AleaSoft Energy Forecasting, February 13, 2023. In the second week of February, prices of almost all European electricity markets increased compared to the previous week, influenced by the increase in demand in most markets, the drop in wind energy production in markets such as the German, the French or the Italian and the decrease in solar energy production in the Iberian Peninsula, despite the fact that gas and CO2 prices fell. On February 9, TTF gas futures reached the lowest settlement price since September 2021.

Solar photovoltaic and thermoelectric energy production and wind energy production

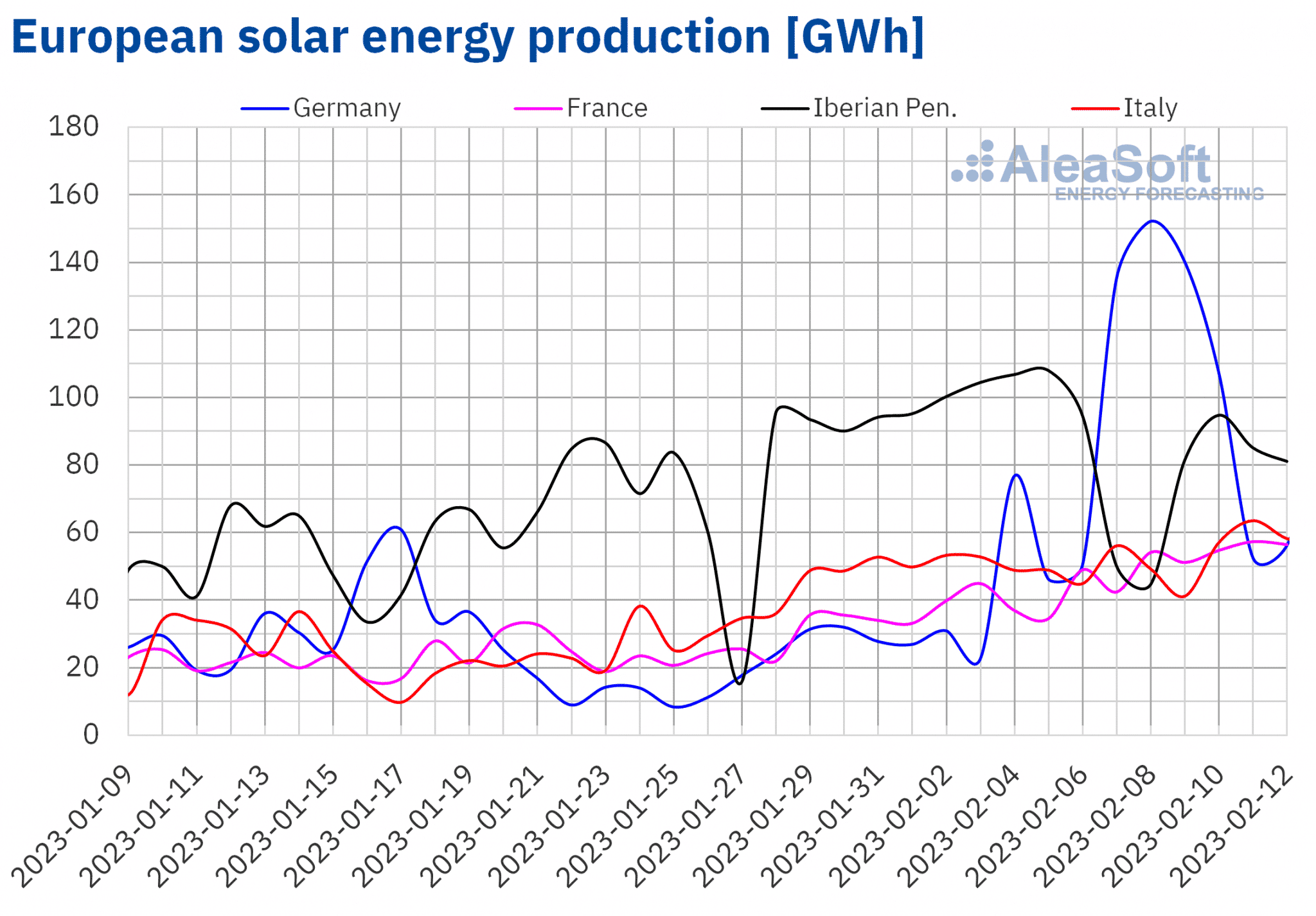

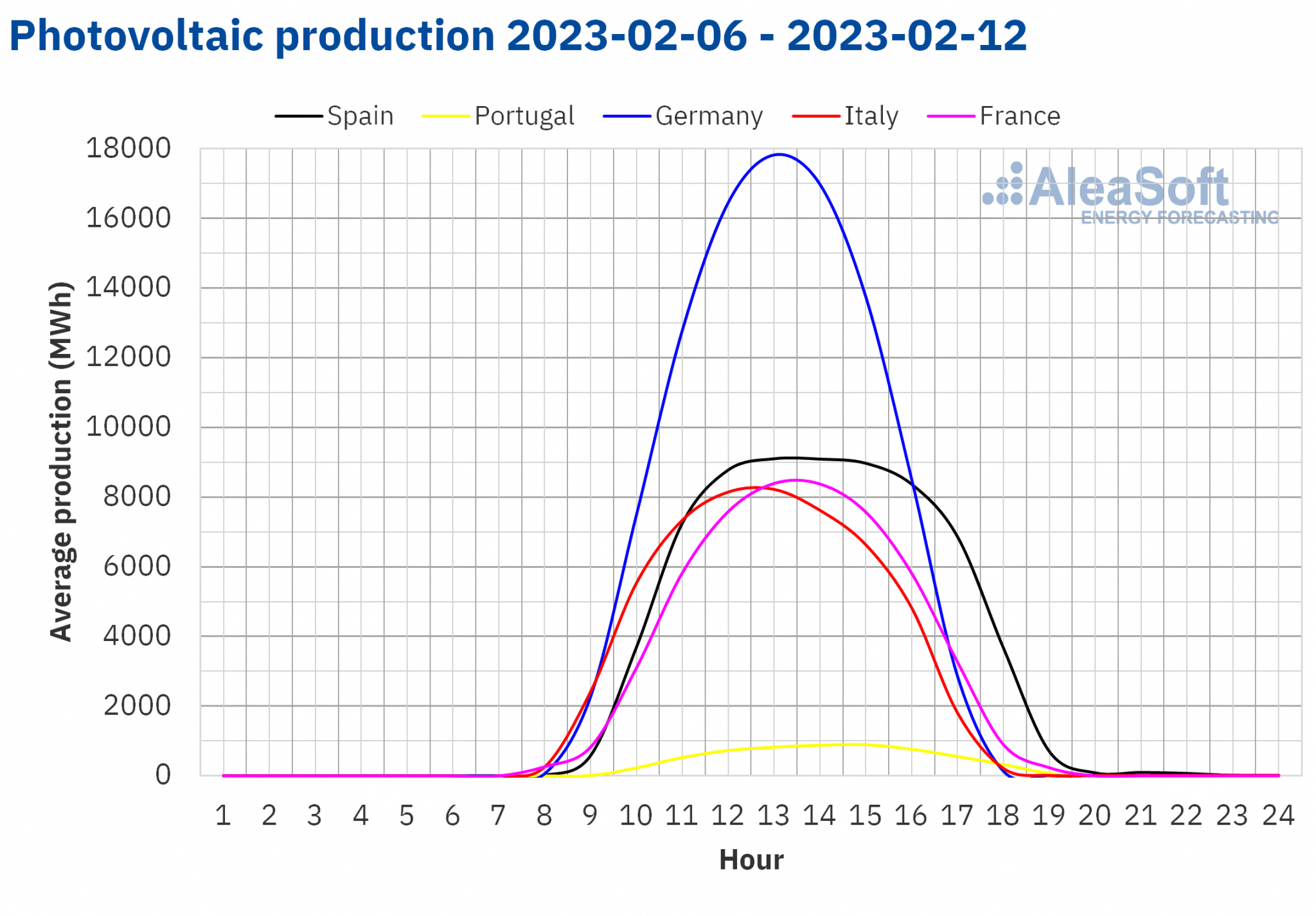

During the second week of February, the solar energy production increased compared to the previous week in most European markets analysed at AleaSoft Energy Forecasting. The largest rise was that of the German market, of 164%, while in the French and Italian markets the increases were 41% and 4.2%, respectively. On the other hand, there was a decrease in the Spanish market, of 23%, and the Portuguese market, of 32%.

For the third week of February, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production might decrease in Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

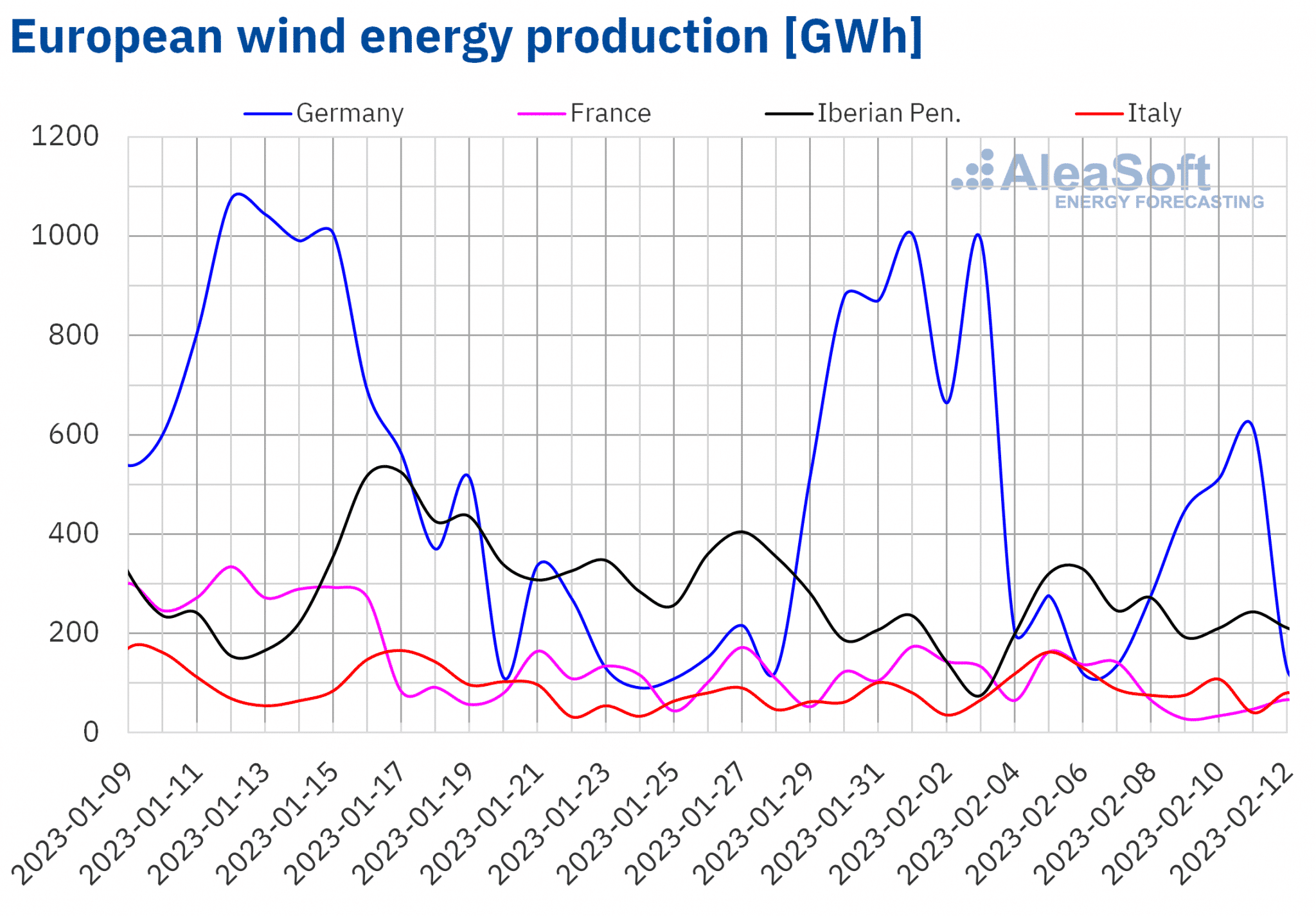

During the week of February 6, the wind energy production increased compared to the previous week in the Iberian Peninsula. The largest rise, of 135%, was that of the Portuguese market, while in the Spanish market it increased by 6.1%. However, the production with this technology decreased in Italy, France and Germany by 4.5%, 43% and 54%, respectively.

For the week of February 13, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that French production might increase, but decreases might be registered in the rest of the markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

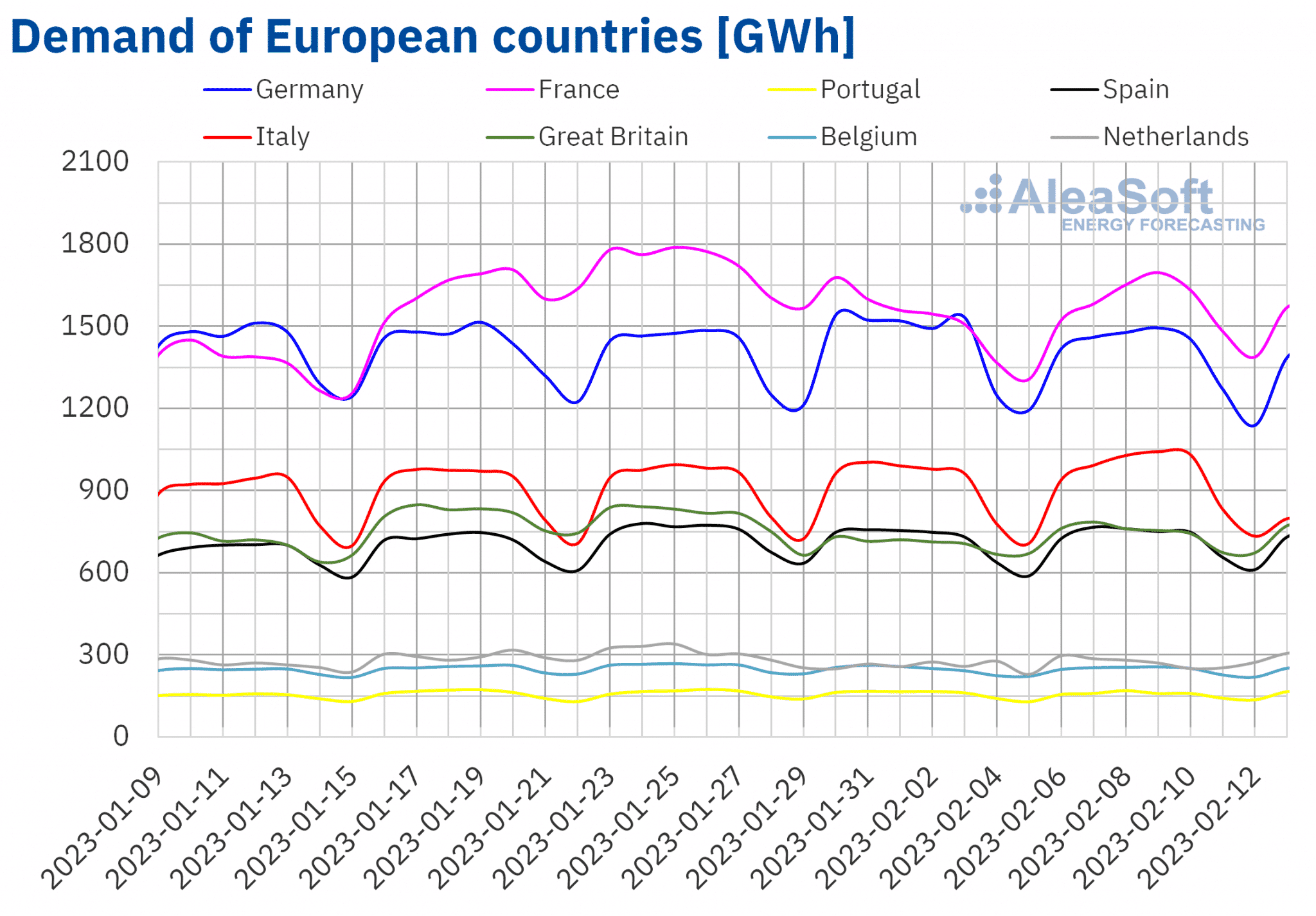

Electricity demand

In the week of February 6, the electricity demand increased in most European markets analysed at AleaSoft Energy Forecasting compared to the previous week. However, in the Belgian, Portuguese and German markets there were decreases of 0.2%, 1.2% and 3.4%, respectively. On the other hand, the largest increase, of 5.4%, was registered in the Dutch market. In the rest of the markets, the demand increased between 1.1% of the Spanish market and 4.7% of the British market.

In the second week of February, average temperatures fell compared to those registered during the previous week in almost all analysed European markets, with decreases exceeding 2.0 °C in most cases. The exception was the Iberian market, where slight increases in temperature were registered. The largest increase, of 0.4 °C, was that of the Portuguese market, which contributed to the decrease in demand in this market.

For the week of February 13, according to the demand forecasting made by AleaSoft Energy Forecasting, decreases are expected in most analysed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

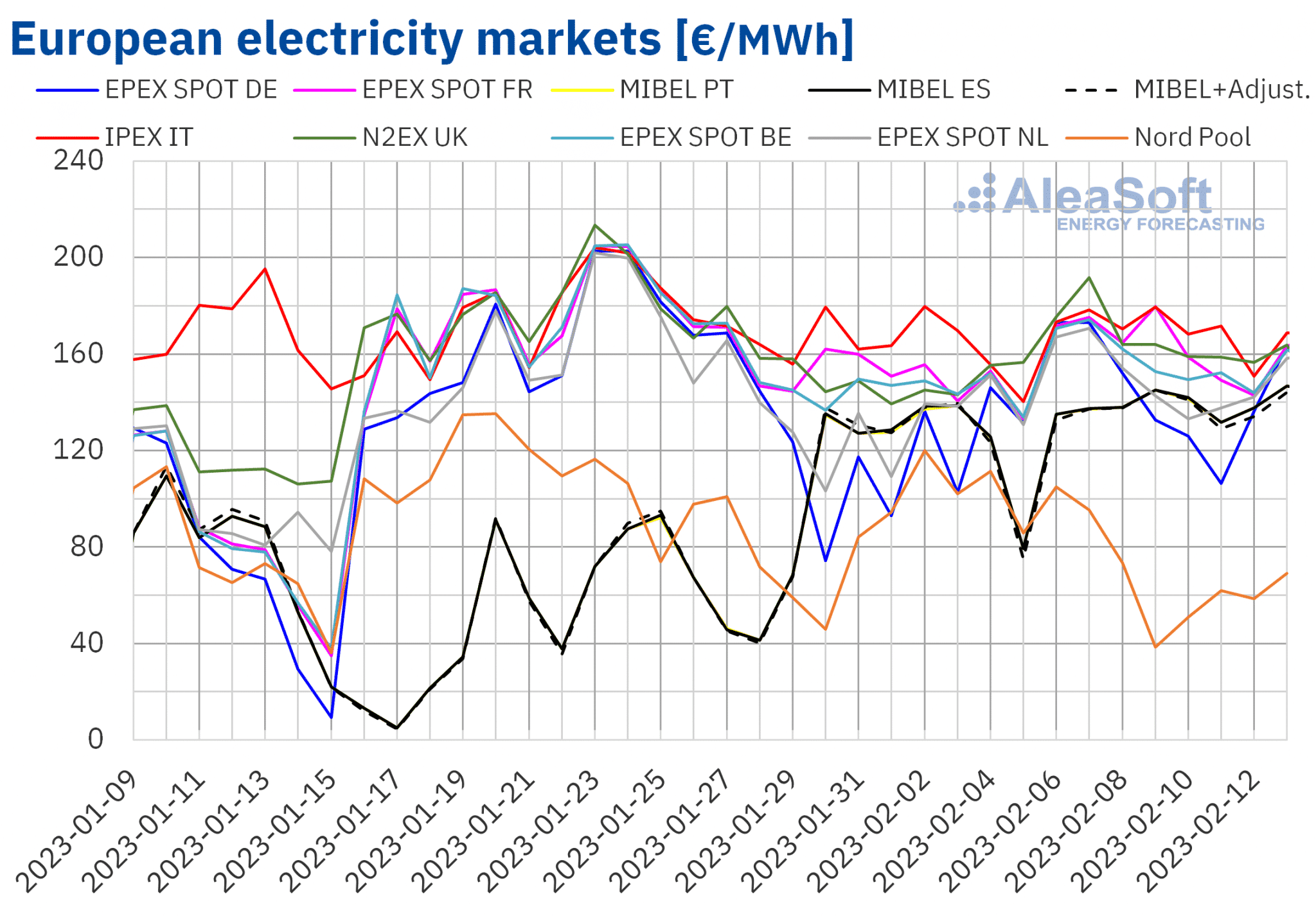

European electricity markets

In the week of February 6, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with a 25% drop. On the other hand, the largest price rise, of 25%, was that of the EPEX SPOT market of Germany. In the rest of the markets, increases were between 3.6% of the IPEX market of Italy and 15% of the EPEX SPOT market of the Netherlands.

In the second week of February, the highest average price, of €170.29/MWh, was that of the Italian market, followed by the average of the N2EX market of the United Kingdom, of €167.08/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €69.02/MWh. In the rest of the analysed markets, prices were between €138.00/MWh of the MIBEL market of Portugal and €163.14/MWh of the French market.

In the case of the Spanish market, the price was €138.13/MWh. Taking into account the adjustment that some consumers have to pay due to the gas price limitation in this market, in the second week of February an average of €136.67/MWh was registered.

Regarding daily prices, on Monday, February 13, a price of €146.77/MWh was reached in the MIBEL market of Spain and Portugal. This price was the highest since December 6, 2022 in this market.

During the week of February 6, the increase in demand in most markets, the drop in wind energy production in markets such as Germany, France or Italy and the decrease in solar energy production in the Iberian Peninsula led to the increase in European electricity markets prices, despite the fact that in this period the average prices of gas and CO2 were lower than those of the previous week.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the third week of February prices might fall in most European electricity markets, influenced by decreases in demand in most markets. In the case of the French market, the increase in wind energy production might also contribute to this behaviour. However, prices might increase in the MIBEL market, where the production with this technology is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

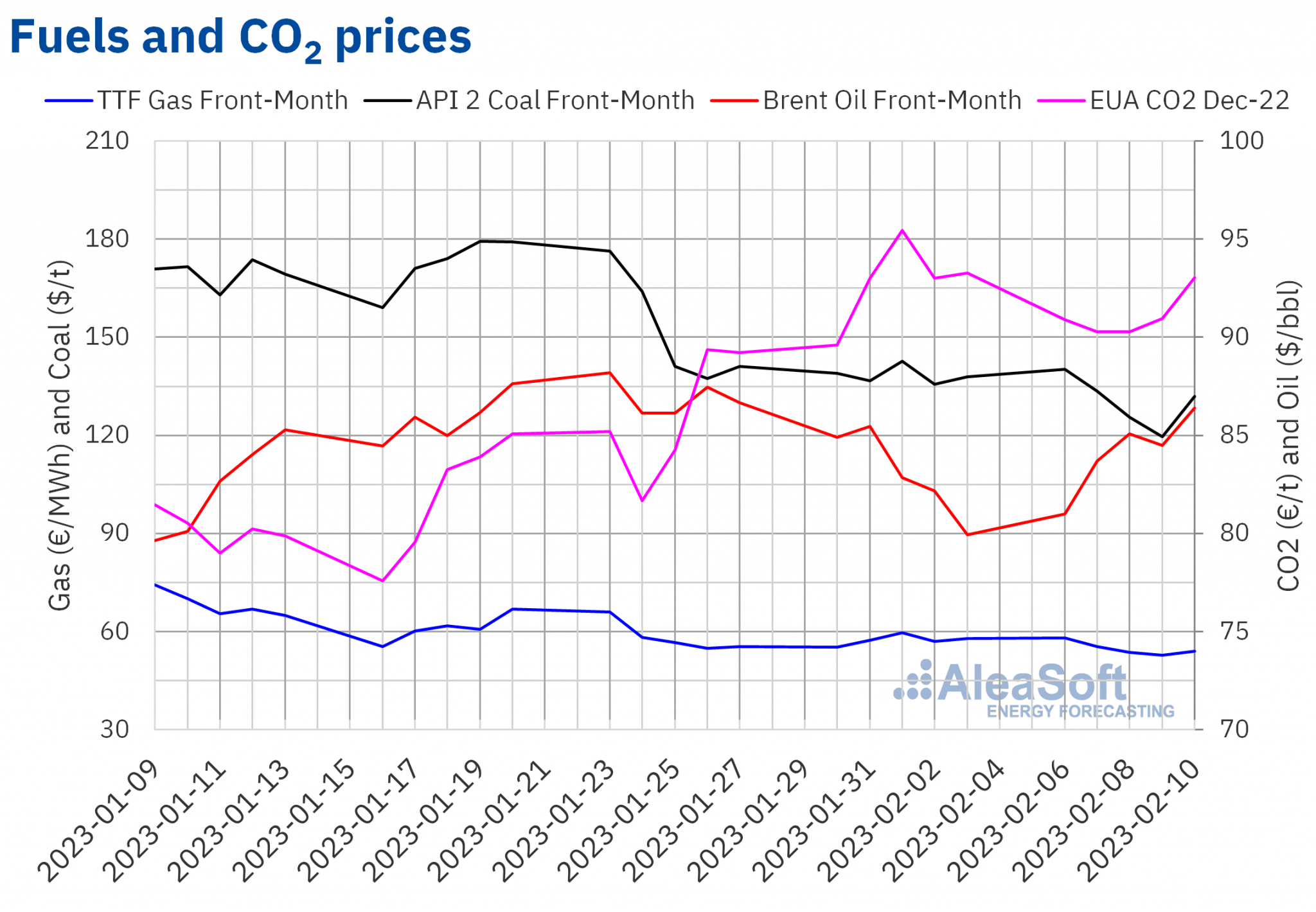

Brent, fuels and CO2

In the second week of February, settlement prices of Brent oil futures for the Front‑Month in the ICE market registered an upward trend, in general. The weekly minimum settlement price, of $80.99/bbl, was registered on Monday, February 6. On the other hand, weekly maximum settlement price, of $86.39/bbl, was reached on Friday, February 10, and it was 8.1% higher than that of the previous Friday.

In the second week of February, Brent oil futures prices were influenced by supply disruptions related to the earthquake occurred in Turkey. The increase in official prices of Saudi Arabia for the Asian market also had an upward influence. In addition, at the end of the week, the announcement by Russia of a production cut for next month in response to the sanctions imposed on this country also contributed to the price increases.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, February 6, the weekly maximum settlement price, of €58.11/MWh, was registered. This price was 5.4% higher than that of the previous Monday. But, subsequently, prices fell until reaching the weekly minimum settlement price, of €52.73/MWh, on Thursday, February 9. This price was 7.5% lower than that of the same day of the previous week and the lowest since the beginning of September 2021. On Friday, February 10, prices recovered until registering a settlement price of €53.95/MWh, which was still 6.8% lower than that of the previous Friday.

In the second week of February, the high levels of the European reserves continued to exert their downward influence on natural gas futures prices. For the third week of February, less cold temperatures, the recovery of gas flows from Norway and the reestablishment of liquefied natural gas exports from the Freeport plant in the United States might continue to favour declines in TTF gas futures prices.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, during the second week of February they remained above €90/t, but lower values than those of the same days of the previous week were registered in almost all sessions. The weekly maximum settlement price, of €93.04/t, was reached on Friday, February 10. But this price was 0.3% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

This Thursday, February 16, at 10:00 CET, the next webinar of the monthly webinars series of AleaSoft Energy Forecasting and AleaGreen will be held, for which it is still possible to request an invitation. In this webinar, the evolution and prospects of European energy markets will be analysed, as well as the importance of forward markets for the renewable energy development. On this occasion, there will be the participation of a guest speaker from European Energy Exchange AG (EEX), Alvaro Ruben Reyes Diaz.

On the other hand, during the month of February, AleaGreen is carrying out a special promotion of the long‑term hourly price forecasting, which is necessary for hybridisation projects of renewable energy, such as wind or photovoltaic energy, with batteries.

Source: AleaSoft Energy Forecasting.