AleaSoft Energy Forecasting, October 17, 2022. Interview by Ramón Roca, director of El Periódico de la Energía, with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

The European Union is preparing for what is expected to be a difficult winter in terms of energy. What do you think of the measures to alleviate the effects of high prices? Are they sufficient? Could other measures have been taken? Are they on time, and do they work?

We welcome measures to incentivise savings and those aimed at helping the most vulnerable consumers and businesses. In this respect, we believe that one measure that would contribute to lower energy prices and to increase savings would be to give large consumers of electricity and gas the possibility of carrying out ERTEs, as it was done during the pandemic.

The introduction of new taxes or caps on the benefits of infra‑marginal technologies were necessary measures in this economic situation. However, these measures may create legal and regulatory uncertainty, which could slow down to some extent the development of new renewable energy projects. Renewable energies are one of the most important pillars for reducing dependence on foreign energy and also for lowering electricity prices, so it is important that these measures are limited in time.

We think there are measures that could have been taken earlier. The rise in gas prices and European electricity markets became sharper after the start of the war in Ukraine, but the price escalation started in 2021, especially in the second part of the year.

We believe that the measures, unfortunately, will not be sufficient. There is just needed to take a look at the case of Spain with the Iberian exception, which managed to get prices generally lower than they would have been if the measure had not been applied, but they are still very high prices for consumers.

What do you think of the + Seguridad Energética plan approved by the government with 73 measures?

This plan is still very new and it needs time to be seen how its measures will materialise. Some of them are attractive, such as the promotion of self‑consumption in public buildings, the increase in electricity invoice transparency, the support for cogeneration, the simplification of state administrative procedures and the coordination of regional administrative procedures for the integration of renewable energies, etc.

The plan also includes positive measures to help the most disadvantaged sectors, such as the reinforcement of electricity and thermal social vouchers, support for gas consumers with community boilers, flexibility in electricity and gas contracts, as well as support for the industrial sector.

With this package of measures, the government aims, among other impacts, to achieve savings in natural gas consumption of between 5.1% and 13.5%, as well as reducing the volatility of electricity prices. We therefore believe that the plan is heading in the right direction.

Several proposals are being discussed in the European Council: an Iberian derogation for the whole of Europe, a cap on gas prices, reform of the FTT and reform of the electricity market (marginalism). What do you think of these four proposals?

We believe that the Iberian exception would be an exportable measure to the rest of the European markets for several reasons. First, because it has shown to work in lowering the market clearing price and also the consumer price, once the adjustment price has been added to compensate combined cycle plants.

Secondly, if all interconnected European markets operated with the same mechanism, prices would fall in all markets, including Spain and Portugal, because combined cycle gas production would be reduced. In few words, a market with more homogeneous rules would be more efficient and with lower prices.

As far as gas market intervention is concerned, it should be treated very cautiously. Any price cap measure, whether for gas or the Iberian exception, should be temporary and only aimed at protecting consumers in an exceptional situation. Maintaining price caps or revenue cuts for certain technologies in the long term can be very damaging to the regulatory stability needed to attract the investments necessary for the energy transition.

And as for market reform, it can also bring long‑term uncertainty. Any reform should be as gradual, consensual and non‑invasive as possible. And it should always be an improvement in order to give the right price signals in the long term. Taking measures in the heat of the moment in the middle of an extraordinary crisis situation may cause us to lose the long‑term view of whether a market is really functioning as expected.

How do you expect prices in the Iberian electricity market to evolve over the coming winter and how do you expect prices in the rest of Europe to evolve?

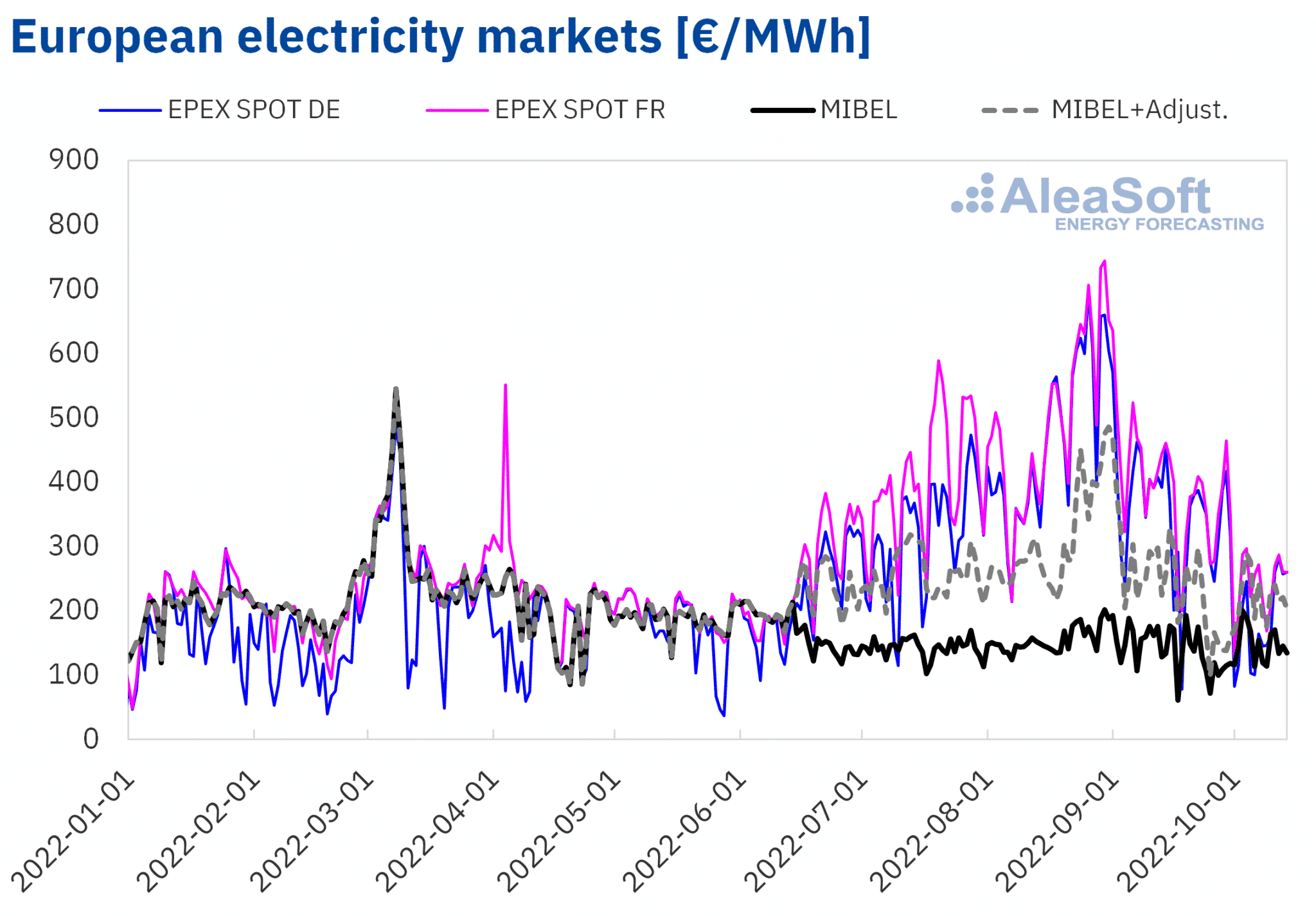

This winter, the differences between the MIBEL market and the rest of the European markets will become more noticeable. With the drop in temperatures and the consequent increase in electricity demand, prices in all markets will increase. But, thanks to the Iberian exception mechanism, prices in Spain and Portugal should show a more discrete variation than the rest of the markets, remaining appreciably lower.

This, of course, is highly dependent on gas prices, CO2 prices and other market variables, such as wind energy production which tends to be higher in winter. However, with the current outlook, we expect European market prices to diverge from Iberian market prices, with the Iberian market remaining at lower levels, mainly in the colder months.

What about gas prices? Can we expect new all‑time highs this winter?

A return to record highs in gas prices in the winter is not ruled out. There are no signs that the conflict between Russia and Ukraine can be resolved in the short term and as we already saw, Russia is using energy prices as one of its weapons. Therefore, fears related to supply problems will remain latent, which will increase the risk that prices will set new records either because of a new setback in the conflict, in retaliation to the measures that the European Union may be taking or if cold wave occur during the coming winter.

The prices of CO2 emission rights have also broken their historical highs this year. At this time of energy crisis, what impact do these prices have on consumers, especially on large electro‑intensive consumers?

CO2 emission rights are a mechanism that was designed with the intention of increasing prices in order to empower the energy transition. Since its creation in 2008 and until December 2020, the price of allowances never exceeded 30 €/t. However, during 2021 they began an upward trend, which led to the current levels. In 2022, both in February and August, they exceeded 95 €/t and are now at levels above 65 €/t. In other words, the maximum value that the market had in its first twelve years has doubled and even tripled in the last two years.

This rise in CO2 prices had a direct impact on electricity prices and, as a consequence, on consumers. Among the most sensitive consumers are electro‑intensive consumers, for whom the cost of energy has a significant impact on their production costs, and the most vulnerable consumers who see their bills increased.

Among the measures being considered to protect consumers from high energy prices, there is no mention of measures on CO2 emission rights, in your opinion, are there any measures that could be taken in this respect?

Since the escalation of electricity market prices began in the second half of 2021, we proposed in various forums a temporary moratorium on CO2 emission rights or a price cap for this market, whose rise has a significant component of speculation. It is true that this market is fulfilling its objective of penalising the most polluting energies and favouring renewable energies, but right now European industry is in a dramatic situation. The CO2 emission rights market was created by the European Union and it is in its hands to regulate it in order to contribute to lowering prices in the electricity markets.

Do you consider the “gas price cap” of the Excepción Ibérica to have been effective?

The gas price cap allowed prices in the Iberian electricity market, which were usually equal to or higher than those in France and Germany, to become lower than those in these markets, even when taking into account the adjustment that part of the consumers have to pay as compensation for the adjustment. It has therefore been effective.

Source: Created by AleaSoft Energy Forecasting using data from OMIE and EPEX SPOT.

Source: Created by AleaSoft Energy Forecasting using data from OMIE and EPEX SPOT.

However, prices including adjustment remain high because gas prices remain high and combined cycle production increased.

EU measures include capping the revenues of infra‑marginal producers, including those with established bilateral contracts. Could this measure affect the PPA market and long‑term regulatory certainty?

It is understandable that the European Union is making efforts to reduce electricity prices in the midst of the current international situation and the gas crisis. This limit on the benefits of infra‑marginal technologies is already applied in Spain since 2021 through Royal Decree‑Law 17/2021 and subsequent modifications. However, at the European level it is a newly adopted measure that also offers freedom to each state to set its own limit, as long as it is below the agreed €180/MWh.

A regulatory change creates a sense of uncertainty in the market, and this may have an impact on the willingness of large investors to invest in that market. EU measures may affect, at least temporarily, the volume of PPA offers in Europe. Projects that are close to their commercial start date will be the most affected, especially if part of the capacity was reserved for the day‑ahead market.

What is your opinion on the auction of renewable PPA with electro‑intensives that AEGE is organising for the beginning of next year?

Electro‑intensive consumers have always demanded more competitive energy prices, as they have in other European countries, and this is crucial in order to have a strong and competitive industry. The situation is further aggravated by the fact that only 10% of the energy that these industries are consuming in 2022 is covered with hedging instruments at fixed prices, whether futures or bilateral contracts. So 90% of the energy consumed is being bought on the day‑ahead market with the price levels and volatility that this entails.

The energy generators are seeking to be able to receive PPA offers at competitive prices, something they say they were not able to do so far. A public auction for renewable projects with standardised products (twelve‑year pay‑as‑produced PPA contracts) could allow them to cover between 30% and 40% of their energy consumption at competitive prices and also, very importantly, with stability in the long term.

If this energy crisis helped us to realise the need to reduce our dependence on external energy sources, what are the guidelines for achieving an energy system with little or no external dependence and, moreover, with zero emissions?

Firstly, electrify the economy to use electricity generated without emissions in as many processes as possible. Extend the use of electric vehicles and green hydrogen in transport, which is the sector with the highest fuel consumption and emissions in Spain and Europe. More efficient and intelligent energy consumption and promotion of self‑consumption. Development of renewable energies to produce all the clean energy needed, with the support of batteries and green hydrogen to store energy for moments of lower renewable energy production. Without a doubt, it is a revolution.

What opportunities may arise for electricity generators and large consumers during the transformation of the energy system in the energy transition? How can AleaSoft Energy Forecasting help them in this process?

We believe that there is too much interest, in the mainstream media and by some providers of long‑term energy market analysis and forecasts, in highlighting the problems, drawbacks and dangers that the energy transition may bring. Among the dangers are the cannibalisation of prices due to the massive entry of renewable energies, that there will be too much renewable energy production and spills at certain times, while, for others, renewable energies will not be able to meet demand, that it is not possible to electrify all transport and industry, and that green hydrogen and batteries are still very immature technologies.

At AleaSoft – AleaGreen we approach the long‑term vision from the perspective of markets equilibrium in the long term. An accelerated energy transition like the one we are going through will obviously bring temporary disruptions. But each disruption will bring an opportunity, whether it is an opportunity for consumers to obtain lower prices, or for producers to use surplus energy for storage or to produce green hydrogen.

To talk about the market is ultimately to talk about producers and consumers, and as soon as opportunities appear on one side or the other, a market actor will appear to seize them and, in some way, restore the balance. Obviously, we expect volatility and mismatches in the future, but with a long‑term perspective, we see that the balance between the prices that producers will be able to offer and the prices that consumers will be willing to pay will be maintained.

In order to take advantage of all these opportunities, we need a clear vision of the future of energy markets, coherent and scientifically based, such as the one we offer at AleaSoft and AleaGreen.

What challenges is the current situation of macrovolatility and uncertainty in energy markets posing for long‑term price forecasting models? How will the current crisis impact electricity market prices over the 2040‑2050 horizon?

The current crisis situation was beyond the reach of any forecasting model that existed in 2019. The advantage of Alea models, which are statistically based models that hybridise classical techniques with neural networks, is that, with a long‑term view, they can understand the current situation as an anomaly due to external conditions, such as gas prices, without the long‑term equilibrium being unduly affected.

So in the long term we do not see that the situation has changed significantly. We see some more volatility but the price trend will continue to be driven by the increase in renewable energies, energy storage capacity, green hydrogen production, international interconnection capacity and demand.

AleaSoft Energy Forecasting recently celebrated its 23rd anniversary. What is the secret of your success? What sets you apart from the competition?

In these 23 years we have been working to provide forecasting services in the energy sector. Forecasts of prices, electricity demand and renewable energy production in all horizons, from the next few minutes to a horizon of 30 or 40 years. Our start in 1999 almost coincides with the emergence of the European electricity markets and we have gradually been providing solutions to the new situations that have arisen in this period, mainly the emergence, firstly, of wind energy production and, more recently, of photovoltaic energy production. We have had to respond to a growing sector with new needs. The challenge is how to improve the quality of forecasts, which new forecasts are needed and which new markets to address. The key to success is the constant improvement of the quality of the forecasts, each time with more competitive offers. The main difference with the competition is that we have a scientific methodology that has been successfully tested over the last 23 years and that, in addition, we use everything that other companies or research centres use in a complementary way when the problem requires it. As a result, what differentiates us from the competition is “better quality and more competitive prices”.

You have now held 25 editions of webinars on energy markets with the participation of important companies in the sector. What feedback do you receive from the audience? What do you take away from this experience?

We started in December 2019. Throughout the pandemic and confinement we continued to run the webinars on a monthly basis and this kept us closely linked to the sector that could not attend face‑to‑face events. In the energy sector it is the only webinar that is held monthly and has the best specialists as guest speakers. The feedback we receive is very positive and allows us to maintain our position as an informative and training reference. As an example of the quality of the guests, in the next editions we will have the third visit of speakers from Deloitte on 20 October 2022, PwC on 19 January 2023 and EY on 16 March 2023. For us it is a fundamental experience to learn first‑hand from the most important companies and to be able to share space with the best specialists in the energy sector. Having hundreds of attendees each month who represent an important part of the sector is both an experience and a great privilege.

In these 23 years you have stood out as an innovative company. Why this constant focus on innovation? At the Energy Night, which took place on 29 September, we presented an award for the Best Energy Innovation Initiative, which was sponsored by you. Is that a coincidence?

Innovation has been our main driver for quality improvement. For instance, at AleaSoft we created a new division this year, AleaGreen, to further activate innovation related to long‑term forecasting, which is necessary for renewable energy investments. The first “Energy Night” award ceremony was a resounding success, so it was a great privilege to sponsor the “Energy Innovation” award.

The energy sector has changed a lot in recent years and this is expected to be the trend in the coming years. Are you offering new services that meet the current needs of your customers?

The decarbonisation expected in the next 20 – 30 years is a big challenge. Everything will be different as we cannot imagine yet. It is a necessity for us to slow down climate change by stopping the emission of pollutants and greenhouse gases. And, even more importantly, to have energy independence. Battery storage, hybridisation and seasonal storage with green hydrogen will play a key role in this energy transition. We are focusing our efforts to develop new services in these fields.

As an example of a new service, we developed a system to generate thousands of hourly price forecasts, simulating multiple variable scenarios. This new service is essential for optimising battery design, optimising hybridisation strategies, hedging for those who buy and sell energy, optimising offers from marketers and, in general, optimising any activity in the sector in the medium and long term.

We are also providing electricity and gas forecasting services in North and South America. Our challenge is to be present in the global energy markets, covering electricity and gas forecasting needs in all continents.