AleaSoft Energy Forecasting, June 19, 2023. Gas and CO2 prices rose for the second consecutive week, causing a general increase in European electricity markets prices. CO2 futures exceeded €90/t, something that had not happened since April. The increase in demand and lower wind energy production in several markets also led to increased prices in the electricity markets. Photovoltaic energy registered daily historical records in Spain and Italy and records so far this quarter in almost all markets.

Solar photovoltaic and thermoelectric energy production and wind energy production

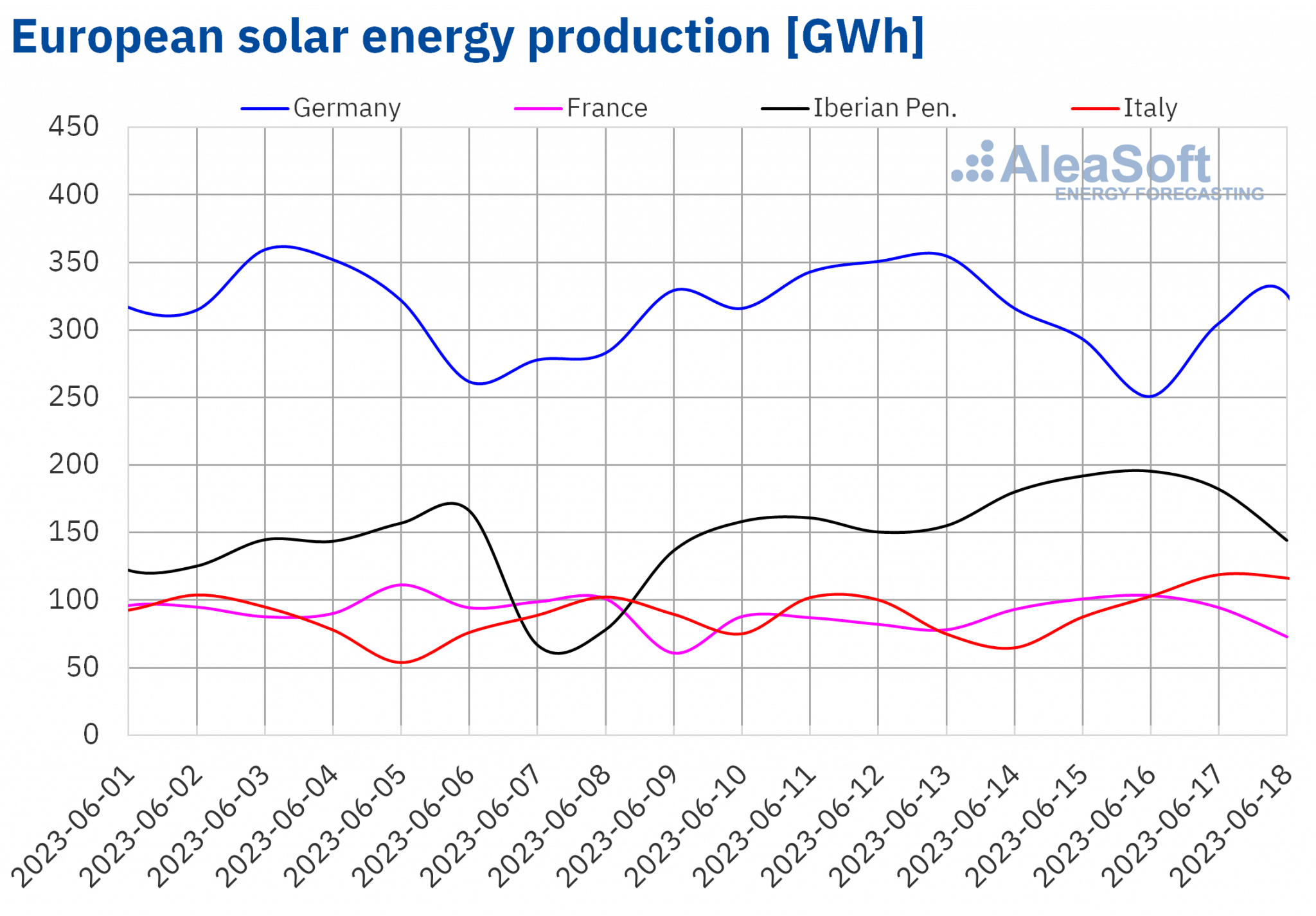

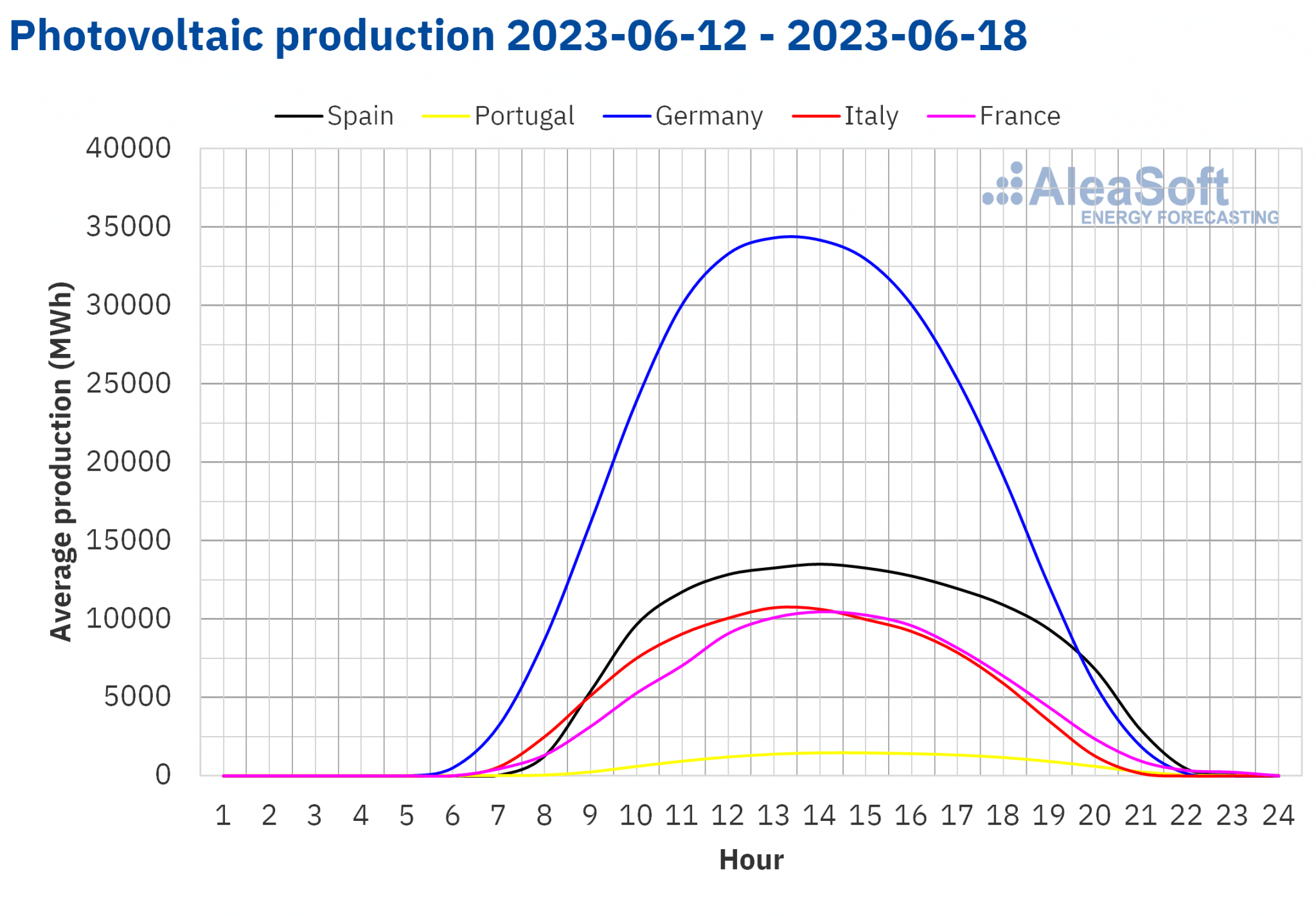

In the week of June 12, solar photovoltaic energy production broke the daily record in the markets of Spain, with 152 GWh generated on Thursday, June 15, and in Italy, with 119 GWh generated on Saturday, June 17. In addition, solar thermoelectric energy production broke the daily record for 2023 so far, with 29 GWh generated on Friday, June 16.

If we compare so far in the second quarter of 2023, specifically the period between April 1 and June 15, with the same period of the previous five years, solar photovoltaic energy production broke a record in almost all analysed markets: in Germany with 17 999 GWh, Spain with9240 GWh, France with 5837 GWh and Portugal with 896 GWh. This trend reflects the continuous increase in the installed capacity of this technology. For example, in the Iberian Peninsula, between May 2018 and May 2023, the installed capacity in Portugal increased by 1542 MW, which represents an increase of 301%, and in Spain 15 967 MW were installed in this period, which in percentage represents an increase of 358%.

Compared to the previous week, solar energy production increased in almost all the main European markets analysed, except for the French market. The biggest increases, 30% and 24% were registered in the Spain and Portugal markets, respectively, followed by a rise of 13% in Italy and 3.0% in Germany. On the other hand, in the same period, solar energy production in the French market fell by 2.5%.

For the week of June 19, the AleaSoft Energy Forecasting solar energy production forecasts indicate that production will decrease in Spain and Germany but could increase in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

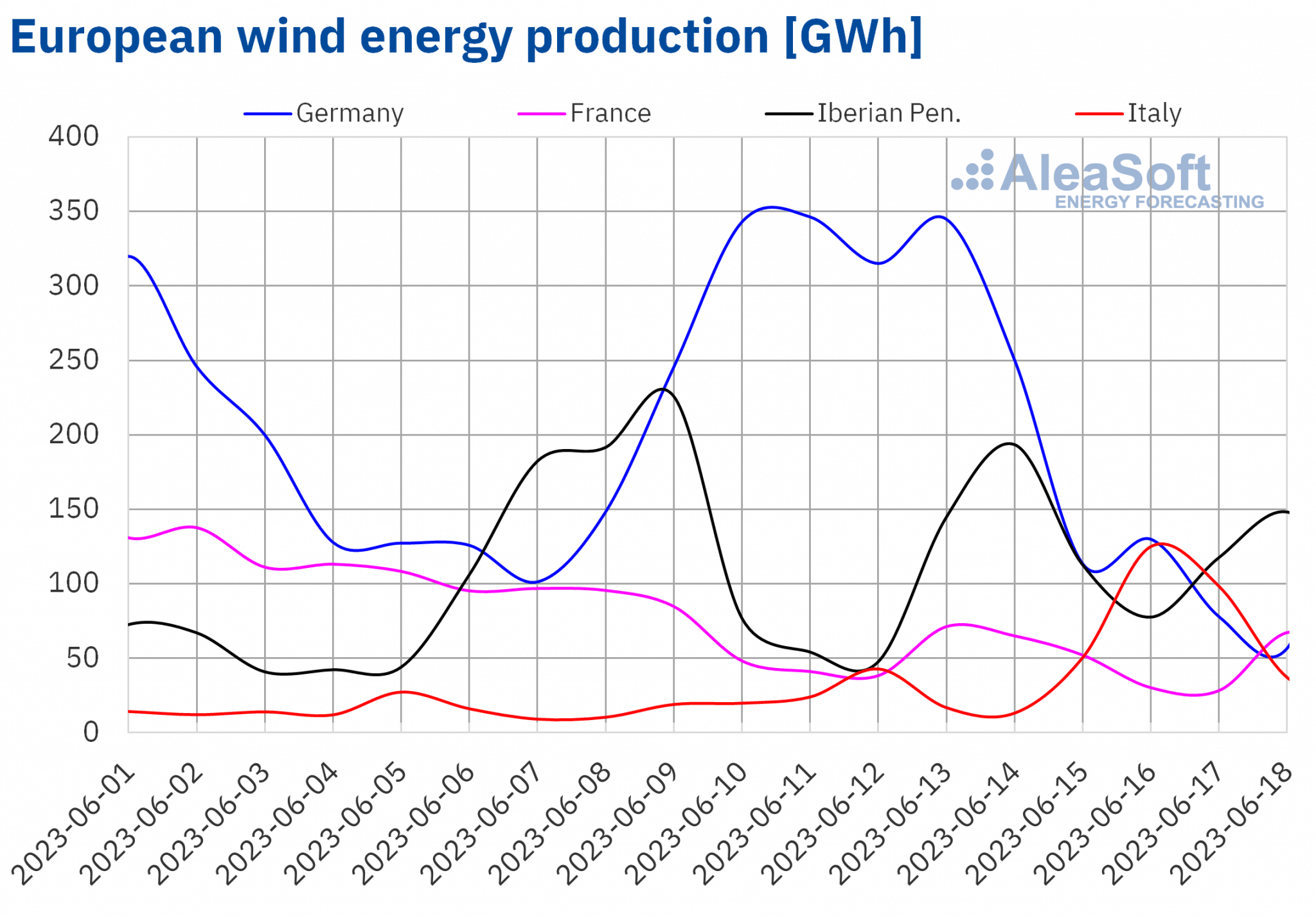

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

If the wind energy production of the period between April 1 and June 15 of the last six years is compared, in 2023 a record was broken in the French market, with 8294 GWh generated with this technology.

In the weekly analysis, in the week of June 12, wind energy production increased compared to the previous week only in the Italian and Spanish markets, with increases of 204% and 7.9%, respectively. In the rest of the analysed markets, falls were between 10% of Germany and 42% of Portugal.

For the week of June 19, the AleaSoft Energy Forecasting wind energy production forecasts indicate expected declines in all the main European markets analysed.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

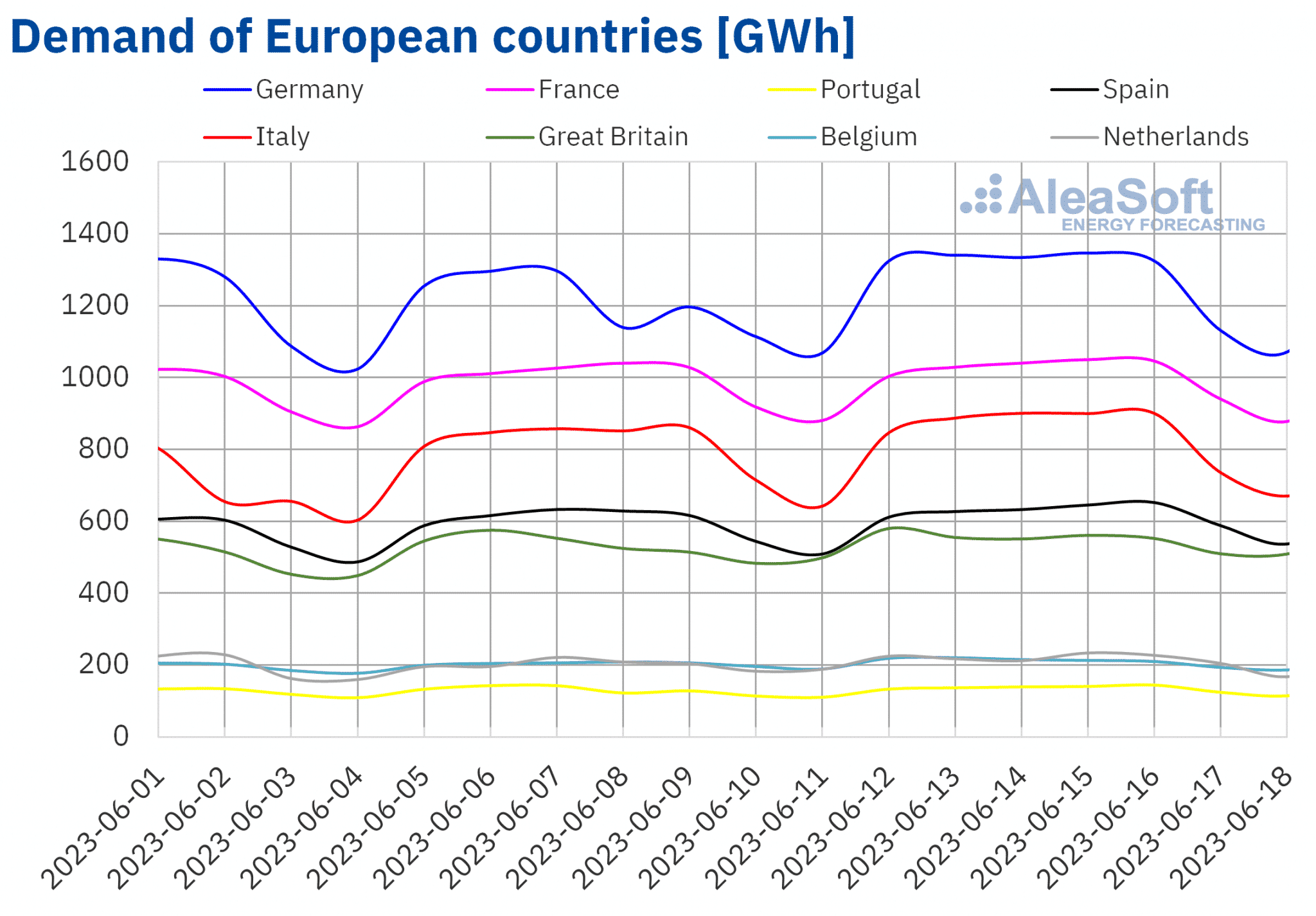

During the week of June 12, the electricity demand increased in all analysed European markets with respect to the previous week. The largest increases, over 6%, were registered in the markets of the Netherlands and Germany, followed by increases of 4.6%, 4.4% and 3.8% in the Italian, Portuguese and Spanish markets, respectively. In Great Britain and Belgium, demand increased by 3.4% in both markets. On the other hand, the French market registered the smallest increase, of 1.4%.

In the German and Portuguese markets, these increases were due to the recovery in demand after the holiday of June 8, Corpus Christi, which in the case of Germany was celebrated in some regions and in Portugal was a national holiday, together with the holiday of June 10, Portugal Day.

Regarding average temperatures, they increased compared to the previous week in most of the analysed markets, with increases of between 0.6 °C in Italy and France and 3.7 °C in Great Britain. The exception was Germany, where average temperatures were 0.6 °C lower than the previous week.

For the week of June 19, according to the demand forecasts made by AleaSoft Energy Forecasting, a rise in demand is expected in most of the European markets analysed, except in the markets of Belgium and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

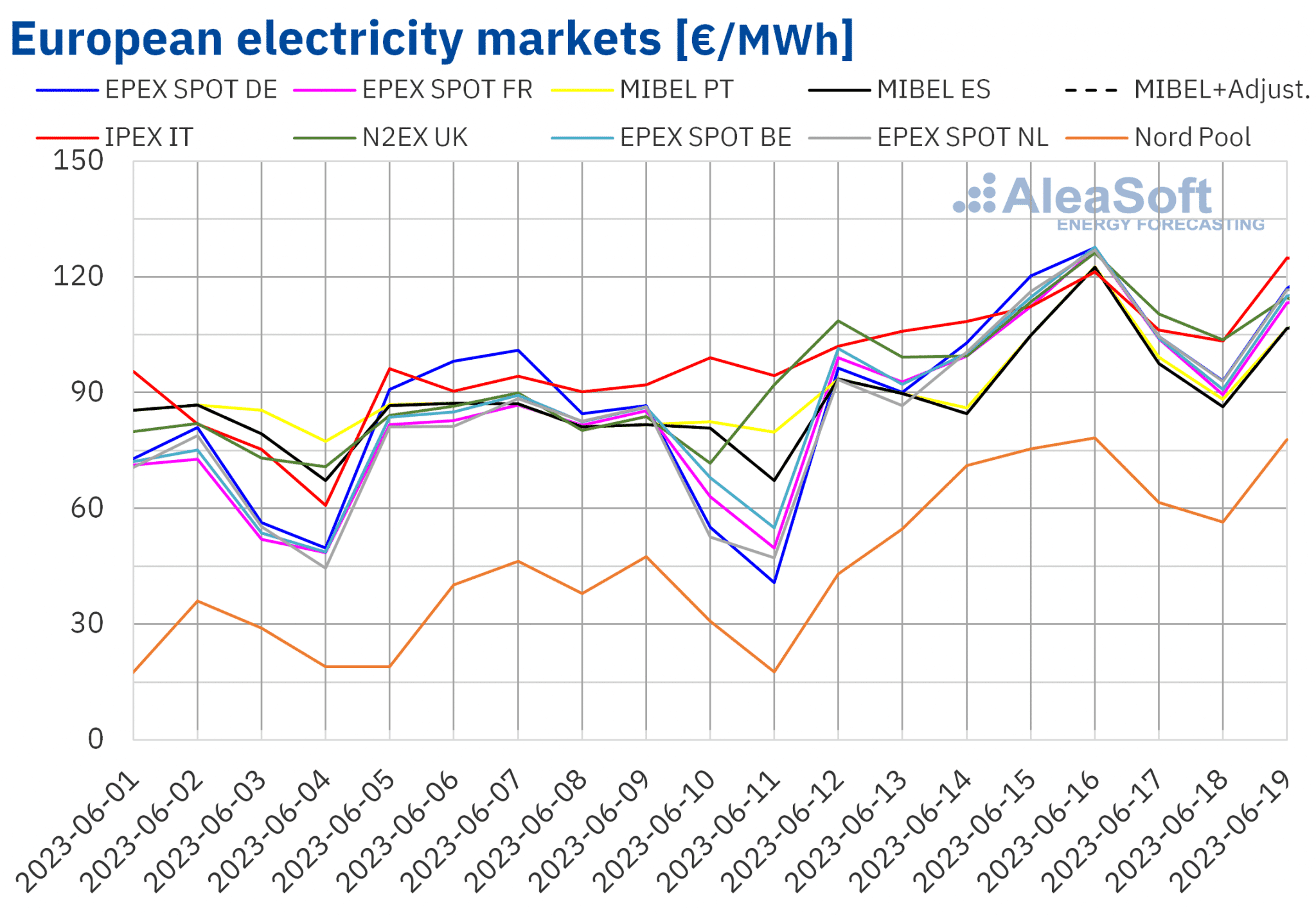

European electricity markets

In the week of June 12, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The highest price increase, of 84%, was achieved in the Nord Pool market of the Nordic countries. On the other hand, the smallest increases, of 16%, 17% and 19%, were registered in the IPEX market of Italy and in the MIBEL market of Portugal and Spain, respectively. In the rest of the markets, prices increased between 29% of the N2EX market of the United Kingdom and 39% of the EPEX SPOT market of the Netherlands.

In the third week of June, the weekly averages exceeded €100/MWh in most European markets. The highest average price, of €108.74/MWh, was that of the British market. On the other hand, the lowest weekly average was that of the Nordic market, of €62.96/MWh. In the rest of the analysed markets, prices were between €97.00/MWh of the Spanish market and €108.51/MWh of the Italian market.

Concerning hourly prices, in the third week of June, they remained above €20/MWh in the main European markets. On the other hand, the highest prices were reached in the German and Dutch markets. The highest hourly price, €197.77/MWh, was registered on Monday, June 19, from 20:00 to 21:00. This price was the highest since April 17 in these markets.

During the week of June 12, the increase in the average price of gas and CO2 emission rights and the increase in electricity demand led to price increases in the European electricity markets. In the case of the German, French and Portuguese markets, the decrease in wind energy production also contributed to this behaviour. Instead, production with this technology increased in Spain and Italy. In addition, in the Iberian and Italian markets, solar energy production also increased. As a result, the lowest price increases were registered in the IPEX and MIBEL markets.

The AleaSoft Energy Forecasting price forecasts indicate that in the third week of June prices could continue to increase in most European electricity markets, influenced by increases in demand and falls in wind energy production, as well as decreases in solar energy production in markets such as Germany or Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

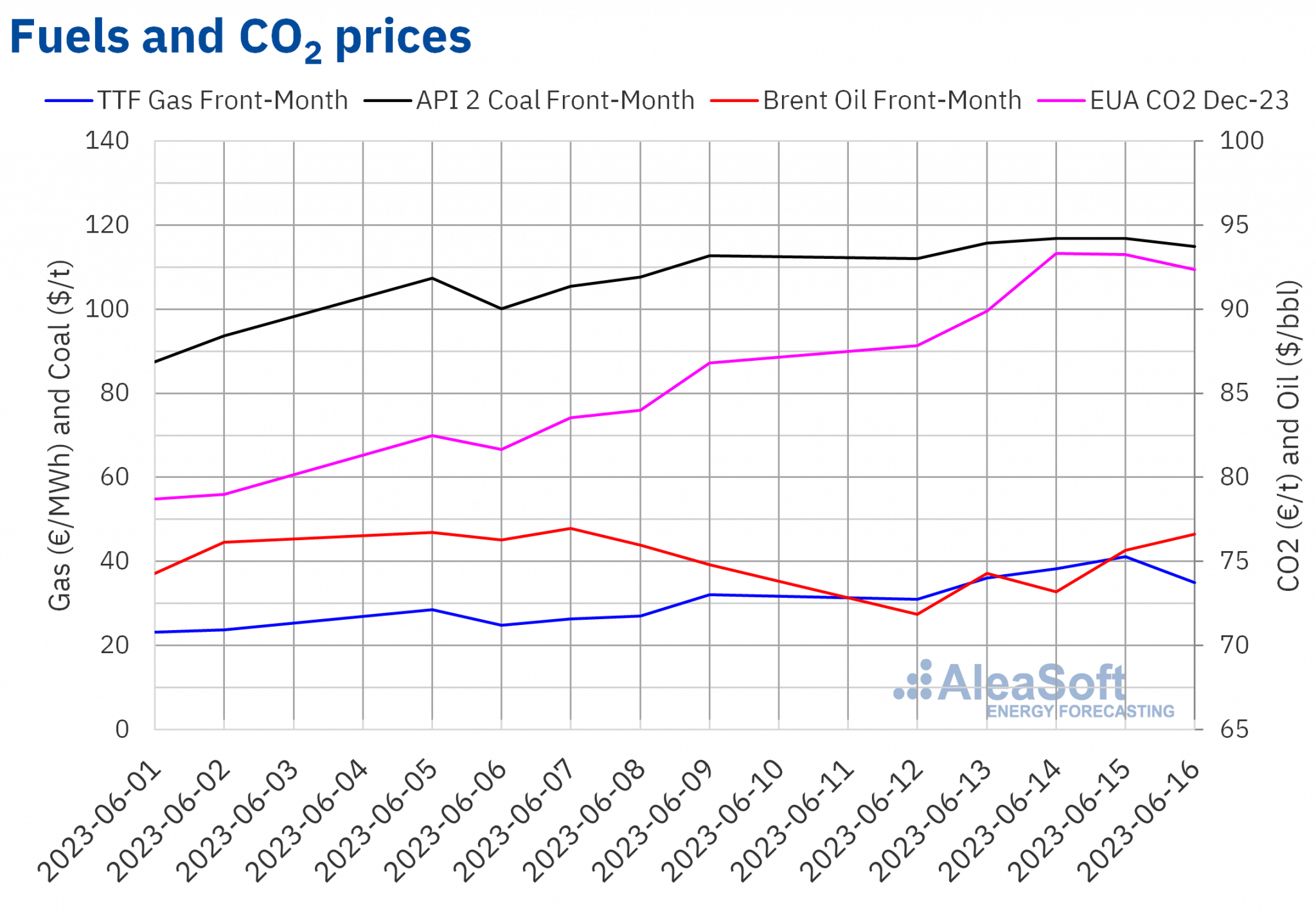

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered the weekly minimum settlement price, of $71.84/bbl, on Monday, June 12. This price was 6.3% lower than that of the previous Monday and the lowest since December 20, 2021. However, during the third week of June there were also price increases. Consequently, on Friday, June 16, the weekly maximum settlement price of $76.61/bbl was reached, which was 2.4% higher than that of the previous Friday.

In the third week of June, concerns about the evolution of demand continued. However, the production cuts announced by OPEC+ and the expectations for measures to improve the Chinese economy exerted their upward influence on prices.

Regarding the TTF gas futures in the ICE market for the Front‑Month, on Monday, June 12, they reached the weekly minimum settlement price of €31.04/MWh. This price was 3.2% lower than that of the last session of the previous week but 9.0% higher than that of the previous Monday. In the following sessions of the week, prices increased until reaching the weekly maximum settlement price, of €41.14/MWh, on Thursday, June 15. This price was 53% higher than that of the previous Thursday and the highest since April 18. However, on Friday, June 16, a 15% drop was registered compared to the previous day and a settlement price of €35.01/MWh was reached, although this price was still 9.2% higher than the previous Friday.

Supply concerns pushed up TTF gas futures prices in the third week of June. On the one hand, supply problems continued from Norway, where some maintenance work could last until July. On the other hand, the news about the closure of the largest gas field in Europe by the Dutch government on October 1 also contributed to supply concerns, influencing prices higher.

Concerning the settlement prices of CO2 emission rights futures in the EEX market for the December 2023 reference contract, the increases that began the previous week continued until a weekly maximum settlement price of €93.32/t on Wednesday, June 14. This price was 12% higher than the previous Wednesday and the highest since April 19. For the rest of the days of the week, the prices remained above €90/t. The settlement price on Friday, June 16, was €92.35/t, 6.4% higher than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

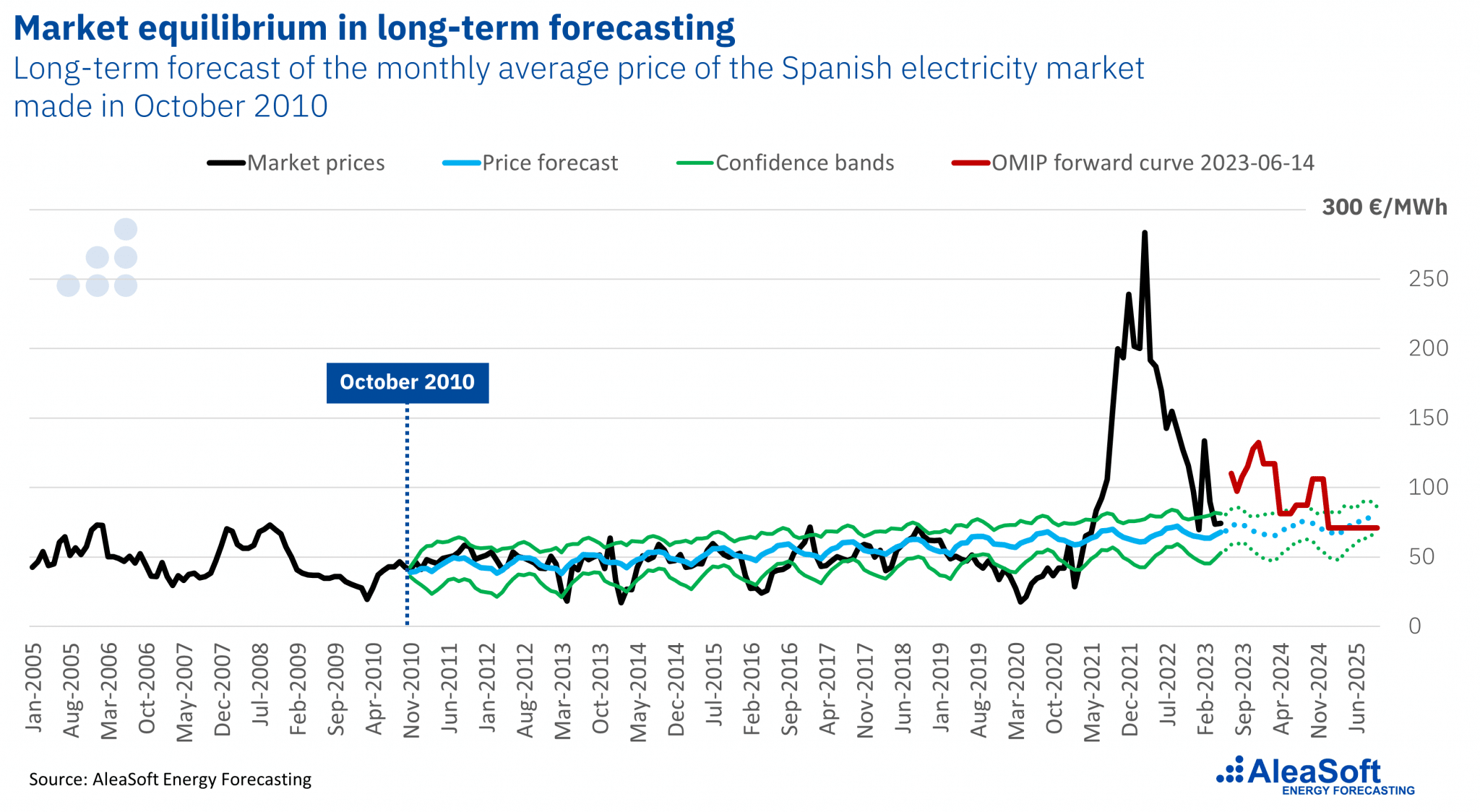

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

In the current energy transition context, it is essential to have coherent long‑term price curve forecasts. To be reliable, these forecasts must take into account the long‑term balance of energy markets prices and have a scientific basis. At AleaSoft Energy Forecasting, a hybrid methodology is used that combines classic statistical techniques with the use of Artificial Intelligence and fundamental models, which allows obtaining robust and coherent price forecasts.

On the other hand, the next webinar of the AleaSoft Energy Forecasting and AleaGreen monthly webinar series will be held on Thursday, July 13. In this webinar, in addition to the evolution of the energy markets, the main vectors of the energy transition will be analysed. The use of probabilistic metrics to obtain long‑term electricity market price forecasts will also be explained.

Source: AleaSoft Energy Forecasting.