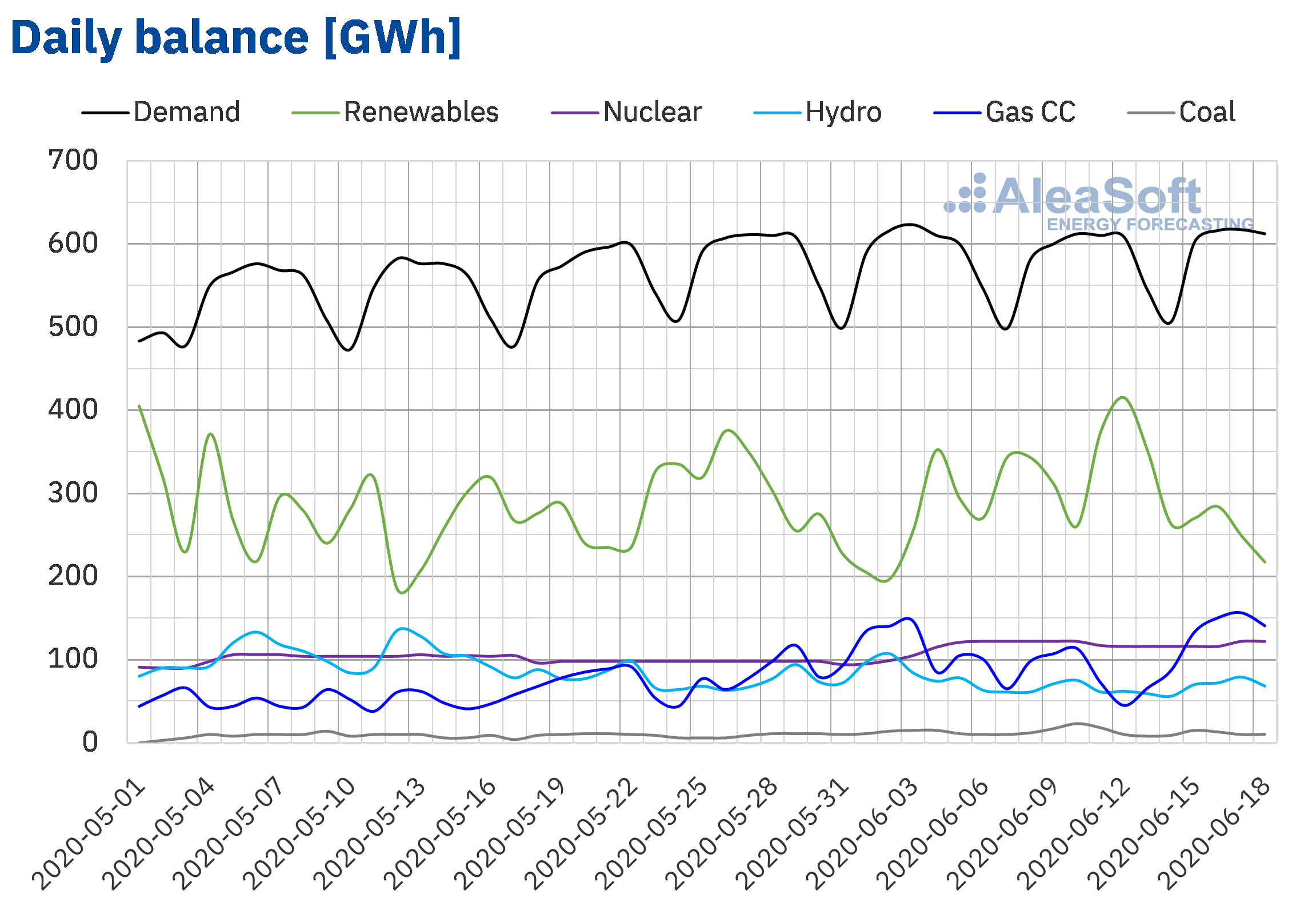

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand increased by 2.1% in Mainland Spain in the first three days of the week of June 15 compared to the same days of the week of June 8. This recovery was fundamentally influenced by the advance to the phase 3 of deconfinement in some autonomous communities. As of June 18, the autonomous community of Catalonia joins the phase 3, which will also contribute to the increasing behaviour of the demand. In this sense, the AleaSoft‘s analysis indicates that the demand will end the week above that of last week.

The average solar energy production in Mainland Spain, which includes the photovoltaic and solar thermal technologies, increased by 5.4% during the period between Monday and Wednesday of the week that started on June 15, compared to the average of the previous week. In the year‑on‑year analysis of the production with this technology, an increase of 35% was registered during the first 17 days of June. For this week, the analysis carried out at AleaSoft indicates that the production will end with little variation compared to the total registered last week.

The average level of the wind energy production in Mainland Spain in the first three days of the week decreased by 46% compared to last week’s average. In the year‑on‑year analysis, the wind energy production during this month until June 17 was 14% higher. For this week, the analysis carried out at AleaSoft indicates that the production with this technology will end up being lower than that registered the previous week.

The daily nuclear energy production between June 15 and 17 decreased 3.3% compared to the average of the first three days of the previous week. The unit 1 of the Almaraz Nuclear Power Plant, which should be started before the end of the week, and the Trillo Nuclear Power Plant, which should start operating the week of June 22, are still disconnected from the electricity grid.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 15 834 GWh stored, according to data from the last Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge, representing a decrease of 18 GWh compared to the previous bulletin.

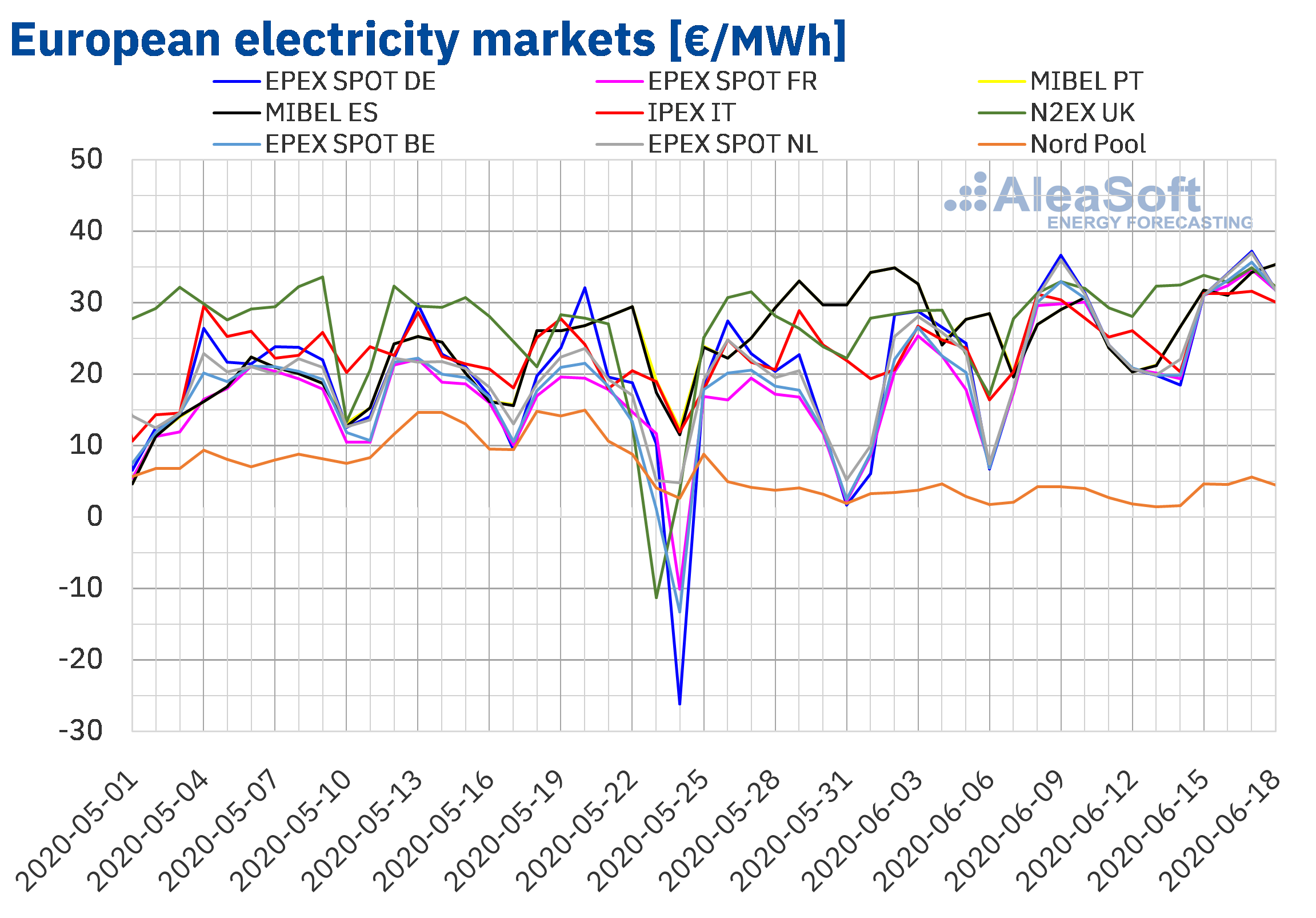

European electricity markets

The first four days of the week of June 15, the prices increased in all analysed European electricity markets compared to those of the same days of the previous week. The highest price rise, of 27%, was that of the Nord Pool market of the Nordic countries, followed by that of the MIBEL market, of 20%, both in Spain and Portugal. While the smallest increase, of 6.5%, occurred in the N2EX market of Great Britain. In the rest of the markets, the price increases were between 8.3% of the IPEX market of Italy and 14% of the EPEX SPOT market of France.

As a consequence of these price increases, the average of the first four days of the week was above €30/MWh in most of the analysed electricity markets. The exception was the Nord Pool market, which had the lowest average price so far this week, of €4.83/MWh. The rest of the markets had average prices between €31.06/MWh of the IPEX market of Italy and €33.55/MWh of the EPEX SPOT market of Germany.

On the other hand, the German market had the highest daily price in the analysed electricity markets, of €37.24/MWh. This price was reached on June 17 and it was the highest in this market since the beginning of March.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The general decrease in wind energy production and the increase in demand in most markets favoured the price increases of the first four days of the week of June 15. The recovery in CO2 and gas prices, although in the latter case still very slight, also supported the rise in prices of the electricity markets.

The AleaSoft’s price forecasting indicates that the first days of the week of June 22, although the increase in wind energy production in some countries such as Germany or France could favour price declines in those markets, the prices of most European electricity markets will remain above €30/MWh.

Iberian market

The average price of the first four days of the week of June 15 increased by 20% compared to that of the same period of the previous week in the MIBEL market of Spain and Portugal. This was the largest price rise in the European electricity markets, after the 27% increase of the Nord Pool market of the Nordic countries.

The rise in prices of the first days of the third week of June is related to the decrease in wind energy production in the Iberian Peninsula and in solar energy production in Portugal, on the one hand, and with the increase in electricity demand on the other. Furthermore, the increase in gas and CO2 prices also contributed to this trend.

The average price from June 15 to 18 was €33.11/MWh for both Spain and Portugal. In this period, the daily average prices remained above €30/MWh. The highest daily price was that of Thursday, June 18, of €35.34/MWh, in both cases. This price is the highest since the first fortnight of March in the Spanish market.

The AleaSoft‘s price forecasting indicates that in the first days of the next week of June 22 the variations in the MIBEL market prices compared to those of the first days of this week will be small, despite a certain decrease in wind energy production in the Iberian Peninsula.

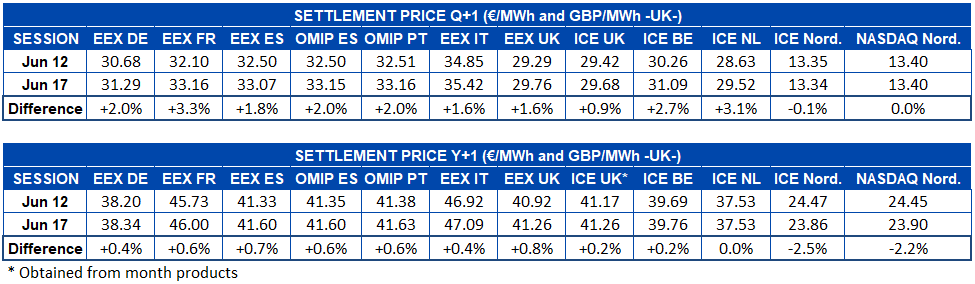

Electricity futures

In the elapsed days of the week of June 15, the electricity futures prices for the third quarter of 2020 registered a recovery in their price. This effect occurred in almost all the markets analysed at AleaSoft. The ICE market of the Nordic countries is the only one that registered a drop in its price, although it was only of €0.01/MWh. The NASDAQ market of this same region settled the session of Wednesday, June 17, with exactly the same price with which it ended the previous week, when on Friday, June 12, it reached a price of €13.40/MWh. In the rest of the markets the increases are between 0.9% and 3.3%.

In the case of the electricity futures for the next year, something similar happened. The futures prices of the Nordic countries fell by more than 2.0%, while increases were registered in the rest of the markets. The ICE market of the Netherlands did not show any variation between the analysed sessions. On the other hand, the EEX market of Great Britain was the one with the highest increase in the price of this product, with an increase of 0.8%. It was closely followed by the Iberian region, where in the EEX market of Spain the increase was 0.7% and in the OMIP market of Spain and Portugal an increase of 0.6% was registered for both countries.

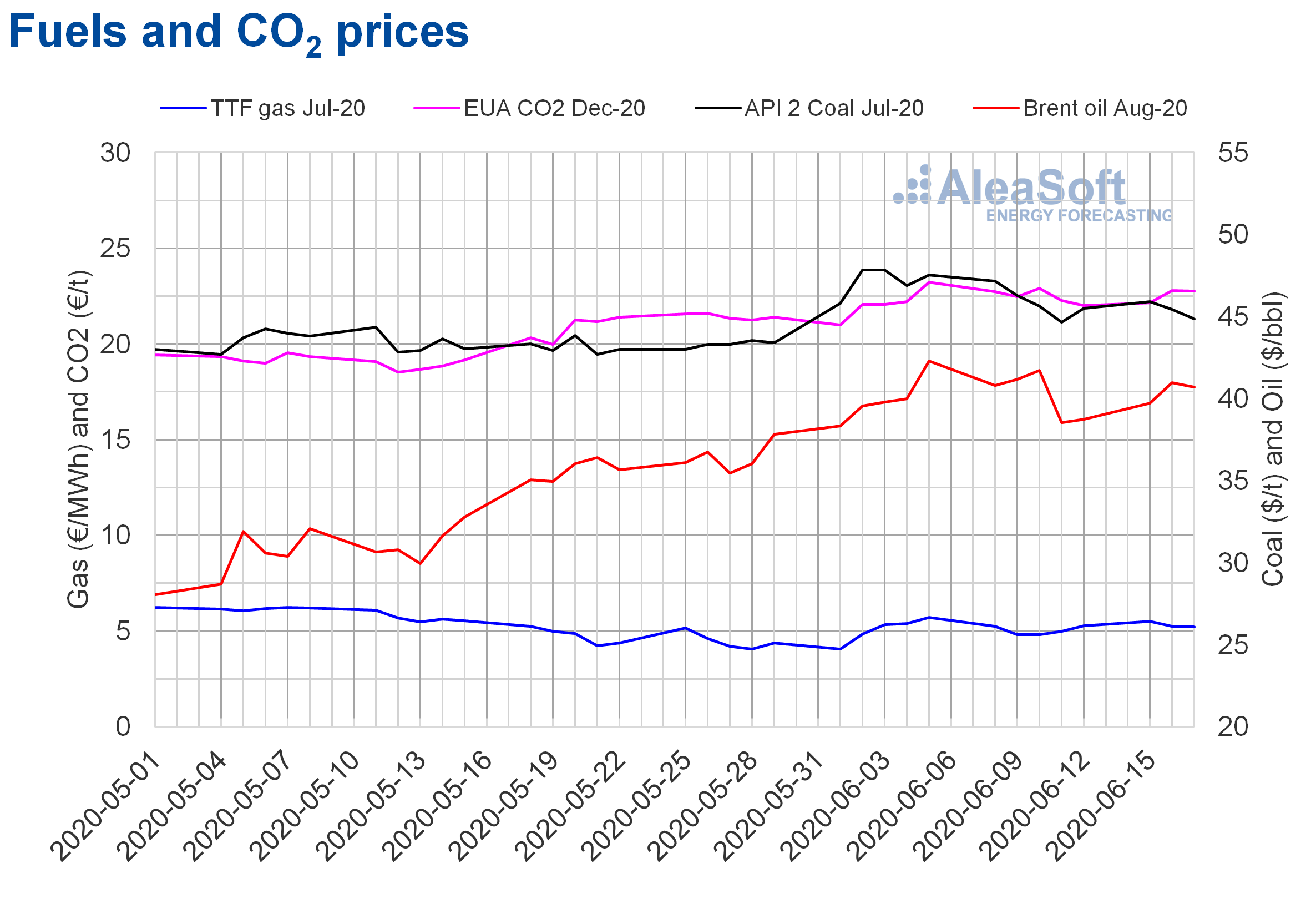

Brent, fuels and CO2

The Brent oil futures prices for the month of August 2020 in the ICE market, after the declines of the end of the previous week, started the week of June 15 with increases until reaching a settlement price of $40.96/bbl on Tuesday, June 16. On Wednesday, June 17, the price dropped slightly to $40.71/bbl. This price was 2.4% lower than that of the previous Wednesday, when the maximum price of that week was reached.

Although the International Energy Agency revised upwards its demand forecasting for this year on Tuesday, the news of a new outbreak of COVID‑19 in China raised concerns about the recovery in demand in recent days. In addition, the United States’ crude oil reserves registered increases during the previous week. These factors could slow the price recovery in the coming days, especially in the event that the coronavirus cannot be prevented from spreading again in China.

Regarding the TTF gas futures prices in the ICE market for the month of July 2020, the first days of this week were higher than those of the same days of the previous week. On Monday, June 15, a settlement price of €5.52/MWh was reached, 5.1% higher than that of the previous Monday and 4.6% higher than that of Friday of last week. But the following days, the prices fell and on Wednesday, June 17, the settlement price was €5.21/MWh. Despite the decrease compared to the beginning of the week, this price was 8.5% higher than that of the same day of the previous week.

Regarding the TTF gas prices in the spot market, the first four days of this week of June 15, they remained above €5/MWh and they were higher than those of the same days of the previous week. The maximum index price so far this week, of €5.35/MWh, was reached on Tuesday, June 16, and it is the highest since the first half of May.

As for the API 2 coal futures in the ICE market for the month of July 2020, despite starting the week of June 15 with a settlement price $0.40/t higher than that of the previous Friday, the settlement prices of the first three days of the week were lower than those of the same days of the previous week and registered decreases as of Tuesday. The settlement price of Wednesday, June 17, was $44.85/t, 1.8% lower than that of the same day of the previous week, but still $0.20/t higher than the minimum settlement price of the previous week, registered on June 11.

On the other hand, the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, began this week of June 15 with increases until reaching a settlement price of €22.78/t on Tuesday, June 16. This price was 1.3% higher than that of the same day of the previous week. But on Wednesday, June 17, there was a slight decrease and the settlement price was €22.75/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

The webinar “Influence of coronavirus on electricity demand and the European electricity markets (III)” of AleaSoft will be held on June 25. The speakers will be Pablo Otín, CEO and co‑founder, at Powertis, Miguel Ángel Amores, Manager of Renewable Energy, at Triodos Bank and Oriol Saltó, Manager of Data Analysis and Modelling, at AleaSoft. The topics to be discussed in the webinar are the evolution of the European energy markets and the financing of renewable energy projects during the COVID‑19 crisis and the future perspectives taking into account the pessimistic scenario of economic growth that the coronacrisis leaves us and the possible appearance of new outbreaks of the epidemic.

Another way to analyse the evolution of the energy markets with updated data is the observatory created at AleaSoft. This tool includes information of the main European electricity markets, as well as the Brent oil, TTF and MIBGAS gas, API 2 coal and CO2 emission rights markets.

Source: AleaSoft Energy Forecasting.