AleaSoft Energy Forecasting, March 27, 2023. Interview by Ramón Roca, director of El Periódico de la Energía, with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

Habemus proposal of the European Commission to reform the electricity market. What do you think?

What we have are some proposals for “improvements” of the European electricity market, but the market itself is not being reformed, it remains the same, marginalist, as in the last 25 years, which we consider to be a fundamental aspect, because it gives legal and regulatory security to future investments. These measures seem good to us because they will encourage more renewable energy generation to allow, in addition to decarbonisation and energy independence, transferring a lower price to consumers, avoiding price increases such as the current ones derived from dependence on gas from outside Europe. The new measures will encourage mid‑ and long‑term contracts through PPA and Contracts for Differences (CfD) to provide more facilities for consumers and producers. As we stated at AleaSoft in multiple publications, it is necessary to cover all time horizons, essential for both those who buy and those who sell energy.

There is not as much reform as expected, right?

Reform? None. As I told you before, fortunately, they are only improvements. After so many years, it is not bad to propose improvement measures, especially with the experience of more than 20 years of European electricity market, the most recent gas price situation and the unstoppable development of renewable energies. If the proposals are analysed, they might have been implemented a long time ago.

What do you think of the proposal sent by the Spanish Government to the European Commission? Too much interventionism?

This proposal did not have a long way to go, since any modification of the European electricity market must be based on two fundamental pillars: free market and not price interventionism. The market must be predictable to be able to invest with time horizons of 30 or 40 years, necessary for investments, and must allow a free balance between supply and demand.

In renewable energy auctions of 2022, fewer MW were awarded than were auctioned. Has this financing instrument for renewable energy projects ceased to be of interest? And PPA?

Auctions are an interesting financing instrument as long as they are voluntary. Less MW were awarded because spot and futures market prices were very high and there were better expectations with PPA or merchant, selling energy directly on the market. Most of those who bid did so above the reserve price set by the ministry, of around €45/MWh.

PPA became much more flexible in all aspects and continue to be the main source of renewable energy projects financing. The financing of merchant projects is also consolidating as a financing alternative and more important financial entities incorporated them among their financeable projects.

What is better PPA or CfD?

Part of the improvements proposed by Europe is focused on encouraging long‑term contracts with the aim of reducing exposure to spot market volatility. Any long‑term contract is essentially good for those who buy and for those who sell.

In the case of PPA, large consumers will be helped with guarantees. These guarantees are currently a barrier for more modest large consumers to access a PPA. In the case of Spain, the electro‑intensive companies have 90% of the guarantees of a PPA covered by the State. These incentives will facilitate the signing of more PPA, which implies more financing for renewable energies, more price stability and a guarantee of 100% green consumption.

In the case of CfD, contracts for difference, it is a new product in Spain. The idea is helping renewable energy generation, fundamentally, to have public aid in exchange for obtaining a stable price in the long term with a counterpart, for example, electro‑intensive industry, which would benefit from this preferential price.

Another figure that is mentioned in the measures are the “forward contracts” that will allow both parties to agree on a price for a prolonged period of time.

Do you think a capacity market is necessary in Spain?

A capacity market is very necessary in Spain. Until now, combined cycle gas turbines have acted as an energy reserve for the periods of largest consumption. Peak hours during the day, in winter, in summer, when we had drought, at night when there is no wind. When we don’t have gas, what will happen? We need a tactical and strategic storage backup system that will be incentivised by this capacity market.

With the increase in renewable energy capacity in Spain, there were episodes of renewable energy curtailments. What can be done to prevent this type of events from occurring more frequently while photovoltaic and wind energy capacity continues to increase? Do you see renewable energy curtailments as a serious problem in the long term?

The growth of renewable energy production has a very fast pace and the evacuation grids of these new plants have to be increased to avoid curtailment in some more saturated nodes. With more generation, it is obvious that the evacuation capacity must increase. With the future development of grids and storage, curtailment will cease to be a concern, from something that might happen on a recurring basis, it will become something that occurs at specific times.

Since the beginning of December, gas prices in Europe have been falling, despite the fact that we are in spring, which has meant some stability in electricity markets. Can it be said that the worst of the crisis passed?

Spring is a breather for the electricity system historically. With more pleasant temperatures, the use of heating decreases, with the consequent drop in the gas and electricity demand. We can say that the worst of the crisis passed, at least for this winter. It is soon to tell what next winter will bring us, but given the levels of gas in storage that we currently have and with the trend in gas prices, it seems unlikely that the price spikes that we saw in 2022 will occur again.

However, CO2 emission rights prices have been increasing since the beginning of the year and exceeded €90/t again. How do you expect this market to behave during 2023? And in the long term until 2030 and 2050?

As we stated in the webinar we held on March 16 with colleagues from EY, this CO2 emissions market has an upward trend in the short, medium and long term. CO2 emission rights are a tool that we have given ourselves in Europe to discourage the consumption of fossil fuels. By design, with the progressive reduction of emission rights, the long‑term price trend is upward, although its impact on electricity market prices will be less and less.

In the current context of stability in markets and lower gas prices, do you think it is necessary to extend the Iberian exception?

The Iberian exception is an exceptional measure, which worked very well, but currently, with low gas prices, it is no longer applied and it does not appear that it will be extended.

Much was said about the approval in recent months, by the Spanish public administrations, of the Environmental Impact Statement (DIA for its acronym in Spanish) after accumulating much delay. Are administrative procedures the largest bottleneck in the development of renewable energy in Spain?

Administrative procedures are undoubtedly the largest bottleneck for the development of renewable energy in Spain. Public administrations should make a great effort these months to enable the projects that obtained the DIA in January to reach Ready to Build as soon as possible and in a phased manner. Renewable energy facilities are necessary sources of wealth creation and should be prioritised to the maximum.

What other challenges will the electricity sector have to face on the way to achieving its decarbonisation?

The largest challenge of the green electricity system is seasonal storage. This issue is not discussed but it is of great strategic importance if we want to forget about gas. The massive generation of green hydrogen for industry, transport and seasonal storage must be a priority for Europe.

At AleaSoft, which, as we already know, has more than 23 years of experience in short‑, mid‑ and long‑term demand and price forecasts for European electricity markets, how do you see the situation of the markets for this 2023? Are things more relaxed now?

As for gas, the situation improved. However, the rise in CO2 emission rights prices does not favour a more pronounced drop in market prices. In a relatively short time, the price outlook for the rest of 2023 went downward.

The rather abrupt disconnection of gas from Russia produced a chaos of high prices but little by little the situation of dependency was overcome.

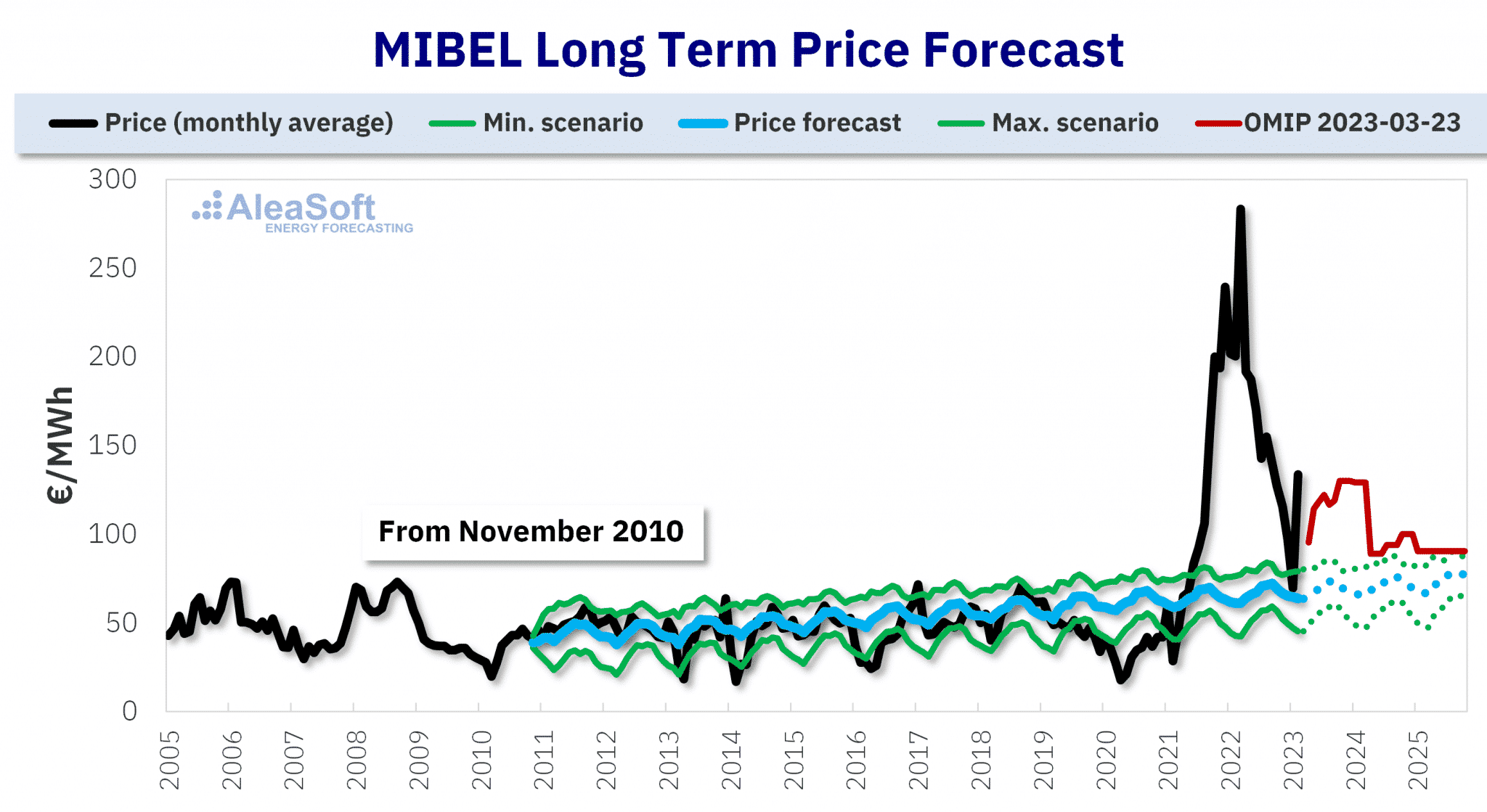

Long term price forecast for the Iberian electricity market MIBEL made at the end of October 2010 by AleaSoft Energy Forecasting.

Long term price forecast for the Iberian electricity market MIBEL made at the end of October 2010 by AleaSoft Energy Forecasting.Source: AleaSoft Energy Forecasting and OMIP.

Are you also offering other interesting services for the different players in the electricity sector?

At AleaSoft we have four divisions. On the one hand, there are databases of variables that influence energy markets and that we offer to our clients in an online platform that allows the consultation, analysis and download of all these data. There are also the specific divisions of forecasts. The division that is in charge of forecasts of all variables in the short term provides forecasting services with a horizon of up to 10 days that are used to generate market offers, trading, generation and consumption management and storage management. The division responsible for mid‑term forecasting, with a horizon of up to three years, forecasts all variables for coverage, planning, hydraulic storage management and strategy analysis. AleaGreen is the long‑term division, especially for the renewable energy development, for example, to assess the price of a PPA, for projects financing, for asset valuation, for audits or for hybridisation and storage analysis. In this last matter of hybridisation and storage, our long‑term price curves forecasts with hourly granularity are very requested to assess investments with batteries.

You are also carrying out important informative work through market analysis news and webinars in which you invite speakers from important companies of the energy sector, consultancies, banking entities, etc. In February you will already carry out the thirtieth edition. How do you value this experience? What feedback do you receive from the participants?

We started the webinars in December 2019 and a few months later we had the confinement, just three years ago. The webinars of AleaSoft became a reference for the energy sector since then, sending a message in support of renewable energy and an analysis of the future market on a monthly basis. For the entire AleaSoft team that participates directly or indirectly, it is a source of professional enrichment and also of personal relationships. We work as a team with our guests and bonds of collaboration and trust are established. Every month we hold two webinars on the same day, at 10:00 in English and at 12:00 in Spanish, with an average of 800 professionals registered for each webinar. Our main objective has been to transmit a vision of the future, especially of renewable energies. It is a great effort, but it has a great reward learning in each webinar.

This year AleaSoft will celebrate 24 years since its foundation. Have you set any goals to celebrate this new milestone?

This year of the 24th anniversary we are planning a quantitative and qualitative leap with an ambitious growth plan. In the first half of the year, we will complete 24 European markets with short‑, mid‑ and long‑term price curves forecasts. In the second half of the year, we will complete 35 European markets and the main markets of America and Asia. In the long‑term case, we are finishing a platform for the valuation of renewable energy assets in the European markets. With the coordinates and characteristics of a wind or photovoltaic farm anywhere in Europe, we can calculate the return on investment in 30 years going to market. We already have this available for the main European markets. By the way, one of the factors that differentiates us from other companies that provide this service, in addition to the scientific nature and coherence, is the speed of delivering the reports at any time of the year and not waiting for the quarterly deliveries that often arrive with long delay.