AleaSoft Energy Forecasting, December 5, 2023. In November, wind energy production reached record highs in France and Italy and was the highest for a November month in Germany. Solar energy production also broke records for a November month in Spain, Portugal, France and Italy. In this context, prices in the main European electricity markets remained stable, with prices rising in Nord Pool, where they were almost three times the October average, and falling in MIBEL, where they were the lowest.

Solar photovoltaic, solar thermoelectric and wind energy production

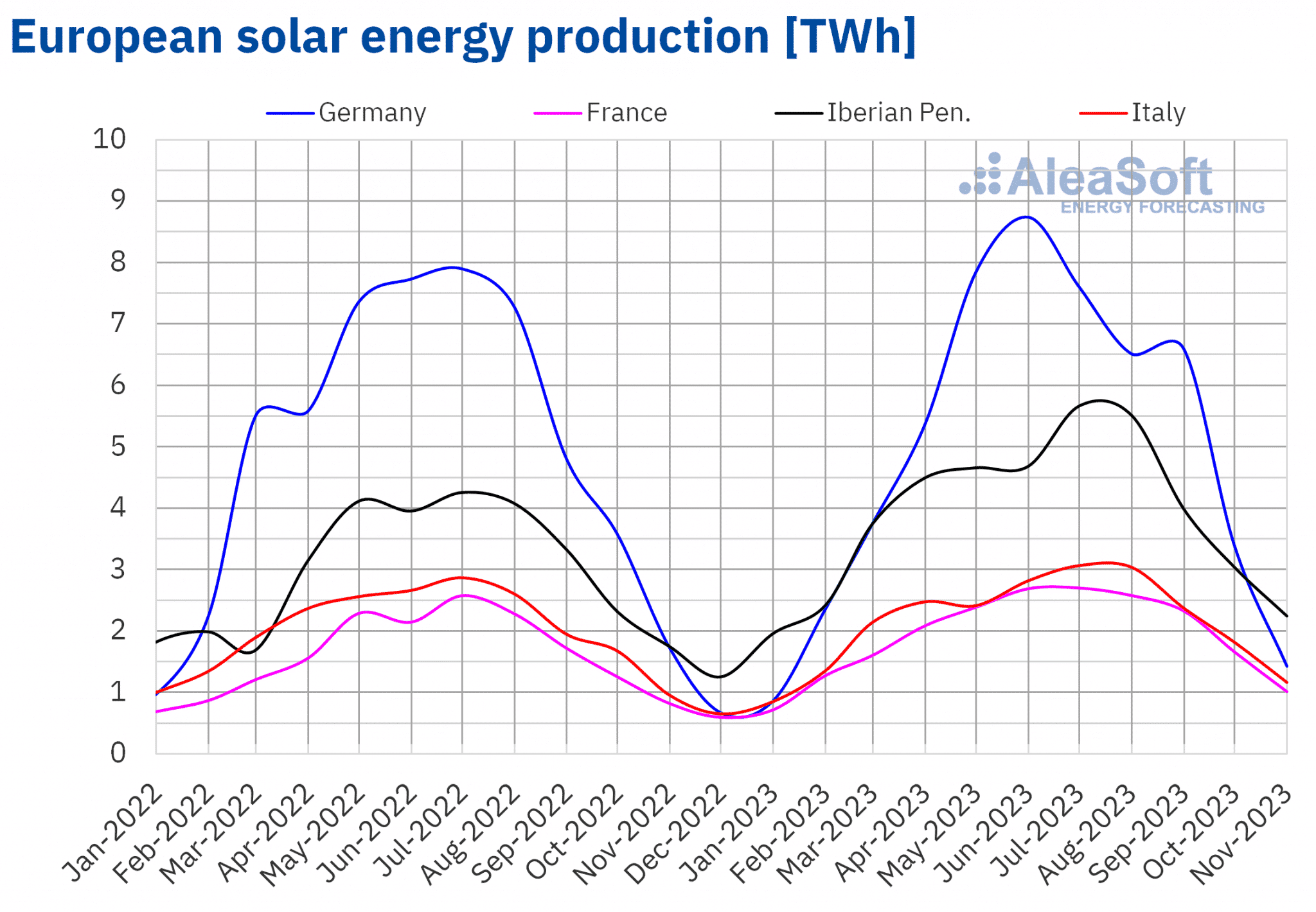

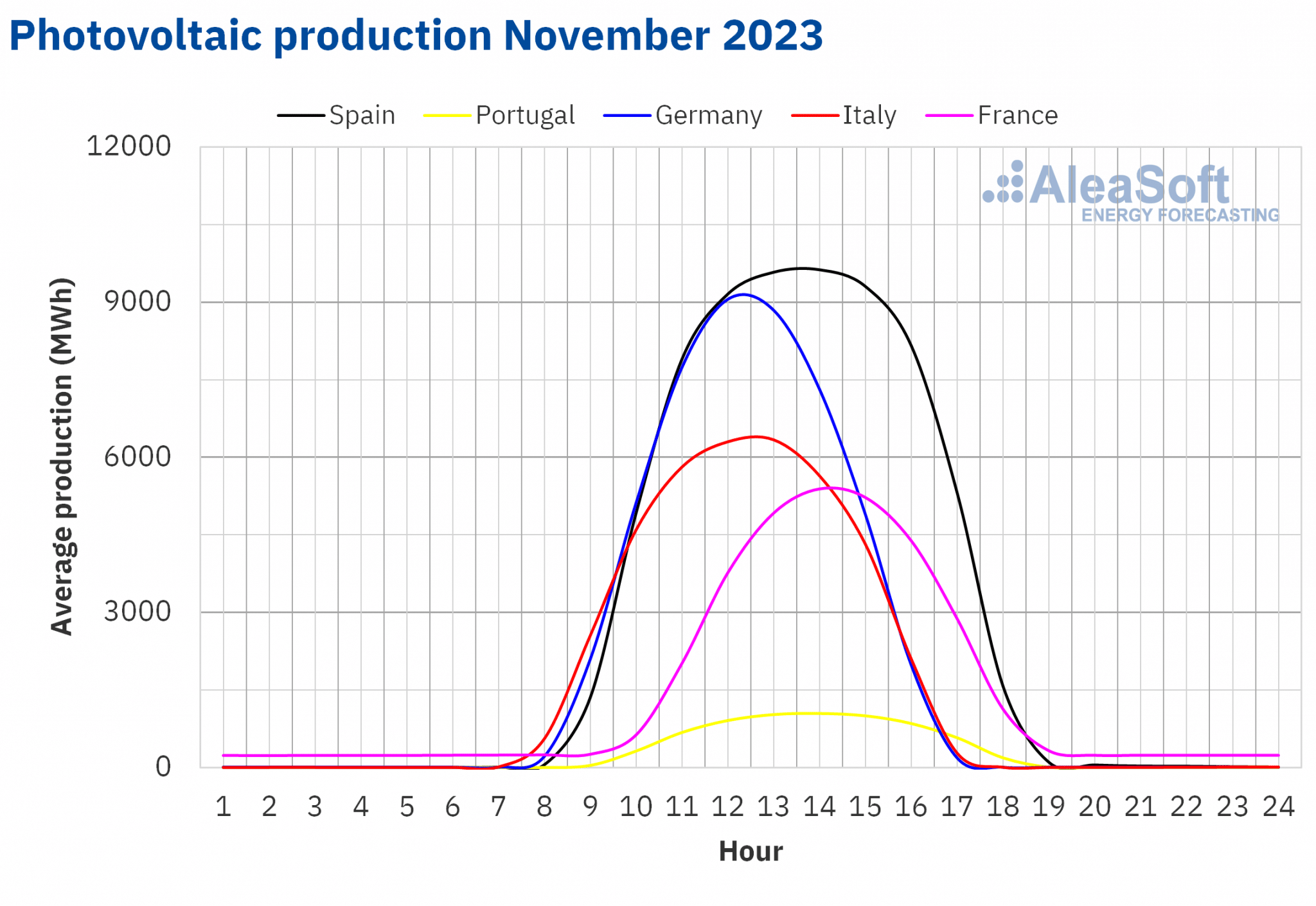

In November 2023, solar energy production increased in most of the main European electricity markets compared to the same month in 2022. The largest increases were registered in the Iberian Peninsula, with values of 38% and 27% in the Portuguese and Spanish markets respectively. The French and Italian markets registered increases of 24% and 22% respectively. The exception to this trend was the German market, where solar photovoltaic energy production fell by 17% year on year.

Compared to the previous month, solar energy production decreased in November in all markets analyzed by AleaSoft Energy Forecasting, in line with the decrease in solar radiation as winter approaches. The decreases ranged from 57% in the German market to 15% in the Portuguese market.

It should be noted, however, that compared to historical November production in previous years, solar energy production in November 2023 was record high in Southern European markets. The Spanish market topped the list of record-breaking markets with 2041 GWh generated. It was followed by the Italian and French markets with 1162 GWh and 1016 GWh respectively. The Portuguese market closed the list with 198 GWh produced using solar technology.

This data reflects the overall increase in installed solar energy production capacity in recent years. For example, according to REN data, installed solar energy capacity in Portugal increased by 3.0 MW between October and November 2023. In addition, according to REE data, the increase in installed solar photovoltaic energy production capacity in Mainland Spain during the same period was 5.2 MW.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

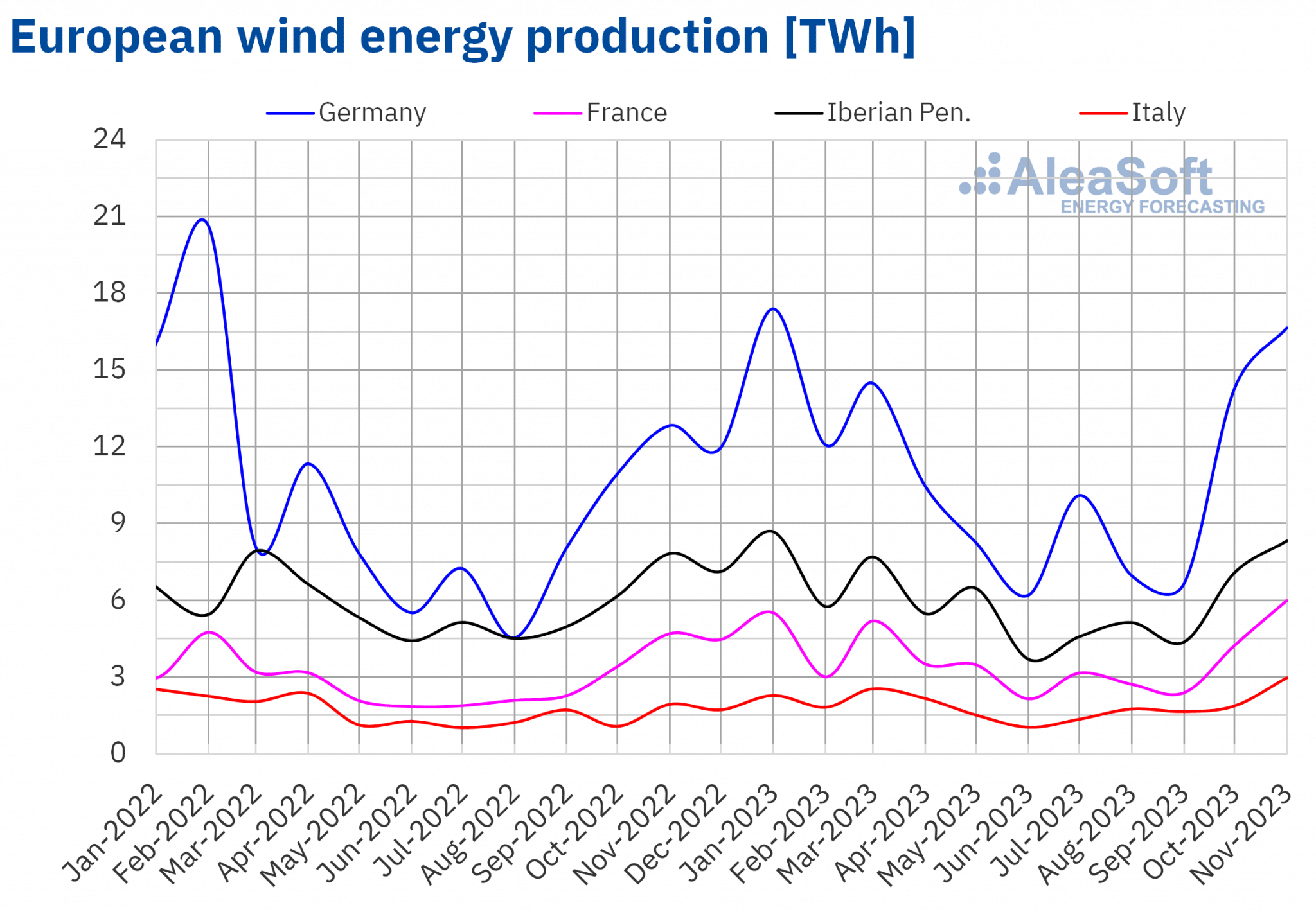

Wind energy production registered year-on-year growth in all major European markets in November 2023. The Italian market registered the highest increase at 54%. In the other analyzed markets, increases ranged from 5.4% in the Spanish market to 30% in the German market.

In November, wind energy production also increased compared to the previous month in all European markets analyzed at AleaSoft Energy Forecasting. The percentage increase of wind energy production in Italy was again the highest at 64%. In the rest of the analyzed markets, the increase ranged from 4.2% in Portugal to 46% in France.

In November 2023, the French and Italian markets registered record highs in wind energy production of 5998 GWh and 2977 GWh, respectively. In addition, the German market also broke the record for wind energy production in November 2023, with 16 649 GWh compared to the same month in previous years.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

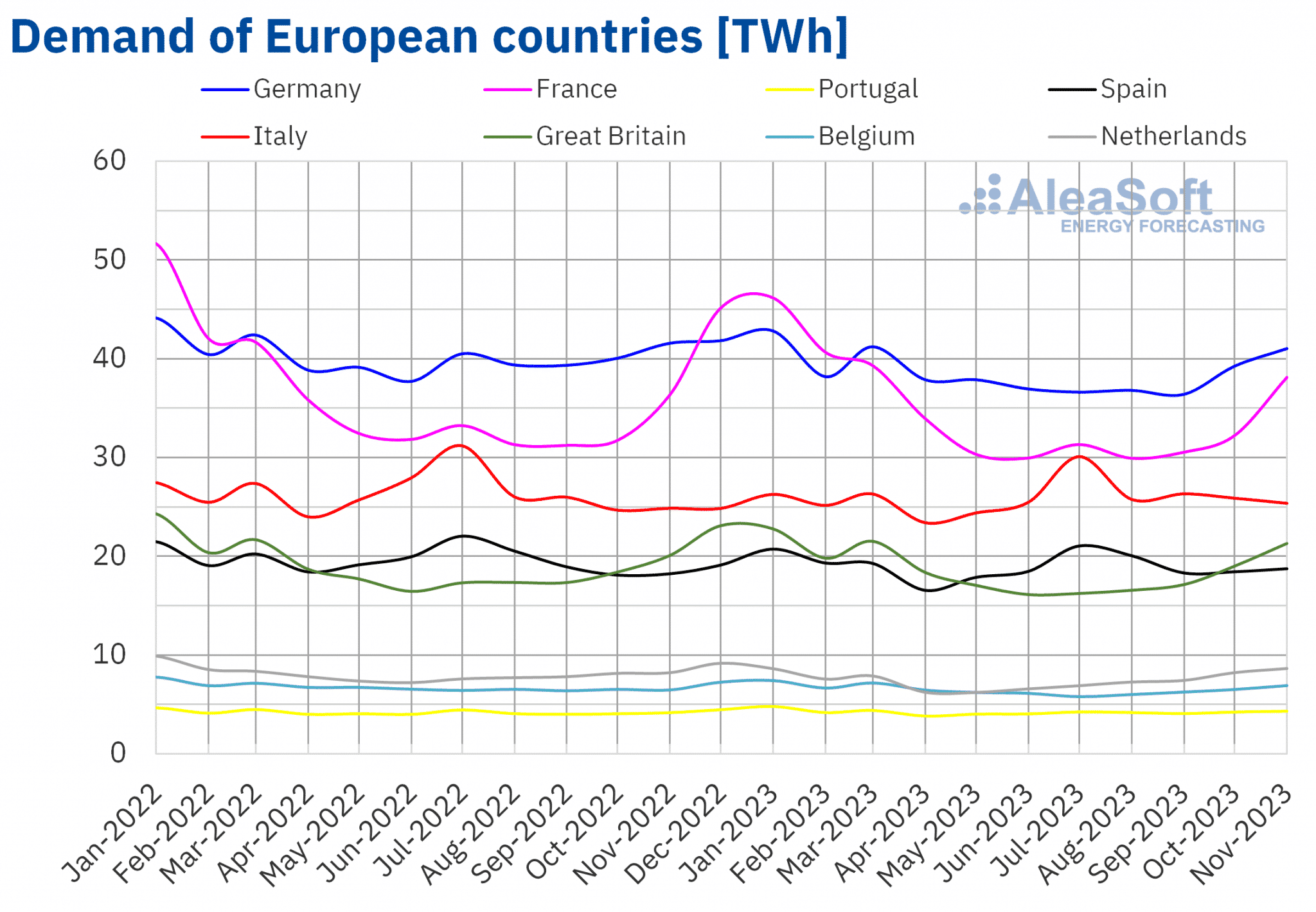

In November 2023, electricity demand increased in most major European markets compared to the same period in 2022. The increases were led by a 6.8% increase in the Belgian market, followed by a 6.0% increase in the British market. In contrast, the Italian market registered the smallest increase of 2.0%. On the other hand, the German market was the only one of the analyzed markets where demand decreased by 1.3% year-on-year.

Comparing electricity demand in October and November 2023, demand increased in November in all European markets analyzed by AleaSoft Energy Forecasting. The British and French markets experienced the largest month-over-month increases of 16% and 22%, respectively. In the rest of the analyzed markets, increases ranged from 1.3% in Italy to 9.5% in Belgium.

November 2023 was slightly cooler than the same month in 2022 in most markets. The year-over-year decrease in average temperatures ranged from 0.04°C in Spain to 1.7°C in Great Britain. In the case of Portugal, average temperatures were similar to October.

Average temperatures in November were lower than in October in all analyzed markets. The Italian market registered the largest temperature decrease of 7.0°C. In the remaining markets, temperature decreases ranged from 4.8°C in Great Britain to 6.3°C in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

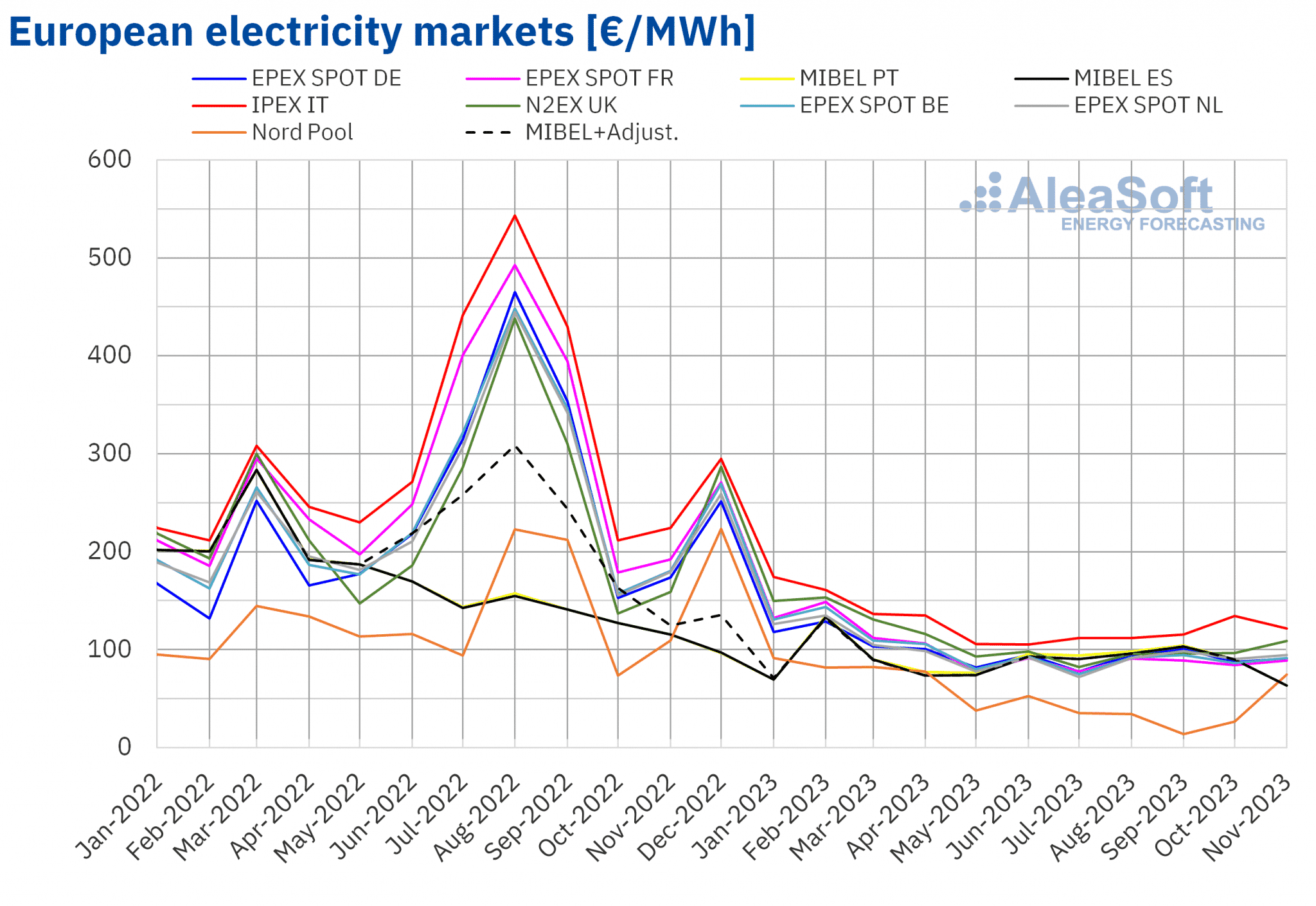

European electricity markets

In the month of November 2023, the monthly average price exceeded €85/MWh in most of the major European energy markets. The exceptions were the MIBEL market ofPortugal and Spain and the Nord Pool market of the Nordic countries, where the averages were €63.26/MWh, €63.45/MWh and €74.58/MWh, respectively. The Italian IPEX market registered the highest monthly price of €121.74/MWh. In the remaining markets, average prices ranged from €88.96/MWh in France’s EPEX SPOT market to €108.84/MWh in the UK’s N2EX market.

In recent months, the average price for most European markets has remained fairly stable. Compared to October, average prices in November increased slightly in most of the European electricity markets analyzed at AleaSoft Energy Forecasting. The exceptions were the Italian market with a decrease of 9.3% and the Iberian market with a decrease of 30%. On the other hand, the Nordic market registered the highest increase of 182%. In the remaining markets, prices increased between 4.3% in the German market and 13% in the UK market.

Comparing the average prices in November with those registered in the same month of 2022, prices fell in all analyzed markets. In this case, the French market registered the largest decrease, at 54%. In the other markets, price decreases ranged from 31% in the UK market to 49% in the Belgian market.

As a result of the price falls registered in the MIBEL market, the November average in Spain and Portugal was the lowest since March 2021. In addition, prices in this market were the lowest on average among the main European electricity markets. In contrast, prices in the Nordic and UK markets were the highest since April 2023. In the case of the French market, its monthly average was the highest since August.

In November 2023, the decline in the average gas price and the increase in wind energy production led to a year-on-year decline in prices in European electricity markets. In addition, solar energy production increased in almost all analyzed markets.

On the other hand, despite the increase in wind energy production, the general decrease in solar energy production compared to the previous month and the increase in demand contributed to price increases compared to October in most of the analyzed markets. The exceptions were the Spanish, Portuguese and Italian markets, which registered the smallest month-on-month increases in demand.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

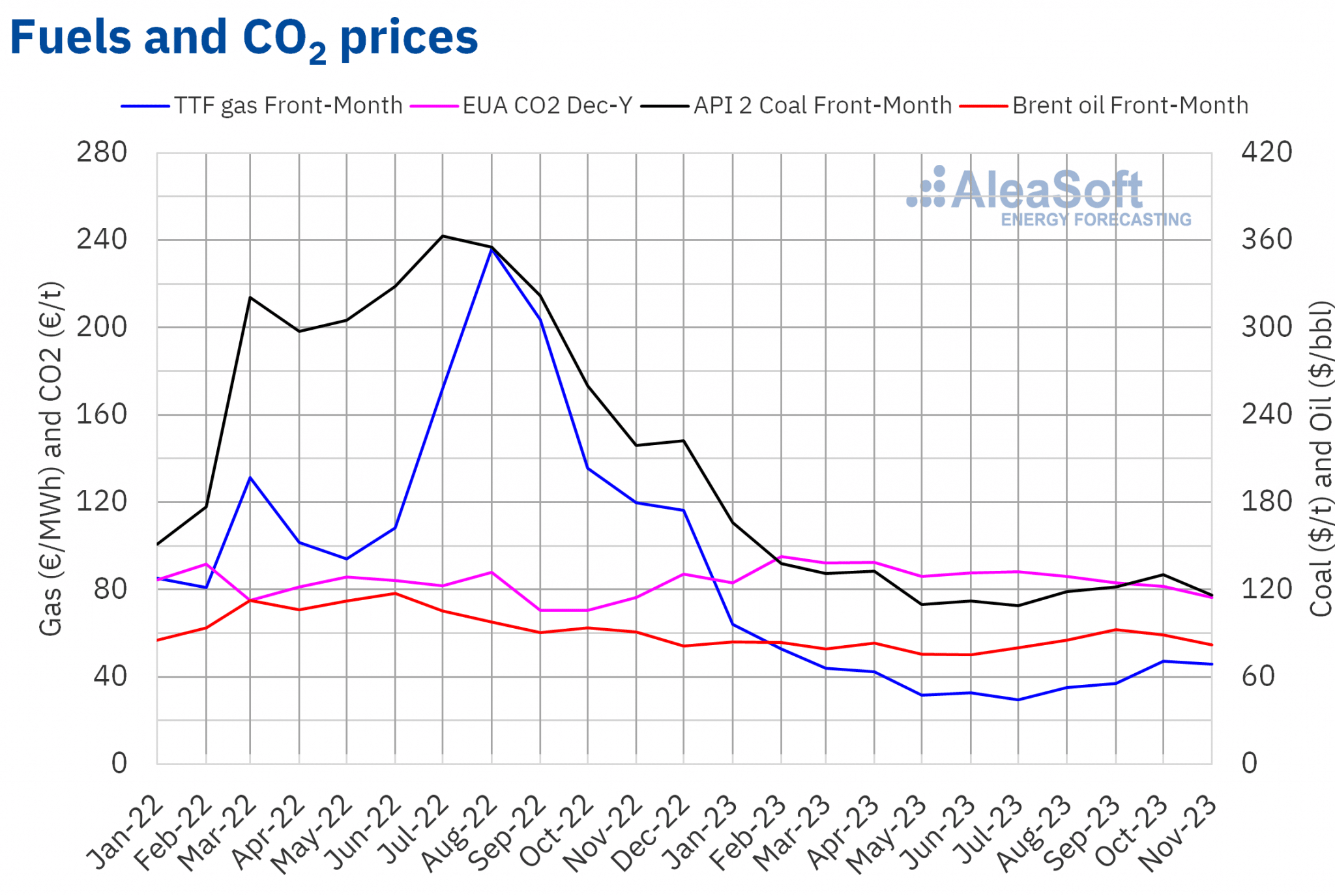

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market averaged $82.03/bbl in November. This was 7.5% lower than the October Front-Month futures price of $88.70/bbl. It was also 9.8% lower than the corresponding November 2022 Front-Month futures contract of $90.98/bbl.

In November, concerns about global economic developments and their impact on oil demand continued to weigh on Brent oil futures prices. The lifting of sanctions on Venezuelan oil exports also contributed to the decline in these futures. On the other hand, fears of supply problems due to instability in the Middle East diminished, which also allowed prices to fall.

As for the Front-Month TTF gas futures in the ICE market, the average value registered during the month of November was €45.75/MWh. Compared to the average Front-Month futures traded in October of €47.07/MWh, they decreased by 2.8%. Compared to the Front-Month Futures traded in November 2022, when the average price was €119.71/MWh, there was a decrease of 62%.

In November, high European inventories, abundant LNG supplies and mild temperatures in the first weeks of the month led to lower prices for TTF gas futures. In addition, Israel resumed gas supplies to Egypt in early November, which also had a downward impact on prices.

CO2 emission rights futures on the EEX market for the December 2023 reference contract reached an average price of €76.22/t in November. This represents a decrease of 6.5% compared to the previous month’s average of €81.53/t. Compared to the November 2022 average for the December 2022 reference contract of €76.26/t, the November 2023 average was only 0.1% lower.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

AleaSoft Energy Forecasting and AleaGreen are organizing the next events in their monthly webinar series. The December webinar is scheduled for Thursday, December 14 and coincides with the fourth anniversary of the series. This edition will focus on AleaSoft’s services for the energy sector, in addition to discussing the outlook for European energy markets in 2024. The first 2024 webinar will be held on January 18. PwC Spain will participate in this webinar for the fourth time.

Source: AleaSoft Energy Forecasting.