AleaSoft Energy Forecasting, June 16, 2023. The energy transition requires coherent long‑term forecasts based on a scientifically based methodology. Long‑term price equilibrium is a key aspect of energy markets. Any long‑term forecasting methodology that does not take into account this fundamental aspect of the markets will not provide reliable forecasts. The use of Artificial Intelligence in long-term energy price forecasts has demonstrated a track record of accuracy for more than two decades.

Especially in the current context of energy transition towards decarbonisation and energy independence, long‑term forecasts and a clear and coherent vision of the future of the energy sector are of fundamental importance for practically any actor in the sector. To achieve the objectives of reducing, and ultimately eliminating, greenhouse gas emissions, it is essential to have tools to guide decision‑making and minimise risks.

For this, it is essential that long-term forecasts are consistent with a vision of a completely decarbonised energy system and that scientifically based methodologies are used, which also respond to the stochastic nature of energy markets.

The functioning of energy markets in the long term

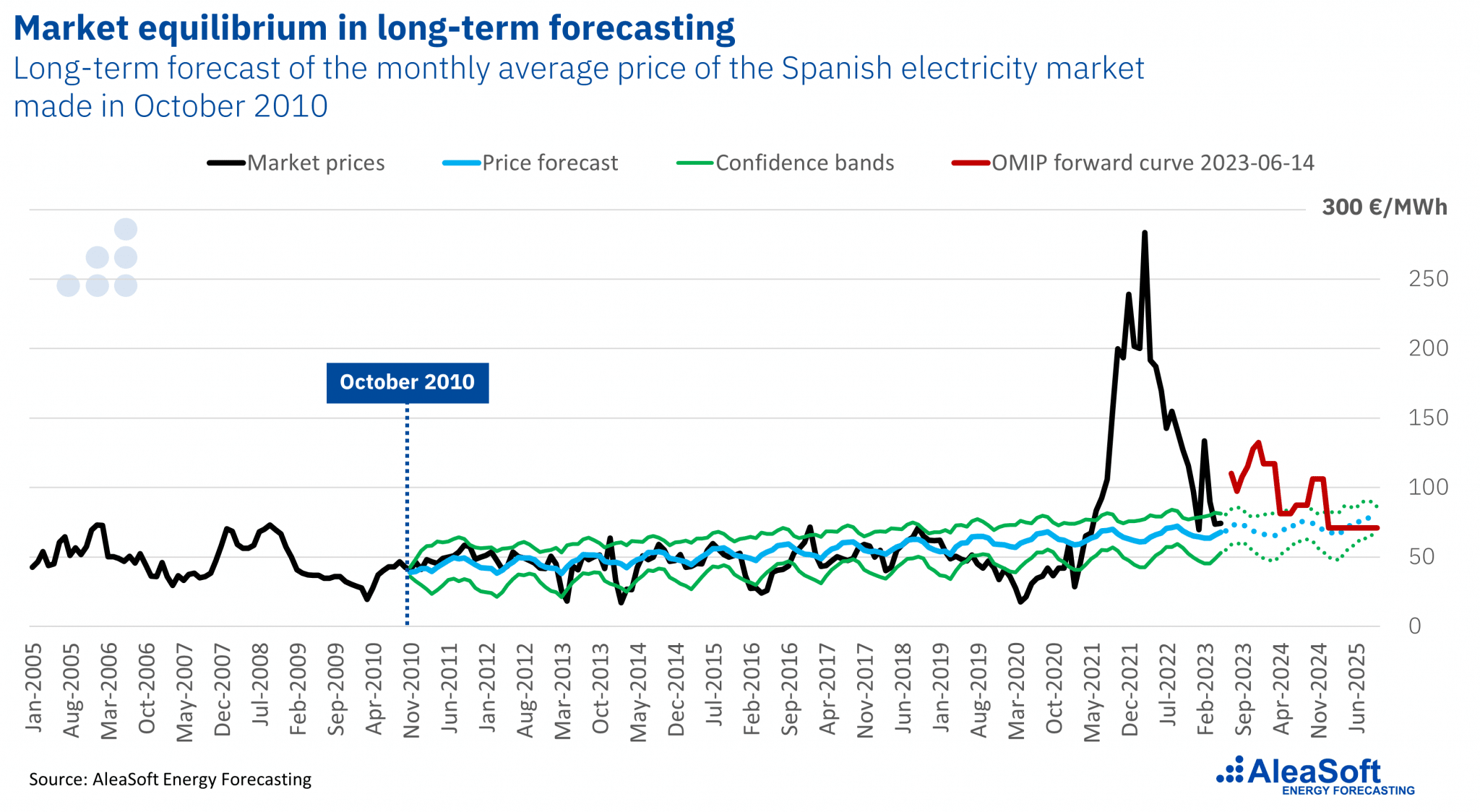

The following graph shows a long‑term forecast of the prices of the Iberian electricity market. This forecast was made in October 2010 using the Alea methodology and is a clear example of how energy markets work in the long term and how forecasts should reflect that operation.

The graph shows the monthly averages of the prices of the Spanish electricity market since 2015. The prices up to October 2010 were used to make the forecast and apparently, they show chaotic behaviour. Even so, the forecast models were able to extract the temporary structure and the relationship with the market variables and, based on this information, project prices into the future.

The operation of the energy markets and, in general, of any liberalised market is based on a market balance between supply and demand. This equilibrium means that the price at which the market matches on average in the long term is the one that allows producers to obtain the expected profitability throughout the lifetime of the project, and for consumers it is the one that allows them to be competitive with their costs.

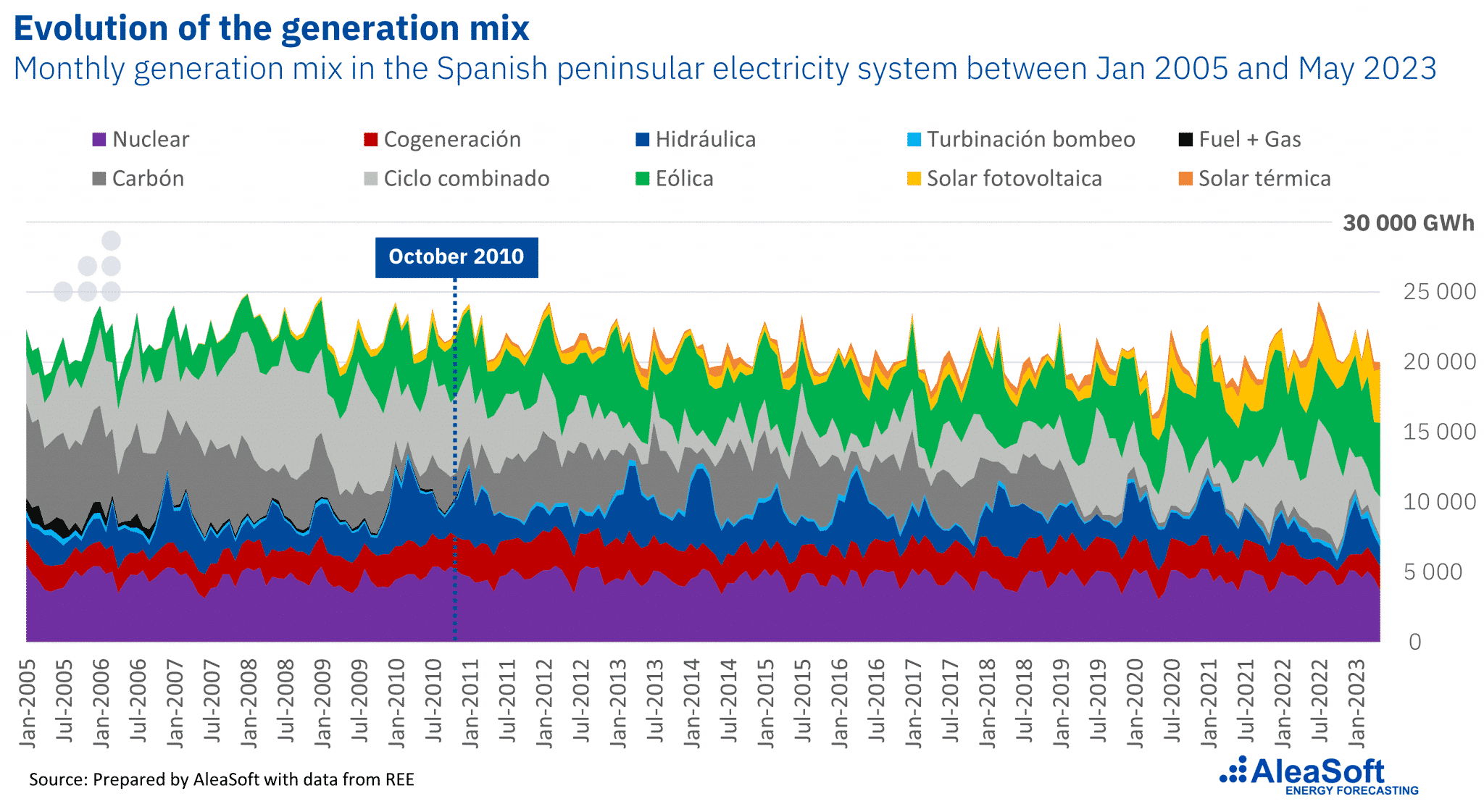

It must be taken into account that this forecast was made more than twelve years ago, with a very different generation mix, as can be seen in the second graph, where the production of combined cycle gas turbines predominated, even with the notable presence of coal, with wind energy, but with a developing photovoltaic energy and with half the interconnection capacity with France.

Since the forecast was made in 2010, wind energy has grown by 45% while solar photovoltaic energy has grown by more than 500%. Combined cycle gas turbines have completely displaced coal‑fired power plants, which have practically disappeared from the mix, and the interconnection capacity between Spain and France has doubled.

Even with the radical change that the Iberian electricity system and the generation mix have undergone, the market equilibrium that the forecast models extracted from the historical data and projected into the future has been maintained with the level and breadth that the forecast estimated. A forecast with this precision has been a valuable input, for example, for financial entities that needed to assess a renewable energy project’s risk and debt volume.

The OMIP futures curve at the end of the forecast shows how, although the market is now out of equilibrium due to the current energy crisis, market prices tend to always return towards the projected equilibrium price. Thus, during the COVID crisis in 2020, when prices fell, the market’s natural tendency was to restore the long‑term balance.

By observing the forecast and the behaviour of actual prices around it, it is easy to analyse the stochastic nature of the market equilibrium. Prices will not always be at the equilibrium price, but will fluctuate and oscillate around it depending on the conditions at any given time: weather that affects demand and renewable energy production, gas and CO2 prices, shutdowns of nuclear reactors etc. But at any time, market’s natural tendency for prices is to move back toward equilibrium.

The Alea models allow this oscillation trend to be reproduced in the forecasts, surpassing other forecasting methodologies that, because they do not take into account the market equilibrium, tend to provide high price forecasts when prices are high and low forecasts when prices are low.

The Alea methodology

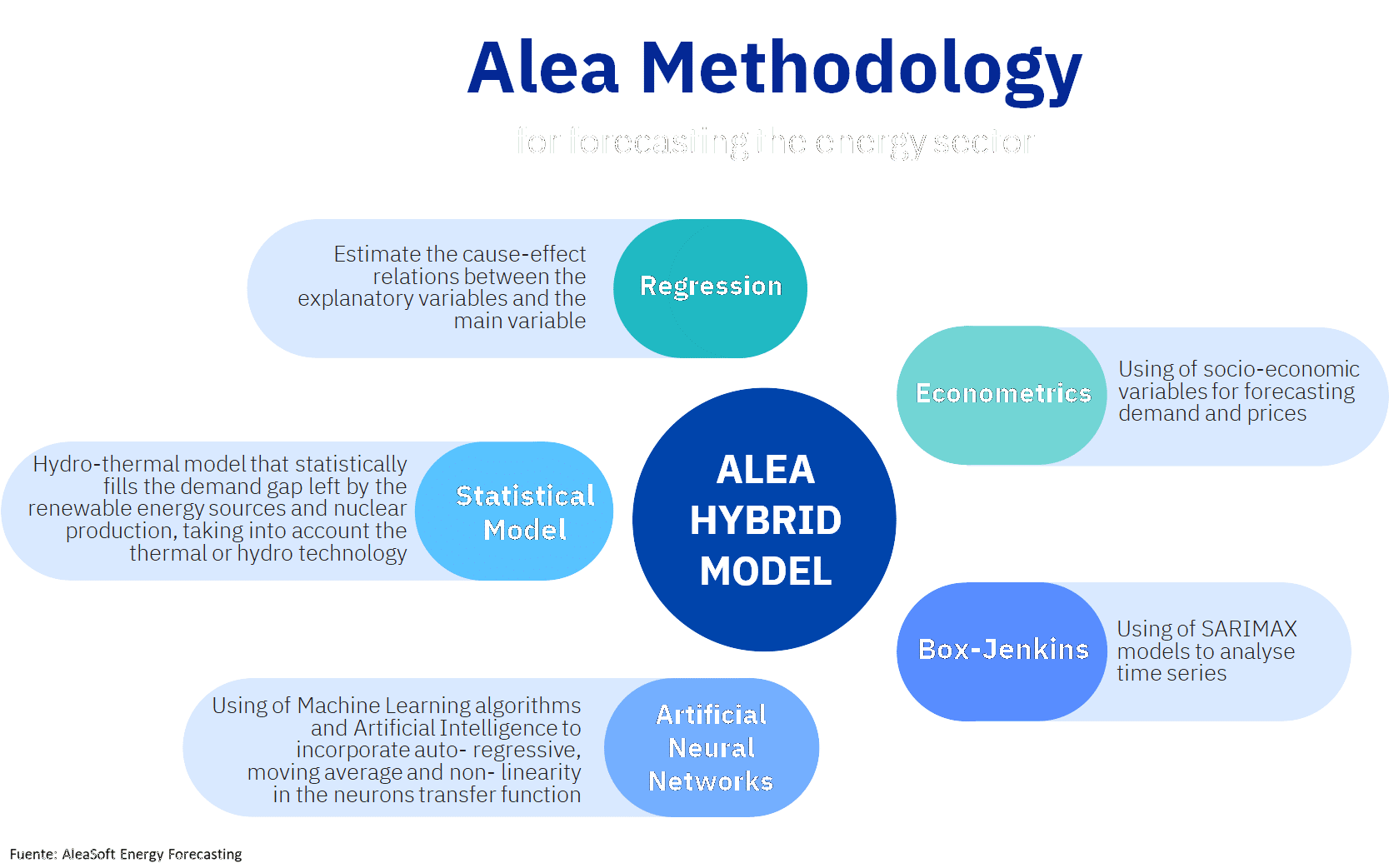

The Alea methodology is a statistically‑based hybrid methodology that combines different classical statistical techniques such as time series analysis, Box‑Jenkins, SARIMAX models, regression, econometric models, among others, with artificial intelligence techniques such as Machine Learning algorithms and recurrent neural networks. The methodology also includes other fundamental model type methodologies, so it represents a complete hybridisation of all forecasting techniques. This methodology makes it possible to adapt to the functioning of the markets at all time scales and the use of probabilistic metrics, very suitable for long‑term forecasts.

Recurrent neural networks allow model errors to be fed back in the past to correct and reduce them. This is also a feature of the moving average part of the SARIMAX models taken from the Box‑Jenkins methodology. With this feedback on the model deviations, it is also possible to compensate for the variables that cannot be present in the model, like the offer strategies of the agents in the electricity market.

The Alea models were precursors of the use of Artificial Intelligence in energy market forecasts with the use of recurrent neural networks in forecast models and, in general, for the analysis of large amounts of time series data and their transformation into market knowledge and intelligence.

For 24 years, these models have provided robust and coherent forecasts for all European energy markets. In addition, this methodology allows for fast and efficient updating with the latest data being introduced to provide up‑to‑date reports very quickly.

AleaSoft Energy Forecasting’s analysis on the prospects for the energy markets in Europe and the financing and valuation of renewable energy projects

In the following edition, number 35, of the monthly webinars organised by AleaSoft Energy Forecasting and AleaGreen, long‑term forecast methodologies will be analysed, among other topics such as some keys to the energy transition and the state of financing of renewable energy projects. To this end, Banco Sabadell and Ecoener will participate.

Source: AleaSoft Energy forecasting.