AleaSoft Energy Forecasting, February 1, 2023. In the month of January 2023, European electricity markets prices decreased with respect to both December and January 2022. The monthly average price was lower than €135/MWh in almost all markets. This behaviour was influenced by the decrease in gas and CO2 emission rights prices. On the other hand, on January 26, TTF gas futures reached the lowest settlement price since the first half of September 2021, of €54.82/MWh.

Solar photovoltaic and thermoelectric energy production and wind energy production

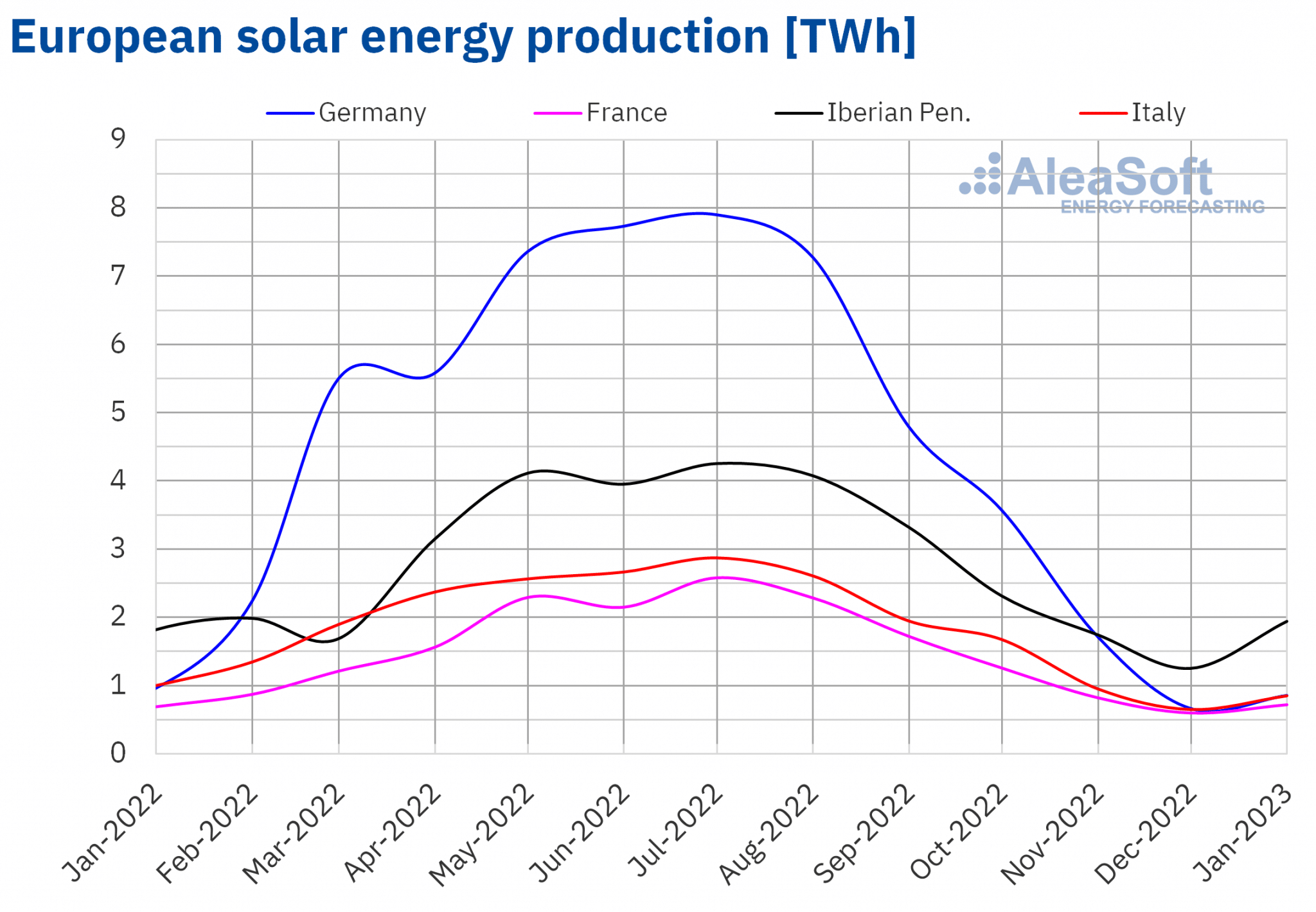

The solar energy production increased in January 2023 in year‑on‑year terms in most markets analysed at AleaSoft Energy Forecasting. The largest rise was that of Portugal, of 23%, while in the markets of France and Spain, the increases were 4.2% and 2.4%, respectively. On the other hand, in the markets of Germany and Italy, the solar energy production decreased year‑on‑year by 11% and 15%, respectively.

In the comparison with December 2022, the solar energy production of January 2023 increased in all analysed markets. The largest rise in this case was also that of Portugal, of 78%, followed by that of Spain, of 53%. In the rest of the main European markets analysed, the increases for the first month of 2023 were 31% in Italy, 29% in Germany and 20% in France.

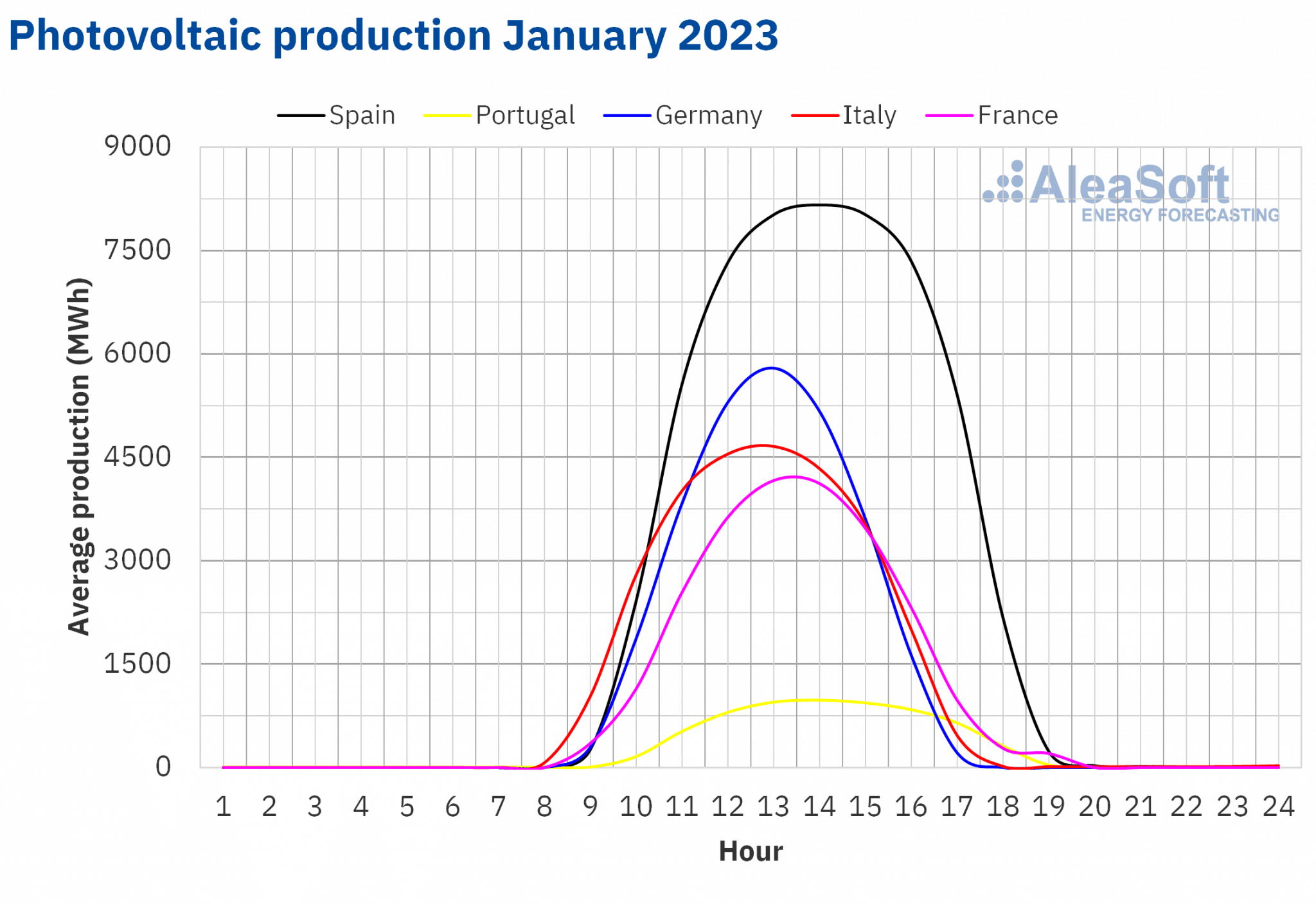

According to REE data, in January 2023, the increase in solar photovoltaic energy capacity of Mainland Spain compared to the installed capacity at the end of December 2022 was 304 MW, which represents an increase of 1.6%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

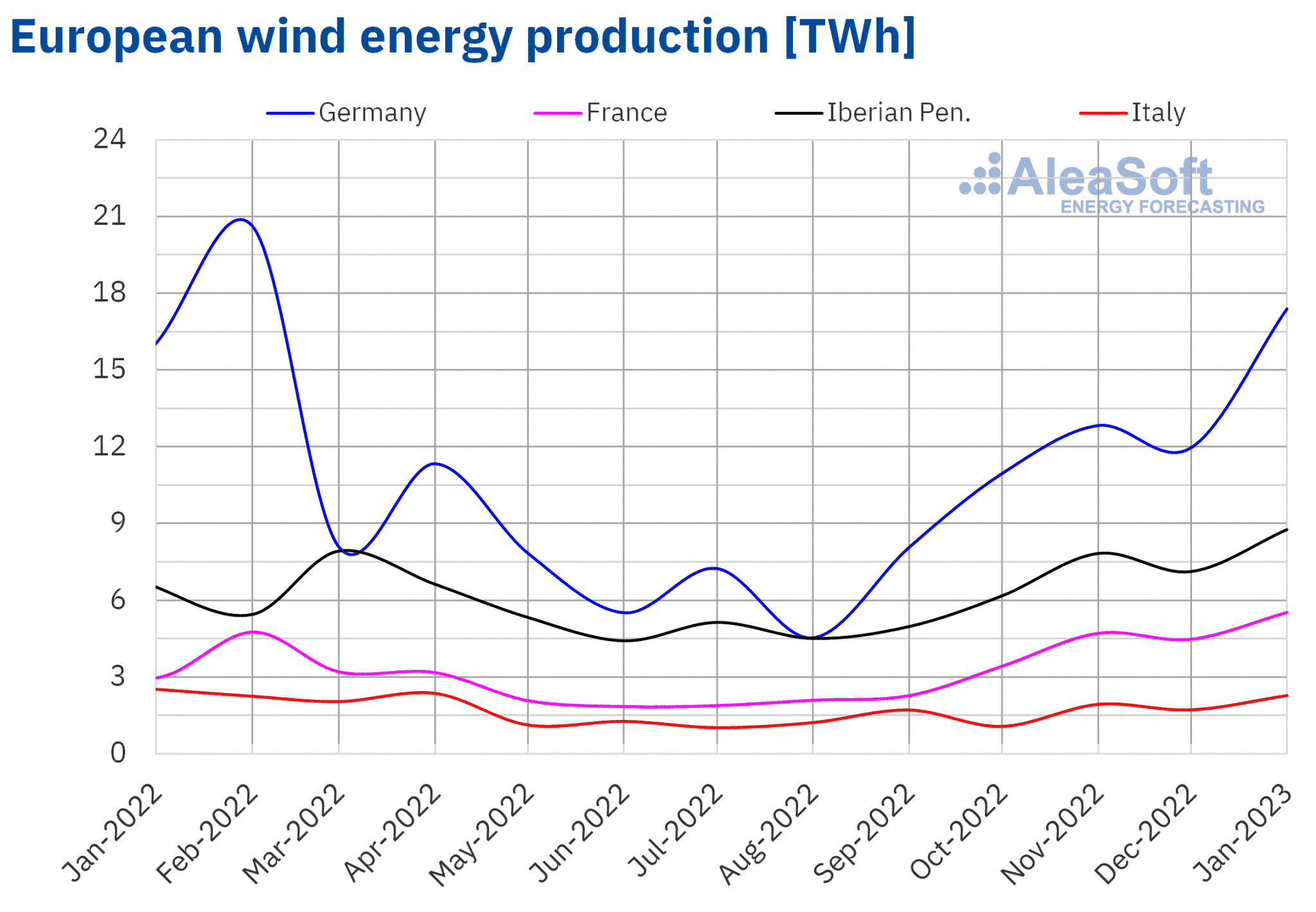

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In the case of the wind energy production of January 2023, year‑on‑year increases were registered in almost all markets analysed at AleaSoft Energy Forecasting. The largest year‑on‑year increase was registered in the French market, which was 86%. In the Spanish market, the increase reached 38%, while in Germany and Portugal, the rises were 8.4% and 8.3%, respectively. On the other hand, the Italian market registered a year‑on‑year decrease of 9.7%.

The production of January 2023 also increased in most European markets compared to that of the previous month. The German market registered the highest rise, of 45%. The increases of the Spanish and Italian markets were 34% and 33%, respectively, and in the French market, the wind energy production increased by 23%. In the case of the comparison with December 2022, there was a decrease in production in the Portuguese market, which was 15%.

On the other hand, according to REE data, in January 2023 the wind energy capacity increased in Mainland Spain by 186 MW, 0.6%, compared to the installed capacity at the end of December 2022.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

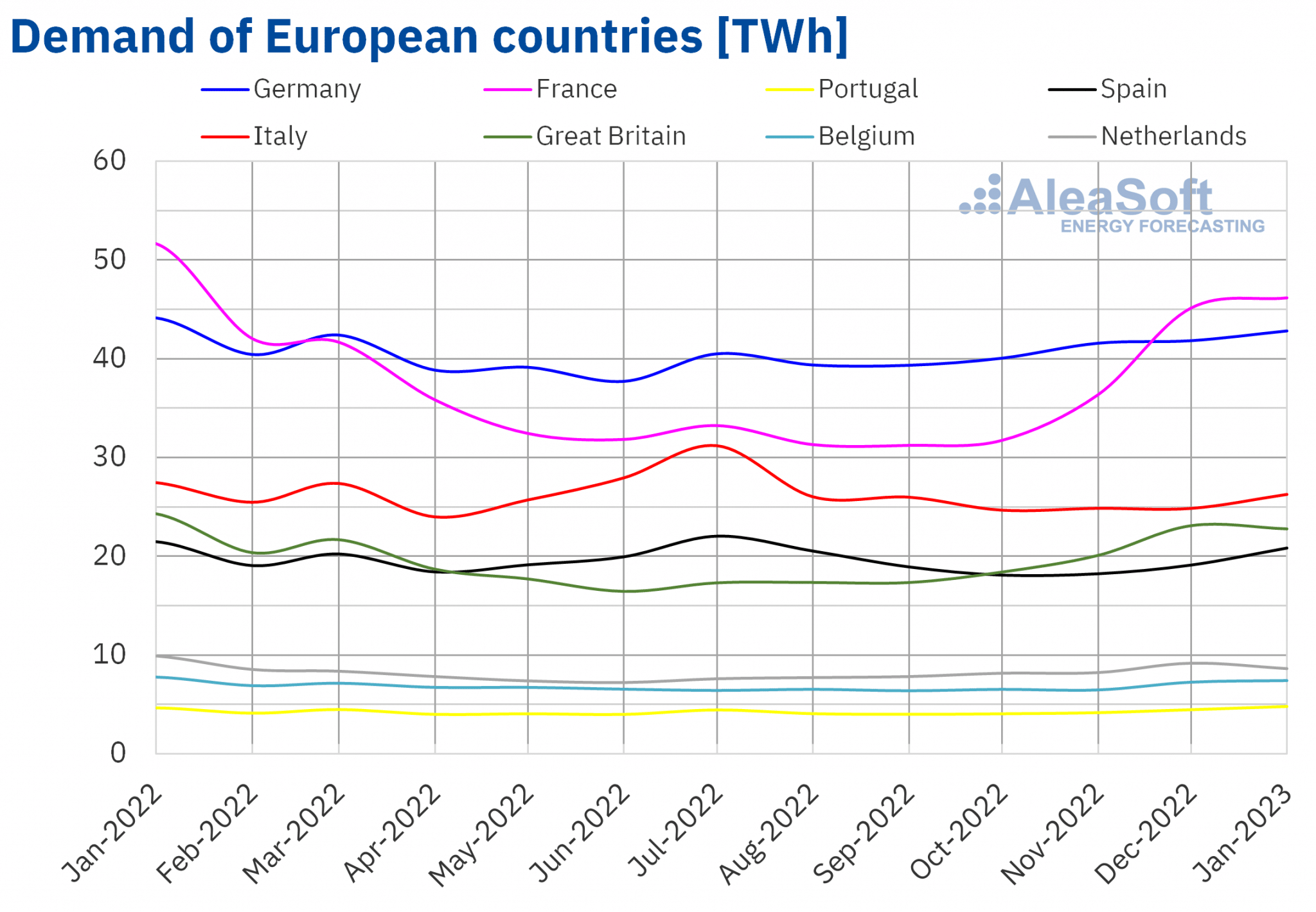

During the month of January 2023, year‑on‑year decreases in electricity demand were registered in almost all European markets. The exception was the Portuguese market with an increase of 3.0%. On the other hand, the largest falls were those of the Dutch and French markets, of 13% and 11% respectively. In the rest of the analysed markets, the year‑on‑year decreases in electricity demand were between 3.0% of the German market and 6.3% of the British market.

The behaviour of the electricity demand in January 2023 compared to the same month of the previous year was influenced by higher average temperatures than those of January 2022 in most markets.

In contrast, compared to December 2022, the electricity demand increased in most analysed markets. In this case, the exceptions were the markets of Great Britain and the Netherlands, where the demand fell by 1.4% and 6.0% respectively. In these markets, average temperatures were reached above those of the previous month by 1.3 °C, in Great Britain, and 1.8 °C, in the Netherlands.

On the other hand, the largest increases in electricity demand compared to the previous month, of 7.3% and 9.0%, were registered in Portugal and Spain respectively, markets in which average temperatures fell by around 3.0 °C. In the rest of the markets, the increases in electricity demand were between 2.2% of the Belgian market and 5.7% of the Italian market.

The increase in electricity demand in January compared to the previous month, in general, was influenced by the recovery of the activity after the Christmas and New Year holidays, as well as by the drop in average temperatures in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

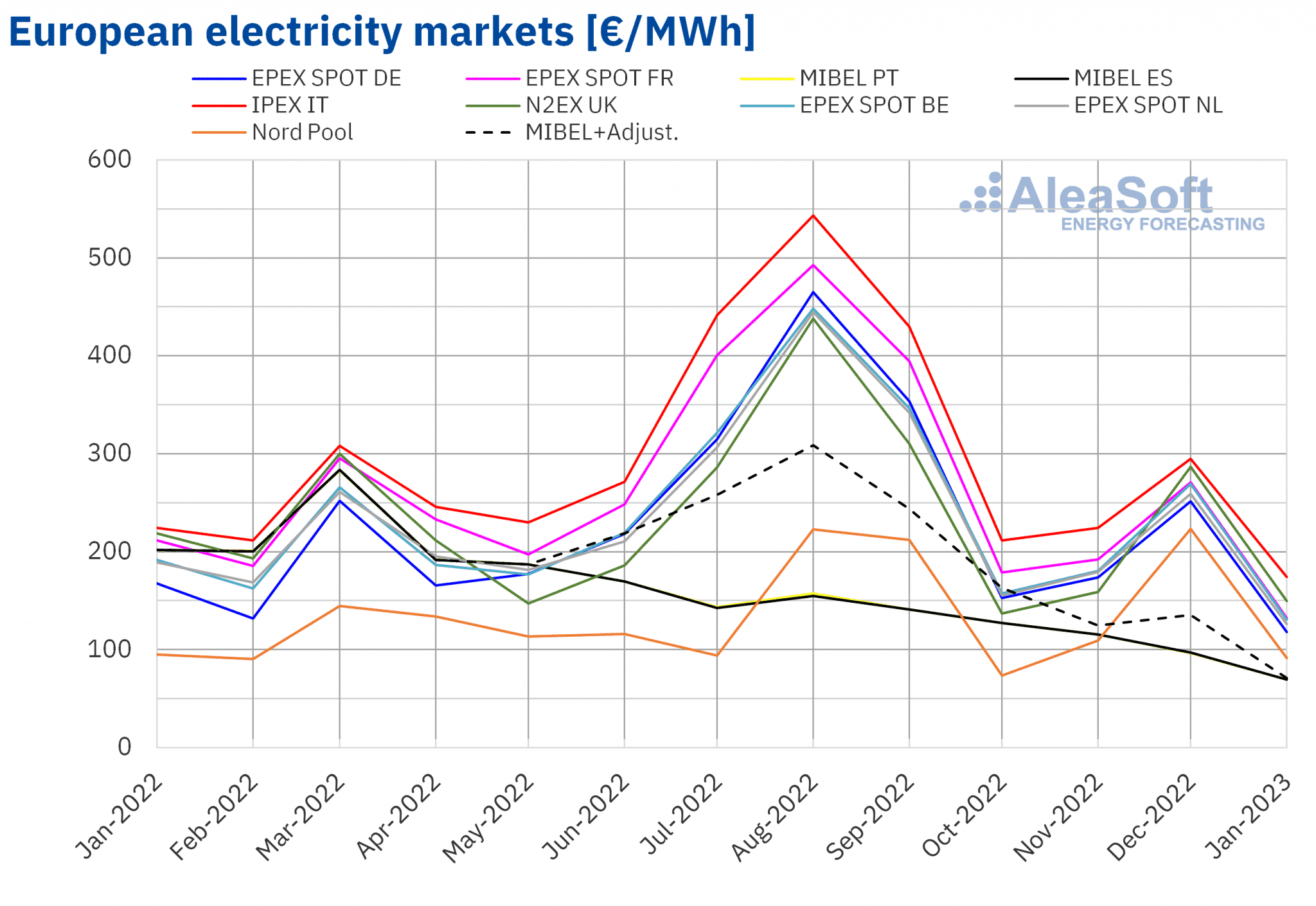

European electricity markets

In the month of January 2023, the monthly average price was below €135/MWh in almost all the European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the averages of the IPEX market of Italy and the N2EX market of the United Kingdom, of €174.49/MWh and €149.61/MWh, respectively. On the other hand, the lowest monthly prices were registered in the MIBEL market of Portugal and Spain, with €69.35/MWh and €69.55/MWh in each case. In the rest of the markets, the averages were between €91.24/MWh of the Nord Pool market of the Nordic countries and €132.10/MWh of the EPEX SPOT market of France.

Compared to the month of December 2022, in January average prices fell in all European electricity markets analysed at AleaSoft Energy Forecasting. The largest fall, of 59%, was registered in the Nord Pool market, while the smallest decreases were those of Spain and Portugal, of 28% in both cases. The rest of the markets registered decreases between 41% of the Italian market and 53% of the German market.

If average prices of the month of January are compared with those registered in the same month of 2022, prices also decreased in all markets. The largest fall was that of the Spanish and Portuguese markets, of 66%. In the rest of the markets, the price decreases were between 3.8% of the Nord Pool market and 38% of the French market.

On the other hand, in the German, Belgian, French and Dutch markets, the average price of January 2023 was the lowest since August 2021, while in the Italian market the price of January was the lowest since September 2021.

In the case of the MIBEL market of Spain and Portugal, the averages of January were the lowest since May 2021. If the adjustment that some consumers have to pay due to the limitation of gas prices in the Iberian market is taken into account, the price of January 2023, which in the case of the Spanish market was €70.90/MWh, continued to be the lowest since the fifth month of 2021.

In the month of January, gas prices dropped considerably compared to the prices of the previous month. CO2 emission rights prices also fell. This favoured the decrease in prices in European electricity markets, despite the increase in demand in most markets. In addition, the general increase in solar energy production and the increase in wind energy production in almost all markets also contributed to this behaviour.

Gas and CO2 emission rights prices, in January, were also lower than those of the same month of the previous year. This favoured the year‑on‑year decline in European electricity markets prices. In addition, the demand fell, favoured by milder average temperatures, and the wind energy production was higher than that of January 2022 in almost all markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

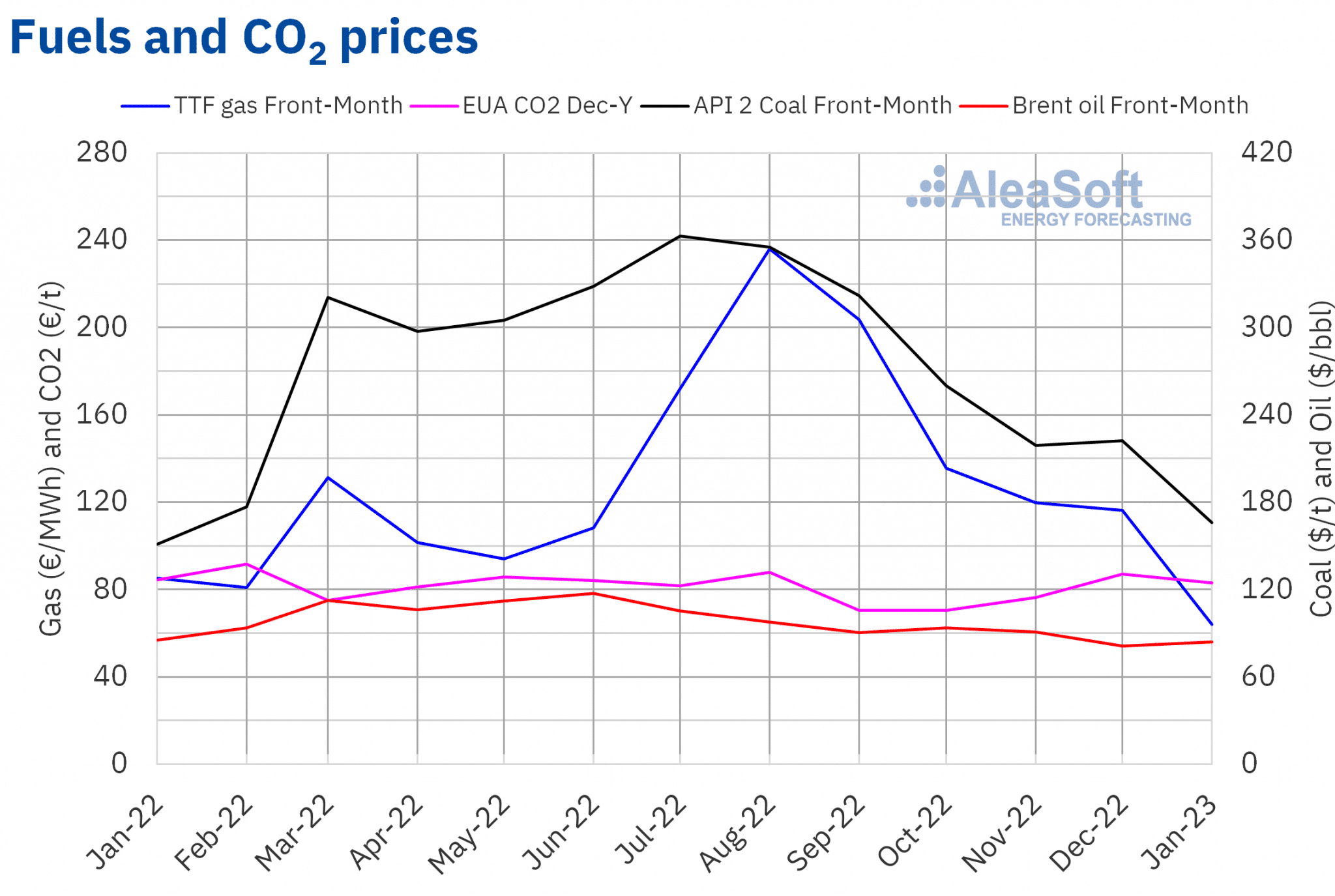

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $84.04/bbl in January. This value was 3.3% higher than that reached by the Front‑Month futures of December 2022, of $81.34/bbl. But it was 1.8% lower than that corresponding to the Front‑Month futures traded in January 2022, of $85.57/bbl.

In January 2023, concerns about the evolution of the global economy and its consequences on the demand persisted. However, expectations about the recovery of the demand in China after the relaxation of the control measures of COVID‑19 contributed to the recovery of Brent oil futures prices compared to the previous month.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the month of January for these futures was €63.92/MWh. Compared to that of the Front‑Month futures traded in December 2022, of €116.22/MWh, the average fell by 45%. If compared with the Front‑Month futures traded in January 2022, when the average price was €85.13/MWh, there was a 25% decrease.

On the other hand, on January 26, 2023, the monthly minimum settlement price, of €54.82/MWh, was reached, which was the lowest since the first half of September 2021.

During the month of January 2023, the high levels of European reserves and the supply of liquefied natural gas by sea allowed prices to fall. In addition, compared to the same month of the previous year, average temperatures were, in general, milder.

In the last week of the month, the news about the completion of repairs at a major liquefied natural gas export facility of the United States also exerted its downward influence on TTF gas futures prices.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price in January of €83.03/t, 6.2% lower than those of the previous month, of €88.53/t. If compared to the average of the month of January 2022 for the reference contract of December of that year, of €84.59/t, the average of January 2023 is 1.8% lower.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On Thursday, February 16, the second webinar of 2023 on European energy markets of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held. On this occasion, the importance of forward markets for the renewable energy development will be analysed, as well as the evolution and prospects of European energy markets. The speakers will be Oriol Saltó i Bauzá, Associate Partner at AleaGreen, and Alvaro Ruben Reyes Diaz, Senior Sales Manager at European Energy Exchange AG (EEX). Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will also participate in the subsequent analysis table.

Source: AleaSoft Energy Forecasting.