AleaSoft Energy Forecasting, April 3, 2023. In the first quarter of 2023, European electricity markets prices decreased compared to the previous quarter and to the same quarter of 2022, due to the decrease in gas prices and the increase in renewable energy production. The solar photovoltaic energy production reached record values in Spain and Portugal. The wind energy production did so in Germany, France and Italy. Gas and Brent registered the lowest settlement prices since 2021, while CO2 reached a historical maximum.

Solar photovoltaic and thermoelectric energy production and wind energy production

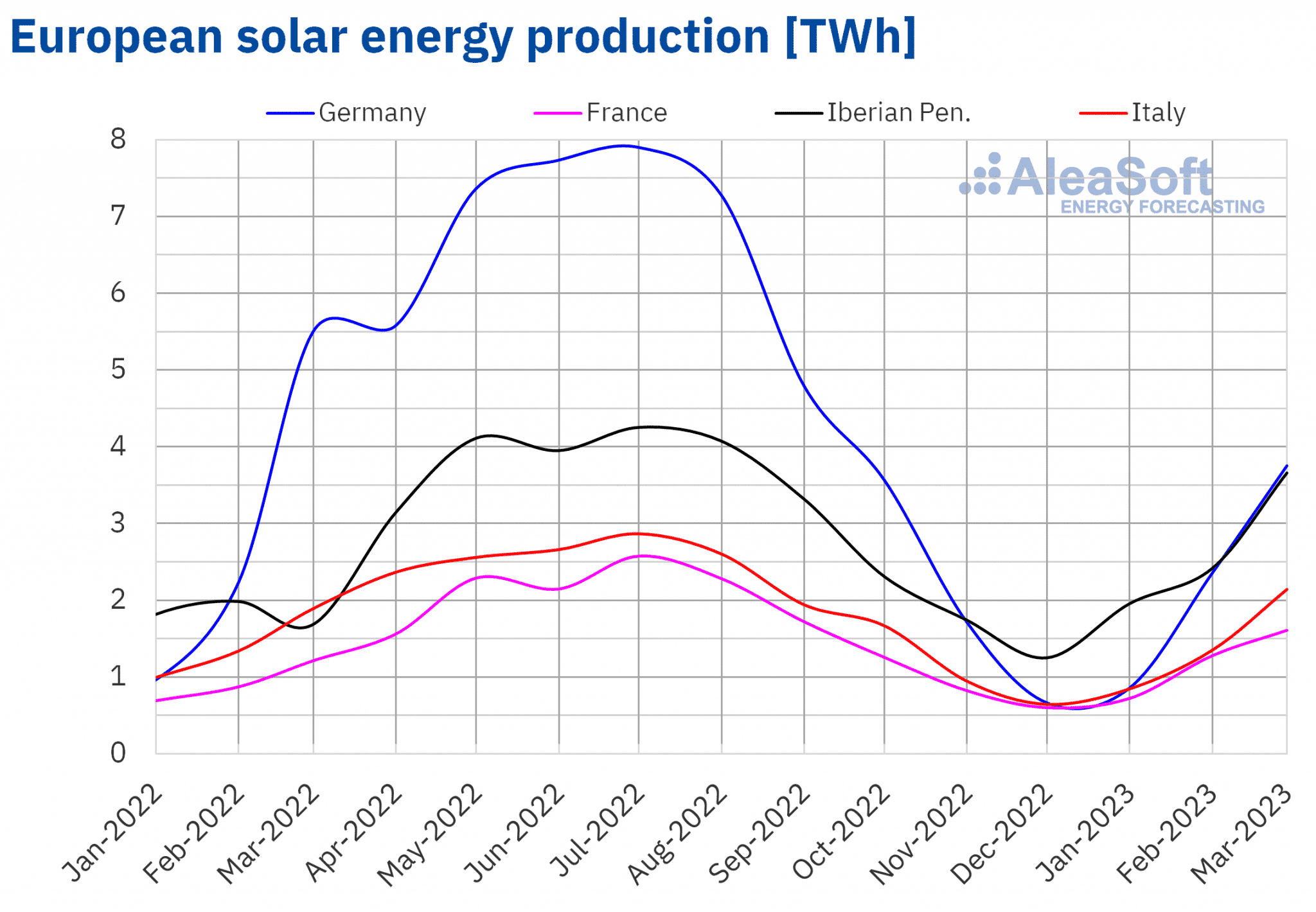

The solar energy production increased in the first quarter of 2023 in year‑on‑year terms in almost all markets analysed at AleaSoft Energy Forecasting. The exception was the German market with a 20% drop. On the other hand, the largest rise, of 46%, was reached in both Spain and Portugal. In the case of France, the increase was 30%, while in Italy the smallest increase in production, of 2.6%, was registered.

In comparison with the last quarter of 2022, the solar energy production of the first quarter of 2023 increased in all analysed markets. In this case, the largest rise was that of Portugal, which reached 58%. The increases in production in Spain, France and Italy were also important, of 48%, 35% and 33%, respectively. On the other hand, the smallest increase, of 17%, was registered in the German market.

According to REE data, in the first quarter of 2023, the increase in solar photovoltaic capacity of Mainland Spain compared to the installed capacity at the end of 2022 was 323 MW, a rise of 1.7%. In the case of Portugal, according to REN data, the installed solar capacity increased by 3.8% compared to December 2022, rising by 73 MW.

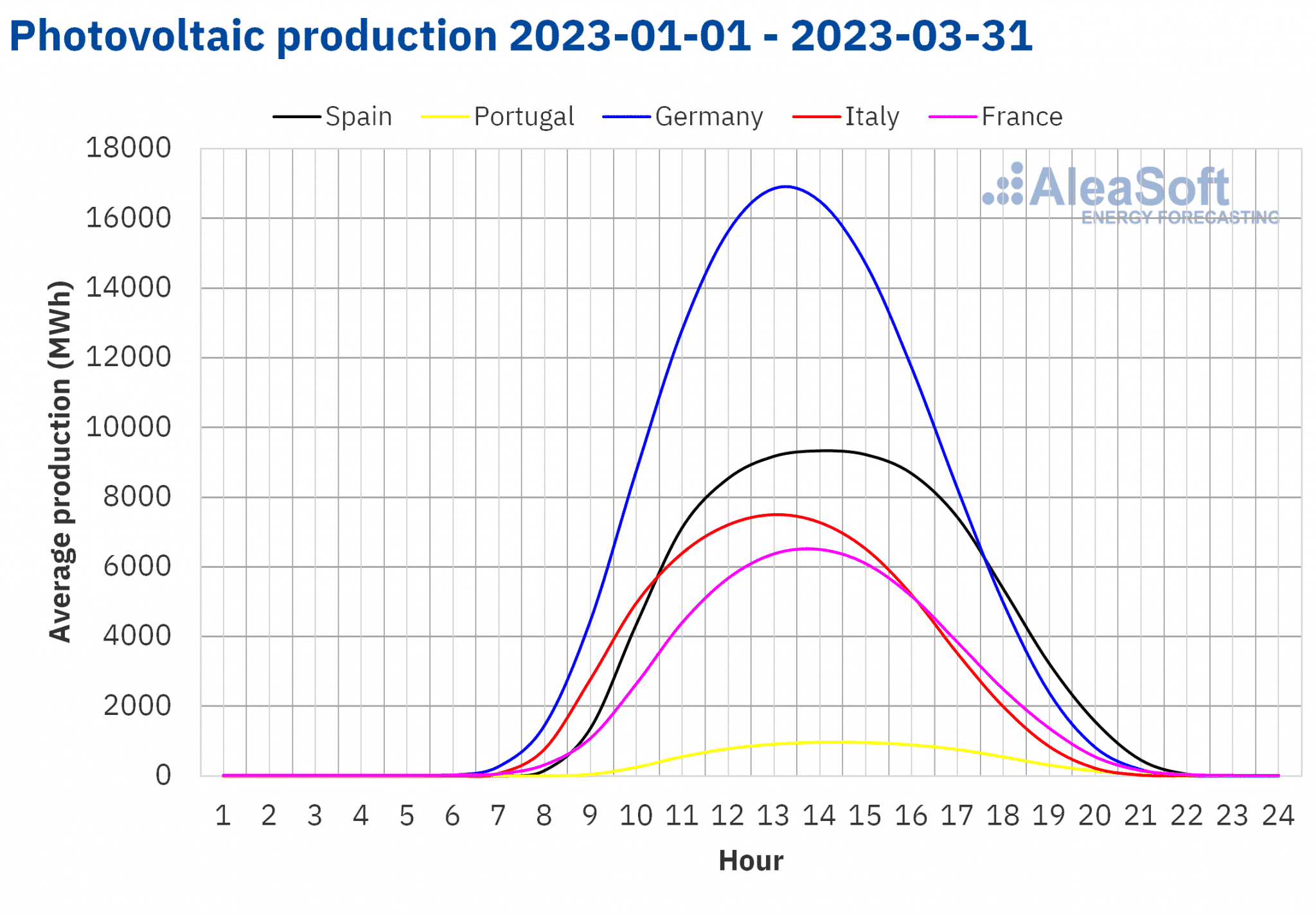

On the other hand, the Spanish photovoltaic energy generation registered a record value, of 14 308 MWh, on Tuesday, March 28, from 13:00 to 14:00. In the case of Portugal, the historical maximum photovoltaic energy generation, of 1592 MWh, was reached on Sunday, April 2, also from 13:00 to 14:00.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

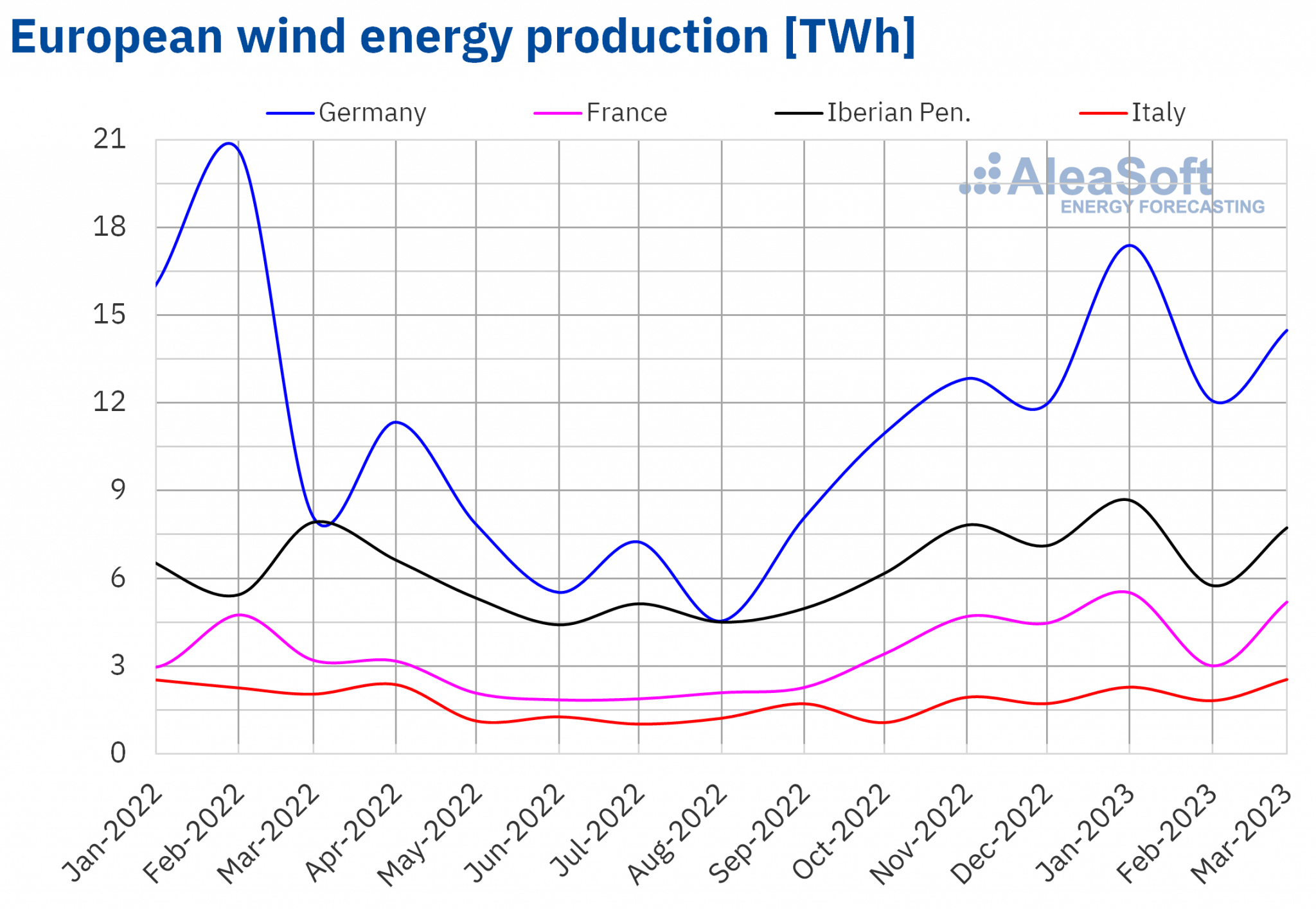

In the case of the wind energy production of the first quarter of 2023, a year‑on‑year rise of 26% was registered in France. In the case of the Spanish market, the production increased by 14%, while in the Portuguese market the increase compared to the previous year was 0.6%. On the other hand, in the markets of Germany and Italy, decreases of 1.9% and 2.7% were registered, respectively.

The production of the first quarter increased in almost all analysed European markets compared to that of the previous quarter. The exception was the Portuguese market with a decrease, of 9.5%. On the other hand, the largest increase in production was that of the Italian market, of 41%, followed by that of the German market, of 23%. In the case of the Spanish and French markets, the increases were smaller, 8.0% and 9.0%, respectively.

According to REE data, in the first quarter of 2023 the wind energy capacity increased in Mainland Spain by 88 MW, 0.3%, compared to the installed capacity at the end of 2022.

On the other hand, the German wind energy production reached a historical maximum of 50 399 MWh on January 14, from 19:00 to 20:00. In March, record values were reached in France and Italy. In France, a record wind energy production of 16 597 MWh was reached on Friday, March 10, from 10:00 to 11:00. In the case of Italy, the wind energy generation reached a historical maximum value of 8290 MWh also on March 10, from 17:00 to 18:00, and on March 15, from 15:00 to 16:00.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

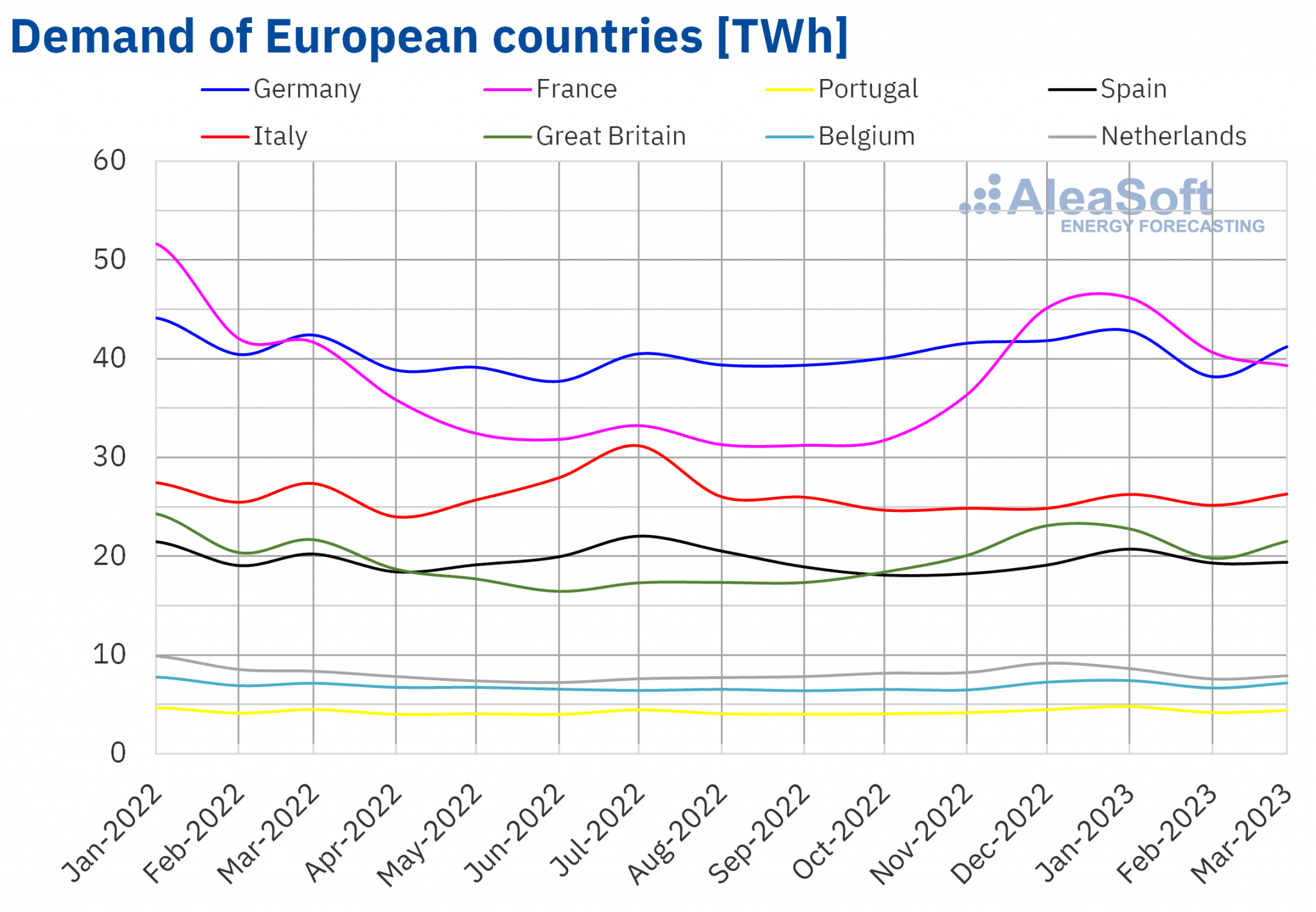

During the first quarter of 2023, year‑on‑year decreases in electricity demand were registered in almost all analysed European markets. The exception was the Portuguese with an increase of 0.9%. On the other hand, the largest fall was that of the Dutch market, of 10%. In the rest of the analysed markets, the year‑on‑year decreases in electricity demand were between 2.2% of the Spanish market and 6.8% of the French market.

In contrast, compared to the last quarter of 2022, the electricity demand increased in most analysed markets. In this case, the exceptions were the markets of Germany and the Netherlands, where the demand fell by 1.0% and 5.7%, respectively. On the other hand, the largest rise in electricity demand compared to the previous quarter, of 11%, was registered in France. In the rest of the markets, the increases in electricity demand were between 4.1% of Great Britain and 6.5% of Spain.

The increase in electricity demand in the first quarter of 2023 compared to the previous quarter was influenced by the general decrease in average temperatures. The maximum decrease in average temperatures, of 4.8 °C, was that of Spain, where the second highest percentage rise in demand was reached compared to the previous quarter. On the other hand, average temperatures were slightly higher than those of the same quarter of the previous year in most analysed markets. This contributed to the year‑on‑year declines in electricity demand.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

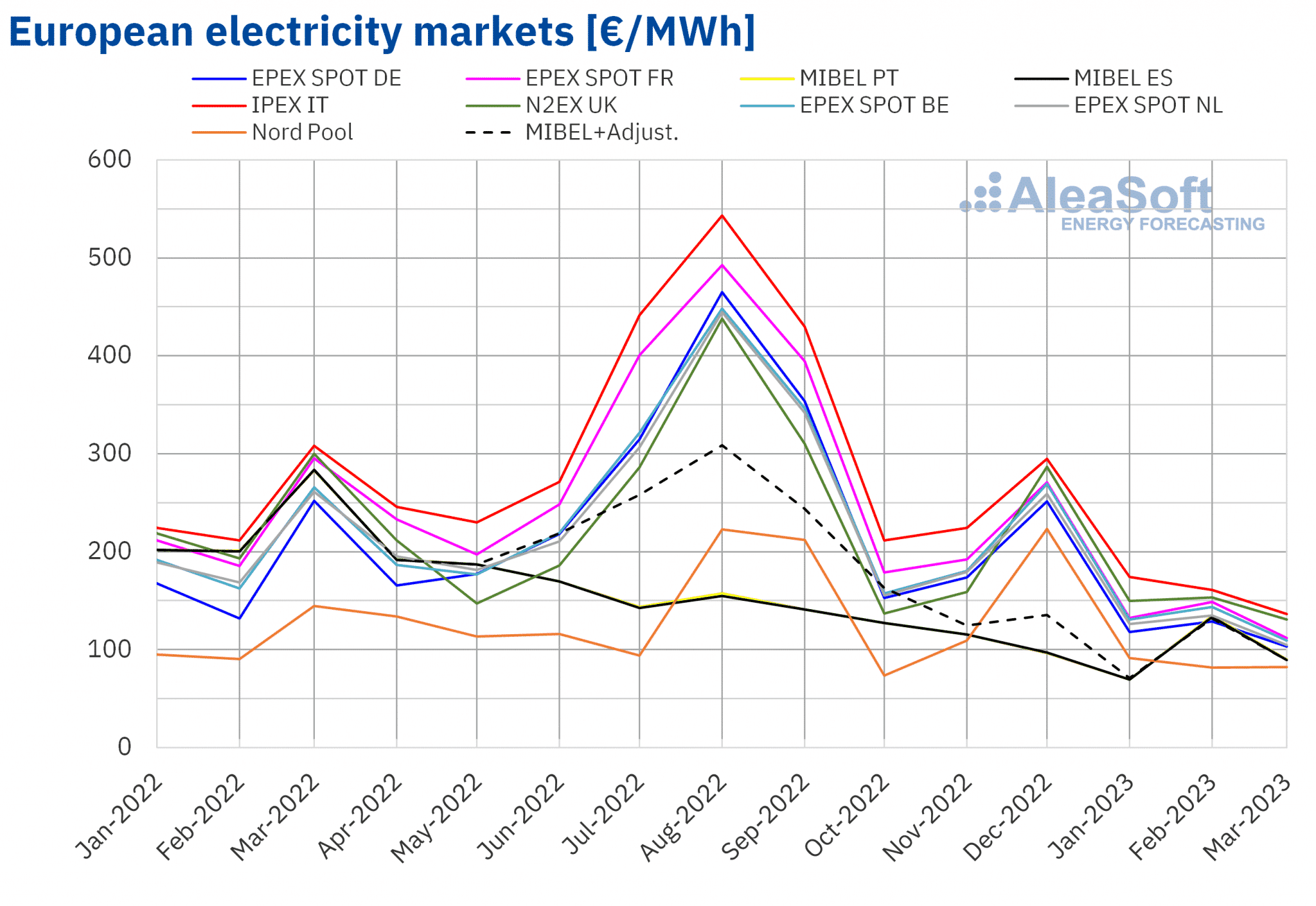

European electricity markets

In the first quarter of 2023, the quarterly average price remained below €130/MWh in most European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the averages of the EPEX SPOT market of France, the N2EX market of the United Kingdom and the IPEX market of Italy, of €130.35/MWh, €144.24/MWh and €157.20/MWh, respectively. On the other hand, the lowest quarterly price, of €85.23/MWh, was registered in the Nord Pool market of the Nordic countries. In the rest of the markets, the averages were between €96.38/MWh of the MIBEL market of Spain and €127.42/MWh of the EPEX SPOT market of Belgium.

Compared to the previous quarter, in the first quarter of 2023 average prices fell in all European electricity markets analysed at AleaSoft Energy Forecasting. The largest fall, of 40%, was that of the German market, while the smallest decreases, of 14% and 15%, were registered in the markets of Portugal and Spain, respectively. The rest of the markets registered price decreases of between 26% of the British market and 39% of the French and Dutch markets.

If average prices of the first quarter of 2023 are compared with those registered in the same quarter of 2022, prices also decreased in all markets. The largest fall was that of the Spanish and Portuguese markets, of 58%. On the other hand, the smallest decrease was that of the Nordic market, of 23%. In the rest of the markets, the decreases were between 37% of the German and Italian markets and 44% of the French market.

On the other hand, these price decreases resulted in the price of the first quarter of 2023 being the lowest since the second quarter of 2021 in the British, Spanish and Portuguese markets. In the rest of the analysed markets, prices of the last quarter were the lowest since the third quarter of 2021.

In the first quarter of 2023, the decrease in gas prices compared to those of the previous quarter, the general increase in solar energy production and the increase in wind energy production in almost all markets led to the decrease in European electricity markets prices compared to the last quarter of 2022, despite the increase in CO2 emission rights prices and demand in most markets.

When comparing with the first quarter of 2022, the decrease in gas prices and the increase in renewable wind and solar energy production in most markets also favoured the decrease in electricity markets prices. In this case, in addition, the electricity demand fell in almost all markets, contributing to the year‑on‑year price declines.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

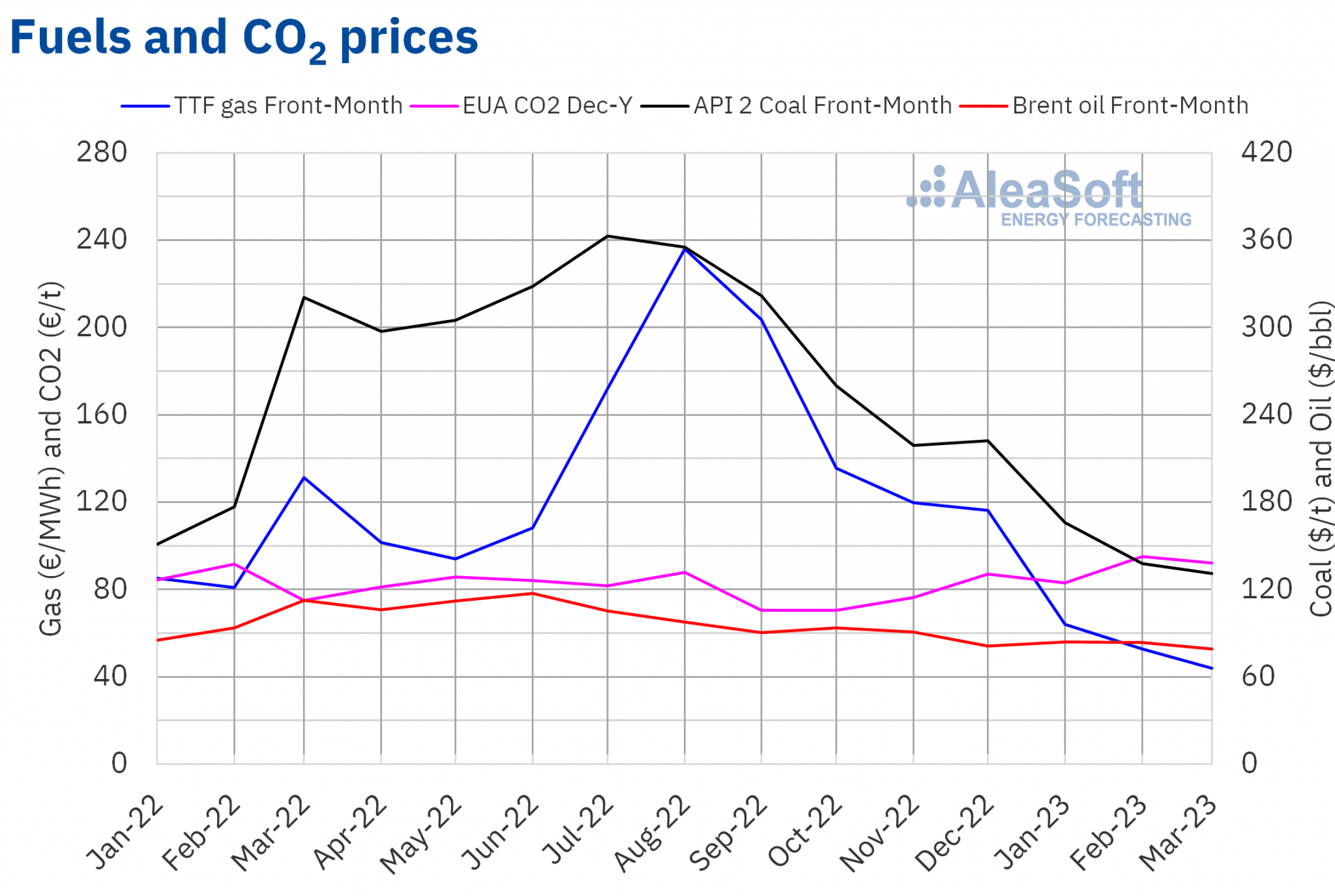

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a quarterly average price of $82.18/bbl in the first quarter of 2023. This value was 7.3% lower than that reached by the Front‑Month futures of the previous quarter, of $88.67/bbl. It was also 16% lower than the price corresponding to Front‑Month futures traded in the first quarter of 2022, of $97.90/bbl.

In the first quarter of 2023, despite expectations of demand recovery in China, Brent oil futures prices continued to be influenced by concerns about the evolution of the economy and its effect on the demand. However, the supply disruptions caused by the earthquake in Turkey that occurred in February, the rise in Saudi Arabia’s official prices for the Asian market and the Russian plans to cut its production and exports in March exerted their upward influence on prices, which remained above $80/bbl for most of the quarter. But, in March, the banking instability increased concerns about the economy and the lowest settlement prices in the quarter were registered. The quarterly minimum settlement price, of $72.97/bbl, was reached on March 17 and it was the lowest since December 2021.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the first quarter of 2023 for these futures was €53.41/MWh. Compared to that of the Front‑Month futures traded in the previous quarter, of €123.74/MWh, the average fell by 57%. If compared with the Front‑Month futures traded in the same quarter of 2022, when the average price was €100.71/MWh, there was a 47% decrease.

As a consequence of the decreases registered during the first quarter of 2023, in the second half of March, settlement prices were below €40/MWh on two occasions. On March 20, the quarterly minimum settlement price, of €39.32/MWh, was reached, which was the lowest since July 2021.

During the first quarter of 2023, the levels of European reserves and the abundant supply of liquefied natural gas by sea allowed the decrease in TTF gas futures prices. Average temperatures less cold than the previous year in most European countries also contributed to this behaviour.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price of €89.92/t in the first quarter of 2023, 15% higher than the average of the previous quarter, of €78.39/t. If compared with the average of the same quarter of 2022 for the reference contract of December of that year, of €83.21/t, the average of the first quarter of 2023 was 8.6% higher.

On the other hand, during the first quarter of 2023, the settlement price of CO2 emission rights futures exceeded €100/t on two occasions, both in the month of February. On February 21, the historical maximum, of €100.34/t, was reached.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will take place on April 20. Raúl García Posada, director of ASEALEN, the Spanish Association of Energy Storage, will participate in the webinar. Jorge Barcelona de Pedro, Head of Sustainable Solutions at Rolls Royce Solutions Ibérica, will also participate in the analysis table after the Spanish version of the webinar. In addition to the evolution and prospects of European energy markets, on this occasion, the vision of the future on the energy storage will be analysed. Negative prices in electricity markets are opportunities for energy storage. To take advantage of them, it is essential to have reliable price forecasts for the daily market and intraday markets.

On the other hand, in the webinar of March with speakers from EY, the importance of PPA for the renewable energy projects financing was analysed. Long‑term hourly price forecasts are essential for the negotiation of PPA and the renewable energy projects financing, since they allow estimating prices captured by a certain project during its lifetime. At AleaGreen, long‑term hourly price forecasts are made for the main European markets, which have a 30‑year horizon and confidence bands. In addition, AleaSoft Energy Forecasting provides consultancy on the energy markets.