AleaSoft, August 6, 2020. Electricity futures in European markets posted an upward trend, driven by rallies in gas and Brent prices, which are slowly climbing away from the lows during the most critical phase of the COVID‑19 pandemic in March and April, and approaching pre-crisis levels. Meanwhile, the growth of solar production in Spain and Portugal continues at a spectacular rate with increases of 30% compared to the first days of August 2019.

Solar photovoltaic and solar thermal energy production and wind energy production

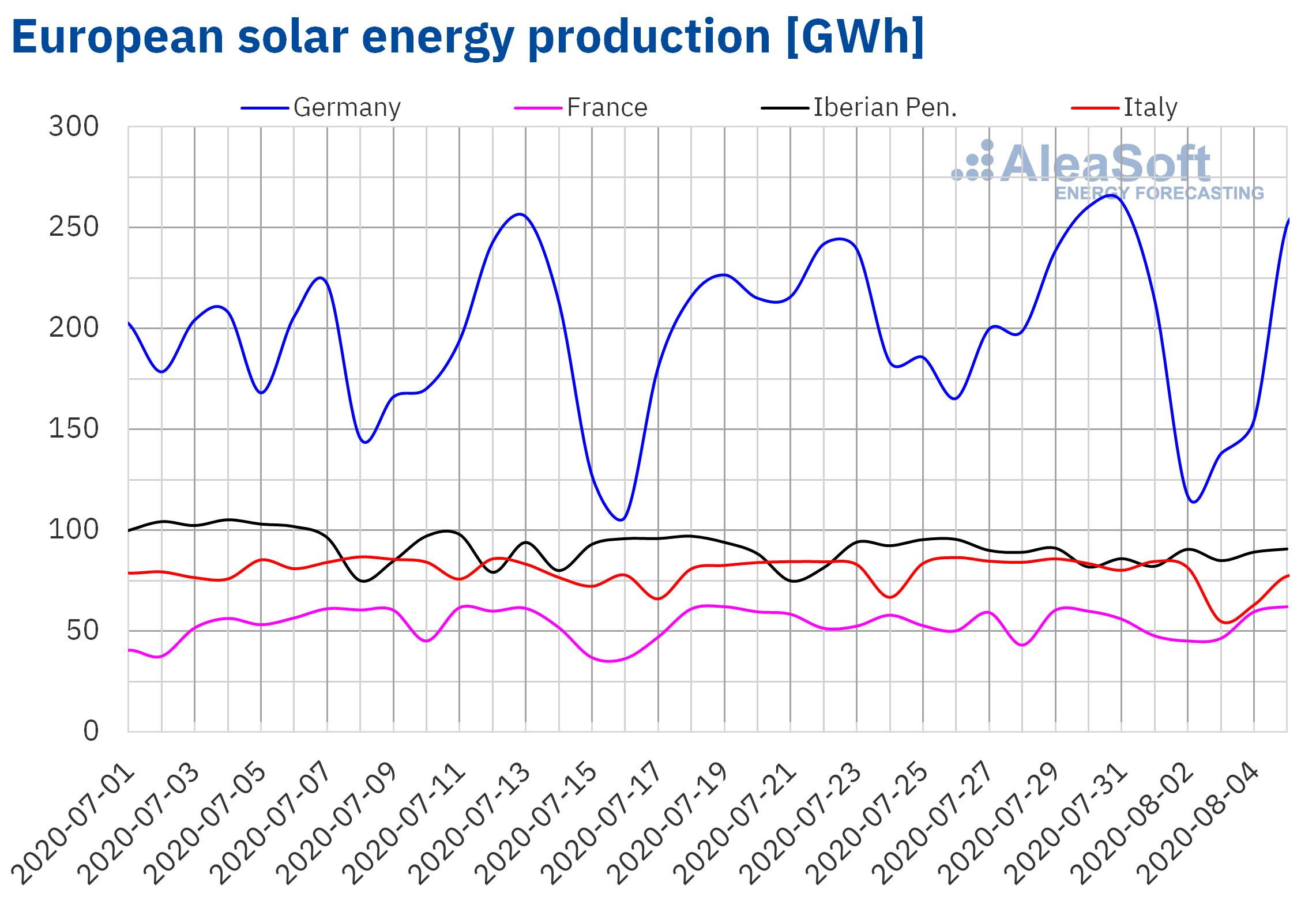

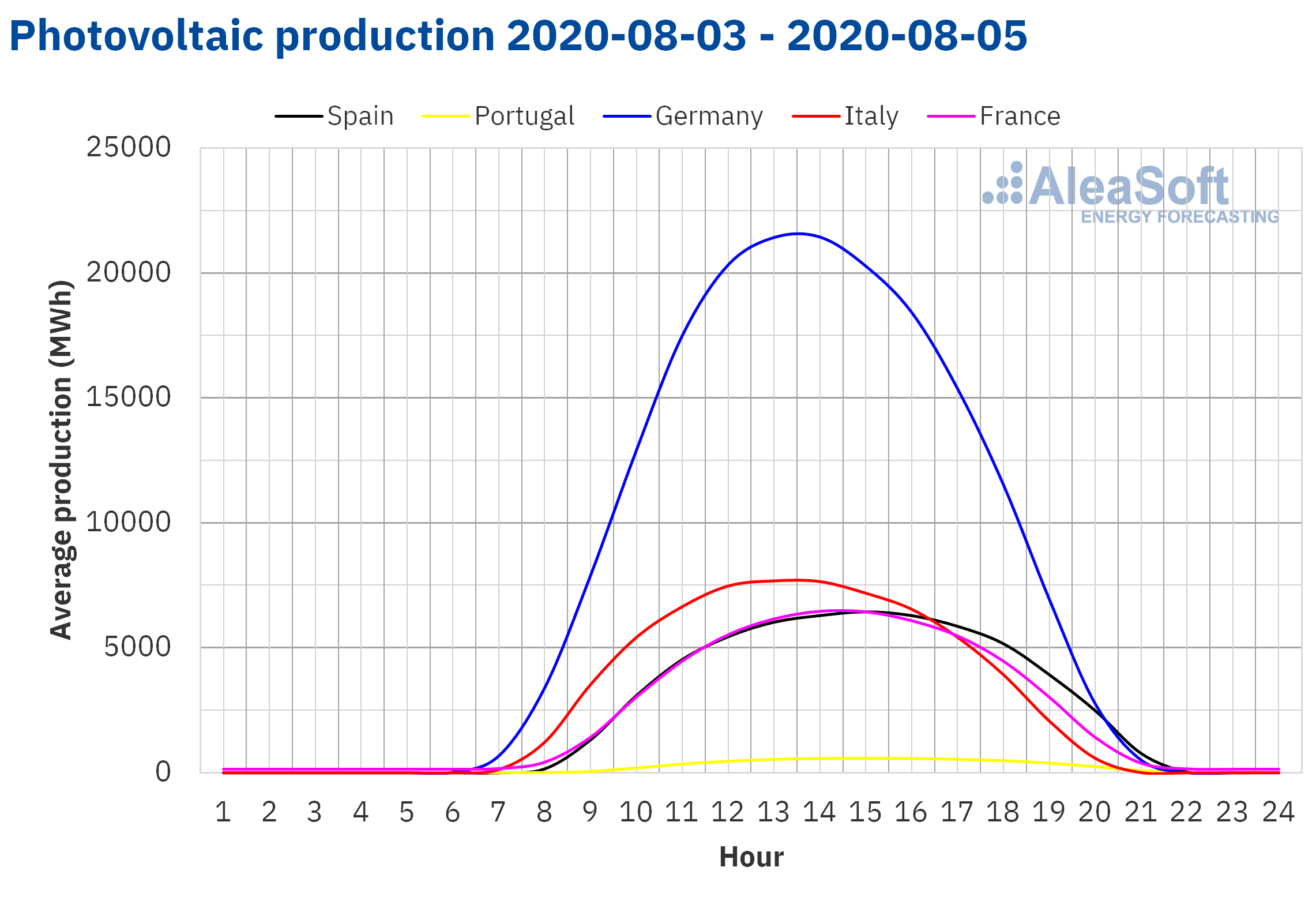

From Monday to Wednesday of the week of August 3, solar energy production performed unevenly compared to the average for the last week of July. The production curve in all the analysed markets was ascending during these three days. However, in Germany and Italy there were falls of 15% and 22% respectively. Regarding the increases, in the Iberian Peninsula and France there were variations of between 1.2% and 5.6% respectively, compared to the previous week.

When comparing the first five days of August in year-on-year terms, the picture is somewhat different. There was only a lower production in the Italian market, of a 5.8%. Increases were registered in the rest of the markets, the most notable being the Iberian Peninsula with a 30% increase. In France it increased by 3.7% and in Germany by 0.8%.

At the end of the first week of August, at AleaSoft it is expected that solar energy production in Spain and Italy will decrease compared to that registered during the week of July 27 and that in Germany it will increase.

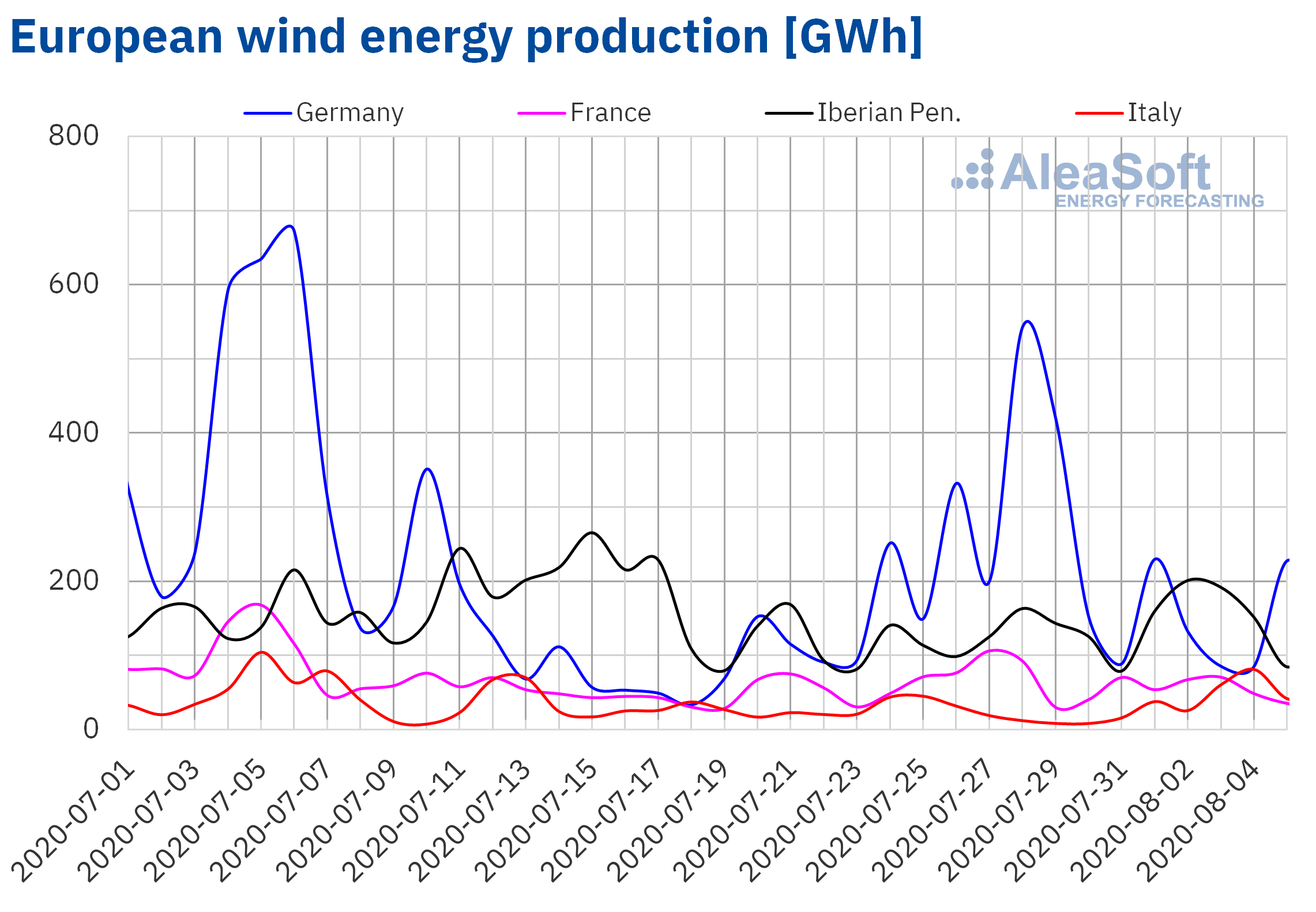

The wind energy production behaved heterogeneously in the European electricity markets from August 3 to 5 compared to the average of the last week of July. In Italy, production tripled compared to the average values for the week of July 27 and reached an increase of 236%, mainly due to the recovery between Monday and Tuesday. In the Iberian Peninsula the increase was only 0.1%, while in France and Germany there were falls of 22% and 47% respectively.

In the days elapsed in August, there were year-on-year increases in wind energy production in all the analysed markets. The increase this time in Italy was 37%. However, the 127% in Germany and 77% in the Iberian Peninsula stand out as the highest values among the analysed markets. In France the increase was 57%.

The AleaSoft‘s wind energy forecasting indicates that at the end of the week of August 3, production will be higher than that of the last week of July in Italy and Portugal, while in the rest of the markets it will be lower.

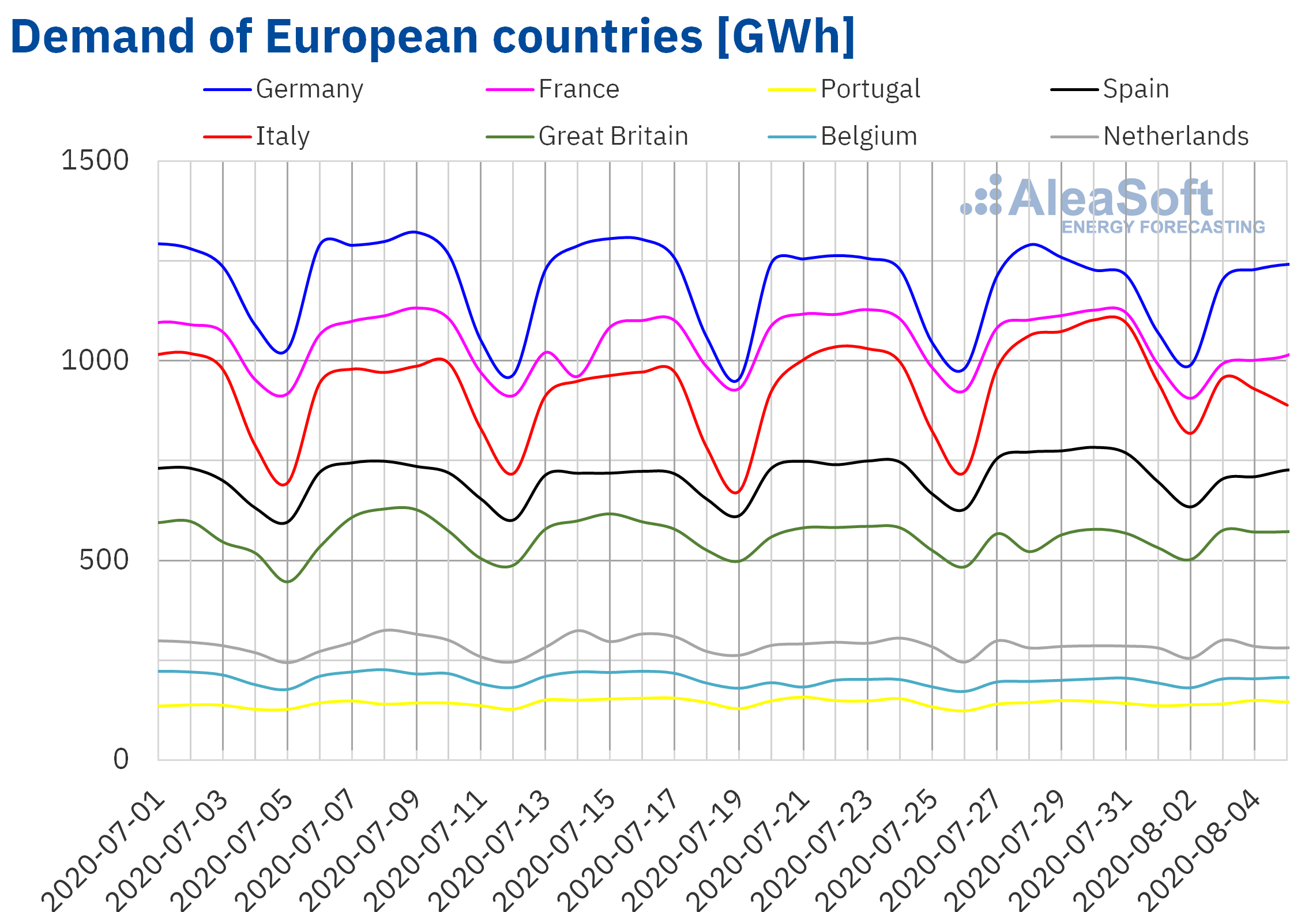

Electricity demand

From Monday to Wednesday of the week of August 3, the electricity demand had significant declines in several markets. The decrease in labour activity during the August holiday period was one of the main causes of these falls. Another influential factor was the drop in average temperatures, up to 3.0 °C higher in the case of Germany. The fundamental decreases occurred in the markets of Italy, France and Spain, with records of 11%, 8.8% and 7.0% respectively. The German market was the one with the smallest drop, 2.3%. On the other hand, in Great Britain, Belgium and Portugal there were increases of 3.9%, 3.6% and 0.5% respectively.

For the week of August 3, at AleaSoft, the electricity demand is expected to decrease in most markets compared to the week of July 27 and to maintain similar values in the markets of Great Britain and Belgium.

The notable decreases registered this week in several European markets can be analysed in greater detail in the AleaSoft‘s electricity market observatories. In particular, the clearly visible falls in the observatories of Italy, France and Spain.

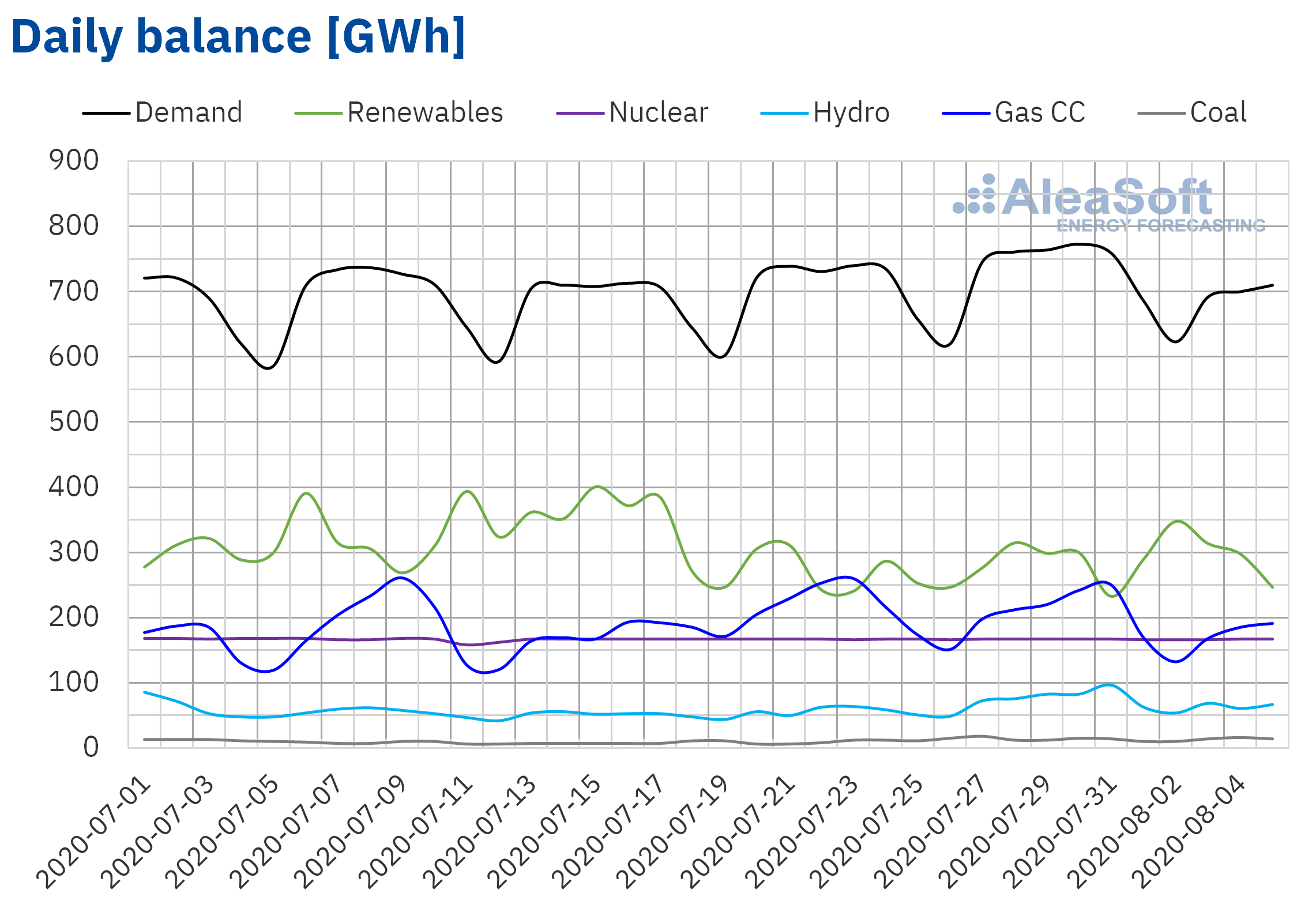

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

At the beginning of the week, the electricity demand of Mainland Spain began to notice the effects of the August holiday period. The 1.4 °C drop in average temperatures also favoured the drop in demand. So far in the first week of August, the drop was 7.0% compared to the last week of July. At the end of the week of August 3, at AleaSoft it is expected that the demand will continue to be lower than the previous week.

The solar energy production, which includes both photovoltaic and solar thermal technologies, had a 1.0% recovery from Monday to Wednesday of the week of August 3 compared to the average of the week of July 27. Comparing the first five days of August year-on-year, the rise was much greater, registering an increase of 30%. At AleaSoft, it is expected that, at the end of the first week of August, solar energy production will be lower than that of the last week of July.

On the other hand, the wind energy production of Mainland Spain fell 6.4% between August 3 and 5 compared to the average for the week of July 27. However, in year-on-year terms, production from August 1 to 5 doubled that registered during the first five days of August 2019, reaching an increase of 108%. At AleaSoft it is expected that, at the end of the week of August 3, the wind energy will decrease compared to the last week of July.

All nuclear power plants in the Iberian Peninsula are up and running and the average production for the first three days of the week on August 3 was 167 GWh.

The level of hydroelectric reserves decreased by 4.0% compared to the previous week’s record, and there are currently 13 492 GWh, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and the Demographic Challenge.

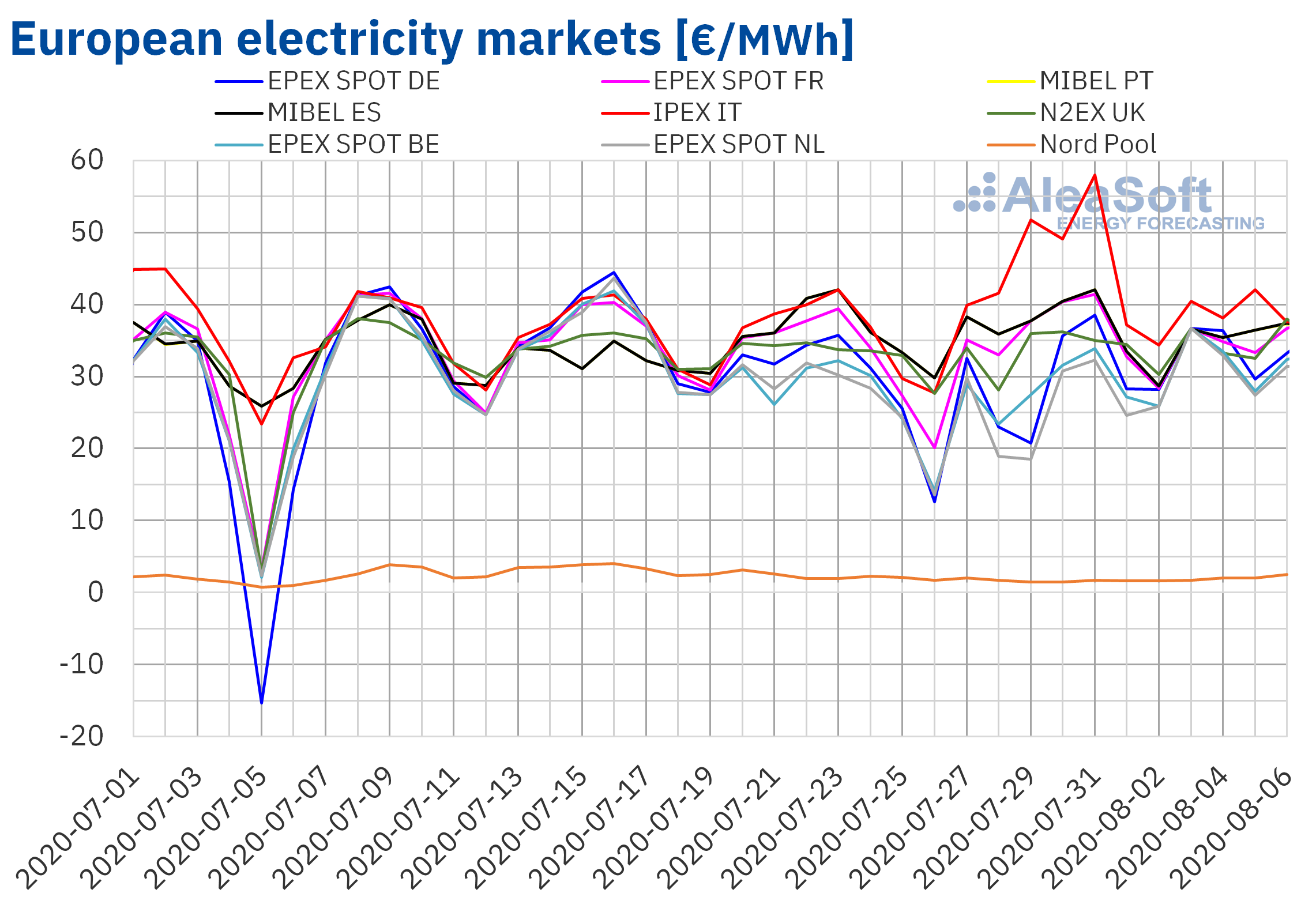

European electricity markets

In the first four days of the week of August 3, the prices of the European electricity markets analysed at AleaSoft remained relatively stable above €30/MWh in most cases, with a specific drop on August 5 in some markets that rallied immediately the next day. Not all markets registered this minimum on the 5th, which had its origin in the EPEX SPOT market in Germany, where that day the renewable energy production presented a considerable increase, lowering the prices. The effect of the price drop in Germany spread to nearby countries that import electricity from German territory, such as the Netherlands or Belgium.

With respect to the same days of the previous week of July 27, from Monday to Thursday of the first week of August, the price was higher between 4.6% of the N2EX market of Great Britain and 31% of the EPEX SPOT market of the Netherlands, except in the MIBEL market of Spain and Portugal, in the EPEX SPOT market of France and in the IPEX market of Italy. In the case of the Italian market, it was precisely the one who registered the greatest decrease so far this week, of 13%, due in large part to the drop in temperatures, which, being less warm, led to a lower demand for electricity.

Regarding the average price for the first four days of the week, the Italian market, despite registering the biggest drop, was the one with the highest price, with an average of €39.56/MWh. On the other hand, the Nord Pool market in the Nordic countries was the one with the lowest price, at €2.06/MWh. The rest of the markets averaged prices between €32.11/MWh and €36.45/MWh.

At AleaSoft, the electricity market prices forecasting indicates that the prices of all the markets will fall in the remainder of the week, favoured by lower demand during the weekend and higher renewable energy production, although the effect will be slowed in certain measure due to the increase in temperatures expected for the next few days.

Iberian market

In the days that elapsed of the first week of August, the MIBEL market of Spain and Portugal presented prices lower than those registered during the same days of the previous week, of July 27. The declines in daily prices were between 1.4% and 7.7% for both countries. The price in this market so far this week was €36.45/MWh in the case of Spain and €36.44/MWh in the case of Portugal, the second and third markets with the highest prices, behind from the Italian market.

At AleaSoft, the prices in this market are expected to continue falling for the rest of the week, mainly driven by lower demand over the weekend. At the end of the week, the average price for the first week of August will be lower than that registered during the last week of July for both markets.

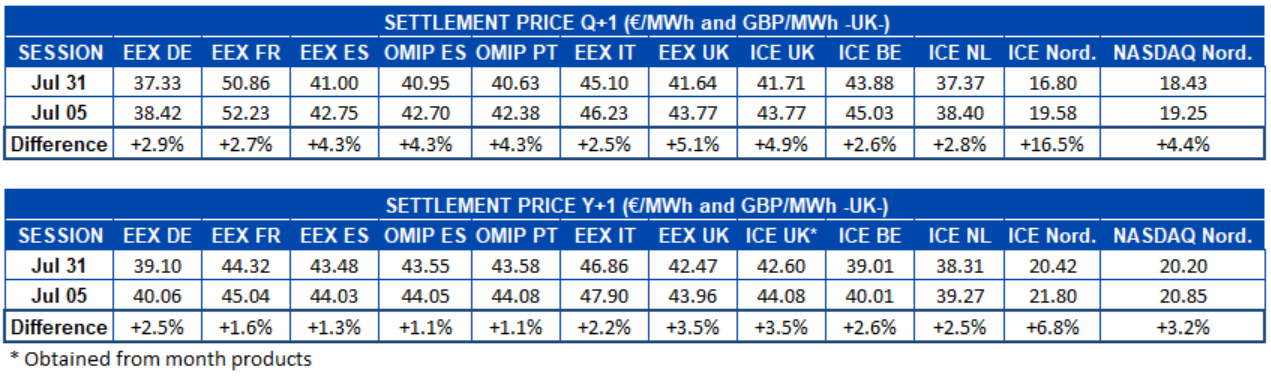

Electricity futures

The prices of the European electricity futures markets registered a general increase during the days of August. In the session of Wednesday, August 5, the product of the fourth quarter of 2020 showed increases of between 2.5% and 5.1% in most markets compared to the session of July 31. In the case of the Nordic countries in the ICE market, the increase in percentage terms rose to more than 16% due to their low price. In absolute terms, the Nordic market was also the leader, but in this case closely followed by Britain’s EEX market, where the variation was the aforementioned 5.1%.

In the case of the futures for next year 2021, there were also increases, although of lesser magnitude. Once again, the ICE market of the Nordic countries led the increases, with a 6.8% variation compared to the session of July 31. In the rest of the markets, the increases for this product were between 1.1% of the OMIP market in Spain and Portugal and 3.5% in the EEX and ICE markets of Great Britain.

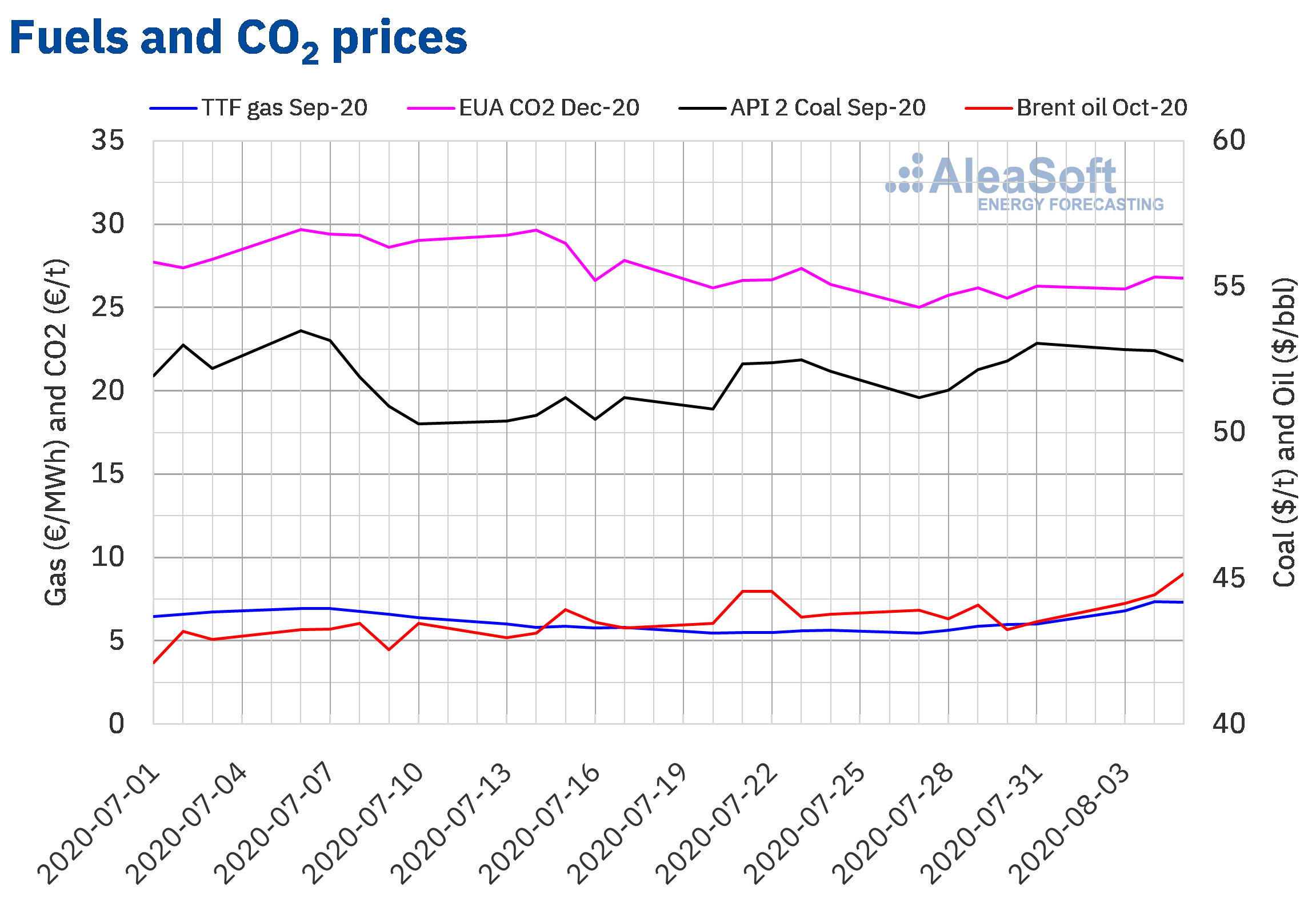

Brent, fuelsand CO2

The Brent oil futures prices for the month of October 2020 in the ICE market remained high and above $44/bbl during the first three days of the first week of August. Prices for this period continued to be higher than those registered from Monday to Wednesday of the last week of July. On Monday, August 3, a price of $44.15/bbl was reached, 1.4% higher than the settlement price of Friday, July 31. In the following days, they continued to increase until reaching, on Wednesday, August 5, the maximum closing price for this period of $45.17/bbl. This price was the highest since the first week of March.

The 1.7% increase in the settlement price on Wednesday, August 5, compared to the previous day, was related to the publication of data on oil reserves in the United States, where there was a considerable drop in crude stocks. However, the increase in COVID‑19 infections around the world and mainly in the United States, may cause demand not to recover quickly, which can lead to further declines in prices.

On the other hand, during the first two days of the week of August 3, TTF gas futures in the ICE market for the month of September 2020 continued the upward trend that was registered since July 28. On Monday there was a settlement price of €6.80/MWh, 24% higher than that of Monday, July 27. On Tuesday, August 4, the maximum price for this period of €7.36/MWh was reached, 8.1% above the price of the previous day and the highest since the first week of May. But on August 5 the price had a slight decline of 0.5% compared to the previous day to €7.32/MWh, the second highest price in this period and 25% higher than on Wednesday of the last week of July.

Regarding the prices of TTF gas in the spot market, the first days of the first week of August, they had values higher than €5/MWh. On Wednesday, August 5, an index price of €6.86/MWh was registered, higher than the previous day by 14% and the highest since April 17, 2020. But for Thursday, August 6, the price decreased by 1.4% to €6.76/MWh.

Regarding the API 2 coal futures prices in the ICE market for the month of September 2020, they started the week of August 3 with prices below $53/t. A price of $52.85/t was reached on Monday, the highest during the first three days of the week, although 0.4% lower than the settlement price on Friday, July 31. In the two following days, a downward trend was registered, although they continued to be higher than the same days in the last week of July. On Wednesday, August 5, the minimum price for the first three days of the week was reached at $52.45/t, 0.7% lower than the previous day. The increase in coal stocks on the world market and the fall in demand due to the coronavirus pandemic are what is pushing coal prices down.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2020, they remained above €26/t during the first three days of the week. On Monday August 3 they reached a settlement price of €26.12/t, 4.4% higher than on Monday July 27. On Tuesday, the maximum price for this period, of €26.84/t, was registered, 2.8% higher than the previous day and the highest since July 23. On Wednesday prices fell by 0.3% to €26.77/t.

AleaSoft expands its series of webinars on electricity markets in the recovery from the crisis

Due to the great reception that are having the two webinars of the new series that AleaSoft is preparing for after the summer on the situation of the electricity markets during the recovery from the COVID‑19 crisis, as well as the interest shown to participate on the part of the speakers of several companies of the European energy sector, the series of webinars was expanded with a third part that will take place on November 26.

Thus, the series of webinars “The energy markets at the end of the economic crisis” will be divided into three parts, the first on September 17, the second on October 29 and the third on November 26, and will feature, so far this moment, with confirmed speakers from Deloitte, Vector Renewables, Engie and AleaSoft. In addition to the evolution and prospects of the energy markets, the status of the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation will be addressed.

Source: AleaSoft Energy Forecasting.