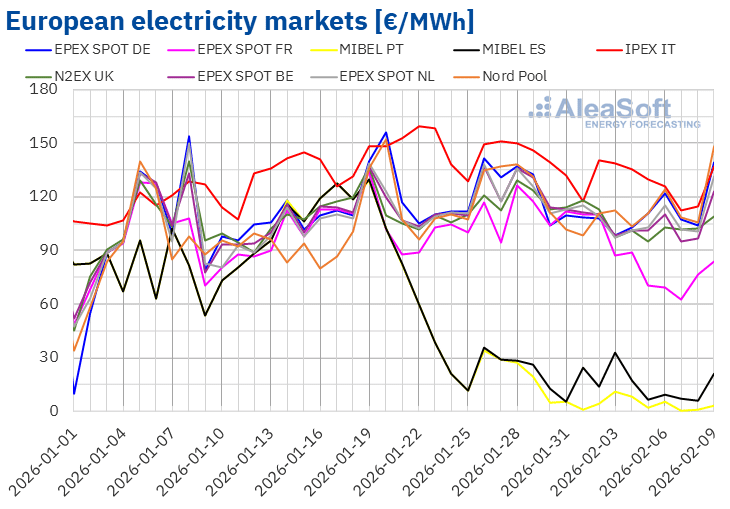

AleaSoft Energy Forecasting, February 9, 2026. At the start of the first week of February, prices in most European electricity markets declined and, despite a slight recovery during the second half of the week in some cases, weekly averages fell compared to the previous week. Even so, prices remained above €100/MWh in most markets, with the exception of Portugal, Spain and France. The Iberian market decoupled again, with significantly lower prices throughout the week. Solar energy production increased in the main markets and wind energy production reached a record level for a February day in Italy, while electricity demand declined in most markets. CO₂ futures registered their lowest level since October 2025.

Solar photovoltaic and wind energy production

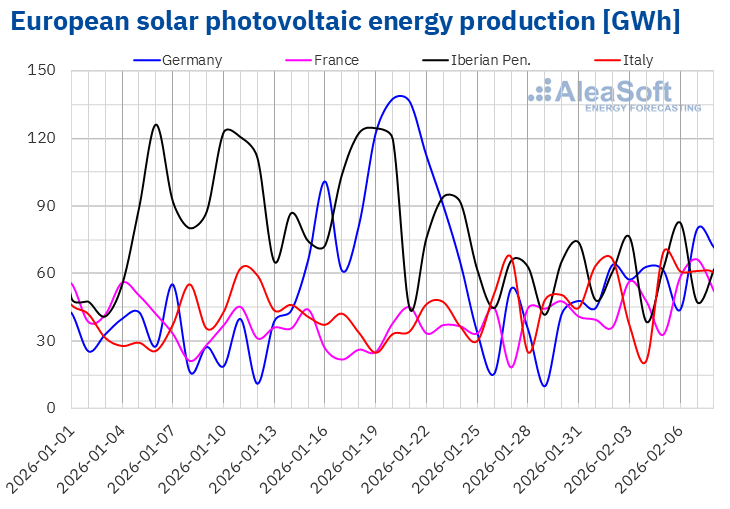

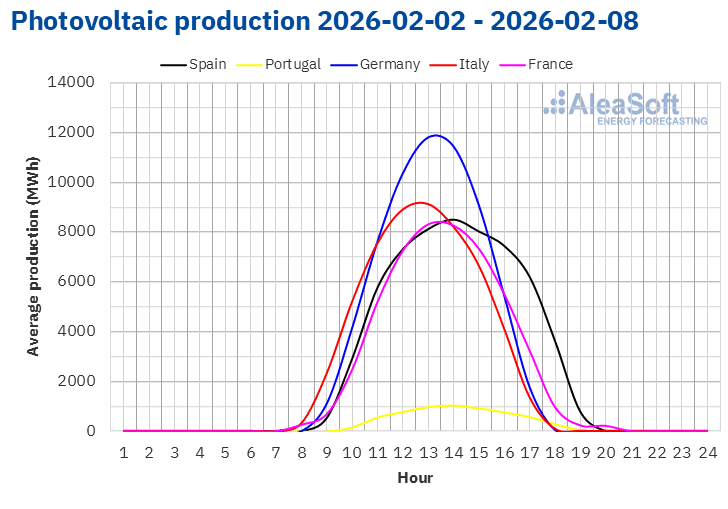

In the week of February 2, solar photovoltaic energy production increased in the main European electricity markets compared to the previous week. The German market registered the largest increase, 77%, reversing the downward trend of the prior week. In the French market, photovoltaic energy production continued to rise for the third consecutive week, with a 25% increase. In the Italian market, production from this technology rose for the second consecutive week, this time by 7.5%. Finally, after three weeks of declines, the Iberian Peninsula registered a 6.8% increase in solar energy production, with rises of 10% in Portugal and 6.4% in Spain.

The Italian and French markets registered daily photovoltaic energy production levels not seen since November. On Thursday, February 5, the Italian market produced 69 GWh of solar energy, a level not registered since November 12. Two days later, the French market reached 66 GWh, a value not registered since November 4.

During the week of February 9, according to AleaSoft Energy Forecasting’s solar energy forecasts, photovoltaic energy production will increase in the German, Italian and Spanish markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

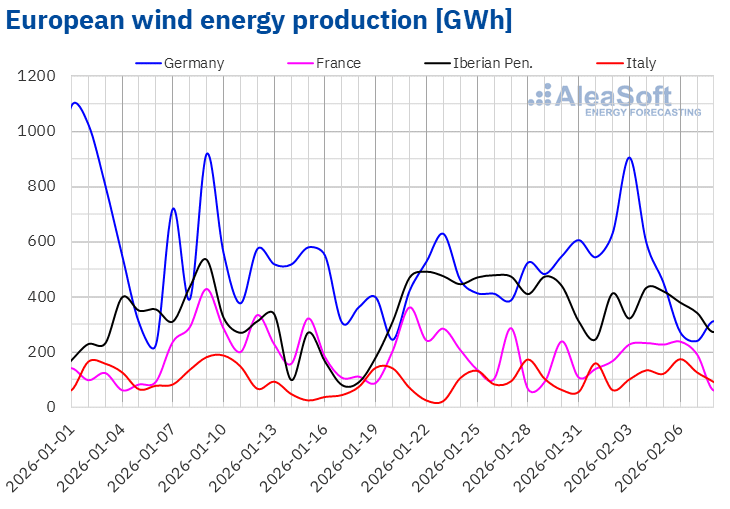

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.During the week of February 2, wind energy production showed mixed trends across the main European markets. The French market registered the largest increase, 30%, reversing the negative trend of the previous week. In the Italian market, wind energy production increased for the third consecutive week, rising by 11% this time. In contrast, the markets of the Iberian Peninsula and Germany showed the opposite trend. The Spanish market registered an 11% drop, extending the downward trend of the previous week. Meanwhile, the German and Portuguese markets reversed the prior week’s positive trend with declines of 2.7% and 0.2%, respectively.

The Italian market set a new all‑time high for wind energy production for a February day, producing 174 GWh on Friday, February 6.

During the week of February 9, according to AleaSoft Energy Forecasting’s wind energy forecasts, production from this technology will increase in the Spanish and French markets. By contrast, production will decline in the Italian, German and Portuguese markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

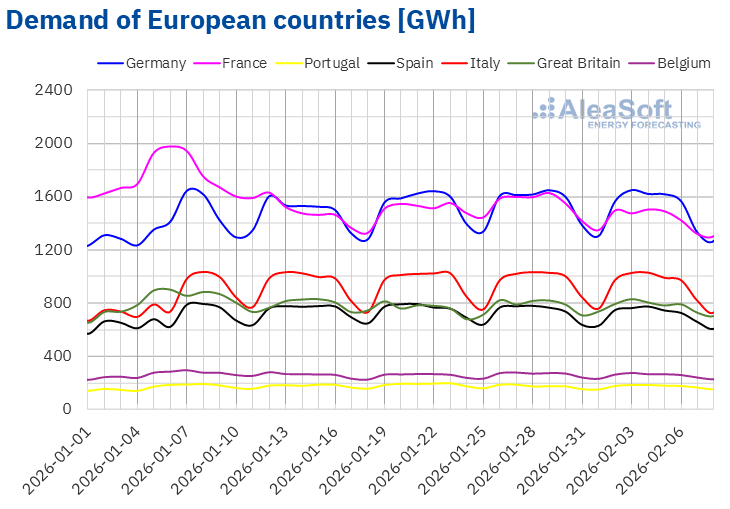

In the week of February 2, electricity demand declined in most major European markets compared to the previous week. The French market registered the largest drop, 6.6%, and reversed the positive trend of the previous two weeks. The Belgian market followed with a 2.2% decline, continuing the negative trend of the prior three weeks. In the Italian and German markets, demand fell by 1.7% and 1.4%, respectively, after five consecutive weeks of increases. The Spanish market, with a 1.4% decline, registered another decline after the previous week’s drop. Finally, the British market registered a 0.9% decrease. In contrast, demand in the Portuguese market increased by 1.8% after the decline of the previous week.

At the same time, average temperatures were milder than the previous week in most analyzed markets, with increases ranging from 0.6 °C in Germany to 4.0 °C in Belgium. However, average temperatures fell by 0.5 °C in Portugal and 0.1 °C in Spain.

For the week of February 9, according to AleaSoft Energy Forecasting’s demand forecasts, the negative trend will continue and demand will decline in the German, French, Italian and Spanish markets. By contrast, demand will increase in the Portuguese, British and Belgian markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

At the beginning of the first week of February, prices in most European electricity markets declined. Although prices recovered slightly during the second half of the week in some cases, the weekly average prices of the main European electricity markets fell compared to the previous week. The IPEX market of Italy and the Nord Pool market of the Nordic countries registered the smallest declines, 8.9% and 9.0%, respectively. By contrast, the MIBEL market of Spain and Portugal registered the largest percentage price drops, 43% and 74%, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 13% in the EPEX SPOT market of Germany and 28% in the EPEX SPOT market of France.

In the week of February 2, despite the price declines, weekly averages remained above €100/MWh in most European electricity markets. The exceptions were the Portuguese, Spanish and French markets, with averages of €4.56/MWh, €13.18/MWh and €80.63/MWh, respectively. By contrast, the Italian market registered the highest weekly average, €128.15/MWh. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged between €101.82/MWh in the Belgian market and €110.86/MWh in the Nordic market.

Regarding daily prices, most markets analyzed at AleaSoft Energy Forecasting kept prices above €90/MWh during the first week of February. The Spanish, French and Portuguese markets were the exceptions. In Portugal, prices stayed below €10/MWh for almost the entire week. On Saturday, February 7, the Portuguese market reached the lowest average of the week among the analyzed markets, €0.54/MWh. This was its lowest daily price since April 9, 2024. Prices in the Spanish market also stayed below €10/MWh during the second half of the first week of February.

Meanwhile, the German, Italian, Dutch and Nordic markets registered daily prices above €115/MWh in some sessions of the first week of February. In the Italian market, daily prices exceeded €135/MWh during the first three days of the week. This market reached the highest daily average of the week among the analyzed markets, €140.36/MWh, on Monday, February 2.

In the week of February 2, lower gas and CO₂ emission allowance prices, higher solar energy production and lower demand in most markets contributed to the decline in European electricity market prices. In France and Italy, higher wind energy production also supported the price drop.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the second week of February, prices will increase in most major European electricity markets, driven by lower wind energy production and, in some cases, higher demand. However, higher wind energy production and lower demand in Spain and France will support price declines in these markets.

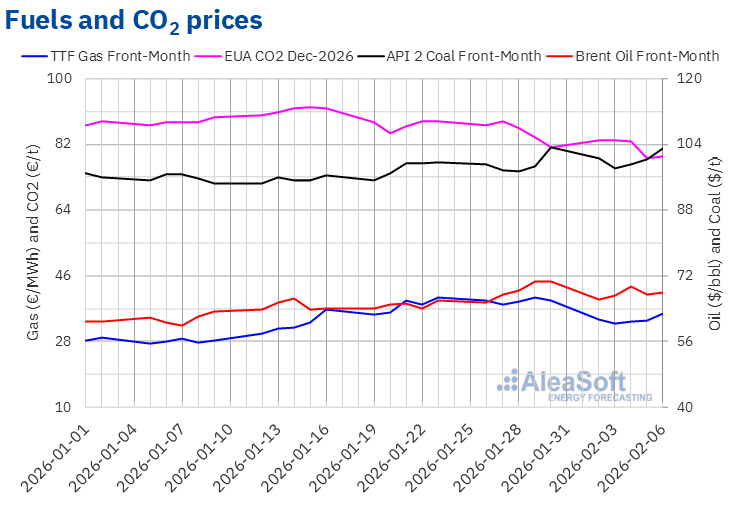

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market remained below $70/bbl during the first week of February. On Monday, February 2, these futures registered their weekly minimum settlement price, $66.30/bbl. In the following sessions, prices increased. On February 4, Brent oil futures reached their weekly maximum settlement price, $69.46/bbl. However, in the last sessions of the week, prices remained below $68.50/bbl. On Friday, February 6, the settlement price stood at $68.05/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 3.7% lower than the previous Friday’s price.

Tensions in the Middle East supported the increase in Brent oil futures prices, reaching the weekly maximum settlement price on February 4. However, expectations surrounding talks between the United States and Iran, scheduled for Friday, February 6, allowed prices to remain lower in the last sessions of the week.

As for TTF gas futures in the ICE market for the Front‑Month, prices started the first week of February with declines. On Tuesday, February 3, these futures registered their weekly minimum settlement price, €32.86/MWh. However, in the remaining sessions of the week, settlement prices increased. As a result, on Friday, February 6, these futures reached their weekly maximum settlement price, €35.69/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was still 9.1% lower than the previous Friday’s price.

Increased availability of liquefied natural gas from the United States allowed settlement prices of TTF gas futures to remain below €36/MWh during the first week of February. Reduced concerns about supply disruptions through the Strait of Hormuz also contributed to keeping prices below those of the previous week. However, the decline in wind energy production increased gas demand for electricity generation, which supported the price increase in the last sessions of the week. Forecasts of low temperatures and low European storage levels also contributed to this behavior.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2026, on Monday, February 2, they reached their weekly maximum settlement price, €83.28/t. Subsequently, prices declined. As a result, on Thursday, February 5, these futures registered their weekly minimum settlement price, €78.20/t. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since October 1, 2025. On Friday, February 6, the settlement price was slightly higher, €78.74/t. However, this price was still 3.1% lower than the previous Friday’s price.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and battery storage

Next Thursday, February 12, AleaSoft Energy Forecasting will hold its 63rd monthly webinar. Tomás García, Senior Director, Energy & Infrastructure Advisory at JLL, will participate for the fifth time in AleaSoft Energy Forecasting’s monthly webinar series. The webinar will cover topics relevant to the energy sector, such as the evolution and prospects of European energy markets, insights from recent BESS transactions in Spain and the key valuation drivers for stand‑alone BESS projects in Spain.

Source: AleaSoft Energy Forecasting.