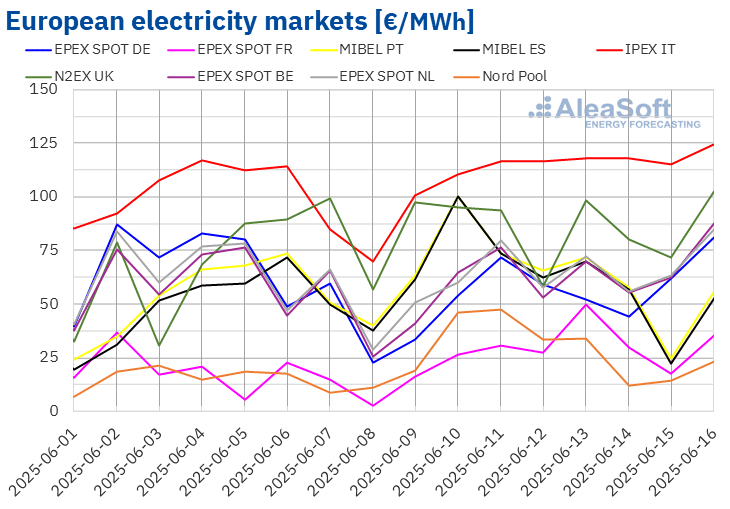

AleaSoft Energy Forecasting, June 16, 2025. In the second week of June, weekly average prices in most major European electricity markets were above €50/MWh and increased compared to the previous week. Even so, most markets registered negative prices, mainly during the middle hours of the day. On Friday, June 13, gas, CO2 and Brent futures reached their highest settlement price since at least the beginning of April. Solar photovoltaic energy registered an all‑time production record in Germany and the highest value for a day in June in France and Italy.

Solar photovoltaic and wind energy production

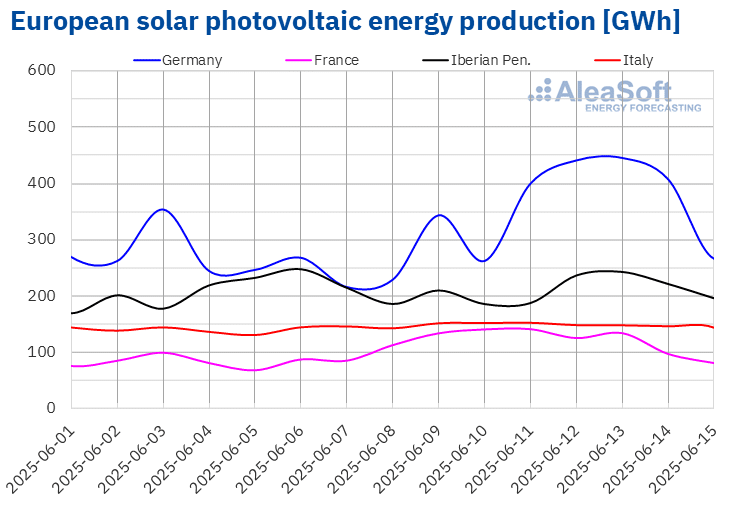

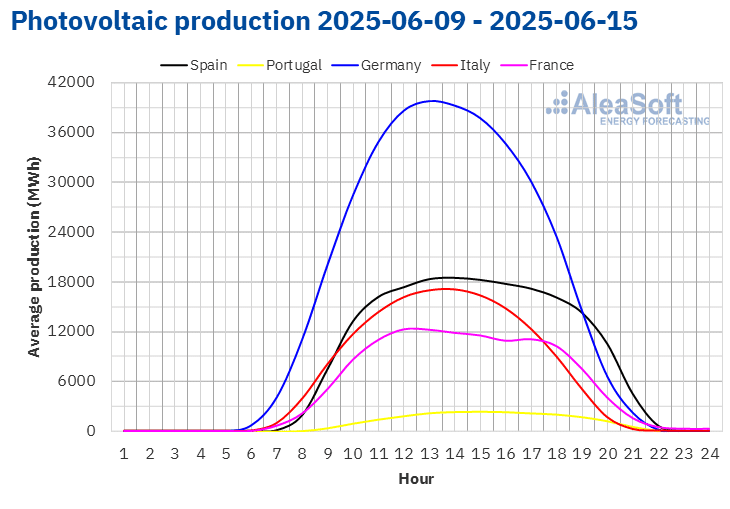

In the week of June 9, solar photovoltaic energy production increased in most major European markets compared to the previous week. Germany registered the largest increase, 41%, followed by France, with an increase of 38%. Spain showed the smallest increase, 1.2%, while production rose by 6.1% in Italy. On the other hand, Portugal accumulated its second consecutive week of declines in production with this technology, with a drop of 8.7%.

During the week, the markets of France, Italy, Spain and Germany reached records for solar photovoltaic energy production. On June 11, France and Italy set new all‑time highs for solar photovoltaic energy generation for a June month, with 134 GWh and 152 GWh, respectively, surpassing the values registered the previous week. On June 12, Spain reached its second highest production ever, with 215 GWh. One day later, on June 13, Germany broke its all‑time record, generating 445 GWh.

For the second week of June, according to AleaSoft Energy Forecasting’s solar energy forecasts, solar photovoltaic energy generation will increase in Germany and Spain, while it will decrease in Italy.

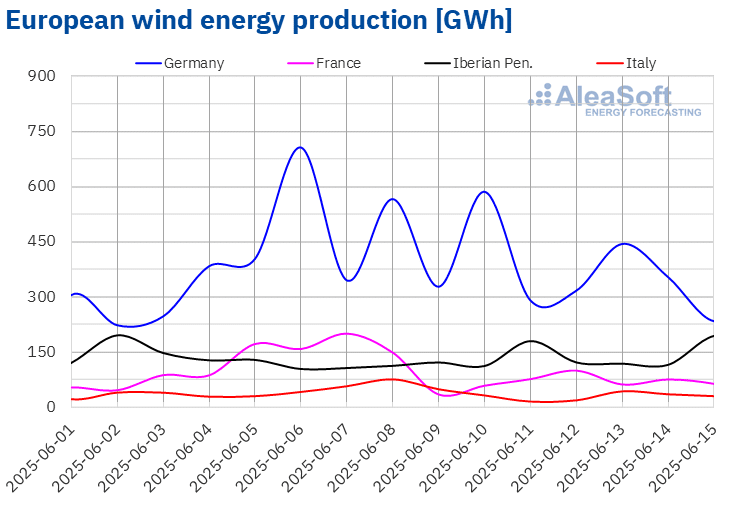

In the second week of June, wind energy production increased in the Spanish market for the second consecutive week, with an increase of 12%. On the other hand, the French, German and Portuguese markets changed their trend and registered decreases, following increases in the previous week. France reached the largest drop, 48%, while Germany and Portugal reduced their production by 11% and 18%, respectively. In the Italian market, wind energy generation decreased for the third consecutive week, falling by 29%.

For the week of June 16, according to AleaSoft Energy Forecasting’s wind energy forecasts, wind energy generation will fall across the board in the analyzed markets.

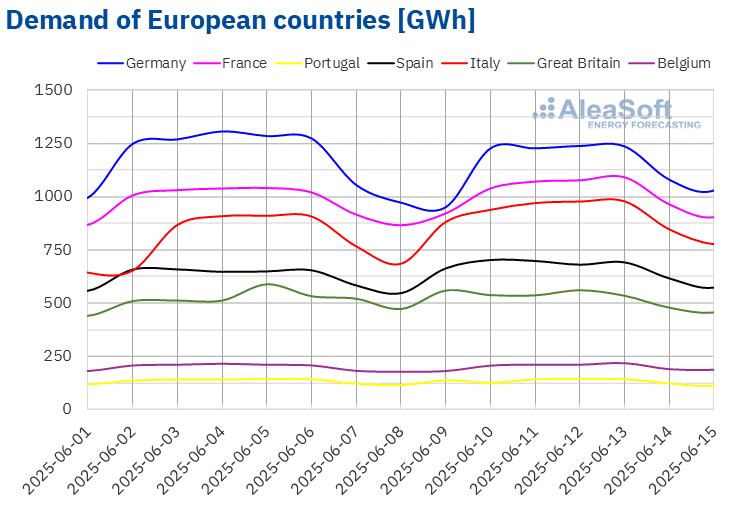

Electricity demand

In the second week of June, electricity demand increased in most major European markets compared to the previous week. The Italian market registered the largest increase, 12%, driven by a recovery in demand following the Republic Day holiday on June 2. France registered a 2.2% rise, even though June 9 was a national holiday, Whit Monday. Spain registered an increase of 5.2%, while Great Britain showed the smallest increase, 0.4%. In contrast, the Belgian, Portuguese and German markets reduced their demand by 0.5%, 1.6% and 5.0%, respectively. Germany and Belgium also had a national holiday on Whit Monday, which led to declines in demand in both markets. In Portugal, the drop in demand was favored by the national holiday on June 10, Portugal Day.

Italy maintained the upward trend for the third consecutive week, while Spain continued it for the fourth week in a row. France and Great Britain also maintained this behavior for a second week. On the other hand, Portugal registered its second week of declines in demand.

Average temperatures increased in all analyzed markets compared to the previous week. Belgium, Great Britain and France registered the largest increases, 3.7 °C, 3.5 °C and 3.4 °C, respectively. Germany showed the smallest increase, 1.2 °C, while Portugal, Italy and Spain had rises of 1.8 °C, 2.0 °C and 2.2 °C, in that order.

According to AleaSoft Energy Forecasting’s demand forecasts, in the third week of June, demand will increase in most major European markets. In contrast, demand will decline in the market of Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

In the second week of June, average prices in most major European electricity markets rose compared to the previous week. The exceptions were the Dutch and German markets, with falls of 0.3% and 17%, respectively. In contrast, the EPEX SPOT market of France and the Nord Pool market of the Nordic countries reached the largest percentage price increases, 65% and 88%, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices rose between 1.7% in the EPEX SPOT market of Belgium and 24% in the MIBEL market of Spain.

In the week of June 9, weekly averages were above €50/MWh in most European electricity markets. The exceptions were the French and Nordic markets, whose averages were €28.14/MWh and €29.43/MWh, respectively. On the other hand, the IPEX market of Italy reached the highest weekly average, €113.55/MWh. In the rest of the analyzed markets, prices ranged from €53.80/MWh in the German market to €84.93/MWh in the N2EX market of the United Kingdom.

Regarding daily prices, on Saturday, June 14, the Nordic market reached the lowest average of the week among the analyzed markets, €12.13/MWh. On the other hand, the Italian market reached prices above €100/MWh during the entire second week of June. Moreover, prices in this market remained above €115/MWh since Wednesday, June 11. On June 13, it registered the highest average of the week, €117.80/MWh. Prices also exceeded €100/MWh in the Iberian market on June 10. On that day, the price was €100.19/MWh in the Spanish and Portuguese markets, which was their highest price since March 14.

As for hourly prices, despite the increase in weekly averages, most European electricity markets registered negative hourly prices in the second week of June. The exceptions were the Italian and British markets. On Saturday, June 14, from 13:00 to 14:00, the German market reached the lowest hourly price of the week, ‑€38.00/MWh. On that day, from 14:00 to 15:00, the Nordic market registered its lowest hourly price since August 26, 2024, ‑€4.94/MWh.

In the week of June 9, the increase in gas and CO2 emission allowance prices and the decrease in wind energy production in most markets led to higher prices in the European electricity markets. In addition, in some markets demand increased and in the Portuguese market solar energy production also decreased.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the third week of June, prices will continue to rise in most major European electricity markets, influenced by increased demand and declining wind energy production in most markets.

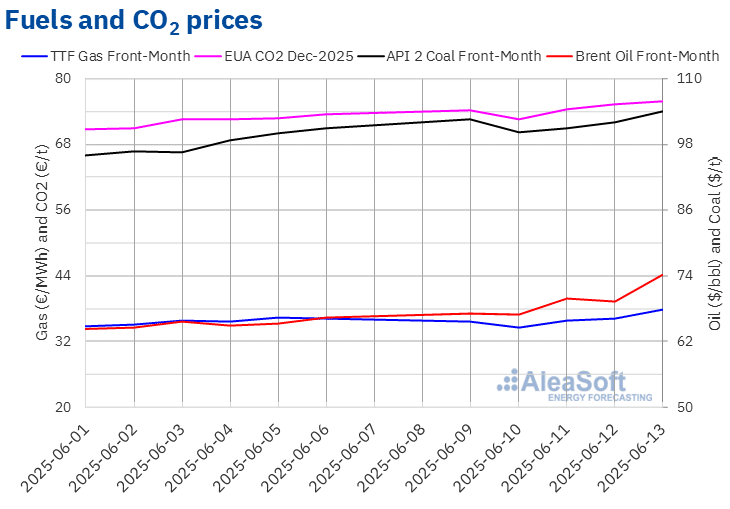

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $66.87/bbl, on Tuesday, June 10. In most sessions of the second week of June, settlement prices remained below $70/bbl. However, on Friday, June 13, these futures registered a 7.0% rise from the previous day. On that day, they reached their weekly maximum settlement price, $74.23/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 12% higher than the previous Friday and the highest since April 3.

Increased tensions between Israel and Iran drove Brent oil futures prices higher at the end of the second week of June. Fears that increased instability in the Middle East could lead to disruptions in the Strait of Hormuz, affecting global oil supplies, exerted an upward influence on prices. On the other hand, data on falling US oil reserves also contributed to the price increase in the second week of June.

As for TTF gas futures in the ICE market for the Front‑Month, on Tuesday, June 10, they registered their weekly minimum settlement price, €34.64/MWh. Subsequently, prices started an upward trend. As a result, on Friday, June 13, these futures reached their weekly maximum settlement price, €37.89/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 4.5% higher than the previous Friday and the highest since April 4.

In the second week of June, fears about the effects on liquefied natural gas supply of increased tensions in the Middle East drove TTF gas futures prices higher. Forecasts of high temperatures and lower wind energy production in Europe, as well as the possibility of supply disruptions from Norway, also exerted an upward influence on prices.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2025, they registered their weekly minimum settlement price, €72.66/t, on June 10. Settlement prices increased in the remaining sessions of the second week of June. As a result, on Friday, June 13, these futures reached their weekly maximum settlement price, €75.94/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 3.3% higher than the previous Friday and the highest since February 18.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets, renewable energy, PPA and batteries

On Thursday, June 12, AleaSoft Energy Forecasting held the 56th webinar in its monthly webinar series. This event featured speakers from Engie Spain for the seventh time in the monthly webinar series. In addition to the evolution of European markets and prospects in the second half of 2025, the webinar addressed the growth opportunities in the renewable sector, the current affairs of the PPA market in Spain, the prospects for energy storage in batteries, as well as the IDAE’s call for aid for energy storage.

During the webinar it was highlighted that the AleaStorage division of AleaSoft Energy Forecasting is supporting companies in the sector in the estimation of revenues from energy storage projects with batteries, both in stand‑alone systems and in hybrid installations with photovoltaic energy. In the case of hybrid systems, they also calculate the optimal battery to maximize revenue. If AleaSoft Energy Forecasting is your market advisor, you can request the recording of the webinar.

Source: AleaSoft Energy Forecasting.