AleaSoft Energy Forecasting, December 4, 2023. In the last week of November, prices in the main European electricity markets rose compared to the previous week. This increase was due to the drop in temperatures, which in most markets was more than 3°C, and which boosted electricity demand. In addition, renewable energy production was lower than the previous week. On November 30, CO2 futures reached their lowest settlement price since October 2022. Gas futures decreased.

Solar photovoltaic, solar thermoelectric and wind energy production

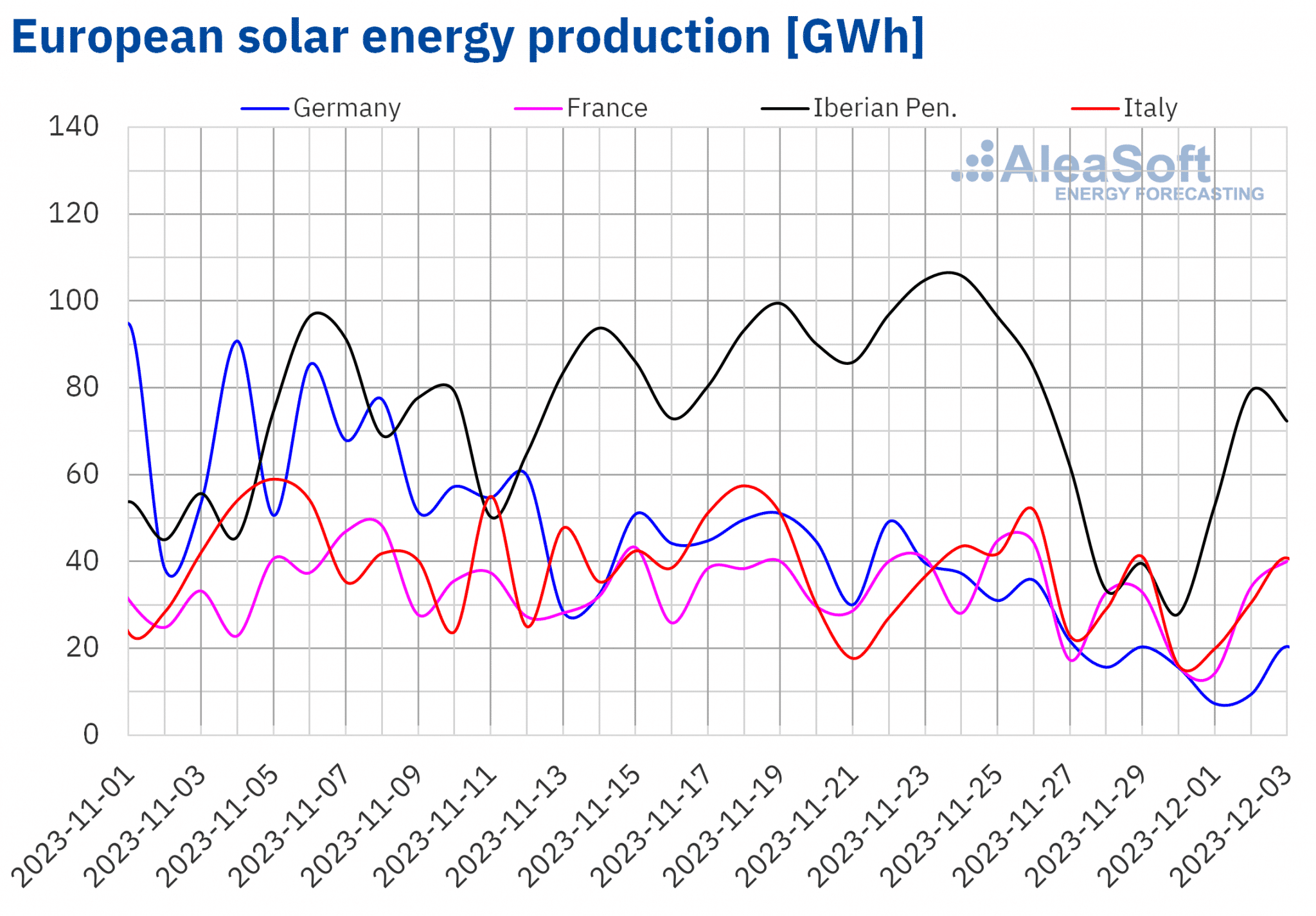

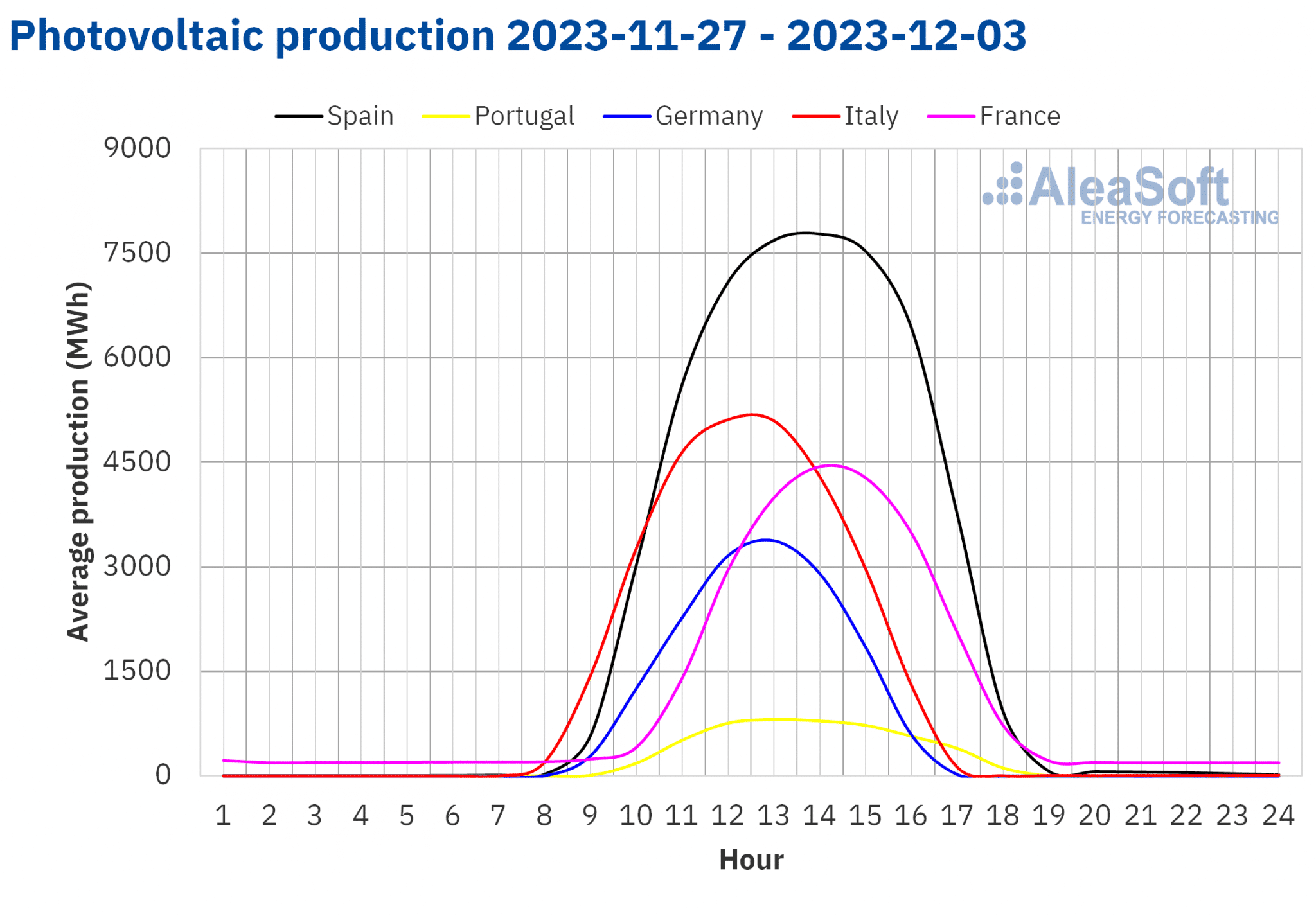

In the week of November 27, the main European electricity markets registered a decrease in solar energy production compared to the previous week. The German market registered the largest decline, which was 59%. The Spanish, Portuguese, French and Italian markets followed the German market, falling by 45%, 44%, 27% and 19% respectively.

According to AleaSoft Energy Forecasting’s solar energy production forecasts, it will recover in Spain in the first week of December, while it will continue declining in Italy and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

As for wind energy production, the Italian, Spanish and Portuguese markets registered an increase in production using this technology during the week of November 27 compared to the week of November 20. The increases were 32%, 7.7% and 3.0%, respectively. However, in the German market, wind energy production decreased by 54%, while in the French market it decreased by 19% during the analyzed period.

AleaSoft Energy Forecasting’s wind energy production forecasts indicate an increase in production using this technology in most of the analyzed markets for the week of December 4, except in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

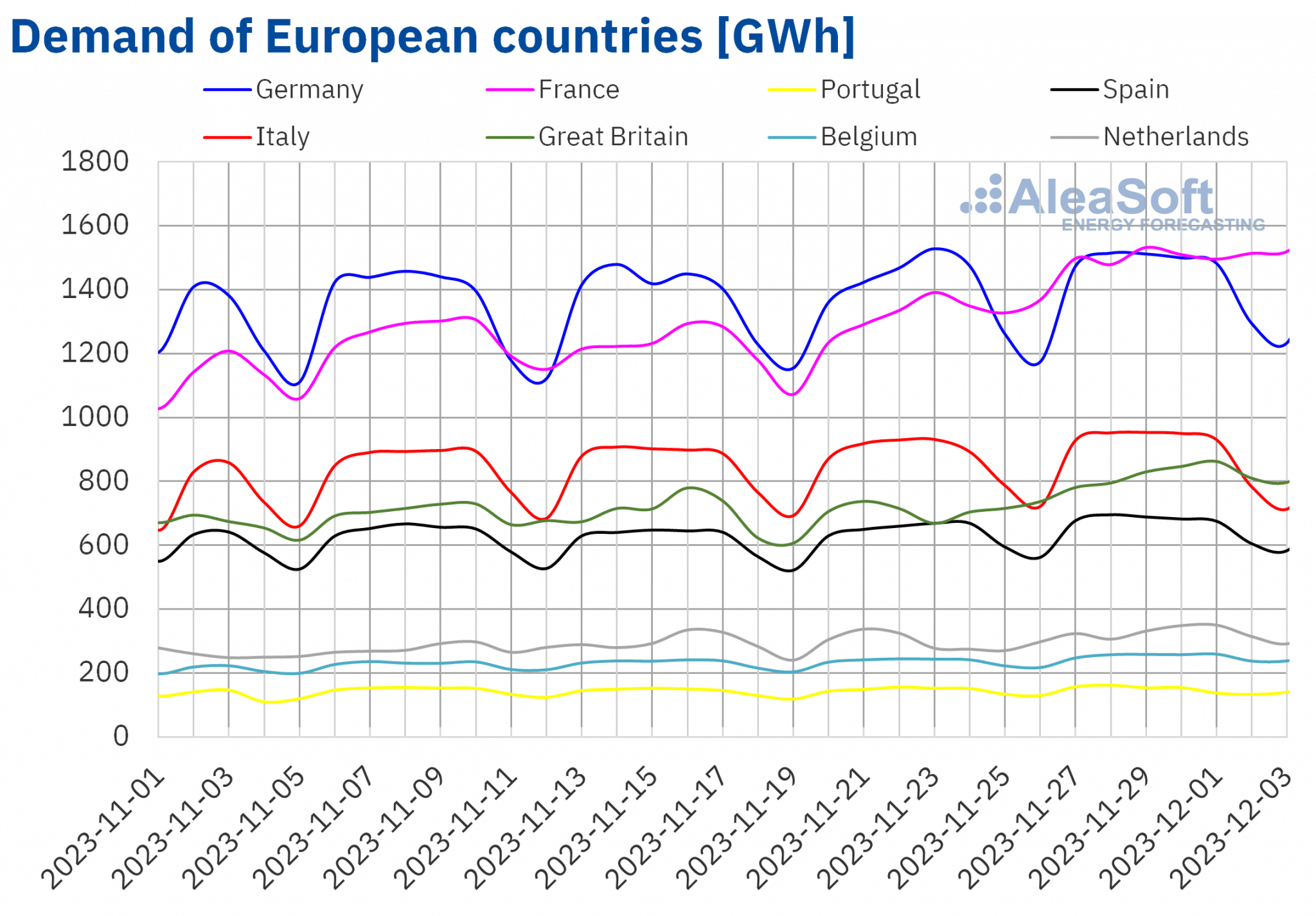

During the last week of November, electricity demand increased in all major European electricity markets compared to the previous week. The markets of Great Britain and France registered the largest increases, 15% and 14% respectively. The market with the smallest increase was Portugal, which celebrated the Independence Restoration holiday on Friday, December 1. In this case, the increase was 2.3%. In the other markets analyzed at AleaSoft Energy Forecasting, demand variations ranged from 2.6% in Italy to 8.5% in the Netherlands.

The fall in average temperatures caused this increase in demand. In the markets of Germany, France, Great Britain, Belgium and the Netherlands, average temperatures fell by more than 3 °C during the week of November 27 compared to the previous week. The Dutch market registered the largest decrease, 5.9 °C. In markets located towards the south of Europe, variations were smaller. In Italy, average temperatures decreased by 0.5 °C while in Spain and Portugal they increased by 0.1 °C and 0.4 °C, respectively.

According to AleaSoft Energy Forecasting’s demand forecasts, electricity demand will continue to rise in Germany, Great Britain and the Netherlands in the first week of December. Spain celebrates the Spanish Constitution Day on December 6 and Spain, Portugal and Italy celebrate the Immaculate Conception on December 8, which will favor a drop in demand in these markets. However, in Portugal, demand will recover after the December 1 holiday, thus exceeding demand of the week of November 27. Demand will also fall in France and Belgium.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

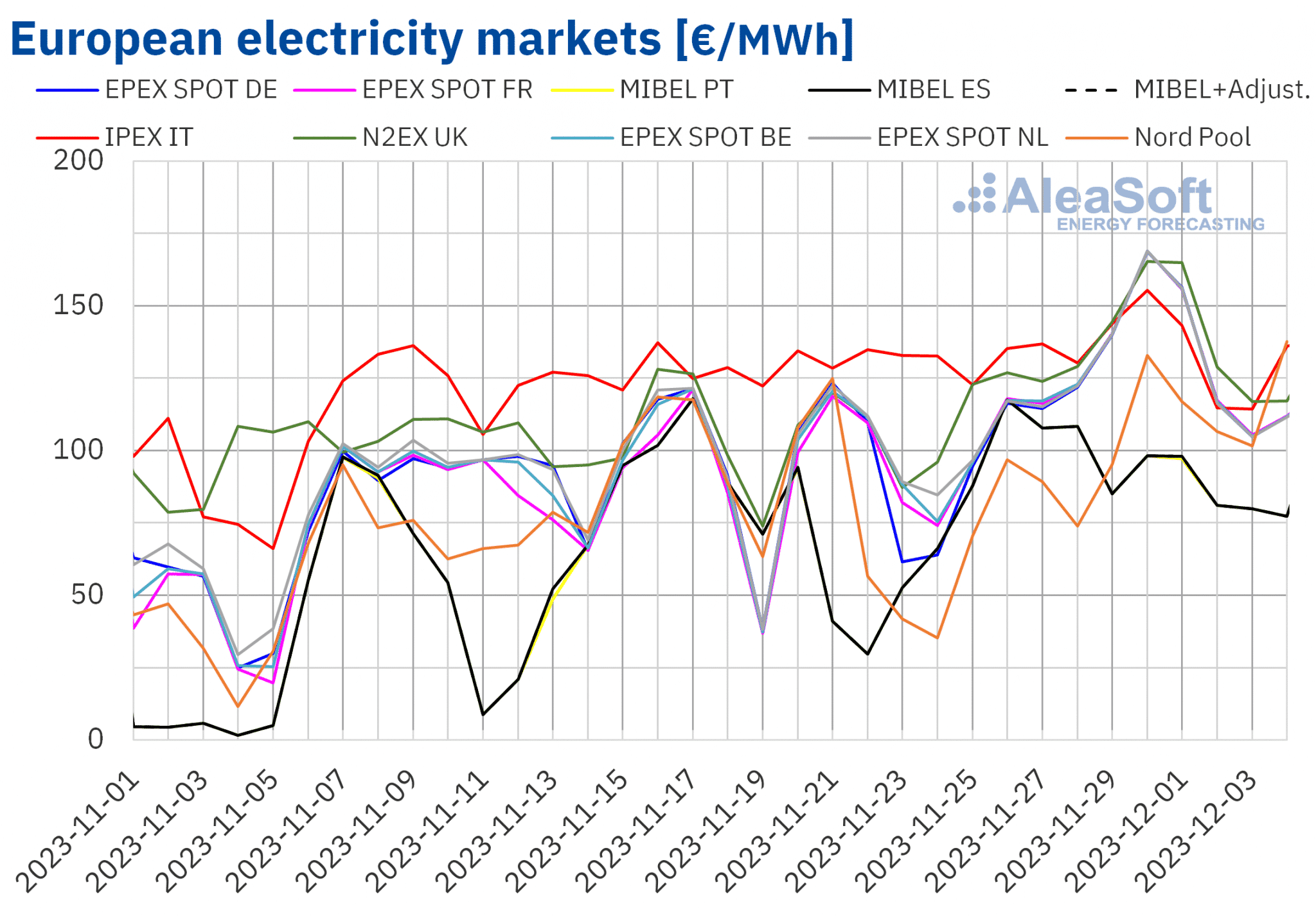

During the week of November 27, daily prices in most of the main European electricity markets increased progressively. The highest prices corresponded to Thursday, November 30. In the case of the Iberian market, although daily prices followed a downward trend since the beginning of the week, on average they were higher than those of the previous week. As a result, the weekly averages of all electricity markets analyzed at AleaSoft Energy Forecasting were higher than those of the previous week. The EPEX SPOT market of Germany registered the largest price rise, 37%, while the IPEX market of Italy had the smallest increase, 1.8%. In the rest of the analyzed markets, prices increased between 26% in the N2EX market of the United Kingdom and 35% in the MIBEL market of Spain and Portugal.

In the last week of November, weekly averages were above €130/MWh in most of the analyzed European electricity markets. The exceptions were the MIBEL market of Portugal and Spain and the Nord Pool market of the Nordic countries, where prices were €93.94/MWh, €94.04/MWh and €102.27/MWh, respectively. On the other hand, the British market registered the highest average, €139.03/MWh. In the rest of the analyzed markets, prices ranged from €131.82/MWh in the German market to €134.04/MWh in the Italian market.

On the other hand, on Thursday, November 30, from 17:00 to 18:00, the German, Belgian, French and Dutch markets registered hourly prices above €260/MWh. The highest prices were those of Germany and the Netherlands, €261.00/MWh in both cases. The French market price, €260.95/MWh, was the highest since the end of August in that market. In the case of the Nordic market, on Monday, December 4, from 8:00 to 9:00, it registered a price of €199.93/MWh, the highest since December 2022.

During the week of November 27, the general increase in electricity demand and the fall in solar energy production had an upward influence on European market prices. In addition, wind energy production fell in some markets, such as Germany and France.

AleaSoft Energy Forecasting’s price forecasts indicate that in the first week of December, prices in the European electricity markets might decrease. The increase in wind energy production in most of the analyzed markets will contribute to this behavior.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

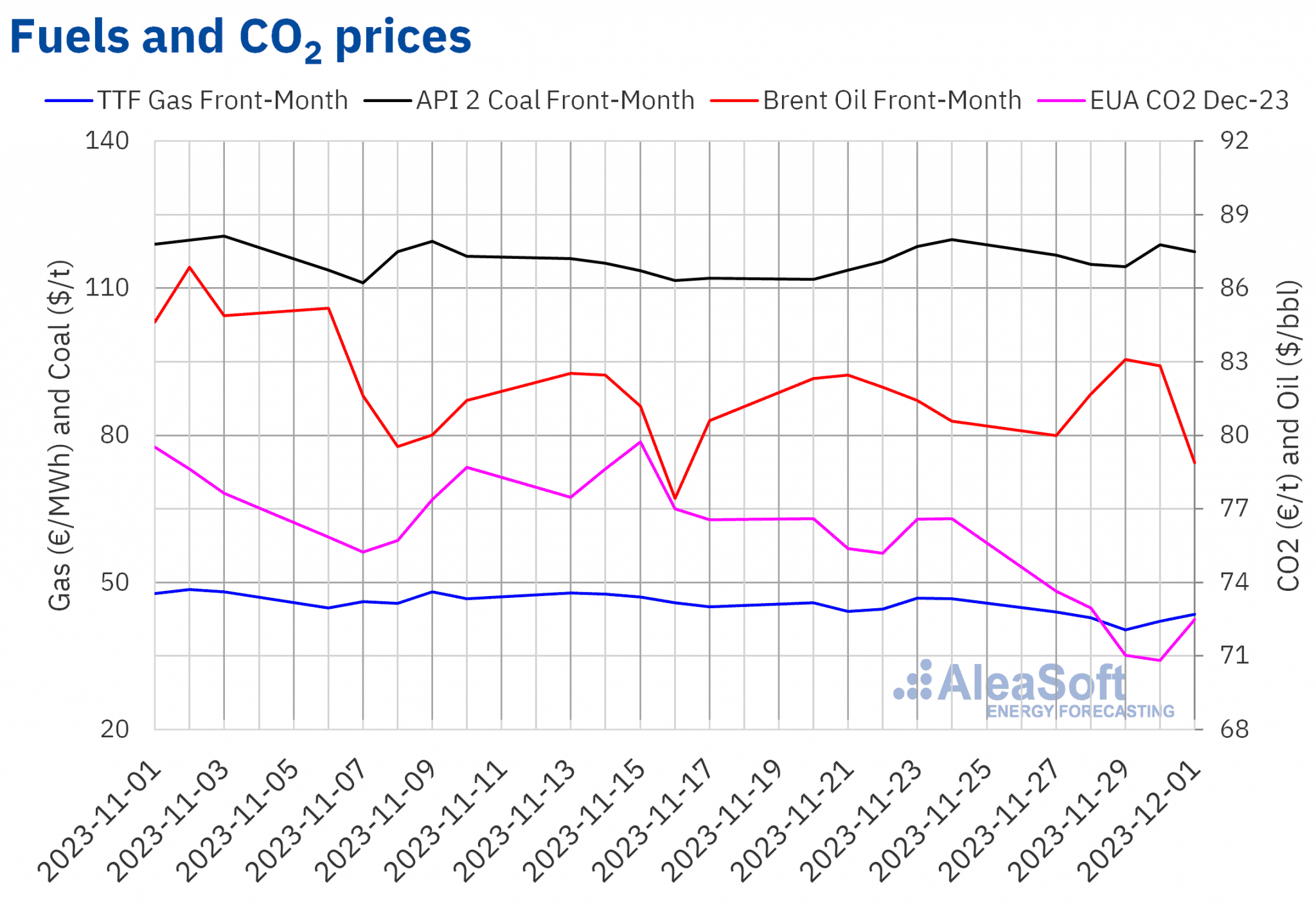

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market started the last week of November with a slight price decline from the previous week. However, prices rose again on Tuesday and Wednesday. These futures registered their weekly maximum settlement price, $83.10/bbl, on Wednesday, November 29. On the remaining days of the last week of November, prices declined to reach the weekly minimum settlement price, $78.88/bbl, on Friday, December 1.

Expectations about the OPEC+ meeting on Thursday, November 30, exerted an upward influence on prices in the first half of the week. However, the production cuts announced by OPEC+ for the first quarter of 2024, which will be voluntary, did not offset the downward influence caused by concerns about the evolution of the global economy in the last sessions of the week.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, these were below €44/MWh in the last week of November. On Monday, November 27, TTF gas futures reached the weekly maximum settlement price, €43.98/MWh. This price was already 5.7% lower than in the last session of the previous week. Prices declined on Tuesday and Wednesday. These futures registered their weekly minimum settlement price, €40.36/MWh, on Wednesday, November 29. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since October 6. In the last sessions of the week, prices recovered. On Friday, December 1, the settlement price was €43.50/MWh.

During the last week of November, high European reserves and abundant supply allowed TTF gas futures prices to be below €44/MWh, despite the increase in demand due to the cold snap on the continent. On the other hand, forecasts of less cold temperatures might exert a downward influence on prices in the coming days.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached their weekly maximum settlement price, €73.64/t, on Monday, November 27. This price was 3.9% lower than in the last session of the previous week. During the week, settlement prices declined until Thursday, November 30. On that day, these futures registered their weekly minimum settlement price, €70.81/t. This price was the lowest since October 2022 for the reference contract of December of that year. On Friday, the settlement price increased to €72.49/t, under the influence of the increase in demand due to low temperatures.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

In the process of expanding into new markets, AleaSoft Energy Forecasting is selecting professional partners in the energy sector. Potential partners should have a solid understanding of energy markets and not be competitors of AleaSoft Energy Forecasting services. Consultants in the energy sector, renewable energy sponsors, as well as experts in the energy markets, can apply to participate in this Partnership Program.

Source: AleaSoft Energy Forecasting.