AleaSoft, July 8, 2021. The TTF gas and CO2 emission rights prices reached their historical highs on Monday, July 5, and in the following session they fell significantly. During the July 8 session, gas prices recovered their July 6 levels. The current behaviour of the market already shows a downward trend in these prices that could be the beginning of a de‑escalation in the mid‑term.

In recent days, TTF gas prices generated several headlines. First, on Monday, July 5, when the August 2021 contract set its historical maximum to date, reaching almost €38/MWh. The next day, Tuesday, July 6, it was news again that prices fell to just over €34/MWh, which represented a significant drop of more than 10% in one session. On Wednesday, July 7, TTF gas prices continued to fall and the market settled at €32.34/MWh. During the session of Thursday, July 8, the prices recovered the values of Tuesday, July 6, with maximums that were around €34/MWh. The behaviour of gas prices during this week is already beginning to mark a downward trend, which might indicate that the maximums were already reached.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

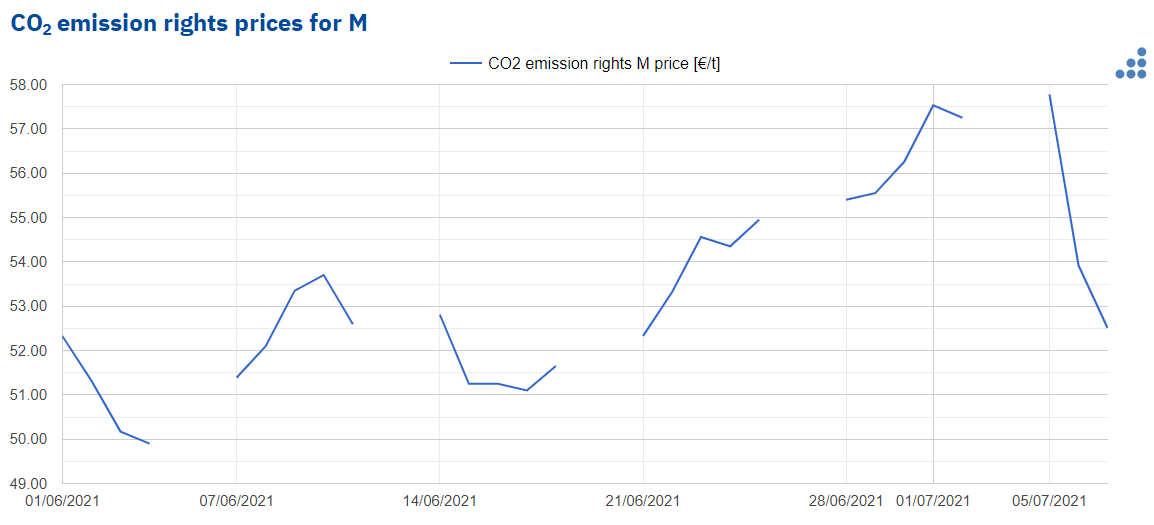

The CO2 emission rights prices accompanied gas prices. Reaching their historical maximum of €57.77/t also on Monday, July 5, and then falling similarly as of Tuesday, July 6, below €54 per ton.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

On next July 15, another AleaSoft’s webinar will be held where the recent evolution of gas and CO2 prices and the prospects on how this trend may impact in the next months of 2021 will be analysed. This time, the central topic will be the half‑year balance of the European electricity markets. The prospects for the energy markets for the second half of the year will also be analysed and the AleaSoft’s vision of the future on the role of green hydrogen in the energy transition will be explained. This webinar will analyse not only the markets that are usually covered, but also others that may offer opportunities such as those of Poland, Greece, Romania and Serbia.

The impact of this possible change in the trend in gas and CO2 prices, as well as the evolution of the rest of the variables, is analysed in AleaSoft‘s long‑term reports, which are now being offered in a special promotion that includes the majority of European markets. These reports have hourly granularity throughout the forecast horizon, which is very useful to calculate the profitability of investments in new renewable energy technologies, and in PPA when defining the best price structure. In addition, the forecasts include the confidence bands corresponding to the 15 and 85 percentiles, obtained using a probabilistic metric.