AleaSoft Energy Forecasting, July 21, 2023. The growth of solar photovoltaic energy in recent years has caused significant changes in the hourly profile of electricity market prices. The lowest prices, which historically occurred at dawn, are now registered during the hours of solar energy production. An example of how demand adapts to these changes is the evolution of the consumption profile of pumping stations. On the other hand, the increase in self‑consumption is also having an impact on the demand profile.

The accelerated energy transition that is taking place in Europe is causing changes in many aspects of the economy, society and, obviously, also in the energy markets. This article reviews some of the most radical changes in recent years in the Spanish electricity market and system.

The impact of solar energy on hourly market prices

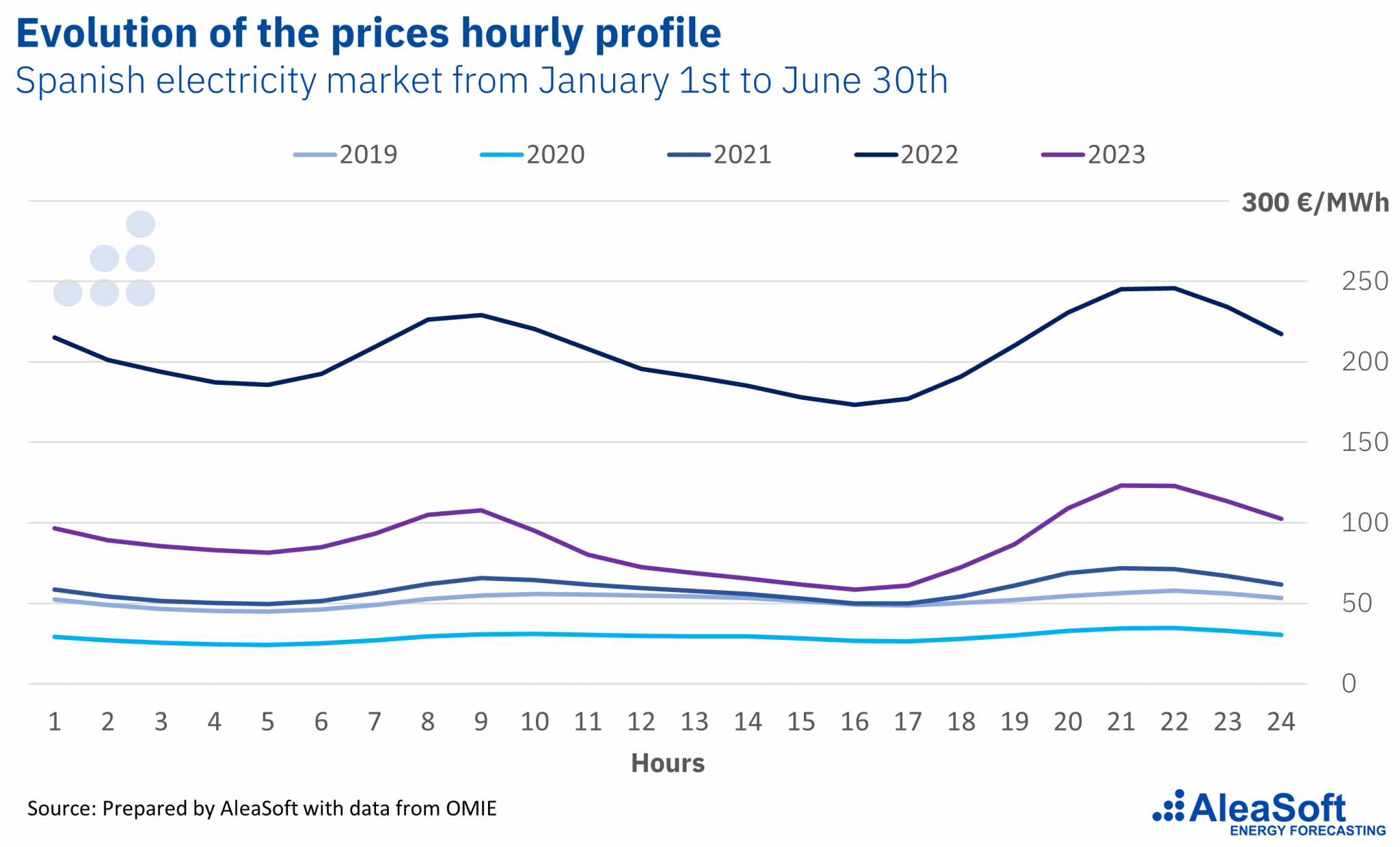

In the two and a half decades of history of the Spanish electricity market, the largest change in the hourly profile of prices has occurred in just the last three years. For more than twenty years, the variation in electricity market prices throughout the 24 hours of the day has followed the demand profile: the lowest prices occurred at dawn, when demand is lower, and the highest prices were registered during the day and the first hours of the night, when the working day and the prime‑time in the first hours of the night took place.

This usual configuration of hourly prices changed, almost suddenly, in 2021. That year, the lowest prices in the day began to occur in the afternoon, between 15:00 and 17:00. In the average price profile for the first half of 2021, the lowest prices in the afternoon reached the same level as the lowest prices in the early morning, with just a difference of 0.3%, while, in the first half of 2019 and 2020, prices during the early morning had been around 8% lower than during the afternoon.

In 2022 and 2023, this change continued to accelerate. In the first half of 2022, prices in the new valley of the afternoon were already 5.6% lower than during the early morning. In the first half of 2023, that difference grew to 27%.

The main cause of the large changes in the hourly profile of prices has been the extraordinary increase in solar photovoltaic energy. Since 2019, the installed solar photovoltaic capacity has multiplied by 2.5, from 8.5 GW in 2019 to 21.1 GW at the beginning of July 2023, according to provisional data from REE (Red Eléctrica de España). This has led to a huge increase in production with this technology, from 8.9 TWh generated during the first half of 2019 to 18.1 TWh of the first half of 2023.

The concentration of solar energy production during the hours when the sun shines produces great downward pressure on market prices during those hours, sometimes even driving prices to values of zero or very close to zero. The change in the profile of hourly prices will continue in the following years and there will be many factors that will influence these changes. In addition to photovoltaic energy, energy storage, green hydrogen production and flexible demand, among many others, will play a key role in this evolution.

The demand also changes

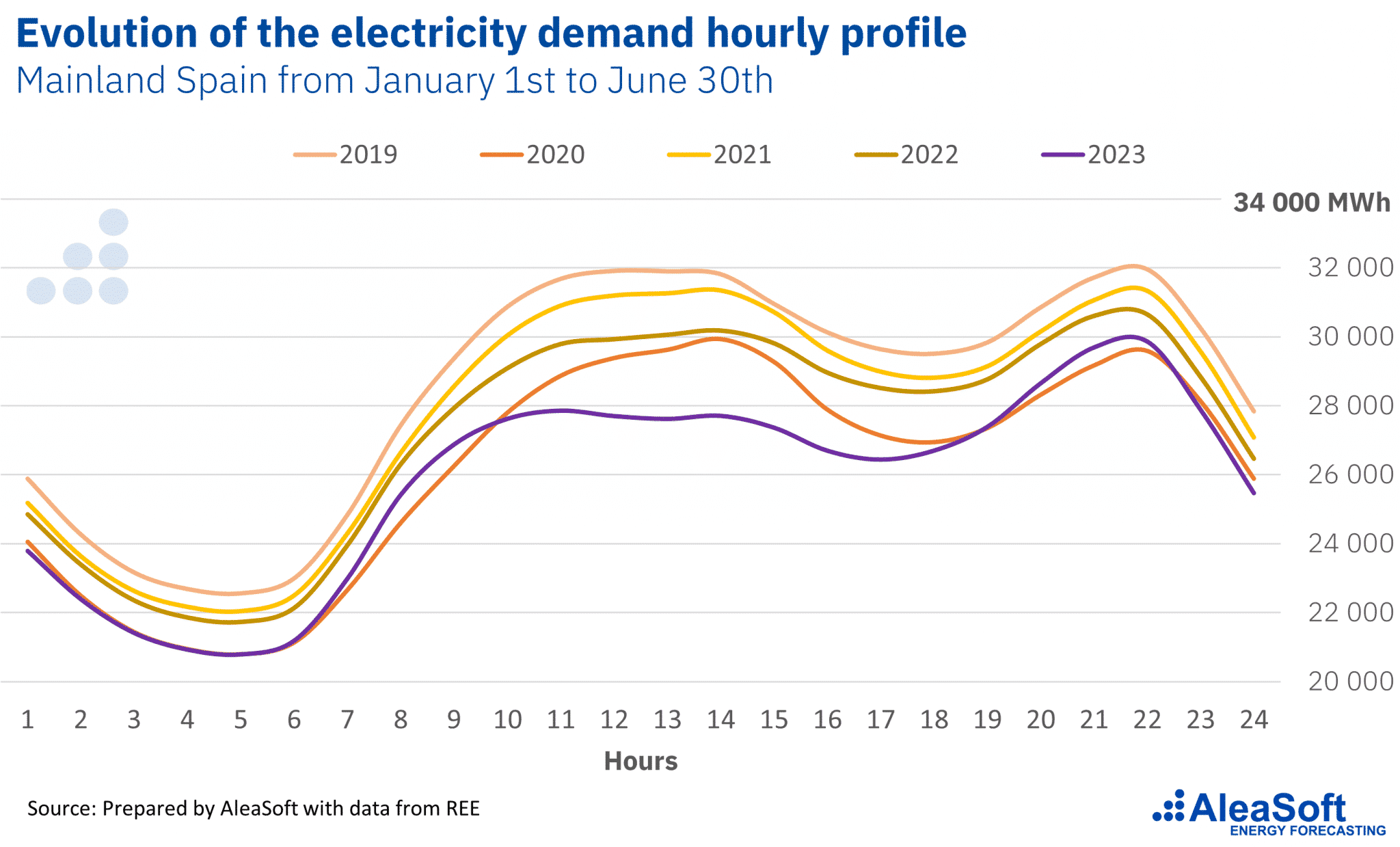

Although changes in the intraday profile of electricity demand in recent years have not been as visible as changes in the price profile, these have also occurred and numbers are clear. The demand profile has historically been fairly stable with lower demand during the early morning hours and higher demand during daylight hours and early evening hours, and higher demand from Monday to Friday and lower demand on weekends.

Although the hourly profile of demand varies throughout the year due to changes in temperatures and daylight hours, on average, there is a valley at dawn and two peaks during the day with a small valley in the afternoon. Regardless of changes in the total volume of demand, the relative height of the two daily peaks in demand has also clearly changed in recent years.

In 2019 and 2021, the height of the two peaks in the average demand profile during the first six months of the year was practically the same, with differences of a maximum of 0.1%. In 2020, the evening peak was 1.1% lower than the morning peak, but that change was mainly related to the impact of the COVID‑19 lockdown measures and can be considered an anomaly. In 2022 the demand profile began to change. The height of the morning peak decreased with respect to the night peak by 1.5% in the first half of the year. In the first half of 2023, that difference reached 6.7%.

Once again, solar photovoltaic energy has been the main factor in changing the hourly shape of electricity demand. In this case in the form of self‑consumption. Self‑consumption with photovoltaic panels reduces electricity consumption from the grid since self‑consumed energy is energy that is not consumed from the grid, with the consequent decrease in demand of the system. Precisely, the morning peak, between 10:00 and 14:00, is where a large part of the solar energy production is concentrated.

The impact of self‑consumption is not surprising considering that the installed self‑consumption capacity in the last decade is growing exponentially, from 22 MW in 2014 to 933 MW in 2019, up to 5342 MW in 2022. Self‑consumption will continue to affect the demand profile in the following years, taking into account that the draft update of the National Energy and Climate Plan (NECP) proposes 19 GW by 2030.

As in the case of the price profile, in addition to self‑consumption, energy storage, green hydrogen production and flexible demand will have a significant impact on the demand profile.

The demand is smart

Regarding the change in the hourly price profile and the prevalence of low prices during sunny hours, in the July edition of the series of monthly webinars organised by AleaSoft Energy Forecasting and AleaGreen, Jorge De Miguel, Managing Director at Ben Oldman, commented that a situation of continuous low prices in a few foreseeable hours, such as the cannibalisation of prices by photovoltaic energy, represent an opportunity for energy‑intensive consumers that will be difficult not to take advantage of it for the industry that is easily mobile to those markets where those opportunities occur. Although it may seem strange now, the demand is smart and will move to take advantage of the new competitive prices opportunities that are appearing.

During the webinar, focused on the renewable energy projects financing, it was analysed that these situations of low prices due to the impact of solar energy production can occur for certain periods of time. But it is difficult for them to occur for a long enough time to affect the IRR (Internal Rate of Return) of renewable energy projects or to condition their financing.

In this sense, Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, commented in the webinar that the original NECP (2021‑2030) set very ambitious objectives for the installed capacity of renewable energies. These objectives, together with the high prices registered in 2022, have caused the installation of new photovoltaic plants to accelerate because it is the most competitive technology. The new NECP must focus on promoting demand and storage to be able to manage and integrate all renewable energy production.

Beyond the objectives of the NECP, which must be ambitious because the renewable potential in the Iberian Peninsula is very large, it will be the market, its prices and the profitability of the projects that will set the pace and the amount of renewable capacity that ends up being installed. As soon as the projects are no longer profitable, more renewable energies will not be installed until demand increases, there is sufficient storage and interconnection capacity.

The adaptation of pumping stations consumption to prices

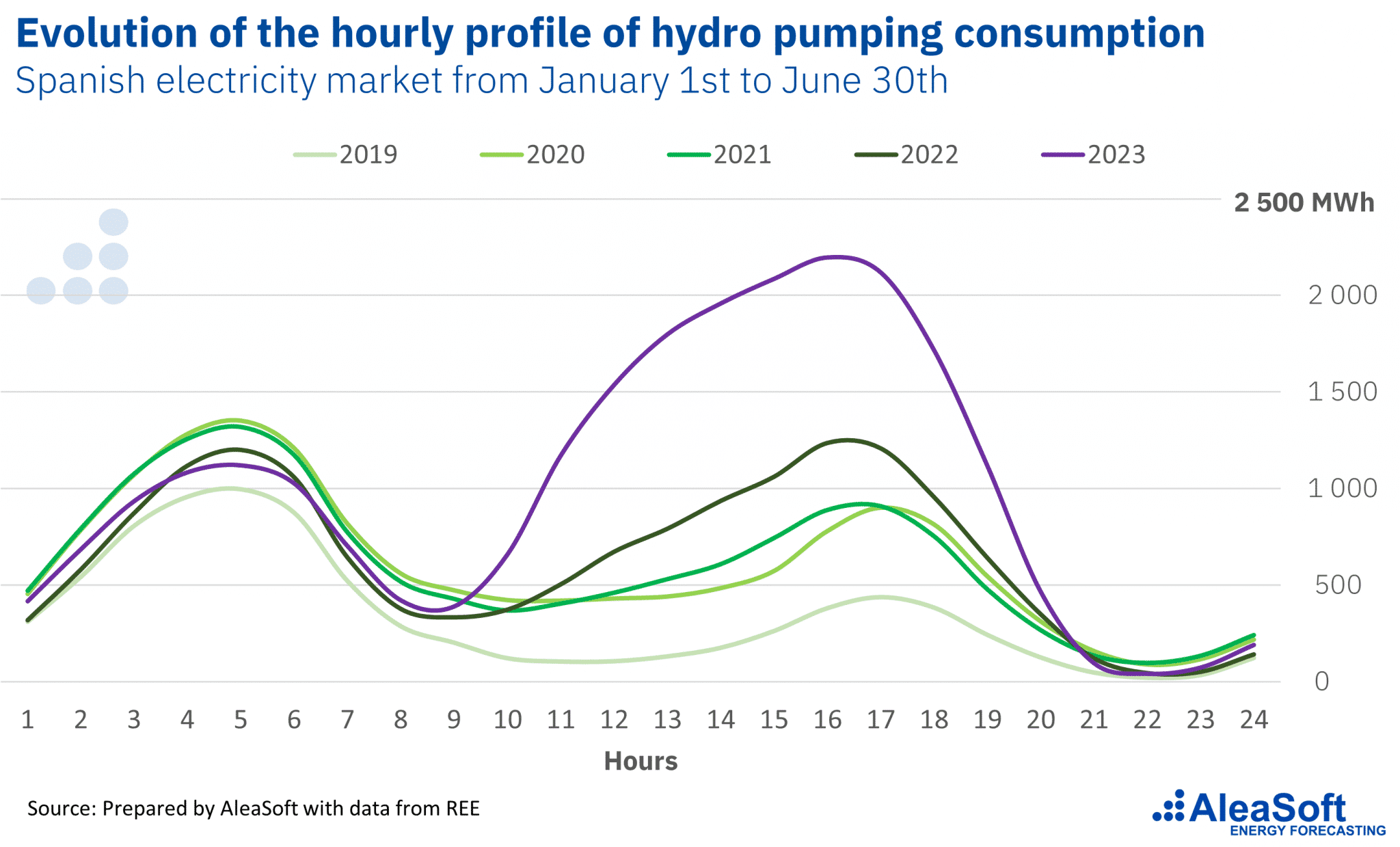

A clear example that demand is smart and that it adapts to prices is the evolution in recent years of the consumption profile of reversible hydroelectric plants, commonly known as pumping stations. These plants, which store energy in the form of potential energy of dammed water, consume energy from the electricity grid to pump water to a higher reservoir when electricity market prices are low. Later, they drop the water back into the lower reservoir to generate electricity and inject it into the grid, when prices are higher.

The consumption profile of these plants has changed drastically in recent years to adapt and take advantage of lower prices that currently occur in the hours with the highest solar energy production. Historically, pumping stations consumed mainly at dawn when prices were lower. With the drop in prices during daylight hours, in recent years, energy consumption in the central hours of the day has increased extraordinarily.

In the first half of 2019, on average, the consumption peak during the day was 56% lower than the consumption peak during the early morning. In 2020 and 2021, this difference narrowed to around 30%. Already during the first half of 2022, the daytime consumption peak exceeded the early morning peak by 3%. The most evident change has occurred during the first six months of 2023 when, on average, the peak of pumping consumption during the day has been practically twice as high as at dawn, specifically 96% higher.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

Previously, the series of monthly webinars organised by AleaSoft Energy Forecasting and AleaGreen has been mentioned. In the next edition, edition number 36, the Director‑General of AEGE (Association of Companies with Large Energy Consumption), Pedro González, will be present to analyse the state of the PPA market for large electro‑intensive consumers.

Registration is also already open for the edition number 37, which will take place on October 19 and will have the participation of Deloitte to analyse in depth the state of the renewable energy projects financing and the importance of forecasting in audits and portfolio valuation.

Source: AleaSoft Energy Forecasting.