January 5th, 2018.‑ The Spanish wholesale electricity market operated by OMIE ended 2017 as the most expensive year since 2008 with an average price of 52.24 €/MWh, 12.57 €/MWh higher than 2016. There are three key factors that explain this increase of the price: on one hand, there is the increase of the electricity demand by 1.1%, making this the third consecutive year with an increase of the demand.

On the other hand, the fall of the production from renewable sources, led by the hydroelectric production, that produced electricity with the reservoirs at historical minimums levels. But also with the wind energy that had a first half of the year historically low, with a production similar to the one of the first half of 2012, when the installed wind power was still increasing.

And finally, the increase of the electricity exports to France at the beginning and the end of the year, due to the increase of the demand in the neighboring country, together with the shutdown of various of their nuclear plants that are the main electricity source in the country.

Evolution of the most important variables of the Spanish market in 2017

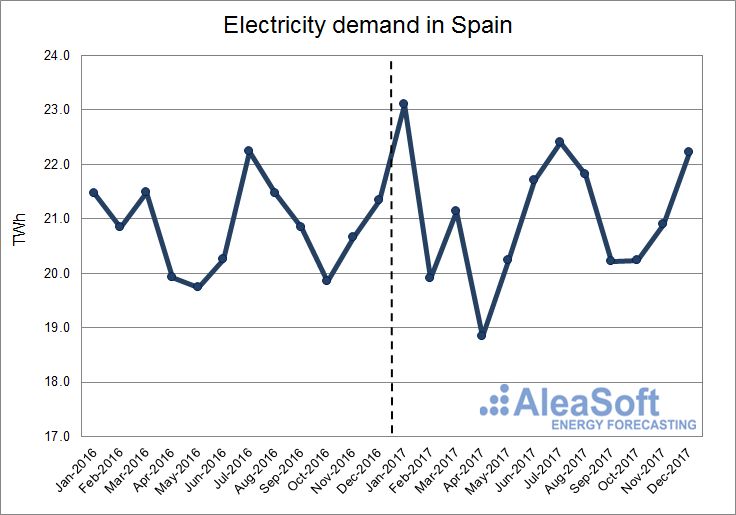

According to data published by REE (Red Eléctrica de España), the electricity demand in mainland Spain in 2017 increased 1.1% compared to 2016. Once the effects of temperature and working patterns are corrected, provisional data from REE suggest that the increase could be around 1.6%, because the warner temperatures registered between February and April, around 1.0°C higher than in 2016, moderated the increase of the demand. The Spanish economy is expected to grow 3.1% in the year just completed. This data makes this year the third consecutive year with an increase of the demand.

January and June registered the largest monthly year-on-year demand increases, 7.6% and 7.2% respectively, mainly due to the temperature differences with the previous year: 3.1°C lower in January, and 2.1°C higher in June.

Evolution of electricity demand in Spain.

Data source: REE.

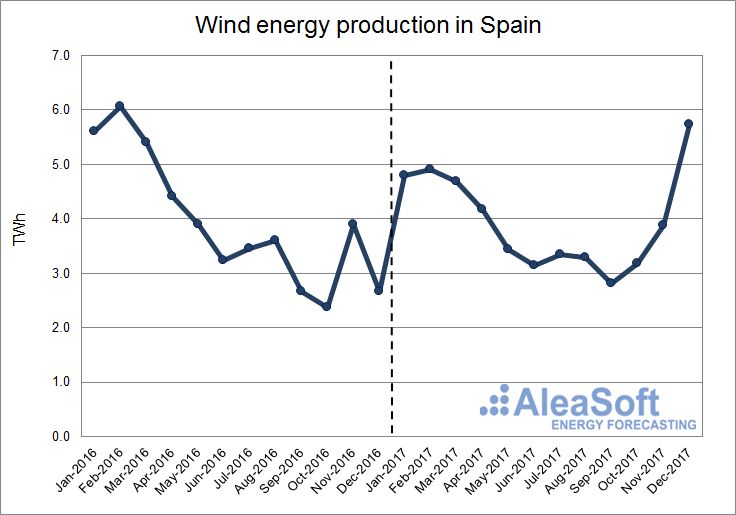

Wind energy production slightly increased by 0.2% in 2017. This increase was achieved thanks to the large increase of the production occurred in December, 114,7% year-on-year, while the trend in the first three quarters of the year was downwards compared to 2016. The very low wind energy production during most of 2017 was one of the key factors, together with the hydroelectric production, of the rise of the price in the wholesale market.

According to data published by REE, up to November, the wind power in mainland Spain decreased 47.1 MW in 2017.

Evolution of wind energy production in Spain.

Data source: REE.

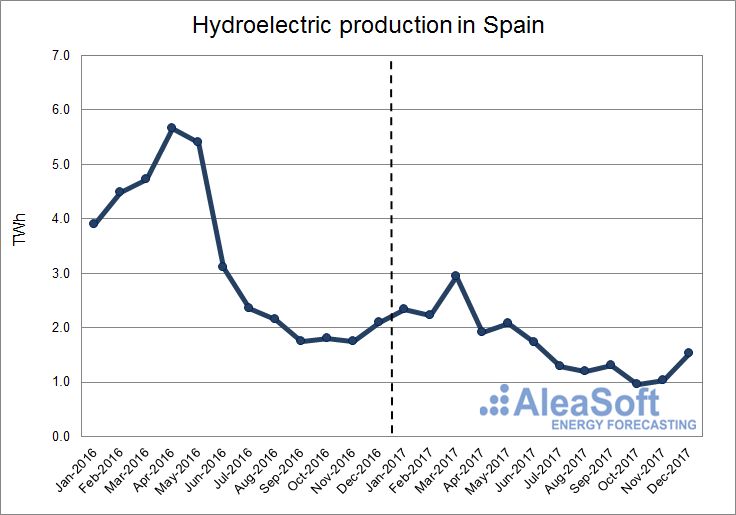

2017 was the second year with lowest hydroelectric production of the last decade with 20 537 GWh, only surpassed by 2012 that produced 19 180 GWh. However, 2017 did have quarterly minimum records of hydroelectric production: the third and the fourth quarters of the year were the ones with the lowest production of, at least, the last eleven years.

Compared to 2016, the decrease of the hydroelectric production was 47.6%. This decrease of the hydroelectric production was the main factor of the rise of the electricity price in the wholesale market.

Evolution of hydroelectric production in Spain.

Data source: REE.

Nuclear production during 2017 slightly decreased by 0.9% compared to 2016. The nuclear power in Spain decreased 455 MW this year due to the permanent shutdown of the nuclear plant in Santa María de Garoña, although it was already not connected to the network since 2012.

Evolution of nuclear production in Spain.

Data source: REE.

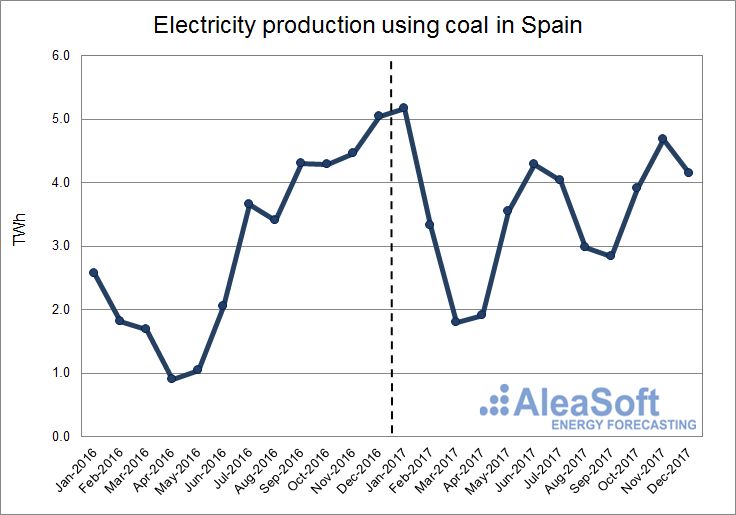

The generation of electricity using coal grew 21.1% in 2017. This year-on-year growth had two clearly different parts: during the first half of the year, the coal-fired plants had to fill the thermal gap left by the decrease of the production of the main renewable sources (hydroelectric and wind energy) and the increase of the electricity exports to France to meet the demand during the shutdown of several nuclear plants. During this first half of the year, the electricity production using coal increased 99.1% compared to the first half of 2016.

By contrast, during the second half of the year, the recovery of the renewable energy production and a larger production of the combined cycles, made the production with coal decrease 10.2% compared to the second half of 2016.

Evolution of electricity production using coal in Spain.

Data source: REE.

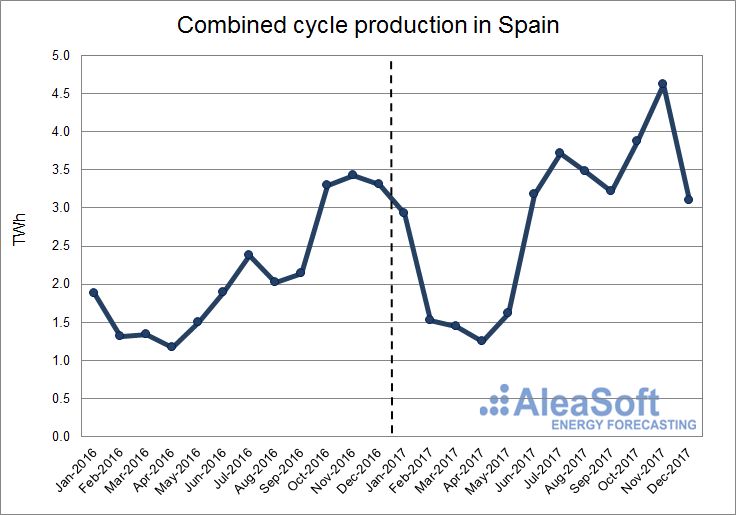

This year, the electricity production of the gas-fired combined cycles increased 32.2% compared to the previous year. The largest year-on-year increase was in the third quarter, 58.9%, when the production of the coal-fired plants decreased but the production of the combined cycled remained stable, in part, due to the increase of the price of the coal.

Evolution of combined cycle production in Spain.

Data source: REE.

Solar photovoltaic production grew 4.8% in 2017. According to data published by REE, up to November, 2.8 MW of this technology were installed in mainland Spain in 2017.

Evolution of solar photovoltaic production in Spain.

Data source: REE.

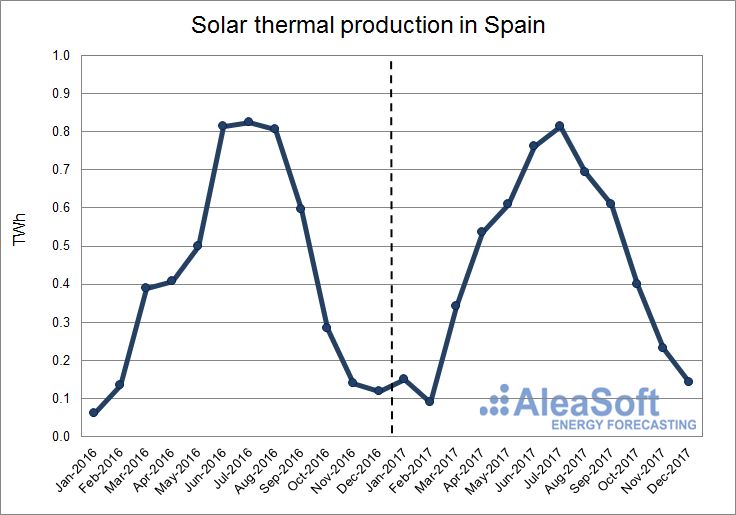

The solar thermal production also registered an increase of 5.9% in 2017. January stands out with a year-on-year increase of 149.0% of the production.

According to data published by REE, up to November, no MW of this technology were installed, and 2017 is already the fourth year in a row without a single MW of solar thermal power installed.

Evolution of solar thermal production in Spain.

Data source: REE.

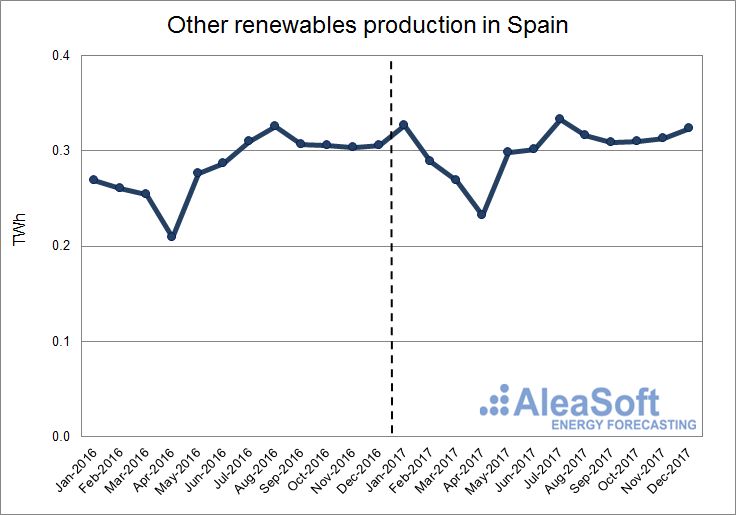

Other renewable technologies, including biogas, biomass, offshore hydroelectric and geothermal, increased their production 6.0% in 2017. This increase was favored by the year-on-year increase during the first half of the year, 10.2%, while in the second half of the year, it was only 2.5%.

According to data published by REE, until November, the net balance of installed power of these technologies during 2017 was ‑7.4 MW.

Evolution of production using other renewable technologies in Spain.

Data source: REE.

Cogeneration production showed an increase of 8.9% in 2017, although the installed power decreased 42.5 MW, according to provisional data published by REE until November.

Evolution of cogeneration production in Spain.

Data source: REE.

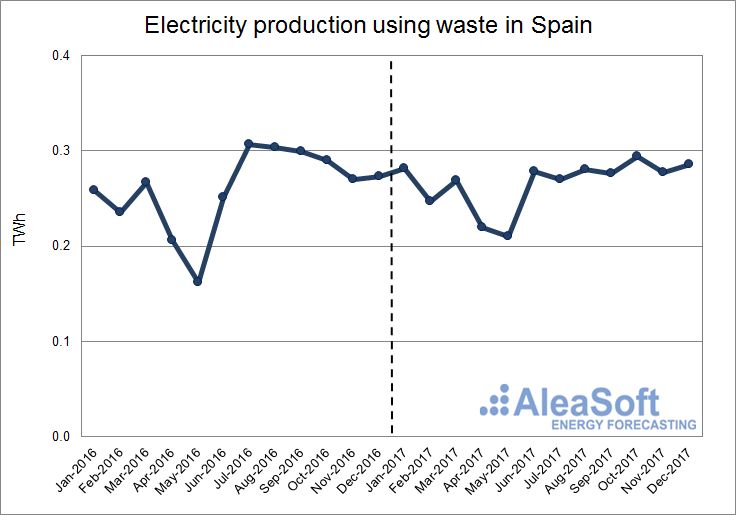

Production using waste increased 2.2% this year. The largest year-on-year increase of the production was registered in May, 30.1%, while the largest decrease was in June, -12.1%.

Evolution of electricity production using waste in Spain.

Data source: REE.

Prices of fuels for electricity generation

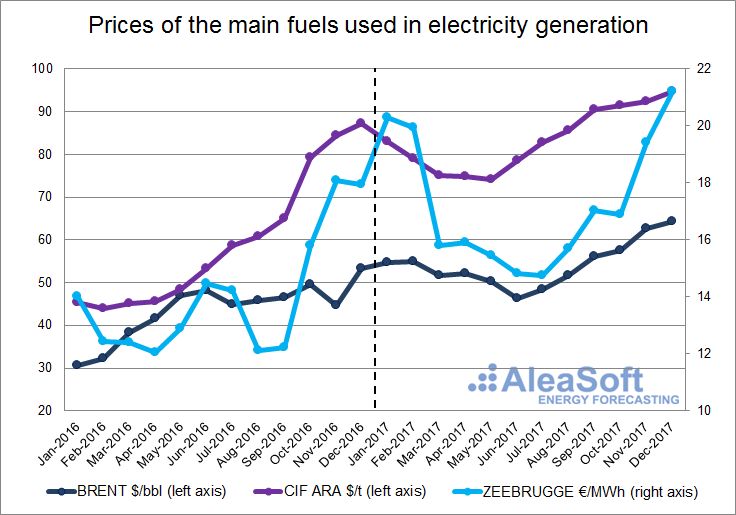

In general, the prices of the main fuels used in electricity generation increased in 2017, mainly during the second half of the year. All of them, Brent oil, CIF ARA coal and Zeebrugge gas, ended the year at higher prices than the end of 2016.

Zeebrugge gas price bottomed in July with a monthly average of 14.74 €/MWh. Then, it started a recovery that brought the price up to 21.20 €/MWh on average in December. The average price of the gas during the 2017 was 17.25 €/MWh.

In September, the barrel of Brent oil reached an average price of $56.15, and beat the monthly maximum of 2017 at that time that was February with $54.87. Then, it kept rising up to $64.37 on average in December. The average price of the Brent barrel during the 2017 was $54.16.

The price of the European coal CIF ARA, that started the year near 83 $/t, kept a slightly downwards trend during the first half of the year. The recovery started in the third quarter, and in December it reached an average price of 94.68 $/t. The average price of the ton of coal during 2017 was $83.49.

Evolution of the price of the main fuels used in electricity generation.

Data source: BRENT – EIA, CIF ARA – EEX, ZEEBRUGGE- NetConnect Germany.

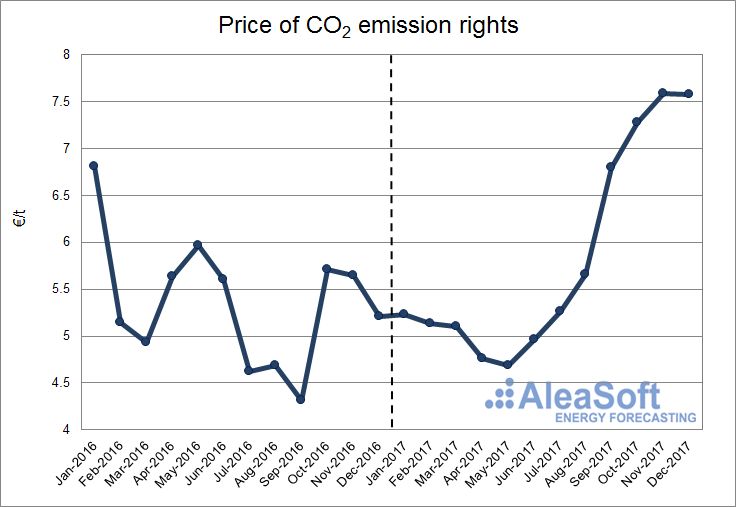

Price of CO2 emission rights

The price of the CO2 emission rights had a similar behavior to that of the price of the fuels for electricity generation. In the first half of the year the price fell down to 4.69 €/t on average in May, and then it started to recover up to 7.59 €/t on average in November, and slightly decreased in December with an average price of 7.57 €/t. The average price of the emission rights during 2017 was 5.84 €/t.

Evolution of the price of CO2 emission rights.

Data source: EEX.

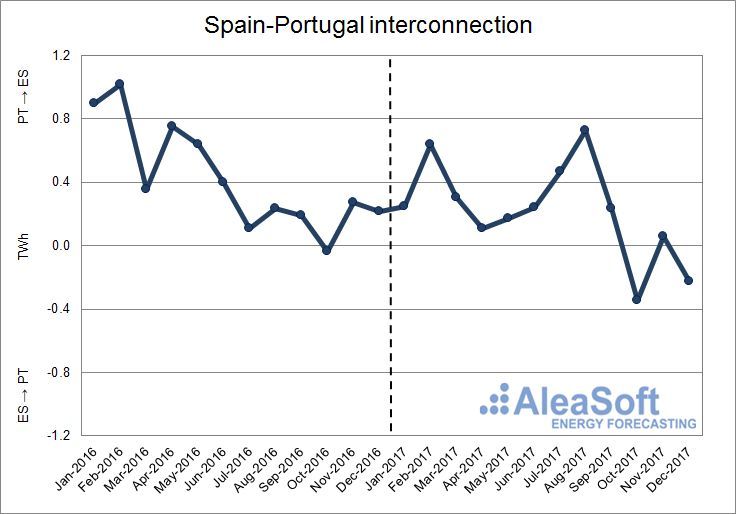

Spain – Portugal interconnection

In all the months of the first three quarters of 2017, the net balance of electricity exchanges between Spain and Portugal placed Spain as a net importer with a balance of 3 134 GWh of electricity imported from Portugal. In the last quarter of the year, the trend was reversed and Spain exported more electricity to Portugal than it imported.

The global balance of the year was 2 625 GWh imported from Portugal.

Evolution of the monthly net balance of the interconnection between Spain and Portugal. Positive values indicate that Spain imports electricity from Portugal, while negative values indicate that Spain exports electricity to Portugal.

Data sources: ENTSO-E and REE.

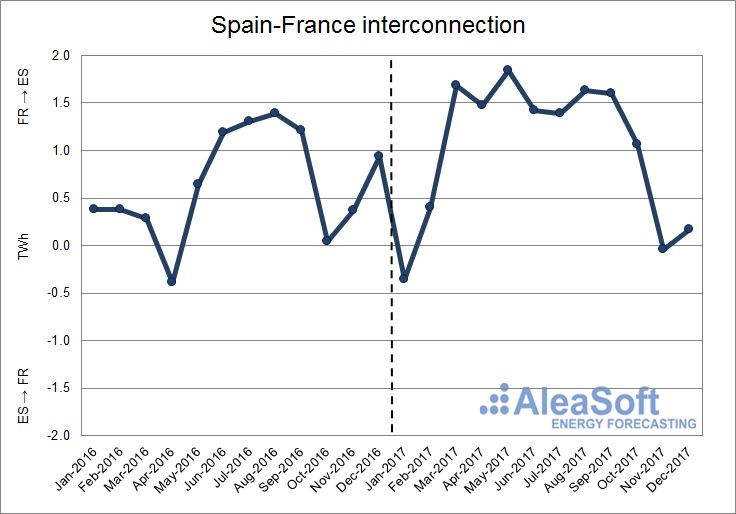

Spain – France interconnection

The net balance of electricity exchanges between Spain and France during 2017 placed Spain as a net importer with 12 278 GWh imported from France. January and November were the only months with an exporting balance for Spain, with 354 GWh and 46 GWh respectively, as the demand from France increased due to the shutdown of several of their nuclear power plants and the decrease of the temperatures.

Evolution of the monthly net balance of the interconnection between Spain and France. Positive values indicate that Spain imports electricity from France, while negative values indicate that Spain exports electricity to France.

Data sources: ENTSO-E and REE.

The Spanish electricity day-ahead market price

The average price of the day-ahead electricity market operated by OMIE in Spain in 2017 was 52.24 €/MWh, and places this year as the most expensive since 2008, when the market framework was quite different, with much less renewable power and the oil price much higher.

The lowest hourly price registered this year occurred in April 30th between 3pm and 5pm and was 2.30 €/MWh. On the other hand, the highest hourly price of the year was 101.99 €/MWh that was registered between 8pm and 9pm in January 25th in the midst of the French nuclear flu.

In all months of 2017, but December, the monthly average price was higher than the same month of 2016. The largest year-on-year differences were in January, 34.96 €/MWh more than January 2016, because of the increase of the production due to the electricity exports to France.

Evolution of Price of the Spanish electricity day-ahead Market.

Data sources: OMIE.

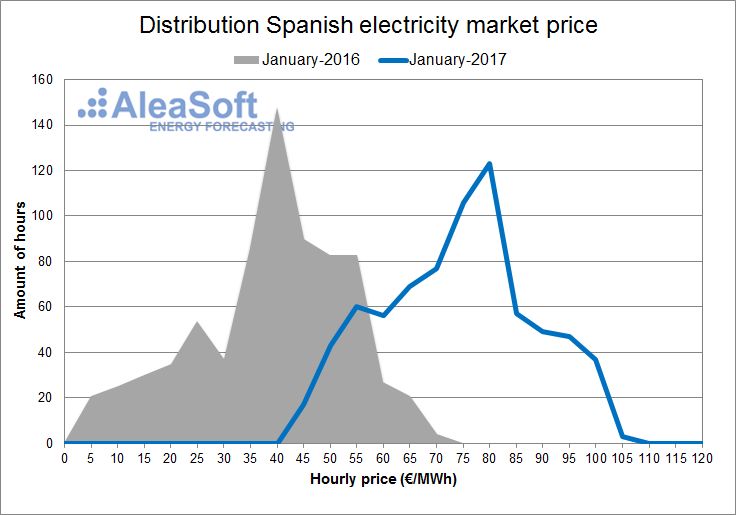

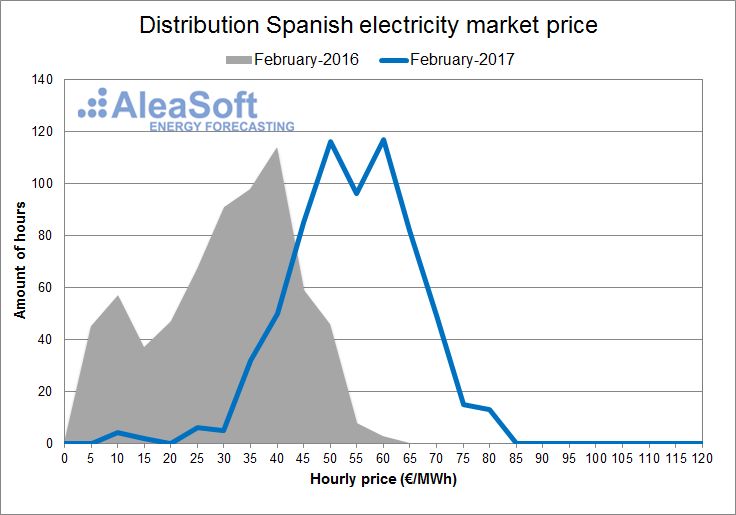

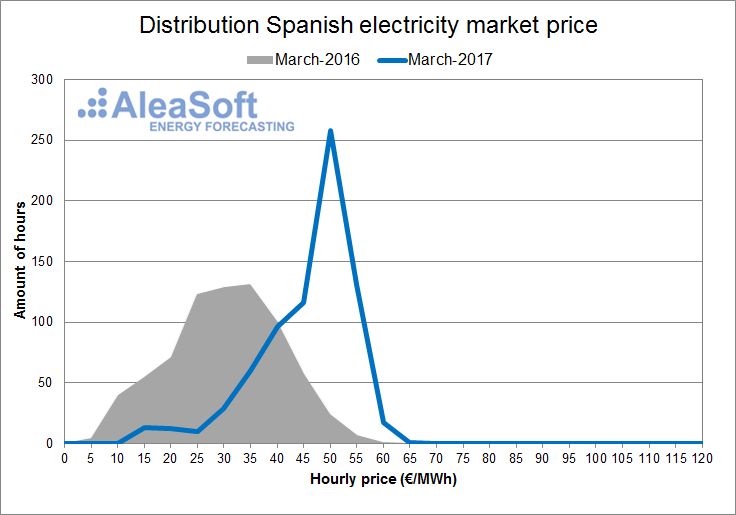

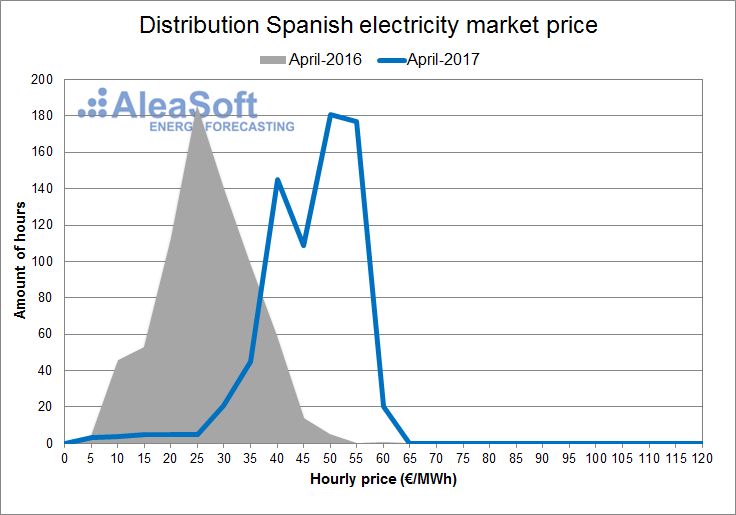

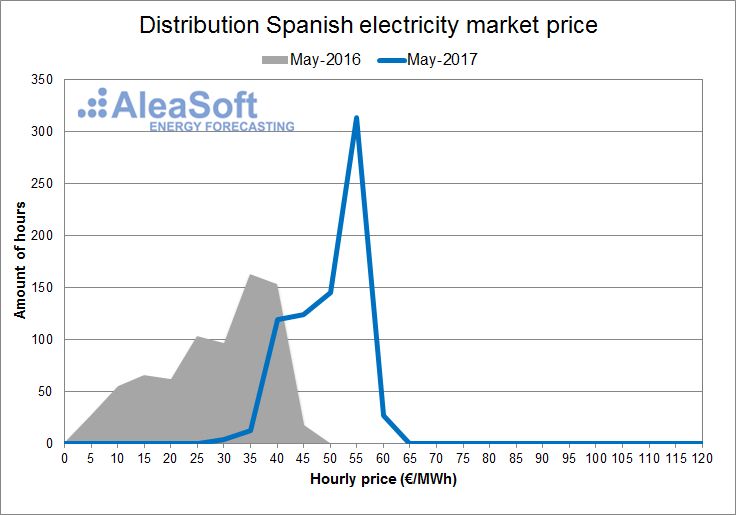

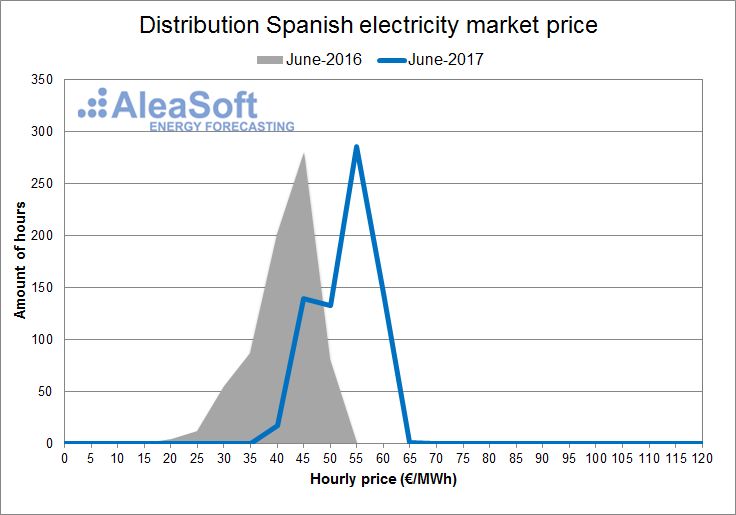

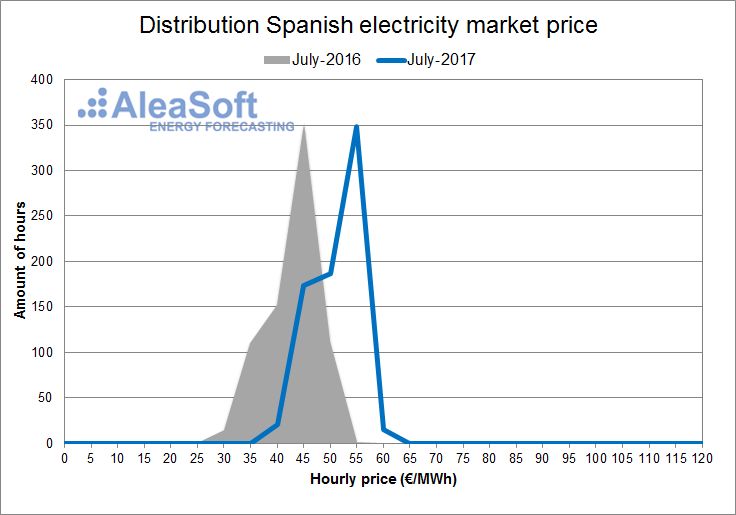

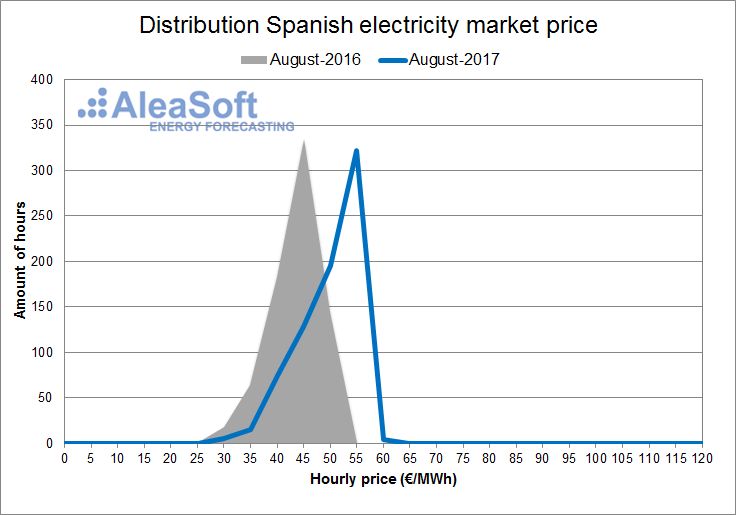

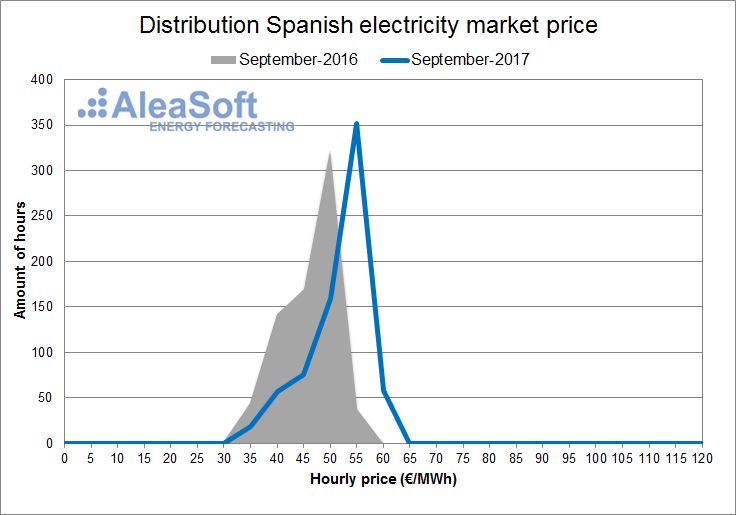

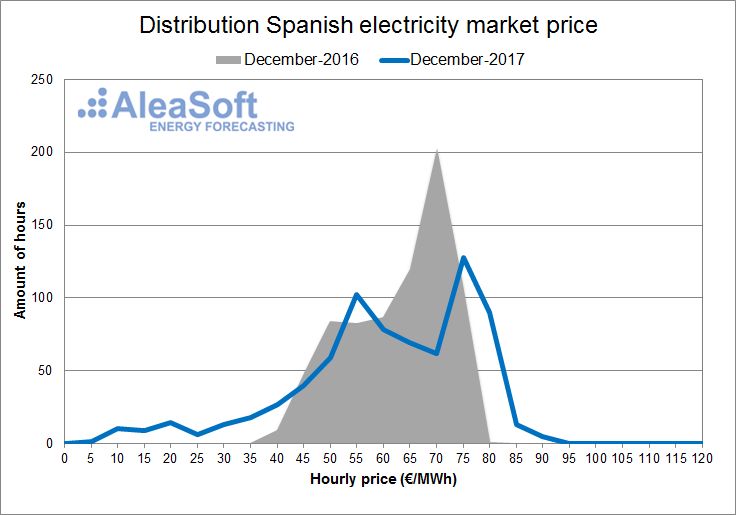

In the graphs showing the distribution of Spanish electricity market hourly price for each month of 2017, one can clearly see that, in most of the months, the prices are shifted towards higher values than in 2016.

Distribution of the hourly price of the Spanish day-ahead market.

Data sources: OMIE.

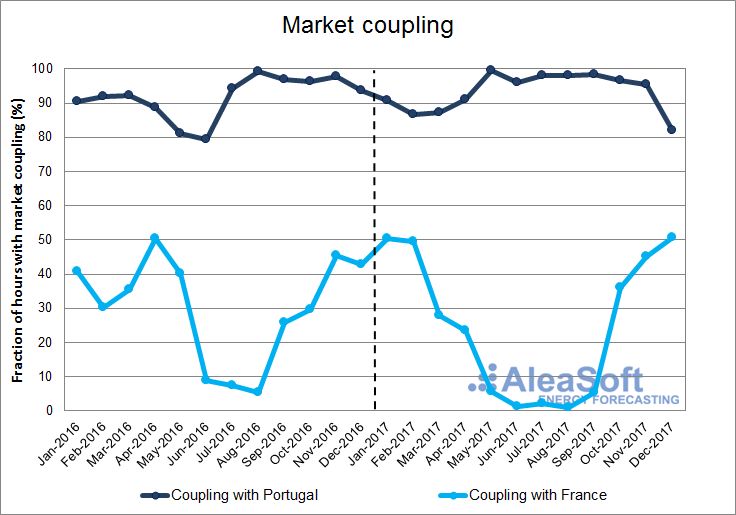

In 2017, the coupling with the Portuguese market occurred the 93% of the hours, while the coupling with the French market only occurred the 25% of the hours.

Evolution of the monthly fraction of hours with market coupling with Portugal and with France.

Data sources: Prepared by AleaSoft from data published by OMIE.