AleaSoft, July 26, 2021. The European electricity markets prices rose in the penultimate week of July, recovering the upward path that was halted in the third week of the month. In several markets, the daily prices exceeded €100/MWh, even registering a historical maximum in the MIBEL market. The panorama of high gas and CO2 prices joined the general fall in wind energy production and the increase in demand in some markets. Gas futures rose and CO2 futures fell to around €51/t.

Photovoltaic and solar thermal energy production and wind energy production

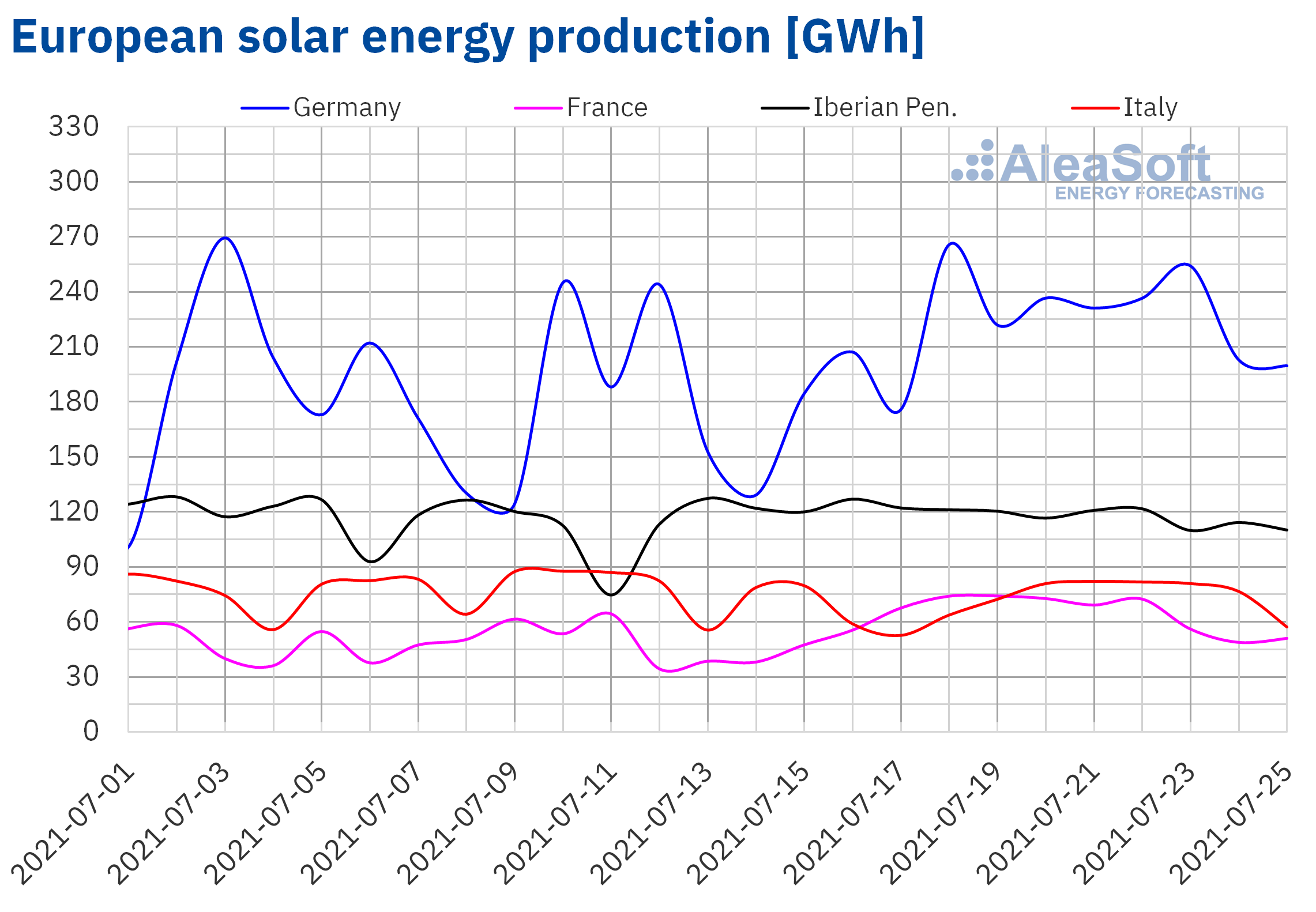

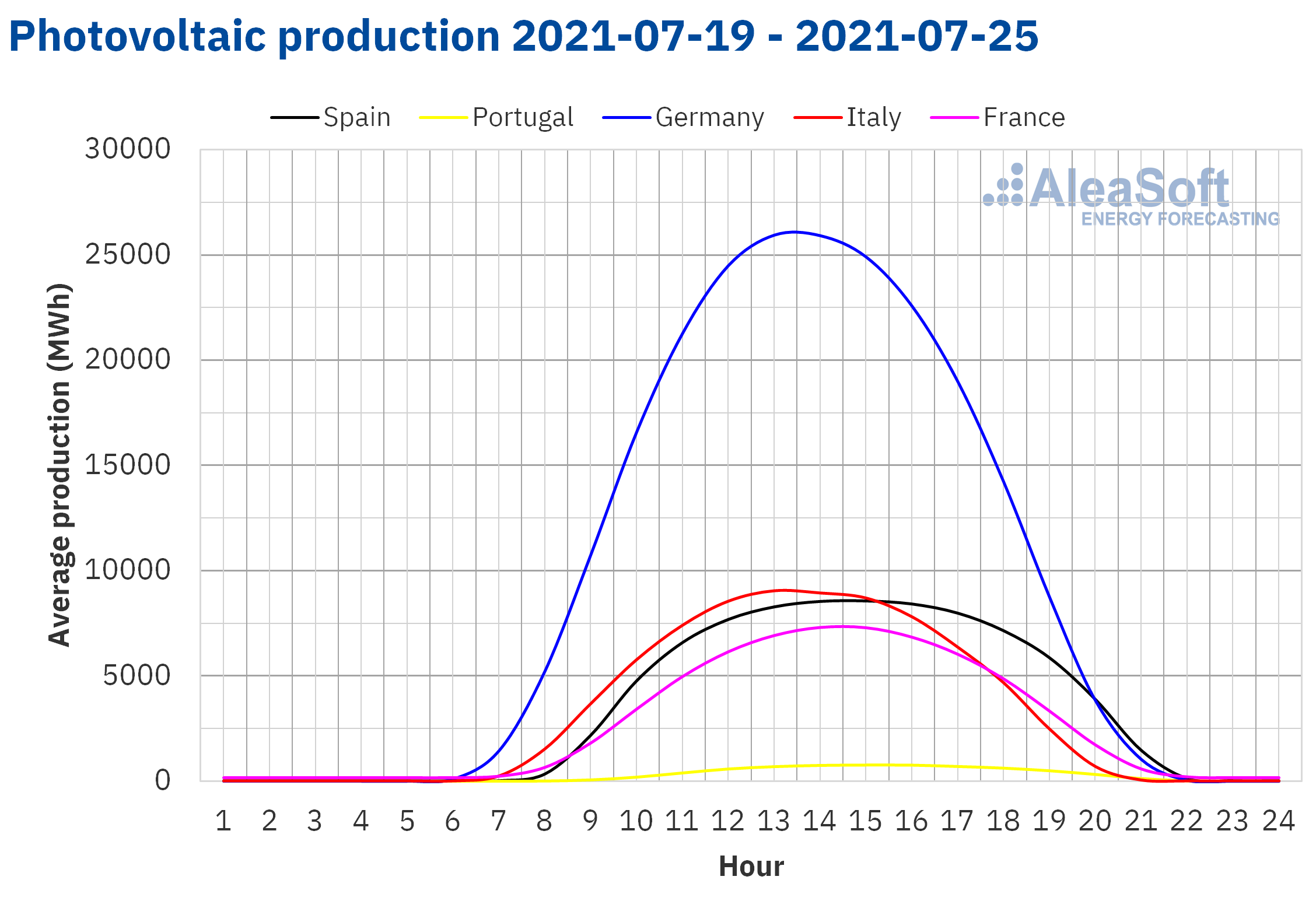

During the week of July 19, the solar energy production increased by 25% in the French market, 16% in the German market and 13% in the Italian market compared to the previous week. However, the production reduced by 4.3% in the Spanish market and 9.4% in the Portuguese market.

For the week beginning July 26, the AleaSoft‘s solar energy production forecasting points to a decrease in the Spanish market. Little variation is expected in the Italian and German markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

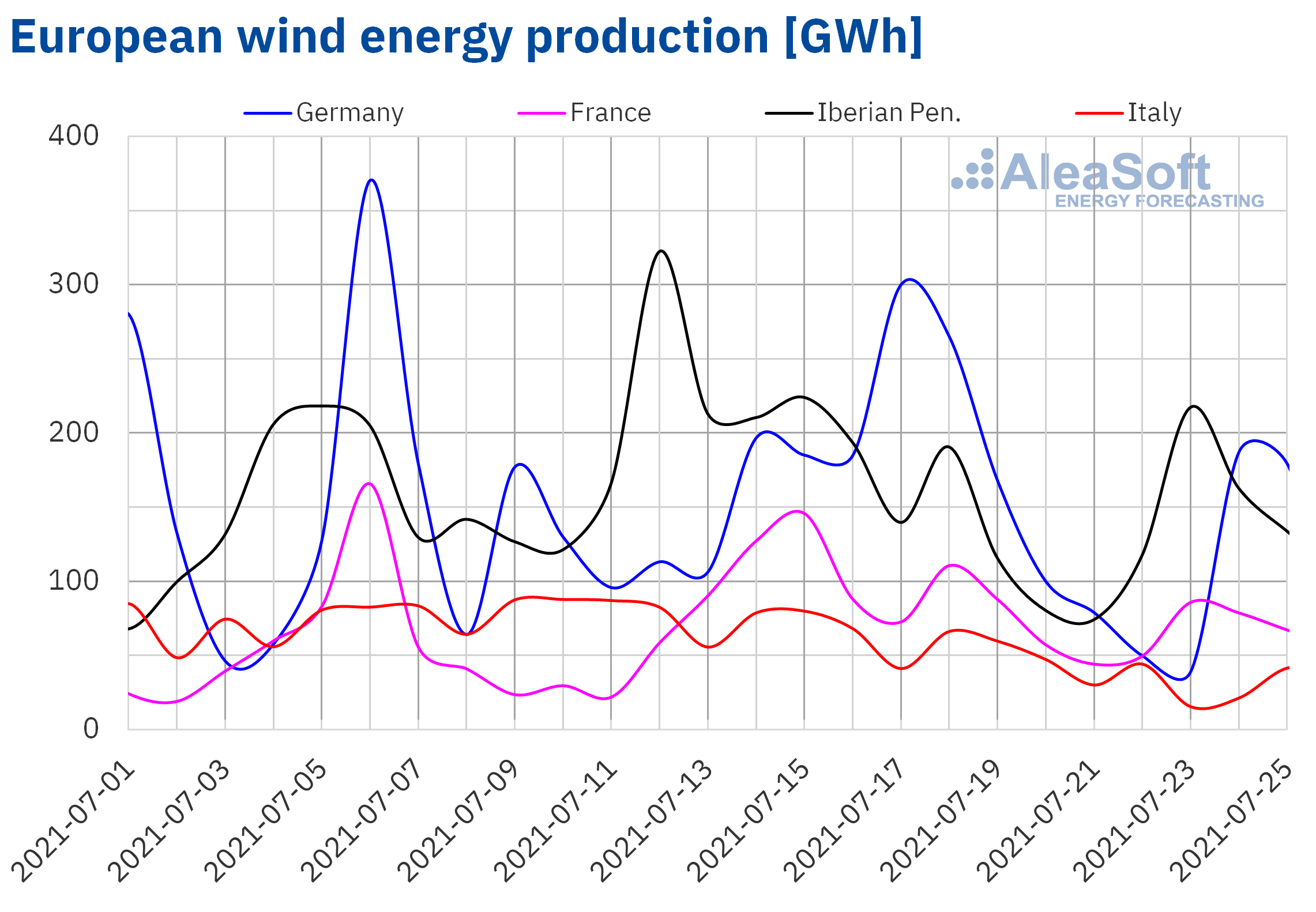

During the fourth week of July, the wind energy production decreased in all the markets analysed at AleaSoft compared to the previous week. In the French market it fell by 32% while in the Iberian Peninsula it fell by about 40%. In the German market, the production with this technology decreased by 41% and in the Italian market the largest drop was registered, of 45%.

For the last week of July, the AleaSoft‘s wind energy production forecasting indicates that it will be higher than that registered the previous week in the markets of Germany and Spain. However, in the Portuguese market a reduction in production is expected, while in the markets of Italy and France little variation is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

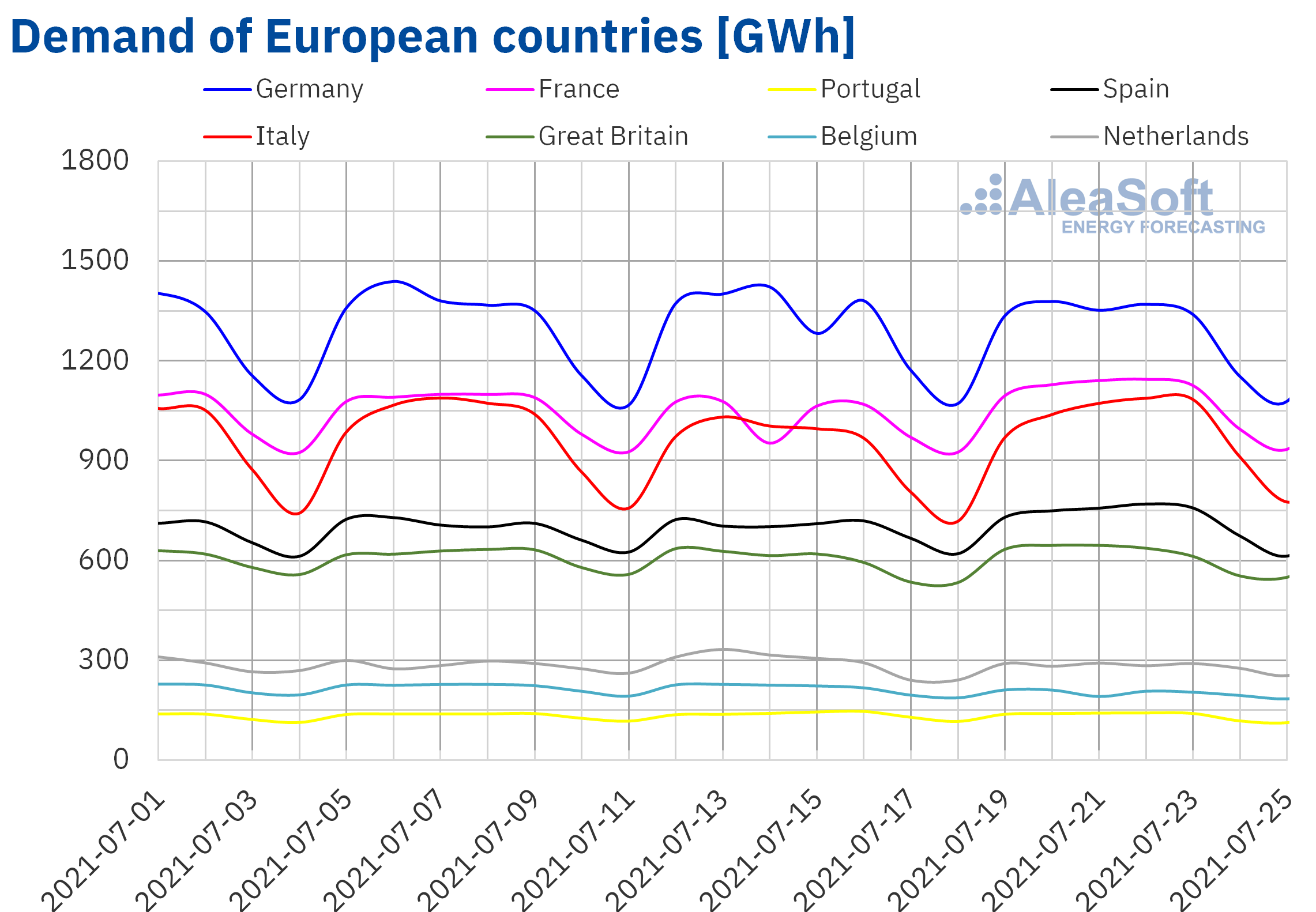

During the week of July 19, the electricity demand behaved heterogeneously in the European electricity markets if the variation compared to the third week of July is analysed. On the one hand, the demand increased in the markets of Great Britain, Spain, France and Italy, favoured by the rise in temperatures. The largest increase was registered in the Italian market and was 6.8%. In the rest of these markets, the growths were between 2.8% of Great Britain and 6.0% of France. In the case of France, part of its increase was due to the recovery in demand after the effect of the holiday of Wednesday, July 14, French National Day. After correcting this effect, the increase was 4.1%.

On the other hand, the demand decreased in the markets of Germany, Portugal, the Netherlands and Belgium, with decreases of 1.0%, 2.0%, 3.4% and 6.6% respectively. In the Belgian market, after correcting the effect of the holiday of July 21, Belgian National Holiday, the demand increased by 1.4%.

For the last week of July, the AleaSoft‘s demand forecasting indicates that it will decrease in most European markets compared to the fourth week of the month, the exception being the markets of the Netherlands and Portugal, where it is expected to increase.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

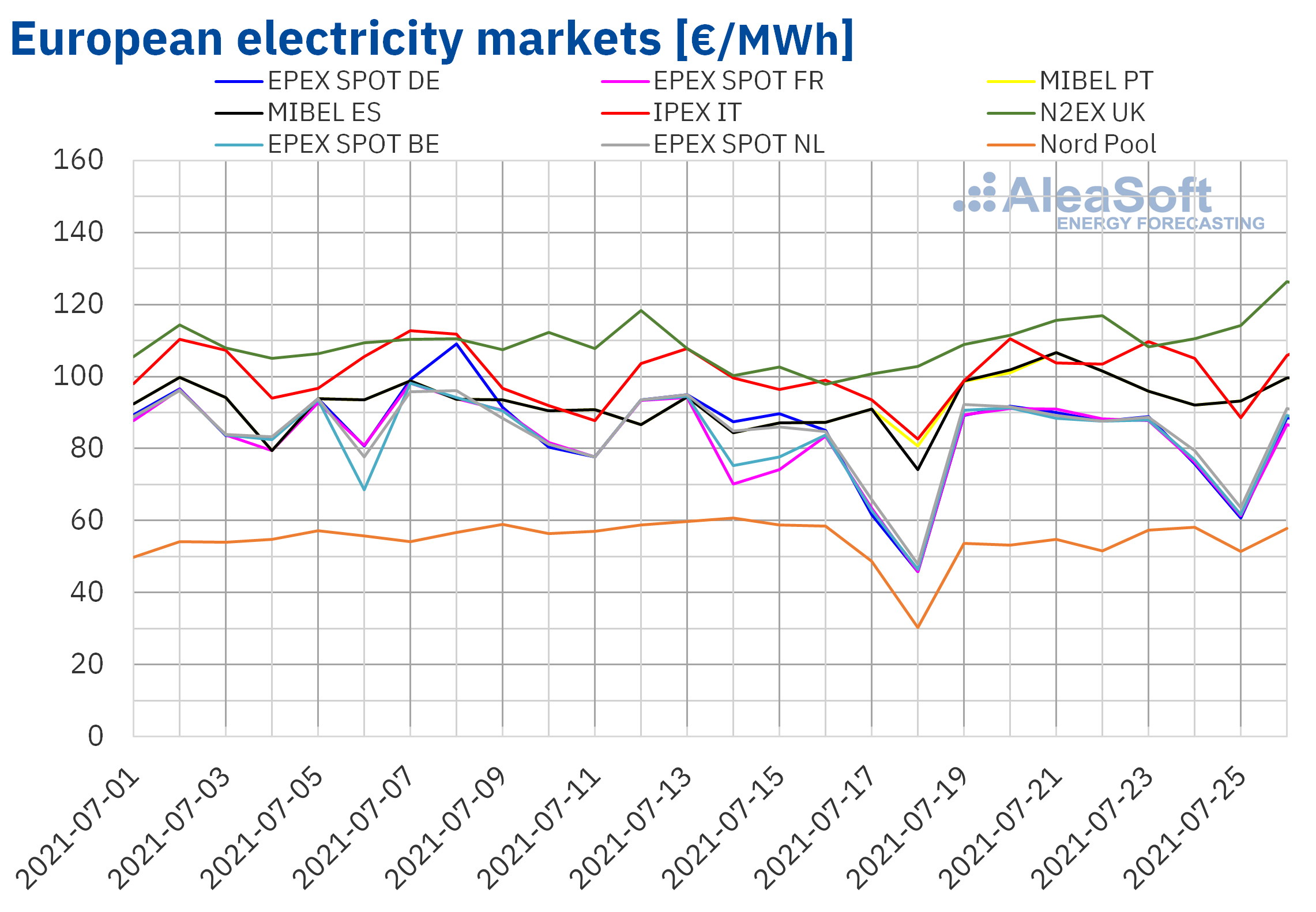

European electricity markets

In the week of July 19, the prices of all the European electricity markets analysed at AleaSoft increased. The largest price rises were those of the MIBEL market of Spain and Portugal, of 14% and 13% respectively, followed by that of the EPEX SPOT market of France, of 12%. On the other hand, the lowest price increase was that of the Nord Pool market of the Nordic countries, of 1.2%. In the rest of the markets, the price increases were between 4.6% of the EPEX SPOT market of Germany and 9.5% of the EPEX SPOT market of Belgium.

In the fourth week of July, the highest weekly average price was that of the N2EX market of the United Kingdom, of €112.24/MWh, followed by the average of the IPEX market of Italy, of €102.82/MWh. On the other hand, the lowest average was that of the Nord Pool market of the Nordic countries, of €54.31/MWh. In the rest of the markets, the prices were between €83.39/MWh of the EPEX SPOT market of Germany and €98.55/MWh of the MIBEL market of Spain.

During the fourth week of July, the daily prices exceeded €100/MWh in the British, Italian, Spanish and Portuguese markets. The highest daily price, of €116.89/MWh, was reached on Thursday, July 22, in the British market. However, in the N2EX market, this price was exceeded by that of Monday, July 26, of €126.34/MWh, the highest in this market since January 15.

In the case of the MIBEL market of Spain and Portugal, the daily prices exceeded €100/MWh from Tuesday to Thursday of the fourth week of July. This happened for the first time in Portugal, whereas in Spain it only happened previously on one occasion. On Wednesday, July 21, the highest daily price in the history of the MIBEL market, of €106.57/MWh, was reached both in Spain and Portugal.

During the fourth week of July, the general fall in wind energy production in Europe favoured the increase in prices in the European electricity markets. The increase in demand in some markets, as well as the high gas and emission rights prices, also contributed to this trend. In addition, in the case of the MIBEL market, these factors were joined by the decrease in solar energy production in the Iberian Peninsula.

The AleaSoft‘s price forecasting indicates that in the week of July 26, prices might fall in most European markets, favoured by the decrease in demand and by the recovery of the wind energy production in countries such as Germany or Spain.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

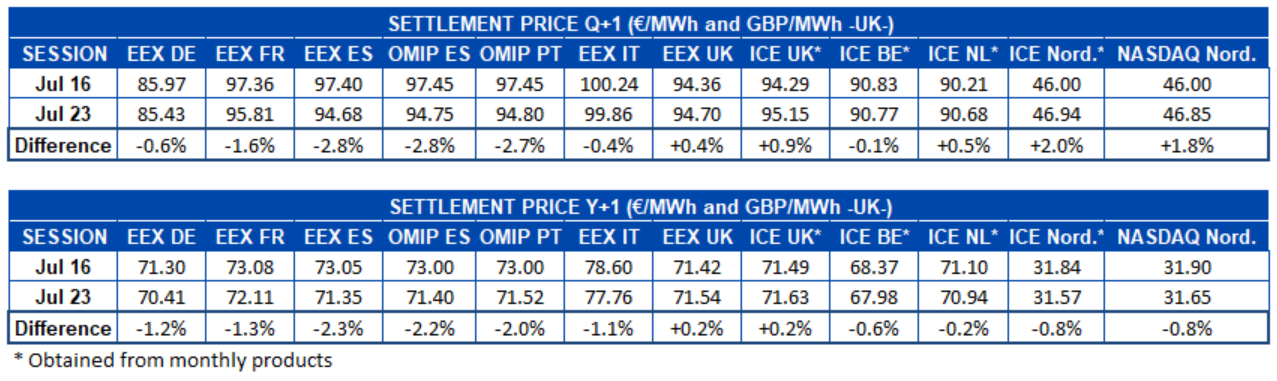

Electricity futures

During the week of July 19, the electricity futures prices for the fourth quarter of 2021 had uneven behaviour in the markets analysed at AleaSoft. On the one hand, the settlement prices of the July 23 session fell compared to those of the July 16 session in the EEX market of Germany, France, Spain and Italy, in the OMIP market of Spain and Portugal and in the ICE market of Belgium. While in the EEX market of the United Kingdom, the ICE market of the United Kingdom, the Netherlands and the Nordic countries and the NASDAQ market of the Nordic countries the prices increased. The largest drop, of 2.8%, was registered in the EEX market of Spain, closely followed by the OMIP market of Spain with only €0.02/MWh difference. The largest rise was that of the ICE market of the Nordic countries, with an increase of 2.0%.

In the case of the electricity futures for the next year 2021, the behaviour was slightly different. In this case only the prices of the UK region increased. In both the EEX market and the ICE market, there were 0.2% increases in prices in the July 23 session compared to the July 16 session. In the rest of the markets, the decreases were between 0.2% marked by the ICE market of the Netherlands and 2.3% registered in the EEX market of Spain.

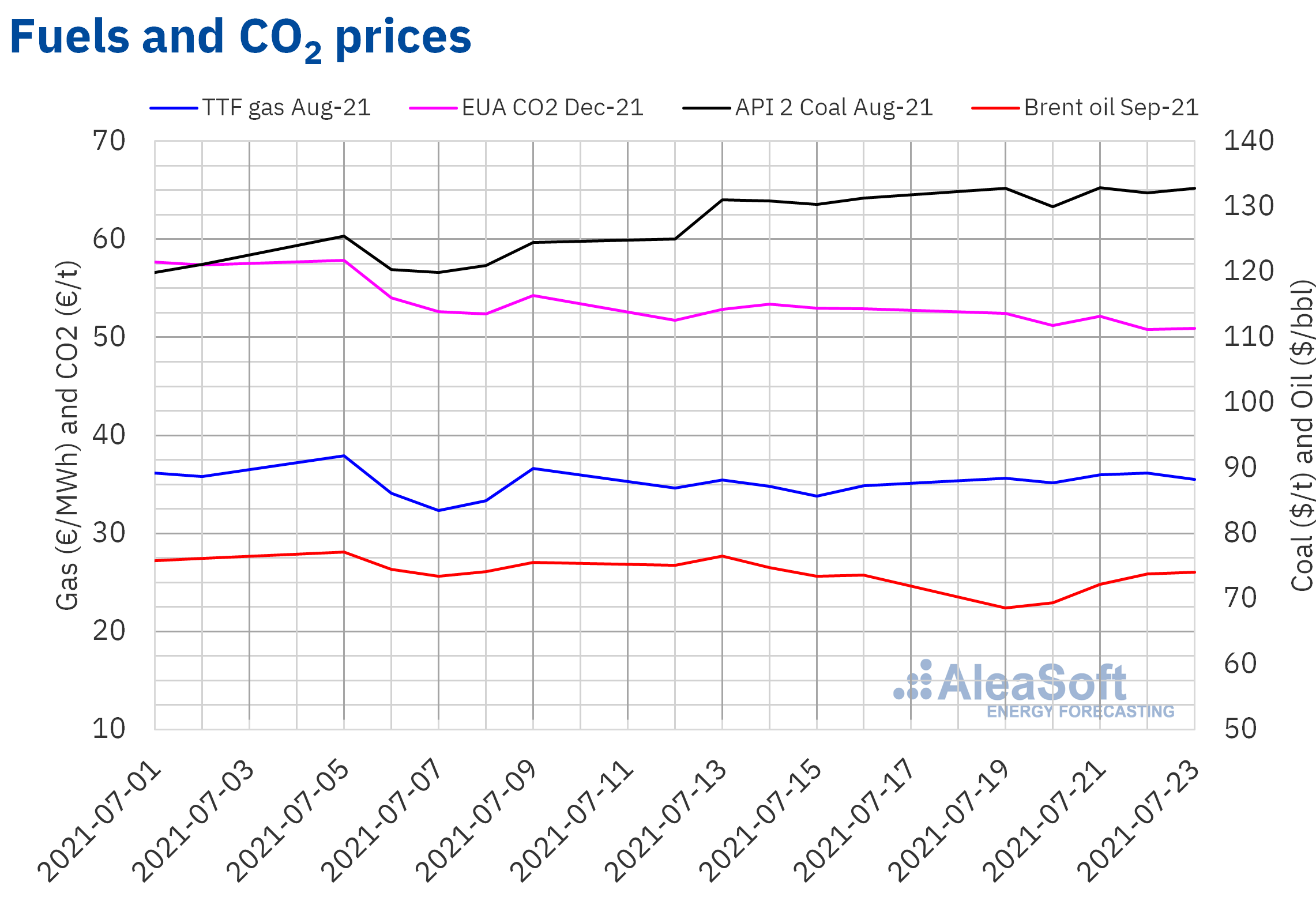

Brent, fuels and CO2

The Brent oil futures for the month of September 2021 in the ICE market began the fourth week of July with price declines. On Monday, July 19, a settlement price of $68.62/bbl was reached, 6.8% lower than that of the previous session. In addition, this price was 8.7% lower than that of the same day of the previous week and the lowest price since the end of May. However, as of Tuesday prices began to recover. On Friday, July 23, the settlement price was $74.10/bbl, already 0.7% higher than that of the previous Friday.

The agreement reached by the OPEC+ on Sunday, July 18, exerted its downward influence on prices in the session of Monday, July 19. According to this agreement, the OPEC+ will progressively increase its production levels in the next five months to adapt them to the increase in demand. On the other hand, the demand continues to recover, favoured by the increase in mobility in Europe, although the expansion of the Delta variant of the coronavirus is worrying.

As for the settlement prices of the TTF gas futures in the ICE market for the month of August 2021, the fourth week of July remained above €35/MWh. The maximum settlement price of the week was that of Thursday, July 22, of €36.13/MWh. This price was 6.9% higher than that of the previous Thursday.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2021, most of the fourth week of July, they registered decreases. On Thursday, July 22, the minimum settlement price of the week, of €50.81/t, was reached. This price was 4.1% lower than that of the previous Thursday and the lowest since the first week of June. On Friday, prices recovered a discreet 0.2% to €50.89/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft’s analysis on the prospects for energy markets in Europe

At AleaSoft, special promotions are being carried out on the short-, mid- and long‑term European electricity markets prices forecasting services. Having forecasts with different horizons is necessary to define energy buying and selling strategies based on diversification, which allow taking advantage of the opportunities that arise in the markets, as well as minimising the risks associated with extreme prices situations, such as the high prices that are currently occurring or the low prices that occurred at other times, for example, in February 2021.

The next AleaSoft’s webinar will be held on October 7 with the participation of invited speakers from Deloitte. Just one year after the first webinar in which speakers from Deloitte participated, the evolution of the European energy markets in the last year, how the renewable energy projects financing changed in the last twelve months and the importance of the forecasting in the audits and the portfolio valuation will be analysed.

Source: AleaSoft Energy Forecasting.