AleaSoft Energy Forecasting, January 7, 2026. In 2025, prices in the main European electricity markets rose until February, fell in spring and stabilised in the second half of the year, with an annual average price above €60/MWh in most markets. Prices increased compared to 2024 due to higher gas and CO₂ prices, as well as rising demand and lower wind energy production in some markets. Even so, 2025 prices were the second lowest since 2021. Photovoltaic energy production reached record levels in the main European markets, as did wind energy production in France.

Solar photovoltaic and wind energy production

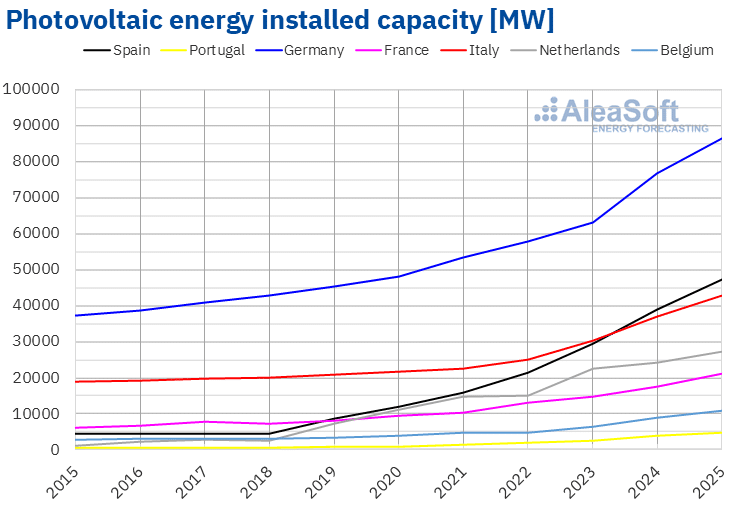

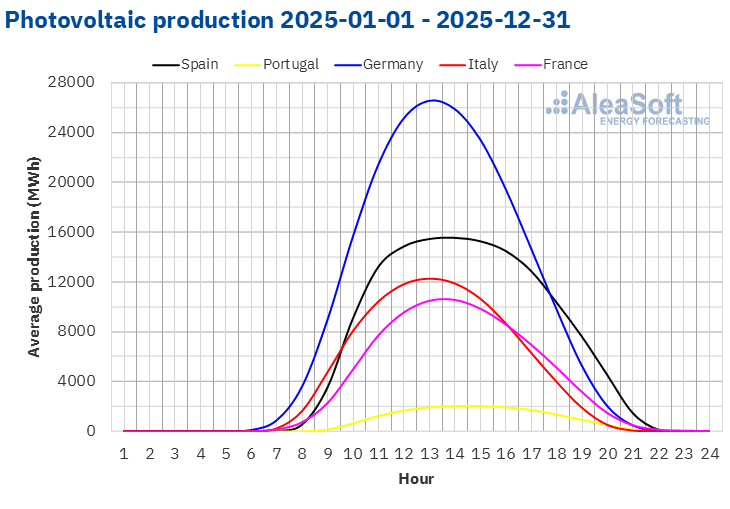

Progress in Europe’s transition towards sustainable energy generation continued in 2025 and is clearly reflected in the data. Installed solar photovoltaic capacity increased in all major European electricity markets compared to 2024. The Portuguese market registered the highest percentage increase, 24%, adding 929 MW to the system in 2025. The Dutch market registered the smallest increase, 12%. According to data from Red Eléctrica, the Spanish peninsular system added 8312 MW in 2025, representing an increase of 21%.

Source: Prepared by AleaSoft Energy Forecasting using data from TERNA, Red Eléctrica, REN and ENTSO-E.

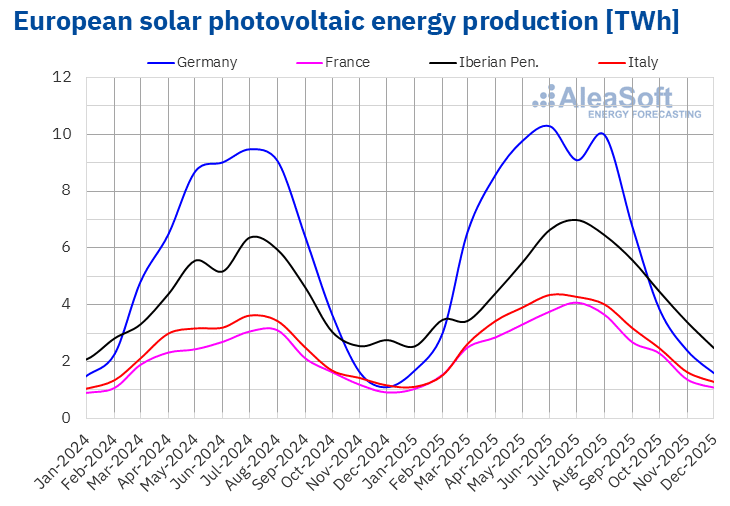

Source: Prepared by AleaSoft Energy Forecasting using data from TERNA, Red Eléctrica, REN and ENTSO-E.The increases in installed capacity led to higher annual solar photovoltaic energy production in the main European markets. In the French market, production from this technology grew by 30% compared to 2024. This was followed by the Portuguese and Italian markets, with increases of 25% and 23%, respectively. In the German market, growth was 17%, while the Spanish market registered the smallest increase, 13%.

Solar photovoltaic energy production in 2025 was the highest on record in all markets analysed at AleaSoft Energy Forecasting. Germany led with 73 392 GWh of photovoltaic energy production in 2025, followed by Spain with a production of 49 162 GWh.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

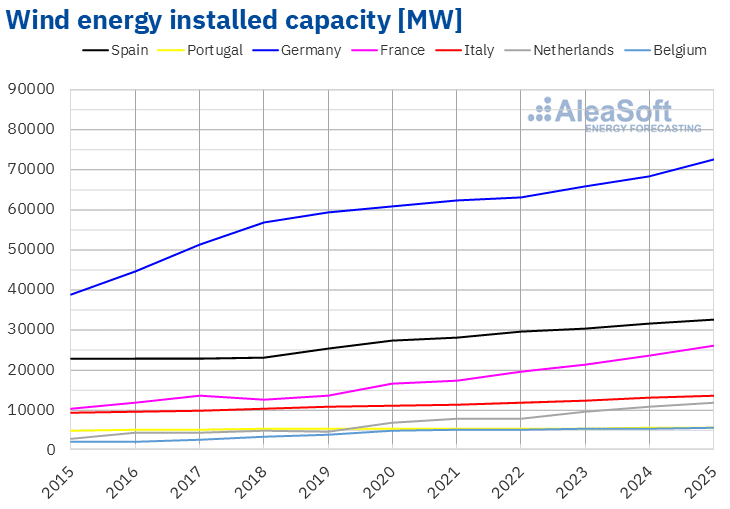

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.In 2025, installed wind capacity increased in the main European electricity markets. However, the increases were smaller than those registered for photovoltaic technology and did not exceed 10%, a figure registered in the French market. By way of comparison, according to data from Red Eléctrica, wind capacity in Mainland Spain increased by 3.2%, with 1019 MW added to the grid. As in the previous year, the Portuguese market registered the smallest percentage increase, 0.7%, with an additional 36 MW.

Source: Prepared by AleaSoft Energy Forecasting using data from TERNA, Red Eléctrica, REN and ENTSO-E.

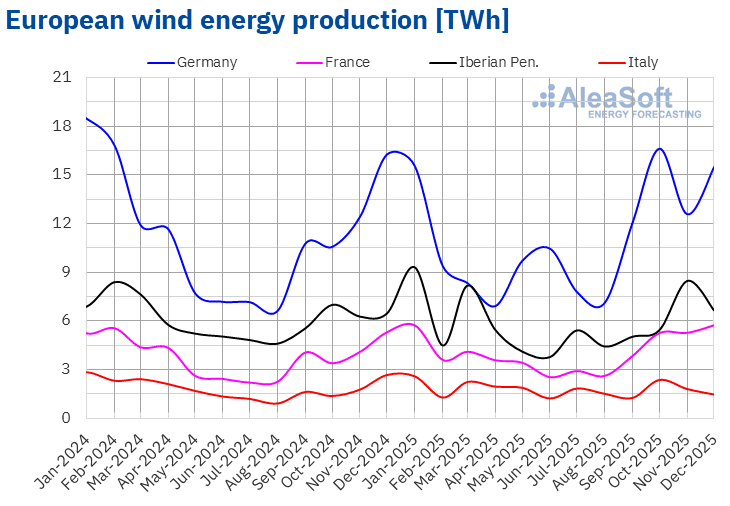

Source: Prepared by AleaSoft Energy Forecasting using data from TERNA, Red Eléctrica, REN and ENTSO-E.By contrast, wind energy production increased only in the French market, by 6.3% compared to 2024. The rest of the main European electricity markets registered a decline in wind energy production in 2025. Portugal led the decreases with a drop of 4.5%. The Spanish market registered the smallest decline, 3.4%, with 57 342 GWh produced in 2025.

In the French market, wind energy production in 2025 was the highest in its history, with a production of 48 605 GWh.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

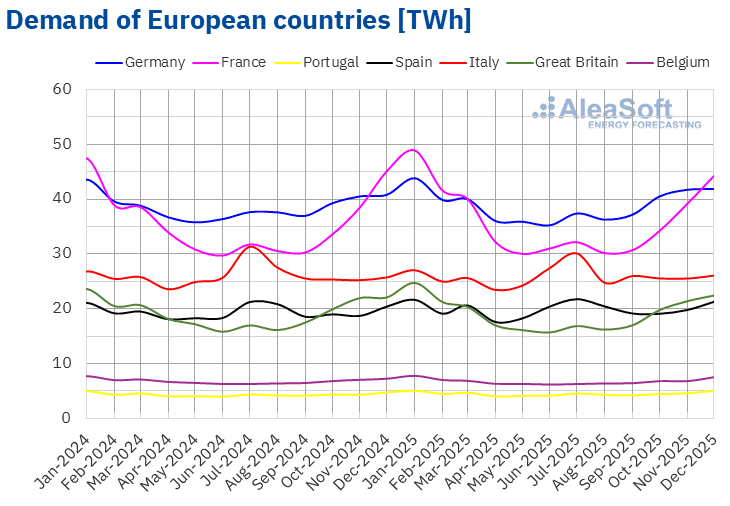

Electricity demand in 2025 was higher than in 2024 in some of the main European electricity markets, and lower in others. This lack of uniformity contrasts with the upward trend registered between 2023 and 2024.

In 2025, the Portuguese market registered the highest growth in electricity demand, with an increase of 3.3%, followed by the Spanish market, where demand grew by 2.0%. In France, the increase was 1.5%. The German market registered the smallest increase, 0.7%, representing a change in trend compared to the decline registered in 2024.

By contrast, the Belgian, British and Italian markets registered lower demand in 2025 than in 2024. In the Belgian market, the decline was 0.8%, while in the British and Italian markets demand fell by 0.5% and 0.4%, respectively.

In 2025, annual average temperatures increased by 0.2 °C in Great Britain and by 0.1 °C in Spain and France. By contrast, in Belgium, Italy and Germany, 2025 was between 0.1 °C and 0.9 °C colder than 2024. In Portugal, average temperatures were similar to those of 2024.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

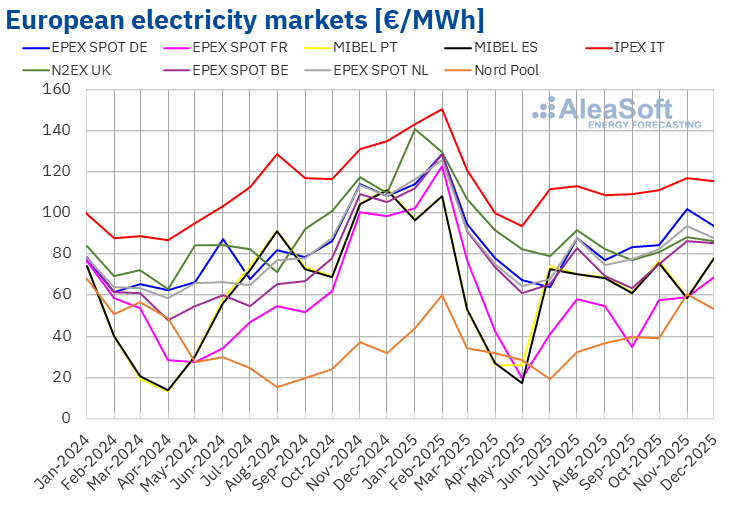

In 2025, prices in most major European electricity markets rose until February and then collapsed during the spring. In June, prices began to recover, stabilising during the second half of the year in most markets. The annual average price was above €60/MWh in most major European electricity markets. The exception was the Nord Pool market of the Nordic countries, with an average of €39.70/MWh. The IPEX market of Italy registered the highest annual average price, €115.94/MWh. In the rest of the European electricity markets analysed at AleaSoft Energy Forecasting, averages ranged from €61.07/MWh in the EPEX SPOT market of France to €94.48/MWh in the N2EX market of the United Kingdom.

When comparing the average prices of 2025 with those registered in 2024, prices rose in all analysed markets. The largest increase was in the Belgian market, 18%, while the smallest increase was in the MIBEL market of Spain, 3.6%. In the remaining markets, price increases ranged from 4.3% in the Portuguese market to 13% in the Dutch market.

Despite these increases, the average prices of 2025 were the second lowest since 2021 in all markets analysed at AleaSoft Energy Forecasting.

In 2025, the decline in wind energy production in most markets, together with the increase in gas prices and CO₂ emission allowance prices compared to the previous year, led to higher prices in European electricity markets. In addition, electricity demand increased in Germany, Spain, France and Portugal, contributing to the year‑on‑year price increases in these markets.

Brent, fuels and CO2

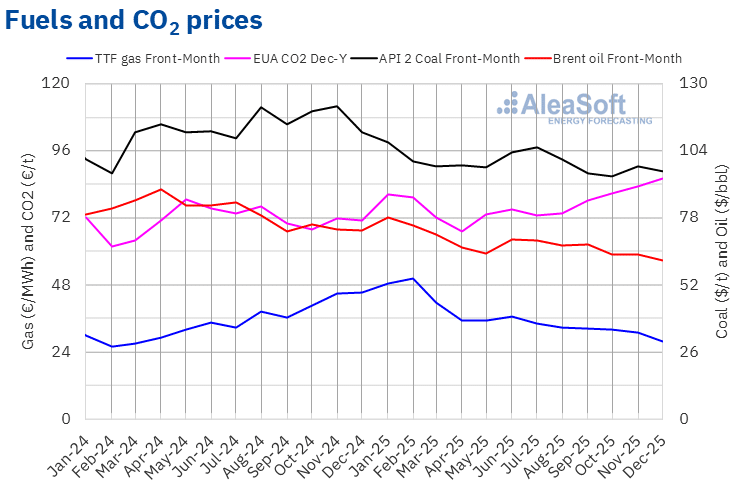

During 2025, settlement prices of Brent oil futures for the Front‑Month in the ICE market followed a predominantly downward trend, reaching an average of $61.63/bbl in December, the lowest since February 2021. As a result, in 2025 these futures reached an average price of $68.19/bbl. This represented a 15% decrease compared to the average reached by Front‑Month futures in the previous year, $79.86/bbl. In addition, the 2025 average was the lowest since 2021.

Despite sanctions on exports from Iran and Venezuela and increased tensions between the United States and Venezuela at the end of 2025, concerns about the evolution of global oil demand, production increases by OPEC+ and reduced instability in the Middle East contributed to the fall in Brent oil futures prices in 2025. The conflict between Russia and Ukraine also influenced price evolution in 2025. While peace talks exerted downward pressure on prices, the lack of progress, Ukrainian attacks on Russian oil infrastructure, as well as US and European sanctions, pushed prices upwards, limiting the fall in the annual average.

As for TTF gas futures prices in the ICE market for the Front‑Month, they continued the upward trend that began in 2024 until February 2025. That month, the monthly average was €50.27/MWh, the highest since March 2023. Prices subsequently fell. However, the annual average for 2025 increased compared to 2024. These futures reached an average price of €36.33/MWh in 2025. This average was 4.8% higher than that of the Front‑Month futures traded in 2024, €34.65/MWh.

At the beginning of 2025, low temperatures, the end of Russian gas supplies through Ukraine and concerns about European storage levels drove up TTF gas futures prices. Subsequently, abundant liquefied natural gas supply and peace talks for Ukraine contributed to the fall in prices. However, disruptions to gas flows from Norway, damage caused by the war to Ukrainian gas infrastructure—which could lead to increased European gas exports to Ukraine during the winter—and the approval by the European Union of a package of sanctions against Russia, including a ban on importing Russian liquefied natural gas from 2027, limited the decline in prices.

In the case of CO₂ emission allowance futures in the EEX market for the reference contract of December 2026, prices rose particularly in the second half of 2025. As a result, these futures reached an annual average price of €76.85/t, which was 8.1% higher than the average registered in 2024, €71.09/t.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing of renewable energy and storage projects

AleaSoft Energy Forecasting has been holding monthly webinars on European energy markets since December 2019. These webinars feature participation by energy sector experts to analyse the most relevant topics, such as the renewable energy project financing, PPA and energy storage. Recordings of most of these webinars are available on the company’s YouTube account (AleaSoft Energy Forecasting).

Source: AleaSoft Energy Forecasting.