AleaSoft, January 19, 2021. The role of the PPAs in the energy transition continues to be very relevant and, according to the experts, it is a tool that will continue to be useful and in force even with the auctions being held. This is because, beyond being important for the financing of the renewable energy projects, the PPAs play a very important role for the consumer.

The last webinar organised at AleaSoft “Prospects for the energy markets in Europe from 2021 (II)”, which was held last Thursday, January 14, focused on the PPAs from the point of view of the consumers. To deepen on the subject, the webinar counted on the participation of several PwC Spain speakers.

The PPAs: beyond getting a fixed price

The PPA contracts are complex tools with which multiple objectives can be achieved for both the producers and the consumers. From the point of view of the offtaker, the energy consumer, the most attractive aspect, and the one that normally fills the headlines, is achieving a fixed price or some variable prices structure with some thresholds or limits. In this way, the consumer can achieve a security in the energy supply prices that allows mitigating or eliminating the market prices risk, with which the PPA is used as a risk management tool.

On the other hand, nowadays the main international companies are announcing new renewable energy consumption targets as a complement to the increase in energy efficiency in their consumption and as part of their corporate social responsibility strategy. In this aspect, the signing of a PPA with a renewable energy generation facility transmits a much more powerful message about a company’s environmental commitment than the simple fact of consuming 100% renewable energy in a generic way. With a PPA agreement, the message is transmitted that not only the company has sensitivity towards the environmental issues, but that it is actively involved in the construction of new renewable energy facilities that will be essential for the ecological transition.

All the angles of a PPA

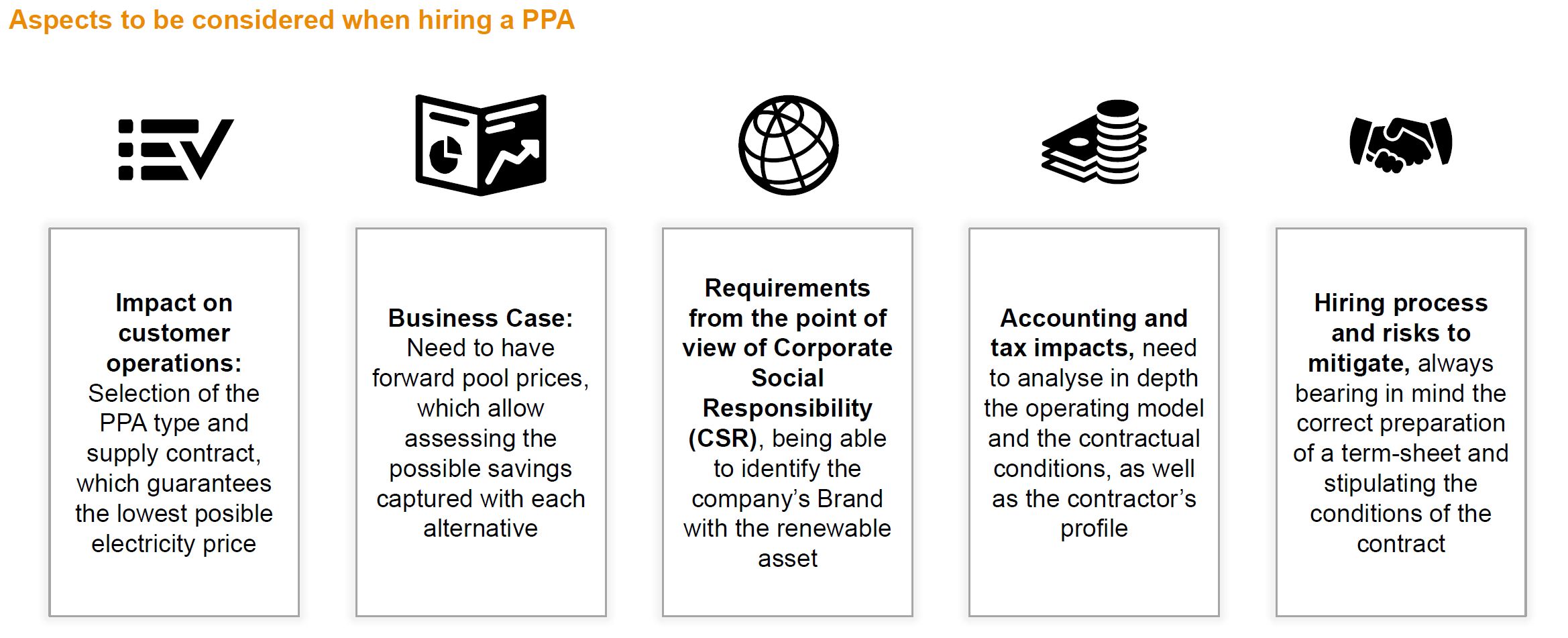

There is no standard PPA. There is no predefined contract that the parties can decide whether to adhere to. The PPAs are tailor‑made contracts for the producer and the offtaker. That is why they are contracts in which each of the aspects must be negotiated, because each one of them will have an impact on many facets, both for the producer and the consumer: operations, taxes, financing, accounting, corporate social responsibility, risks management and a long etcetera. During the webinar, the need for, beyond the commercial team, both the legal and financial teams, among others, to be present in the PPA negotiation process was highlighted.

Source: PwC Spain.

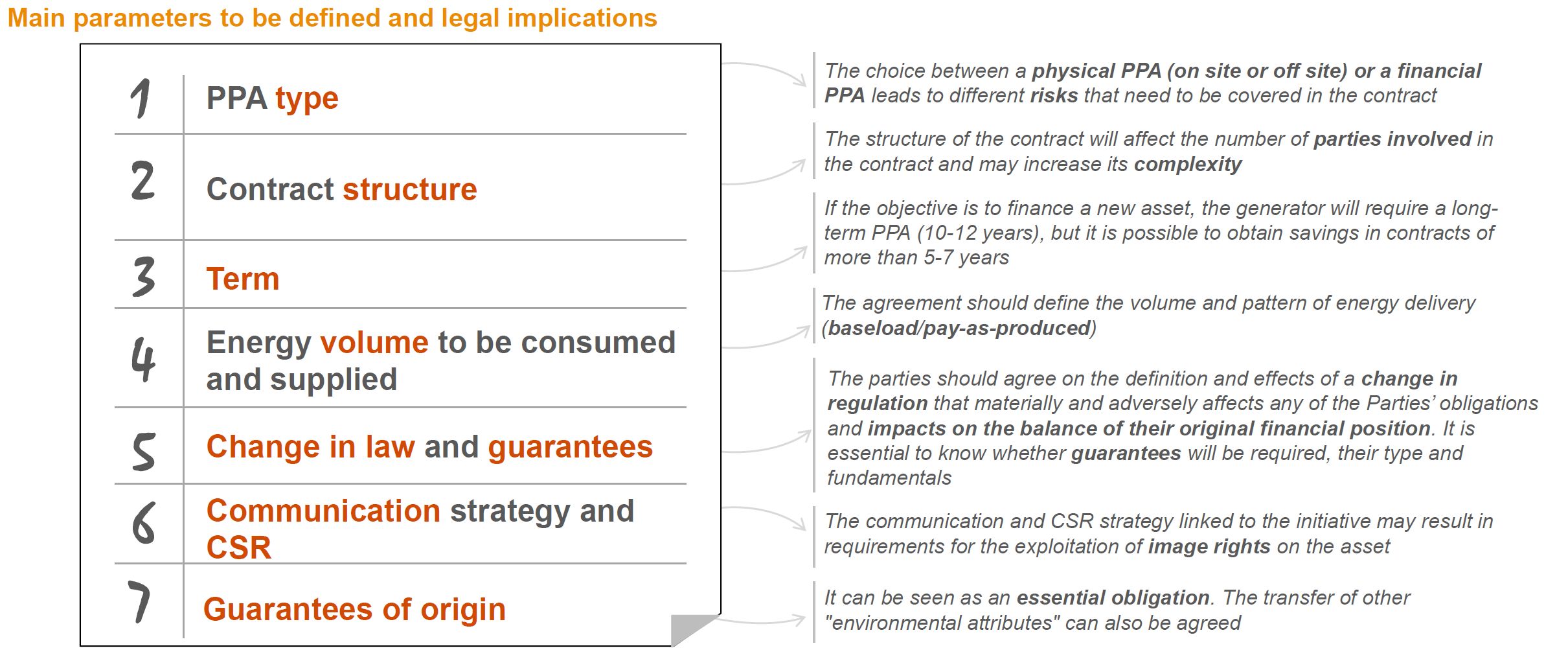

Source: PwC Spain.

Regarding the impact that the PPA will have on the consumer’s energy costs, it is necessary to have long‑term electricity market prices forecasts that cover at least the duration of the contract. These forecasts are necessary to test the financial model and estimate the impact on the company’s accounts. Having confidence bands in the prices forecasting allows quantifying the risk associated with the estimates.

From the legal point of view, the negotiation of a PPA contract is a complex process, since it must take into account all the possible cases that might occur during its entire duration: from a regulatory change (it must also be agreed what is understood by regulatory change and what is not) to situations in which the producer cannot supply all the agreed energy or the consumer cannot consume it.

Source: PwC Spain.

Source: PwC Spain.

The PPAs and the renewable energy auctions

Among the questions from the webinar attendees, there were several about what impact the prices reached in the next renewable energy auctions could have on the PPAs. The doubts were not limited to how a low price in the auctions could affect the price of the PPAs, but to the usefulness or necessity of the PPAs themselves in a scenario with auctions.

As for the possibility of low prices as a result of the auctions, it is not clear what impact this could have on the prices of the PPAs. Everything will depend on how the market price is affected and how the retailers will transfer those prices to their end customers. Regarding the utility of the PPAs, despite the existence of the renewable energy auctions, the experts agreed that the PPAs will continue to be a basic tool for both renewable energy producers and consumers.

The key role of the green hydrogen in the energy transition

In the analysis table after the webinar presentations, in addition to the PPAs, the most relevant issues of the present and the future of the energy markets were also discussed. The green hydrogen and how it will create a floor in the electricity market prices and it will help to avoid the curtailments took special relevance.

The financing of the renewable energy projects in Europe from 2021

The recording of this webinar can be requested through this link or writing to webinar@aleasoft.com. The third part of this series is scheduled for February 18, and this time it will have the collaboration of ENGIE, to analyse the prospects for the energy markets and the financing of the renewable energy projects from this 2021. Later, the fourth part of the webinar series is scheduled for March 18 and it will feature the collaboration of speakers from EY (Ernst & Young).

Source: AleaSoft Energy Forecasting.