AleaSoft developed an energy forecasting methodology that is unique, guaranteeing the highest degree of efficiency and accuracy. This methodology has been in use for more than 25 years in some of the most important companies in the energy sector in Europe. More than 400 models that have been obtained with this methodology are in service in different European markets.

AleaSoft supplies electricity and gas markets prices forecasts in the short, medium and long term in most European markets, providing services to traders, retailers, large consumers, utilities, renewable energy developers, banks and investment funds. Main European electricity markets: MIBEL (Spain and Portugal), EPEX SPOT (France, Germany and Austria, Belgium, The Netherlands, Switzerland, Luxembourg and United Kingdom), IPEX (Italy), Nord Pool Spot (Norway, Sweden, Finland, Denmark, Estonia, Lithuania and Latvia), SEM (Ireland), POLPX (Poland), OPCOM (Romania), N2EX (United Kingdom), CROPEX (Croatia), HEnEx (Greece), OTE (Czech Republic), HUPX (Hungary), OKTE (Slovakia), SEEPEX (Serbia), EPEX SPOT SEE (Bosnia and Herzegovina), IBEX (Bulgaria), CSE (Cyprus), BSP Southpool (Slovenia), Landsnet (Iceland), MEMO (North Macedonia), MEX (Malta) and MEPX (Montenegro). AleaSoft also supplies forecasting services in some American markets such as SEN (Chile).

AleaSoft complements the energy prices forecasts with forecasts of other related variables that are also of interest for those interested in the market, such as forecasts of commodity prices (oil, gas, coal, CO2 emissions), demand, production by technology (wind, hydro and solar), meteorological variables, exchange rate, economic indices, and in general of all the variables that influence the energy price.

For the long‑term prices forecasts, the use of renewable energy production penetration scenarios, especially of wind and photovoltaic energy, is of particular interest.

The prices forecasting reports have as output the expected prices values and the confidence bands with the associated probabilities.

AleaSoft offers the following energy price forecasting products and services:

AleaSoft offers price forecasting services at the long term for European markets. Price forecasts have an hourly granularity and 30 years of horizon. The main variables that are taken into account to generate the price forecasts are:

In addition, plans to increase the interconnection capacity between the main European electricity markets are taken into account and thus the convergence of market prices is taken into account.

Forecasts are generated using all registered data available at that time.

The forecasts take into account the scenarios for the dissemination of new and existing technologies (electric vehicles, batteries, self-consumption, heat pumps, etc.) and their impact on the demand volume and the hourly profile of the price curve.

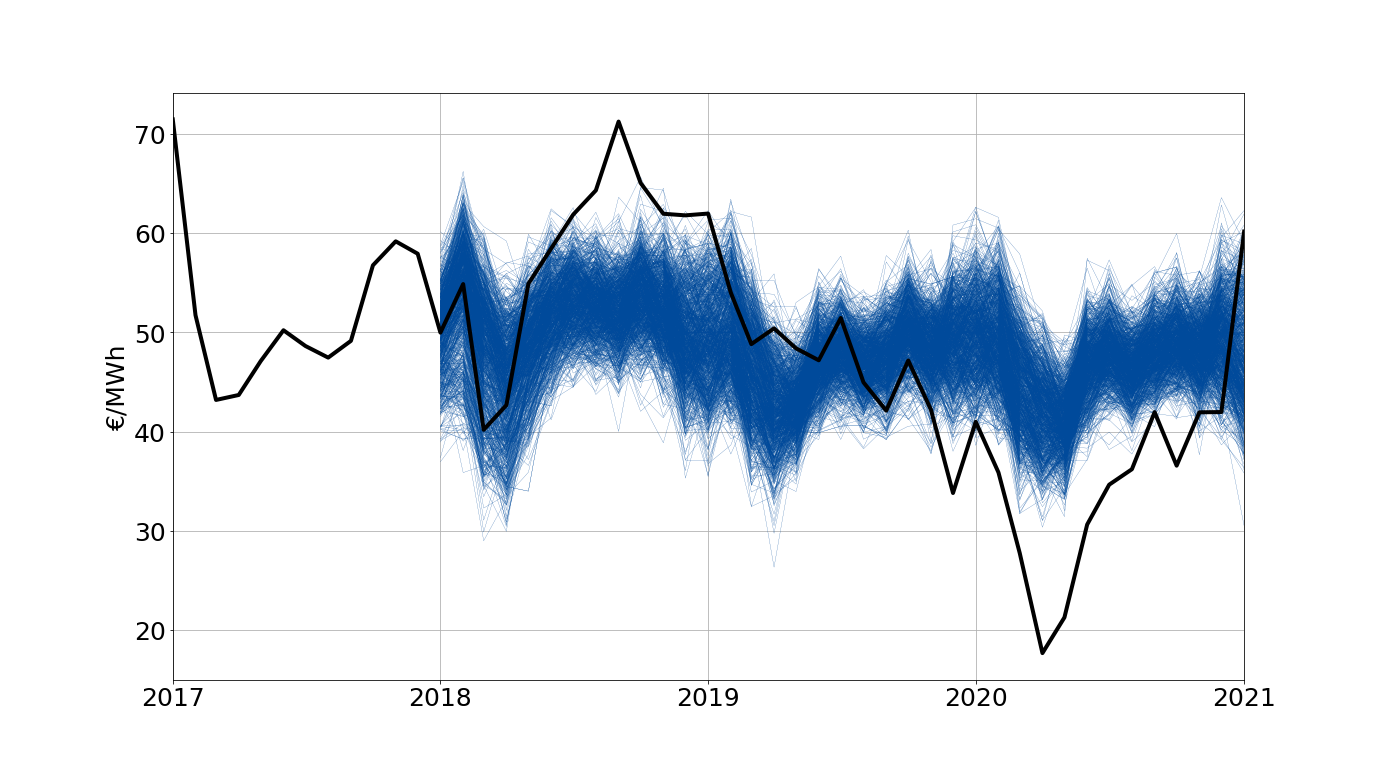

The forecasts include the maximum and minimum confidence bands with annual granularity. The calculation of the bands is made using a sufficiently large number of price simulations generated from random simulations of the explanatory variables, taking into account the probability associated to each simulation of the variables. The variability and the probability of occurrence of each simulation of the variables is be determined by their past behavior and by the realistic future scenarios of the variable.

In a PPA (Power Purchase Agreement), having reliable price forecasts at the long-term is essential for all parties involved: investors, manufacturers, installers, managers, producers and consumers.

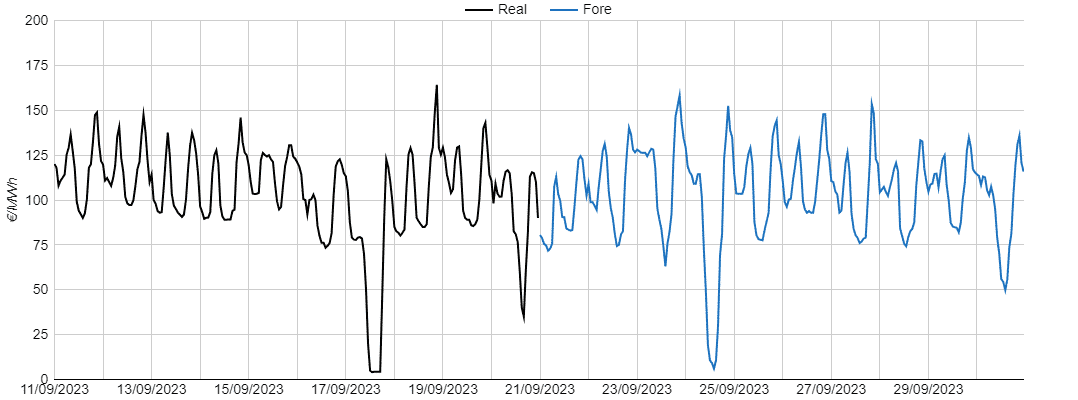

The AleaSoft’s short‑term energy markets prices forecasts have a 10‑day horizon with an hourly interval. The short‑term forecasts are essential for any actor that participates in the daily market: producers, direct consumers, retailers, traders, etc. The forecasts are offered in product format and service format. The product format consists of the installation of an application that works automatically, both for updating the data and for obtaining the forecasts. The service format consists of the daily sending of the updated forecasts of the prices and of the main explanatory variables. The main explanatory variables used in the short‑term energy markets prices forecasts are the demand, which in turn uses temperature and labour as explanatory variables, and the production of the different technologies, including wind, solar, hydroelectric and nuclear energy. In addition, the price forecasts of the interconnected countries are taken into account and the forecast is optimised with the available exchange capacity in the international interconnections.

The AleaSoft‘s electricity market prices simulations service includes 1000 price simulations with a horizon of up to three years and hourly or monthly granularity. These simulations are an essential input for advanced analysis for the risk management and allow obtaining probability distributions, Value-at-Risk estimates and confidence bands. All this with a completely scientific based probabilistic metric.

To obtain the price simulations, 1000 simulations of the following explanatory variables are carried out, taking into account the most probable average scenarios, the historical variability, the expected variability and the temporal correlations between them:

Copyright ©2024 Alea Business Software S.L.