AleaSoft Energy Forecasting, July 10, 2023. Interview by Ramón Roca, director of El Periódico de la Energía, with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

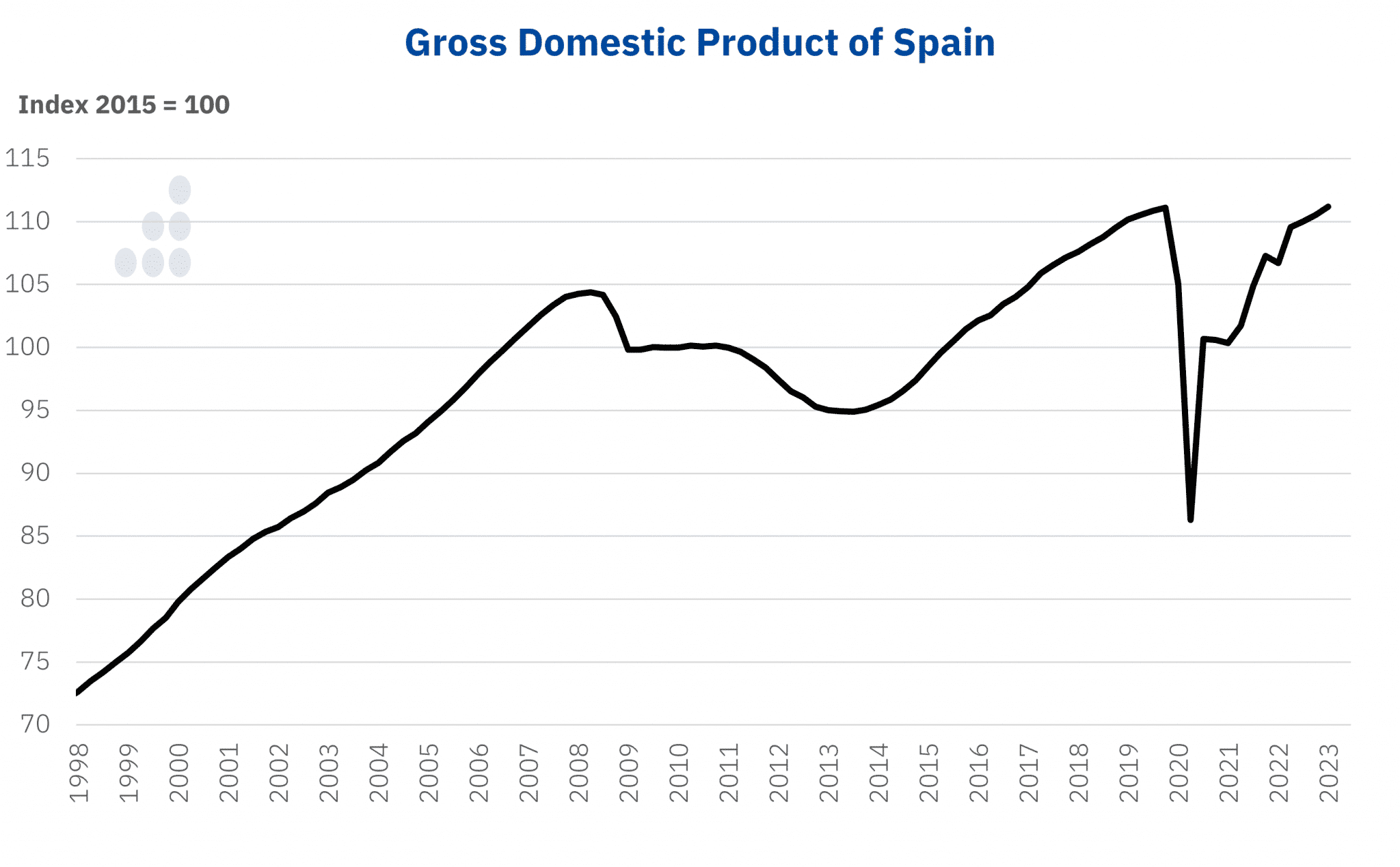

Once the first half of 2023 is over, how do you see the economy evolving after the COVID crisis and the most critical part of the energy crisis has passed?

The Spanish economy has evolved very favourably during this first half of the year, especially if we compare it with other European countries. GDP has grown by 4.2%, year‑on‑year variation, and inflation is below 2%. In the case of electricity market prices, the monthly values are still high, around €90/MWh, but with levels of the summer of 2021, leaving behind the high prices of 2022.

Source: Prepared by AleaSoft Energy Forecasting using data from the INE.

Source: Prepared by AleaSoft Energy Forecasting using data from the INE.

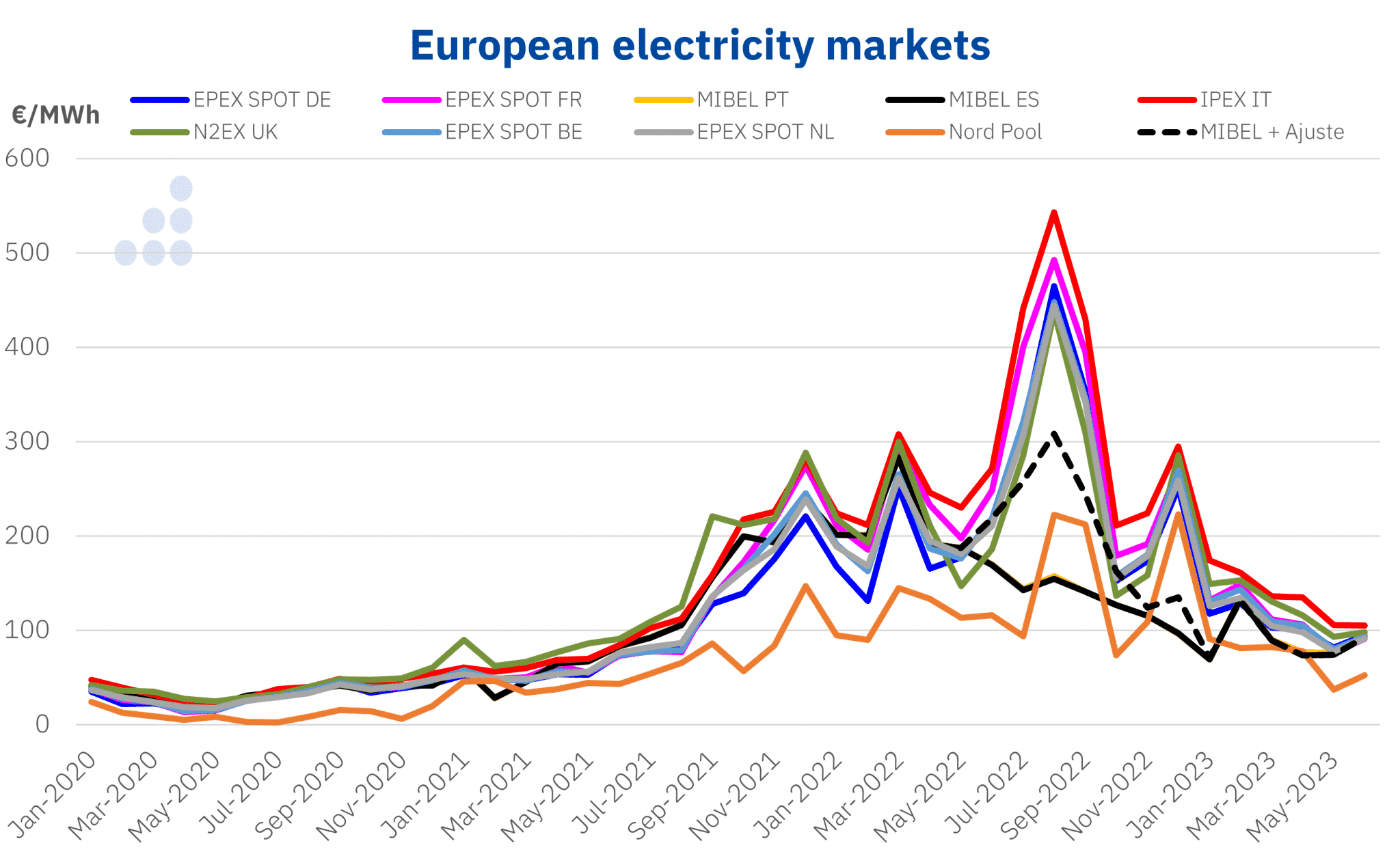

Finally, in the first part of the year European electricity markets prices began to move away from last year’s highs. What happened? Can the energy crisis return?

Indeed, during the first part of 2023 prices fell and, as a result, the average price for the first half of the year was the lowest since the second half of 2021.

The fundamental cause of this decline is gas prices, which fell thanks to the high levels of European reserves. The increase in photovoltaic and wind energy capacity also helped, resulting in record productions during the first half of the year in several European markets, as well as the drop in electricity demand.

In the summer months, if there are heat waves that increase the electricity demand for cooling or that cause nuclear shutdowns, especially in the French ones, a small energy crisis cannot be ruled out.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

What price behaviour do you expect at AleaSoft in the second half of the year?

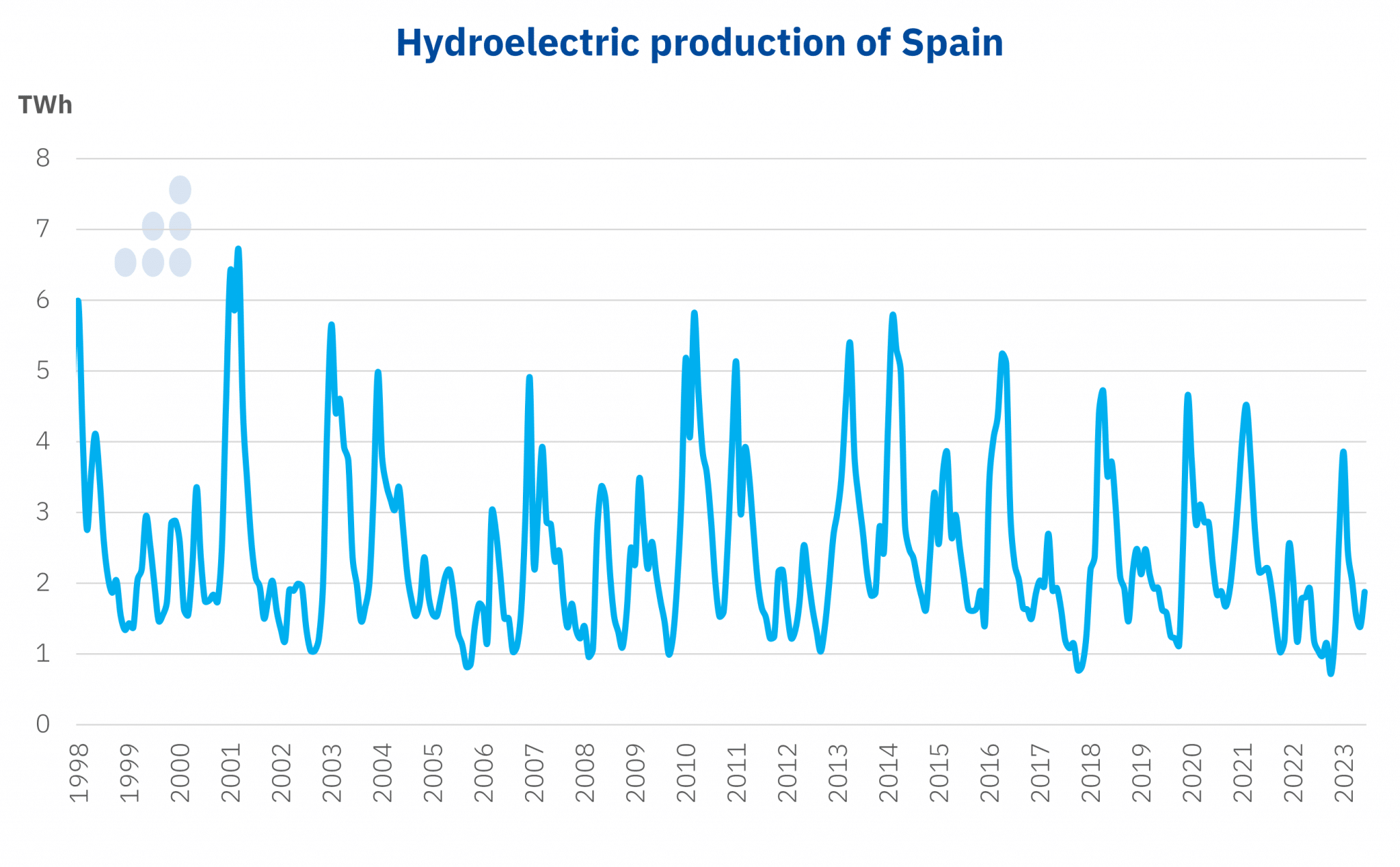

It will depend on several factors. First, it depends on the evolution of gas and CO2 prices, which directly impact electricity markets prices. Also, as I mentioned before, if there are heat waves, the demand will increase, which will also push prices up. Likewise, it should be considered that hydroelectric production may be affected if the drought worsens.

In the second half of 2023, we expect monthly prices to be between €90/MWh and €100/MWh in the summer and autumn months and to exceed €100/MWh in November and December.

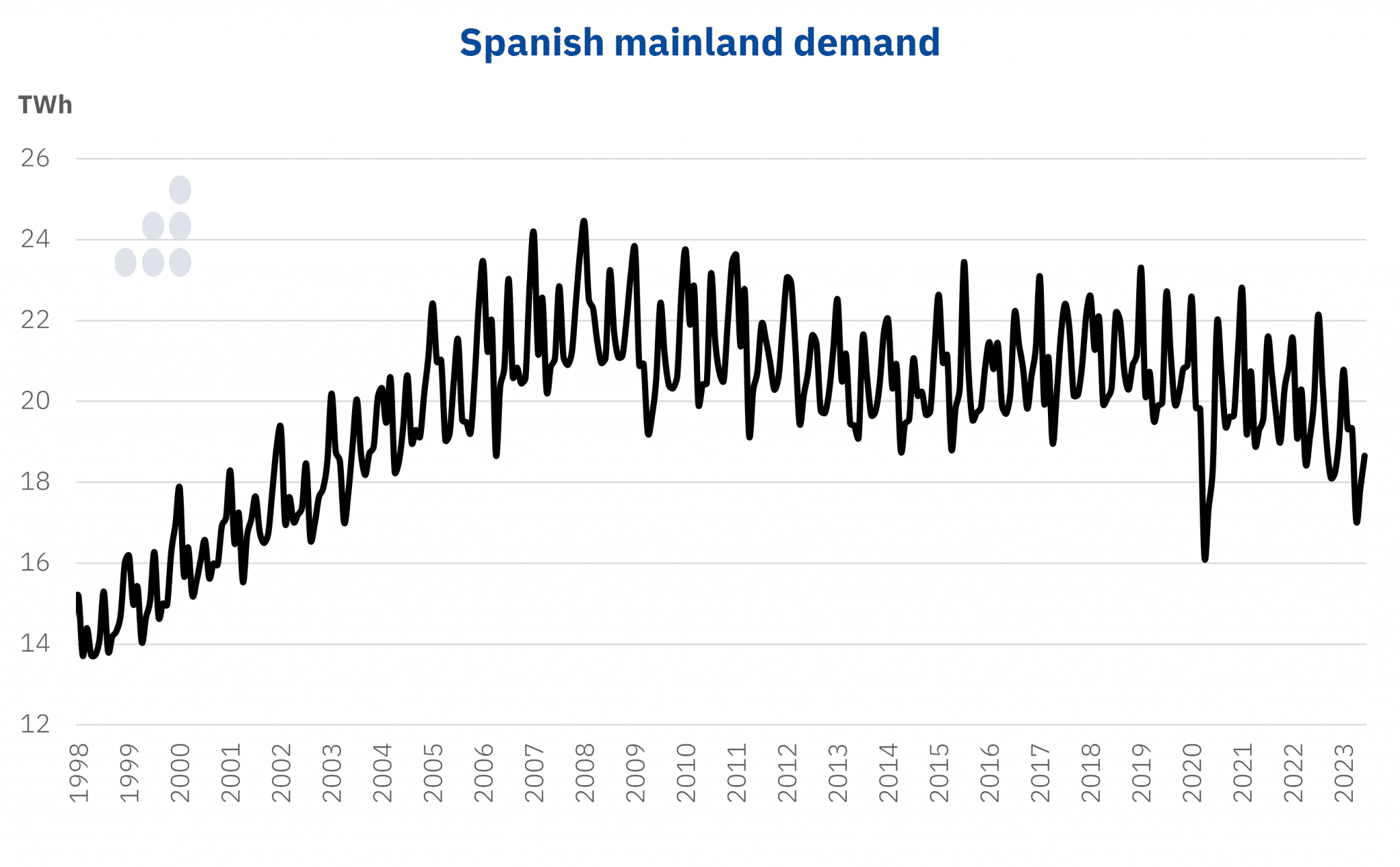

Also in the first half of the year electricity demand was low. Can it come back?

Yes, for example, if the drop in demand during the confinement period of the COVID crisis is not taken into account, in 2020, the electricity demand of Mainland Spain in April of this year was the lowest in more than two decades.

This drop in demand is due to several factors. Winter and spring temperatures were milder than usual for those times, industry demand fell due to high energy prices in 2022, and self‑consumption and energy efficiency increased.

We expect demand to be higher in the second half than in the first if temperatures are at average levels. The increase could be greater if there are heat waves in summer or cold waves in winter.

Industrial demand should gradually recover as market prices drop and PPA prices drop.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

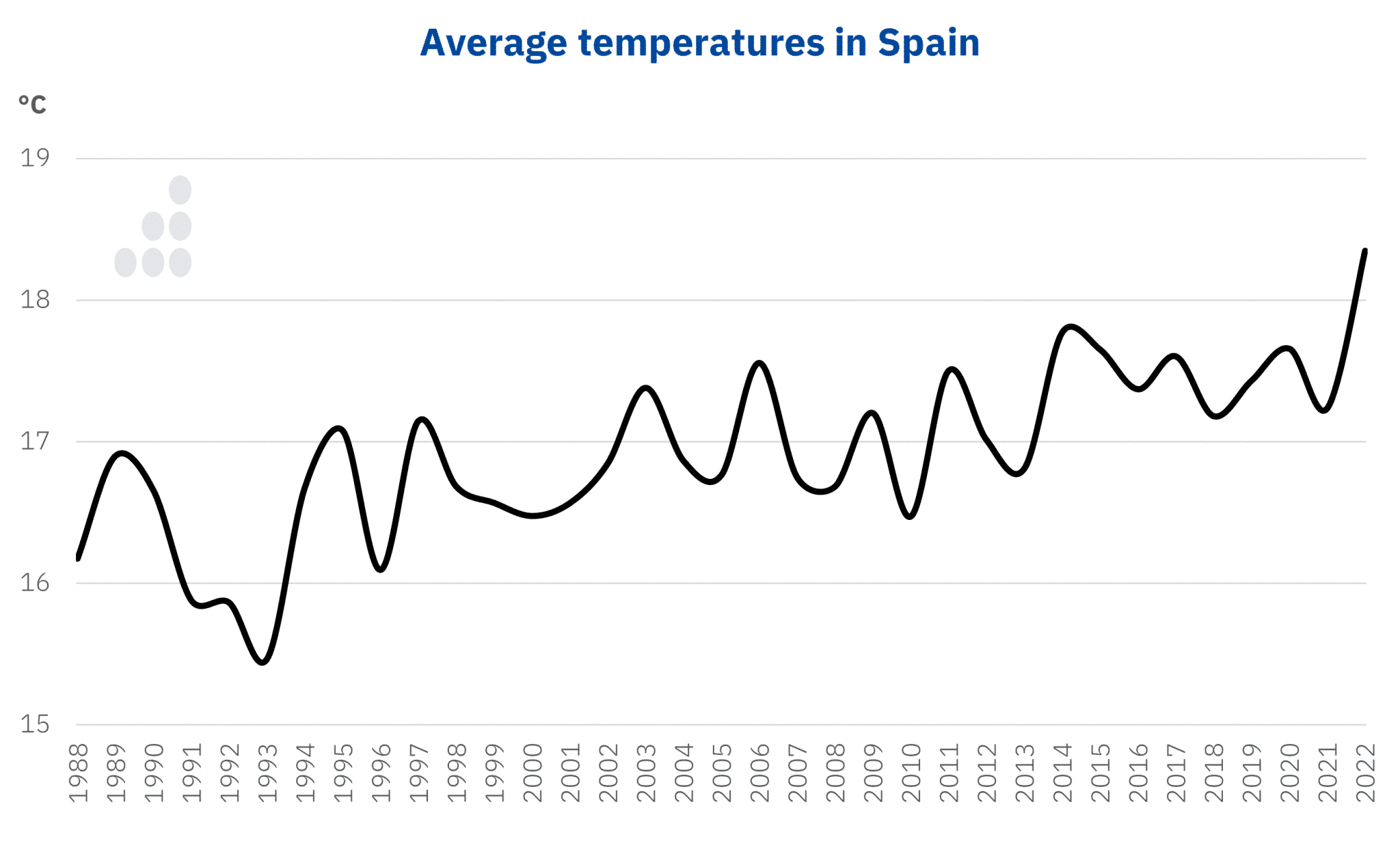

With climate change, more frequent episodes of high temperatures and drought are taking place. What will happen in summer if there is a lot of heat and less hydroelectric production?

As you say, we are already noticing the effects of climate change. The year 2022 was the warmest in Spain since registered history. It was also the sixth driest year since the 1960s.

Source: Prepared by AleaSoft Energy Forecasting using data from public sources.

Source: Prepared by AleaSoft Energy Forecasting using data from public sources.

In addition, the scientific community recently officially agreed that we are under El Niño phenomenon, which is associated with increased temperatures and extreme weather events of heavy rain in some regions and drought in others.

Although with global warming even the extreme values of previous years of El Niño and La Niña have been diluted. Now we will have more heat like in the worst El Niño years and more drought like in the worst La Niña years.

The State Meteorological Agency (Aemet) estimates that there is a probability between 60% and 70% that temperatures will be above average values in July, August and September, and that there is a 50% probability that rains above average will occur in large areas of the Peninsula and the Balearic Islands.

The summer will be very hot, with more electricity consumption for cooling. If forecasts for increased rainfall are not met, the drought will also contribute to high prices. In addition, we will not only have hotter summers but longer ones, that is, more summer days. This will continue for years to come, perhaps worse, if greenhouse gas emissions do not decrease.

It is necessary to be careful with heat waves, especially older people and those who work outdoors. It’s essential to hydrate and avoid being in the sun for long time.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

How do you see the development of renewable energy in Spain?

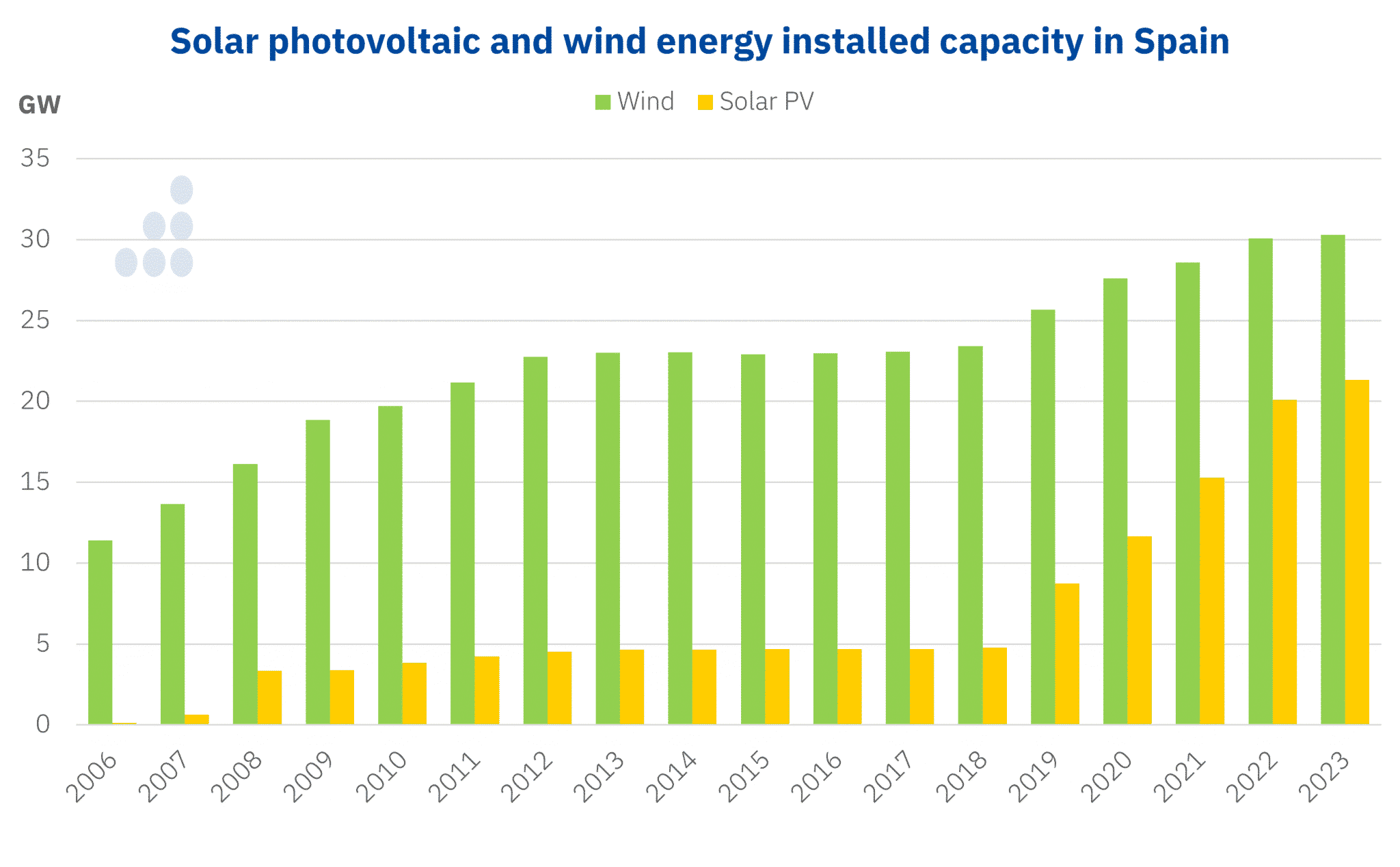

In recent years it has been very positive. From the end of 2018 to the beginning of July 2023, the installed capacity of solar photovoltaic energy has increased by 349% in Spain as a whole, according to data from Red Eléctrica de España (REE), and wind energy by 29%, although the development of wind energy started earlier. In the coming years both will continue to grow.

The development of wind and photovoltaic energy is essential for our country, not only to achieve decarbonisation, perhaps it is more important to achieve energy independence and move from energy importers to exporters.

The State must provide complete assistance to the renewable sector to guarantee the necessary future investments.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

Do you believe that the drop in prices in the first half of 2023 and that prices close to zero in solar hours have started to happen, as well as renewable energy curtailments, is causing nervousness among renewable energy developers?

When speaking with clients and in general with agents in the sector, they have conveyed their concern about this situation to us. We come from 2022 where prices were extraordinarily high and many expected them to continue like this, partly motivated by overly optimistic market price forecasts provided by some consultants.

In addition, in recent months prices have been close to zero during daylight hours on days with lower demand, especially in spring, which worries the photovoltaic energy sector. This is in addition to the curtailments of renewable energies that have been occurring. Yes, all of this makes developers and investors in renewable energy nervous. We have gone in a few weeks from euphoria of high prices in 2022 and in the future to a more realistic scenario and great concern about the lack of renewable demand and storage.

And what do banks think? Will they continue betting on renewable energies? Have you seen any change in trend in the financing of renewable energy projects and in PPA in 2023 considering how the first part of the year was?

Banks recognise that the future is renewable and continue to bet on its development. It must also be taken into account that prices in the Spanish electricity market have fallen, but the average for the first half of the year was higher than €80/MWh, an unthinkable value until the beginning of 2019. What can happen is that interest stops by merchant projects and that PPA gain more relevance as an alternative to finance renewable energy projects. Also in recent months there has been a greater tendency for banks and investors to invest in wind energy than in photovoltaic energy.

Do you see a high risk of zero or negative prices and renewable curtailments in the Spanish electricity system of the coming years, based fundamentally on renewable energies?

Yes, there are going to be near‑zero prices and curtailments, but not on a sustained basis. We see negative prices in the daily market as unlikely.

The electricity market is in equilibrium and if there are hours when prices are lower, the demand will move towards those hours. But it is necessary that the Government take measures that help to displace the demand. For example, it is urgent that the tariff periods be changed so that the lowest prices are located in the solar hours and thus encourage consumption during these hours. It is also necessary to encourage the purchase of electric vehicles, implement direct aid and a capacity market to help battery projects, improve the infrastructure of the transmission and distribution grid to avoid or reduce curtailments and it is necessary to plan and develop the infrastructures to produce, store and distribute green hydrogen, ammonia and methanol.

It is strategic for the industry to switch from consuming polluting and imported fossil fuels to consuming electricity from renewable sources produced in the country.

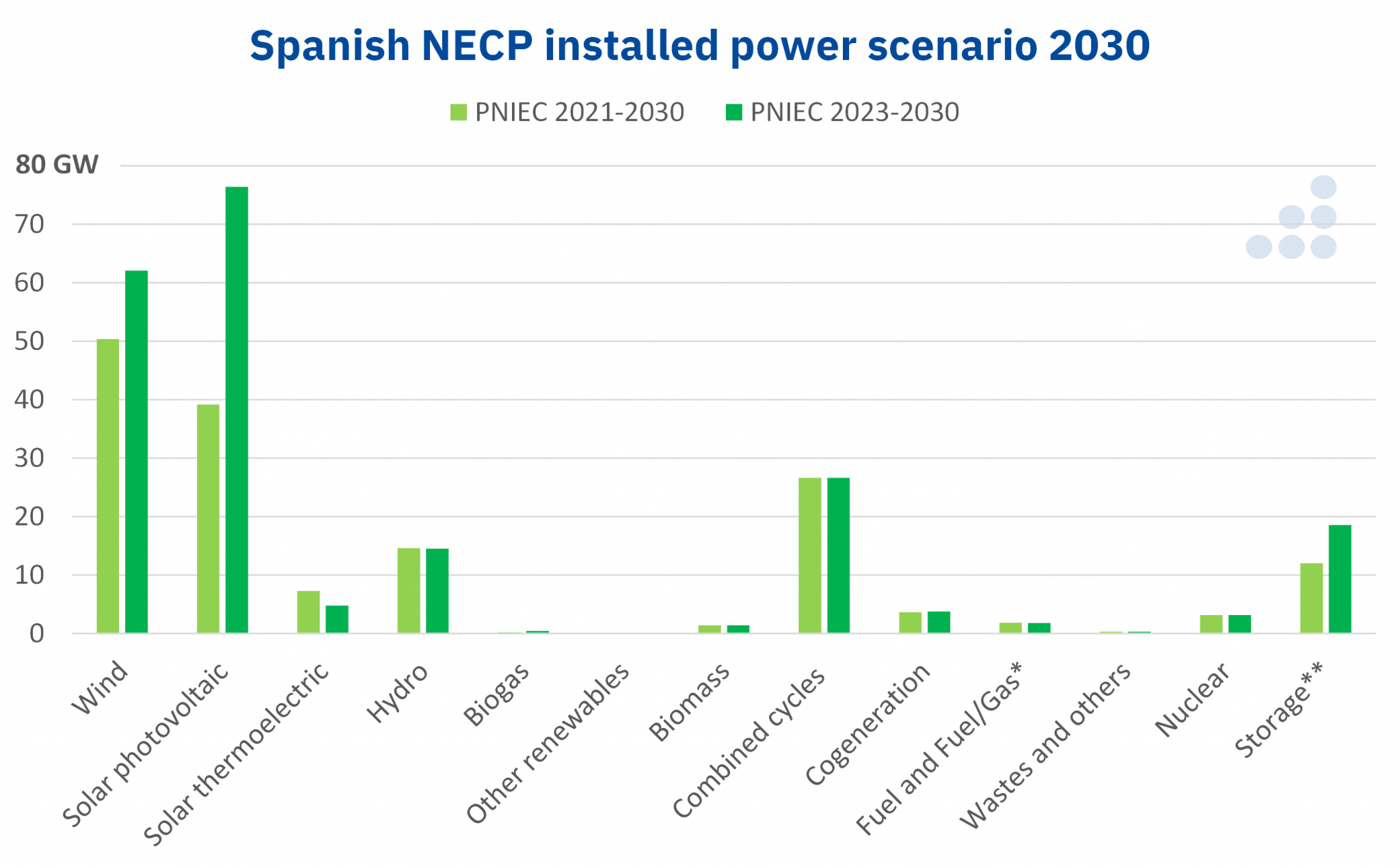

The Government recently published the draft of the new version of the NECP. What do you think? What is being said in the sector?

This draft update of the NECP has as positive the commitment to renewable energies, especially solar photovoltaic and wind energy, by proposing an increase in the objective to 2030 in line with the expectations of the main renewable associations and with the potential of Spain to develop these technologies. The prominence given to self‑consumption, energy storage, green hydrogen and biogas is also very significant. But we see that there is a lack of ambition in the objective of increasing electricity demand, something that is essential to accommodate all the new renewable energy capacity that is aspired to.

The opinions that we have heard from the sector are more or less along these lines, because it will not be possible to advance adequately in the development of renewable energies without increasing the green energy demand.

And, on the other hand, the ambition of this plan must be translated into a well‑thought‑out and planned roadmap, which meshes all the elements in an orderly manner so that it is possible to achieve the fundamental objectives, which are the decarbonisation of the economy and the energy independence from abroad.

Trillion‑euro investments are required to achieve the final objectives of decarbonisation and energy independence, but the investments must be profitable and there must be absolute legal certainty.

Source: Prepared by AleaSoft Energy Forecasting using data from the NECP.

Source: Prepared by AleaSoft Energy Forecasting using data from the NECP.

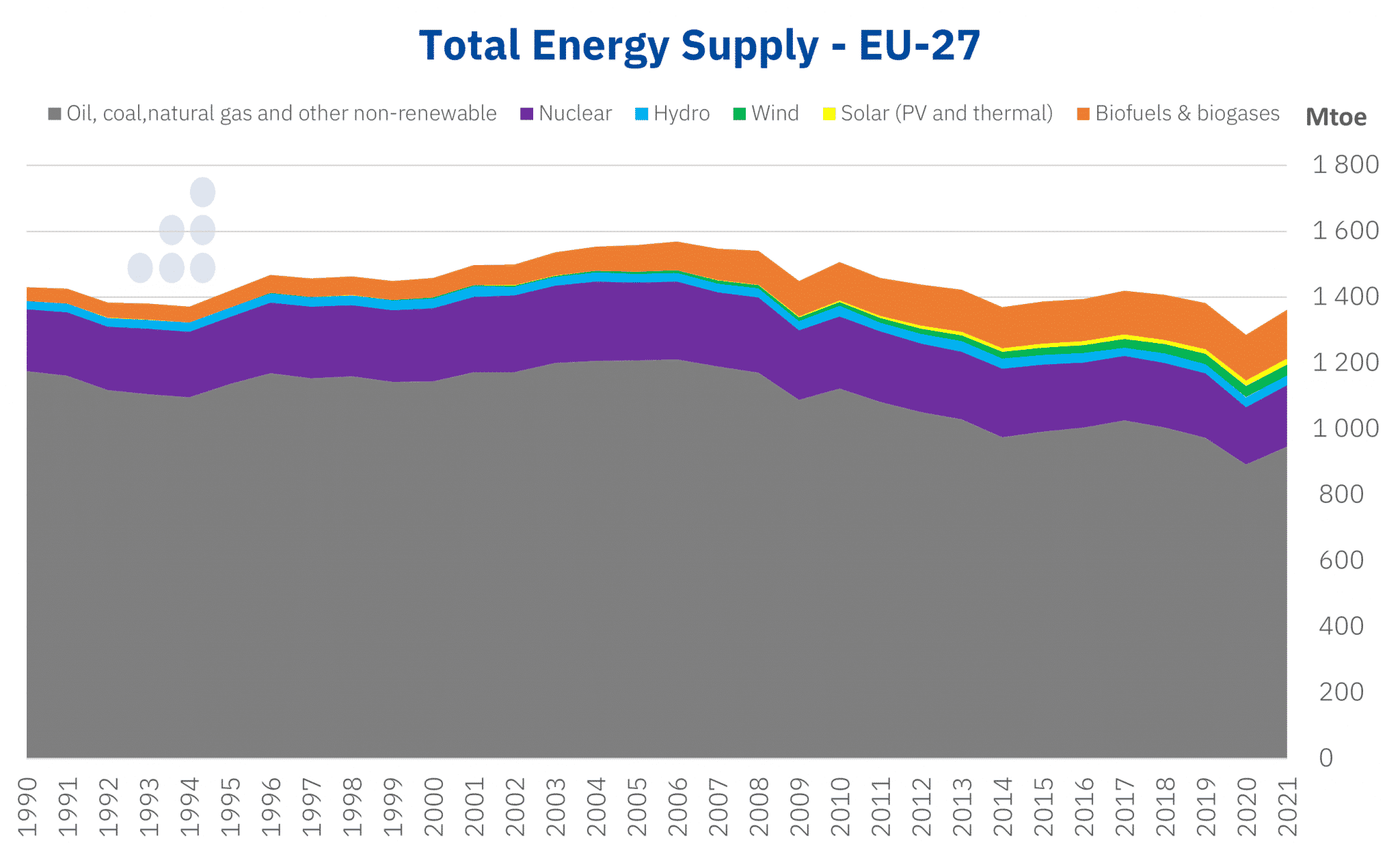

In the NECP, much more prominence is given to photovoltaic and wind energy than they had until now, and self‑consumption, energy storage, green hydrogen and biogas, for example, are gaining weight. Are these vectors enough to carry out the energy transition?

These vectors are fundamental, without a doubt, but the energy transition will require a radical change in the way we produce and consume energy that will require other vectors. For example, the demand for renewable energy. There is great concern in the wind and renewable sector due to the lack of green demand. We all know that if renewable energy production increases and consumption does not increase, prices sink and investments are no longer profitable. At this time, the NECP must place more emphasis on how to increase demand and storage in an objective and credible way.

In addition, the demand for renewable energy will help decarbonise the economy as a whole, not just the electricity sector, which is vital because 70% of final energy consumption in the European Union comes from fossil fuels.

Source: Prepared by AleaSoft Energy Forecasting using data from the INE.

Source: Prepared by AleaSoft Energy Forecasting using data from the INE.

It is also important to prepare the electricity transmission and distribution grids to avoid congestion when transporting renewable energy to the points of consumption and thus avoid curtailments.

Another fundamental vector is international interconnections. Spain and the Iberian Peninsula in general is an energy island and it is necessary to increase the interconnection capacity with the rest of Europe in order to become exporters of renewable energy.

Smart grids will also be essential to manage a more decentralised generation and a more flexible demand.

The Capture, Use and Storage of CO2 (CCUS) will be necessary to help to decarbonise some industrial sectors in which it is difficult to do it in other ways, such as steel, iron or cement.

Last but not least, regulation. Adequate, stable and non‑interventionist regulation, which responds to an orderly renewable energy development strategy, is essential to attract investment and encourage the development of all vectors that will make the energy transition possible.

What is necessary for energy storage and green hydrogen to take off in Spain?

Batteries and green hydrogen are not yet competitive without aid, and pumping stations are projects that take a long time to develop. Therefore, they need support instruments to get them off the ground, for example with a capacity market or direct aid.

In addition, in the case of storage, they should be given priority when granting access permissions to the grid because they are technologies that are urgently needed.

In the case of hydrogen, all necessary infrastructures to produce, transport and store it must be planned and developed ahead of time. Likewise, green hydrogen linked to green industrial consumption must be developed, such as the production of green ammonia or methanol.

Artificial Intelligence is becoming more and more fashionable and the applications and processes that use it are on the rise. As a PhD in Artificial Intelligence and as CEO of a pioneering company in the use of Artificial Intelligence, what opportunities and threats do you see in the coming years in the use of this technology?

Artificial Intelligence only offers advantages and opportunities, in a way it is like a higher stage of computing and no one has ever cared about all that computing has been doing and all the advances we have made thanks to it. With Artificial Intelligence, the productivity and quality of any activity will greatly increase.

Generative Artificial Intelligence will allow the creation of new content and that will bring exponential development in all areas. The world we will have in five years will be very different and better than the current one in large part thanks to Artificial Intelligence.

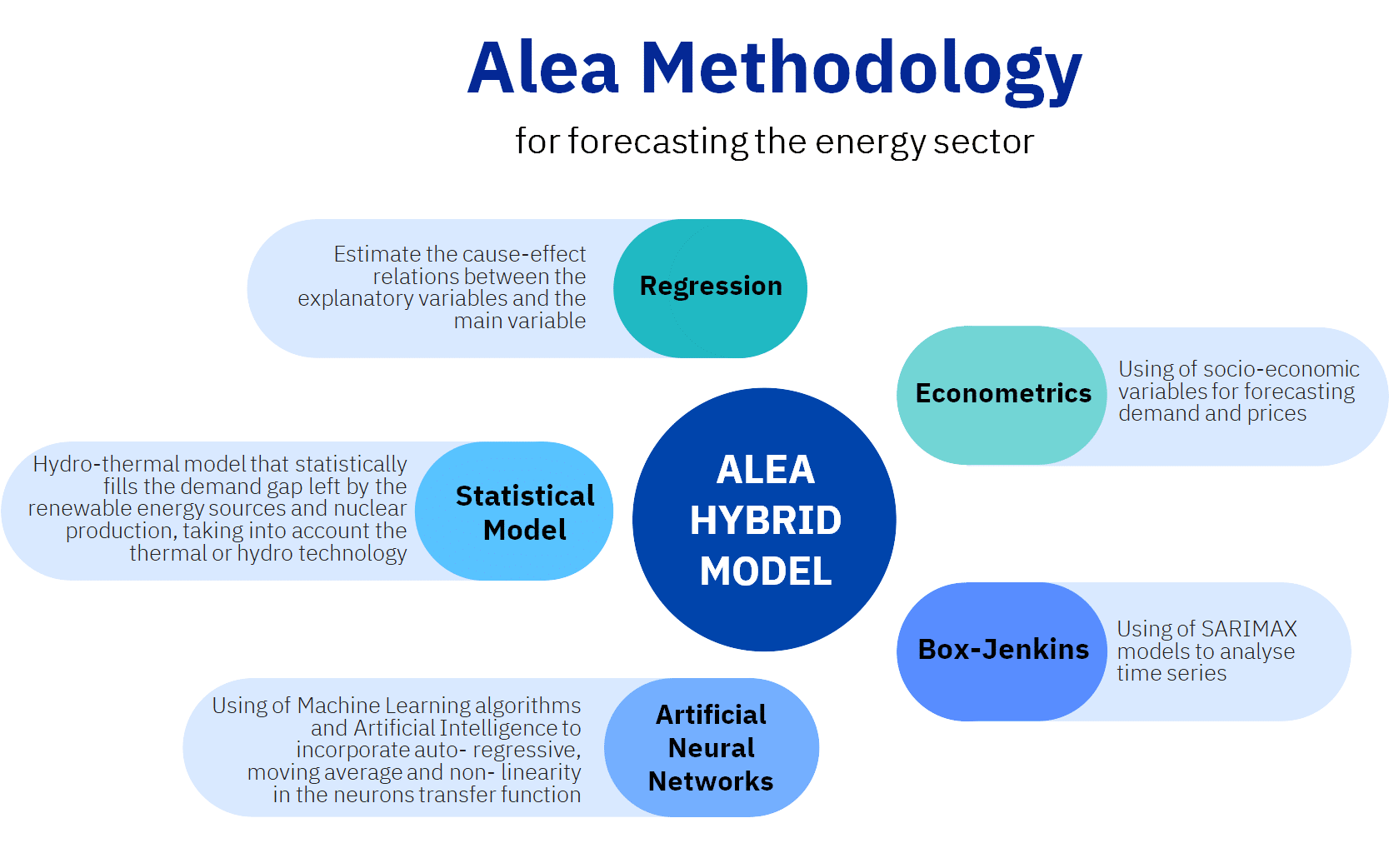

The forecast models that you have been carrying out for more than 24 years use a hybrid methodology that combines Artificial Intelligence techniques and classical statistics. How do these models behave for long‑term forecasts?

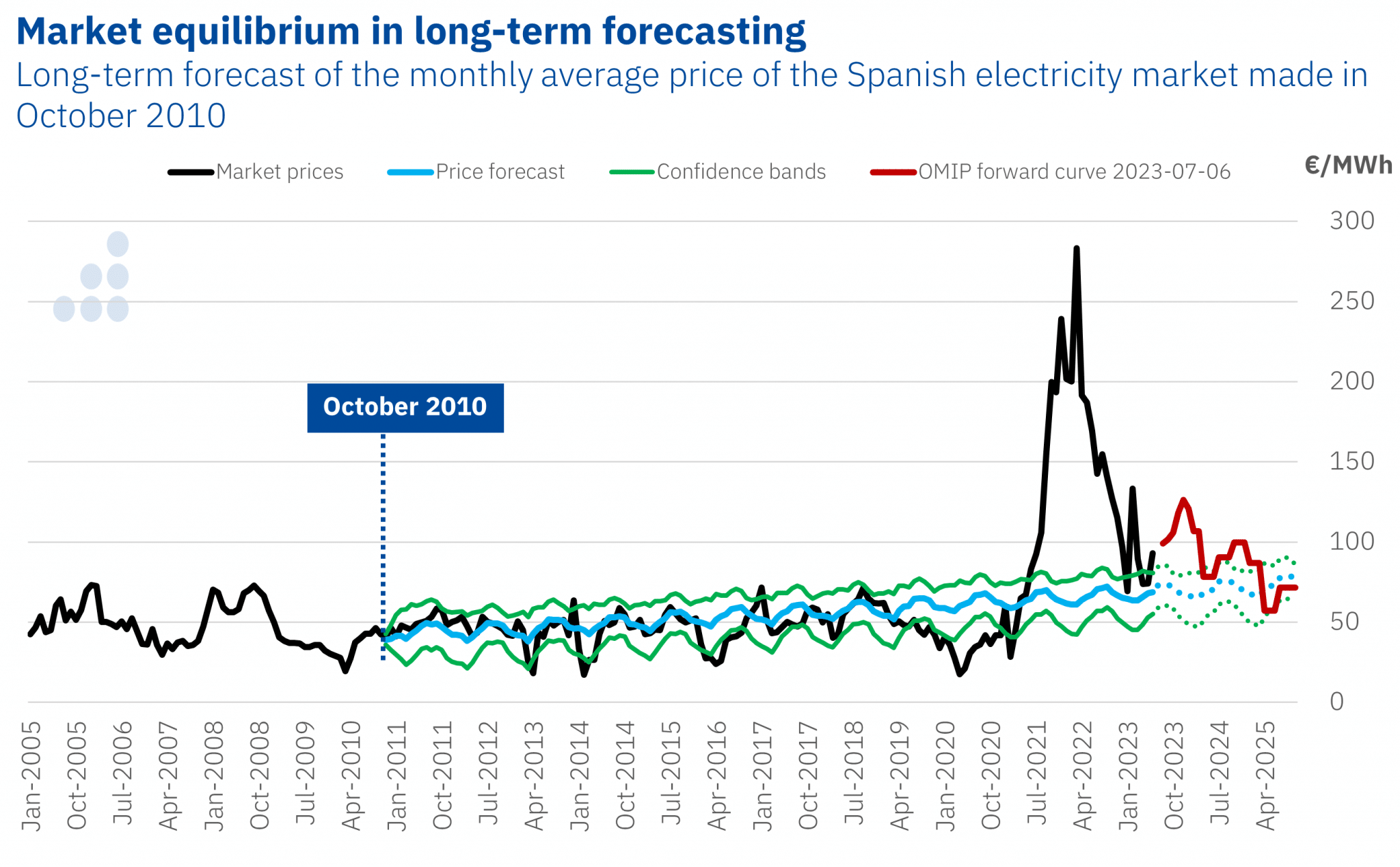

There is a saying that says that a picture is worth a thousand words, so to answer this question I will show the graph of a long‑term price forecast for the Spanish electricity market that we made in October 2010. In the graph it is possible to see how the Alea methodology was able to capture the market equilibrium and project prices into the future, even when the electricity generation mix at the time the forecast was made was very different from the current one.

Source: AleaSoft Energy Forecasting.

Source: AleaSoft Energy Forecasting.

The scientific basis of the Alea methodology makes the forecasts robust and consistent, which has helped us earn the trust of our clients.

Source: AleaSoft Energy Forecasting.

Source: AleaSoft Energy Forecasting.

We have also seen that you use probabilistic metrics in long‑term markets price curves forecasting. Can you explain to us what they consist of and what advantages they have? What are the AleaLow?

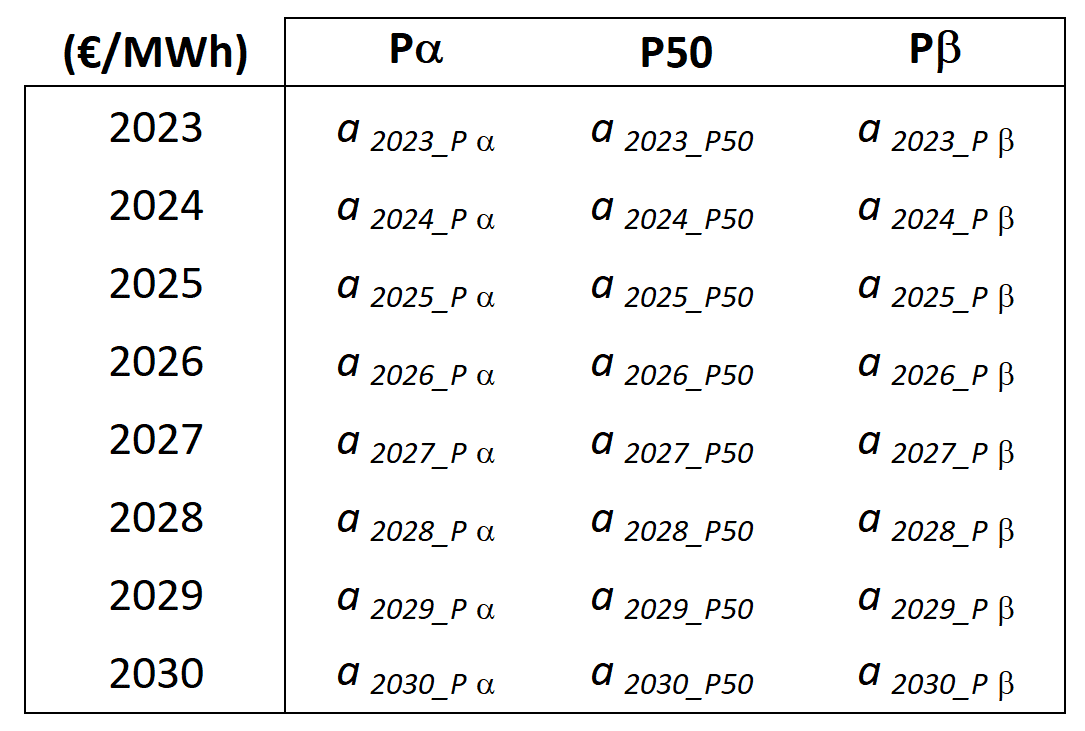

Probabilistic metrics allow estimating long‑term price fluctuations with an associated probability, something that is essential for investment risk management. With probabilistic metrics, market prices are analysed as stochastic processes and their probability distribution is determined from simulations of the explanatory variables. In this way, the confidence bands can be obtained, which represent the probability that the price exceeds or remains below a determined value for each year of the horizon.

Source: AleaSoft Energy Forecasting.

Annual confidence bands for different Pa and Pb probabilities included in AleaSoft’s long term market price curve forecasting service, in addition to the central P50 forecast

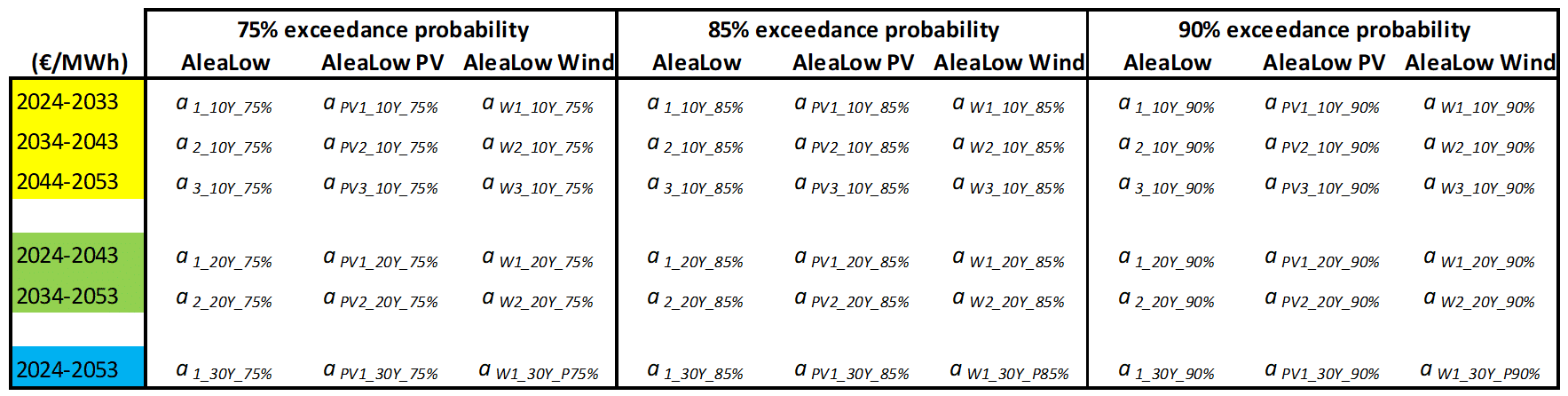

The AleaLows are another probabilistic metric included in AleaSoft’s long‑term price forecasting service, which estimate a price for which there is a specific probability that the average market price during the entire forecast horizon, or a set of years, is greater than this value. In the financing of renewable energy projects, the AleaLow allow the financial entity to determine the feasibility of the project being able to repay the debt within the required period. The AleaLows are calculated both for the market price and for the prices captured by solar photovoltaic (AleaLow PV) and wind energy (AleaLow Wind).

Source: AleaSoft Energy Forecasting.

Source: AleaSoft Energy Forecasting.Table with the AleaLow, AleaLow PV and AleaLow Wind for various sets of years of the AleaSoft’s long term market price curve forecasting service

It will soon be two years since AleaGreen was created, the AleaSoft division specialised in long‑term market price curves forecasting. How have you been?

It has been a success to create this division specialised in long‑term price curves forecasting and complementary services related to consultancy in renewable development, helping to finance projects, PPA, M&A, risk management and intermediation in PPA and renewable assets.

We have grown considerably, covering more and more markets, for example, all Europe and more specialised services.

We are dedicating a lot of R&D resources and we are growing with highly qualified personnel.

What other services does AleaSoft offer? How do you see the future prospects of AleaSoft and AleaGreen?

The main services are related to price forecasts in all time horizons: in the short, medium and long term, which is what AleaGreen does.

In addition to electricity markets price forecasts, we do forecasts for all variables on which the price depends: demand, renewable energy production, etc.

A complementary service that we offer is Alea Energy DataBase, a compilation of all necessary data in the energy sector and that must be kept updated as part of the digitalisation process.

At AleaGreen, in addition to generating a long‑term price curve forecasting report, we help our clients to find counterparties in the search for PPA and in renewable assets.

We currently offer all these services for all European markets and we are working to have them ready for the main markets of the American continent and some important markets of Asia.

The future vision of AleaSoft and AleaGreen is to be a world reference in the sector of forecasting and consulting to support the development of renewable energies on all continents.