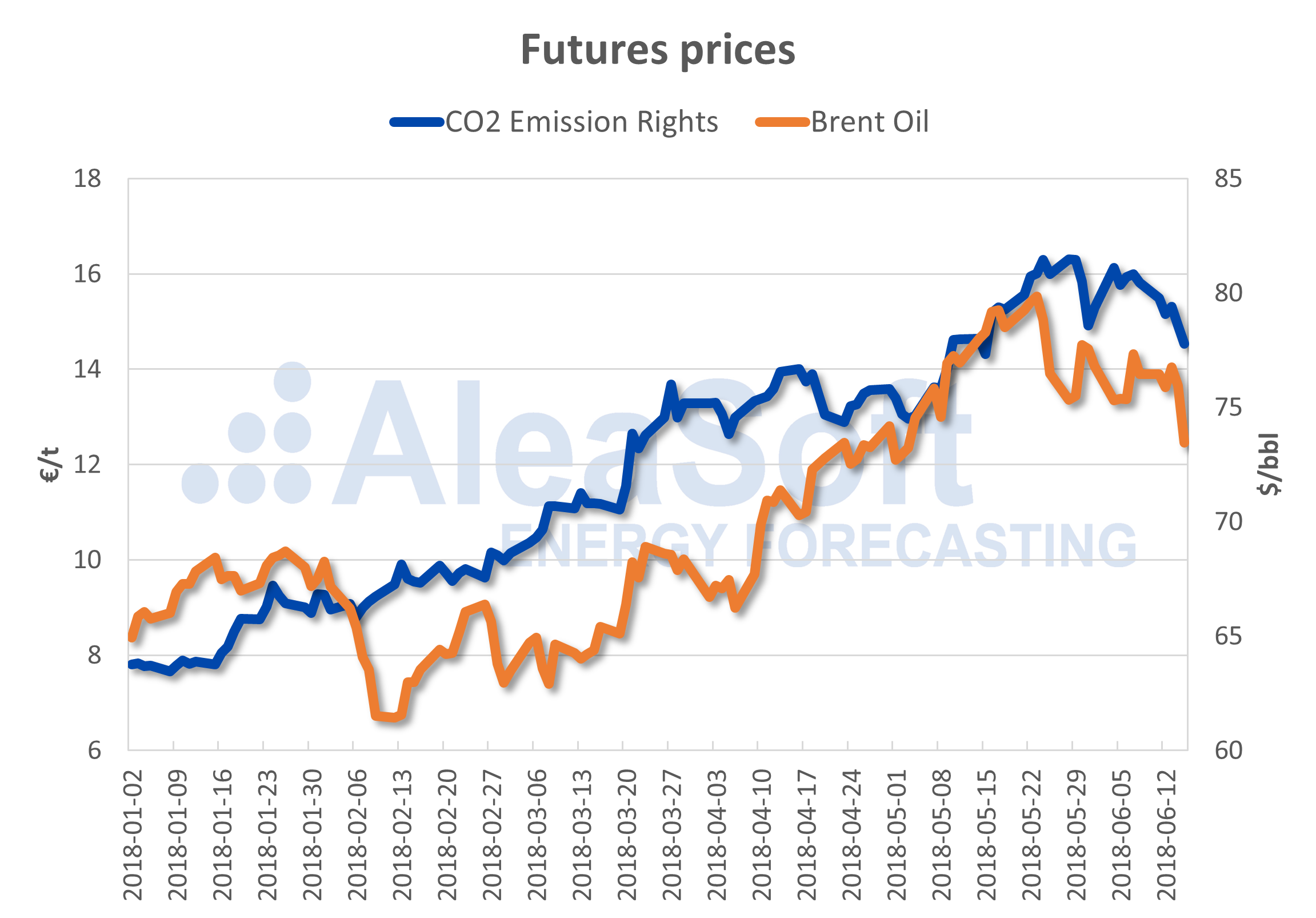

AleaSoft, June 18th, 2018. The prices of the CO2 emission rights begin to show setbacks after four consecutive months of sharp increase. Brent futures also fell last week. Meanwhile, fuels (gas and coal) and electricity futures remain relatively stable, but they also show signs of being able to decrease.

The price of EUA CO2 emission rights futures for the December 2018 reference contract fell by 6.2% over the past week, with the steepest drop from Thursday to Friday, 2.5%. The drop of prices last week is the first sign of clear price relaxation after the values recorded at the end of May, with a maximum of 16.31 €/t on May 28th, which were prices not seen since 2011. The redefinition of the renewable production target from 27% to 32% in the European Union last week points to an additional emission reduction, which would require fewer rights to buy, which in turn would push prices down. AleaSoft estimates that the profit taking after the high prices and the perspectives of increase of available emission rights in the auctions during next months, are the main factors of the fall of prices. Today, June 18th, its price in the ICE Futures Europe market has opened with a slight upwards trend.

Meanwhile, Brent oil futures fell 3.3% last Friday, June 15th, after three fairly stable weeks. In this month of June, the futures of gas and coal fuels slowed their price rally that since February has triggered gas futures by 42% and coal futures by 24%, according to the analyzed data by AleaSoft.

Source: ICE.

The electricity futures of the Spanish electricity market in OMIP closed on Friday, June 15th, a week with very slight increases with respect to the previous Friday, 0.4% for the Q3-18 product and 0.5% for Q4-18, and they slow down the slight downward trend that began at the beginning of this month of June, after the significant rise in futures that led to Q3-18 and Q4-18 above 65 €/MWh at the end of May.

The futures prices for the Spanish electricity market for this week of June 18th closed on Friday at 58.00 €/MWh in the OMIP market. AleaSoft‘s forecasts estimate that the average spot market price will be below that price, because, although the increase in temperatures will lead to an increase in demand that will push the price upwards, the expected increase of the wind energy production in the second half of the week will counteract by pushing the price down.