AleaSoft Energy Forecasting, October 3, 2023. In the third quarter of 2023, average prices fell to below €100/MWh in most European electricity markets. Falling gas prices and lower electricity demand in some markets, combined with higher renewable energy production in most markets, contributed to lower prices. Solar photovoltaic energy production in the quarter was at record levels in Southern European markets and France.

Solar photovoltaic, solar thermoelectric and wind energy production

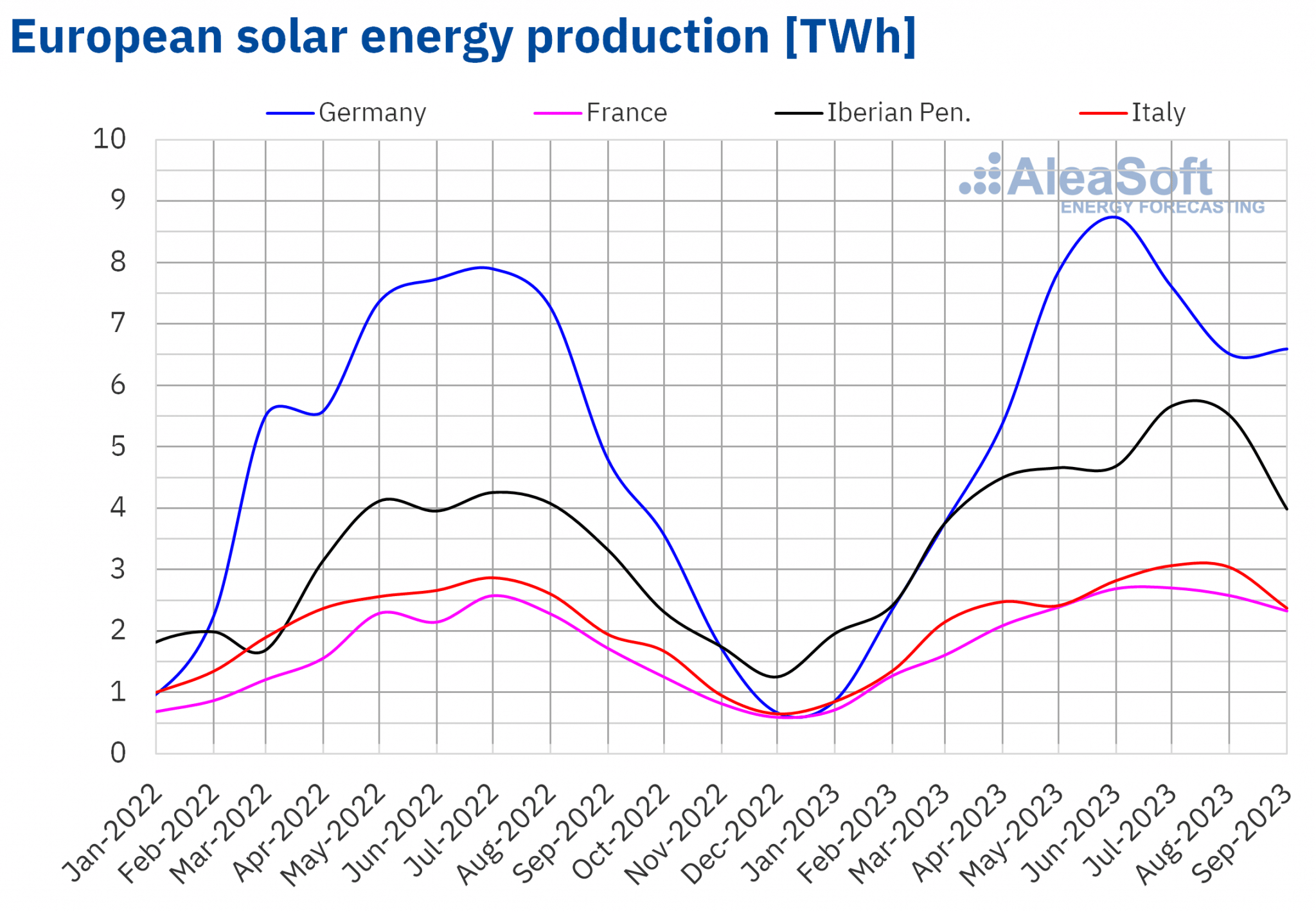

In the third quarter of 2023, solar energy production increased in all markets analyzed at AleaSoft Energy Forecasting compared to the same period in 2022. The largest increase, 38%, was registered in the Portuguese market, followed by the 29% rise in the Spanish market. The French and Italian markets registered increases of 16% and 14%, respectively. Solar energy production in the German market increased the least, by 3.7%.

Compared to the second quarter of 2023, the upward trend continued in most analyzed markets. The quarter‑on‑quarter increase in solar energy production ranged from 6.4% in Italy to 2.8% in France. The German market, which declined 8.7%, was the exception.

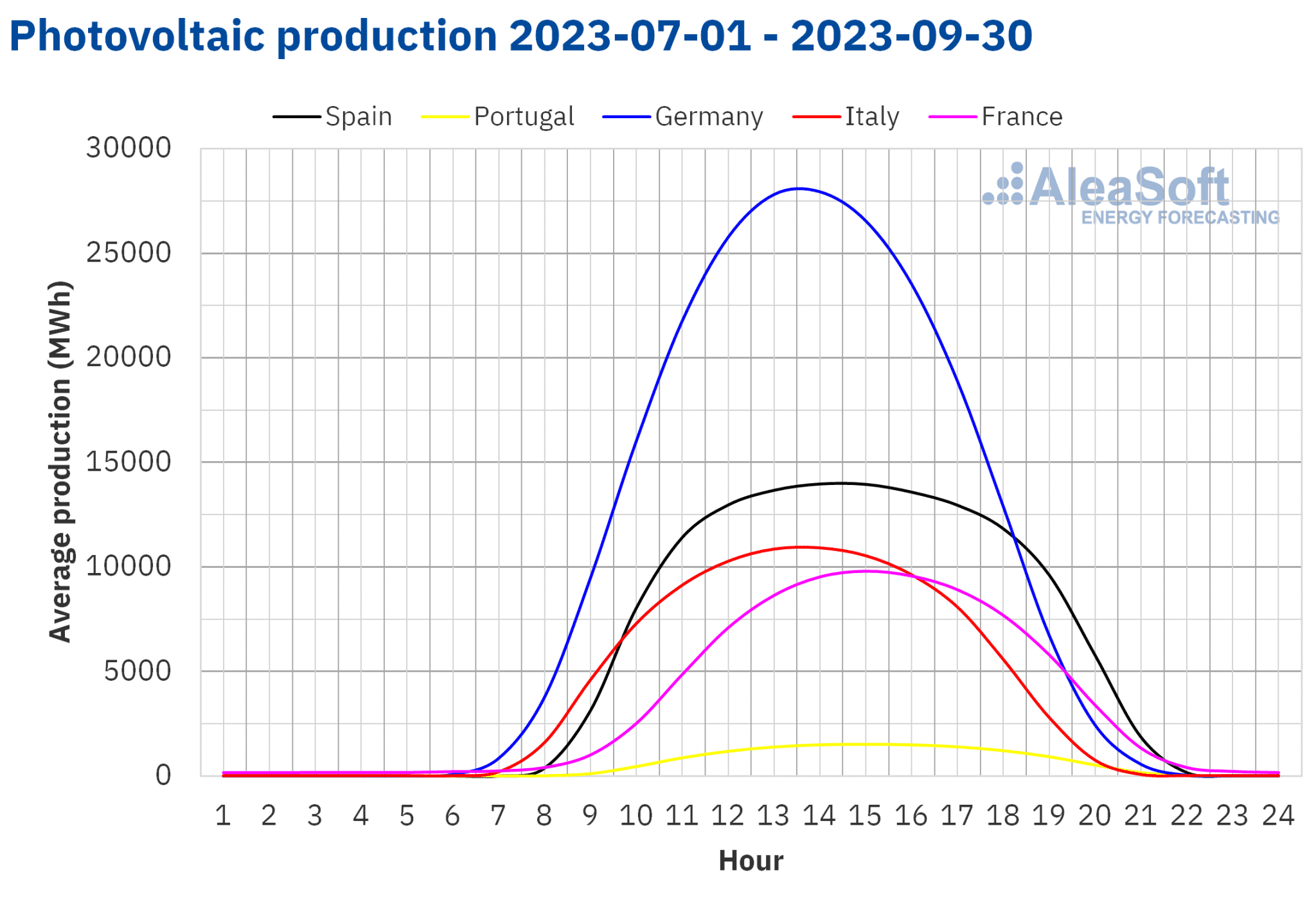

In addition, the Spanish, Italian, French and Portuguese markets registered the highest quarterly solar photovoltaic energy production in history, with 12 087 GWh generated in Spain, 8 482 GWh in Italy, 7 611 GWh in France and 1 172 GWh in Portugal.

On the other hand, according to data from Red Eléctrica de España (REE), solar photovoltaic capacity in Mainland Spain increased by 260 MW between the second and third quarters of 2023. During the same period, Portugal’s installed photovoltaic capacity increased by 164 MW, according to REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Wind energy production increased in the third quarter of 2023 compared to the same period of 2022 in most of the markets analyzed at AleaSoft Energy Forecasting. The largest rise, 32%, was registered in the French market, followed by increases in the Portuguese, Italian and German markets, which were 22%, 20% and 19%, respectively. On the other hand, in the Spanish market, the production using this technology decreased by 11% during the analyzed period.

Wind energy production increased by 3.2% in the Portuguese market compared to the second quarter of 2023. On the other hand, for the rest of the markets analyzed at AleaSoft Energy Forecasting, wind energy production decreased compared to the previous quarter. The Italian market was the one with the smallest decrease, 2.6%. Meanwhile, the largest decreases were registered in the markets of Spain and France, 17% and 13%, respectively. In the German market the drop in wind energy production was 7.9%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

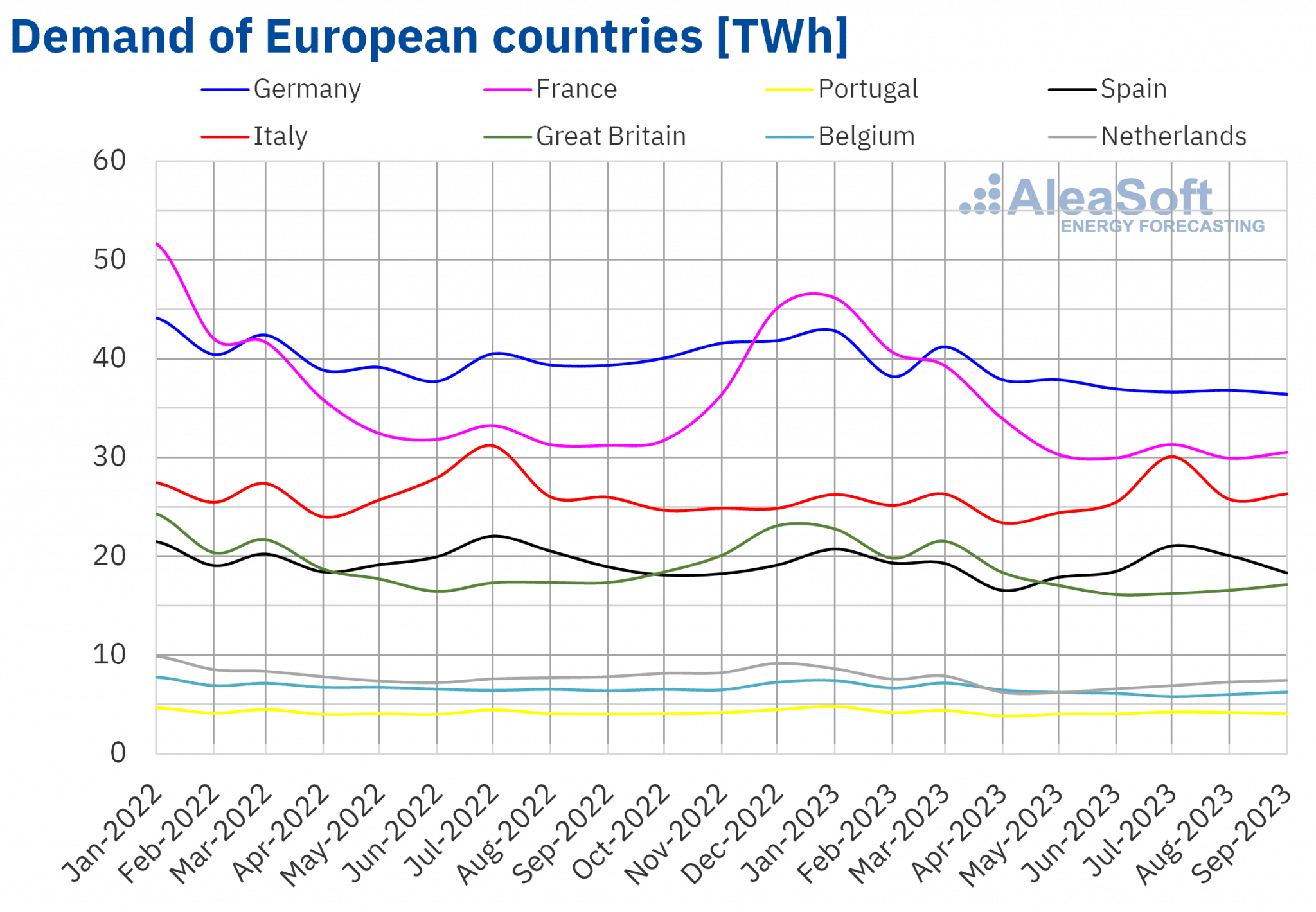

In the third quarter of 2023, electricity demand decreased compared to the same period of the previous year in all analyzed European markets. The largest drop, 7.9%, was registered in the German market, followed by declines of 6.6% and 6.5% in the Belgian and Dutch markets, respectively. In the rest of analyzed markets, the decrease in demand ranged between 0.1% in the Portuguese market and 4.2% in the French market.

Compared to the previous quarter, demand was heterogeneous. Demand increased in the Dutch and Southern European markets. The largest increase, 9.8%, was registered in the Netherlands, followed by the Italian and Spanish markets with increases of 8.5% and 7.7%, respectively. The smallest increase, 1.8%, was registered in the Portuguese market. On the other hand, in the other analyzed markets, demand declined by 5.7% in the German and French markets, followed by decreases of 6.3% in Great Britain and 7.1% in Belgium.

Similarly, the year‑to‑year variation of average temperatures in the third quarter of 2023 did not show a clear trend compared to the same quarter of 2022. On the one hand, average temperatures increased by 0.7 °C in Germany, 0.2 °C in Belgium and 0.1 °C in the Netherlands. By contrast, in the rest of the analyzed countries, average temperatures decreased between 0.7 °C in the United Kingdom and 0.1 °C in Portugal and France. No change in average temperature was observed in Italy.

Compared to the previous quarter, the average temperature in the third quarter of 2023 increased in all analyzed countries due to the seasonal transition from spring to summer. The increases ranged from 3.7 °C in Great Britain to 7.0 °C in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

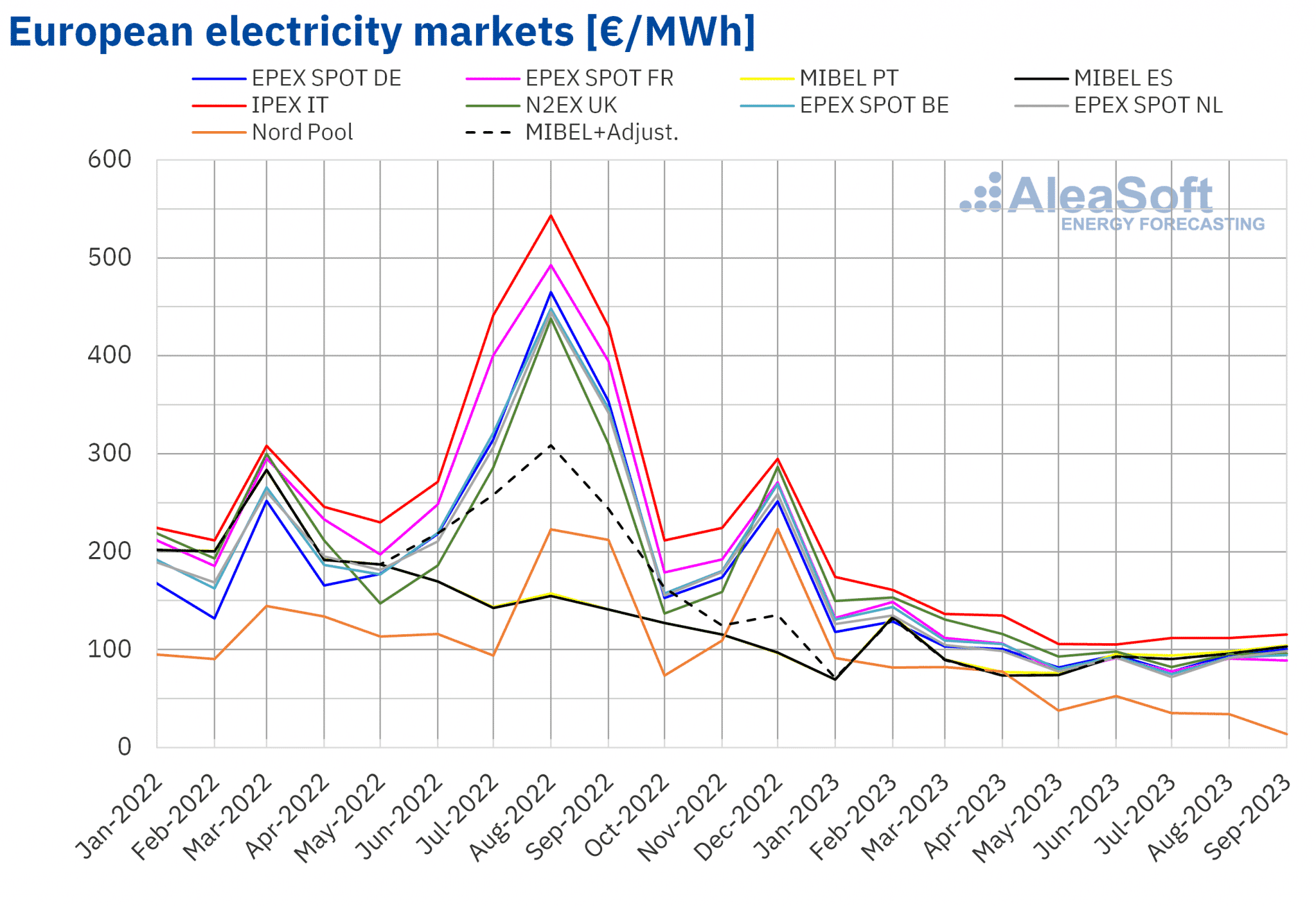

In the third quarter of 2023, the quarterly average price remained below €100/MWh in almost all European electricity markets analyzed at AleaSoft Energy Forecasting. The exception was the average of the IPEX market of Italy, €113.20/MWh. On the other hand, the Nord Pool market of the Nordic countries registered the lowest quarterly price, €27.77/MWh. In other markets, averages ranged from €85.71/MWh in EPEX SPOT market of France to €98.54/MWh in MIBEL market of Portugal.

Compared to the previous quarter, in the third quarter of 2023, average prices decreased in most European electricity markets analyzed at AleaSoft Energy Forecasting. The exception was the MIBEL market of Portugal and Spain, with increases of 19% and 20%, respectively. On the other hand, the Nordic market registered the largest decrease, 50%. Other markets registered price decreases ranging from 1.8% in the German and Italian markets to 11% in the N2EX market of the United Kingdom.

Comparing average prices in the third quarter of 2023 with those in the same quarter of 2022, prices fell in all analyzed markets. The largest drop, 84%, was in the Nordic market. On the other hand, the Portuguese and Spanish markets registered the smallest declines, 33% and 34%, respectively. In other markets, price decreases ranged from 74% in the British market to 80% in the French market.

On the other hand, these price declines led the price of the third quarter of 2023 to be the lowest since the second quarter of 2021 in the German, Belgian, British, French, Italian and Dutch markets. In the case of the Nordic market, the last quarter average was the lowest since the fourth quarter of 2020.

In the third quarter of 2023, lower gas prices compared to the previous quarter and higher solar energy production in almost all markets led to lower prices in European electricity markets compared to the previous quarter. In addition, electricity demand declined in some markets.

Compared to the third quarter of 2022, the significant drop in gas prices, the general decline in electricity demand and the rise in both solar and wind energy production in most markets also favored lower prices in European electricity markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

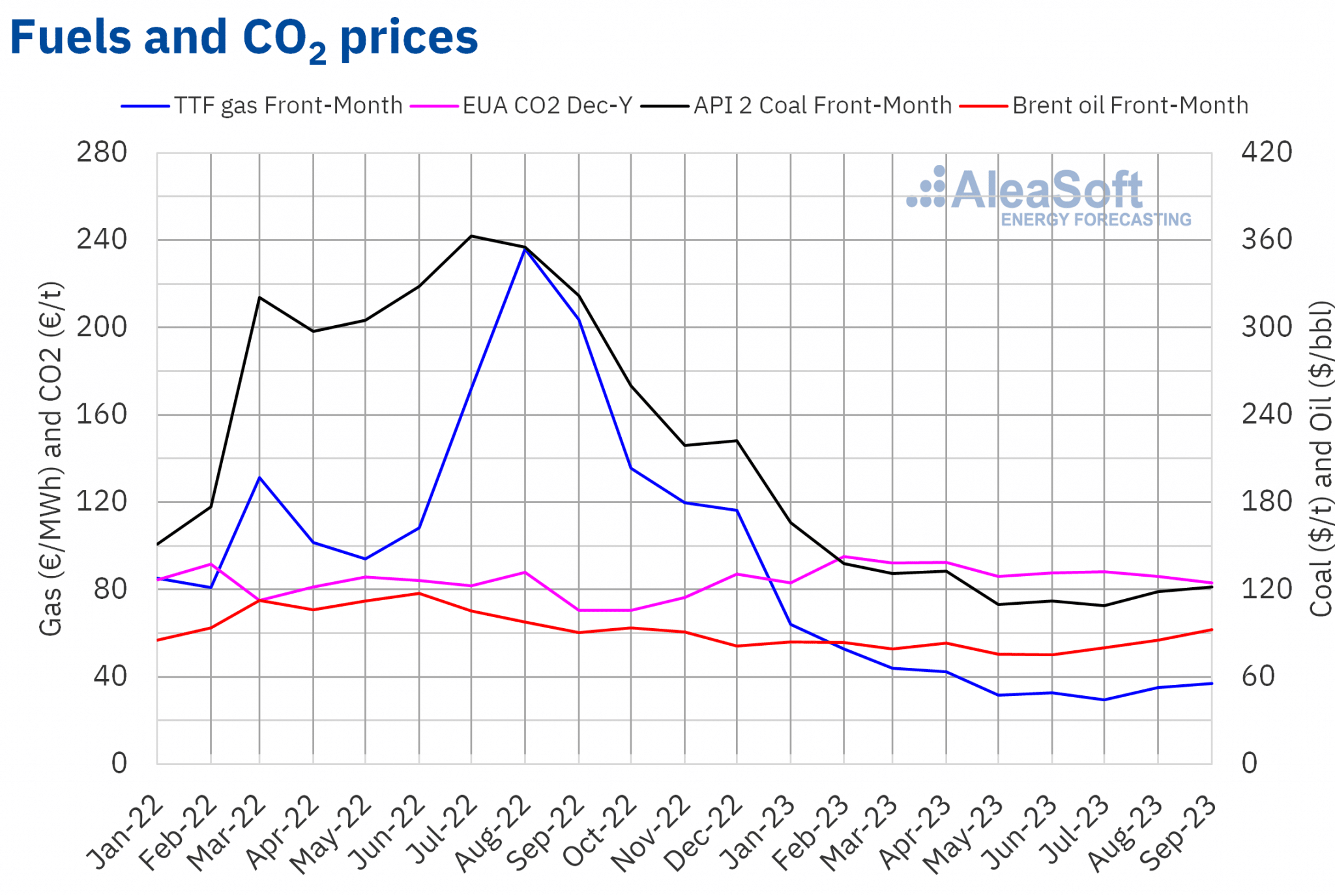

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a quarterly average price of $85.92/bbl in the third quarter of 2023. This value was 11% higher than the previous quarter’s Front‑Month futures price, $77.73/bbl. But it was 12% lower than the corresponding to Front‑Month futures traded in the third quarter of 2022, $97.70/bbl.

During the third quarter of 2023, concerns about the evolution of the global economy and fears of further interest rate hikes persisted. However, production cuts by Saudi Arabia and Russia exerted their upward influence on Brent oil futures prices. The outlook for the recovery of the Chinese economy also contributed to the price increase compared to the previous quarter.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the third quarter of 2023 for these futures was €33.82/MWh. Compared to that of the Front‑Month futures traded in the previous quarter, €35.13/MWh, the average decreased by 3.7%. Comparing to the Front‑Month futures traded in the same quarter of 2022, when the average price was €204.78/MWh, there was a decrease of 83%.

During the third quarter of 2023, TTF gas futures prices were affected by alterations in the gas flow from Norway due to maintenance. Concerns about liquefied natural gas supply due to labor disputes at Australian export facilities also had an upward impact on prices. However, high European inventory levels allowed the quarterly average price to decline.

The average price of CO2 emission rights futures in the EEX market for the reference contract of December 2023 in the third quarter of 2023 was €85.69/t, 3.2% lower than the previous quarter’s average, €88.48/t. Compared to the average for the same quarter of 2022 for the reference contract of December 2022, €80.04/t, the average for the third quarter of 2023 was 7.1% higher.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On October 4 and 5, the X Solar Forum will be held in Madrid. AleaSoft Energy Forecasting will be one of the sponsors of this event organized by UNEF. In addition, Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will participate in the table scheduled for the 5th, at 17:30, which will analyze the impact of price expectations in electricity markets on the financing conditions of photovoltaic energy projects and their profitability.

The next webinar in the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will take place on Thursday, October 19, and it will feature speakers from Deloitte for the fourth time. The guest speakers will share their vision and experience on the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation. In addition, this webinar will analyze the prospects for European energy markets for the winter 2023‑2024.