AleaSoft Energy Forecasting, July 4, 2023. In the first half of 2023, average prices of European electricity markets fell, ranking as the lowest since the second half of 2021. The fundamental causes of these falls are the decrease in gas prices and electricity demand in some markets, as well as a renewable energy production that increased in most markets. The solar photovoltaic energy production of the period was a record in the markets of southern Europe and wind energy production in Spain and France.

Solar photovoltaic and thermoelectric energy production and wind energy production

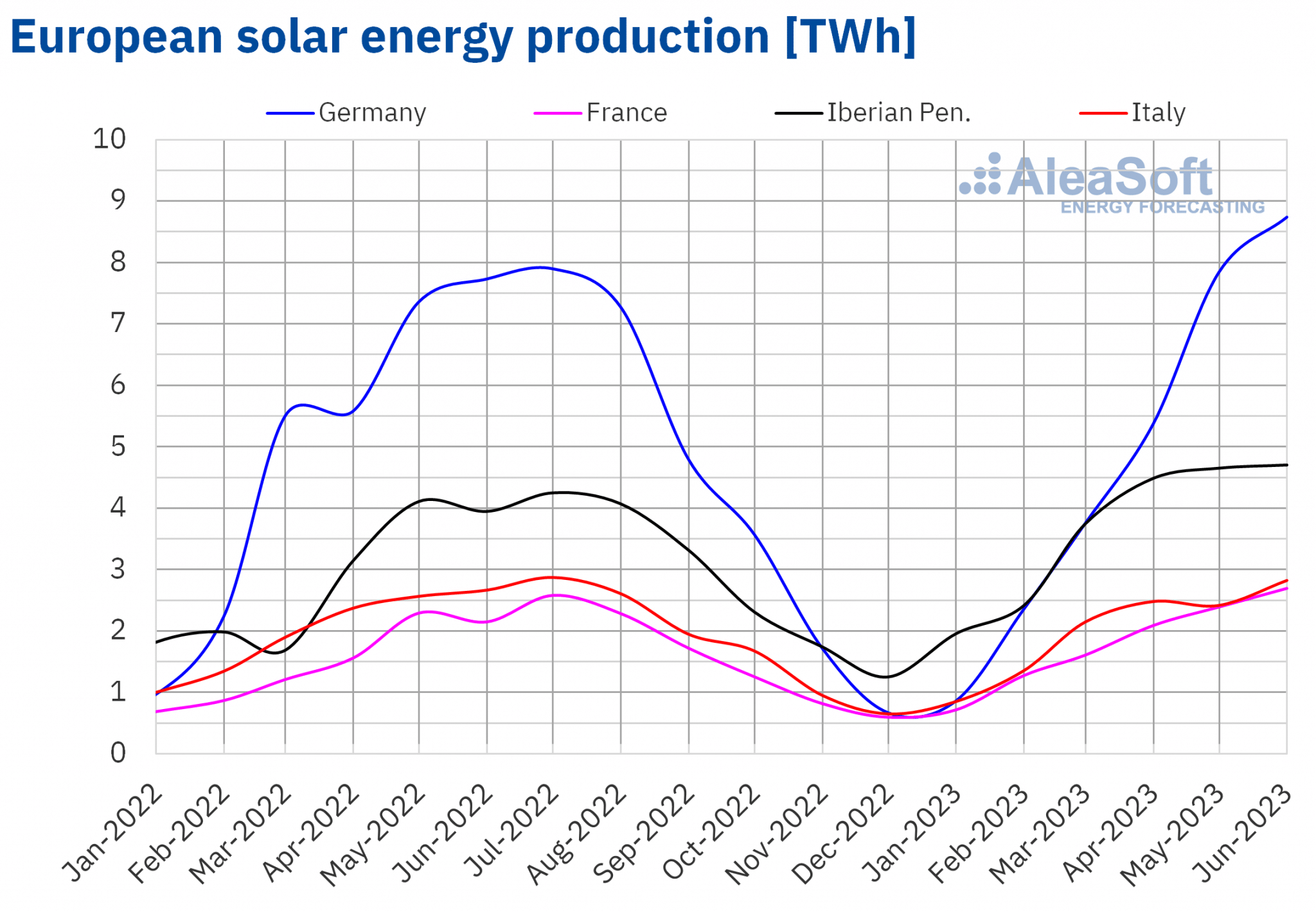

In the first half of 2023, solar energy production increased in most of the main European markets analysed at AleaSoft Energy Forecasting, when compared to the same period of the previous year. The most pronounced rise, of 41%, was registered in the Portuguese market, followed by the Spanish and French markets, where the increases were 31% and 23%, respectively. The smallest increases were observed in the Italian market and were 1.9%. On the other hand, in the German market, solar energy production fell by 1.6% year‑on‑year in the first six months of 2023 as a whole.

Compared to the second half of 2022, the solar energy production of the first half of 2023 increased in all analysed markets. Also in this case, the largest rise was registered in the Iberian Peninsula, with increases of 38% and 30% in Portugal and Mainland Spain, respectively. In Germany, Italy and France more moderate increases were observed, of 12%, 13% and 16% in each case.

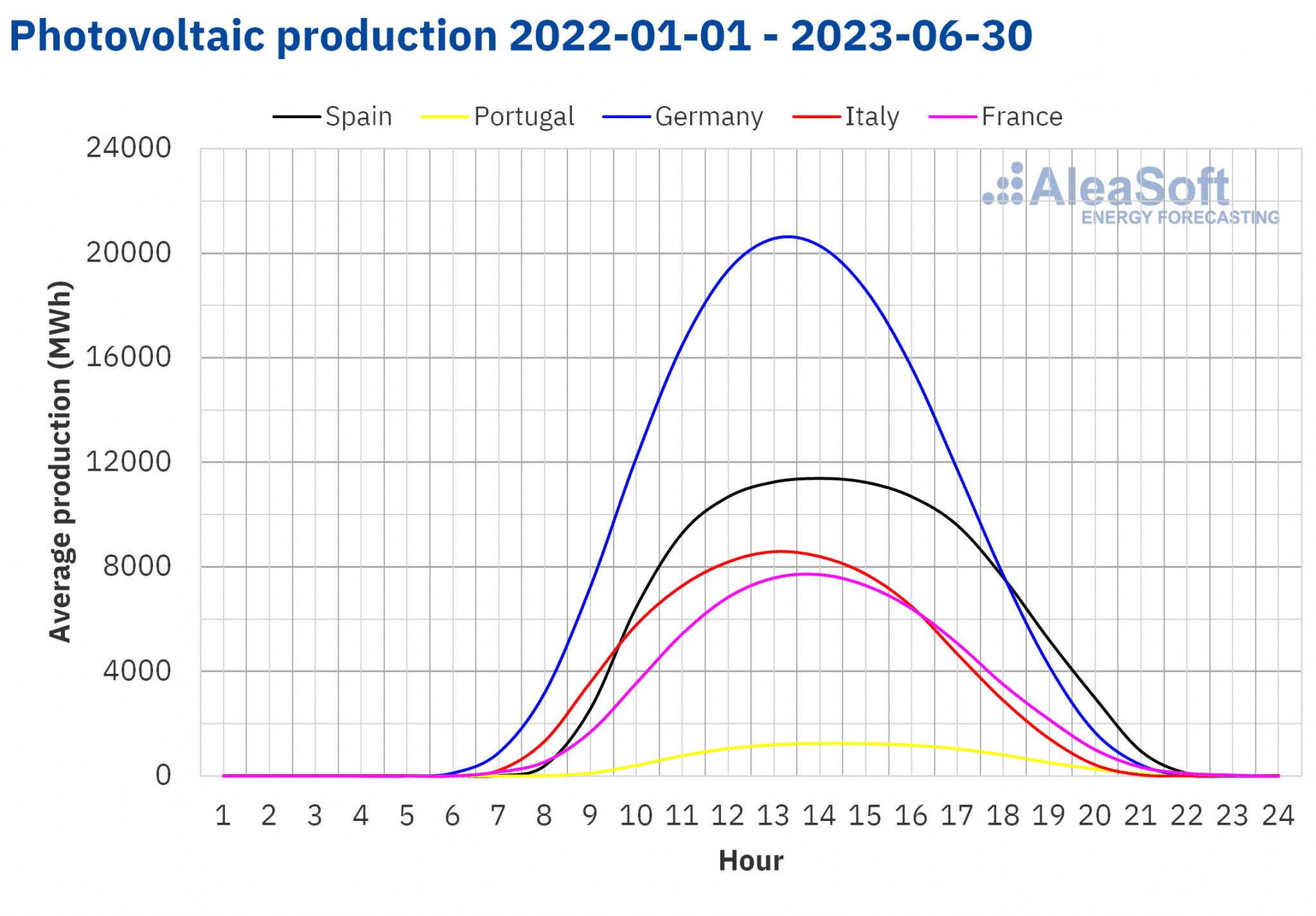

In addition, in the Spanish, French, Italian and Portuguese markets, the half‑yearly solar photovoltaic energy production was the highest in history, with 18 080 GWh generated in the case of Spain, 10 772 GWh in the case of France, 12 054 GWh in the case of Italy and 1780 GWh in the case of Portugal.

On the other hand, according to data from Red Eléctrica de España (REE), in June 2023 solar photovoltaic capacity in Mainland Spain was 1230 MW above the installed capacity at the end of 2022. In the same period, the increase in solar photovoltaic capacity in Portugal with respect to the installed capacity at the end of December 2022 was 161 MW.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

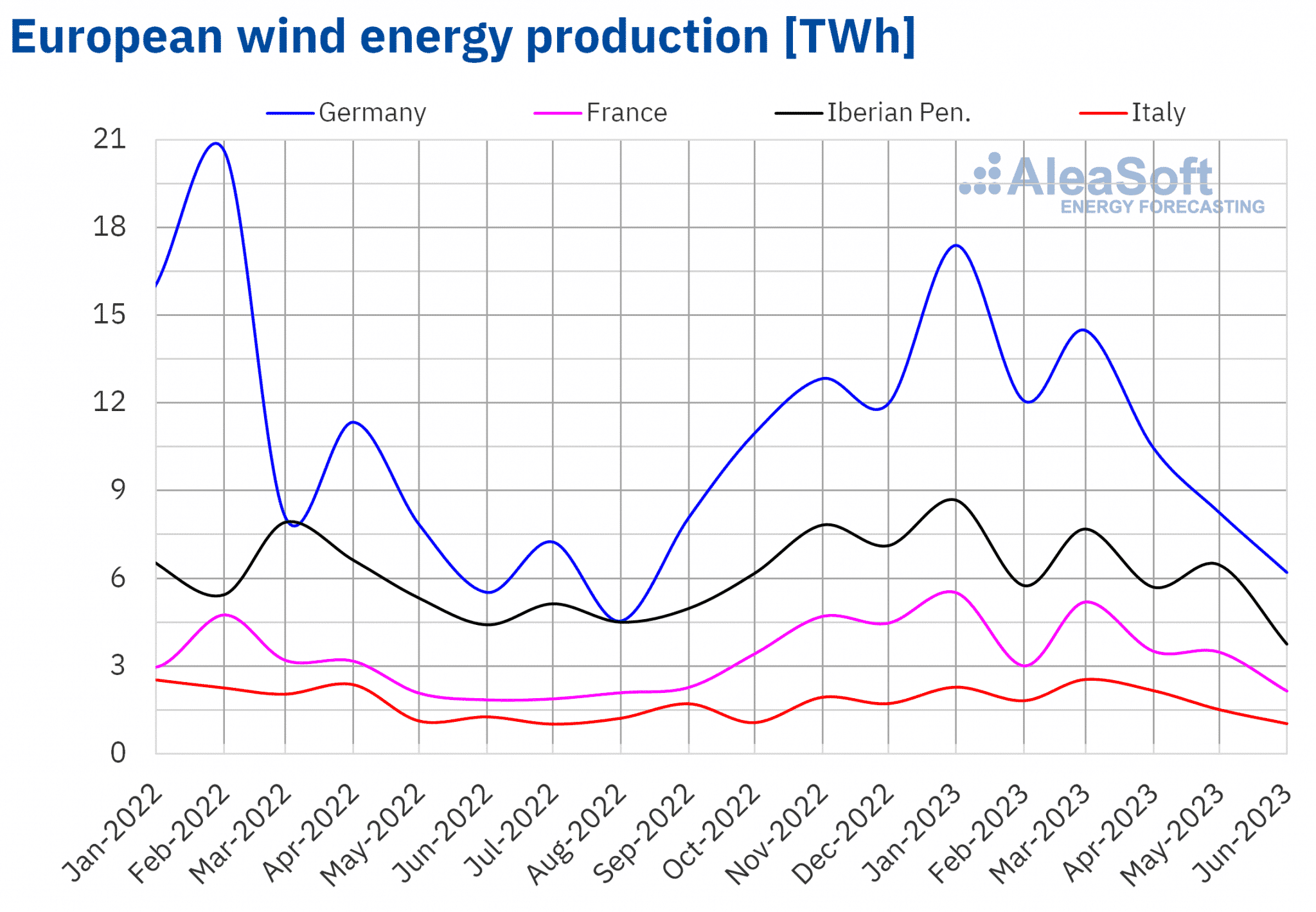

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In the case of the wind energy production, in the first half of 2023 it increased by 27% in the French market and by 5.2% in the Spanish market, when compared to the same period of 2022. On the other hand, the Portuguese, German and Italian markets registered falls of 0.1%, 0.9% and 2.0% respectively.

Compared to the last semester of 2022, the wind energy production of the first part of 2023 increased in all markets analysed at AleaSoft Energy Forecasting, except in the Portuguese market where it decreased by 0.6%. The largest increase, of 31%, was registered in Italy, followed by the increases of 24%, 21% and 6.9% of the German, French and Spanish markets, respectively.

In addition, in the Spanish and French markets, the half‑yearly wind energy production, of 31 715 GWh and 22 889 GWh, respectively, was the highest in all half‑yearly periods of history to date.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

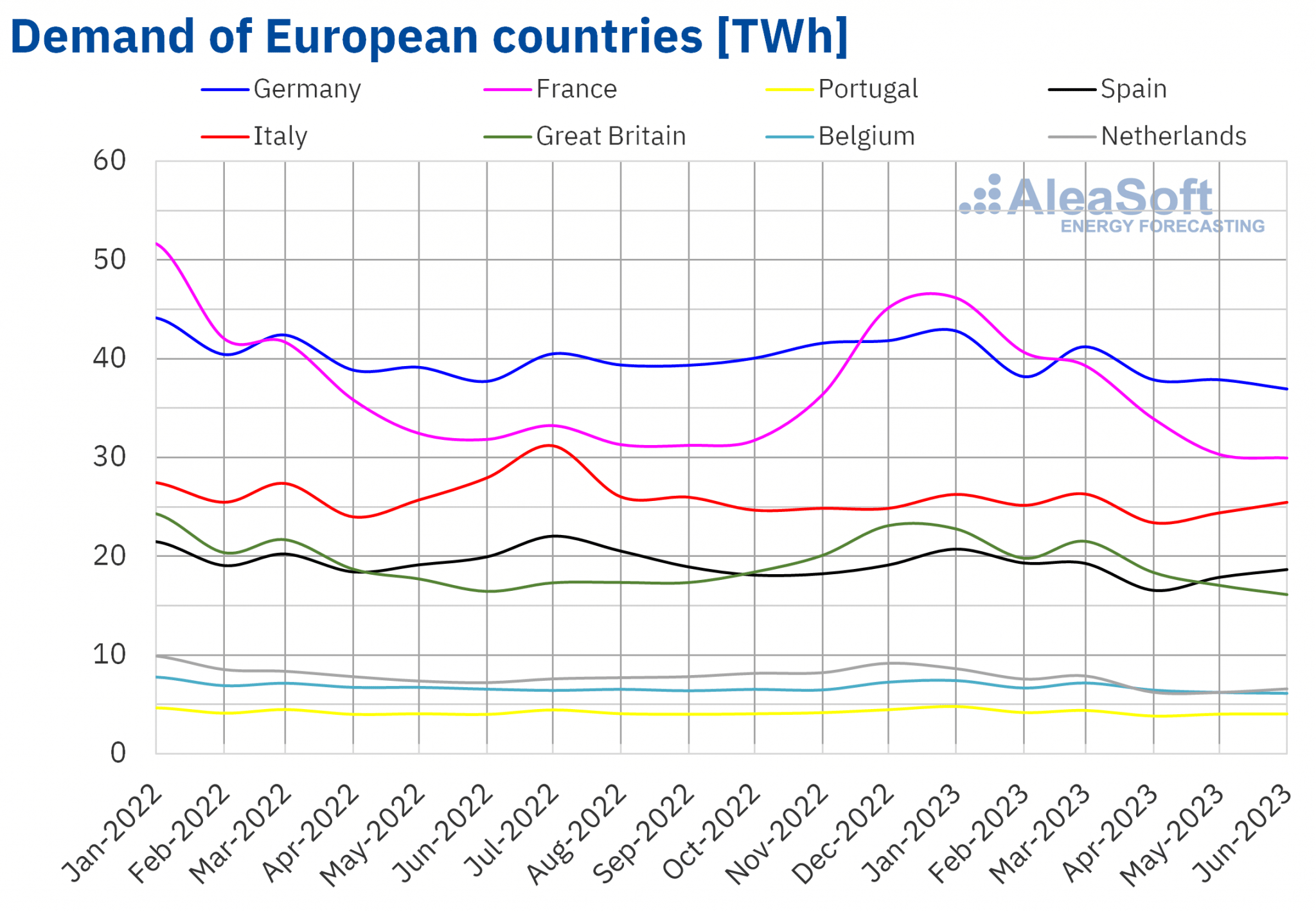

Electricity demand

During the first half of 2023, year‑on‑year decreases in electricity demand were registered in all analysed European markets. The largest fall, of 12%, was that of the Dutch market, followed by that of the French market, of 6.4%. In the rest of the analysed markets, the decreases were between 0.2% of the Portuguese market and 4.6% of the Spanish market.

Compared to the previous half‑yearly period, the electricity demand rose between 0.2% and 5.4% in the markets of France, Portugal, Great Britain and Belgium. On the other hand, decreases of between 3.2% and 11% were registered in Germany, Spain, Italy and the Netherlands.

Except in the Iberian Peninsula, year‑on‑year drops in average temperatures were registered in the first half of the year. The decreases were between 0.1 ºC of Germany, Italy and Great Britain and 0.3 ºC of Belgium. In the Netherlands, temperatures remained similar to those of the first half of 2022.

Compared to the second half of 2022, average temperatures were lower in all markets, with drops ranging from 3.4 ºC in Great Britain and the Netherlands to 5.5 ºC in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

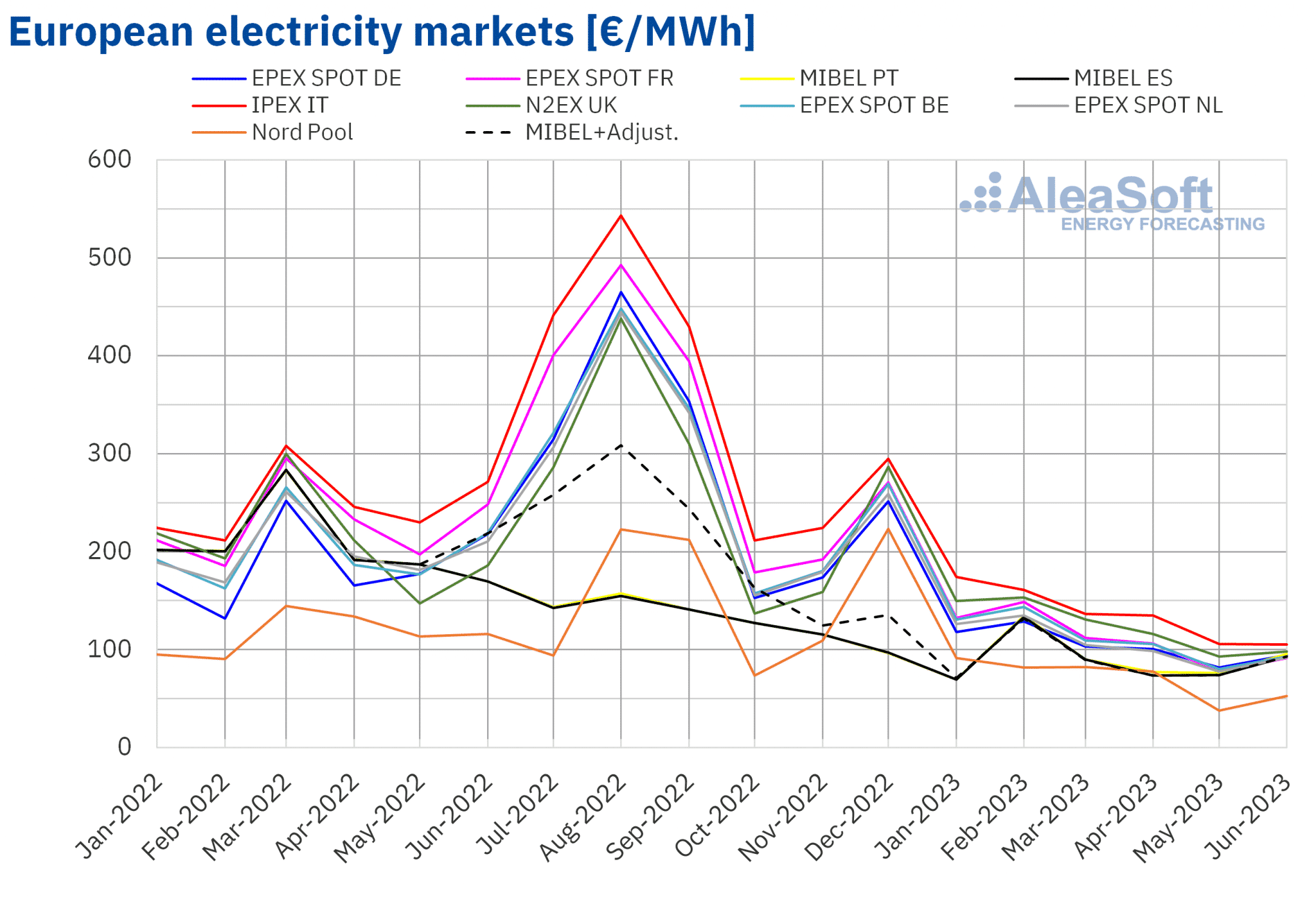

European electricity markets

In the first half of 2023, the half‑yearly average price remained below €115/MWh in most European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy, whose averages were €123.15/MWh and €136.10/MWh, respectively. On the other hand, the lowest half‑yearly price, of €70.42/MWh, was registered in the Nord Pool market of the Nordic countries. In the rest of the markets, the averages were between €88.27/MWh of the MIBEL market of Spain and €110.85/MWh of the EPEX SPOT market of France.

Compared to the previous half‑yearly period, in the first half of 2023 average prices fell in all European electricity markets analysed at AleaSoft Energy Forecasting. The largest fall, of 66%, was that of the French market, while the smallest decreases, of 31% and 32%, were registered in the markets of Portugal and Spain, respectively. The rest of the markets registered price decreases of between 54% of the British market and 64% of the German market.

If average prices of the first half of 2023 are compared with those registered in the same half of 2022, prices also decreased in all markets. The largest falls were those of the Portuguese and Spanish markets, of 56% and 57%, respectively. On the other hand, the smallest decrease was that of the Nordic market, of 39%. In the rest of the markets, the decreases were between 41% of the British market and 52% of the French market.

On the other hand, these price drops resulted in the price for the first half of 2023 being the lowest since the second half of 2021 in all analysed markets.

In the first half of 2023, the decrease in the average price of gas compared to the previous half, the general increase in solar energy production, the increase in wind energy production in almost all markets and the decrease in demand in some of them led to the decrease in European electricity markets prices compared to the previous half, despite the increase in CO2 emission rights prices.

When compared to the first half of 2022, the decrease in the average price of gas and electricity demand, the increase in solar energy production in almost all markets and the increase in wind energy production in markets such as Spain or France also favoured the decrease in electricity markets prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

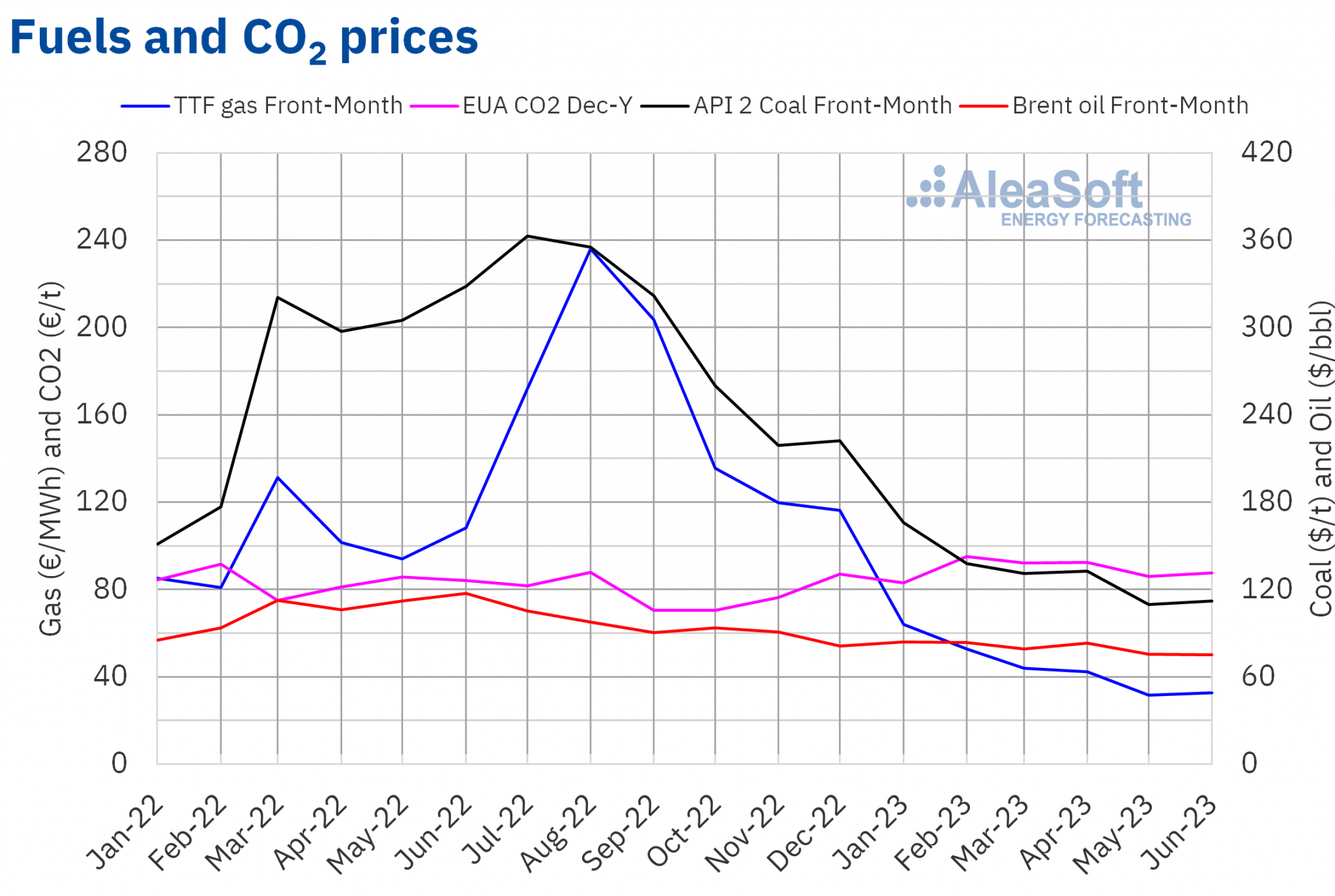

Brent oil futures for the Front‑Month in the ICE market registered a half‑yearly average price of $79.97/bbl in the first half of 2023. This value was 14% lower than that reached by the Front‑Month futures of the previous half‑yearly period, of $93.26/bbl. It was also 24% lower than that corresponding to the Front‑Month futures traded in the first half of 2022, of $104.94/bbl.

During the first half of 2023, concerns about the global economy and the evolution of demand exerted their downward influence on Brent oil futures prices. These concerns worsened from March as a result of the instability in the banking sector. The rises in interest rates and the negotiation process for the debt ceiling in the United States also had an influence on the evolution of prices. However, the cuts agreed by OPEC+, as well as those announced by Saudi Arabia and Russia, contributed to avoiding settlement prices below $70/bbl in the first half of 2023. In addition, supply problems related to the earthquake of Turkey occurred in February and the US government’s plans to replenish its strategic reserves also exerted their upward influence on prices.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the first half of 2023 for these futures was €44.34/MWh. Compared to that of the Front‑Month futures traded in the previous half‑yearly period, of €164.88/MWh, the average fell by 73%. If compared with the Front‑Month futures traded in the same half of 2022, when the average price was €100.99/MWh, there was a 56% decrease.

During most of the first half of 2023, TTF gas futures prices decreased progressively due to the abundant supply of liquefied natural gas by sea and the decline in demand, which resulted in high levels of European reserves. However, in June the supply from Norway was affected by a breakdown. In addition, competition for the supply of liquefied natural gas from the United States with Asian markets also exerted an upward influence on prices. News of the closure of Europe’s largest gas field in October also contributed to supply concerns at the end of the period.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price of €89.22/t in the first half of 2023. This price was 13 % higher than the average of the previous half‑yearly period, of €79.23/t. If compared with the average for the same half of 2022 for the reference contract of December of that year, of €83.53/t, the average for the first half of 2023 was 6.8% higher.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

Long‑term price forecasting is essential for large consumers, financing and valuation of renewable energy projects or risk management. The long‑term energy markets price forecasting service of AleaSoft Energy Forecasting and AleaGreen includes scientifically‑based probabilistic metrics to obtain reliable and quality forecasts. In addition, these forecasts have a 30‑year horizon and hourly granularity.

Source: AleaSoft Energy Forecasting.