AleaSoft Energy Forecasting, August 21, 2023. Prices in European electricity markets rose in the third week of August. The increase in gas and CO2 prices, together with the general decrease in wind energy production and the increase in demand due to higher average temperatures, favored the price increase in all European electricity markets. The week’s average TTF gas and CO2 prices were 6.1% and 4.2% higher, respectively, than the previous week.

Solar photovoltaic and thermoelectric energy production and wind energy production

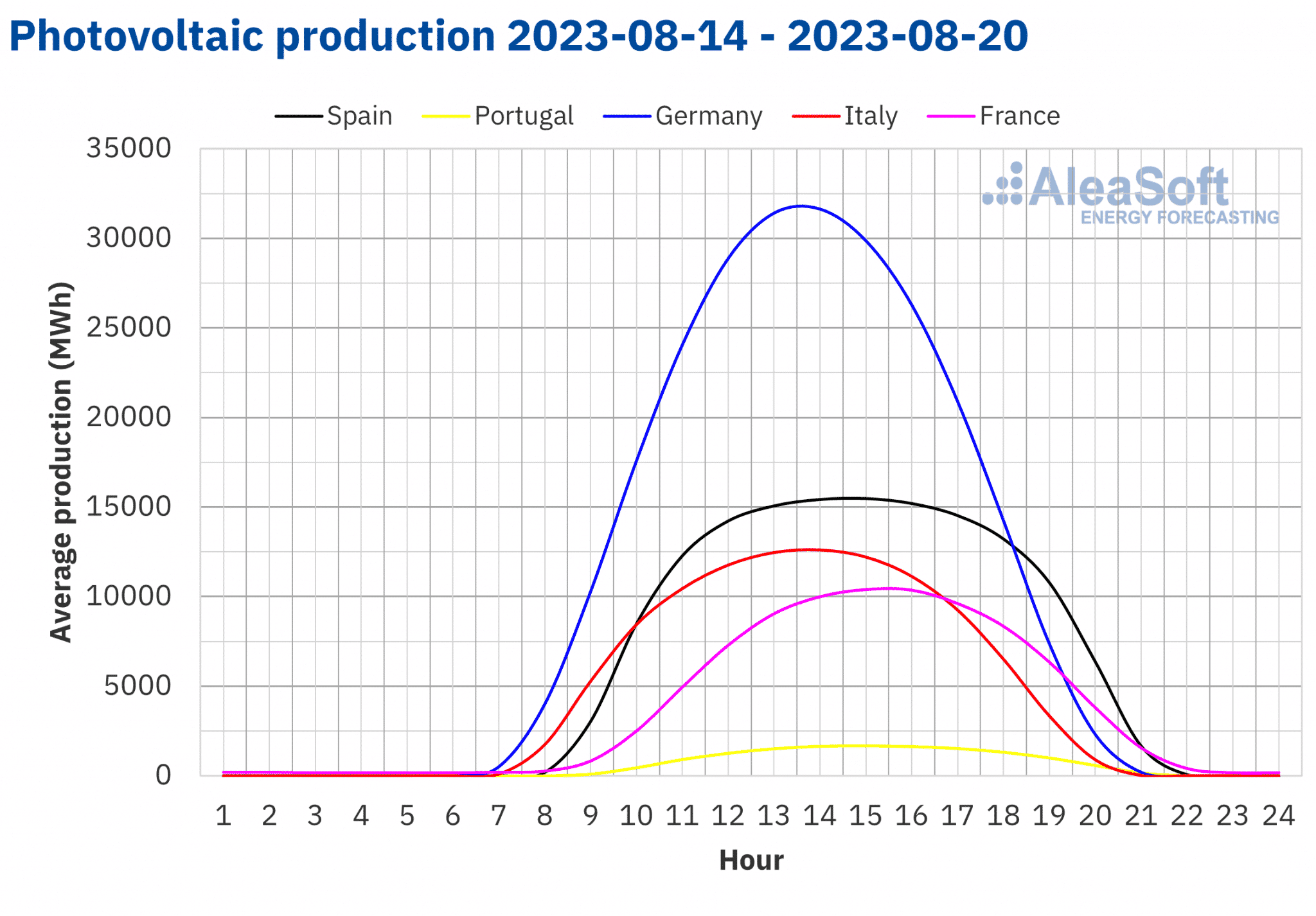

During the week of August 14, solar photovoltaic energy production reached an all‑time record for hourly production in Portugal. In this market, a production of 1727 MWh was registered between 13:00 and 14:00 on Thursday, August 17.

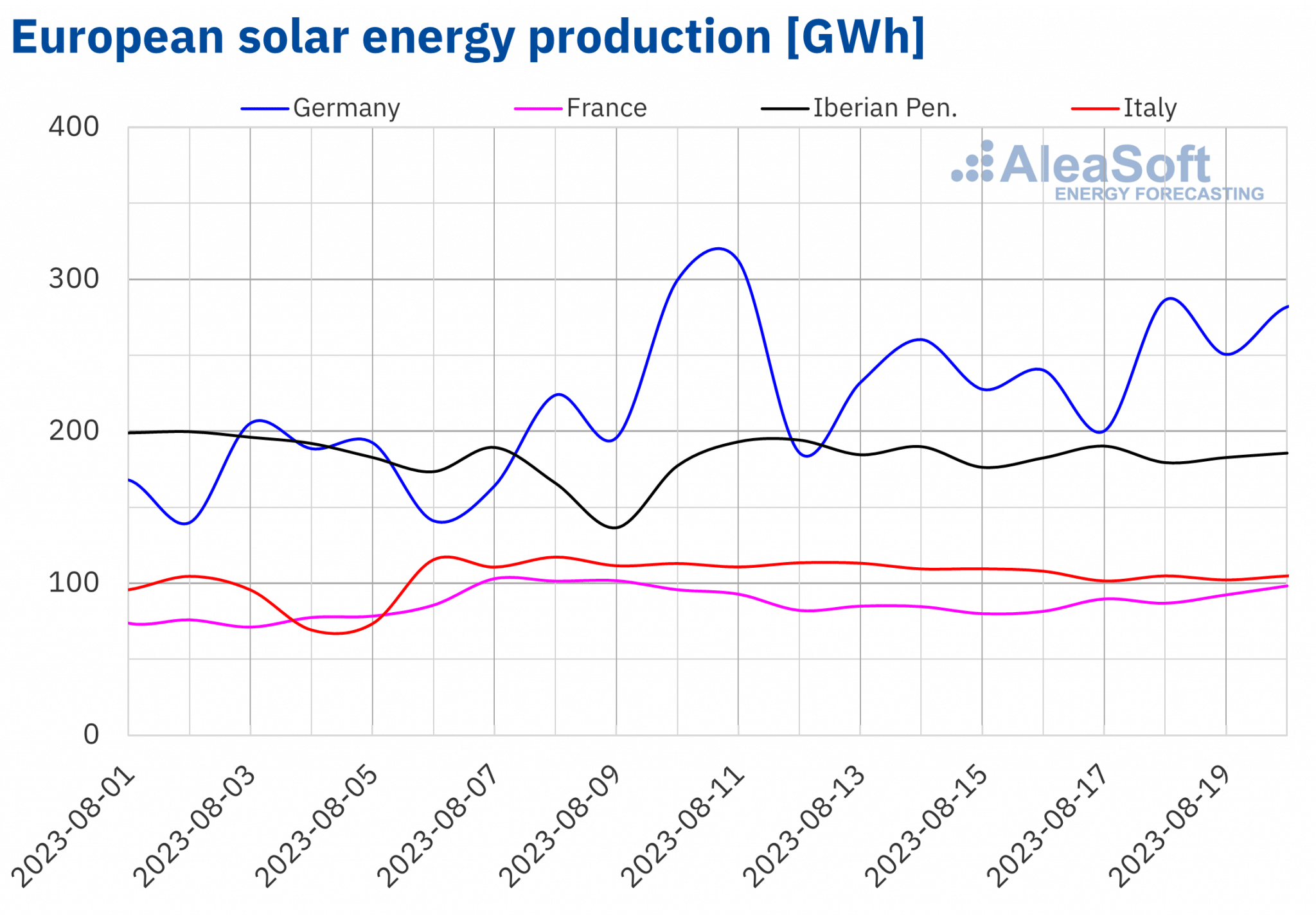

Comparing solar energy production, which in the case of Spain includes solar thermal energy, with the previous week, solar energy production increased in the German, Spanish and Portuguese markets, with increases of 8.3%, 3.7% and 1.2%, respectively. The opposite trend was observed in the Italian and French markets, with decreases of 6.3% and 7.3%, respectively.

For the week of August 21, according to AleaSoft Energy Forecasting’s solar energy production forecasts, solar energy production is expected to decrease in the German and Italian markets, while it is expected to increase in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

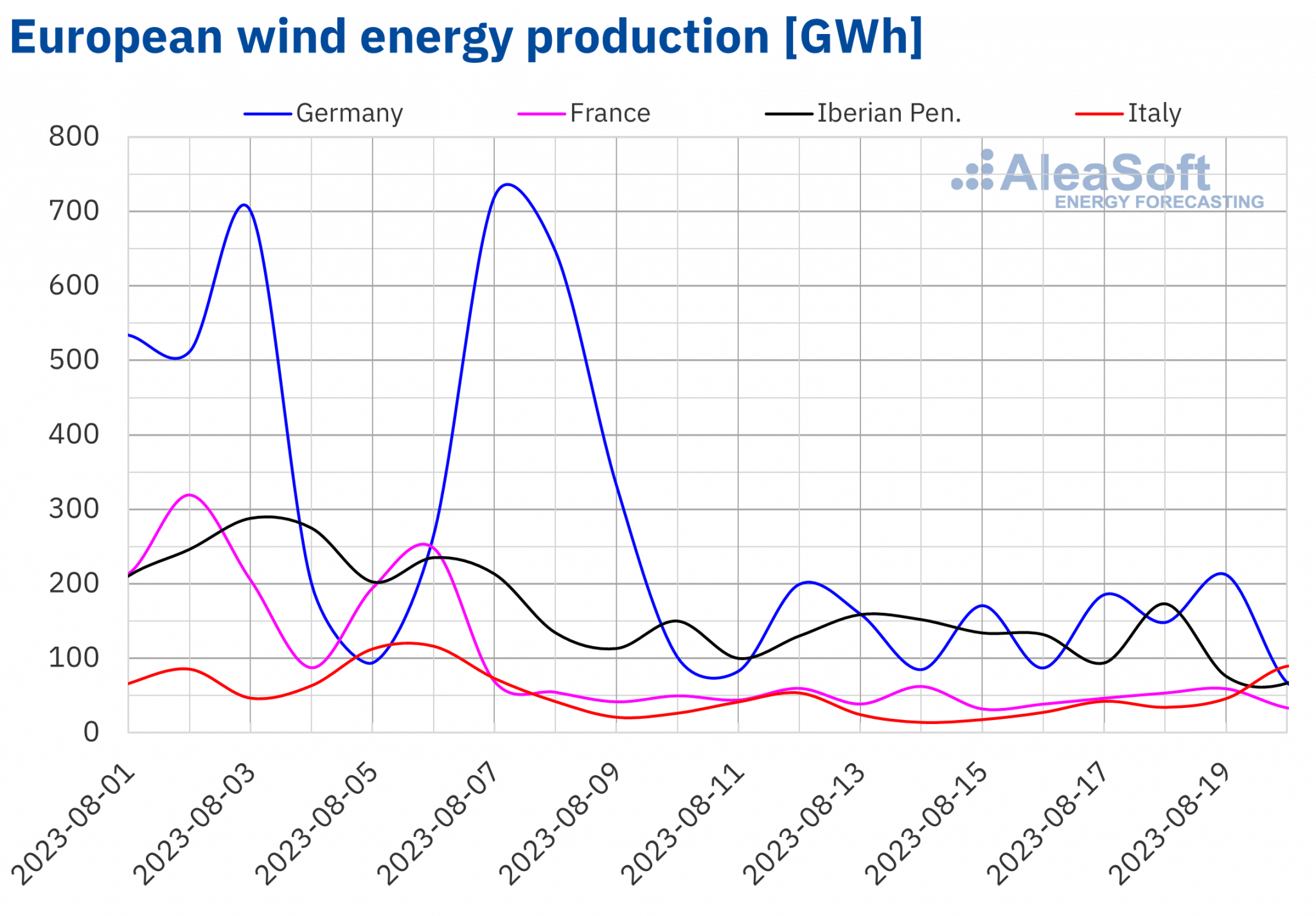

In the third week of August, compared to the previous week, wind energy production dropped in all analyzed markets. The most substantial decrease, of 57%, was observed in the German market. In the remaining markets the production drop ranged from 3.7% in the Italian market to 18% in the Spanish market.

For the week of August 21, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that wind energy production will increase in most of the markets analyzed, with the exception of the German and French markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

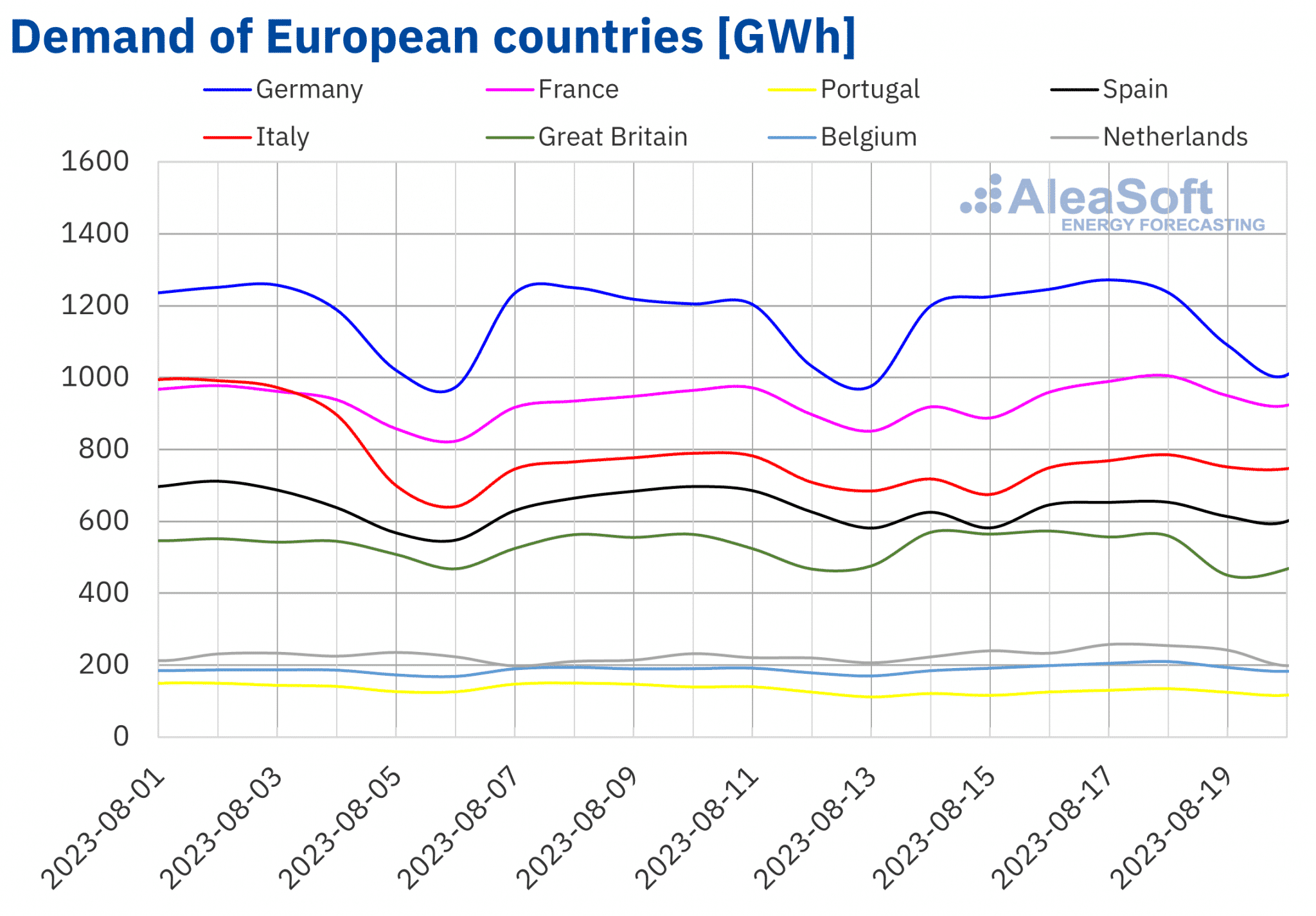

In the week of August 14, electricity demand increased in the Central and Northern European markets and decreased in the Southern European markets analyzed at AleaSoft Energy Forecasting compared to the previous week. The strongest rise, of 9.8%, was observed in the Dutch market, followed by the 4.8% increase registered in the Belgian market. In the French, German and British markets, the increase in demand ranged from 2.3% to 1.8%. The opposite trend was observed in the Iberian Peninsula, with a fall of 9.6% in the Portuguese market and 4.3% in the Spanish market. Similarly, demand in the Italian market decreased by 1.1%.

During this period, average temperatures increased in most analyzed European countries compared to the previous week. Temperature increases ranged from 0.8 °C registered in Great Britain to 4.8 °C registered in Germany, which influenced the increase in demand in these markets. The exceptions were Spain and Portugal, where average temperatures fell by 0.4 °C and 0.8 °C, respectively, which, together with the reduction in working hours due to the Assumption Day holiday on Tuesday, August 15, favored the decrease in demand during the week.

For the week of August 21, according to the demand forecasts done by AleaSoft Energy Forecasting, electricity demand will increase in most of the European markets analyzed, with the exception of the Dutch and British markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

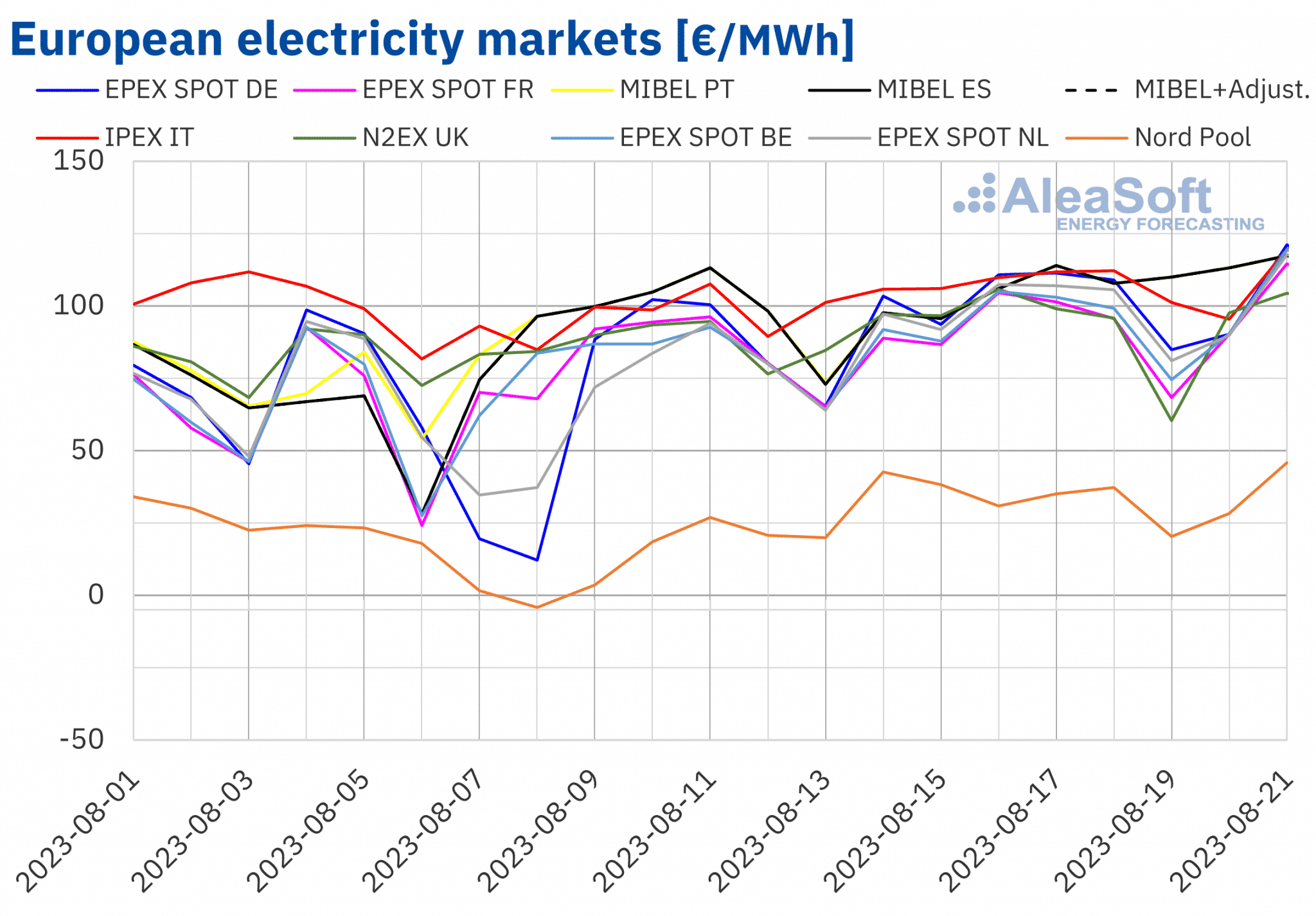

European electricity markets

In the week of August 14, prices in all European electricity markets analyzed at AleaSoft Energy Forecasting increased compared to the previous week. The Nord Pool market of the Nordic countries registered the largest price increase of 168%. For the EPEX SPOT market of Germany and the Netherlands, prices increased by 50% and 46%, respectively. In the other markets, prices rose between 7.5% in the N2EX market of United Kingdom and 17% in the EPEX SPOT market of Belgium.

In the third week of August, weekly averages were above €90/MWh in almost all European electricity markets. The exception was the Nordic market with the lowest average of €33.25/MWh, despite the price increase registered in this market. On the other hand, the MIBEL market of Spain and Portugal had the highest average price of €106.24/MWh. In the other markets analyzed, prices ranged from €90.77/MWh in the French market to €105.97/MWh in the IPEX market of Italy.

As far as hourly prices are concerned, high prices were registered in most European electricity markets on Monday, August 21 from 20:00 to 21:00. The highest price of €203.45/MWh was registered in the German and Dutch markets. In the case of the Dutch market, this was the highest price since April.

During the week of August 14, the increase in the average price of gas and CO2 emission rights pushed up prices in the European electricity markets. The general decrease in wind energy production and the increase in demand in most markets also contributed to this behavior. In addition, solar energy production decreased in France and Italy.

AleaSoft Energy Forecasting’s price forecasts indicate that prices might continue to rise in the fourth week of August in most of the European electricity markets analyzed, influenced by the increase in electricity demand in most markets and the decrease in wind energy production in markets such as Germany and France.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

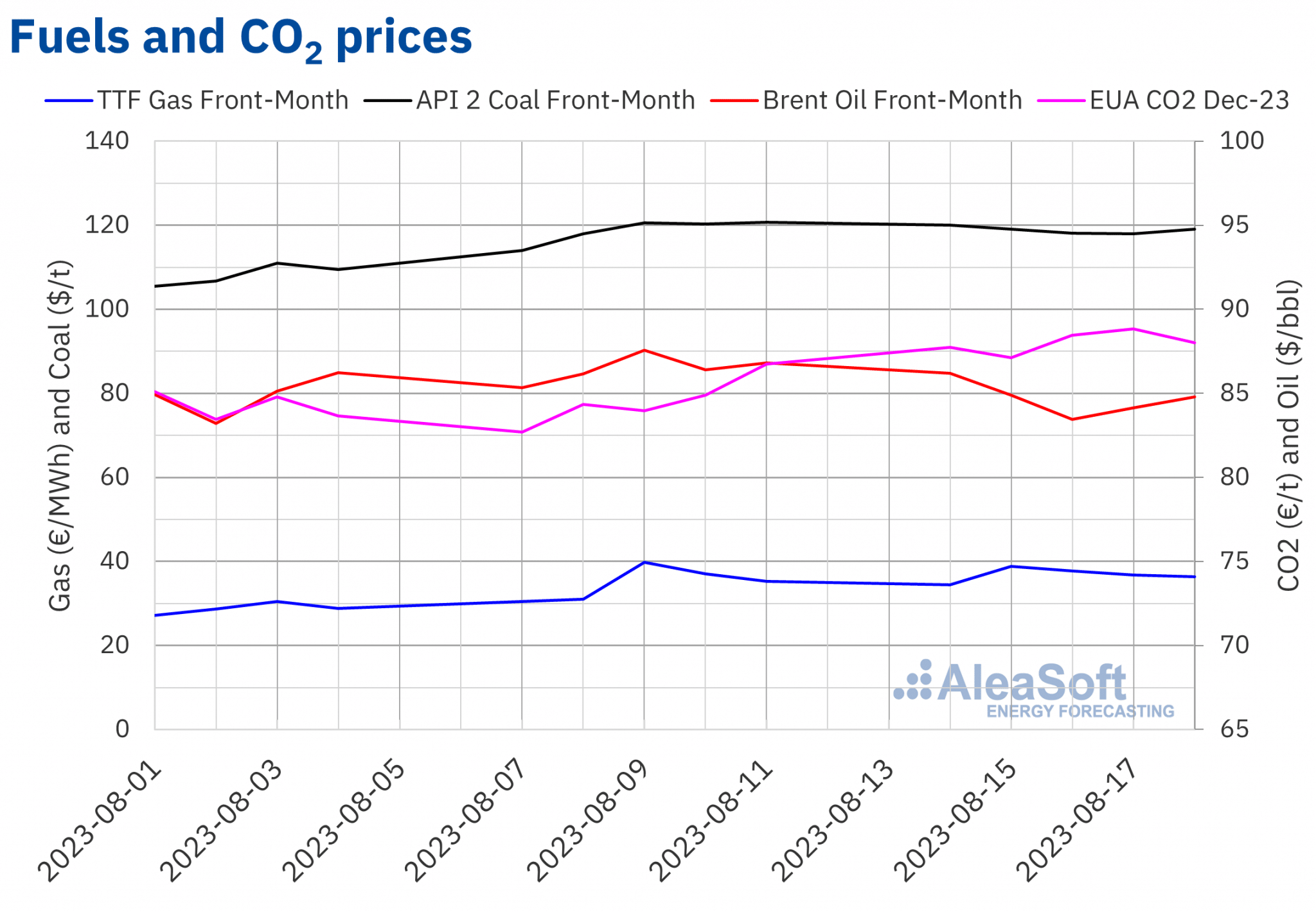

Brent, fuels and CO2

Front‑Month Brent oil futures in the ICE market reached the weekly maximum settlement price of $86.21/bbl on Monday, August 14, which was 1.0% higher than the previous Monday. However, settlement prices remained below $85/bbl in the following sessions of the week. The weekly minimum of $83.45/bbl was reached on Wednesday, August 16. This price was 4.7% lower than the previous Wednesday.

In the third week of August, concerns about the development of the Chinese economy weighed on Brent oil futures prices. Fears of further interest rate hikes also led to lower prices compared to the previous week.

As for TTF gas futures in the ICE market for the Front‑Month, the settlement price on Monday, August 14, was €34.43/MWh, 2.5% lower than the last session of the previous week. This price was also the lowest in the third week of August. However, on Tuesday, prices increased by 13% compared to the previous day and reached the weekly maximum settlement price of €38.81/MWh. This price was 25% higher than the previous Tuesday. Subsequently, prices decreased, but remained above €36/MWh. On Friday, August 18, a settlement price of €36.41/MWh was registered. This price was 3.1% higher than the previous Friday.

In the third week of August, news of possible strikes at Australian liquefied natural gas export facilities pushed TTF futures prices higher. However, high European inventories allowed prices to fall again. In the fourth week of August, news of possible strikes in Australia may continue to influence price movements.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, they remained above €87/t during the third week of August. The weekly minimum settlement price of €87.13/t was registered on Tuesday, August 15, and was 3.3% higher than on the previous Tuesday. On the other hand, the weekly maximum settlement price of €88.84/t was reached on Thursday, August 17. This price was 4.6% higher than the previous Thursday. On Friday, August 18, the settlement price fell slightly to €88.01/t. However, this was still 1.5% higher than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar in the AleaSoft Energy Forecasting and AleaGreen monthly webinar series will be held on Thursday, September 7. In addition to the usual analysis of the evolution and prospects of European energy markets, benefits of PPA for large and electro‑intensive consumers will be analyzed. AleaSoft Energy Forecasting services that contribute to risk management and energy transition will also be explained. Pedro González, Director‑General of AEGE, Association of Companies with Large Energy Consumption, will participate in the analysis table after the Spanish version of the webinar.

On the other hand, the October webinar is also being organized, which will take place on October 19. The webinar will have the participation of speakers from Deloitte. On this occasion, topics to be discussed include the prospects for European energy markets for the winter of 2023‑2024, the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation.

Source: AleaSoft Energy Forecasting.