AleaSoft Energy Forecasting, July 17, 2023. In the second week of July, gas prices fell and, as a consequence, European electricity markets prices fell. This trend was also favoured by lower electricity demand in most markets, higher wind energy production in some cases and stable CO2 prices that on average were below those of the previous week. In Mainland Spain, the photovoltaic energy production record was broken again on July 14 with 159 GWh.

Solar photovoltaic and thermoelectric energy production and wind energy production

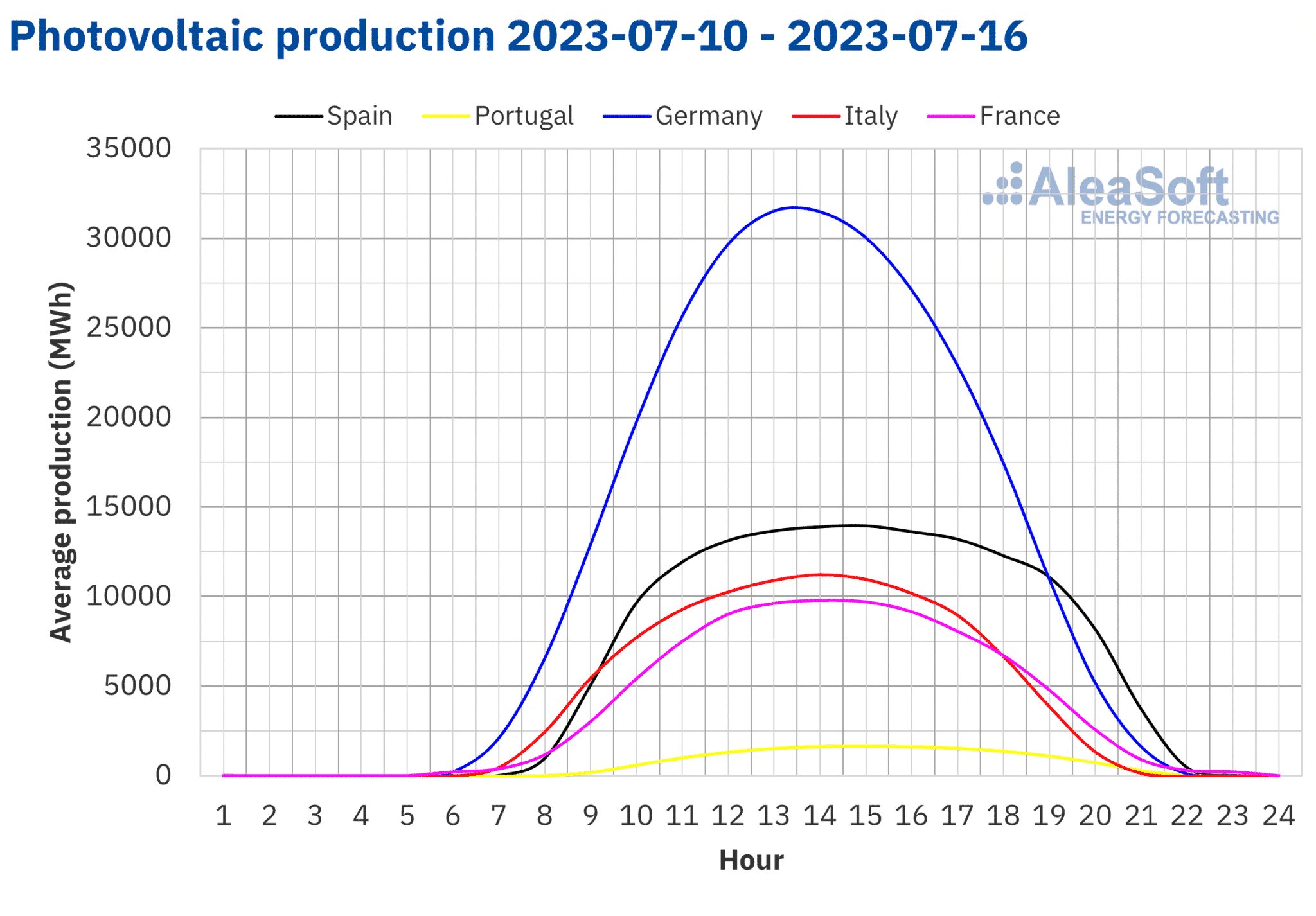

In the week of July 10, the solar photovoltaic energy production broke the daily record in the Spanish market, where a generation of 159 GWh was registered on Friday, July 14.

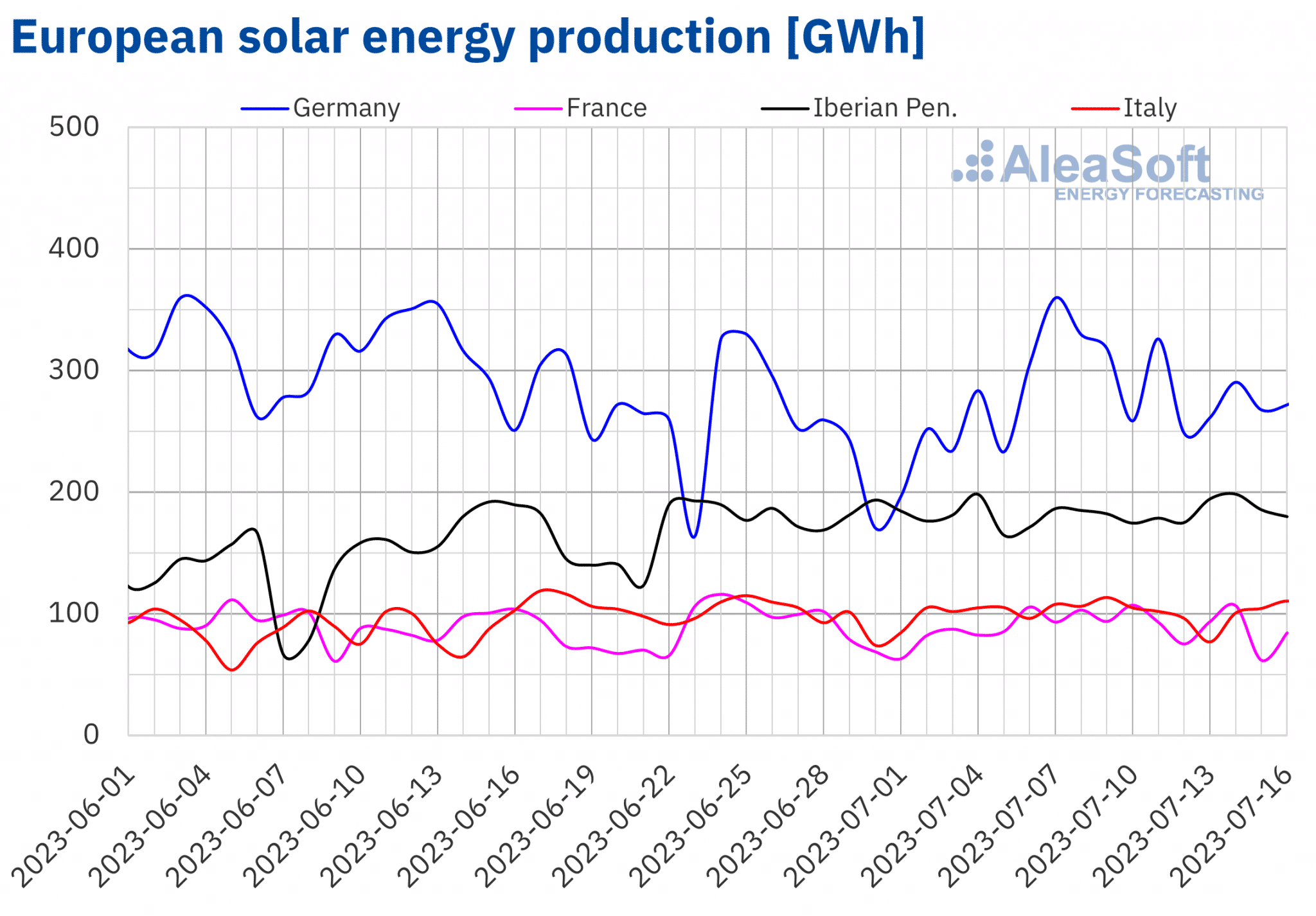

Comparing the solar energy production, which in the case of Mainland Spain includes photovoltaic and solar thermoelectric energy, of the second week of July with respect to the previous week, increases were registered in the Iberian market. In the Spanish market, the increase was 1.4%, while in the Portuguese market the rise was 1.2%. In the rest of the analysed markets, the production with this technology decreased, with the French market being the one with the lowest decrease, of 4.5%. In the Italian and German markets, the decreases were 5.5% and 6.7% respectively.

When analysing the behaviour of solar photovoltaic energy production in the first half of July compared to the same period since 2015, records were registered in all analysed markets. In the first fifteen days of July 2023, the production in the markets of Portugal and Mainland Spain was 48% and 35% higher than that registered between July 1 and 15, 2022. In Germany the increase was 12%, while the markets of Italy and France were those with the least rise, of 6.9% and 2.3%, respectively.

For the week of July 17, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that production will increase in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

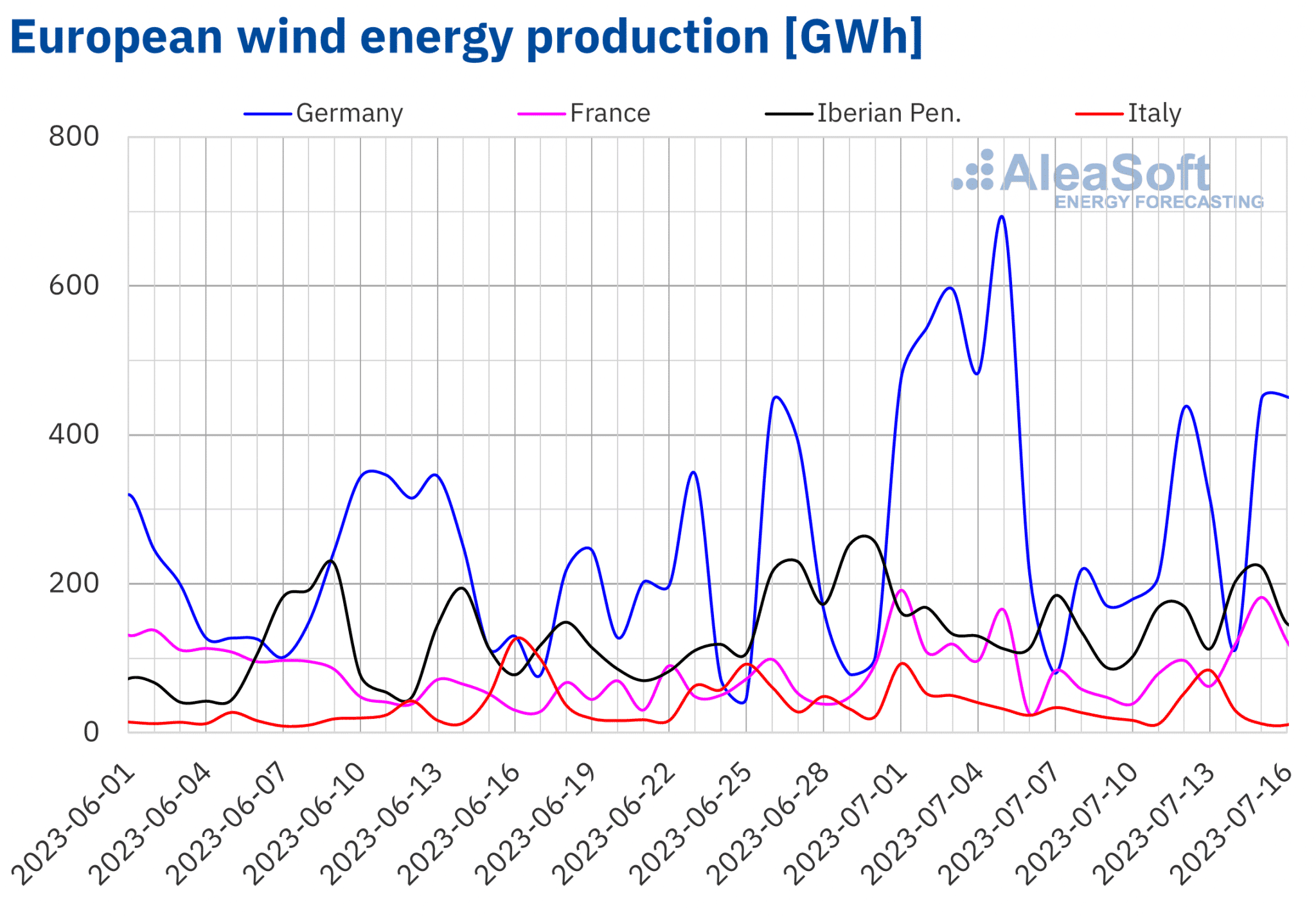

In the second week of July, the wind energy production increased in most analysed markets compared to the previous week. The largest increase was registered in the Spanish market, which was 29%, followed by the 18% increase in the French market and the 12% increase in the Portuguese market.

On the other hand, in the German and Italian markets, the wind energy production decreased in the week of July 10 compared to the previous week. The largest decrease was registered in the German market, which was 12%, followed by the decrease of 4.2% in the Italian market.

As for the wind energy production registered between July 1 and 15 since 2011, in the French and German markets, the highest production with this technology was registered in the first half of July 2023.

For the third week of July, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates increases in the Italian and Spanish markets. On the other hand, for the markets of France, Portugal and Germany, decreases in production with this technology are expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

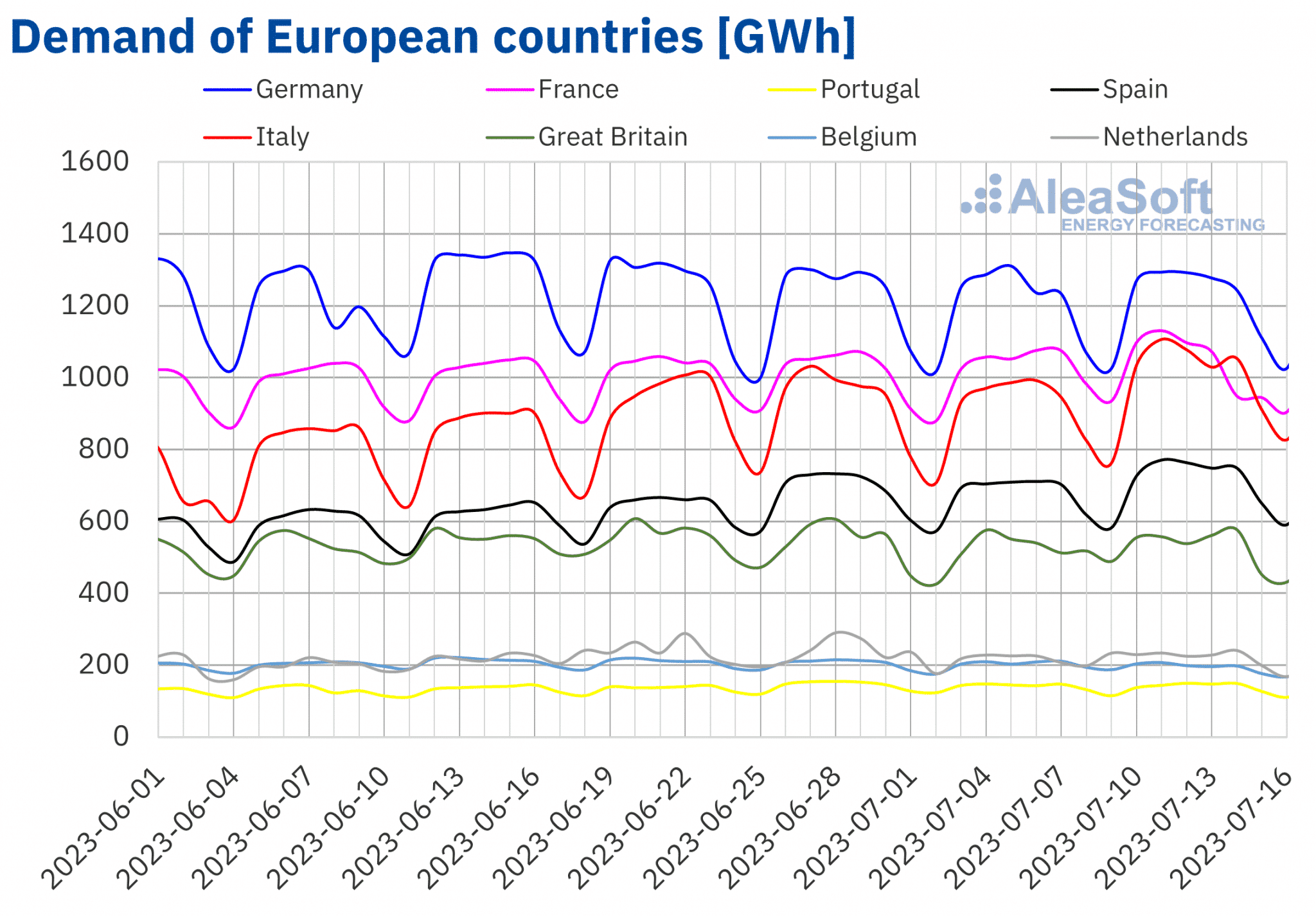

During the week of July 10, the electricity demand fell in most analysed European markets compared to the week that preceded it. The largest decrease, of 4.9%, was registered in the Belgian market. In the markets of France, Great Britain, Portugal and the Netherlands, the decreases in demand were between 0.1% of the French market and 0.9% of the Dutch market. In the case of France, the drop in demand was related to the holiday of Friday, July 14, French National Day.

However, in some markets the demand increased. The highest rise was registered in the Italian market, which was 9.8%. In the Spanish market and in the German market, the demand increased by 5.9% and 1.2%, respectively.

The drop in demand in Great Britain coincided with a drop in average temperatures of 0.2 °C. In the rest of the analysed markets, the average temperature increased compared to the previous week, between 0.7 °C of Belgium and 2.5 °C of Italy.

For the third week of July, according to the demand forecasts done by AleaSoft Energy Forecasting, the demand is expected to drop in most of the main European markets analysed, with the exception being the markets of Portugal, Italy and France.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

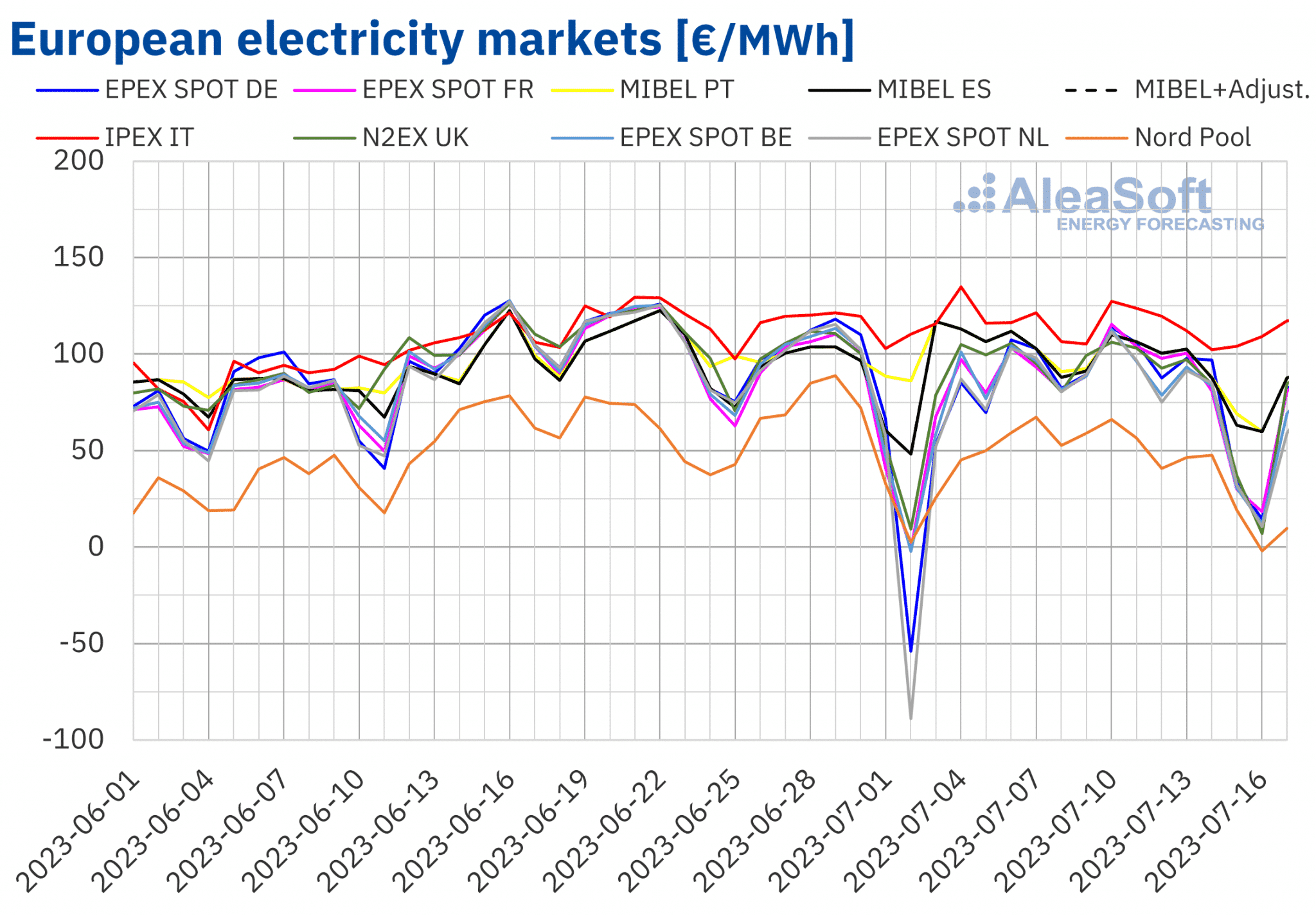

European electricity markets

In the week of July 10, prices of the main European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest fall in prices was that of the Nord Pool market of the Nordic countries, of 24%, while in the case of the IPEX market of Italy, a slight decrease of 2.2% was registered. In the rest of the markets, prices fell between 6.8% of the EPEX SPOT market of Germany and 21% of the N2EX market of the United Kingdom.

In the second week of July, the weekly averages were below €80/MWh in most European electricity markets. The exceptions were the Italian market, with the highest average price, of €113.98/MWh, and the MIBEL market of Spain and Portugal, with averages of €89.89/MWh and €90.82/MWh, respectively. On the other hand, the lowest weekly average was that of the Nordic market, of €39.20/MWh. In the rest of the analysed markets, prices were between €71.81/MWh of the Dutch market and €78.57/MWh of the German market.

Regarding hourly prices, on Wednesday, July 12, negative prices were registered in the Belgian and Dutch markets. There were also negative prices in these markets on Monday, July 17. Likewise, on July 15 and 16, negative hourly prices were registered in the German, Belgian, British, French, Dutch and Nordic markets, influenced by the drop in demand over the weekend and the increase in wind energy production in some markets. The lowest hourly price, of ‑€73.76/MWh, was reached on Sunday, July 16, from 14:00 to 15:00, in the Dutch and Belgian markets.

During the week of July 10, the decrease in the average price of gas and CO2 emission rights, the drop in demand in most markets and the increase in wind energy production in markets such as France, Spain or Portugal, caused price falls in European electricity markets.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the third week of July prices may continue to fall in most European electricity markets, influenced by decreases in electricity demand and increases in wind and solar energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

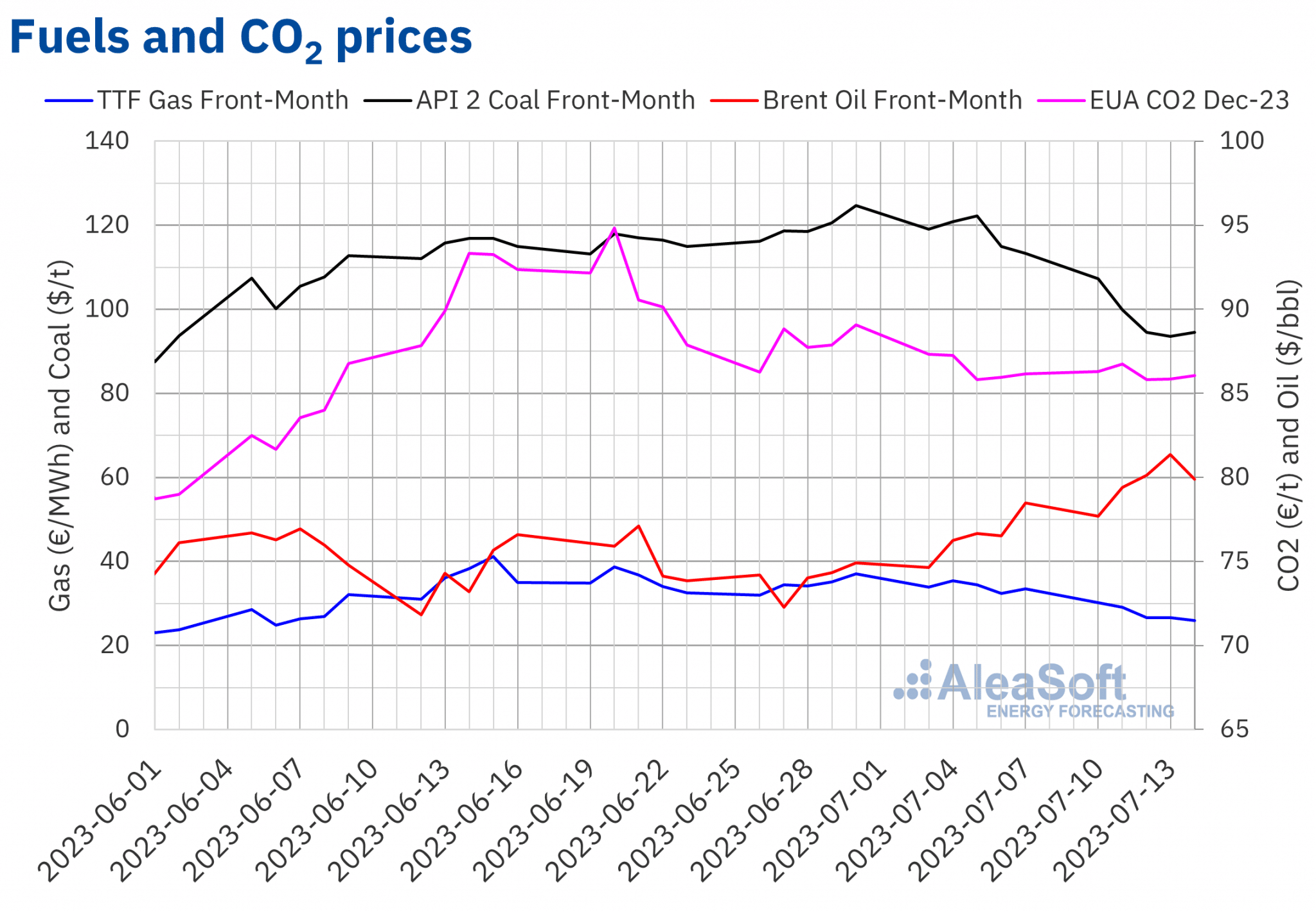

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market, on Monday, July 10, registered the weekly minimum settlement price, of $77.69/bbl, which was 4.1% higher than that of the previous Monday. In the following sessions of the second week of July, settlement prices increased. As a result, on Thursday, July 13, the weekly maximum settlement price, of $81.36/bbl, was reached. This price was 6.3% higher than that of the previous Thursday and the highest since April. On Friday, July 14, the settlement price was $79.87/bbl. Despite the decrease, this price was still 1.8% higher than that of the previous Friday.

In the second week of July, supply disruptions from Libya and Nigeria exerted their upward influence on Brent oil futures prices. The upward modification of OPEC’s forecasts for world oil demand for 2023 also contributed to this trend. However, that same week, the International Energy Agency also modified its demand forecasts, but downwards.

As for TTF gas futures prices in the ICE market for the Front‑Month, during the second week of July they registered a downward trend. Thus, on Monday, July 10, the weekly maximum settlement price, of €30.23/MWh, was reached. This price was already 11% lower than that of the previous Monday. Subsequently, prices continued to fall until registering the weekly minimum settlement price, of €25.96/MWh, on Friday, July 14. This price was 22% lower than that of the previous Friday and the lowest since June 6.

The situation of high levels of European reserves and abundant supply continued to favour the decrease in prices. The discovery of a new gas field in Norway also influenced TTF gas futures prices downward in the second week of July. In addition, at the end of the week, maintenance work was completed in Norway, contributing to the increase in supply from this country. However, the increase in Asian demand affected the supply of liquefied natural gas in the second week of July. This may continue to happen in the coming weeks. In addition, in the third week of July, the high temperatures in Europe may favour increases in demand.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2023, in the second week of July they remained without major variations. The weekly maximum settlement price, of €86.73/t, was reached on Tuesday, July 11. This price was 0.6% lower than that of the previous Tuesday. On the other hand, the weekly minimum settlement price, of €85.81/t, was registered on Wednesday, July 12, repeating the same price reached on the previous Wednesday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

On Thursday, July 13, the last webinar of AleaSoft Energy Forecasting and AleaGreen was held. The topics analysed in this webinar included the evolution of European energy markets, price forecasting methodologies, the energy transition, the update of the National Energy and Climate Plan (NECP) of Spain and the renewable energy projects financing. Speakers from Banco Sabadell, Ecoener and Ben Oldman participated in the analysis table of the webinar in Spanish.

The next webinars of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen are scheduled for September 7 and October 19. In the case of the webinar of September, in addition to the evolution and prospects of European energy markets, benefits of PPA for large and electro‑intensive consumers will be analysed. The AleaSoft Energy Forecasting services that contribute to risk management and energy transition will also be explained. On the other hand, Pedro González, Director‑General of AEGE, Association of Companies with Large Energy Consumption, will participate in the analysis table that is carried out in the second part of the webinar in Spanish.

In the case of the webinar of October, prospects for European energy markets for the winter 2023‑2024, the renewable energy projects financing and the importance of forecasting in audits and portfolio valuation will be analysed. For this, there will be the participation of speakers from Deloitte for the fourth time.

Source: AleaSoft Energy Forecasting.