AleaSoft Energy Forecasting, March 1, 2023. In February, the decrease in wind energy production and the increase in CO2 prices led to monthly price rises in European electricity markets. However, the drop in gas prices and demand in most markets, as well as the increase in solar energy production, allowed the year‑on‑year drop in prices. On the other hand, Brent and TTF gas futures prices fell, while CO2 futures prices increased, reaching record values of over €100/t.

Solar photovoltaic and thermoelectric energy production and wind energy production

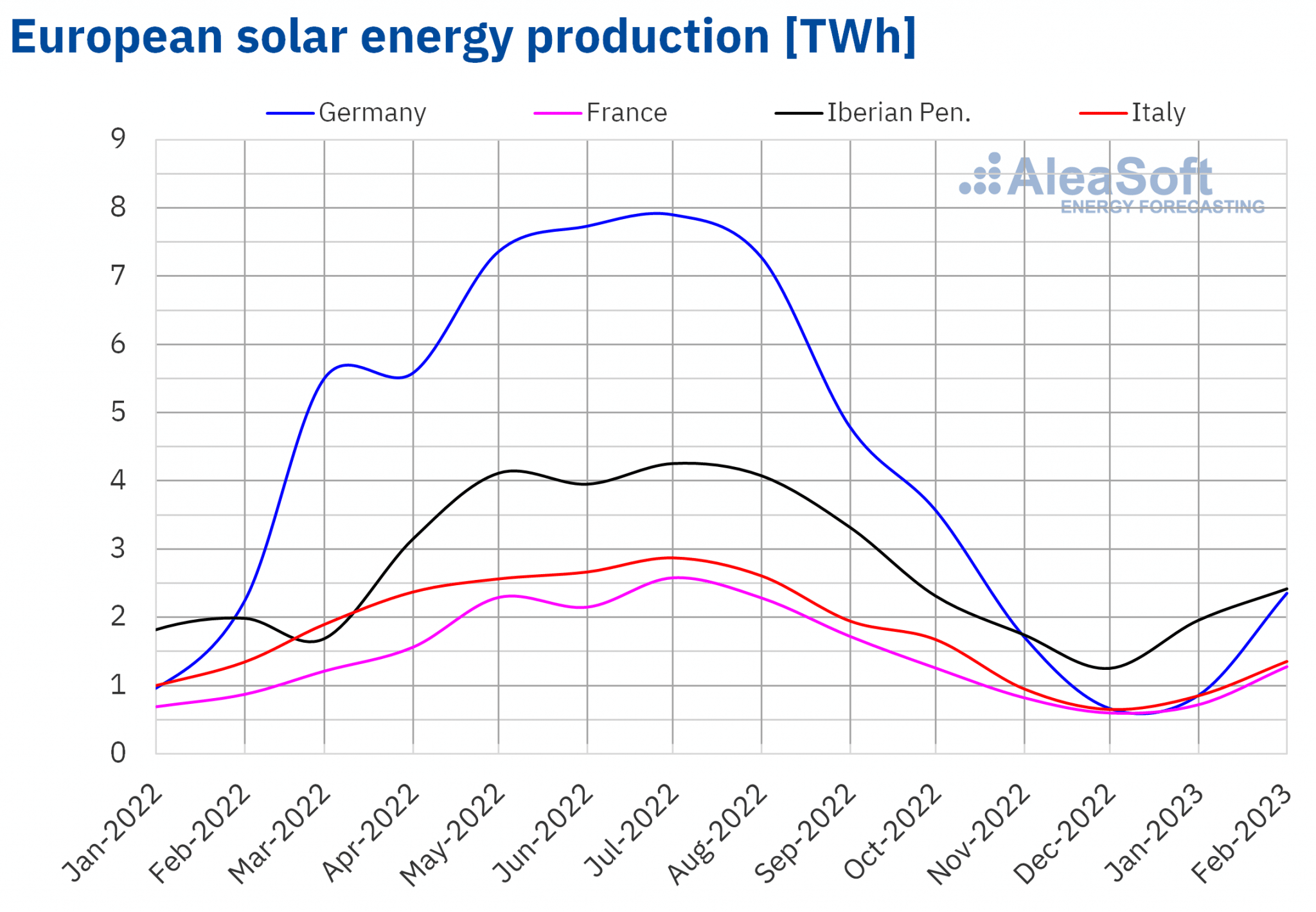

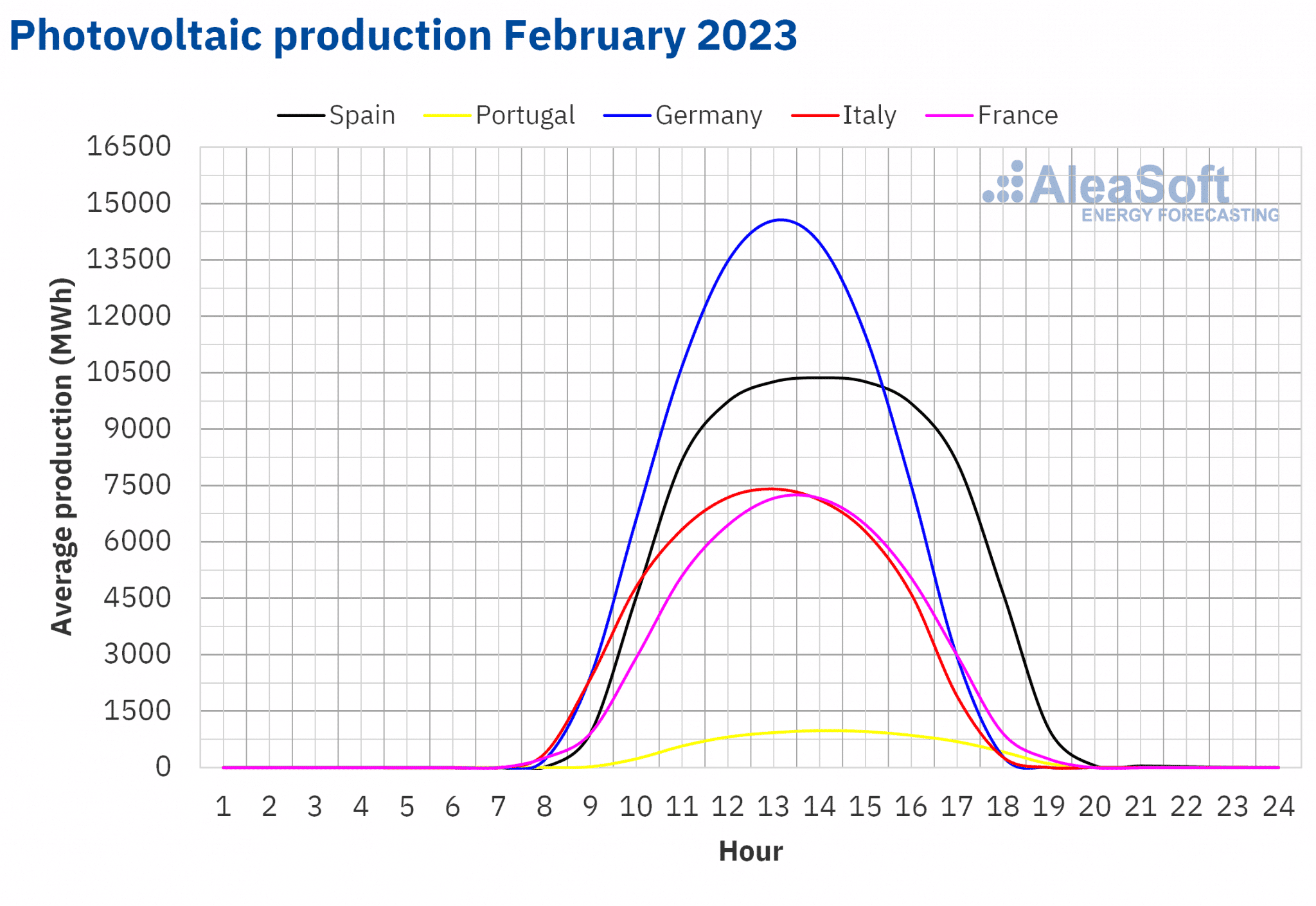

The solar energy production increased in February 2023 in year‑on‑year terms in all markets analysed at AleaSoft Energy Forecasting. The largest rise was that of France, of 47%, while in the markets of Spain and Portugal, the increases were 20% and 13%, respectively. On the other hand, in the markets of Italy and Germany, the smallest increases in production were registered, of 0.7% and 5.3%, respectively.

In the comparison with January 2023, the solar energy production for February also increased in all analysed markets. In this case, the largest rise was that of Germany, which reached 204%. The increases in production in France, Italy and Spain were also important, of 96%, 77% and 40%, respectively. On the other hand, the smallest increase, of 6.9%, was registered in the Portuguese market.

According to data of REE, in February 2023, the increase in solar photovoltaic energy capacity of Mainland Spain compared to the installed capacity at the end of January was 324 MW, 1.7% in percentage terms.

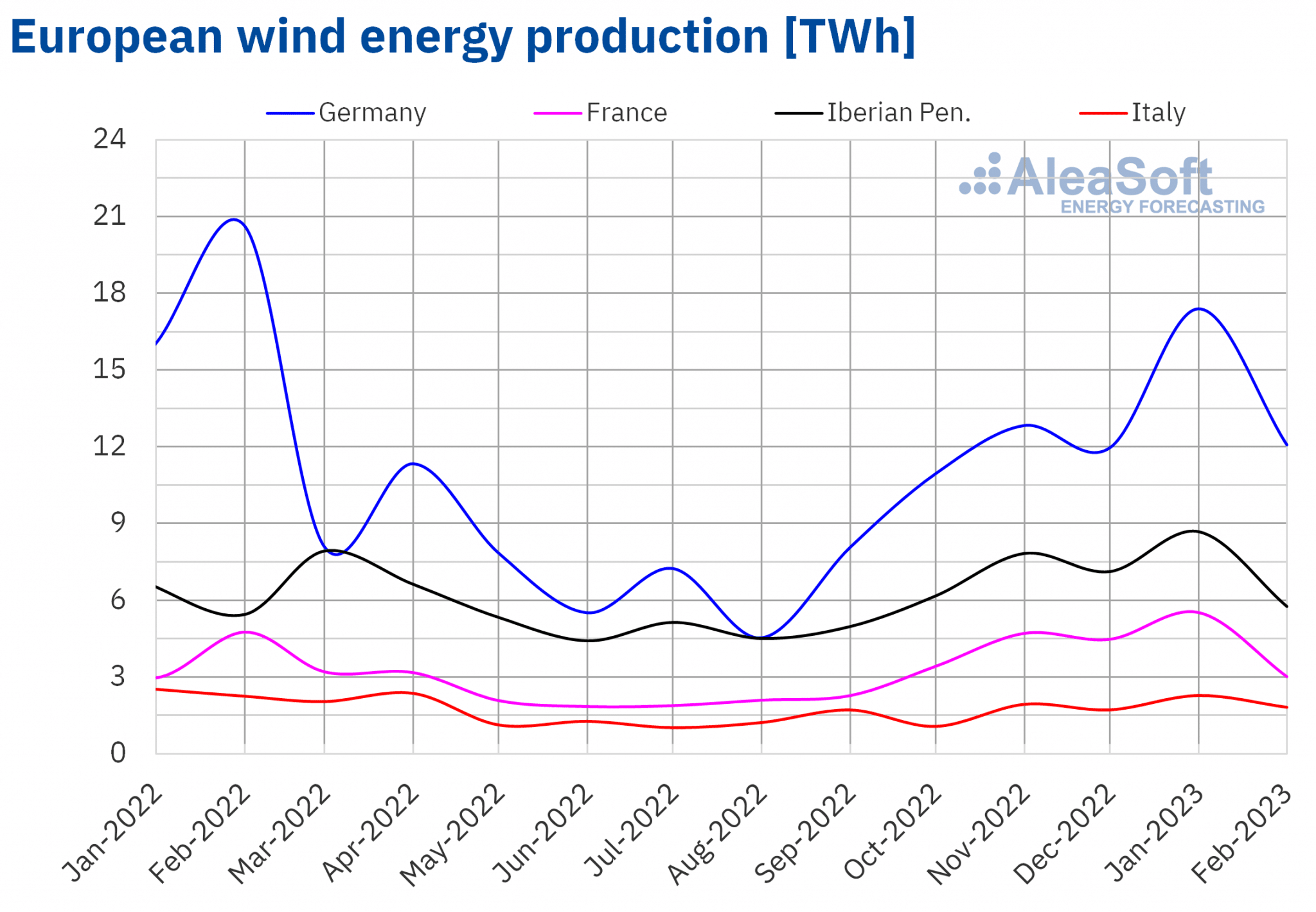

In the case of the wind energy production of February 2023, there was a significant year‑on‑year rise in the Portuguese market, of 30%. But in the rest of the markets analysed at AleaSoft Energy Forecasting there were decreases. In the case of the Spanish market, there was a slight reduction compared to the production of the same month of the previous year, of 0.1%. On the other hand, in the markets of Italy, France and Germany the decreases reached 19%, 37% and 42%, respectively.

The production of February fell in all analysed European markets compared to that of the previous month. The smallest decrease, of 7.0%, was that of the Portuguese market, followed by that of the Italian market, of 12%. In the case of the German and Spanish markets, the decreases were 23% and 30%, respectively, while the French market registered the largest drop, of 39%.

On the other hand, according to data of REE, in February 2023 the wind energy capacity increased in Mainland Spain by 18 MW, 0.06%, compared to the capacity installed at the end of January.

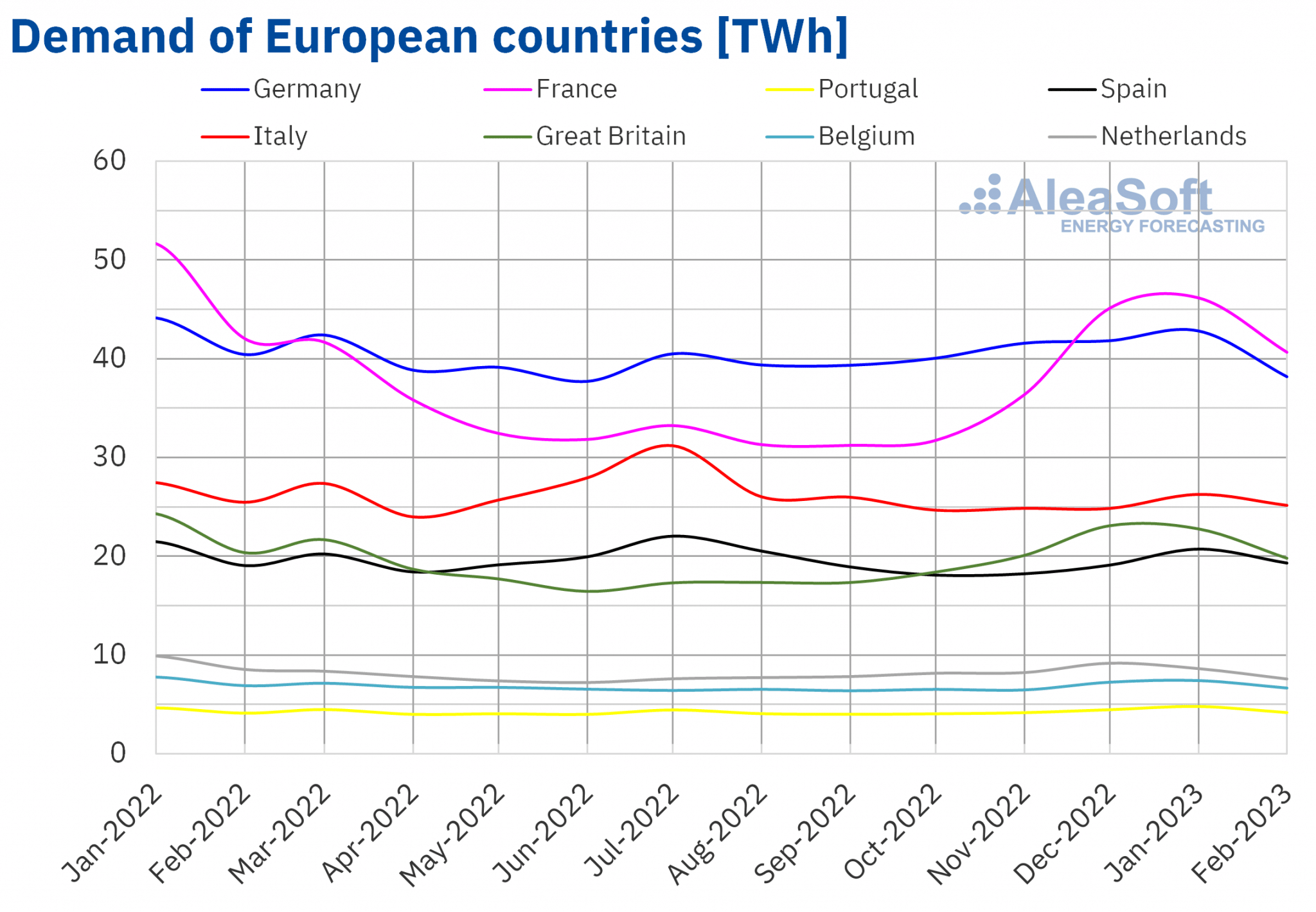

Electricity demand

During the month of February 2023, year‑on‑year decreases in electricity demand were registered in most European markets. The exceptions were the Spanish and Portuguese markets with increases of 1.2% and 1.5%, respectively. On the other hand, the largest fall was that of the Dutch market, of 11%. In the rest of the analysed markets, the year‑on‑year decreases in electricity demand were between 1.2% of the Italian market and 5.6% of the German market.

Compared to January, the electricity demand also decreased in most analysed markets. In this case, the exceptions were the markets of Spain and Italy, where the demand increased by 3.2% and 6.1%, respectively. On the other hand, the largest falls in electricity demand compared to the previous month, of 3.5% and 3.7%, were registered in Portugal and Great Britain, respectively. In the rest of the markets, the decreases in electricity demand were between 0.5% of the Belgian market and 2.7% of the Dutch market.

The drop in electricity demand in February compared to the previous month was influenced by a slight increase in average temperatures in most markets. The maximum increase in average temperatures, of 1.4 °C, was that of Great Britain, where the maximum drop in demand compared to the previous month was reached.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

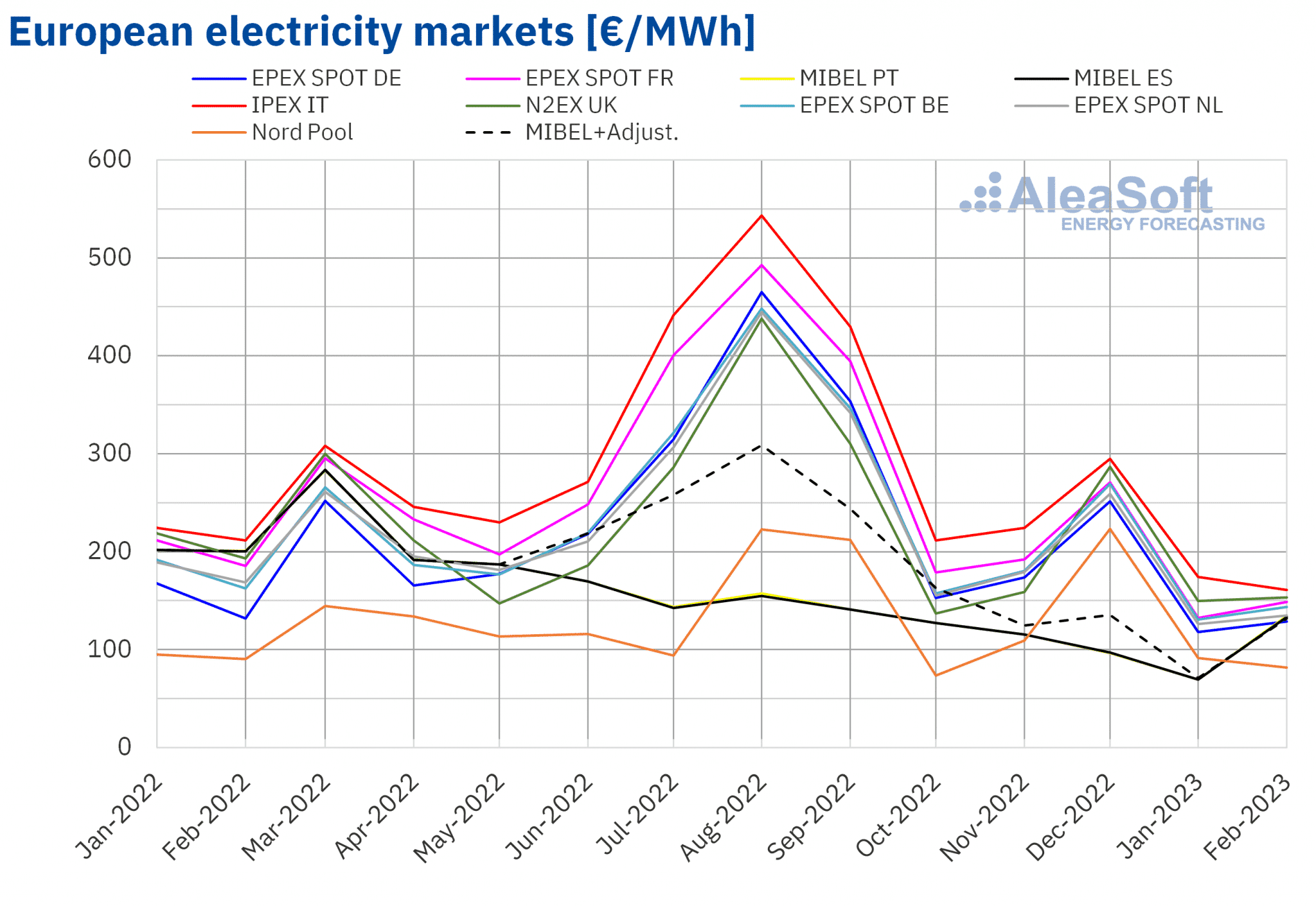

In the month of February 2023, the monthly average price was above €130/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the averages of the Nord Pool market of the Nordic countries and the EPEX SPOT market of Germany, of €81.61/MWh and €128.75/MWh, respectively. On the other hand, the highest monthly price, of €161.07/MWh, was registered in the IPEX market of Italy. In the rest of the markets, the averages were between €133.47/MWh of the MIBEL market of Spain and €153.08/MWh of the N2EX market of the United Kingdom.

Compared to the month of January, in February the average prices rose in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the Italian market and the Nordic market, with decreases of 7.7% and 11%, in each case. On the other hand, the largest rises, of 92% and 94%, were registered in the markets of Spain and Portugal, respectively. The rest of the markets registered price increases of between 2.3% of the British market and 13% of the French market.

On the other hand, if average prices for the month of February are compared with those registered in the same month of 2022, prices fell in all markets. The largest fall was that of the Spanish and Portuguese markets, of 33%. In the rest of the markets, the price decreases were between 2.2% of the German market and 24% of the Italian market.

On the other hand, the downward behaviour of prices in the IPEX market resulted in the price registered in February 2023 being the lowest since September 2021 in this market, despite being the highest average for February in all analysed markets.

In the month of February, the general decrease in wind energy production, as well as the increase in CO2 emission rights prices compared to those of the previous month, led to the increase in prices in almost all European electricity markets, despite the drop in gas prices and demand in most markets.

In February 2023, the decrease in gas prices compared to those of the same month of the previous year was even larger, while CO2 emission rights prices were only slightly higher. Also the reductions in demand were larger in some cases. These factors, together with the general increase in solar energy production, allowed the year‑on‑year decrease in European electricity markets prices.

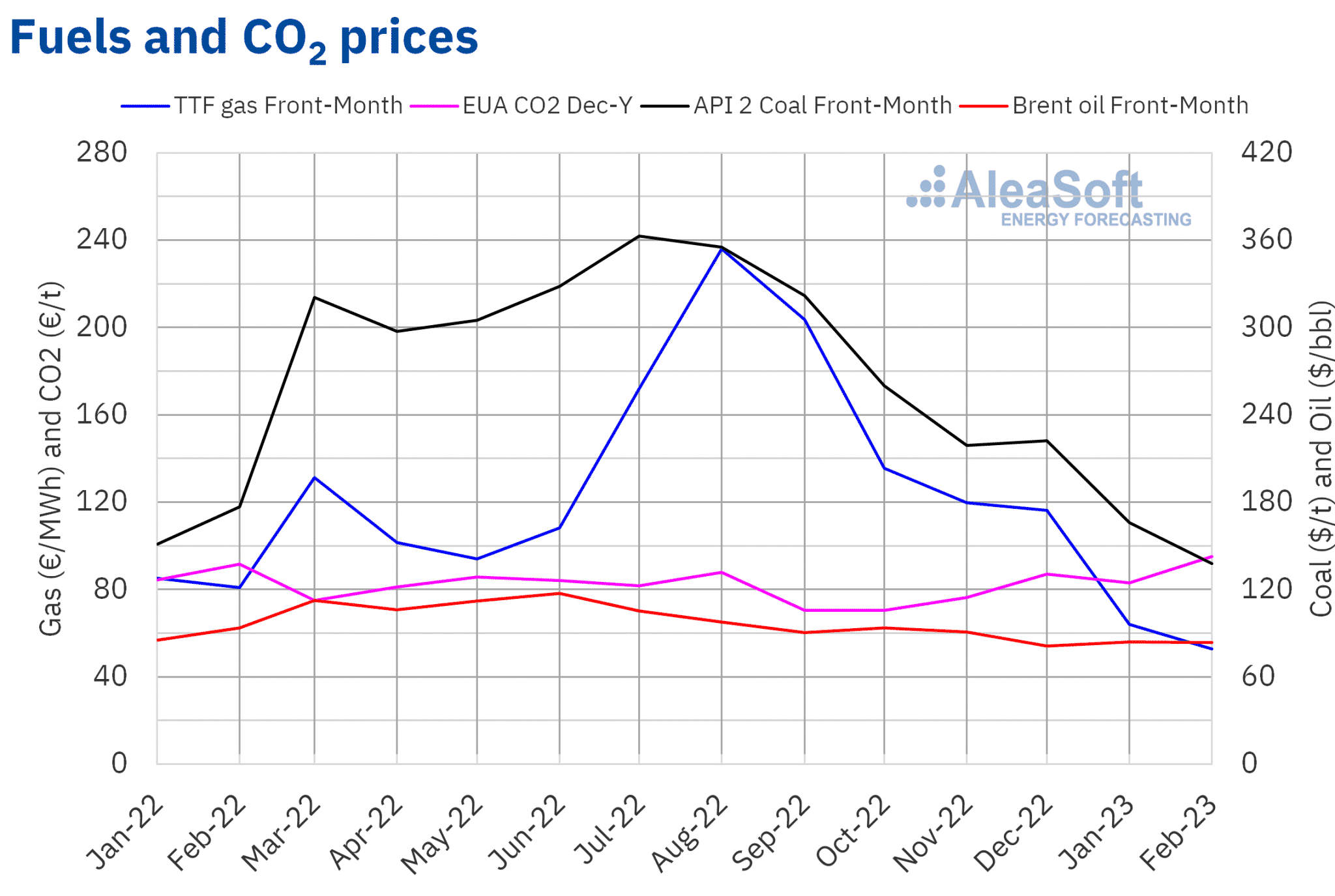

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $83.54/bbl in February. This value was 0.6% lower than that reached by the Front‑Month futures of January, of $84.04/bbl. It was also 11% lower than that corresponding to the Front‑Month futures traded in February 2022, of $94.10/bbl.

In February, Brent oil futures prices continued to be influenced by fears about the evolution of the economy, despite expectations of demand recovery in China. However, in the second week of the month, the supply interruptions due to the earthquake of Turkey and Saudi Arabia’s rise in official prices for the Asian market led to the increase in prices. At the end of that week, the announcement of a cut in Russian production in March also contributed to the rises. As a consequence, on February 13 the monthly maximum settlement price, of $86.61/bbl, was reached.

Subsequently, the announcement that the government of the United States would sell oil from its strategic reserves, as well as the increase in commercial crude reserves of this country, combined with concerns about the economy to continue exerting their downward influence on prices. But the plans to reduce Russian exports from western ports in March allowed prices to recover in the last days of the month.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the month of February for these futures was €52.65/MWh. Compared to that of the Front‑Month futures traded in the month of January, of €63.92/MWh, the average fell by 18%. If compared with the Front‑Month futures traded in February 2022, when the average price was €81.91/MWh, there was a 36% decrease.

As a consequence of the downward trend registered by these futures during the month of February, the monthly minimum settlement price, of €46.66/MWh, was reached on the last day of the month, which was the lowest since August 2021.

During the month of February 2023, the levels of European reserves continued to be high for the time of year. This, together with abundant supply of liquefied natural gas by sea, contributed to the decrease in TTF gas futures prices. In addition, compared to the previous month, average temperatures were higher in many European countries.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price in February of €95.01/t, 14% higher than the average of the previous month, of €83.03/t. If compared with the average of the month of February 2022 for the reference contract of December of that year, of €91.18/t, the average of February 2023 was 4.2% higher.

On the other hand, on February 21, the monthly maximum settlement price, of €100.34/t, was reached, which was a historical maximum for these futures. In the penultimate session of the month, a settlement price above €100/t was registered again, although this time it was a little lower, of €100.23/t.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The third webinar of 2023 of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, March 16. For the third time, there will be the participation of invited speakers from EY. On this occasion, prospects for European energy markets for spring 2023, the renewable energy projects financing and the importance of PPA and self‑consumption will be analysed. The main novelties in the regulation of the Spanish energy sector, as well as the main considerations to take into account in the portfolio valuation, will be presented too.

On the other hand, the long‑term price forecasting is essential for hybridisation projects of renewable energy, such as wind or photovoltaic energy, with energy storage systems, such as batteries. The long‑term price forecasts of AleaGreen for European electricity markets have a 30‑year horizon, hourly granularity and confidence bands.

Source: AleaSoft Energy Forecasting.