AleaSoft, October 19, 2020. The TTF gas prices, the benchmark in Europe, exceeded €14/MWh in the third week of October. In the spot market, this did not happen since December 2019. This fact, together with the increase in demand and the decrease in renewable energy production, mainly the wind energy, favoured the general increase in prices in the European electricity markets. The CO2 prices fell below €25/t due to the concerns about the effects of the measures to curb the second wave of COVID‑19 in Europe.

Photovoltaic and solar thermal energy production and wind energy production

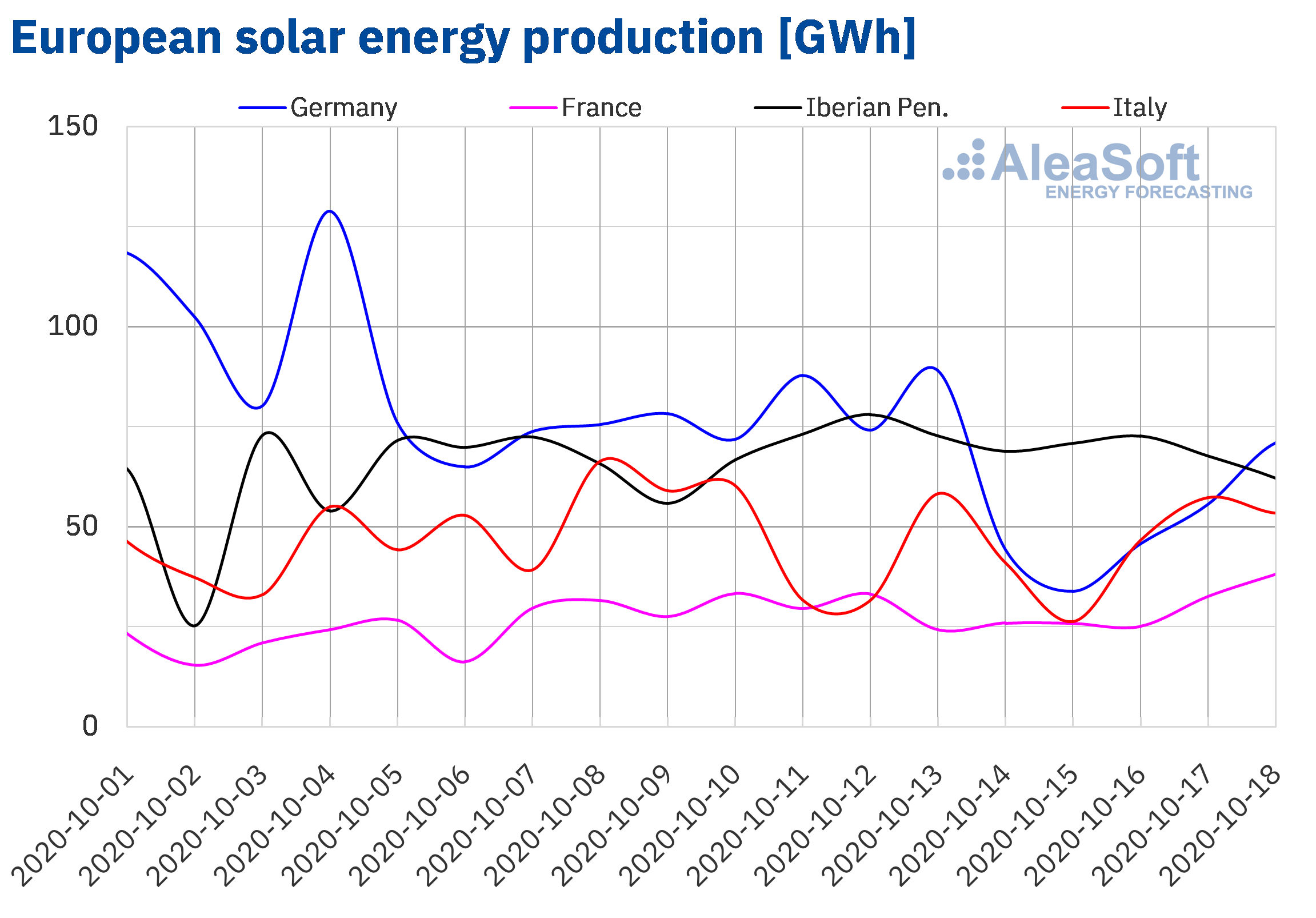

During the third week of October, the solar energy production decreased by 22% in the German market compared to the previous week. In the Italian market, the production decreased by 11%, while in the French market it increased by 5.5% and in the Iberian Peninsula by 3.8%.

In the year‑on‑year analysis, during the first 18 days of October, the solar energy production increased by 50% in the Iberian Peninsula and by 4.4% in the French market. On the contrary, in the German market it decreased by 8.2% and in the Italian by 1.6%.

For the week of October 19‑25, the AleaSoft‘s solar energy production forecasting indicates that there will be a decrease in the Spanish market. On the contrary, an increase in solar energy production is expected in the German market and in the Italian market it is expected to vary little compared to the third week of October.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

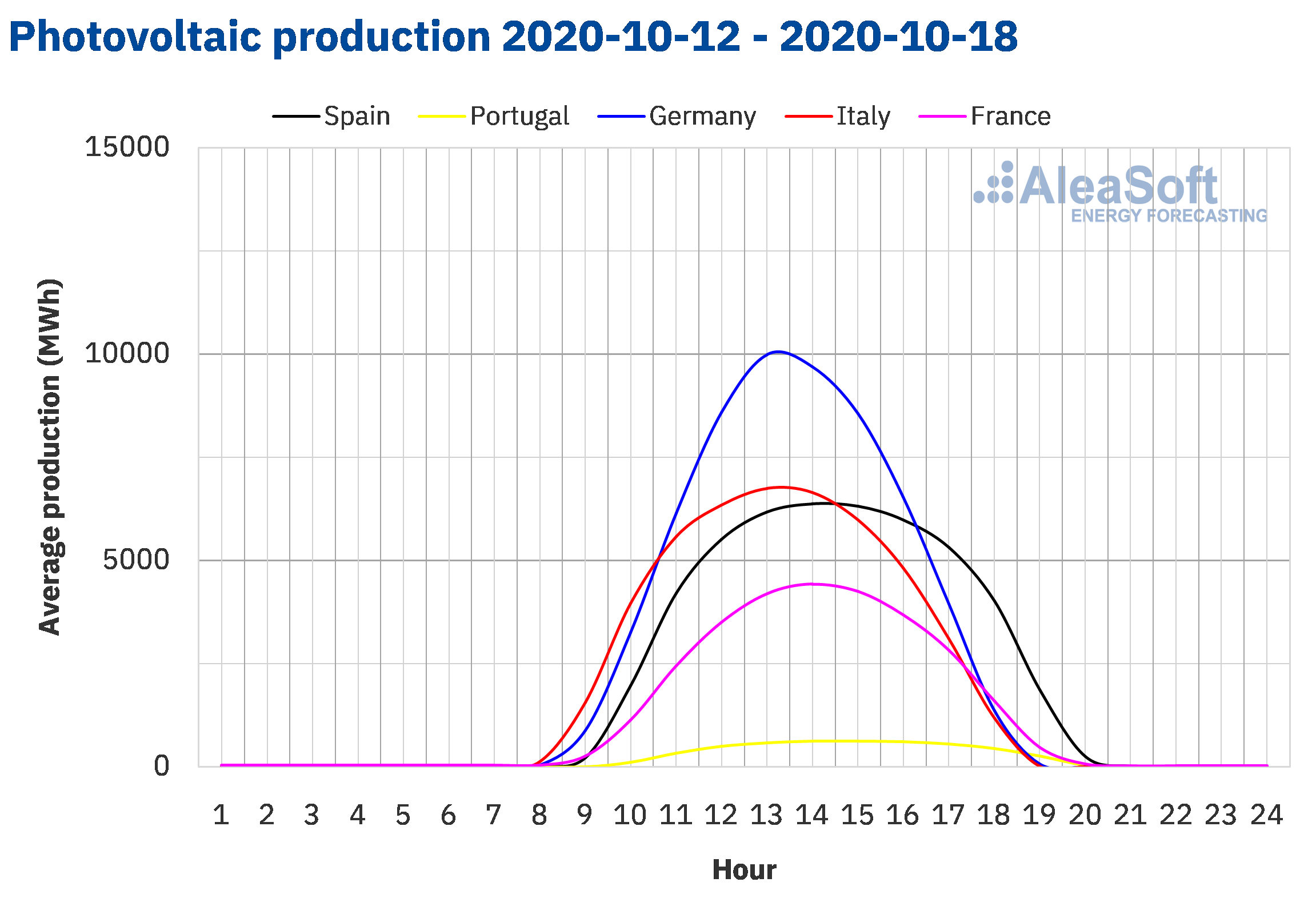

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

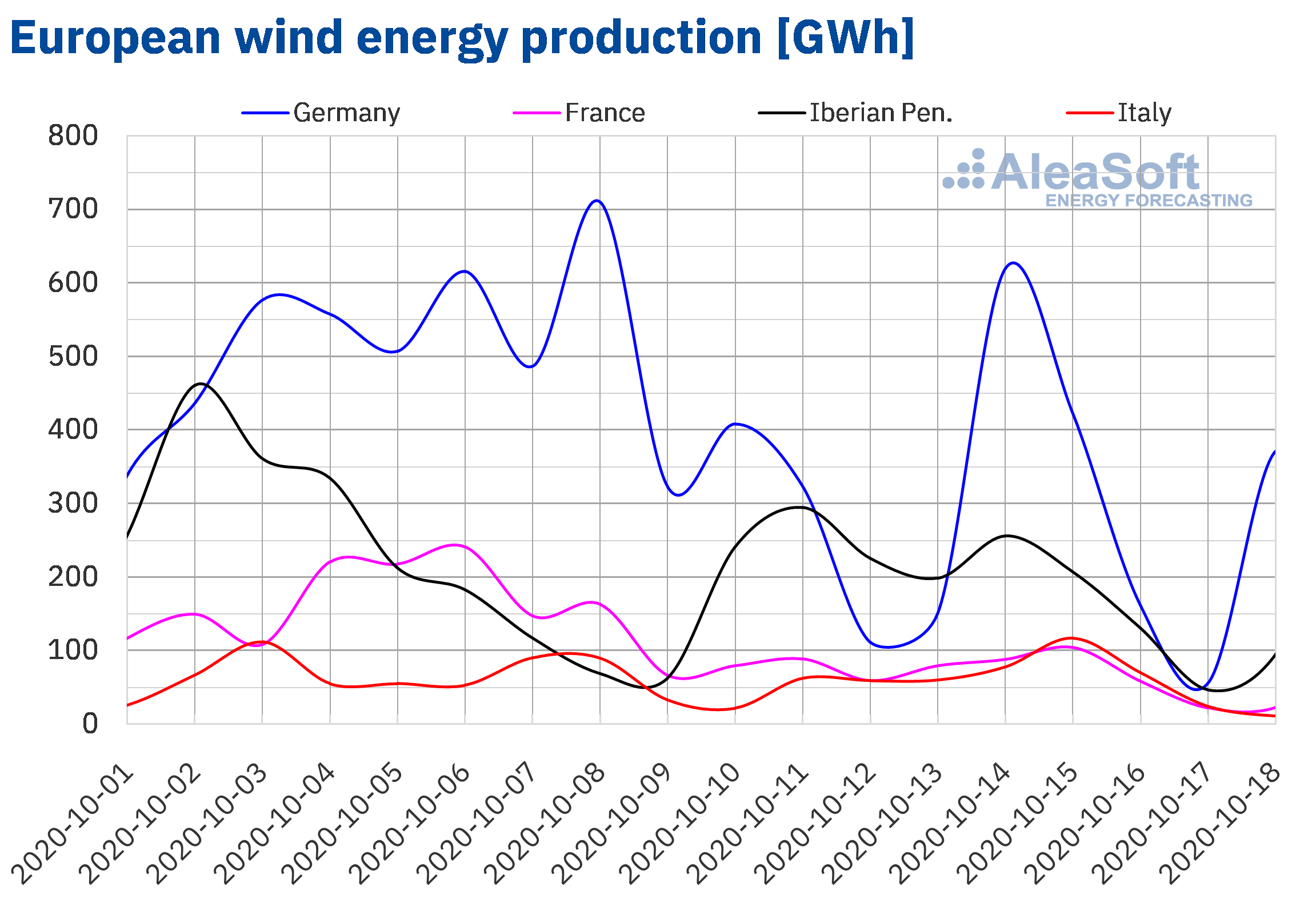

From October 12 to 18, the wind energy production decreased by 57% in the French market, by 44% in the German market and by 1.7% in the Iberian Peninsula, compared to the second week of October. On the contrary, in the Italian market it increased by 3.5%.

During the period between October 1 and 18, there was a 29% increase in wind energy production in the Iberian Peninsula and a 23% increase in the Italian market, compared to the same days of 2019. On the other hand, the wind energy production in the French market decreased by 7.9% while in the German market it fell by 3.4%.

For the fourth week of October, the AleaSoft‘s wind energy production forecasting indicates an increase in most of the markets analysed at AleaSoft, except in the Italian market, where a reduction in production with this technology is expected compared to the week of October 12.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

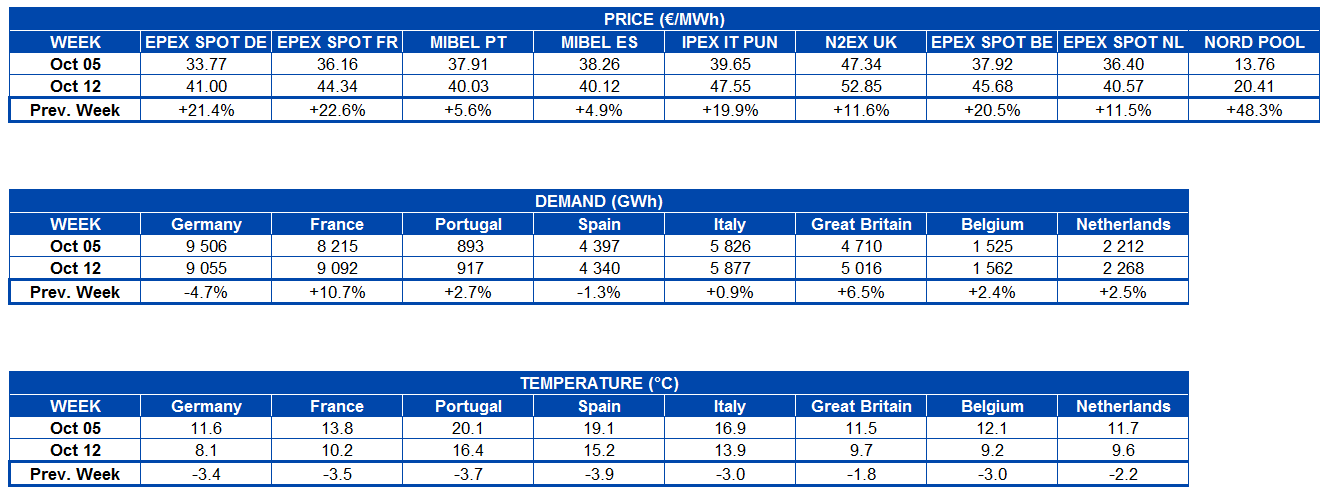

Electricity demand

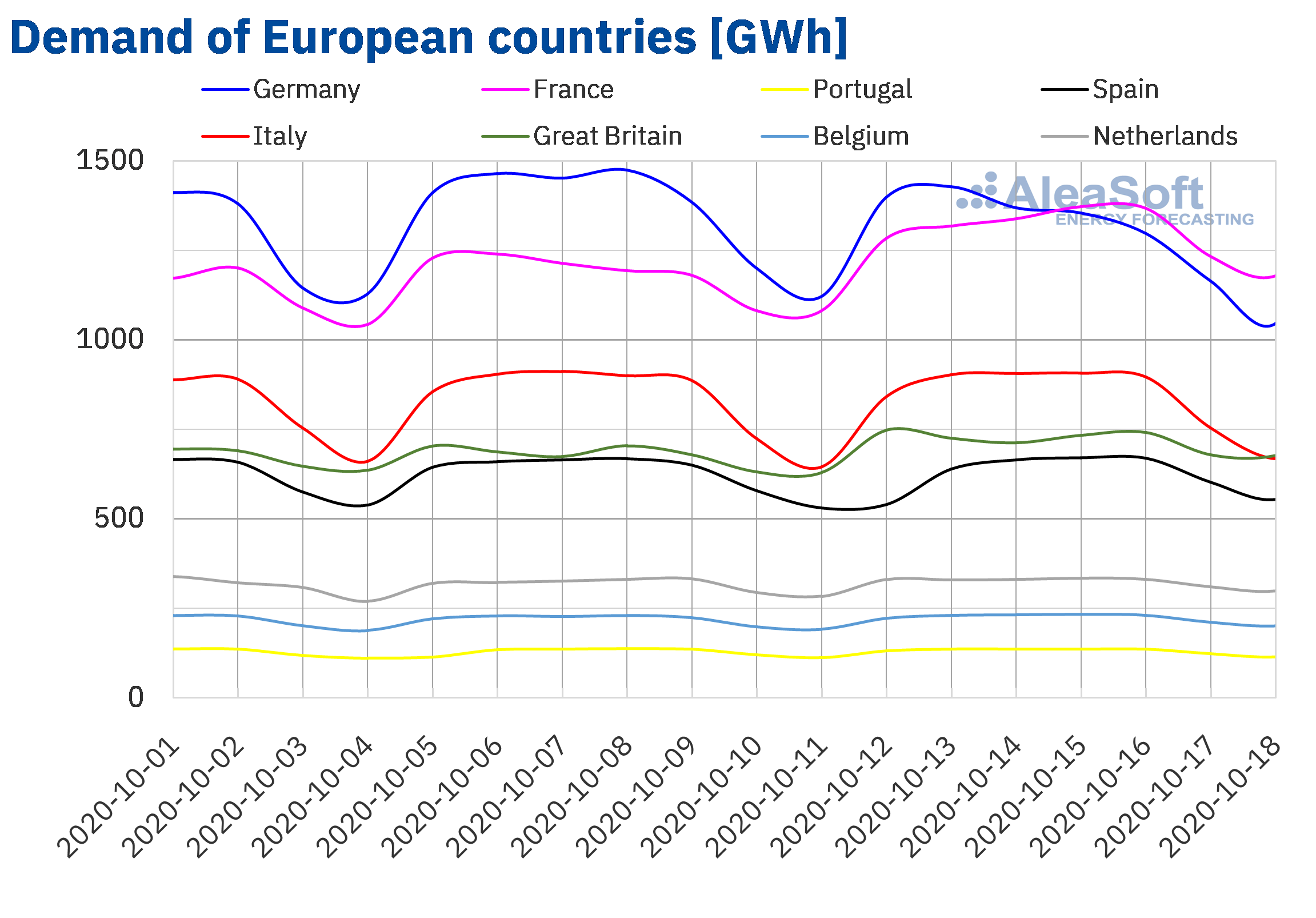

The decreases in average temperatures in Europe caused the electricity demand to increase in most electricity markets during the week of October 12 compared to the previous week. Decreases were only registered in the markets of Germany and Spain, where the decreases were 4.7% and 1.3% respectively. The effect of October 12, National Holiday of Spain, was an influential factor in the drop in demand in the Spanish market. Once this effect was corrected, the variation in demand in Spain represented an increase of 0.9%.

On the other hand, in France, the demand rose by 11%, favoured by the 3.5 °C drop in average temperatures. At the AleaSoft‘s observatory of the French market, it is possible to see the increase in demand during each day of the third week of October. In the British market there was an increase of 6.5%, while in the rest of the markets the demand increased between 0.9% and 2.7%.

For the week of October 19, the AleaSoft‘s demand forecasting points to a recovery in demand in most markets. In some markets such as those of Spain, France and Great Britain, the behaviour of the electricity demand could be influenced downward, due to the new measures and mobility restrictions announced in these countries since the week of October 12 to stop the spread of COVID‑19.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

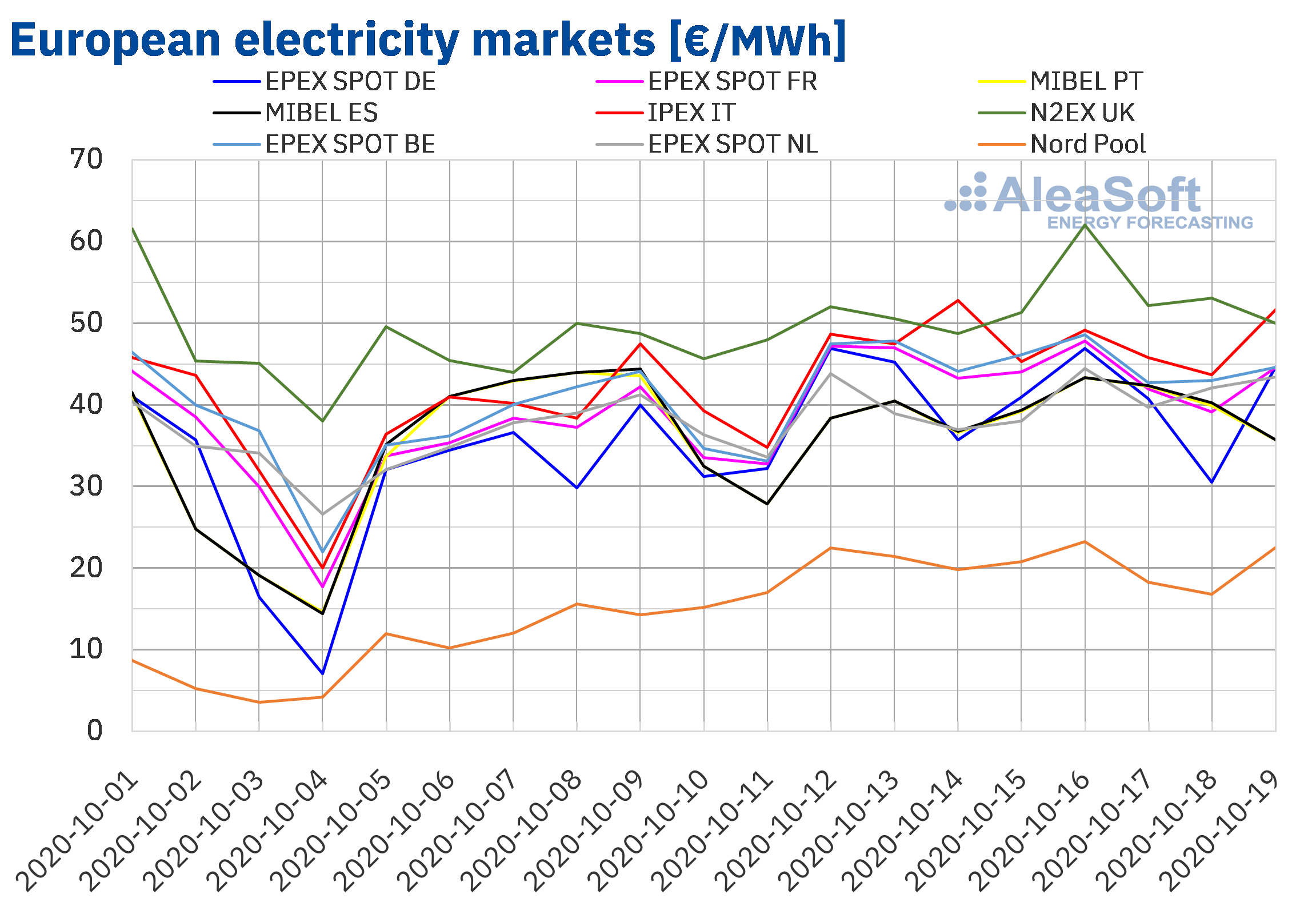

European electricity markets

The week of October 12, the prices of all the analysed European electricity markets increased compared to those of the previous week. The market with the highest price increase, of 48%, was the Nord Pool market of the Nordic countries. On the other hand, the market with the lowest price increase was the MIBEL market of Spain and Portugal, with increases of 4.9% and 5.6% respectively. In the rest of the markets, the price increases were between 11% of the EPEX SPOT market of the Netherlands and 23% of the EPEX SPOT market of France.

In the analysed period, weekly average prices above €40/MWh were reached in all European electricity markets, except in the Nord Pool market. This market had the lowest average price, of €20.41/MWh. On the other hand, the highest average, of €52.85/MWh, was that of the N2EX market of Great Britain, followed by that of the IPEX market of Italy, of €47.55/MWh.

On the other hand, the third week of October, the prices of the European electricity markets were loosely coupled. The British market presented the highest daily prices, except on Wednesday, October 14, when it was replaced by the Italian market. Instead, the lowest prices were those of the Nord Pool market. In the rest of the markets, the lowest prices during the week alternated between the Iberian market, the Netherlands market and the German market.

On October 16, the highest daily price of the week, of €62.05/MWh, was reached in the British market. In this market, the prices exceeded €50/MWh almost every day of the third week of October. On the 14th, the daily price of the Italian market also exceeded this amount, reaching €52.82/MWh. The rest of the markets had lower daily prices. The minimum daily price of the week, of €16.79/MWh, was reached on Sunday, October 18, in the Nord Pool market.

Regarding the hourly prices of the third week of October, the price of the hour 20 of Friday, October 16, reached in the British market, of €202.91/MWh, stands out.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

In the third week of October, the fall in wind energy production in Germany, France and Spain and the decrease in solar energy production in Germany and Italy, as well as the increase in demand in most of the analysed electricity markets, favoured the increase in prices in the European markets. Another factor that led to this rise is the recovery in gas prices, which exceeded €14/MWh.

The AleaSoft‘s price forecasting indicates that in the week of October 19, the prices will fall in most of the analysed European electricity markets due to increases in wind energy generation, except in the IPEX market, where a significant decrease in production with this technology is expected.

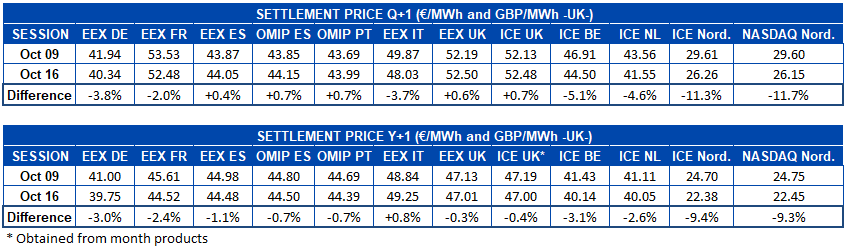

Electricity futures

The European electricity futures markets prices registered a heterogeneous behaviour for the product of the next quarter at the settlement of the session of October 16 compared to that of October 9. On the one hand, in the EEX market of Germany, France and Italy, the ICE market of Belgium, the Netherlands and the Nordic countries and the NASDAQ market of the latter region, the prices were reduced. The markets with the greatest variation were those of the Nordic countries, with a decrease close to 12%, while the smallest decrease was registered in the French market, which was 2.0%. On the other hand, the prices increased in the EEX market of Spain and Great Britain, in the OMIP market of Spain and Portugal and in the British ICE market. The largest increase, of 0.7%, was registered in the OMIP market of Spain and Portugal and in the ICE market of Great Britain.

In the case of the prices for the calendar year 2021, the behaviour of the markets was somewhat more homogeneous. In the vast majority of the markets analysed at AleaSoft, the prices fell. The exception was the EEX market of Italy, which registered an increase of 0.8% in its settlement price compared to that of October 9. In the rest of the markets, the decreases were between 0.3% of the EEX market of Great Britain and 9.4% of the ICE market of the Nordic countries.

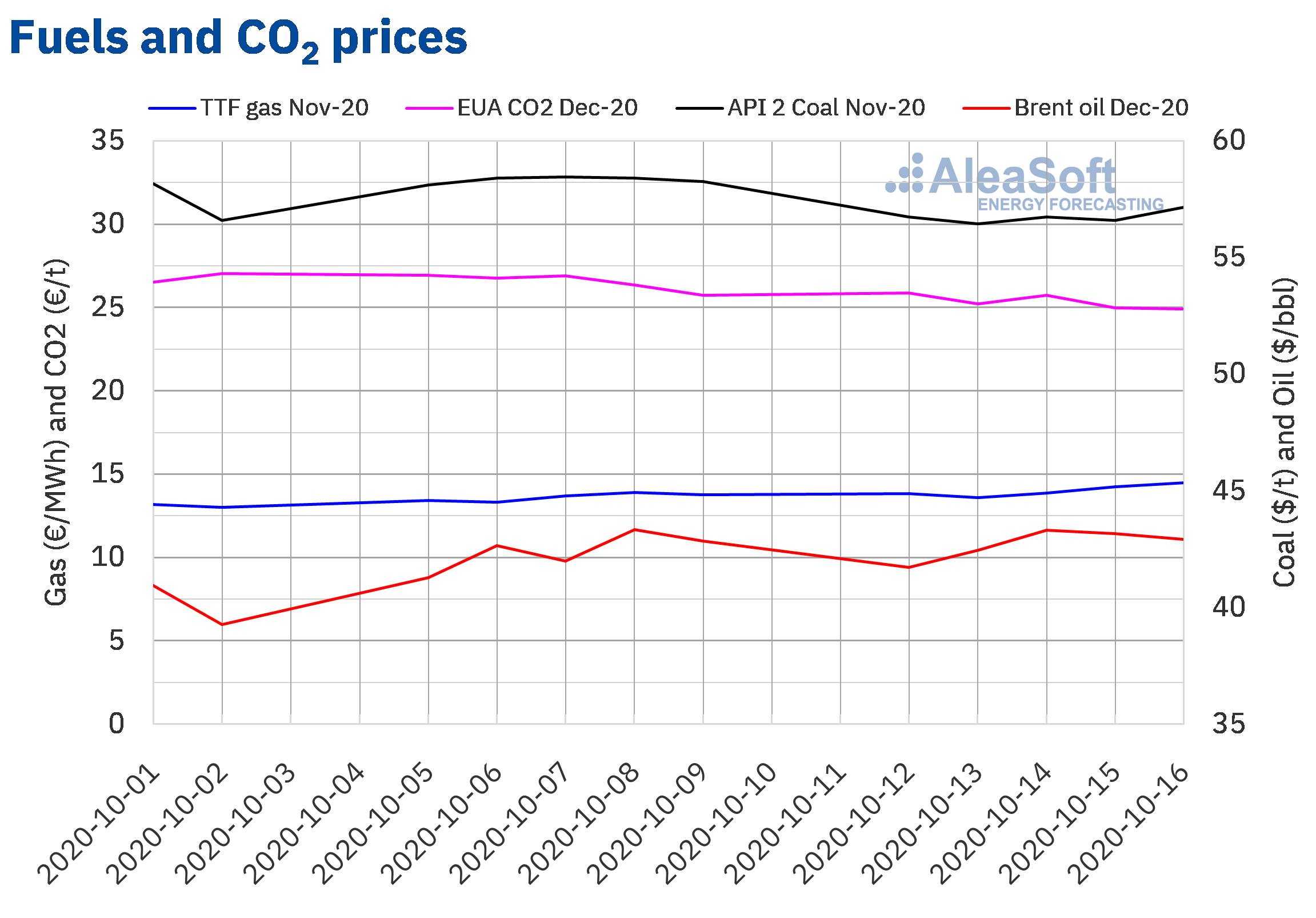

Brent, fuels and CO2

The Brent oil futures for the month of December 2020 in the ICE market, on Monday, October 12, reached a settlement price of $41.72/bbl, 2.6% lower than that of the last session of the week previous. Instead, on Tuesday and Wednesday, the prices rose to register a settlement price of $43.32/bbl on October 14. But, subsequently, the prices fell again. Despite this, the settlement price of Friday, October 16, of $42.93/bbl, was still 0.2% higher than that of the previous Friday.

In the first half of the third week of October, the decline in crude oil reserves of the United States and the news about the production levels of the OPEC+ countries favoured the recovery of the prices. But the concerns about the impact on the demand of the measures to try to contain the increase in COVID‑19 cases in the Northern Hemisphere exerted its downward influence on the Brent oil futures prices, which fell again.

As for the TTF gas futures prices in the ICE market for the month of November 2020, the third week of October they had a generally upward trend. On Friday, October 16, the maximum settlement price of the week, of €14.50/MWh, was reached. This price was 5.4% higher than that of the same day of the previous week and the highest since the second half of February.

Regarding the TTF gas prices in the spot market, on Tuesday and Wednesday of the third week of October they fell, but the rest of the days they increased. As a result, the index price for the weekend of October 17 and 18 was €14.48/MWh. This price was the highest since December 2019.

On the other hand, the API 2 coal futures in the ICE market for the month of November 2020 had settlement prices below $57/t almost every day of the third week of October. On Friday, October 16, there was a recovery of 1.0% and a settlement price of $57.15/t was reached. But this price was still 1.9% lower than that of the previous Friday.

As for the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, the third week of October they were lower than those of the same days of the previous week. On Monday, October 12, the settlement price was €25.88/t. But, due to the decreases registered during the week, the settlement price of Friday, October 16, was €24.90/t. This price was 3.2% lower than that of the previous Friday and the lowest since the end of June. The evolution of the prices was influenced by the concerns about the consequences that could derive from the new measures implemented to stop the spread of COVID‑19 in Europe.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the second wave of the pandemic

Since the beginning of the COVID‑19 pandemic, at AleaSoft an informative work was carried out to inform all agents of the energy sector about the evolution of the markets and the prospects in the mid and long term. Within this framework, various webinars were held in which speakers from leading companies in the renewable energy sector such as Banco Sabadell, Engie, JLL, Powertis and Triodos Bank participated. The next webinar “Energy markets in the recovery from the economic crisis (II)”, which is being organised for October 29, will have the participation of two speakers from the consulting firm Deloitte, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, as well as Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft. In the webinar, in addition to analysing the evolution of the energy markets taking into account the uncertainty generated by the second wave of the pandemic, the financing of the renewable energy projects and the importance of the forecasting in the audits and portfolio valuation will also be discussed.

Continuing with the informative work of the company, its CEO, Antonio Delgado Rigal, will participate in the discussion table “Are auctions the appropriate response to uncertainties in the electricity market?” of the VII Solar Forum of UNEF on October 21.

The most up‑to‑date scenarios of the evolution of the economy as well as the prospects for the recovery from the crisis are taken into account in the long‑term prices curves of the European electricity markets of AleaSoft. This type of forecasting is a fundamental input in the consulting on renewable energies, for example, in the PPA, in the portfolio valuation and audits, and in the risk and coverage management.

The AleaSoft‘s observatories allow the evolution of the main European electricity, fuels and CO2 emission rights markets to be monitored. In this tool, the data is updated daily and presented in comparative graphs of the last few weeks, which allows analysing how the markets are reacting in this second wave of the pandemic.

Source: AleaSoft Energy Forecasting.