AleaSoft Energy Forecasting, December 9, 2025. In the first week of December, most major European electricity markets registered week‑on‑week declines and prices below €95/MWh, with lows in France, Spain and Portugal, although several markets registered daily prices above €100/MWh. In addition, many markets set solar photovoltaic energy production records for a December day, Spain registered the highest daily wind energy production for a December day in four years and TTF gas futures reached their lowest level since April 2024, falling below €27/MWh.

Solar photovoltaic and wind energy production

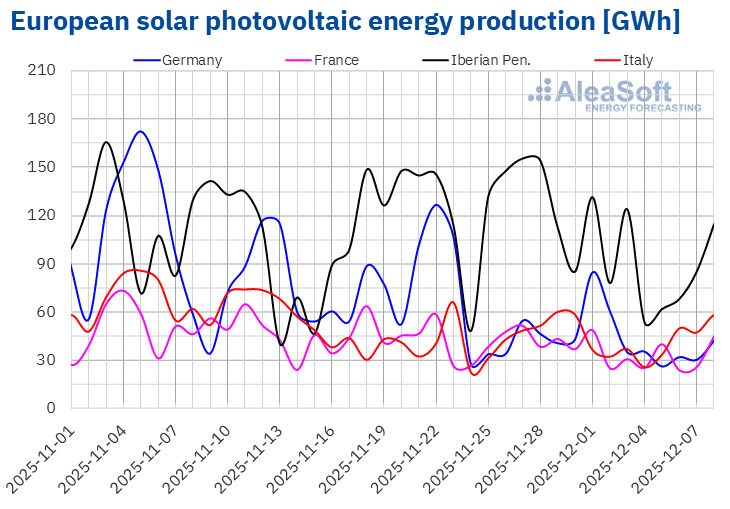

In the week of December 1, solar photovoltaic energy production increased by 8.7% in the German market compared to the previous week. Meanwhile, the markets of Italy, France and the Iberian Peninsula registered declines for the second consecutive week. The Portuguese market registered the largest drop, 33%, followed by the 27% decline in the Spanish market. The Italian market registered the smallest reduction, 17%, while in France production from this technology fell by 22%.

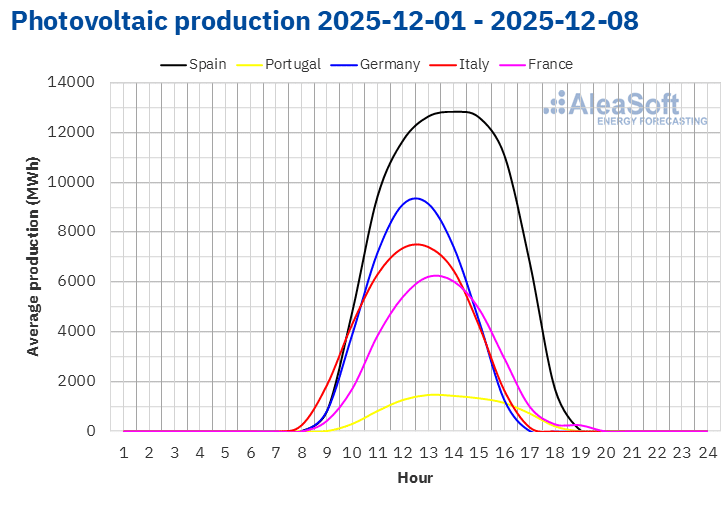

Despite the declines, most markets reached all‑time records for solar photovoltaic energy production for a December day. On Monday, December 1, the markets of Spain, Germany, France and Portugal reached their highest daily photovoltaic energy generation for a December, with 117 GWh, 85 GWh, 49 GWh and 14 GWh, respectively. Italy registered its highest solar photovoltaic energy production for a December on Monday the 8th, with 58 GWh.

In the week of December 8, according to AleaSoft Energy Forecasting’s solar energy forecasts, solar energy generation will rebound in the markets of Italy, Germany and Spain.

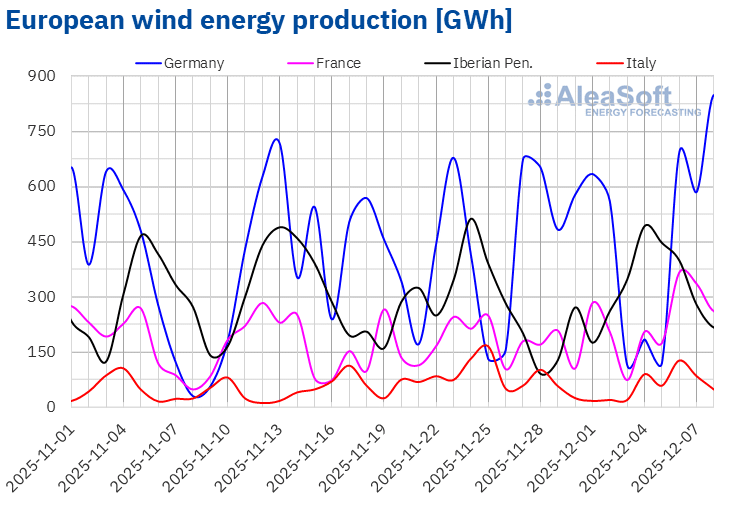

During the first week of December, wind energy production increased in the markets of the Iberian Peninsula and France compared to the previous week. The Portuguese market registered the largest increase, 56%, followed by France with 34% and Spain with 23%. These three markets registered increases for the second week in a row. By contrast, the German and Italian markets registered declines of 6.3% and 29%, respectively. Germany registered drops for the second consecutive week.

On Thursday, December 4, the Spanish market reached the highest daily wind energy production for a December in the past four years, with 369 GWh.

In the week of December 8, according to AleaSoft Energy Forecasting’s wind energy forecasts, the German market will reverse the downward trend and register increases. Conversely, the markets of the Iberian Peninsula, Italy and France will register declines in wind energy generation.

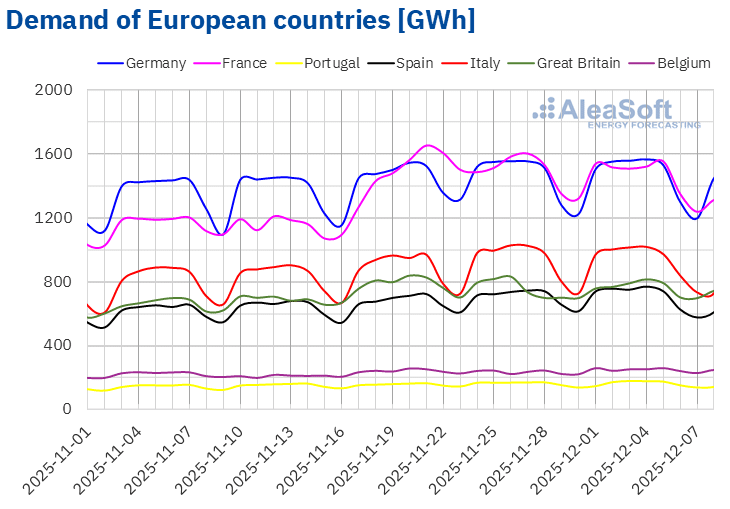

Electricity demand

In the first week of December, electricity demand increased in most major European markets. The Belgian market registered the largest rise, 6.2%, followed by the 0.9% increase in the British market. Both markets registered an upward trend after declines in the previous week. In Germany, Italy, Portugal and Spain, demand rose between 0.2% in Germany and 0.6% in Spain. These four markets registered five consecutive weeks of increases. France was the exception, as demand fell by 1.5%, marking a second consecutive week of declines.

During the week, all analyzed markets registered higher average temperatures than the previous week. Italy and Belgium registered the largest increase, 1.0 °C in both cases. In Germany, Great Britain, Spain, France and Portugal, average temperatures increased between 0.2 °C in Germany and 0.7 °C in Portugal.

For the second week of December, according to AleaSoft Energy Forecasting’s demand forecasts, demand will decrease in all analyzed markets, driven mostly by milder temperatures than in the previous week. In the Spanish and Italian markets, demand will also fall due to the holiday on Monday, December 8, the Immaculate Conception Day.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

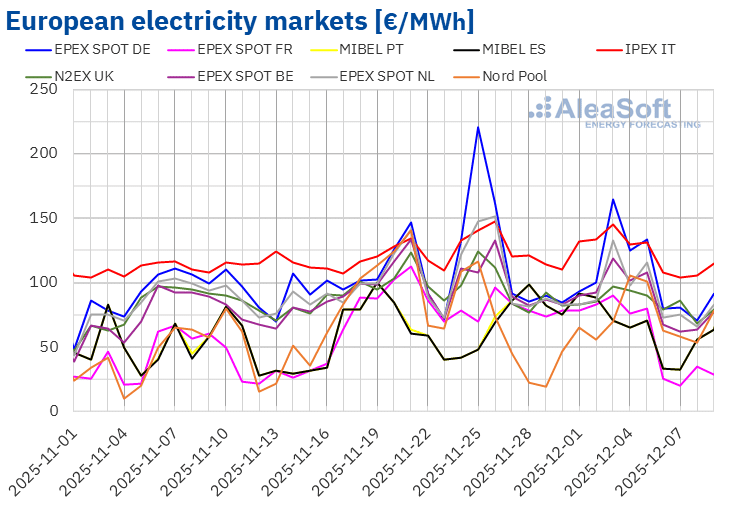

In the first week of December, average prices in most major European electricity markets fell compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with a 20% increase. The IPEX market of Italy registered the smallest decline, 0.4%, while the EPEX SPOT market of France registered the largest percentage drop in prices, 19%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 7.7% in the EPEX SPOT market of Belgium and 12% in the EPEX SPOT market of the Netherlands.

In the week of December 1, weekly averages were below €95/MWh in most European electricity markets. The exceptions were the German and Italian markets, with averages of €110.97/MWh and €126.15/MWh, respectively. The MIBEL market of Spain and Portugal and the French market had the lowest weekly averages, €64.51/MWh, €64.51/MWh and €64.65/MWh, respectively. In the remaining markets analyzed at AleaSoft Energy Forecasting, prices ranged between €73.79/MWh in the Nordic market and €94.62/MWh in the Dutch market.

Regarding daily prices, France registered the lowest average of the week among the analyzed markets, €20.18/MWh, on Sunday, December 7. In addition to France, Spain and Portugal also registered prices below €35/MWh over the weekend.

On the other hand, most markets analyzed at AleaSoft Energy Forecasting registered prices above €100/MWh in some sessions of the first week of December, except Spain, France, Portugal and the N2EX market of the United Kingdom. In Italy, daily prices exceeded €100/MWh throughout the entire first week of December. However, the German market reached the highest daily average of the week, €164.81/MWh, on December 3.

In the week of December 1, the drop in weekly gas prices contributed to the decline in European electricity market prices. The increase in wind energy production in the Iberian Peninsula and France helped the Spanish, French and Portuguese markets to register the lowest weekly averages. In addition, demand fell in France, while solar energy production increased in Germany.

AleaSoft Energy Forecasting’s price forecasts indicate that in the second week of December, prices could continue to fall in most major European electricity markets, supported by lower demand. In addition, wind energy production will increase significantly in Germany. In contrast, prices will rise in Spain and Portugal, influenced by declining wind energy production in the Iberian Peninsula.

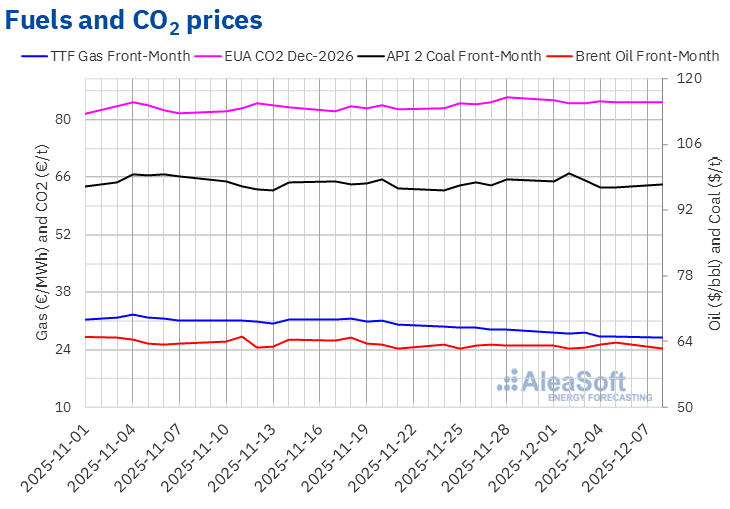

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $62.45/bbl, on Tuesday, December 2. According to data analyzed at AleaSoft Energy Forecasting, this was the lowest price since October 22. Subsequently, prices rose. As a result, on Friday, December 5, these futures reached their weekly maximum settlement price, $63.75/bbl, which was 0.9% higher than the previous Friday. However, after a 2.0% decline from Friday, on Monday, December 8, the settlement price was $62.49/bbl.

At the beginning of December, peace talks for Ukraine continued to exert downward pressure on Brent oil futures prices. However, the lack of progress in the talks, as well as Ukrainian attacks on Russian oil infrastructure, contributed to rising prices during the last sessions of the first week of December. In addition, growing tensions between the United States and Venezuela and the possibility of a cut in US interest rates, which could boost demand, also supported the recovery of prices.

On the other hand, increased Iraqi production and concerns about demand drove Brent oil prices down at the start of the second week of December. This week, the International Energy Agency and OPEC+ plan to release their reports on demand evolution.

As for TTF gas futures in the ICE market for the Front‑Month, in the first week of December they continued the downward trend of the previous week. On Monday, December 1, these futures reached their weekly maximum settlement price, €28.23/MWh. Conversely, after a 4.0% decline from the previous day, on Thursday, December 4, these futures registered their weekly minimum settlement price, €27.09/MWh. A slight rebound followed on Friday, December 5, with a settlement price of €27.27/MWh, 5.4% lower than the previous Friday.

According to data analyzed at AleaSoft Energy Forecasting, on Thursday, December 4, the settlement price was the lowest since April 6, 2024. However, on Monday, December 8, the price dropped even further, to €26.87/MWh, although it remained above the value registered on April 5, 2024.

Gas flows from Norway and abundant supplies of liquefied natural gas, as well as forecasts of milder temperatures, contributed to the decline in prices in the first week of December. Peace negotiations for Ukraine also continued to exert downward pressure on TTF gas futures prices.

Regarding settlement prices of CO2 emission allowance futures in the EEX market for the reference contract of December 2026, they remained below €85/t during the first week of December. On Monday, December 1, they reached their weekly maximum settlement price, €84.85/t. Conversely, these futures registered their weekly minimum settlement price, €84.00/t, on December 3. On Friday, December 5, the settlement price was €84.19/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 1.5% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the progress and prospects of the five‑year period of batteries

On Thursday, December 4, AleaSoft Energy Forecasting held the 61st edition of its monthly webinar series. The session in Spanish focused on the balance of the first year of the five‑year period of batteries and the prospects for the next years of the five‑year period. The session featured Antonio Hernández García, Partner of Regulated Sectors at EY, Jaume Pujol Benet, Partner, Financial Advisory at Deloitte, and Oscar Barrero Gil, Partner responsible for the Energy Sector at PwC Spain. On the other hand, the session in English analyzed the evolution of European electricity markets during 2025 and the main strategic vectors of the energy transition, such as renewable energy, demand, grids and energy storage.

Source: AleaSoft Energy Forecasting.