AleaSoft Energy Forecasting, October 31, 2025. Electricity is an essential commodity for any economy, yet its operation as a market is complex. Since the late 20th century, Europe has moved from a state-controlled model with regulated prices to a liberalised market model, where prices are determined by supply and demand. This transformation has been one of the most significant changes in the European electricity sector.

What is an electricity market?

An electricity market is an organised system in which different agents (such as generators, retailers, and large consumers) buy and sell electrical energy. Unlike other goods, electricity cannot easily be stored in large quantities, so it must be produced and consumed simultaneously which makes its management more complex and gives electricity markets certain distinctive features.

The different electricity markets are classified according to the time horizon of the bids they handle. Among them, the following stand out: the day-ahead wholesale market (also known as the spot market), where supply and demand bids are matched for every 15‑minute period of the following day; the intraday markets, which allow buying and selling positions to be adjusted closer to the time of delivery; the forward markets, where contracts are traded for the delivery of electricity in the future, from days to years ahead, at prices agreed upon at the time of the deal; and finally, the balancing and ancillary services markets, which operate in real time to maintain the stability of the system.

Liberalisation of the electricity sector

Until the 1990s, most European countries had electricity systems controlled by the state or by large vertically integrated monopolies. Prices were regulated, and consumers could not choose their supplier. From that decade onwards, the European Union promoted the liberalisation of the sector with the aim of creating a single European energy market.

Liberalisation opened electricity generation and retailing to the competition, allowing consumers to choose their electricity retailer. At the same time, transparent wholesale markets were established, and a separation was created between regulated activities (the transmission and distribution of electricity) and competitive activities (generation and retailing). In Spain, this process was formalised by the Electricity Sector Act of 1997, which introduced the wholesale market managed by OMIE (Iberian Energy Market Operator).

How is the electricity price formed?

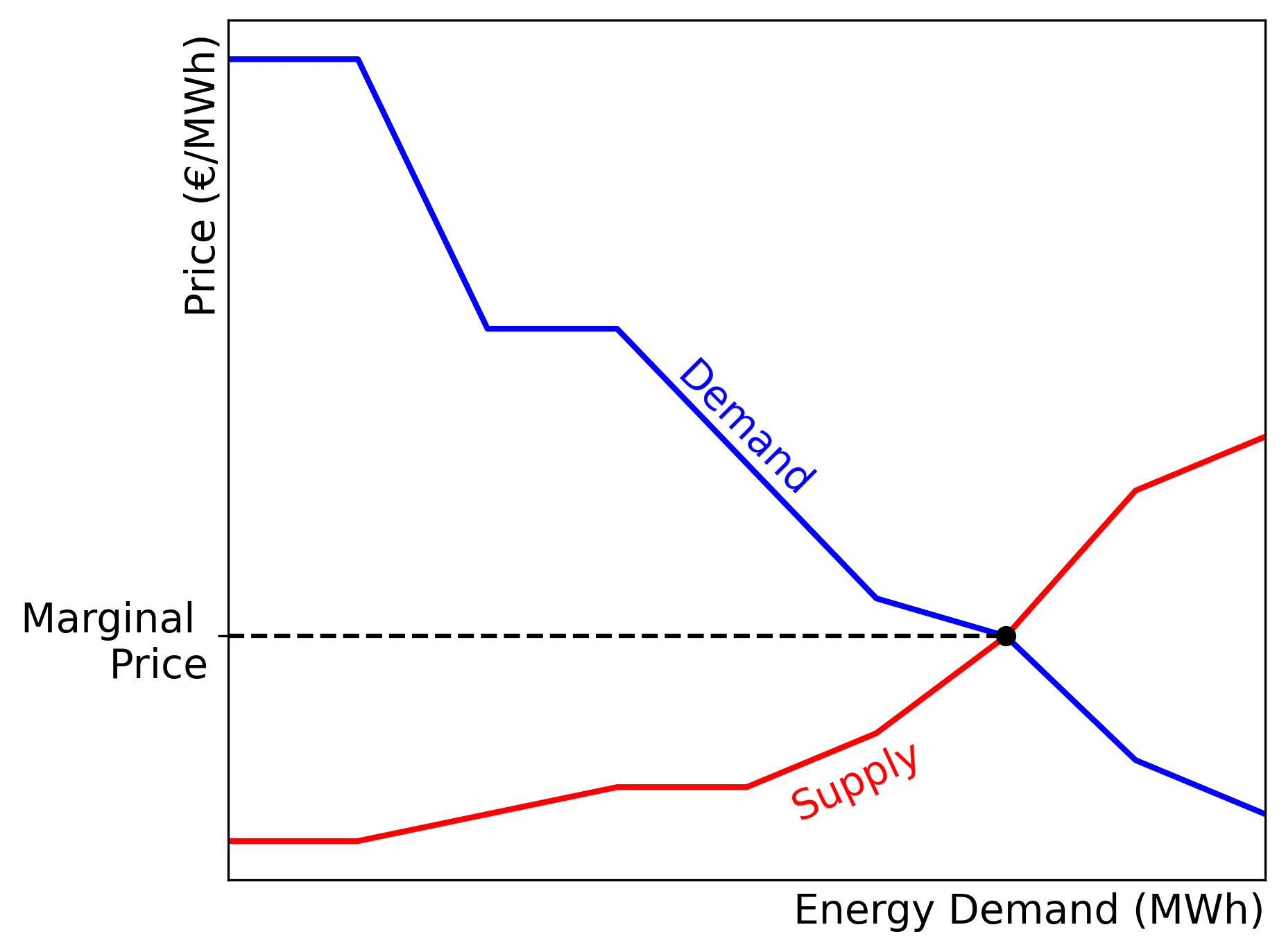

In the day-ahead wholesale market, generators submit offers to sell electricity at a given price for each 15-minute block of the following day. Meanwhile, retailers and large consumers submit their demand bids to purchase energy. The market operator (OMIE in Spain and Portugal) arranges the sale offers from lowest to highest price and the purchase bids from highest to lowest, matching supply and demand until the required quantity is met.

The clearing price (also known as the marginal price) is set by the last technology needed to meet demand. This model is called the ‘marginal pricing system‘ and it is part of European legislation. For example, if demand is met by wind energy, hydro, and gas generation, the price paid to all generators corresponds to the offer made by the last technology accepted among those three, even for those that offered lower prices. In this way, the system incentivises the most efficient and lowest‑cost generators to participate in the market.

The marginal pricing system is considered the most efficient because it constantly reflects the real cost of producing the final unit of energy required to meet demand. All generators receive the same price for the electricity they supply to the system, encouraging low‑cost technologies to offer at the lowest possible price to be dispatched.

This mechanism promotes competition, transparency, and economic efficiency, ensuring that electricity is generated at the lowest overall cost for the system. Alternatives such as pay‑as‑bid systems, where each generator would be paid the price it offered, reduce the incentive to bid in line with real costs encouraging participants to bid as high as possible just below the last technology expected to meet demand.

Moreover, the marginal pricing model provides consistency across all European electricity markets, since it is applied in a harmonised manner across countries. This coherence allows for price comparison, risk management, and integrated investment planning at the European level. Breaking this common framework would mean losing the reference that currently structures all market prices and time horizons, creating fragmentation, uncertainty, and even potential chaos in price formation and investment signals.

Electricity futures markets reflect expectations about the prices that will be formed in the day‑ahead market over the future period they refer to. As these contracts are settled precisely against day‑ahead prices, the structure and functioning of the marginal pricing system directly determine the level and volatility of future prices. If the price formation mechanism of the day‑ahead market were different, futures would be based on other references and would therefore display different prices.

For this reason, the marginal pricing system not only defines how electricity prices are set every 15 minutes but also sustains the coherence of the entire price time curve, from intraday markets to futures with years ahead. Changing the rules of the day‑ahead market would mean altering the entire price structure on which risk management, financial contracts, and investment decisions in the electricity sector are based.

The role of a retailer

Retailers are companies that purchase electricity on the wholesale market and sell it to consumers. They can be traditional retailers (linked to large electricity companies) or new independent firms.

Since liberalisation, consumers have been able to choose which retailer to contract with, and there are two main types. Free-market retailers offer their clients customised prices, services, and contracts, while in some countries, regulated or reference retailers, appointed by the government, can offer regulated tariffs.

Interconnected market and European integration

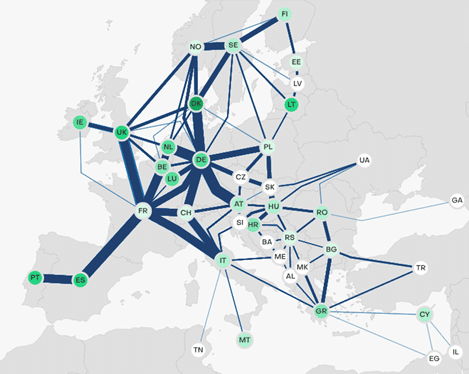

One of the key objectives of liberalisation has been the creation of a single European electricity market. To achieve this, countries have progressively integrated their wholesale markets through physical interconnections and common rules.

Thanks to these interconnections, countries can import or export electricity, taking advantage of surpluses or covering shortages. Moreover, the existence of a unified and common market promotes price convergence, efficiency, and security of supply across the continent.

Spain and Portugal form the MIBEL (Iberian Electricity Market), which is in turn interconnected with France and, indirectly, with the rest of Europe.

Advantages and challenges of the liberalised system

The transformation of the electricity sector into a liberalised system has brought several benefits, such as greater price transparency, the possibility for consumers to choose their supplier, increased competition among generators and retailers, and stronger incentives for efficiency and innovation.

At the same time, liberalisation also presents challenges, including the need to protect vulnerable consumers, price volatility, complexity for less‑informed consumers, and the necessity for regulatory and technical coordination between countries.

Liberalisation has represented one of the most significant changes in the energy sector. Today, with the large‑scale integration of renewables, the electrification of demand, and the digitalisation of the system, a new phase in the evolution of the European electricity market is underway.

This article is the second part of a series on the key milestones of the electricity system and its outlook for the coming years, entitled “The electricity system in evolution”. The series aims to provide an updated and structured overview of the present and future of the European electricity system.

Forecasts and analyses by AleaSoft Energy Forecasting for renewable energy and storage projects

The AleaBlue division of AleaSoft Energy Forecasting provides short‑ and medium‑term forecasts for energy markets, essential for planning, energy management, bidding strategies, risk hedging, and decision‑making. Its services include price forecasts for wholesale markets, intraday, and ancillary services, which are key tools for optimising market participation strategies for generators, consumers, retailers, and energy storage systems.

In addition, the online platform Alea Energy Database, part of the AleaWhite division, compiles energy market information in a structured way and incorporates analytical and data visualisation tools. Within seconds, it provides access to historical and current market variables in a single, unified, and continuously updated environment.

Source: AleaSoft Energy Forecasting.