AleaSoft, July 30, 2020. During the first days of the last week of July, there was a drop in prices in most of the European electricity markets, except in the Italian IPEX. In the latter, the price of July 29 exceeded €50/MWh. The renewable energy production, mainly the wind energy, increased in most of the markets, which favoured the reduction in the prices. On the other hand, in Italy the decrease in wind energy was combined with the increase in demand, which caused the rise in prices.

Photovoltaic and solar thermal energy production and wind energy production

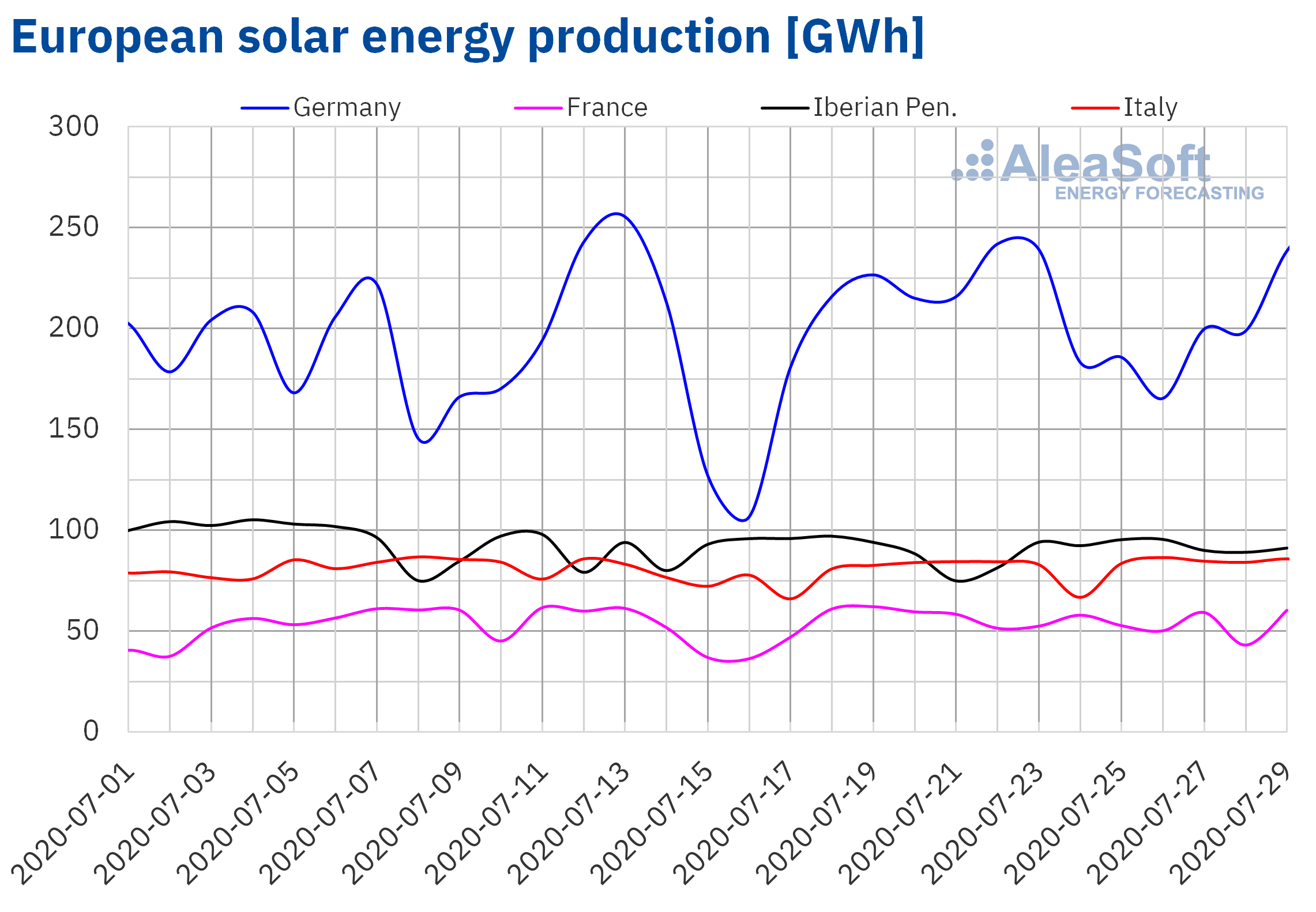

The solar energy production increased in the European electricity markets from July 27 to 29 compared to the average of the fourth week of the month, although in general the production was similar in both periods. The only market where the production fell was in the French, where the drop was 0.8%. The main increases were registered in Portugal and Italy, which were 3.8% in both territories. While, the rises in Germany and the Iberian Peninsula were 2.8% and 1.4% respectively.

In the year‑on‑year analysis of the first 29 days of July, increases were registered in all markets. In the Iberian Peninsula, the solar energy generation increased significantly by 58%. In Italy the increase was 16%, while in Germany and France they were 5.3% and 7.5% respectively.

The AleaSoft’s solar energy production forecasting indicates that at the end of the week 31 of 2020 the generation with this technology will be higher than that registered during the week of July 20 in Germany and Italy. However, a drop in solar energy production of Spain is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

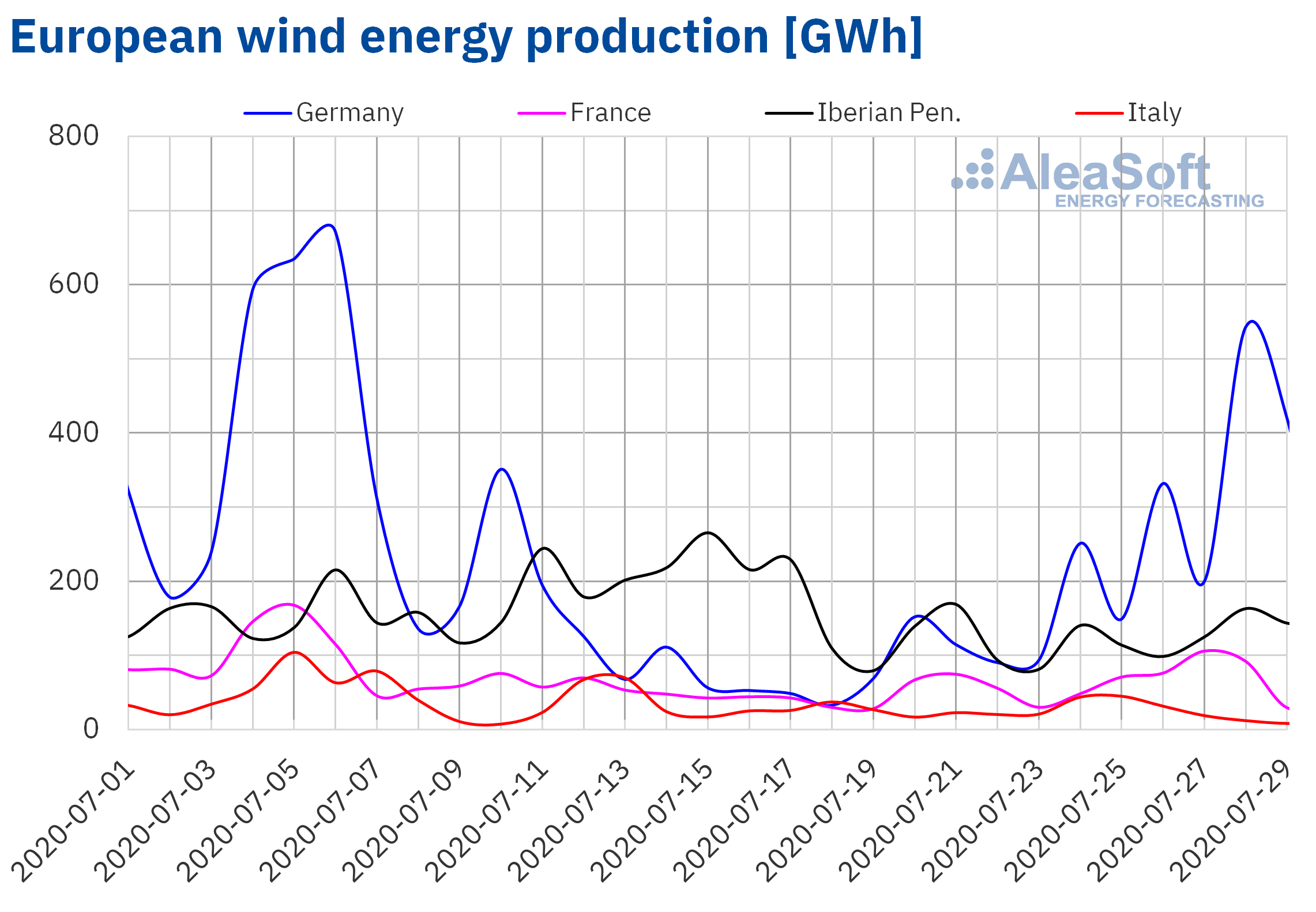

In most of the European markets, the wind energy production rose significantly from Monday to Wednesday of the week of July 27 compared to the average of the week of July 20. The generation with this technology doubled in Germany by increasing by 129%. In France and the Iberian Peninsula there were increases of 25% and 20% respectively. However, the Italian market was the only one where the wind energy production decreased, registering a drop of 54%.

Comparing the days from July 1 to 29, 2020 compared to the same period of 2019, the wind energy production also increased in all markets, except in the Italian market. In this comparison, Germany, the Iberian Peninsula and France registered increases of 3.7%, 26% and 29% respectively. On the other hand, the fall of the Italian market was 16% for this period.

At the end of the week of July 27, at AleaSoft the wind energy production is expected to exceed that of the fourth week of July in most markets. By contrast, the wind energy generation in Italy is expected to be lower.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

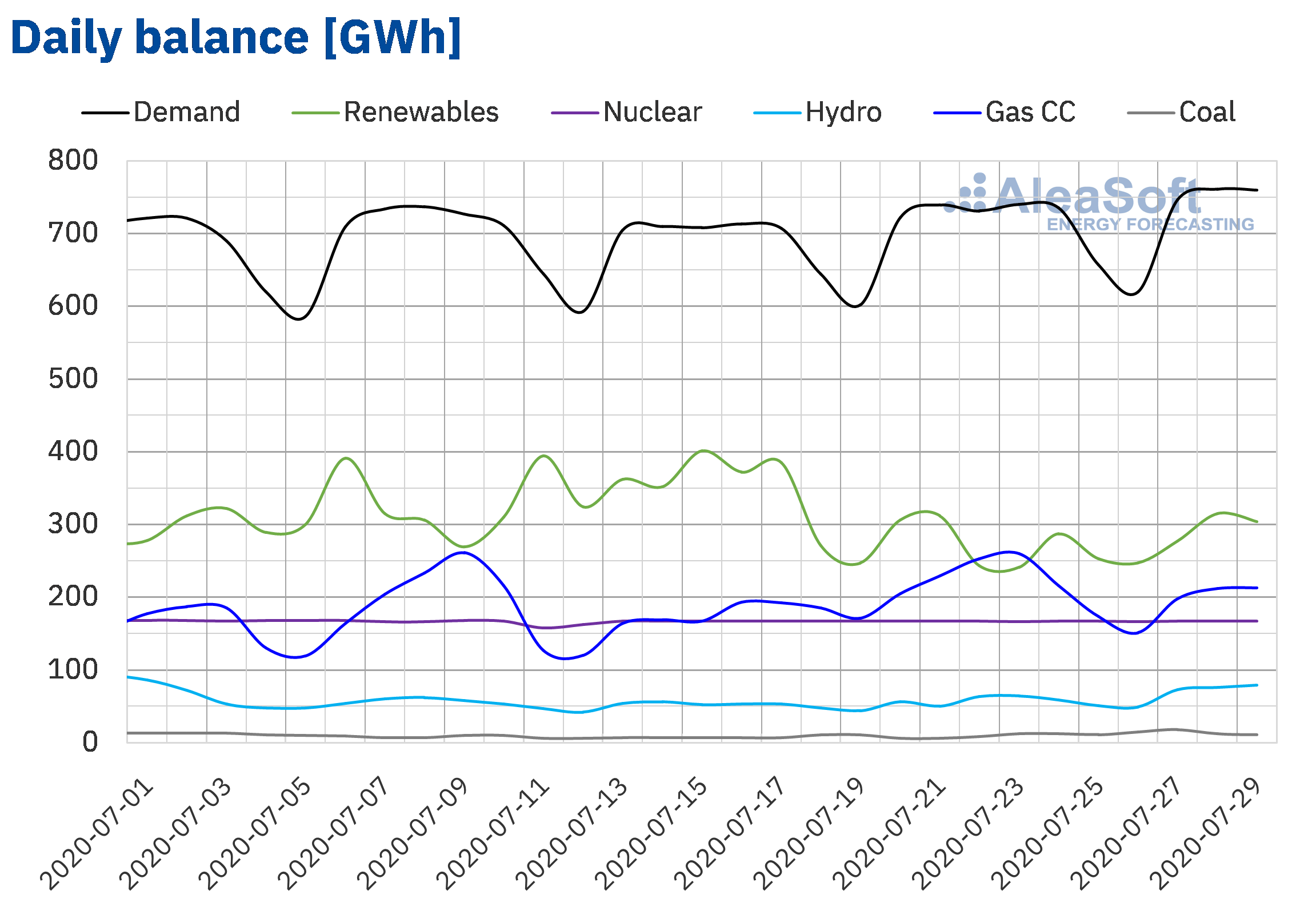

Electricity demand

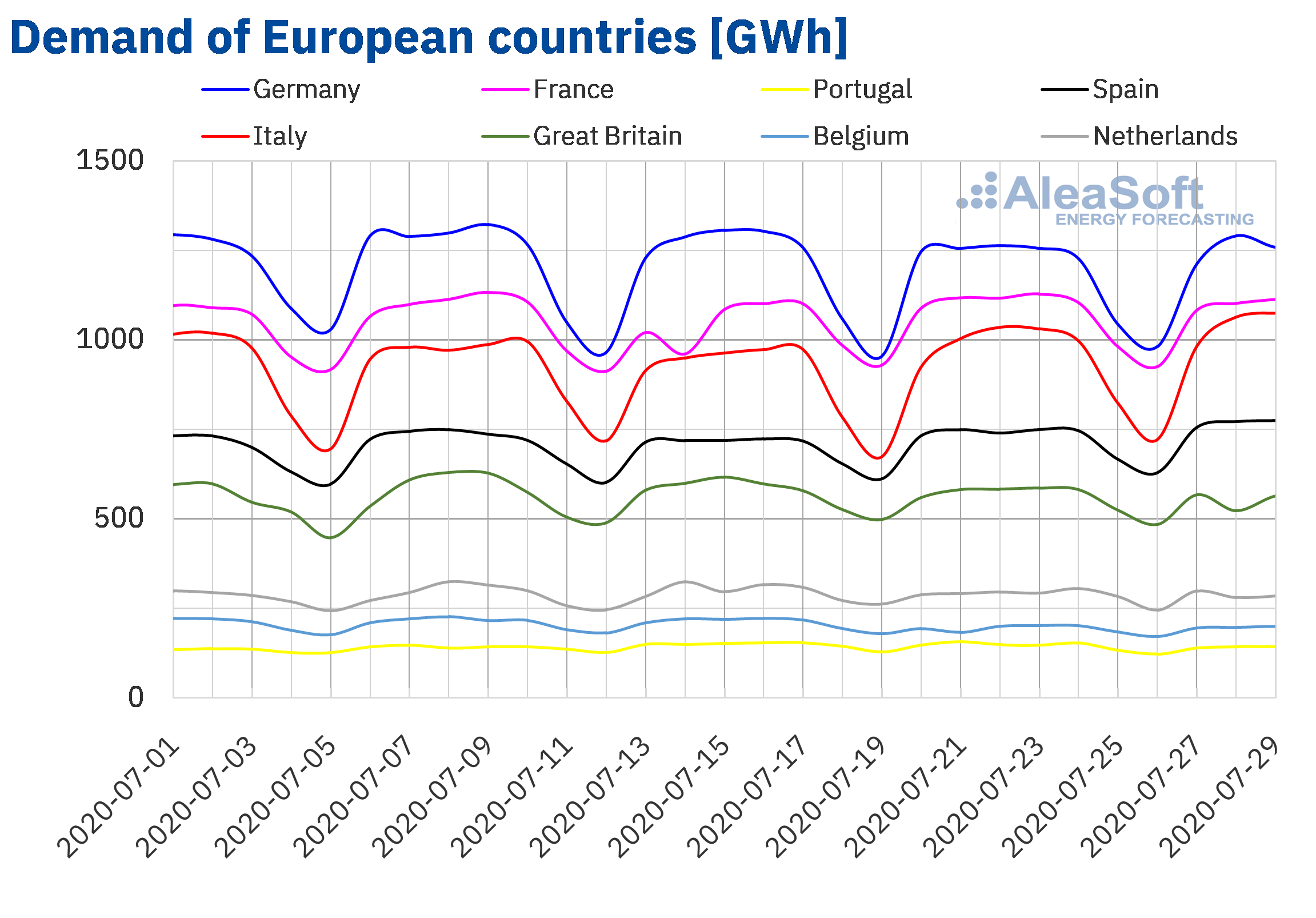

From Monday to Wednesday of the fifth week of July, the electricity demand in the European markets registered a heterogeneous behaviour compared to the same days of the fourth week of the month. During this period, the demand fell in the markets of France, Portugal, Great Britain and the Netherlands. The variations were between ‑5.9% of Portugal and ‑0.7% of France. In the case of the German market, the demand was very similar to that registered between July 20 and 22.

On the other hand, in the markets of Italy, Spain and Belgium, the demand increased in the first three days of the week of July 27 between 5.3% and 2.7%. In the case of Belgium, the increase was due to the recovery in demand after the effect of the holiday of July 21, National Holiday of Belgium.

At the AleaSoft’s observatories it is possible to analyse the behaviour of the demand and other variables of interest of the main European electricity markets in recent weeks.

According to the AleaSoft’s electricity demand forecasting, at the end of the week the demand will be higher than that registered during the week of July 20 in most of the European markets. Conversely, lower demand is expected in the markets of Portugal, Great Britain and the Netherlands.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

In Mainland Spain, the electricity demand increased by 3.7% in the first three days of the week of July 27 compared to the same days of the week of July 20. The main cause of this increase was the increase in average temperatures during this period, of 1.3 °C. At AleaSoft it is expected that at the end of the fifth week of July, the weekly demand will conclude above that of the fourth week of July, due to the increase in temperatures from Thursday, July 30, when the first heat wave of the summer is expected.

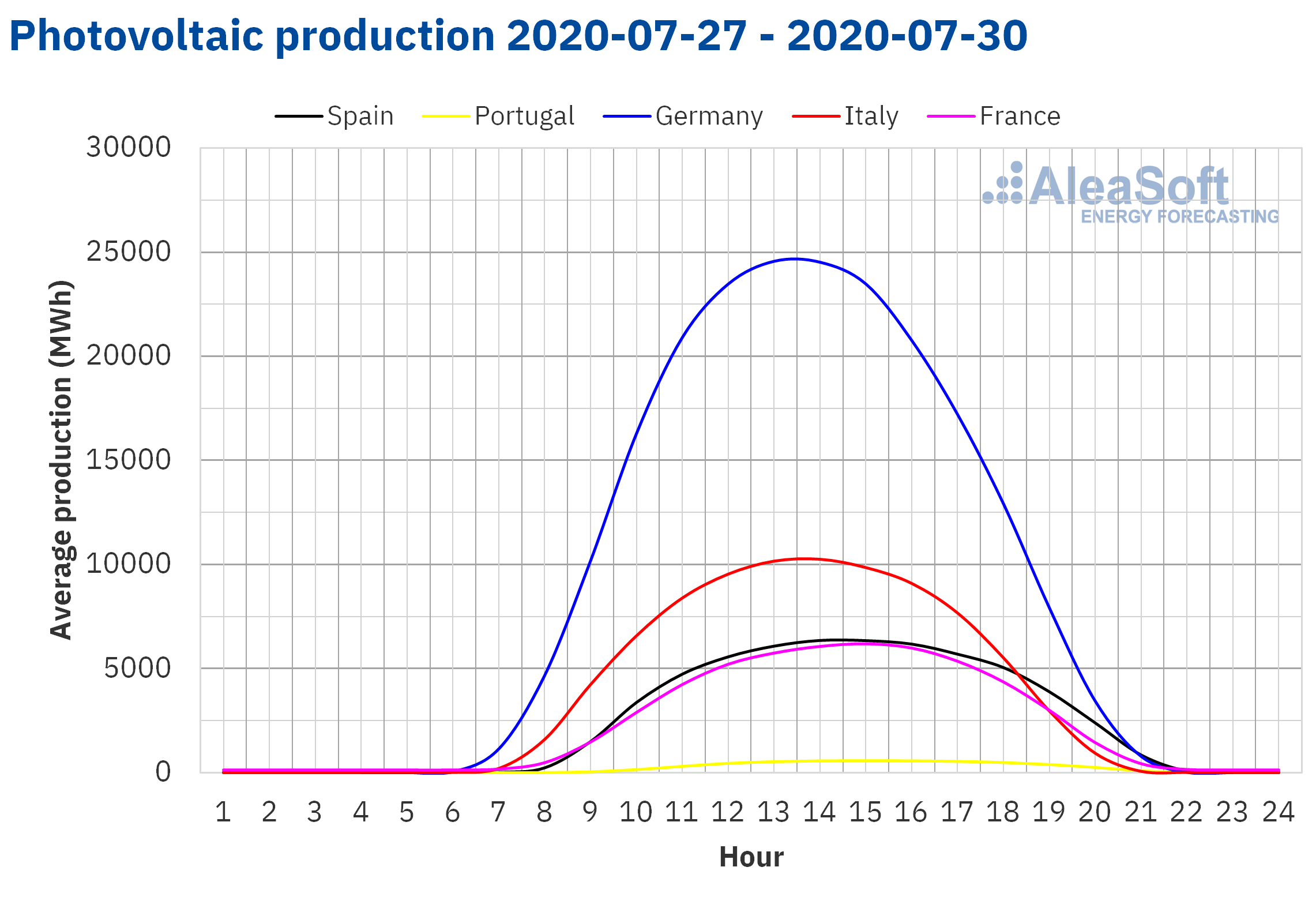

The renewable energy production rose from July 27 to 29 in Mainland Spain compared to the average of the week of July 20. The average of the solar energy production, which includes the photovoltaic and solar thermal technologies, registered an increase of 1.2%. In the year‑on‑year comparison of the days elapsed of July, the increase was a remarkable 60%. However, at AleaSoft it is expected that by the end of the week 31 of 2020 the solar energy production will be lower than that of the fourth week of July.

Meanwhile, the wind energy production of Mainland Spain registered an increase of 25% from Monday to Wednesday of the week 31 of 2020 compared to the average of the week 30. Likewise, there was a year‑on‑year increase of 30% during the days elapsed of July. At AleaSoft, the wind energy production is expected to end the week with total values higher than those of the week of July 20.

Currently, all nuclear power plants are underway and no shutdowns are scheduled for the coming weeks. From Monday, July 27, to Wednesday, July 29, the nuclear energy production was maintained with an average of 167 GWh per day.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently store 14 060 GWh, according to data from the Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge. This level represents a fall of 2.7% compared to the previous bulletin and 61% of the total capacity.

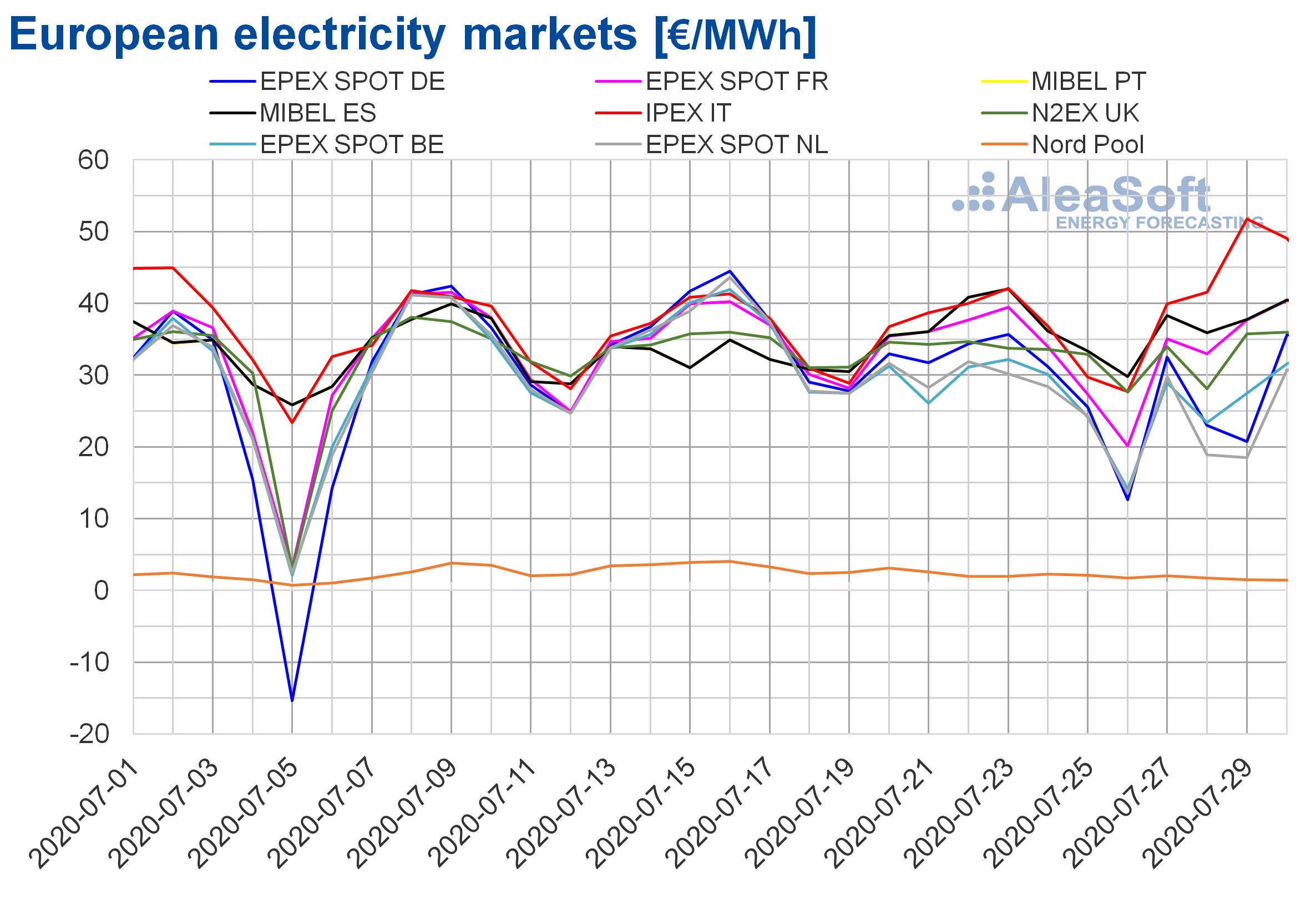

European electricity markets

The first four days of the week of July 27 there were price declines in almost all the analysed European electricity markets compared to the same period of the week of July 20. The only exception was the IPEX market of Italy, where the prices increased by 16%. On the other hand, the greatest drop in prices, of 31%, was that of the Nord Pool market of the Nordic countries. While the MIBEL market of Spain and Portugal, the EPEX SPOT market of France and the N2EX market of Great Britain had the smallest price decreases, of 1.4%, 1.7% and 2.5% respectively. In the rest of the markets, the price falls were between 7.7% of the EPEX SPOT market of Belgium and 20% of the EPEX SPOT market of the Netherlands.

The European markets prices were not coupled during the first four days of the fifth week of July. The average price reached €45.57/MWh in the Italian market. In the case of the markets with the smallest price declines, the Iberian, the French and the British, the average price continued above €30/MWh. In the rest of the markets, the prices were lower than this amount. The markets with the lowest averages were those of the Nordic countries and the Netherlands, with €1.66/MWh and €24.49/MWh respectively.

As for the daily prices of the analysed European electricity markets, from Tuesday to Thursday they exceeded €40/MWh in the Italian market, reaching a daily price of €51.73/MWh on Wednesday, July 29. While on Thursday, July 30, there were also daily prices above €40/MWh in the markets of France, Spain and Portugal.

At the opposite extreme, the daily prices of the Nord Pool market remained between €2.02/MWh of Monday, July 27, and €1.44/MWh of Thursday, July 30.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The general increase in wind energy production in Europe favoured the price drops during the first days of the fifth week of July. But in the case of Italy, the production with this technology decreased, which combined with an increase in demand, resulted in a rise in prices.

The AleaSoft’s price forecasting indicates that the first four days of the week of August 3 there will be price increases in the markets of Great Britain, Belgium, the Netherlands and Germany. In the latter, a significant reduction in generation with solar and wind renewable sources is expected. In the rest of the markets, the prices are expected to fall, specifically in the Italian market, the decrease will be due to the recovery of the wind energy production and the fall in demand. As a result, the market prices will be more coupled, with daily values between €30/MWh and €40/MWh, with the exception of the Nord Pool market, which will continue with lower prices.

In some regions of France, a considerable increase in temperatures is expected and it is feared that the increase in river water may cause the closure of some nuclear power plants, since it is often used in cooling processes. If this happens, it can cause an increase in the electricity markets prices.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week number 31 of 2020 fell 1.4% compared to the same period of the week of July 20. In this period, the dominant trend in the European markets prices was down, but the Iberian market was the one with the smallest variation in its average.

Despite this slight decrease in prices, the average price from July 27 to 30, of €38.09/MWh for both markets, was the second highest in Europe, after the average of the Italian market. In this period, the daily prices of Spain and Portugal had values between €35.89/MWh of Tuesday, July 28, and €40.45/MWh of Thursday, July 30.

During the first days of the last week of July, the increase in wind and solar energy production in the Iberian Peninsula favoured the decrease in prices in the MIBEL market. However, the increase in demand in Spain limited the fall in prices.

The AleaSoft‘s price forecasting indicates that the month of August will begin with increases in wind energy production that will allow the prices to continue falling in the MIBEL market.

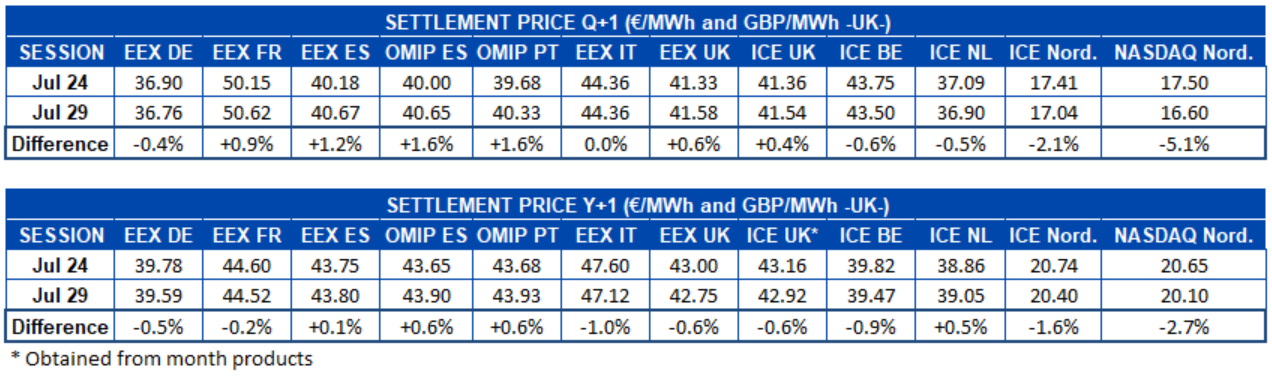

Electricity futures

From Monday to Wednesday of the fifth week of July, the electricity futures prices for the next quarter behaved heterogeneously in the European markets. In the EEX market of Germany, the ICE market of Belgium, the Netherlands and the Nordic countries and the NASDAQ market of the Nordic countries, the prices were reduced. This last market was the one that registered the greatest decrease, with a decrease of 5.1% in the settlement price of the session of Wednesday, July 29, compared to the settlement price of Friday, July 24. On the other hand, the EEX markets of France, Spain and Great Britain, OMIP of Spain and Portugal and ICE of Great Britain registered price increases, the largest being that of the OMIP market of Spain and Portugal, which increased by a 1.6% for both countries. The EEX market of Italy settled the session of Wednesday, July 29, with exactly the same settlement price of Friday, July 24, of €44.36/MWh.

The electricity futures prices for the calendar year 2021 also registered disparate behaviours. The prices of the markets of the Iberian region increased, both in the EEX of Spain and in the OMIP of Spain and Portugal and in the ICE market of the Netherlands. Out of these, the one that increased the most was, as in the quarterly product, the OMIP market of Spain and Portugal, with an increase of 0.6%. Meanwhile, in the EEX markets of Germany, France, Great Britain, ICE of Great Britain, Belgium, the Nordic countries and NASDAQ also of the Nordic countries, the prices were reduced in the days elapsed of the week of July 27. The market with the greatest decrease was the NASDAQ of the Nordic countries, with a 2.7% decrease in the settlement price of July 29 compared to that of the session of July 24.

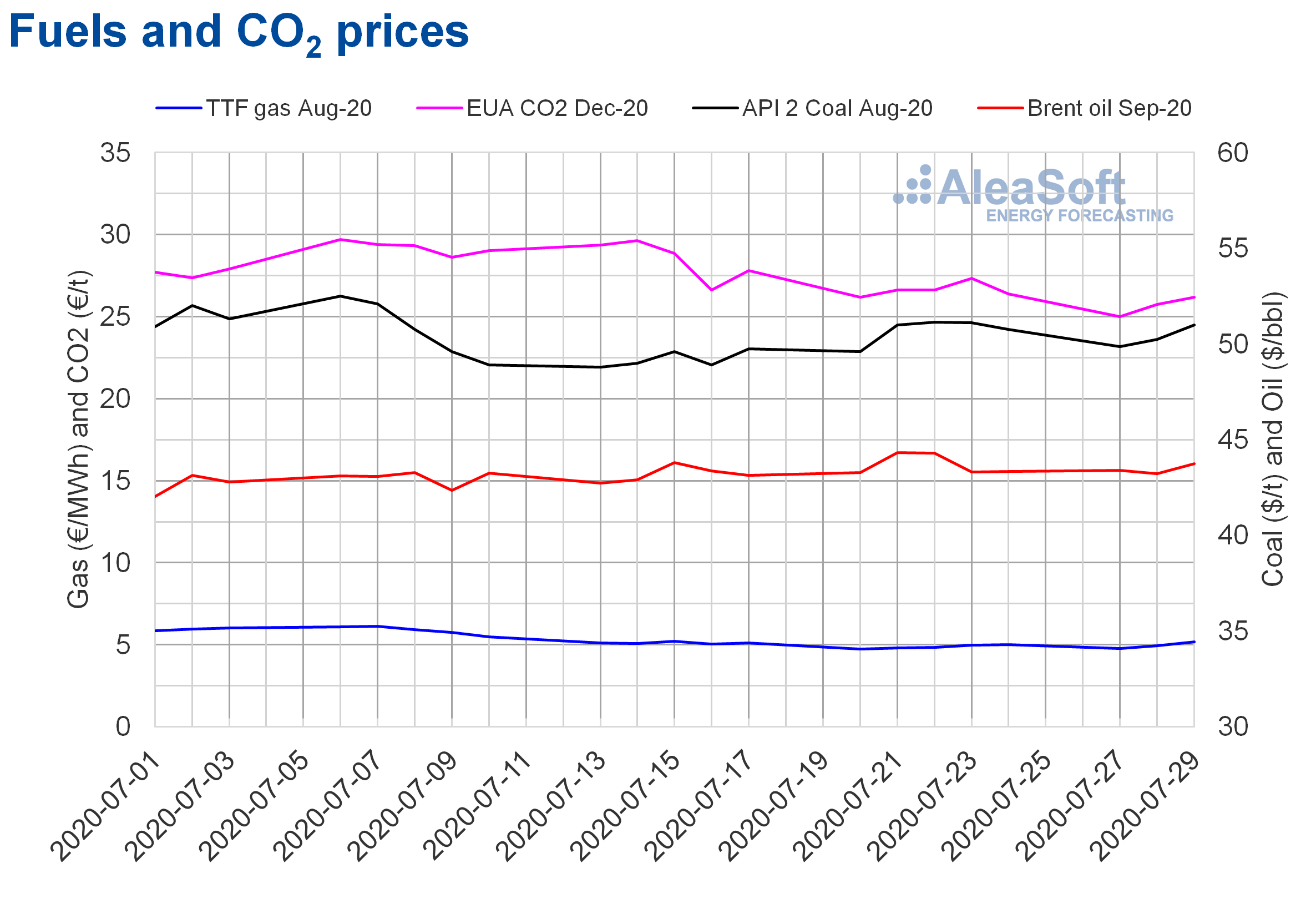

Brent, fuels and CO2

The Brent oil futures prices for the month of September 2020 in the ICE market, the first three days of the fifth week of July, remained above $43/bbl. The maximum settlement price of this period, of $43.75/bbl, was reached on Wednesday, July 29. Instead, the minimum, of $43.22/bbl, was that of Tuesday, July 28. This price was the lowest since July 17. In general, the prices were stable since July 23.

The 1.2% rise in the settlement price of Wednesday, July 29, compared to the previous day was related to the publication of data on the decline in crude oil reserves of the United States. However, the effect that the new cases of COVID‑19 are having on the recovery of the economy of this country can cause further price drops. Furthermore, from August 1, the OPEC+ will begin to increase its production, which may also exert downward influence on the prices in the coming days.

On the other hand, the TTF gas futures in the ICE market for the month of August 2020, on Monday, July 27, had a settlement price of €4.79/MWh, the third lowest since June 1. But on Tuesday and Wednesday the prices increased and the settlement price of Wednesday, July 29, was €5.18/MWh. This price was 7.2% higher than that of Wednesday, July 22, and the highest during the second half of July.

Regarding TTF gas prices in the spot market, the first days of the last week of July, had values below €5/MWh. On Tuesday, July 29, an index price of €4.54/MWh was registered, the lowest in the last ten days. But then the prices increased and on Thursday, July 30, the index price was €4.89/MWh.

As for the API 2 coal futures prices in the ICE market for the month of August 2020, they started the week of July 27 with prices below $50/t. But on Tuesday, July 28, its settlement price already exceeded this amount and on Wednesday, July 29, a settlement price of $51.00/t was reached. However, despite the recovery, this price was still 0.3% lower than that of Wednesday of the fourth week of July.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2020, on Monday, July 27, they reached a settlement price of €25.01/t, 4.5% lower than that of Monday, July 20, and the lowest since the end of June. But on Tuesday and Wednesday, the prices rose by 2.9% and 1.7% respectively. This allowed the settlement price of Wednesday, July 29, to be €26.18/t. This recovery may be related to the increase in temperatures in France that could force some of its nuclear reactors to stop in the coming days.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

Next September 17 at AleaSoft the series of webinars that were organised since the coronavirus crisis began will continue. On this occasion, in addition to updating the topics that were addressed in the previous webinars, related to the evolution of the energy markets in the current scenario and the financing of the renewable energy projects, the importance of having forecasting carried out with a model with a scientific basis and with coherent results in the audits and the portfolio valuation will be discussed.

The energy markets observatories are another way to monitor the evolution of the main European electricity, fuels and CO2 emission rights markets, with daily updated data. In the observatories, the data of the fundamental variables of these markets can be visualised with graphs of the last weeks.

Source: AleaSoft Energy Forecasting.