AleaSoft Energy Forecasting, September 2, 2025. In August, prices in the main European electricity markets fell compared to July, with most monthly averages dropping below €75/MWh. The fall in electricity demand, together with TTF gas prices reaching their lowest monthly level since August 2024, contributed to these declines. Solar photovoltaic energy production, although generally lower than in July, was the second highest in their history in Germany and Portugal, while wind energy production also decreased compared to July.

Solar photovoltaic and wind energy production

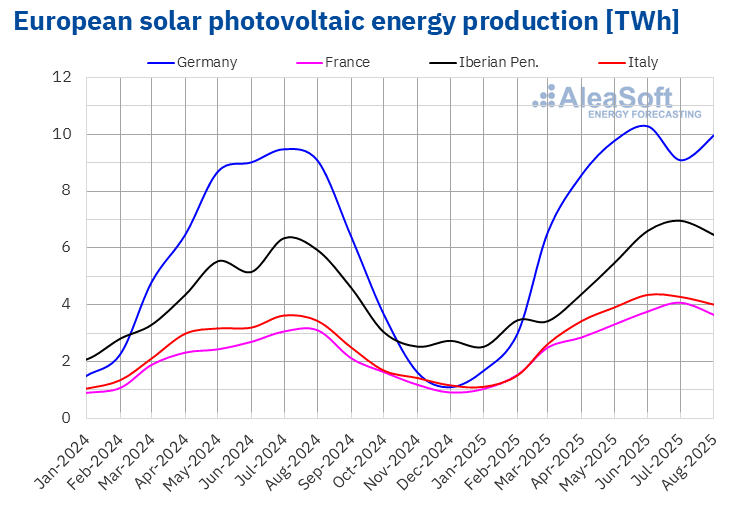

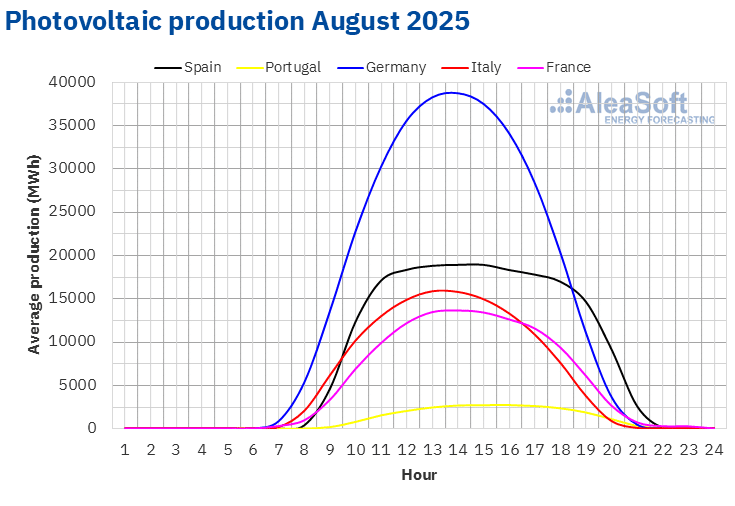

In August 2025, solar photovoltaic energy production increased in the main European electricity markets compared to the same month of the previous year. France and Italy registered the largest increase, 17% in both markets. They were followed by Portugal and Germany, with year on year growth of 13% and 10%, respectively. The Spanish market registered the smallest increase, 8.7%.

Compared to July 2025, solar photovoltaic energy production increased in Germany, by 10%. By contrast, France, the Iberian Peninsula and Italy registered lower generation than in the previous month. The French market registered the largest fall, 11%, while the Italian market registered the smallest, 6.3%. The Spanish and Portuguese markets reduced their generation by 7.0% and 8.7%, respectively.

In August 2025, Germany and Portugal reached the second highest monthly photovoltaic energy generation in their history. Germany generated 9955 GWh, a figure just behind the maximum registered in June 2025, 10 269 GWh. Portugal added 729 GWh, after the record registered in July, 797 GWh.

The year on year increase in photovoltaic energy generation was associated with greater installed capacity. According to data from Red Eléctrica, between August 2024 and August 2025 the Spanish market added 6622 MW of solar photovoltaic energy capacity. Over the same period, the Portuguese market incorporated 977 MW into the system, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

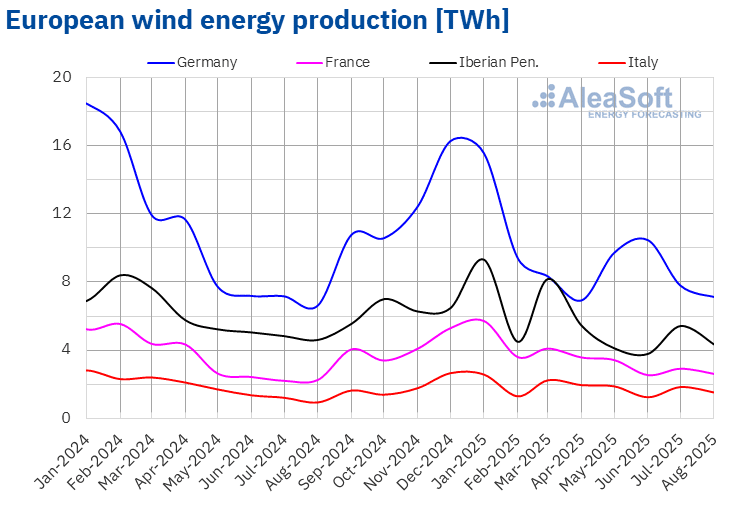

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.In August 2025, wind energy production increased in most major European electricity markets compared to August 2024. Italy registered the largest increase, 65%, while Germany registered the smallest, 7.5%. In France, generation from this technology grew by 16%. The Iberian Peninsula was the exception, with declines of 3.2% in Portugal and 6.3% in Spain.

Compared to the previous month, wind energy production decreased in the main European electricity markets. Spain registered the largest fall, 21%, while Germany registered the smallest, 8.6%. France, Portugal and Italy registered declines of 10%, 17% and 18%, respectively.

According to data from Red Eléctrica, between August 2024 and August 2025, the Spanish market increased its wind energy capacity with 1042 MW of new additions. Over the same period, the Portuguese market added 3.0 MW to the system, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

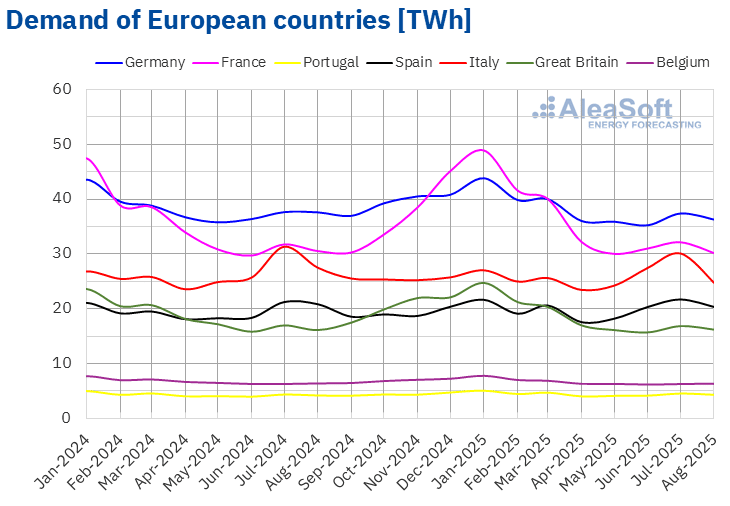

In August 2025, electricity demand decreased in most major European electricity markets compared to the same month of the previous year. The Italian market registered the largest decline, 10%, while the Belgian market registered the smallest fall, 0.7%. The French, Spanish and German markets registered decreases of 1.2%, 2.4% and 3.5%, respectively. On the other hand, demand increased in the Portuguese and British markets in year on year terms. The Portuguese market registered the largest rise, 2.8%, while the British market registered a more moderate increase, 0.5%.

Compared to July 2025, demand also decreased in most major European electricity markets. Italy registered the largest fall, 18%, while Germany registered the smallest, 2.9%. The British, Portuguese, French and Spanish markets registered decreases ranging from 3.8% in Great Britain to 6.3% in Spain. In contrast, in the Belgian market demand increased by 1.2%.

Average temperatures increased compared to the same month of 2024 in Spain, Portugal and Great Britain, with rises of 0.1 °C, 0.5 °C and 0.7% respectively. In contrast, France, Belgium, Germany and Italy registered decreases ranging from 0.2 °C in France to 2.0 °C in Italy.

Likewise, average temperatures in August exceeded those of July in the markets of France and the Iberian Peninsula, with increases of 0.4 °C in France, 0.7 °C in Portugal and 0.8 °C in Spain, as a result of the heat wave that affected these countries during the first fortnight of August. On the other hand, average temperatures in Germany, Italy, Belgium and Great Britain were lower than those registered in the previous month, with decreases ranging from 0.4 °C in Italy and Germany to 0.6 °C in Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

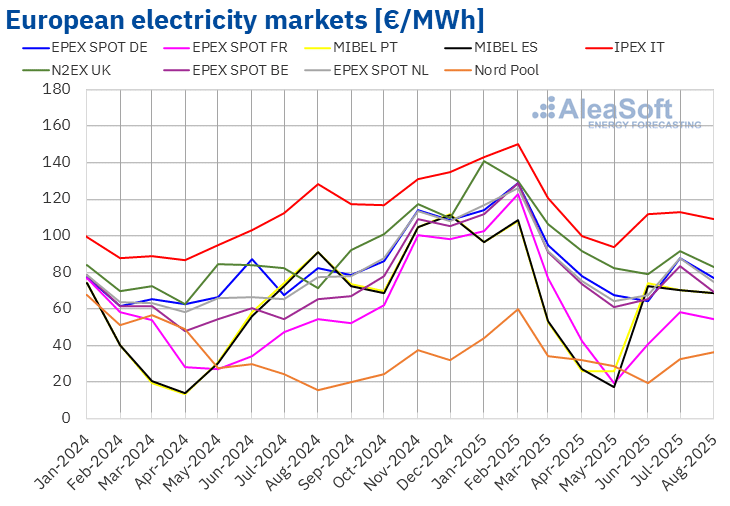

In August 2025, the average monthly price was below €75/MWh in most major European electricity markets. The exceptions were the market of Germany, the N2EX market of the United Kingdom and the IPEX market of Italy, whose averages were €76.99/MWh, €82.58/MWh and €108.79/MWh, respectively. The Nord Pool market of the Nordic countries and the market of France registered the lowest monthly prices, €36.47/MWh and €54.44/MWh, respectively. In the rest of the European electricity markets analysed at AleaSoft Energy Forecasting, the averages ranged from €68.44/MWh in the MIBEL market of Spain to €74.58/MWh in the market of the Netherlands.

Compared to July, average prices fell in most of the European electricity markets analysed at AleaSoft Energy Forecasting. The Nordic market was the exception, with an increase of 13%. The Portuguese market registered the smallest decline, 2.0%. In contrast, the Dutch and Belgian markets registered the largest percentage price drops, 15% and 17%, respectively. In the rest of the markets, prices fell between 2.2% in the Spanish market and 12% in the German market.

Comparing average prices in August with those registered in the same month in 2024, prices also fell in most markets. The Belgian, British and Nordic markets were the exceptions, with increases of 5.3%, 16% and 138%, respectively. In this case, the French market price fell only slightly, by 0.2%. The Iberian market registered the largest percentage price drop, 25%. In the rest of the markets, price declines ranged from 3.3% in the Dutch market to 15% in the Italian market.

The Nordic market, although in August 2025 it reached the lowest average among the European electricity markets analysed at AleaSoft Energy Forecasting, registered its highest monthly price since March as a result of the upward trend it presented.

In August 2025, the decline in gas prices compared to the previous month, as well as the drop in demand in most markets, contributed to the decline in prices in European electricity markets. In addition, in the case of the German market, solar energy production increased compared to July.

Compared to August 2024, gas and CO2 emission allowance prices fell, contributing to the year on year decline in prices in most European electricity markets. The year on year increase in solar energy production also favoured this trend. In addition, electricity demand fell in most markets and, in the German, French and Italian markets, wind energy production increased compared to August 2024.

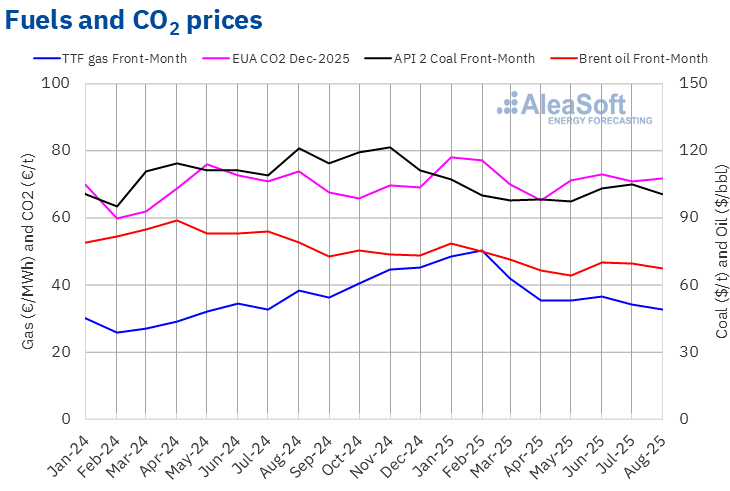

Brent, fuels and CO2

Brent oil futures for the Front Month in the ICE market registered a monthly average price of $67.26/bbl in August 2025. According to data analysed at AleaSoft Energy Forecasting, this monthly average was the lowest since June. This value was 3.3% lower than that reached by Front Month futures for July 2025, which was $69.55/bbl. It was also 15% lower than that corresponding to Front Month futures traded in August 2024, $78.88/bbl.

In August, concerns about the evolution of demand and OPEC+ production increases exerted a downward influence on Brent oil futures prices. Peace negotiations for Ukraine also contributed to the decline in prices. However, the evolution of the conflict and the possibility of new US sanctions on countries importing Russian oil limited the price declines.

As for TTF gas futures in the ICE market for the Front Month, the average value registered during August 2025 was €32.70/MWh. According to data analysed at AleaSoft Energy Forecasting, this was the lowest monthly average since August 2024. Compared to the average of Front Month futures traded in July, which was €33.96/MWh, the August average fell by 3.7%. Compared to Front Month futures traded in August 2024, when the average price was €38.35/MWh, there was a 15% decrease.

Despite reductions in gas flows from Norway due to maintenance work, abundant supplies of liquefied natural gas allowed European reserves to continue to increase in August, contributing to the decline in prices. Expectations of a peace agreement between Russia and Ukraine also exerted downward pressure on TTF gas futures prices. However, difficulties in the negotiations and the threat of new sanctions against Russia and countries importing Russian gas limited the decline in prices.

In the case of CO2 emission allowance futures in the EEX market for the reference contract of December 2025, they reached an average price in August of €71.81/t. According to data analysed at AleaSoft Energy Forecasting, this monthly price increased by 1.1% compared to the July average, which was €71.00/t. Compared to the August 2024 average, €73.75/t, the August 2025 average was 2.6% lower.

AleaSoft Energy Forecasting’s analysis on the prospects for energy storage

AleaStorage division of AleaSoft Energy Forecasting provides advanced solutions for the optimisation and management of energy storage systems. AleaStorage services include revenue and profitability calculations for systems with energy storage capacity, as well as the sizing of optimal storage in hybrid systems. These services are based on high quality scientific price forecasts. AleaStorage solutions are available for stand alone battery projects, hybrid systems of renewable technologies, such as wind or solar energy, with batteries, hybrid self-consumption systems with batteries and other hybrid systems, such as hydraulics, cogeneration or consumption.

Source: AleaSoft Energy Forecasting.