AleaSoft, February 1, 2021. As expected after the high prices of the first half of January, which reached record values in some markets, the monthly prices of the European electricity markets rose year‑on‑year and compared to December 2020. The low temperatures at the beginning of the year caused the increase in demand and in gas and CO2 prices, which registered the highest value in at least the last two years. The Brent futures reached the highest value since February 2020.

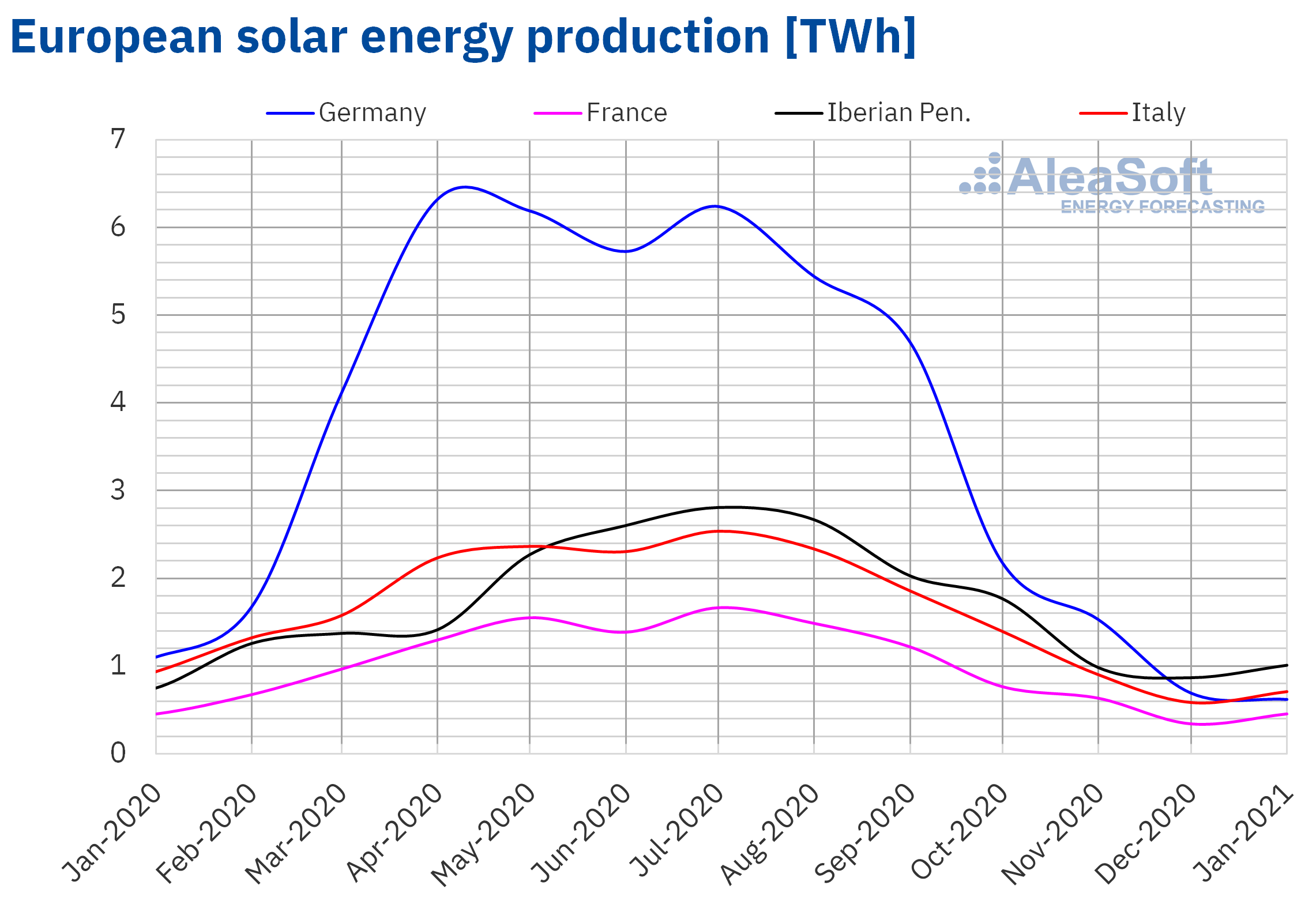

Photovoltaic and solar thermal energy production and wind energy production

The solar energy production of January decreased by 5.5% year‑on‑year in the whole of the analysed European markets, dragged down by the drop in production in two of the main markets in terms of solar energy, Germany, where the production fell by 44%, and Italy, where there was a decrease close to 24%. On the other hand, in the Iberian Peninsula, the solar energy production increased by 32% during this period, while in the French market the variation was 0.3%.

On the contrary, compared to the last month of 2020, the solar energy production during the month of January grew by 13% in the overall analysed European markets, although there was a reduction of 10% in the German market. In the French market, the production grew by 33% during this period, in the Italian market it increased by about 21% and in the Iberian Peninsula by 16%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

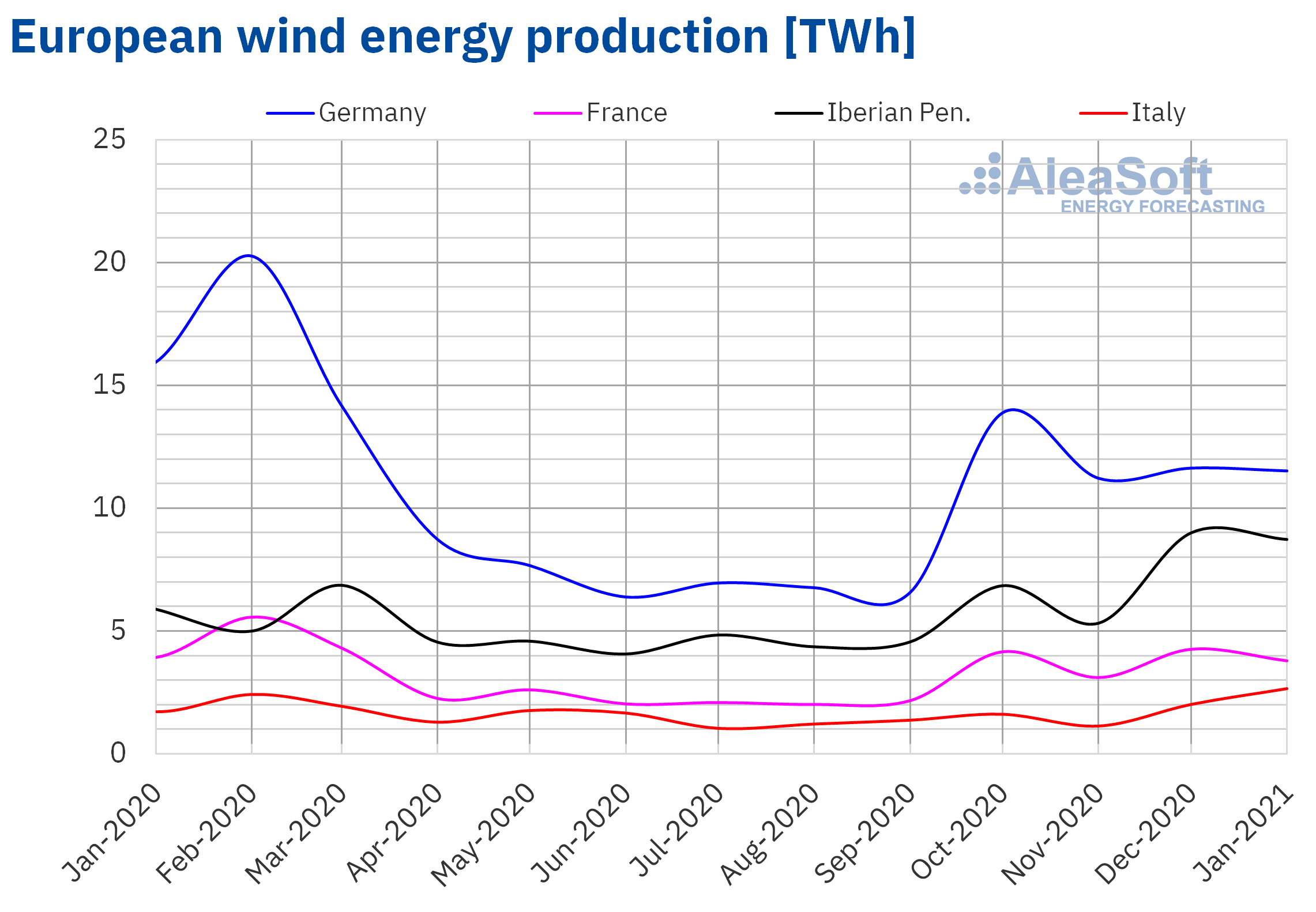

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

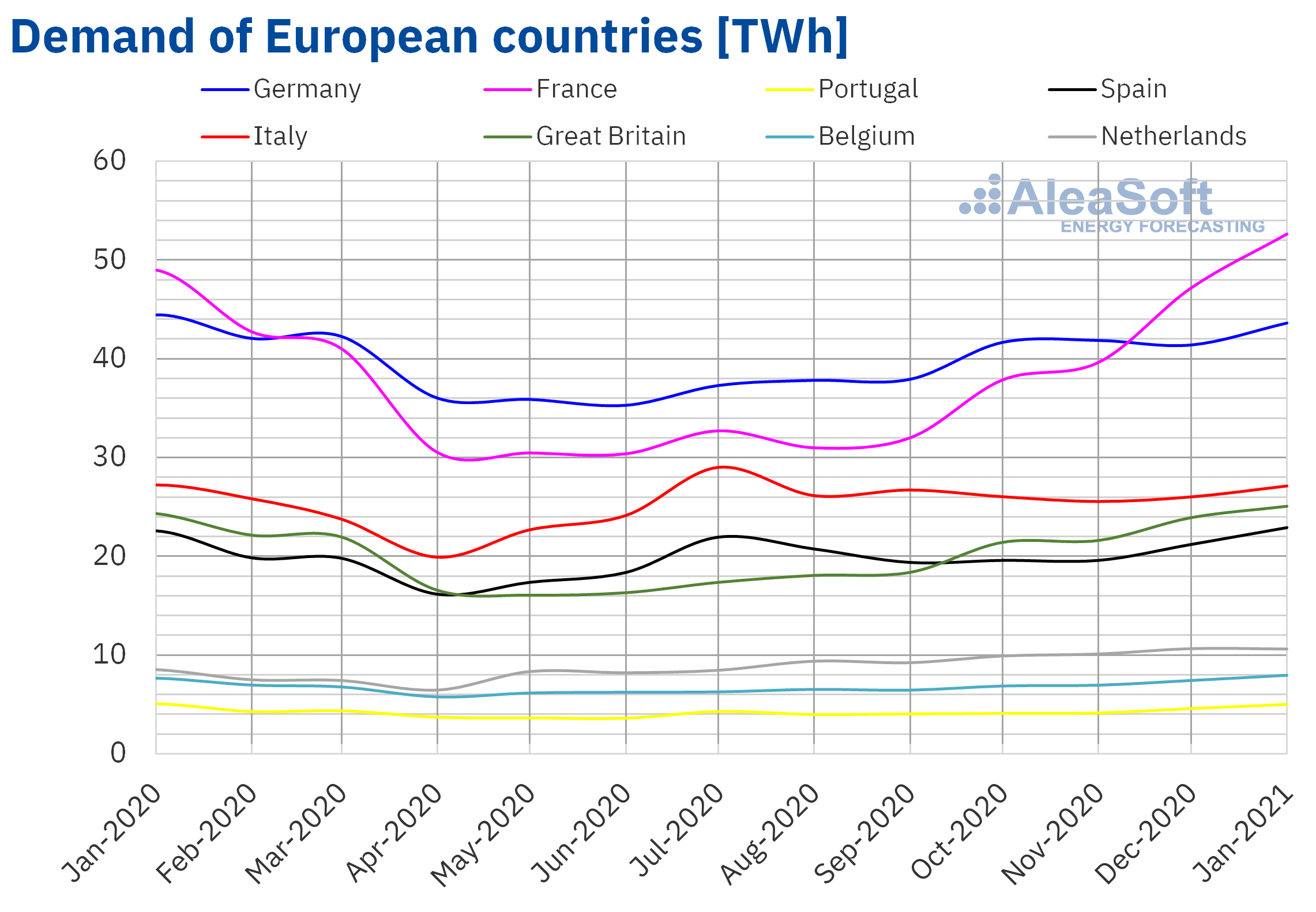

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

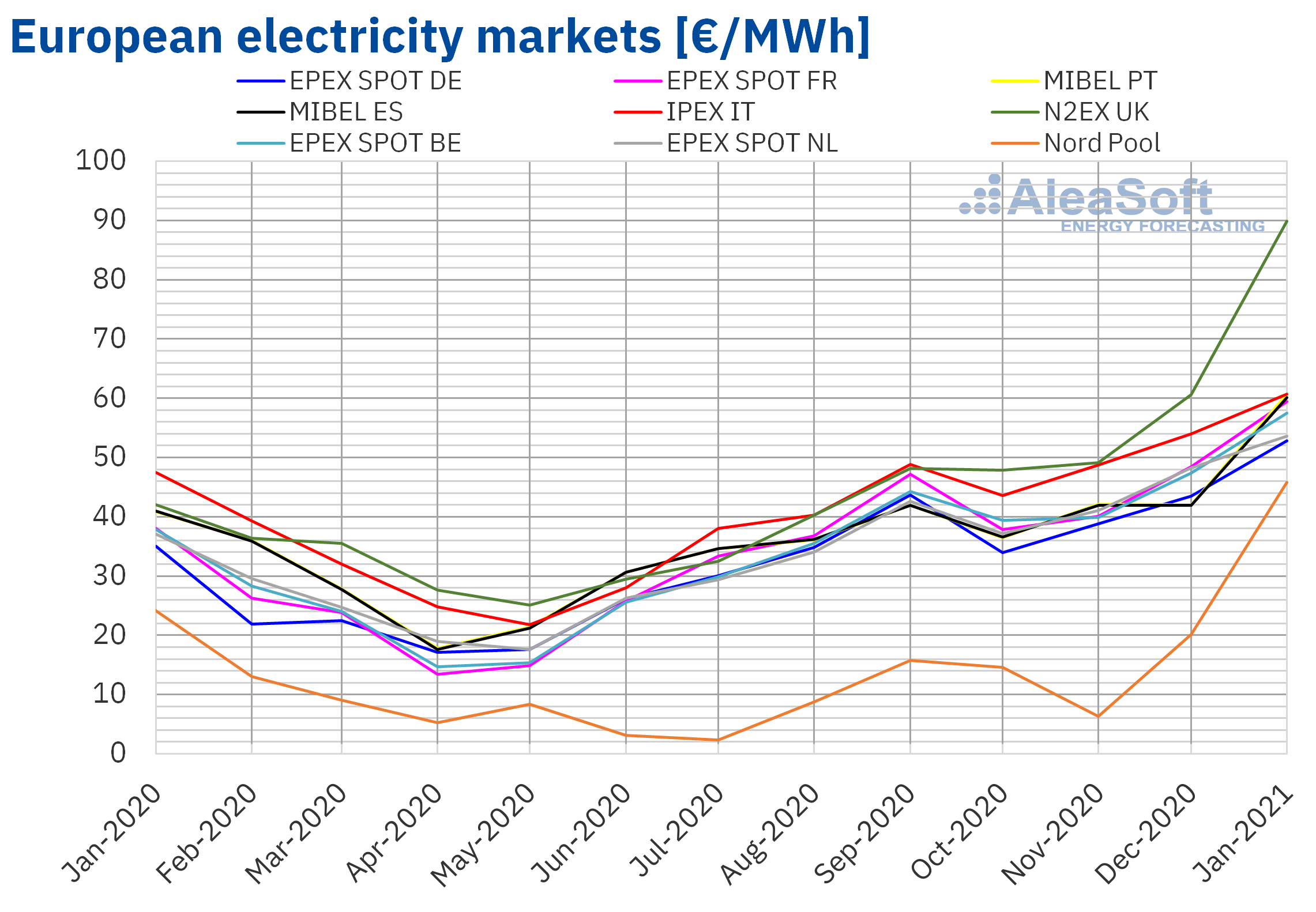

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

The wind energy production during the month of January was 28% lower in the German market compared to January 2020. In the French market it fell by 3.5%, while in the Iberian Peninsula and the Italian market there were increases of 47 % and 55% respectively.

Comparing the production of January 2021 with that of December 2020, the increase of 32% in the Italian market stands out. However, in the rest of the markets analysed at AleaSoft, the production with this technology fell between 1.0% and 11%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

In the first 31 days of 2021, the electricity demand exceeded that of January 2020 in all the markets in Europe, except Germany and Italy. This increase was largely caused by the daily records of the first two weeks of January. One of the factors causing these increases was the drop in average temperatures, which fell to 3.4 °C in the British market. The markets of France and Belgium were those that registered the largest increases in demand, of up to 7.4% in the first of them. On the other hand, the markets of Germany and Italy had decreases of less than 2.0%.

Comparing with the previous month, the increases registered in January 2021 were even higher than from the year‑on‑year point of view. These rising values were led by the markets of France, Portugal and Spain, where the demand increased by at least 8.0% in all cases. The only market where the demand did not rise compared to December 2020 was the Netherlands, which registered a slight drop.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In January 2021, the monthly average price was above €45/MWh in all the European markets analysed at AleaSoft. The lowest average, of €45.81/MWh, was registered in the Nord Pool market of the Nordic countries. In contrast, the UK N2EX market reached the highest monthly average price, of €89.85/MWh. In the rest of the markets, the averages were between €52.81/MWh of the EPEX SPOT market of Germany and €60.71/MWh of the IPEX market of Italy.

Compared to the month of December 2020, the average prices of all the European electricity markets analysed at AleaSoft increased in January. The highest price rise, of 128%, was registered in the Nord Pool market. The price increases in the British market and in the MIBEL market of Portugal and Spain, of 48%, 44% and 43% respectively, were also important. While the smallest increases were those of the Dutch market, of 11%, and the Italian market, of 12%. The rest of the markets had price increases close to 20%.

If the average prices of last January are compared with those registered in the same month of 2020, there were also price increases in all markets, which were in general more pronounced than the increases compared to the previous month. In this case, the N2EX and Nord Pool markets had the largest price increases, of 114% and 90% respectively. In contrast, the lowest price increase, of 28%, occurred in the Italian market. In the rest of the markets, the price increases were between 45% of the Netherlands and 57% of France.

On the other hand, the highest daily price of the month was reached on January 13 in the British market. With a value of £198.79/MWh, this was the highest daily price since 2010 in this market. That day, at the hour 19, an hourly price of £1499.62/MWh was reached, which was also the highest in the last eleven years in the British market.

On the other hand, the minimum daily price, of €1.42/MWh, was reached on Sunday, January 31, in the MIBEL market of Spain and Portugal. This price was the lowest in this market since the beginning of March 2014. This Sunday, January 31, during several hours in the early morning, the hourly price was €0.16/MWh, the lowest since end of December 2019 in this market. These low prices were favoured by the increase in wind energy production in the Iberian Peninsula together with the decrease in demand due to the weekend and milder temperatures.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During most of the month of January, the low temperatures favoured the increase in demand in the European electricity markets, causing price increases. The decrease in wind energy production in some markets also favoured that the prices increased. Furthermore, the evolution of the gas and emission rights prices also exerted an upward influence on the European electricity markets prices.

Electricity futures

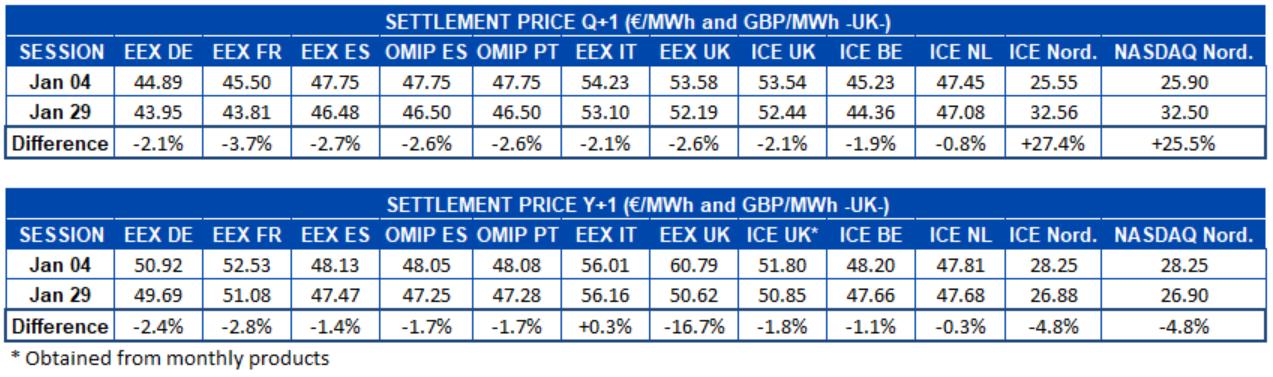

Between the first and last sessions of January 2021, the electricity futures prices for the second quarter of the same year registered a predominantly downward behaviour. The ICE and NASDAQ markets of the Nordic countries were the only markets where the price rose, by 27% and 26% respectively. In the rest of the markets analysed at AleaSoft, the prices fell between 0.8% of the ICE market of the Netherlands and 3.7% of the EEX market of France.

In this same period, the futures for the year 2022 registered a similar behaviour. In this case, the EEX market of Italy was the one that behaved contrary to the rest and its prices rose by 0.3% between the two analysed sessions. Meanwhile, in the rest of the markets the decreases were between 0.3% and 4.8%. Once again, the ICE market of the Netherlands was the one with the lowest variation during the analysed period.

Brent, fuels and CO2

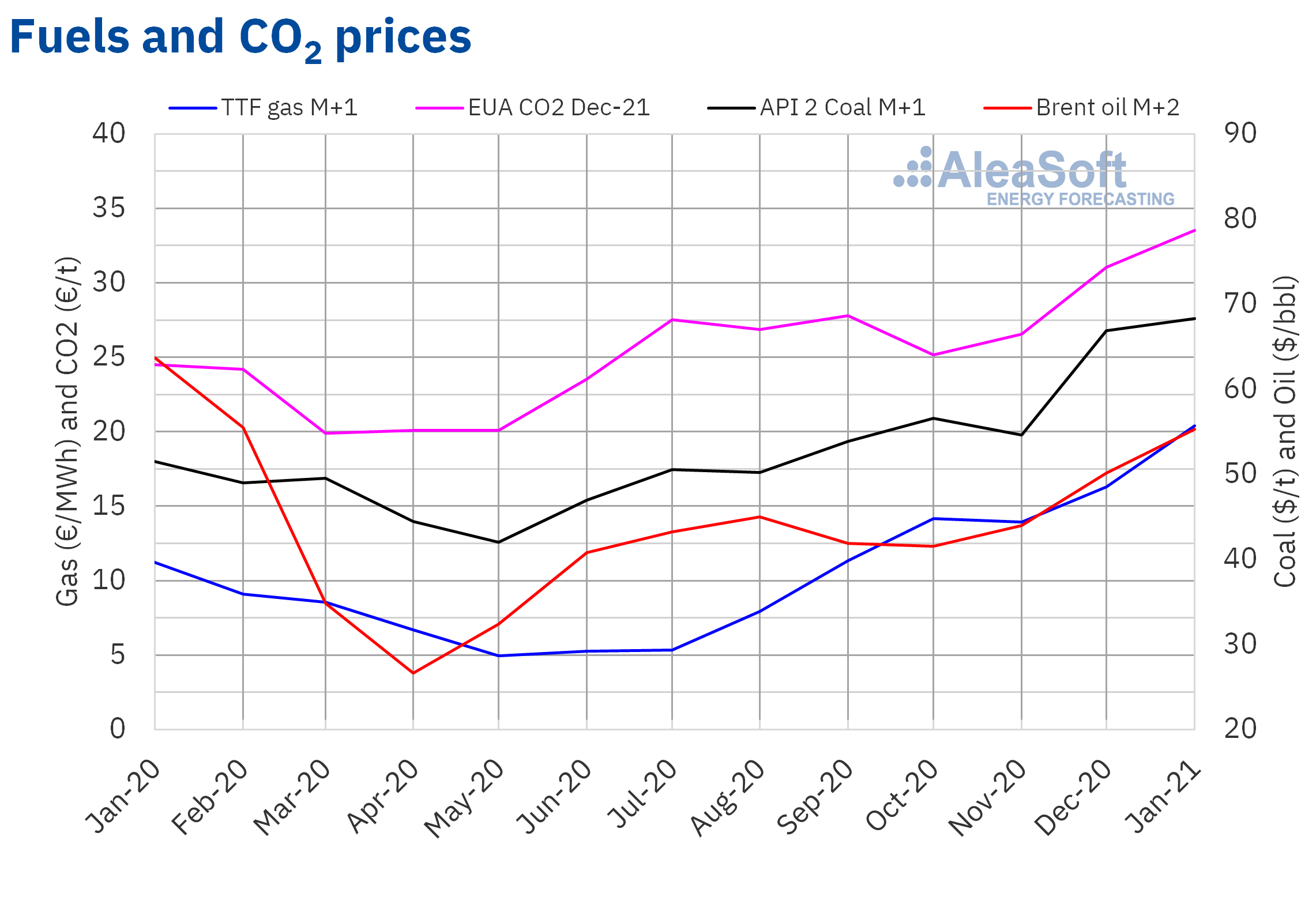

The settlement prices of the Brent oil futures for March 2021 in the ICE market in January remained above $50/bbl. The monthly minimum settlement price, of $51.09/bbl, was registered on Monday, January 4. Instead, the maximum monthly settlement price, of $56.58/bbl was reached on Tuesday, January 12. This price was the highest since February 2020. On the other hand, the monthly average price was $55.32/bbl. This value is 10% higher than the one reached by the futures for the month M+2 in December 2020, of $50.14/bbl, but still 13% lower than that corresponding to the M+2 futures traded in January 2020, of $63.67/bbl.

The increase in the OPEC+ production levels at the beginning of the new year favoured the lowest prices in January to be registered at the beginning of the month. But the start of the vaccinations against the COVID‑19 and the new commitments made by the OPEC+ to limit its production allowed the prices to rise. The expectations about the measures to support the economy of the new United States government also exerted their upward influence on the prices. However, the worsening evolution of the pandemic and the restrictions to contain it continue to threaten the recovery of the demand. In addition, the month of January ended with problems in the availability of the vaccines, which delays the vaccination campaigns.

Regarding the TTF gas futures in the ICE market for the month of February 2021, they reached their minimum settlement price, of €17.56/MWh, on January 6. The following days, the prices rose rapidly until reaching the monthly maximum settlement price, of €26.15/MWh, on Tuesday, January 12. This price was the highest in the last two years. These increases were favoured by the low temperatures in the northern hemisphere. But, subsequently, the prices fell again, influenced by the recovery in temperatures, stabilising around €20/MWh the rest of the month.

On the other hand, the average value registered during the month of January was €20.40/MWh. Compared to that of the futures for the month M+1 traded in December 2020, of €16.29/MWh, the average increased by 25%. If compared to the M+1 futures traded in January 2020, when the average price was €11.23/MWh, there was an 82% increase.

As for the settlement prices of the CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the month of January, they remained above €30/t. The monthly minimum settlement price, of €31.62/t, was reached on Monday, January 18. On the other hand, the maximum settlement price, of €34.91/t was reached on Friday, January 8. This price was the highest since November 2018.

On the other hand, the average price in January was €33.54/t, 8.0% higher than that of December 2020, of €31.06/t. If compared with the average of the month of January 2020 for the product of December of that year, of €24.50/t, the average of January 2021 was 37% higher.

The evolution of the gas prices and the absence of auctions during most of the month had an influence on the emission rights futures prices in January.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets and prospects from 2021

At AleaSoft, a series of webinars is being organised since the end of last year to analyse the “Prospects for the energy markets in Europe from 2021”. The next webinar will be held on February 18 and it will feature the participation of speakers from Engie, who will talk about the PPAs and their coexistence with the renewable energy auctions. The fourth part of this series of webinars is being organised for March 18, with the presence of speakers from EY (Ernst & Young) on this occasion.

On January 28, AleaSoft participated in a private event with institutional investors organised by the North American investment bank J.P. Morgan. At this meeting, the international interest that the results of the renewable energy auctions in Spain aroused was made clear. The prospects for the Spanish electricity market at the long term, according to the AleaSoft‘s forecasts, was the main topic discussed, arousing great interest in the forecasting of prices captured by the renewable energies, especially the photovoltaic energy, as well as the impact that the increase in electric vehicles and the production of green hydrogen will have on the electricity demand.

On February 4, a workshop will be held at AleaSoft to show the Alea Energy Database (AleaApp), a tool that compiles data from the energy markets and facilitates their visualisation and analysis through comparative graphs of several variables, calculation of the moving average, temporality changes of the series, among others.

On the other hand, on February 11, a workshop will be held targeted at the agents operating in the electricity spot and futures markets, which aims to show how to make the most of the mid‑term market prices forecasting and stochasticity.

Source: AleaSoft Energy Forecasting.