AleaSoft Energy Forecasting, January 30, 2023. In the fourth week of January, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The general decrease in wind energy production, the increase in demand in most markets and the increase in CO2 prices contributed to this behaviour. On the other hand, on Thursday, January 26, TTF gas futures registered their lowest settlement price since September 2021, of €54.82/MWh.

Solar photovoltaic and thermoelectric energy production and wind energy production

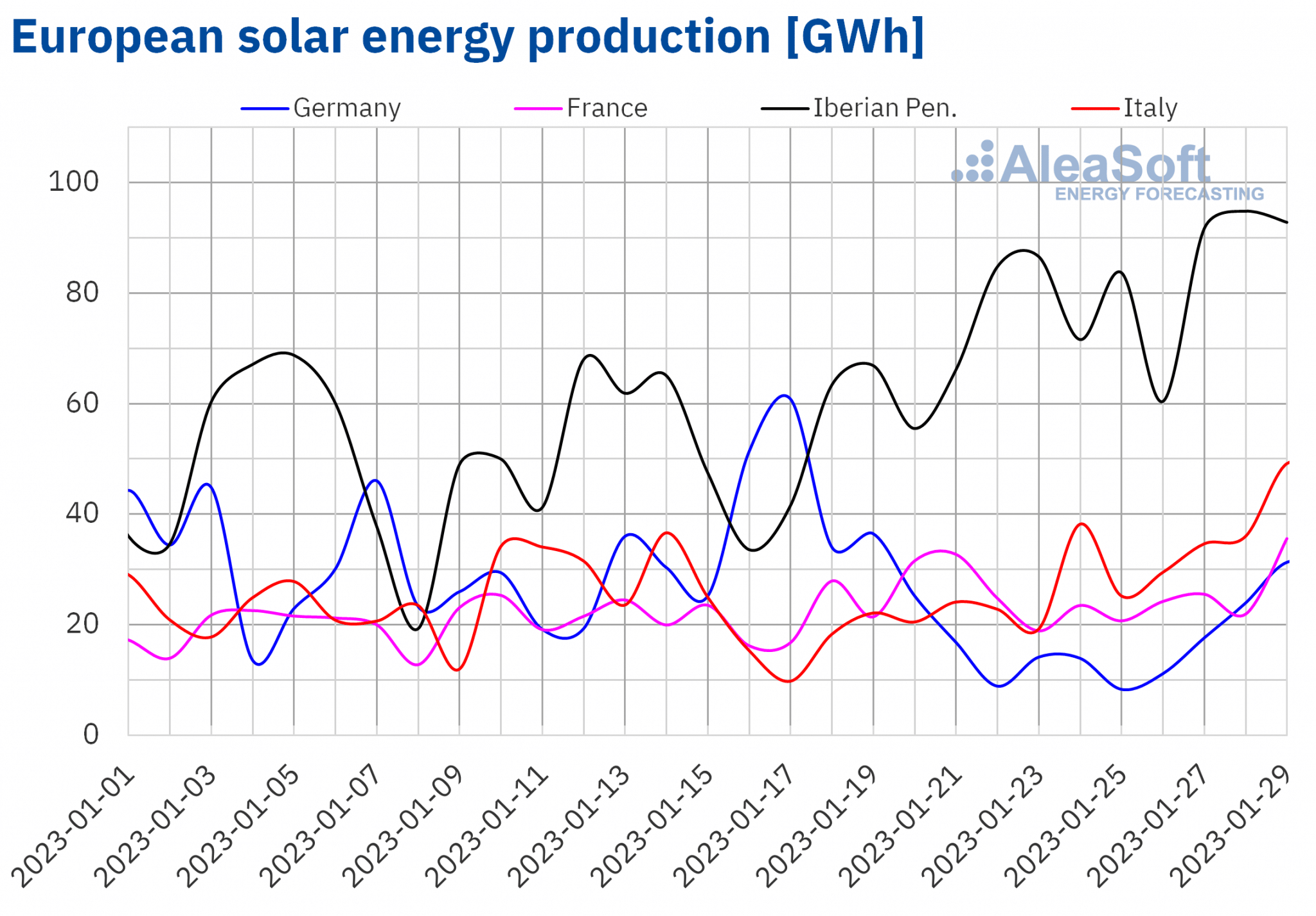

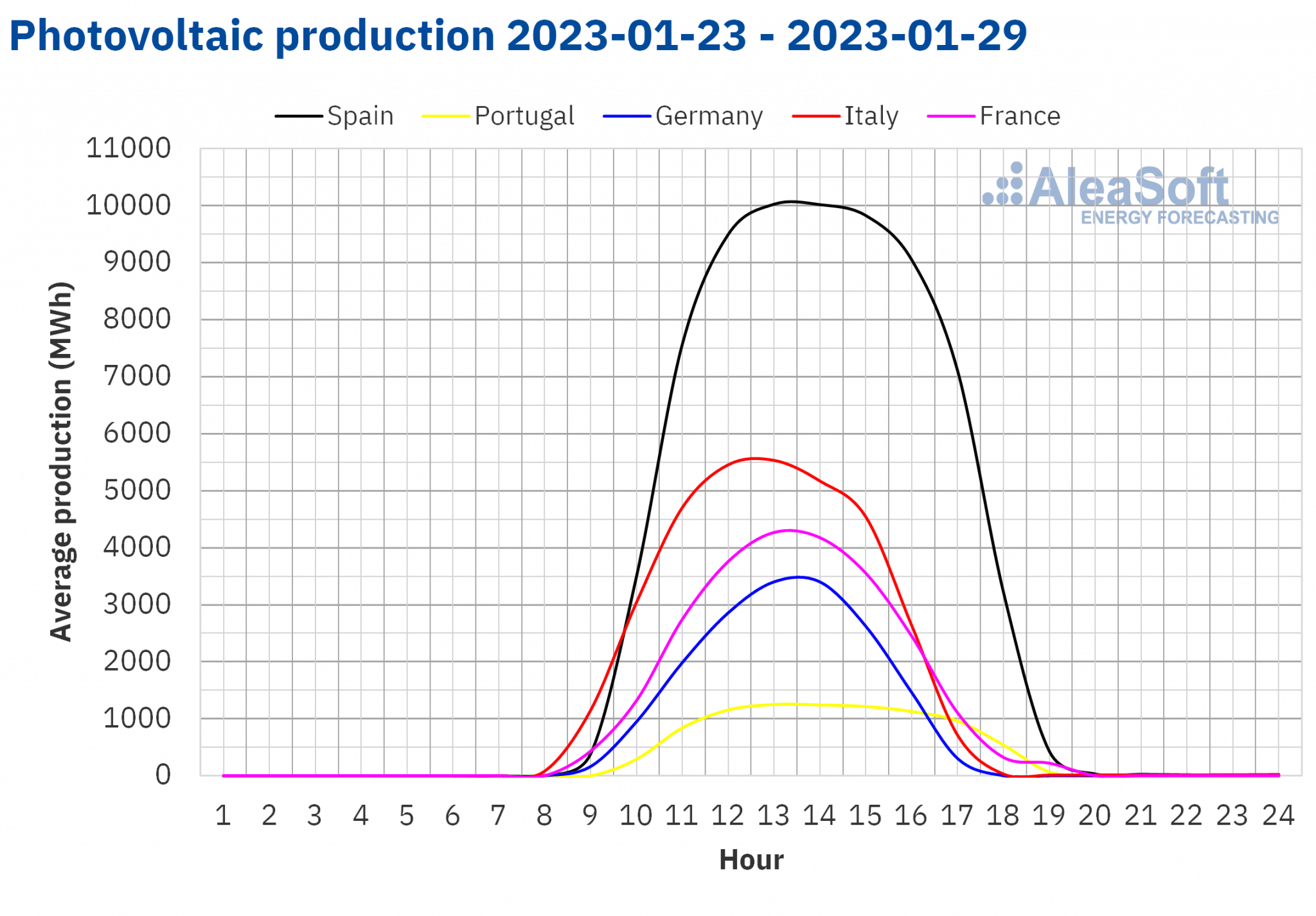

During the fourth week of January, the solar energy production increased compared to the previous week in most European markets analysed at AleaSoft Energy Forecasting. The largest rise was that of the Italian market, of 74%. In the Portuguese market, the increase reached 56% and, in the Spanish market, the increase was 40%. However, in the German and French markets there were decreases of 49% and 0.6%, respectively.

For the first week of February, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production might increase in the German and Italian markets, while in Spain it might decrease slightly.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

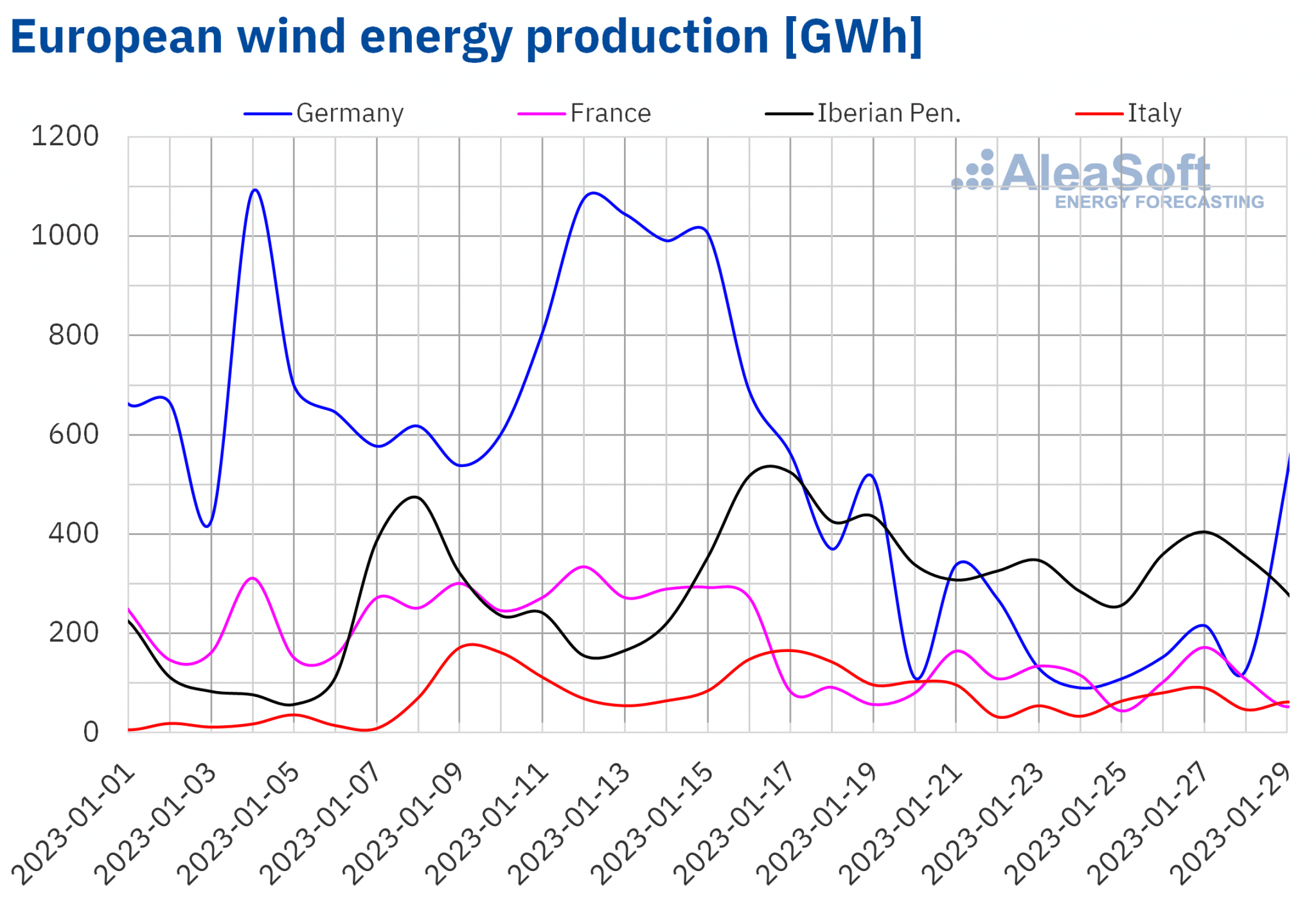

During the week of January 23, the wind energy production decreased compared to the previous week in all markets analysed at AleaSoft Energy Forecasting. The largest fall, of 53%, was that of the German market, followed by that of the Italian market, of 45%. In the Portuguese market, the wind energy production fell by 34%, while in the Spanish and French markets, the production with this technology fell by 18% and 15%, respectively.

For the week of January 30, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that it might increase significantly in the German and Italian markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

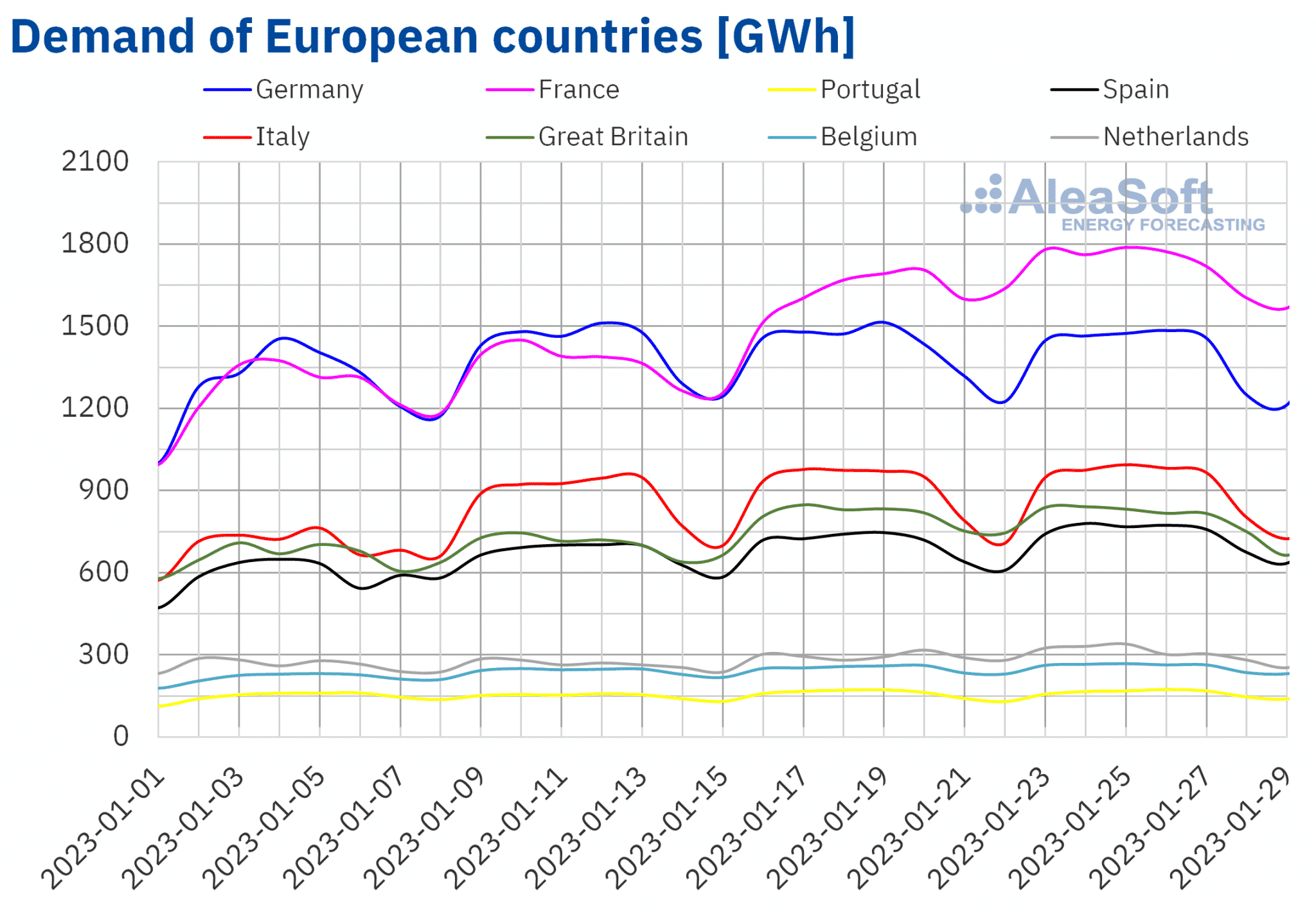

In the week of January 23, the electricity demand increased in almost all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exceptions were the German and British markets, with decreases of 1.1% and 1.3%, respectively. On the other hand, the largest increase, of 5.0%, was registered in the French market, followed by the rise of 4.7% of the Spanish market. In the rest of the markets, the demand grew between 1.4% of the Italian and Portuguese markets and 3.8% of the Dutch market.

In the fourth week of January, average temperatures fell compared to those registered during the previous week in most analysed European markets, contributing to the increase in demand. The largest decreases, of more than 3.0 °C, were registered in the Iberian Peninsula.

For the week of January 30, according to the demand forecasting made by AleaSoft Energy Forecasting, decreases are expected in most analysed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

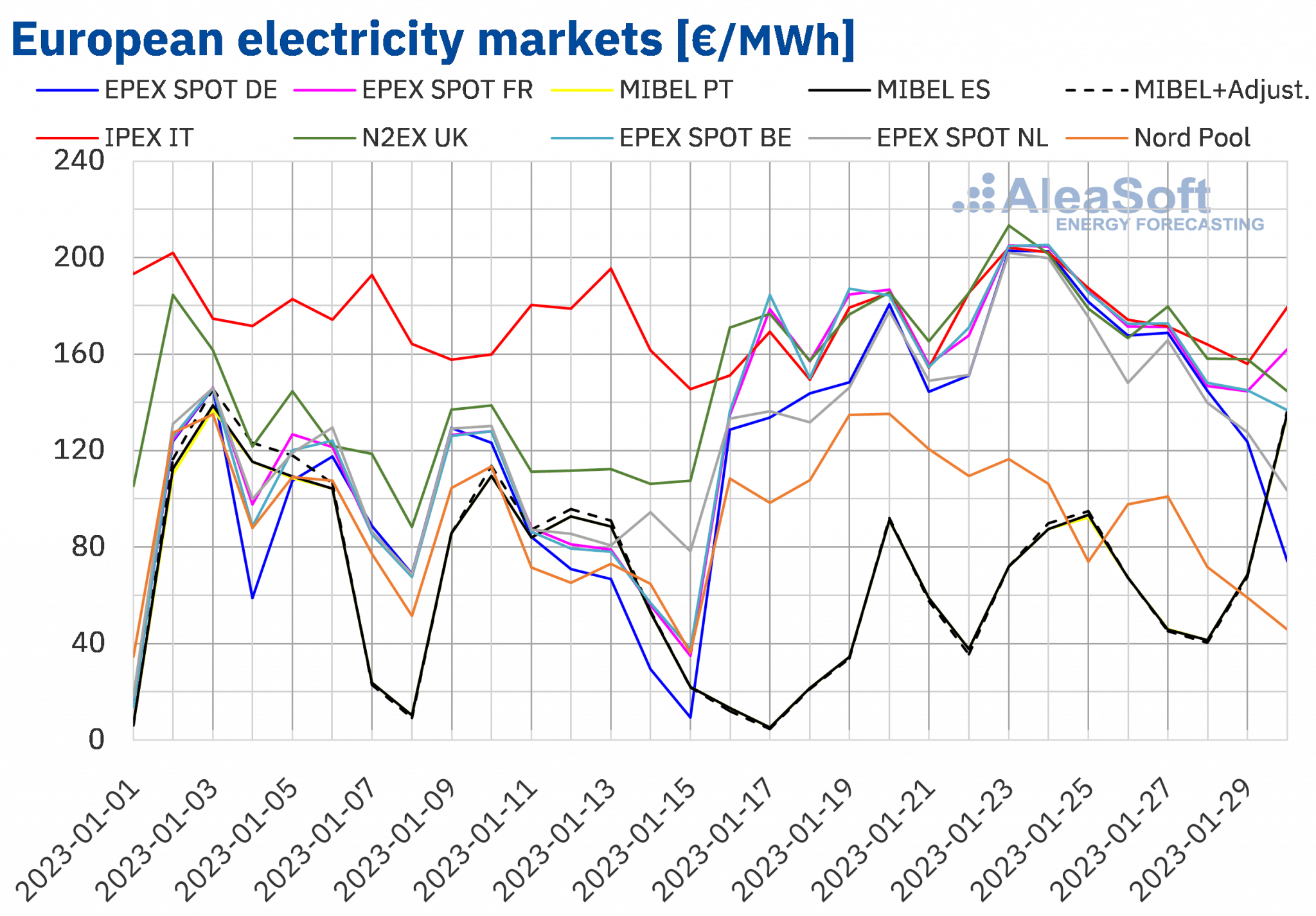

European electricity markets

In the week of January 23, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with a 23% drop. On the other hand, the highest price rise, of 81%, was that of the MIBEL market of Spain and Portugal. In the rest of the markets, increases were between 3.2% of the N2EX market of the United Kingdom and 16% of the EPEX SPOT market of Germany.

In the fourth week of January, the highest average price, of €179.86/MWh, was that of the IPEX market of Italy, closely followed by the average of the British market, of €179.46/MWh. On the other hand, the lowest weekly averages were those of the Portuguese and Spanish markets, of €67.85/MWh and €67.93/MWh, respectively. In the rest of the analysed markets, prices were between €89.42/MWh of the Nordic market and €176.30/MWh of the Belgian market.

Taking into account the adjustment that some consumers have to pay due to the gas price limitation in the Iberian market, MIBEL market prices continued to be the lowest, registering an average of €68.15/MWh in the Spanish market.

Regarding hourly prices, on January 24, from 19:00 to 20:00, a price of €220.00/MWh was registered in the Spanish and Portuguese markets, which was the highest in these markets since December 5, 2022. This price was repeated on Monday, January 30, at the same hour.

On the other hand, in the German, Belgian, French and Dutch markets, on Monday, January 23, from 9:00 to 10:00, prices equal to or greater than €270.00/MWh were registered. That day, from 18:00 to 19:00, an hourly price of £255.06/MWh was reached in the N2EX market. These prices were the highest in these markets since the second half of December 2022.

During the week of January 23, the increase in demand in most markets and the general decrease in wind energy production led to the increase in European electricity markets prices. The rises were also favoured by the increase in CO2 prices. In addition, in markets such as Germany and France, the solar energy production also fell.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the first week of February prices might drop in most European electricity markets, influenced by the decrease in demand and the increase in wind and solar energy production in some markets. However, in the Iberian market, prices might continue to rise.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

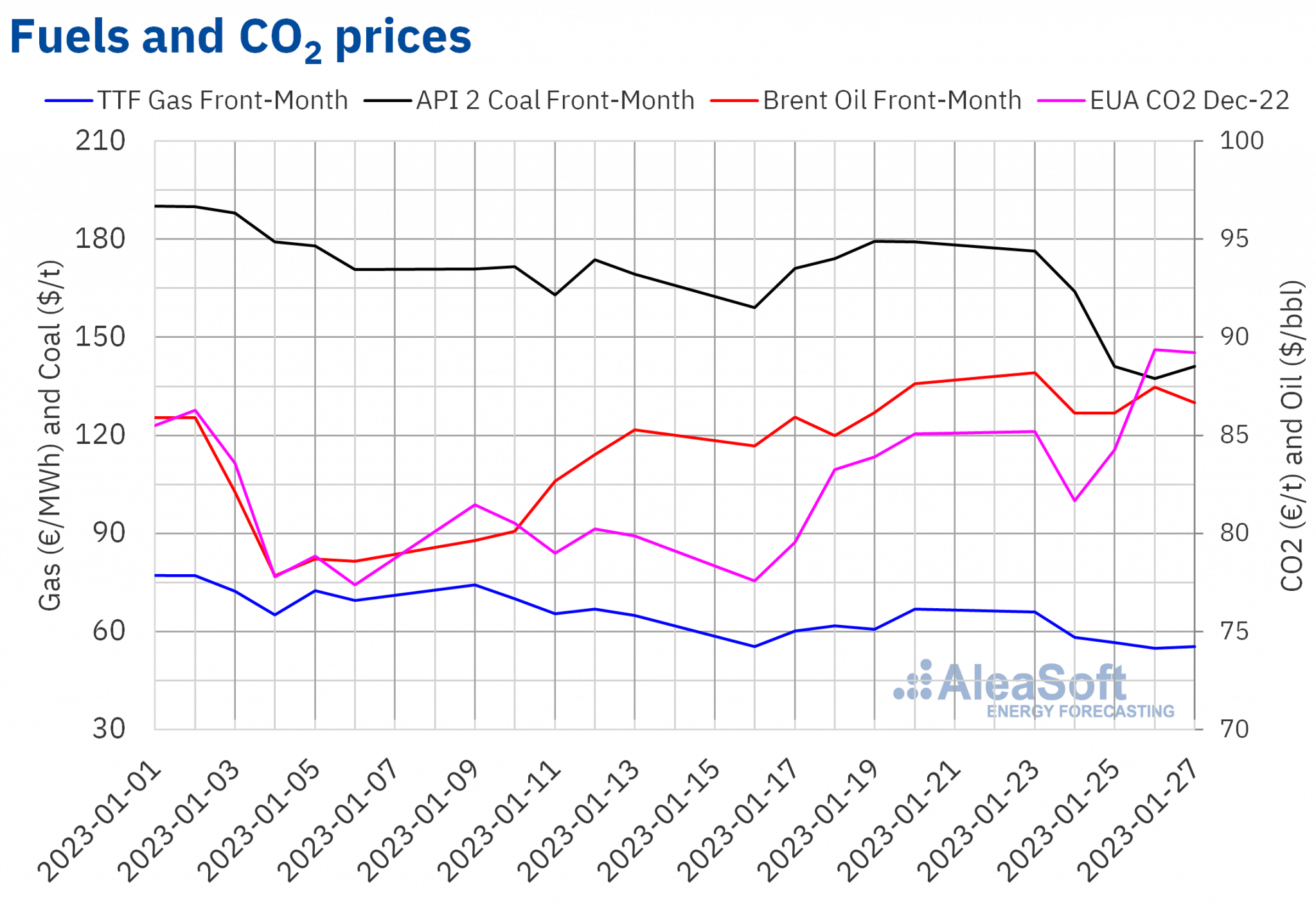

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market reached the weekly maximum settlement price, of $88.19/bbl, on Monday, January 23. This price was 4.4% higher than that of the same day of the previous week and the highest since November 2022. Subsequently, prices fell and on Wednesday, January 25, the weekly minimum settlement price, of $86.12/bbl, was registered, which was still 1.3% higher than that of the previous Wednesday. After recovering slightly on Thursday, on Friday, January 27, prices fell again to register a settlement price of $86.66/bbl, 1.1% lower than that of the previous Friday.

Expectations about the recovery of the demand in China contributed to the fact that Brent oil futures prices remained above $85/bbl in the fourth week of January, despite concerns about the inflation and the evolution of the global economy.

As for TTF gas futures in the ICE market for the Front‑Month, they reached the weekly maximum settlement price, of €66.00/MWh, on Monday, January 23. This price was 19% higher than that of the same day of the previous week. Subsequently, prices fell and on Thursday, January 26, the weekly minimum settlement price, of €54.82/MWh, was registered. This price was 9.7% lower than that of the previous Thursday and the lowest since September 2021. On Friday, January 27, prices recovered slightly and a settlement price of €55.43/MWh was registered, which was 17% lower than that of the previous Friday.

The forecasts of milder temperatures and the high levels of European reserves favoured the price declines registered in the fourth week of January. Expectations of an increase in liquefied natural gas supply from the United States as a result of the completion of the repairs carried out at the Freeport LNG export plant also contributed to this behaviour.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, in the fourth week of January, they remained above €80/t. The weekly maximum settlement price, of €89.37/t, was reached on Thursday, January 26. This price was 6.5% higher than that of the previous Thursday and the highest since December 2022. On Friday, January 27, the settlement price fell slightly to €89.23/t, being 4.9% higher than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

Recently, the environmental impact statements of a large number of renewable energy projects were approved in Spain. Taking this circumstance into account, at AleaSoft Energy Forecasting and AleaGreen a special promotion of long‑term price forecasts is being carried out, which are useful for PPA, assets valuation and financing. These price forecasts are characterised by having a 30‑year horizon and hourly granularity, in addition to including confidence bands.

Source: AleaSoft Energy Forecasting.