AleaSoft Energy Forecasting, November 2, 2023. In October, wind energy production reached all‑time records for that month in the main European markets. Photovoltaic energy production was also the highest for an October month in most markets. This increase in renewable energy production, especially wind energy, allowed market prices to remain stable with a downward trend in almost all markets, despite an increase in electricity demand and gas prices.

Solar photovoltaic, solar thermoelectric and wind energy production

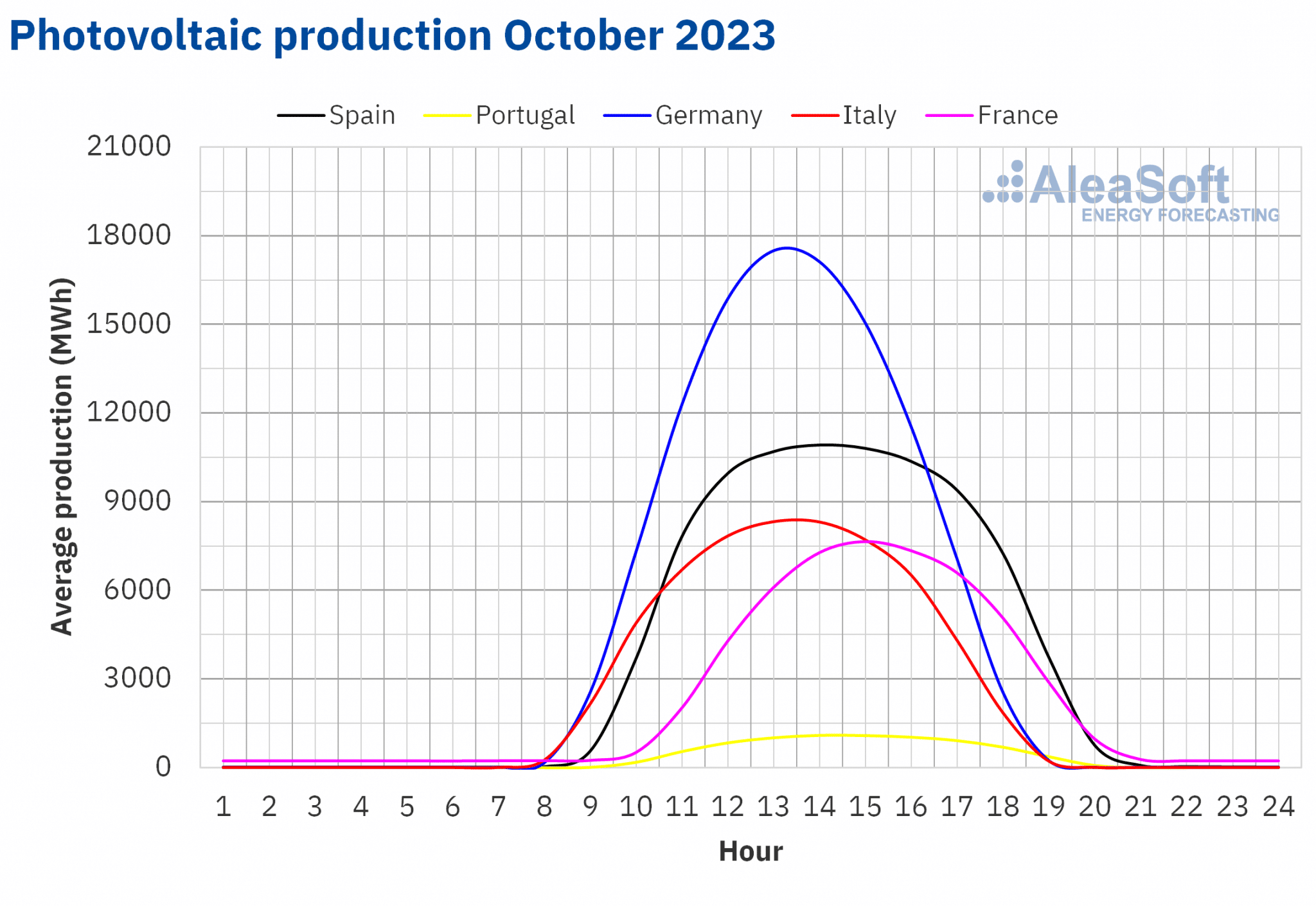

In October 2023, solar energy production increased in most major European markets compared to the same month last year. The French and Iberian markets registered the largest increases, 32% and 28%, respectively. The Italian market registered an increase of 8.6%. In these markets, solar photovoltaic energy production in October 2023 broke historical records when compared to the same month in previous years, with the Spanish market leading the way with 2502 GWh. The exception was the German market, where photovoltaic energy production fell by 5.2% compared to October 2022.

In contrast, in October, solar energy production decreased in all markets analyzed at AleaSoft Energy Forecasting compared to the previous month, due to the seasonal change and the decrease in sunshine hours. The declines ranged from 50% in the German market to 26% in the Italian and Portuguese markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

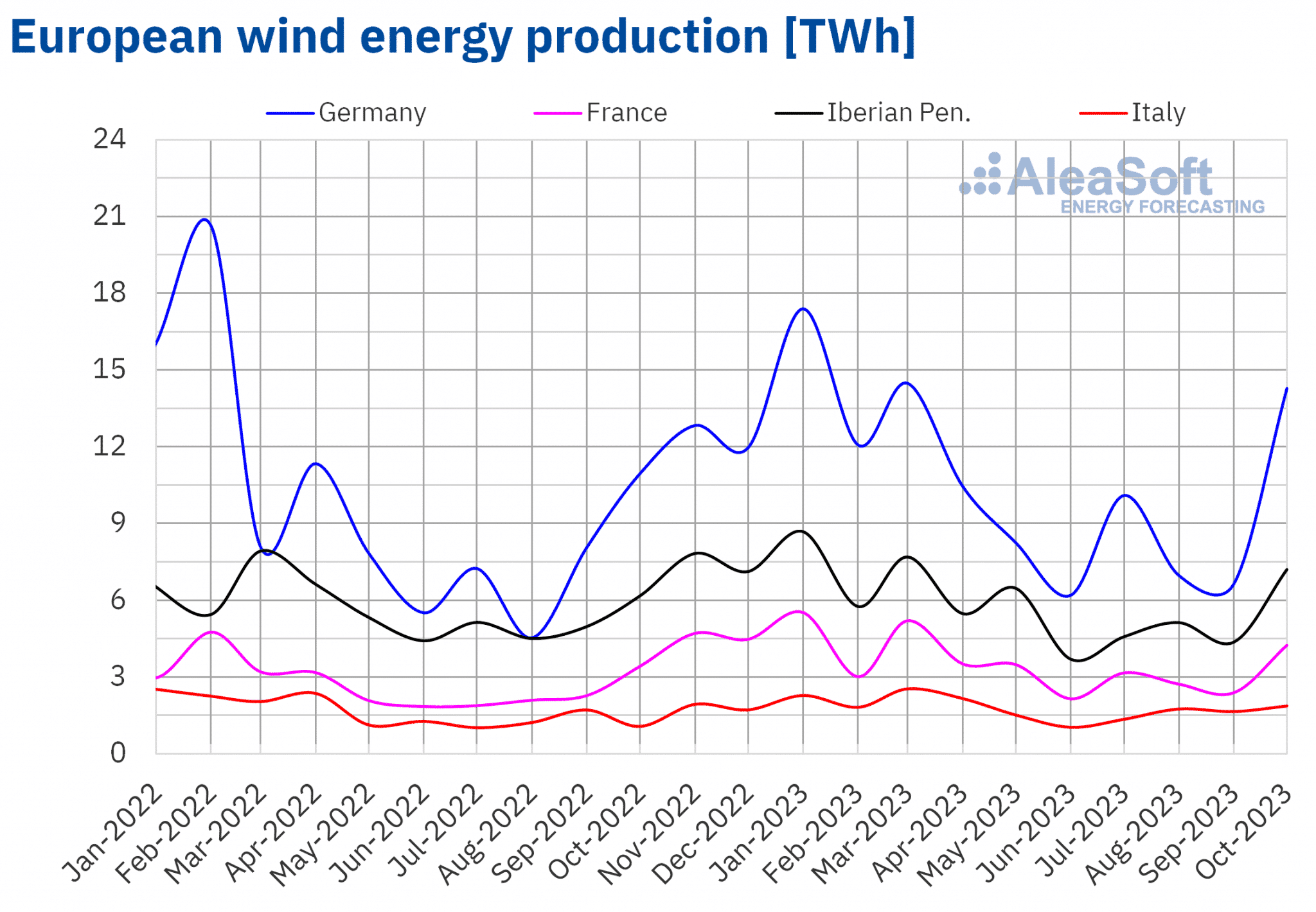

As for wind energy production, all major European markets registered a year‑on‑year growth in October 2023. Increases ranged from 16% in the Spanish market to 75% in the Italian market. In all analyzed markets, wind energy production in October 2023 broke historical records when compared to the same month in previous years. The German market registered the highest wind energy production, 14 278 GWh. Spain came in second place, producing 5829 GWh with this technology in the same period. In October 2023, wind energy production also increased compared to the previous month in all major European markets. Increases ranged from 10% to 108% in the Italian and German markets, respectively.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

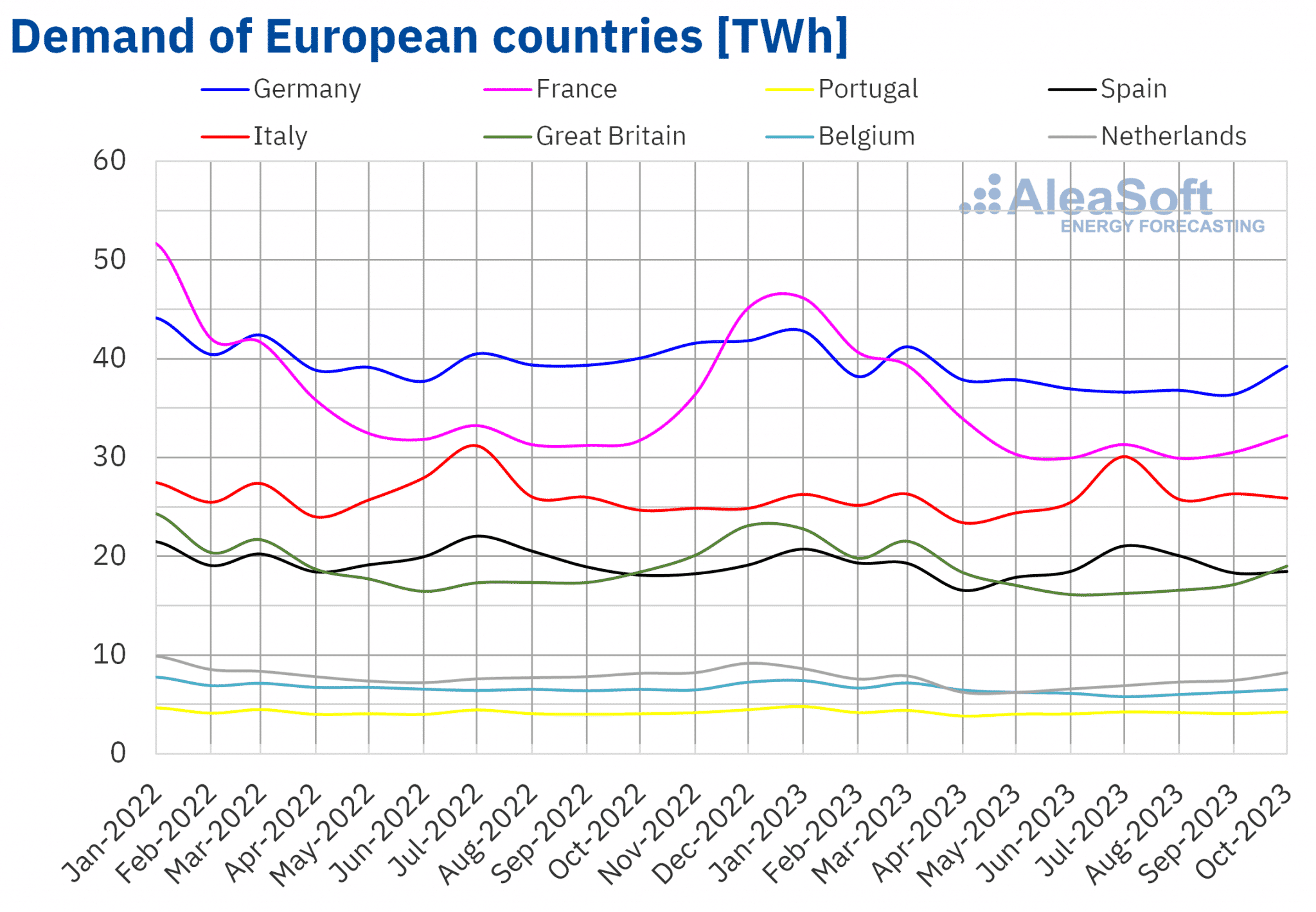

In October 2023, electricity demand increased in most major European markets compared to the same period in 2022. The increases were led by the 4.9% registered in the Italian market, followed by a 4.3% increase in the Portuguese market. The smallest increase, 0.9%, was in the Netherlands market. Only two markets, Germany and Belgium, registered declines, 2.0% and 0.1%, respectively.

A similar trend was observed when comparing electricity demand in September and October 2023. Electricity demand increased as most European markets entered the heating season. Increases ranged from 0.4% in Portugal to 7.3% in Great Britain. Only two Southern European markets, Italy and Spain, saw demand decline by 4.8% and 1.6%, respectively, compared to the previous month.

After a historically hot summer this year, October was slightly cooler than the same month in 2022. The decrease in average temperatures ranged from 0.1 °C in Portugal and the Netherlands to 0.8 °C in France. The exception was Italy, where average temperatures increased by 1.1 °C compared to the same period last year. After the seasonal change, average temperatures in October were lower than in September in all analyzed markets. In Southern Europe, decreases ranged from 3.3 °C in Italy to 2.0 °C in Portugal. In the remaining markets, temperature decreases were larger and ranged from 5.6 °C in Germany to 4.7 °C in Belgium and the Netherlands.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the month of October 2023, the monthly average price was below €95/MWh in almost all major European electricity markets. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy. In these markets the averages were €96.55/MWh and €134.26/MWh, respectively. On the other hand, the Nord Pool market of the Nordic countries registered the lowest monthly price, €26.47/MWh. In the other markets, averages ranged from €84.26/MWh in the EPEX SPOT market of France to €90.24/MWh in the EPEX SPOT market of the Netherlands.

In general, prices in the European electricity markets analyzed at AleaSoft Energy Forecasting were fairly stable in October compared to previous months. Compared to September, average prices in October showed a certain downward trend in most European electricity markets. The exceptions were the British market, with a slight increase of 0.7%, the Italian market, with an increase of 16%, and the Nordic market, with a rise of 95%. On the other hand, the MIBEL market of Portugal registered the largest drop, 14%. In the other markets, declines ranged from 5.0% in the French market to 13% in Germany and Spain.

Comparing average prices for the month of October with those registered in the same month of 2022, prices fell in all analyzed markets. In this case, the largest drop, 64%, was in the Nordic market. In the other markets, price declines ranged from 29% in the British, Spanish and Portuguese markets to 53% in the French market.

As a result of the registered price declines, the average of October was the lowest since May in the Iberian market. In the case of Germany, Belgium, France and the Netherlands, the averages were the lowest since July.

In October 2023, the fall in the average gas price and the generalized increase in wind energy production compared to October 2022 led to a year‑on‑year decrease in European electricity market prices. Solar energy production also increased in almost all analyzed markets, contributing to the price decline.

On the other hand, the increase in wind energy production compared to the previous month also contributed to the price decreases registered in most electricity markets compared to September, despite the increase in the average gas price.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $88.70/bbl in October. This was 4.2% lower than the September Front‑Month futures price, which was $92.59/bbl. It was also 5.2% lower than the price of the Front‑Month futures traded in October 2022, $93.59/bbl.

During October, concerns about the evolution of the global economy and demand continued to exert a downward influence on Brent oil futures prices. This resulted in price declines compared to both the previous month and the same month of the previous year. News of the lifting of sanctions on Venezuelan oil also contributed to this behavior. But fears about the effects of instability in the Middle East on oil supply prevented further declines.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the month of October was €47.07/MWh. Compared to the average for the Front‑Month futures traded in the month of September, €36.88/MWh, there was an increase of 28%. Compared to the Front‑Month futures traded in October 2022, when the average price was €135.48/MWh, there was a decrease of 65%.

In October, supply concerns drove prices higher than in the previous month. Labor disputes at Australian liquefied natural gas export plants, a leak in a Baltic Sea pipeline and instability in the Middle East were the main causes of these concerns. But, on the other hand, above‑normal temperatures, abundant liquefied natural gas supplies and high levels of European stocks kept the monthly average well below the October 2022 average. Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price in October of €81.53/t. This represents a slight decrease of 1.7% compared to the previous month’s average, which was €82.95/t. Compared to the October 2022 average for the December 2022 reference contract, €70.49/t, the October 2023 average was 16% higher.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the vision of the future of energy storage

The next webinar in the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen is scheduled for November 16. The webinar will focus on the prospects for European energy markets for the winter 2023‑2024 and the vision of the future for batteries and energy storage. Luis Marquina de Soto, President of AEPIBAL, the Business Association of Batteries and Energy Storage, will participate in this webinar as a guest speaker.

Source: AleaSoft Energy Forecasting.