AleaSoft Energy Forecasting, August 14, 2023. In the second week of August, gas futures rebounded, approaching €40/MWh on August 9. This, together with the fall in wind power production, favored prices increase in most European electricity markets. Even so, weekly averages for all markets were below €100/MWh, which has not happened since early June. On August 9, Brent futures reached the third highest value of 2023, above $87/bbl.

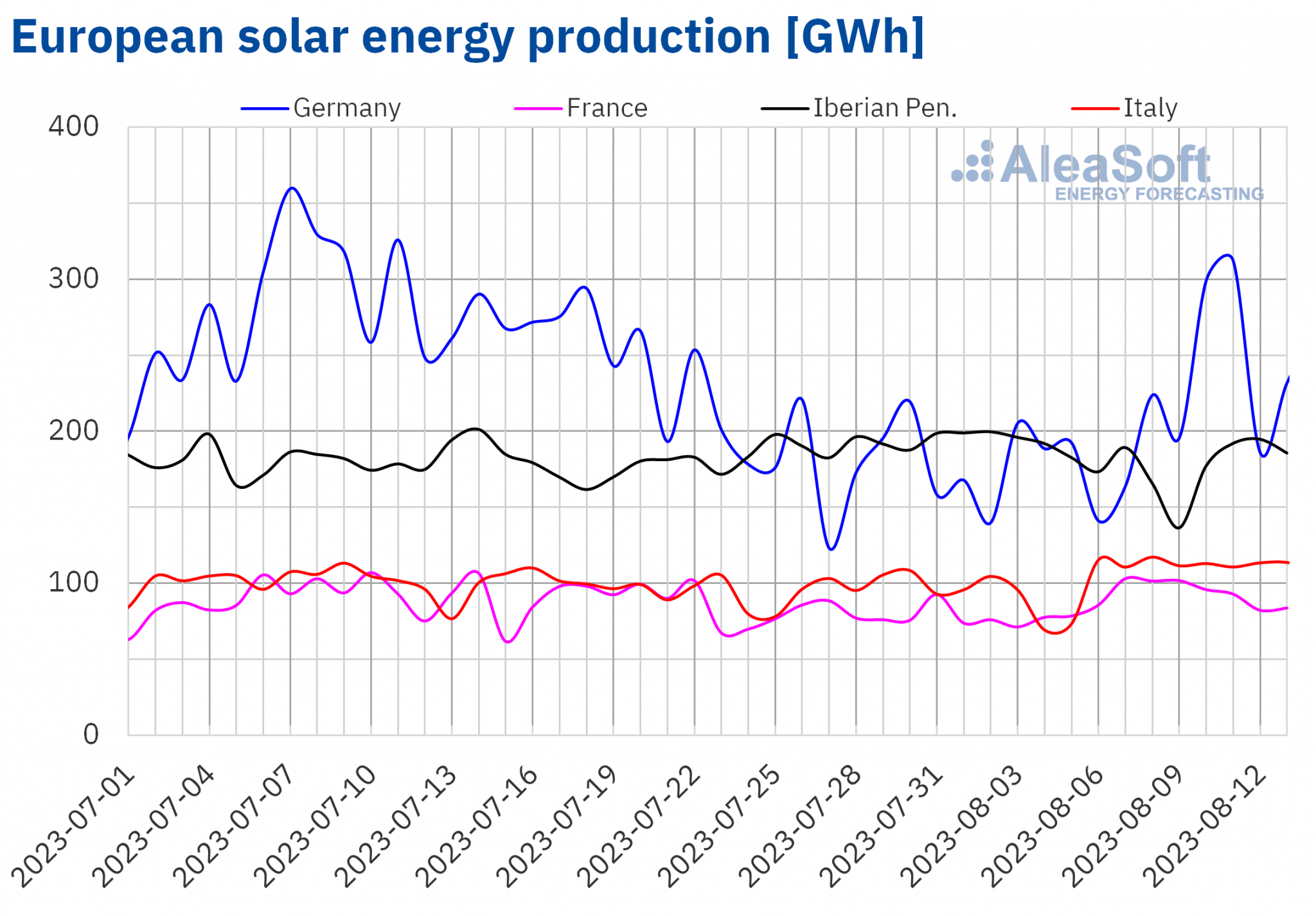

Solar photovoltaic and thermoelectric energy production and wind energy production

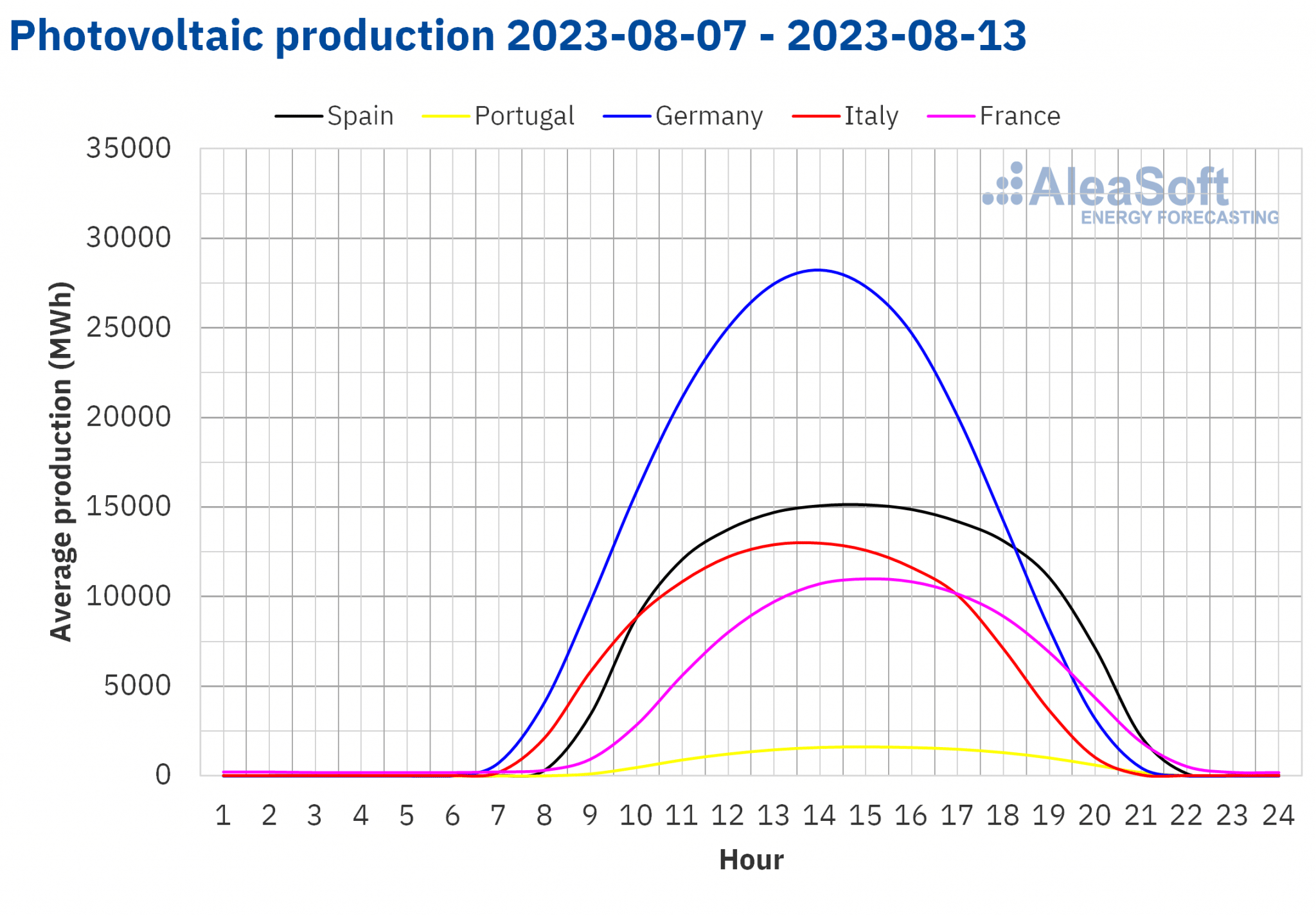

During the week of August 7, solar photovoltaic energy production reached all-time hourly production records in Italy and Mainland Spain. In Italy, 13 510 MWh were generated on Tuesday, August 8, between 13:00 and 14:00. Also, the hourly solar photovoltaic energy production record in Mainland Spain was 16 126 MWh, generated between 14:00 and 15:00 on Friday, August 11.

Comparing solar energy production, which in the case of Spain also includes solar thermoelectric energy, with respect to the previous week, an increase was recorded in the German, Italian and French markets. In the case of Germany, the increase was 35%. In Italy and France the increases were 22% and 19% respectively. In contrast, in the Portuguese and Spanish markets, solar energy generation decreased by 5.7% and 7.6% respectively.

For the week of August 14, according to AleaSoft Energy Forecasting’s solar energy production forecasts, it is expected to increase in the German and Spanish markets, while in Italy is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

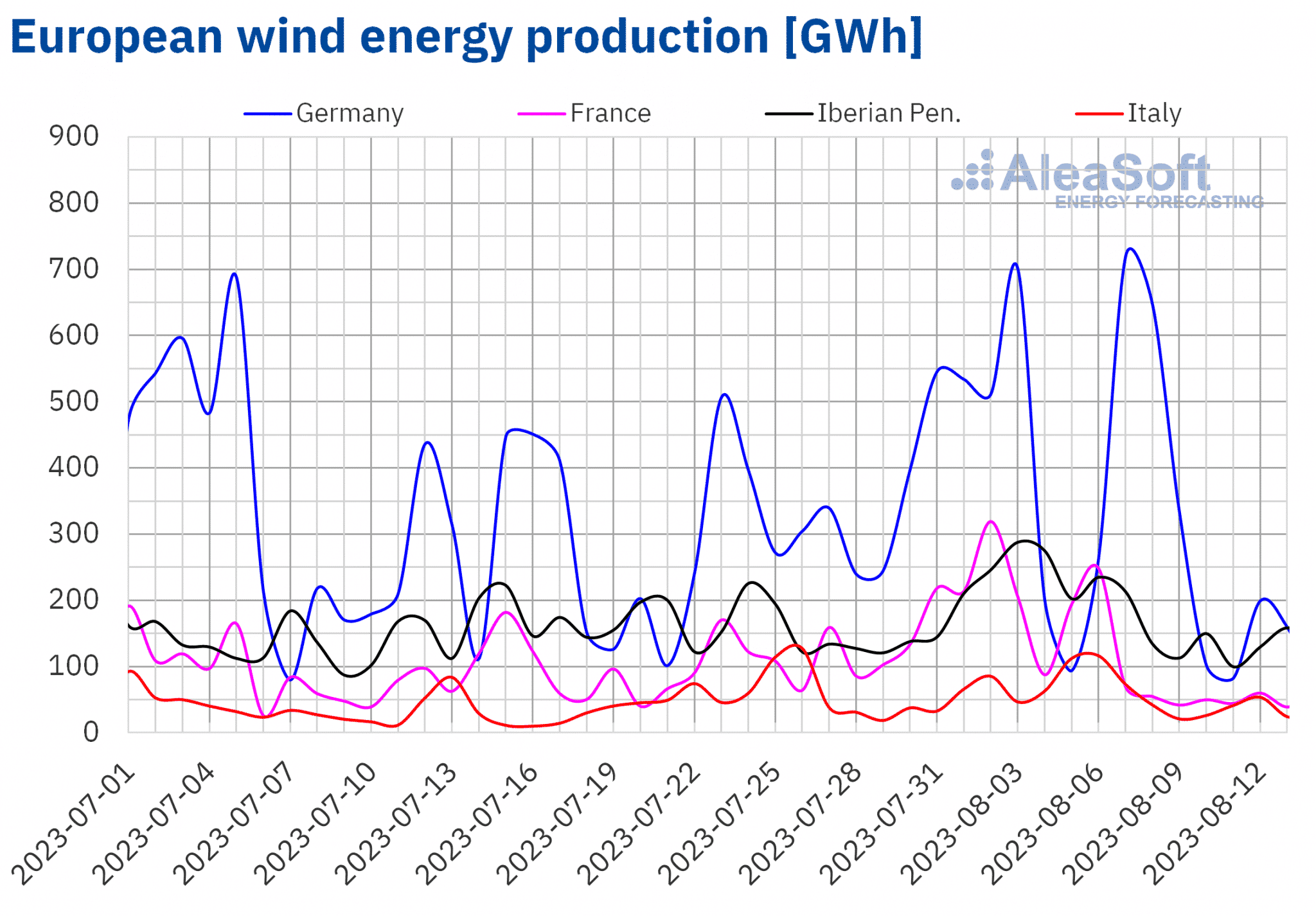

During the second week of August, wind energy production decreased in all the analyzed markets. The French market recorded the largest decrease, of 76%, followed by the Italian and Portuguese markets, decreasing 46% and 44% respectively. In the Spanish market the fall was 36%, while the German market recorded the smallest decrease, of 21%.

For the third week of August, AleaSoft Energy Forecasting‘s wind energy production forecasts indicate that the production with this technology will continue to fall for all markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

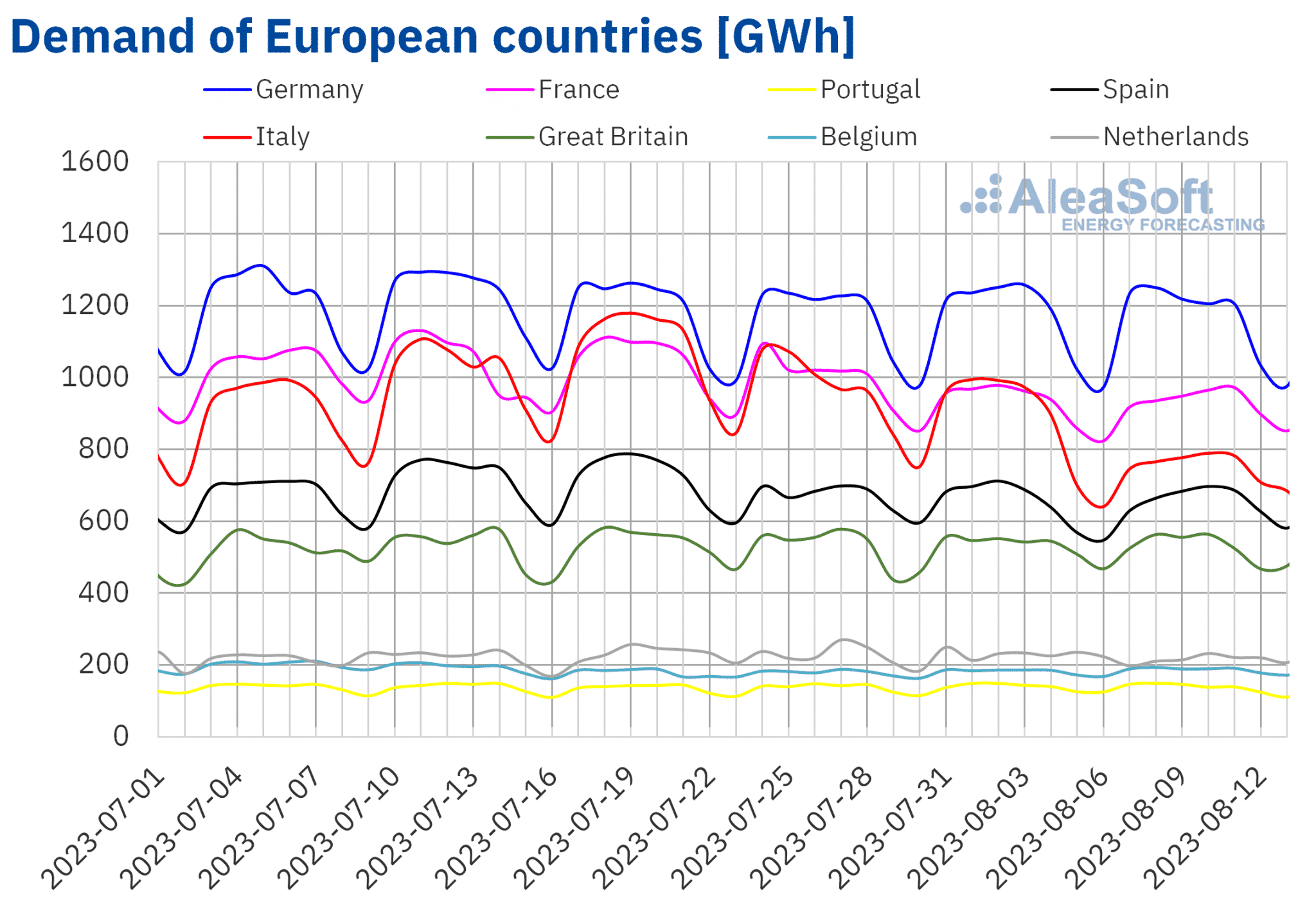

Electricity demand

In the week of August 7, electricity demand was down in most of the European markets analyzed by AleaSoft Energy Forecasting compared to the previous week. The largest decrease was recorded in the Italian market, of 15%, followed by a 6.8% drop in demand in the Dutch market. In the German, British and Portuguese markets, the decreases were 0.3%, 1.1% and 1.5% respectively. In the Belgian market, demand increased by 2.6% and in the Spanish market by 0.8%.

On the other hand, most of the European markets analyzed recorded increases in average temperatures compared to the previous week. The increases ranged from 0.5°C in Germany to 1.7°C in Belgium. The exception was the Italian market, where the average temperature decreased by 1.6°C, which, together with the lower workload in August, favored the decrease in demand during the analyzed period.

For the week of August 14, according to demand forecasts made by AleaSoft Energy Forecasting, electricity demand will decrease in most of the European markets analyzed. The exceptions will be the markets of Great Britain, Italy and the Netherlands, where it is expected to increase.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

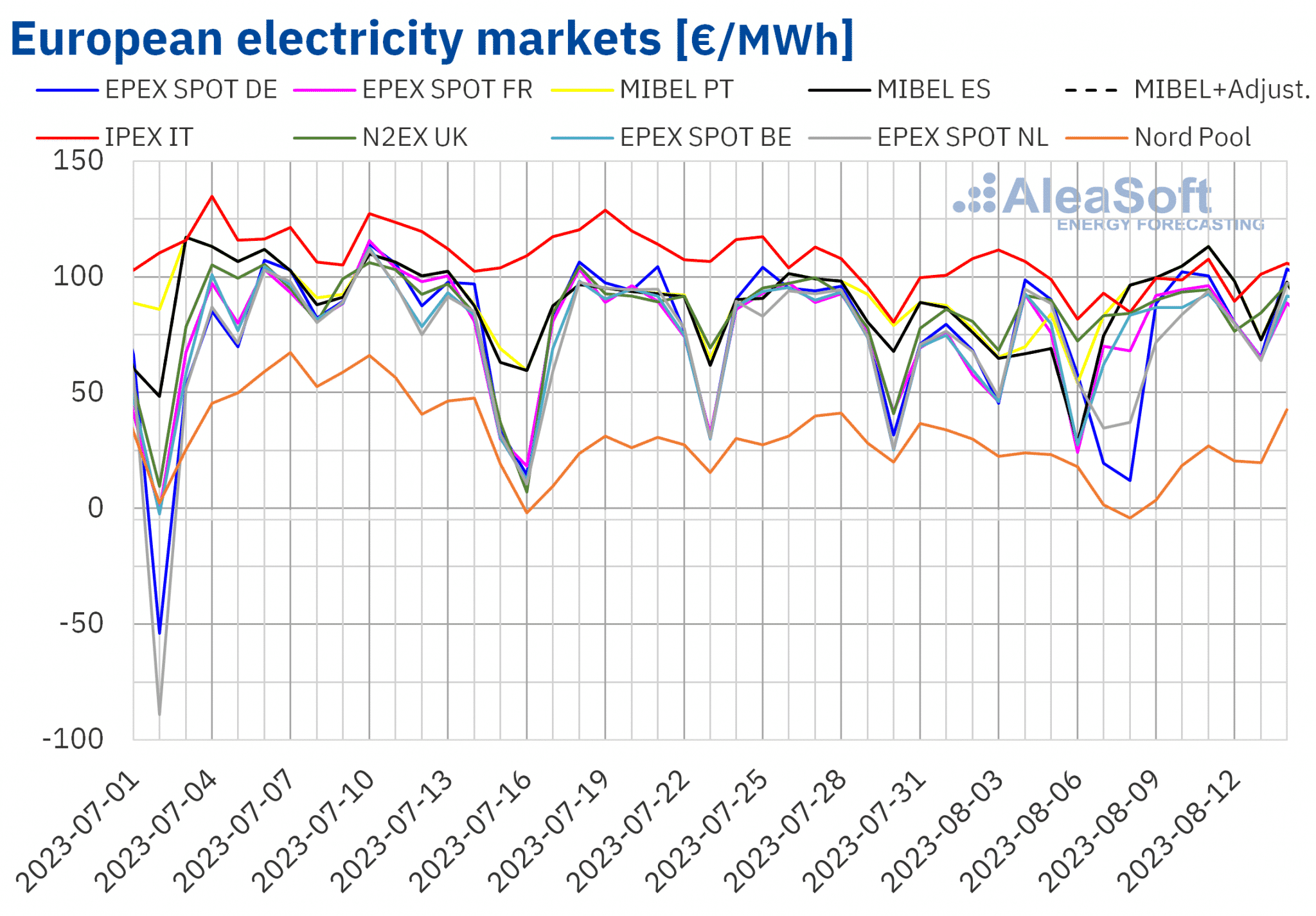

European electricity markets

In the second week of August, prices in the main European electricity markets analyzed byAleaSoft Energy Forecastingshowed a mixed performance, although in most cases prices increased compared to the previous week. However, average prices in all markets were below €100/MWh, which has not happened since the beginning of June.

The markets where the weekly average rose compared to the first week of August were the MIBEL market in Spain and Portugal, up 37% and 27% respectively, the EPEX SPOT market in France and Belgium, up 28% and 23% respectively, and the N2EX market in the United Kingdom, up 6.9%. Prices decreased in the remaining markets. The Nord Pool market in the Nordic countries recorded the largest drop, by 54%, and was again the market with the lowest average for the week at €12.43/MWh. The EPEX SPOT markets in Germany and the Netherlands and the IPEX market in Italy recorded decreases of 8.4%, 7.2% and 4.7% respectively. With the exception of Italy, which was, despite the price drop, once again the market with the highest average price of the week at €96.31/MWh, the markets in which the prices fell recorded negative values for several hours during the week.

In the Nordic market, there were seven hours with negative prices on August 7, one of which was the last hour of the day. In addition, prices were below €0/MWh for 24 hours on August 8 and the first 7 hours on August 9, making 32 consecutive hours with negative prices. The lowest price, which was ‑€10/MWh, was recorded on August 8 between 15:00 and 16:00. The Netherlands and Germany also had seven hours with negative prices on August 7. On August 8, there were 16 hours below €0/MWh in Germany and nine in the Netherlands. On that day, the lowest price of the week was reached in both markets between 14:00 and 15:00, ‑€21.77/MWh in Germany and ‑€79.22/MWh in the Netherlands. This last value is also the lowest of those recorded during the week in all the markets analyzed. In the Netherlands, there was also one hour with a price below zero on August 9 and another on August 13. In Belgium, although the average price rose during the week, there were four hours with negative prices on August 7, on hour on August 8, and one hour on August 13, the lowest price being that of the hour between 14:00 and 15:00 on August 7, at ‑€51.42/MWh.

In contrast, on August 11 Spain and Portugal recorded a daily price of €113.09/MWh, which was the highest since July 4.

The upward price trend in most markets is due to the increase in gas prices and the decrease in wind production compared to the previous week. In addition, there was a decrease in solar energy production in the Iberian Peninsula and an increase in demand in Spain and Belgium. In the case of Italy, where no negative prices were recorded during the week, the fall in prices was favored by a significant drop in electricity demand and an increase in solar energy production.

According to AleaSoft Energy Forecasting’s price forecasts, prices will increase in most of the markets in the week of August 14, except for the Iberian Peninsula, where a slight decrease is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from OME, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OME, EPEX SPOT, Nord Pool and GME.

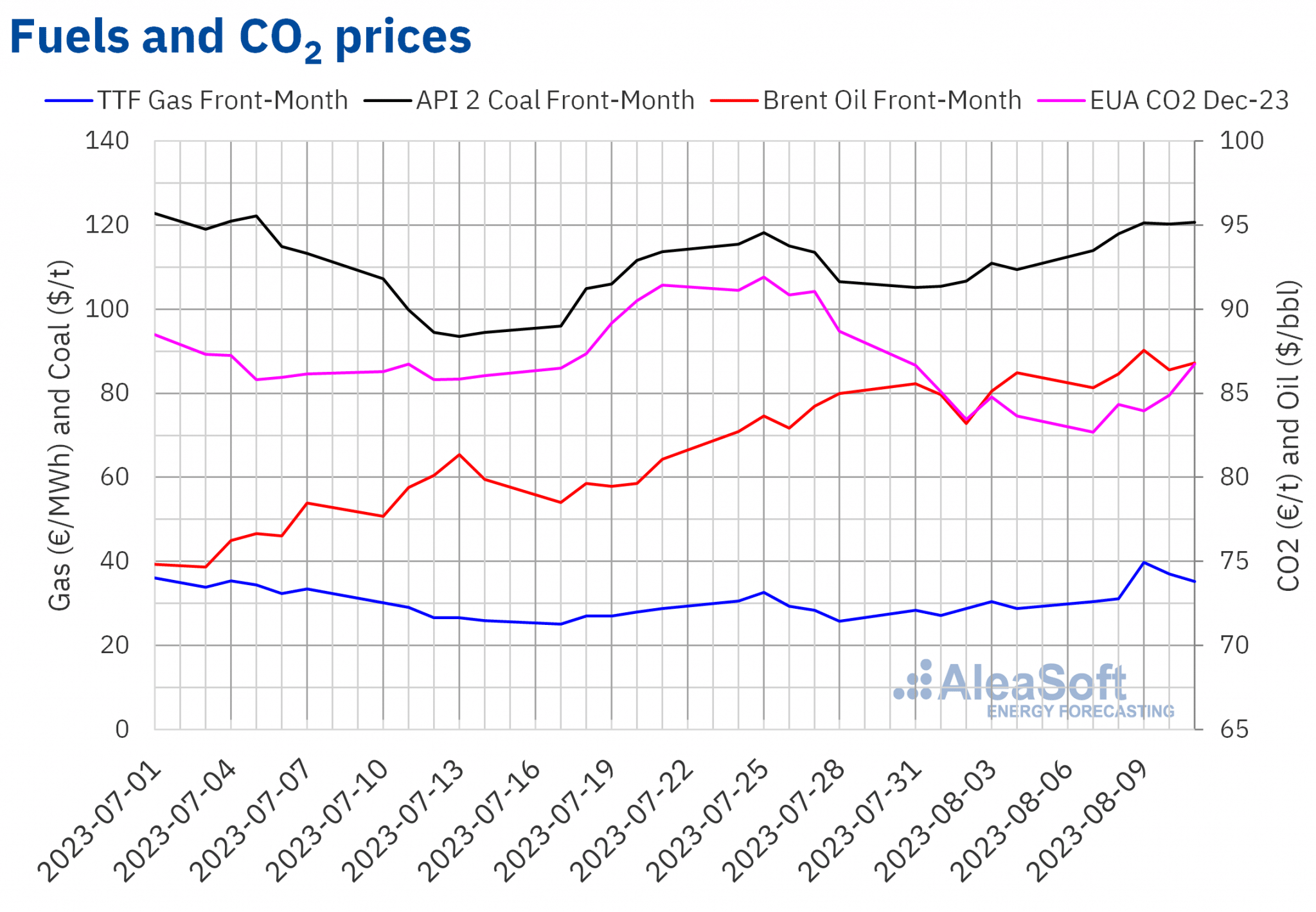

Brent, fuels and CO2

Although the settlement price of Front‑Month Brent oil futures in the ICE market fell on Monday, August 7, compared to Friday, August 4, closing at $85.34/bbl, the rest of the days of the week were above $86 and maintained a rising trend for most of the days. For example, Wednesday, August 9,recorded the highest settlement price of the week at $87.55/bbl, which was also the highest since January 24 and the third highest of 2023 so far. The weekly average of settlement price was 1.7% higher than the week of July 31.

Since the beginning of August, TTF gas futures prices on the ICE market for the Front‑Month have been on an upward trend, albeit with peaks around €31/MWh. However, on Wednesday, August 9, they rebounded to settle near €40/MWh, at €39.82/MWh, the highest since June 16. This price was 28% higher than the previous day. Since March 1, 2022, a few days after Russian invasion of Ukraine began, there has not been a daily gas price increase of this magnitude, which followed the announcement of worker strikes at two natural gas fields in Australia. This announcement raised concerns about the stability of supply in the Asian market and the possibility of increased global competition for LNG. Although settlement prices fell on Thursday 10 and Friday 11, they remained above €35/MWh. The weekly average for the week of August 7 was 21% higher than the previous week.

Settlement prices for CO2 emission rights futures on the EEX market for the reference contract of December 2023 began the week of August 7 with a settlement price that day of€82.68/tonne, the lowest since June 7. However, on the remaining days of the week, prices trended upwards to settle at €86.73/tonne on Friday, August 11, the highest this month so far. However, the weekly average of settlement prices for the week of August 7 was 0.2% below the previous week’s average.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

AleaSoft Energy Forecasting was founded in 1999 and it is a pioneer in Spain in the use of Artificial Intelligence, specifically to obtain forecasts of price, demand and production by technologies of the energy markets with several horizons: short, medium and long term. The scientific basis of the forecasts, combining Artificial Intelligence with advanced statistical and time series techniques, such as the Box‑Jenkins methodology, results in forecasts that stand out for their quality and consistency. This is how AleaSoft Energy Forecasting has earned the trust of its clients during more than 24 years of experience.

Source: AleaSoft Energy Forecasting.