AleaSoft Energy Forecasting, September 4, 2023. In August 2023, prices in most European electricity markets increased, ranging between €90/MWh and €112/MWh. Higher gas prices, as well as lower solar energy production, contributed to these increases. On the other hand, Spain, Italy, France and Portugal registered all time records of photovoltaic and wind energy production for a month of August.

Solar photovoltaic and thermoelectric energy production and wind energy production

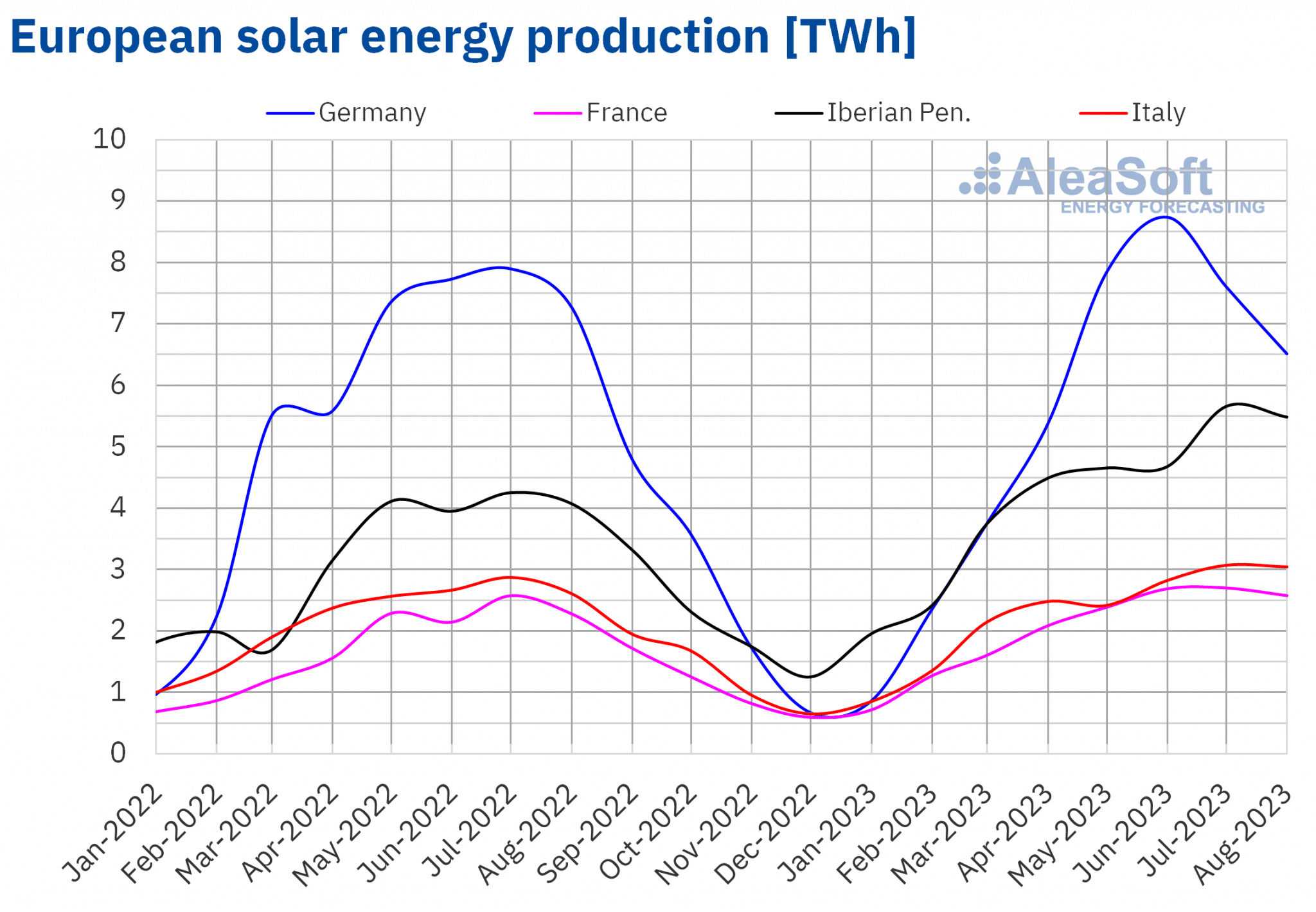

In August 2023, solar energy production increased in most of the markets analysed at AleaSoft Energy Forecasting compared to the same month of the previous year. The largest increases were registered in the Iberian Peninsula, with values of 43% and 33% in the markets of Portugal and Spain, respectively. The smallest increases were observed in the Italian market, 17%, and in France, 13%. The exception was the German market, where solar energy production fell by 10% compared to August of the previous year.

Compared to July 2023, solar energy production of August decreased in all analysed markets. The fall ranged between 0.8% observed in the Italian market and 14% registered in the German market.

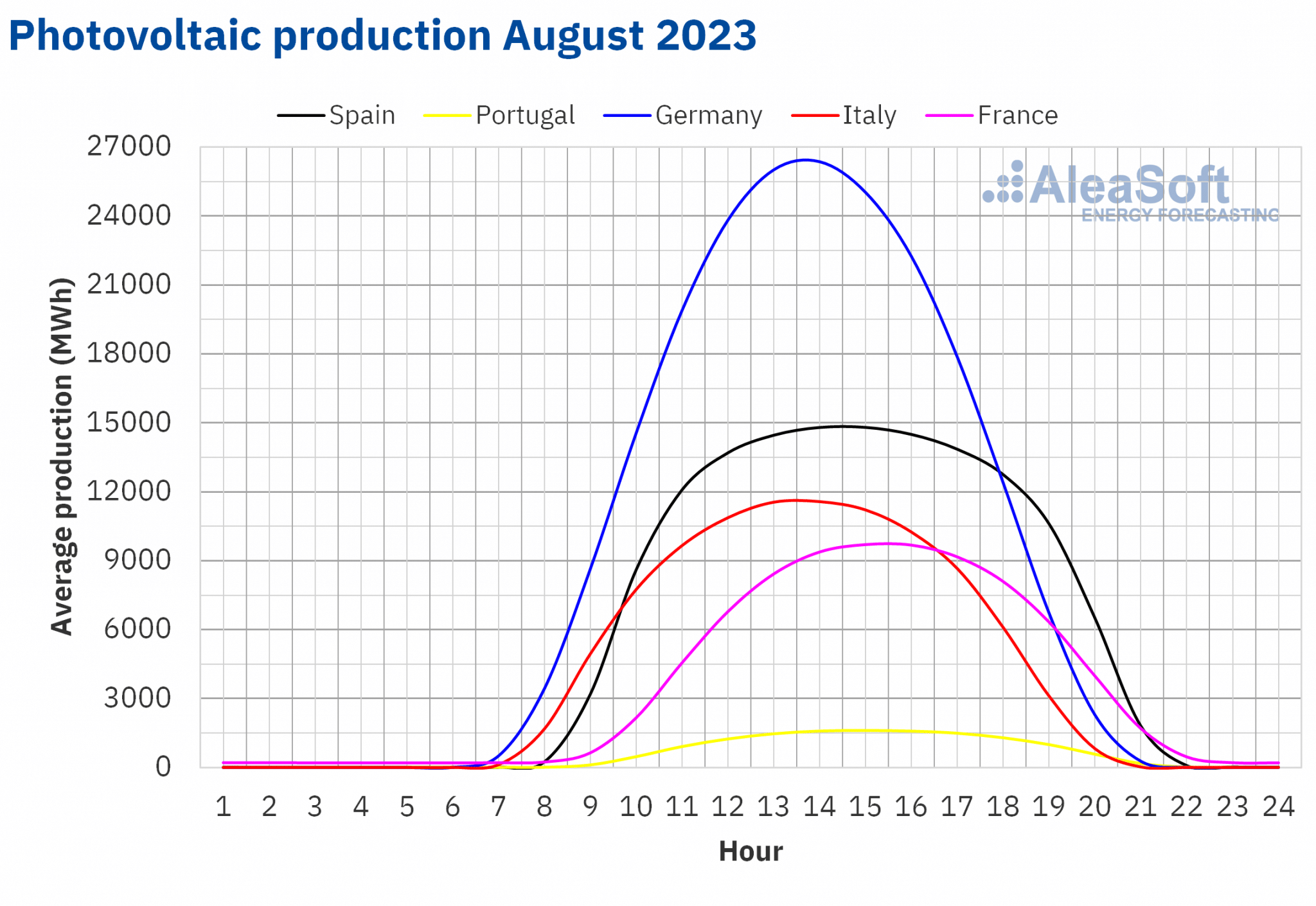

On the other hand, solar photovoltaic energy production in August 2023 broke records in Southern European markets compared to historical August production in previous years. The Spanish market topped the list with 4312 GWh generated, followed by the Italian market and the French market with 3042 GWh and 2579 GWh of production, respectively. The Portuguese market closed the list with 422 GWh produced using this technology.

These data reflect the general increase in installed capacity of solar energy production in recent years. For example, according to data from REN, the Portuguese electricity system operator, in August 2023, the installed capacity of solar photovoltaic energy production increased by 7 MW compared to that installed at the end of July.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

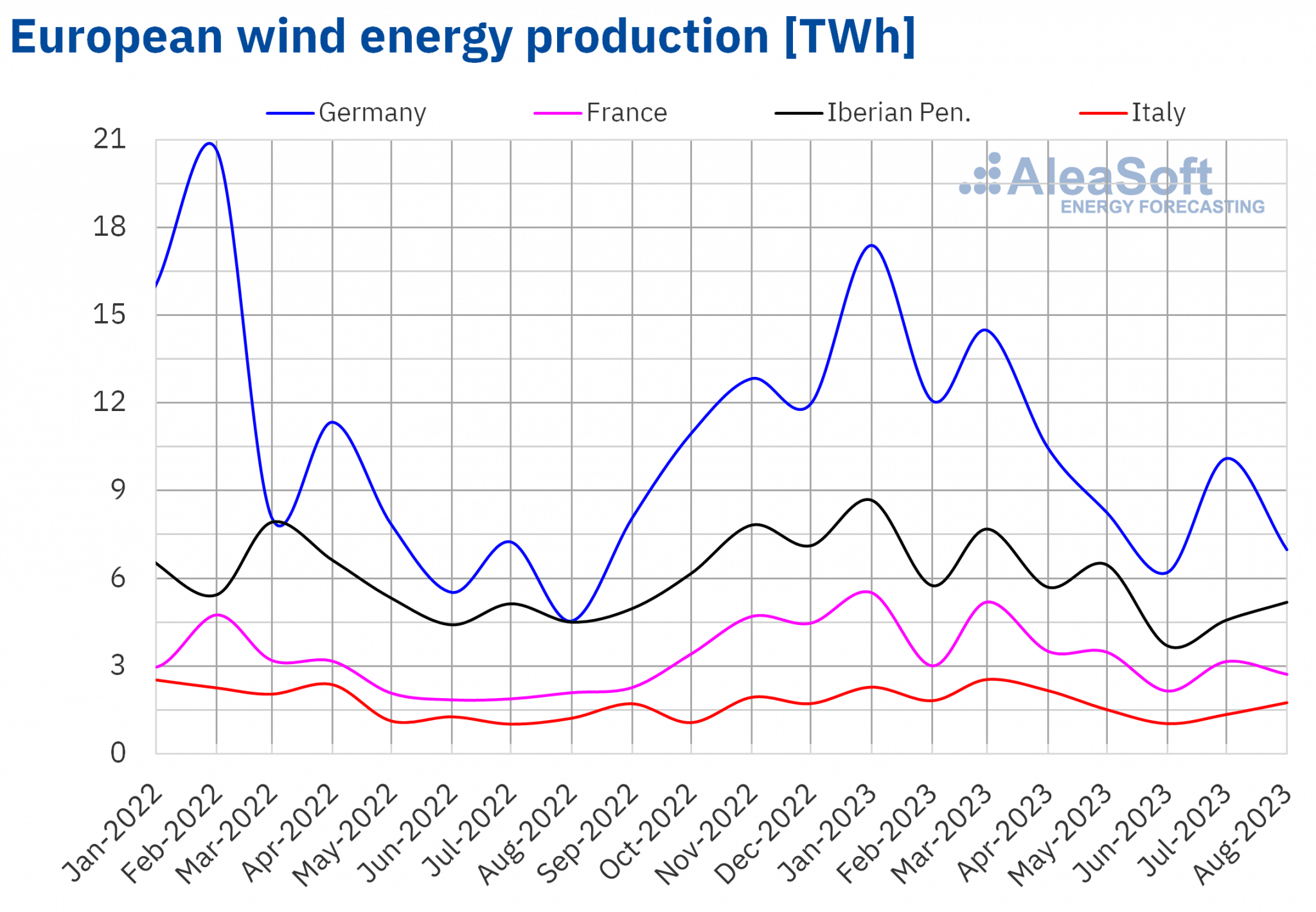

Regarding wind energy production, in August 2023, a year‑on‑year rise was registered in all markets analysed at AleaSoft Energy Forecasting. The largest increase, which was 54%, was registered in the German market, followed by increases of 51%, 44% and 30% in the Portuguese, Italian and French markets, respectively. The Spanish market was the one with the smallest increase in generation using this technology, 1.6%.

Compared to the previous month, wind energy production increased in the Southern European markets in August 2023. In the Italian market it increased by 30%, while in Spain and Portugal, by 14% and 10% respectively. In contrast, wind energy production fell by 31% in the German market and by 14% in the French market.

As solar energy production, wind energy production in August 2023 broke records in Southern European markets compared to historical August production in previous years. The Spanish market topped the list with 4143 GWh generated. The French, Italian and Portuguese markets registered 2726 GWh, 1751 GWh and 1043 GWh respectively. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

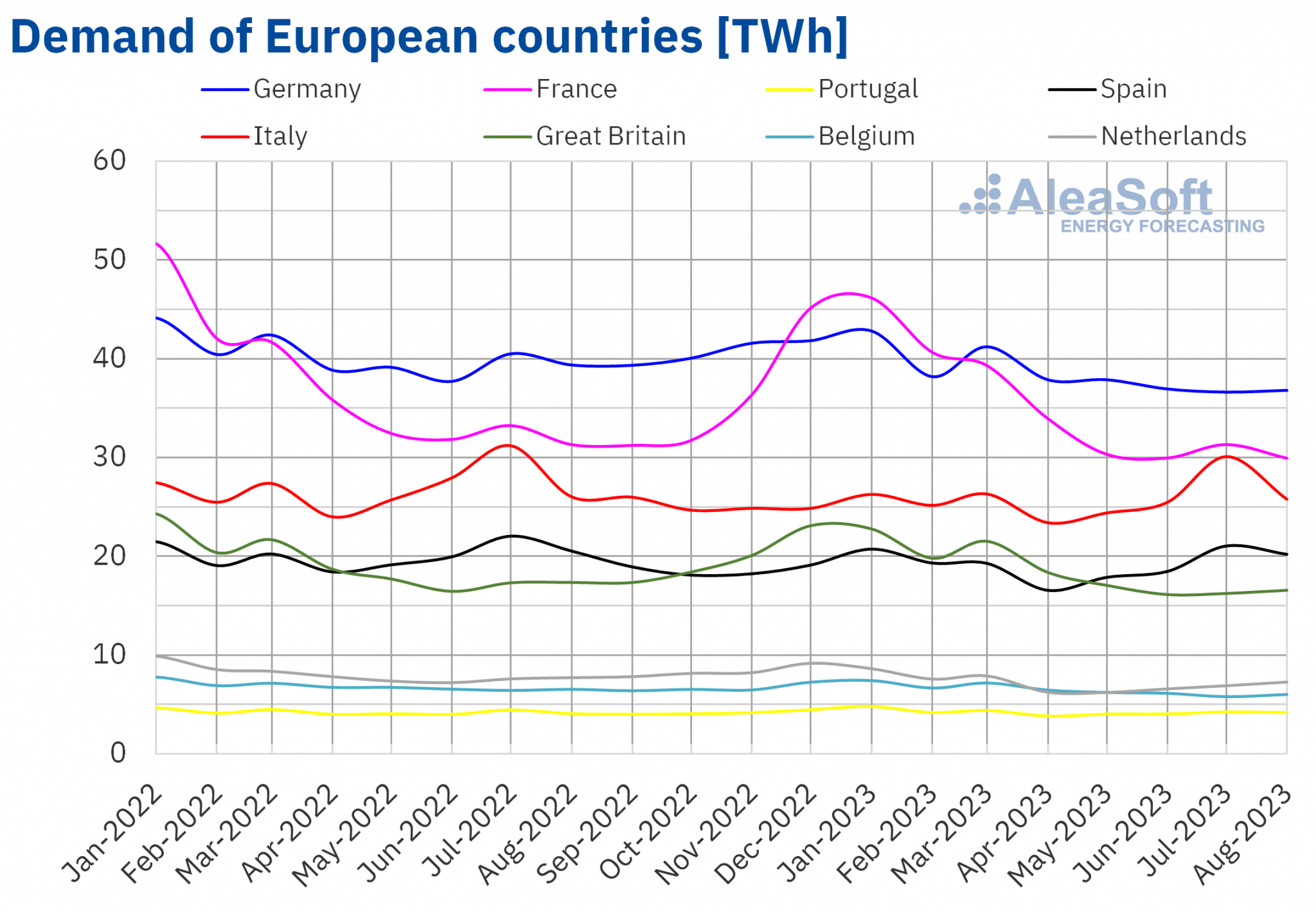

In the month of August 2023, a year‑on‑year decline in electricity demand was registered in most of the analysed European markets. The Belgian market registered the largest decrease of 7.9%, followed by the German and Dutch markets with decreases of 6.5% and 5.7% respectively. On the other hand, the smallest declines were observed in the Italian market (1.0%) and the Spanish market (1.4%). The exception was the Portuguese market, where electricity demand increased by 2.8%.

Year‑on‑year changes in average temperatures followed similar trends to electricity demand. Portugal was the only country where the average temperature increased by 0.7 °C. In the rest of the analysed countries, average temperatures remained similar, like in Spain, or were lower than in August of the previous year. The smallest decrease of 0.7 °C occurred in Italy, while the largest decrease of 2.5 °C was registered in Belgium.

Compared to the month of July, the largest increase in electricity demand was registered in the Dutch market, which was 5.3%, followed by increases of 3.7% in the Belgian market and 2.0% in the British market. The German market registered the smallest increase in demand, 0.5%. On the other hand, in Southern Europe, electricity demand decreased, ranging between 1.5% in Portugal and 14% in Italy.

In most of the analysed countries, the variation in average temperatures between August and July 2023 did not exceed ± 0.5 °C. The exceptions were Italy with a 1.2 °C decrease in temperatures and Portugal with a 0.8 °C increase in temperatures. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

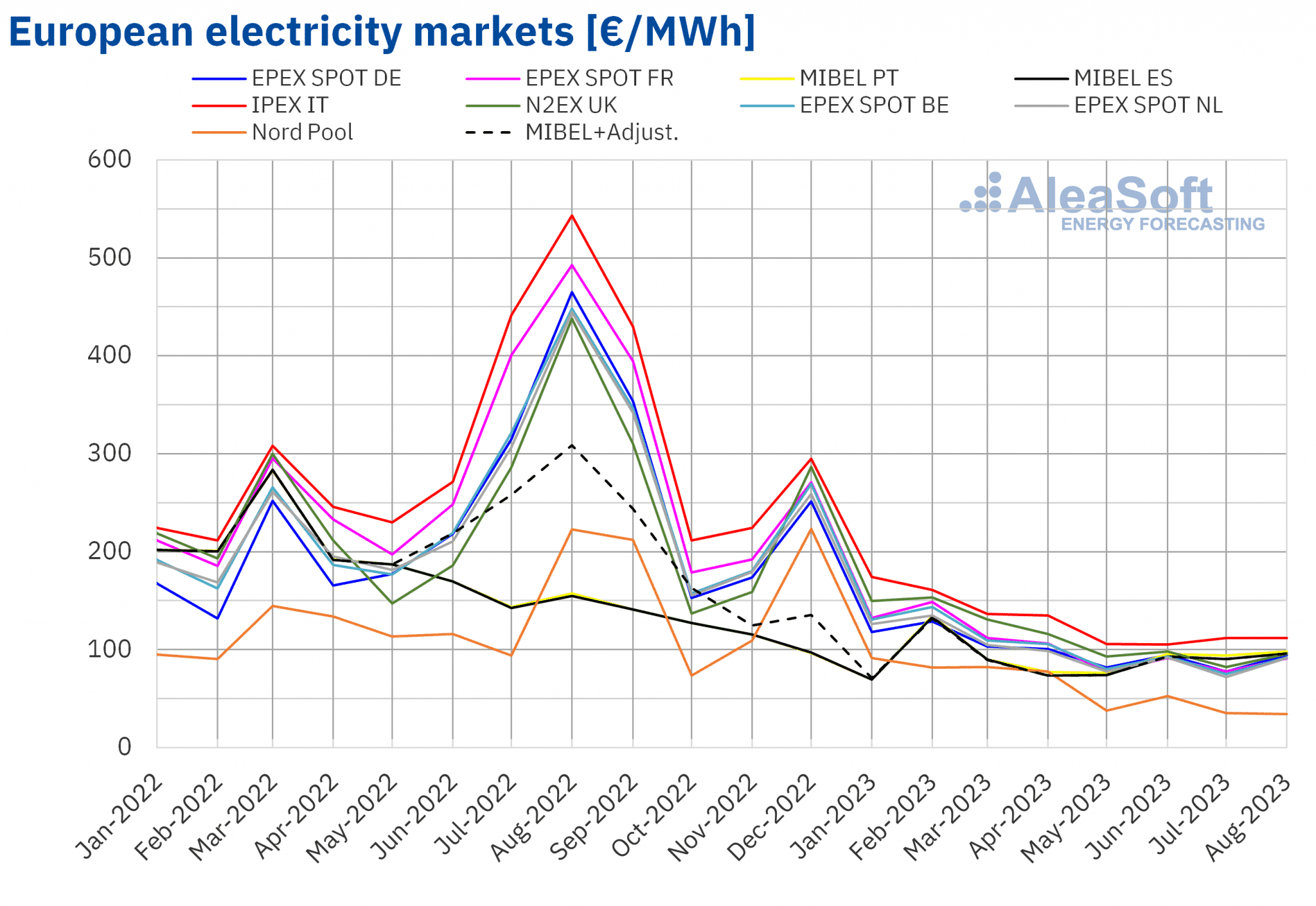

European electricity markets

In the month of August 2023, the monthly average price exceeded €90/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the average of the Nord Pool market of the Nordic countries, which was €34.17/MWh. On the other hand, the highest monthly price, €111.89/MWh, was registered in the IPEX market of Italy. In the rest of the markets, averages were between €90.87/MWh in the EPEX SPOT market of France and €97.86/MWh in the MIBEL market of Portugal.

Compared to the month of July, in August, average prices rose in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the Nordic market, with a decrease of 2.7%, and the Italian market, in which the price only registered a slight decrease of 0.2%. On the other hand, the largest rise, of 27%, was reached in the Dutch market, while the MIBEL market of Portugal and Spain registered the smallest increases, which were 4.3% and 6.2%, respectively.

If average prices for the month of August are compared with those registered in the same month of 2022, prices decreased in all analysed markets. In this case, the largest drop was that of the Nordic market, 85%. In the rest of the markets, prices decreases were between 38% in the Iberian market and 82% in the French market.

As a result of the registered prices declines, the average of August was the lowest since December 2020 in the Nordic market. On the other hand, prices of the Spanish and Portuguese markets were the highest since February 2023.

In August 2023, the year‑on‑year decrease in European electricity markets prices was caused by the fall in the average price of gas and the decrease in demand. Additionally, wind and solar energy production increased in almost all analysed markets. On the other hand, the increase in the average price of gas compared to the previous month, the general drop in solar energy production and the decrease in wind energy production in markets such as Germany and France, as well as the increase in demand in some markets, contributed to the prices increases compared to the month of July.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

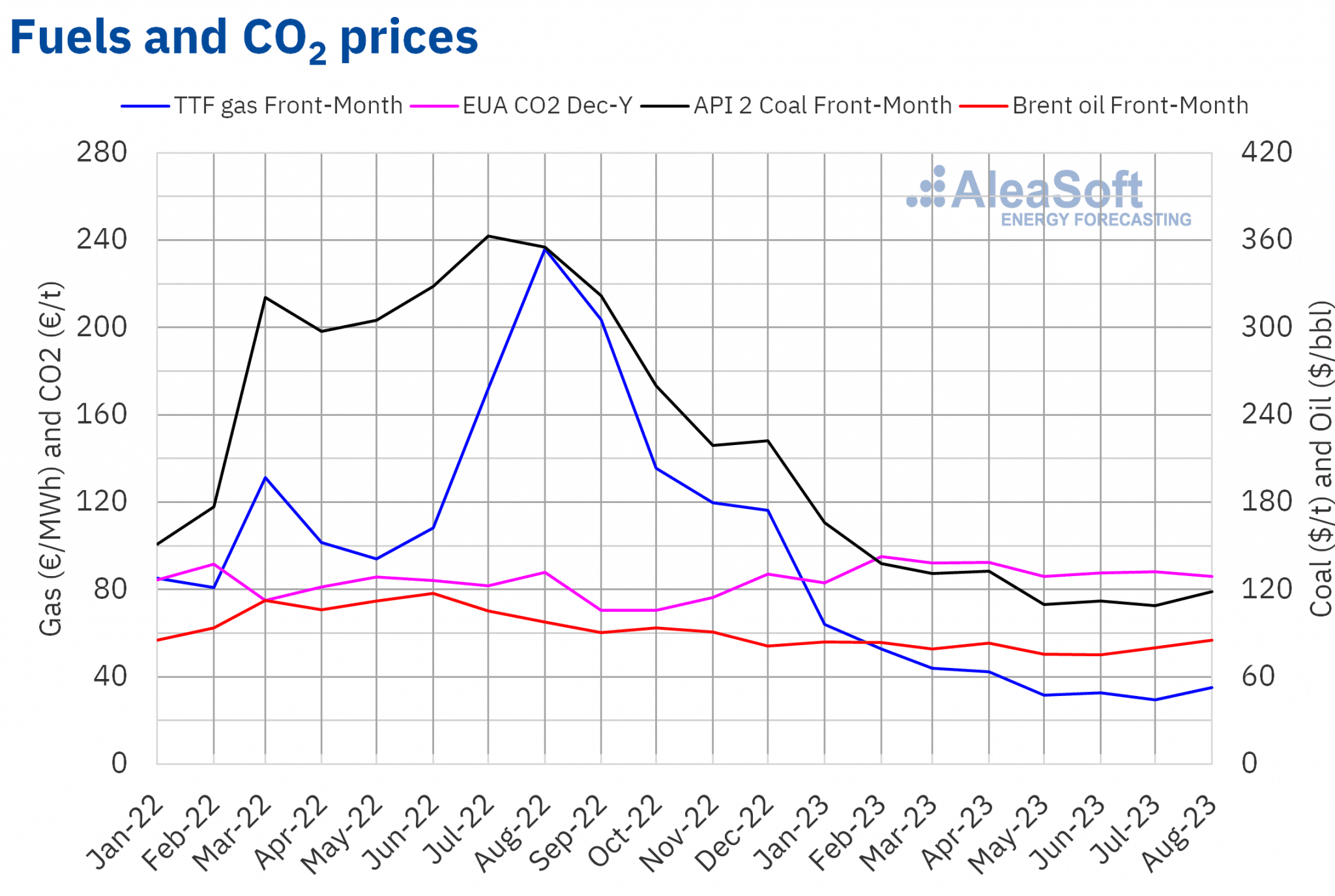

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $85.10/bbl in the month of August. This value was 6.2% higher than that reached by the Front‑Month futures of July, which was $80.16/bbl. But, it was 13% lower than that corresponding to the Front‑Month futures traded in August 2022, which was $97.74/bbl.

During the month of August, production cuts favoured the increase in Brent oil futures prices compared to the previous month, despite concerns about the evolution of the economy and fears of new increases in interest rates.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the month of August for these futures was €35.00/MWh. Compared to that of the Front‑Month futures traded in the month of July, of €29.48/MWh, the average increased by 19%. If compared to the Front‑Month futures traded in the month of August 2022, when the average price was €235.96/MWh, there was a decrease of 85%.

In August, TTF gas futures prices were influenced by news about the possibility of strikes in Australia. The possible decrease in gas exports from that country led to a decrease in shipments of liquefied natural gas to Europe, as the supply was diverted to Asian markets. However, high levels of European reserves prevented further price increases.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price in August of €86.06/t. This represents a decrease of 2.2% compared to the average of the previous month, which was €88.02/t. If compared to the average for the month of August 2022 for the reference contract of December of that year, which was €87.74/t, the average for August 2023 was 1.9% lower.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on energy markets in Europe

The September webinar of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will take place next Thursday, September 7. As usual, the evolution and prospects of European energy markets will be analysed in the webinar. The AleaSoft Energy Forecasting services that contribute to risk management and energy transition will also be explained. Another important topic that will be discussed in the webinar is the benefits of PPA for large and electro‑intensive consumers. Pedro González, Director‑General of AEGE, Association of Companies with Large Energy Consumption, and Jaime Vázquez, PPA Director at Econergy Renewables, will also participate in the analysis table after the Spanish version of the webinar.

Source: AleaSoft Energy Forecasting.