AleaSoft, November 10, 2020. When renewing an energy supply contract, it is important that it is framed and fits in with the short, mid and long‑term strategy and vision of the energy acquisition of the company. On the other hand, it is essential that, if the objective is to achieve a robust strategy that allows to mitigate the market prices risk and take advantage of times with low prices, this strategy is based on a reliable market prices forecasting.

The end of the year 2020 is approaching, a completely exceptional year in practically every aspect of the daily life, the economic activity and, obviously, the energy markets. In the current panorama of uncertainty due to the economic crisis, caused by the first wave of the COVID‑19 pandemic during the second quarter of the year, and at the height of the second wave, with consequences yet to be known, the moment to renew the energy supply contracts is more uncertain than ever.

The large energy consumers, from electro‑intensive industries to multinational companies with many supply points, through data centres and large commercial facilities, have enough energy volume to be able to negotiate the conditions that most favour them. Even so, in an uncertain moment like the present, making the right decisions is not exempt from certain risk.

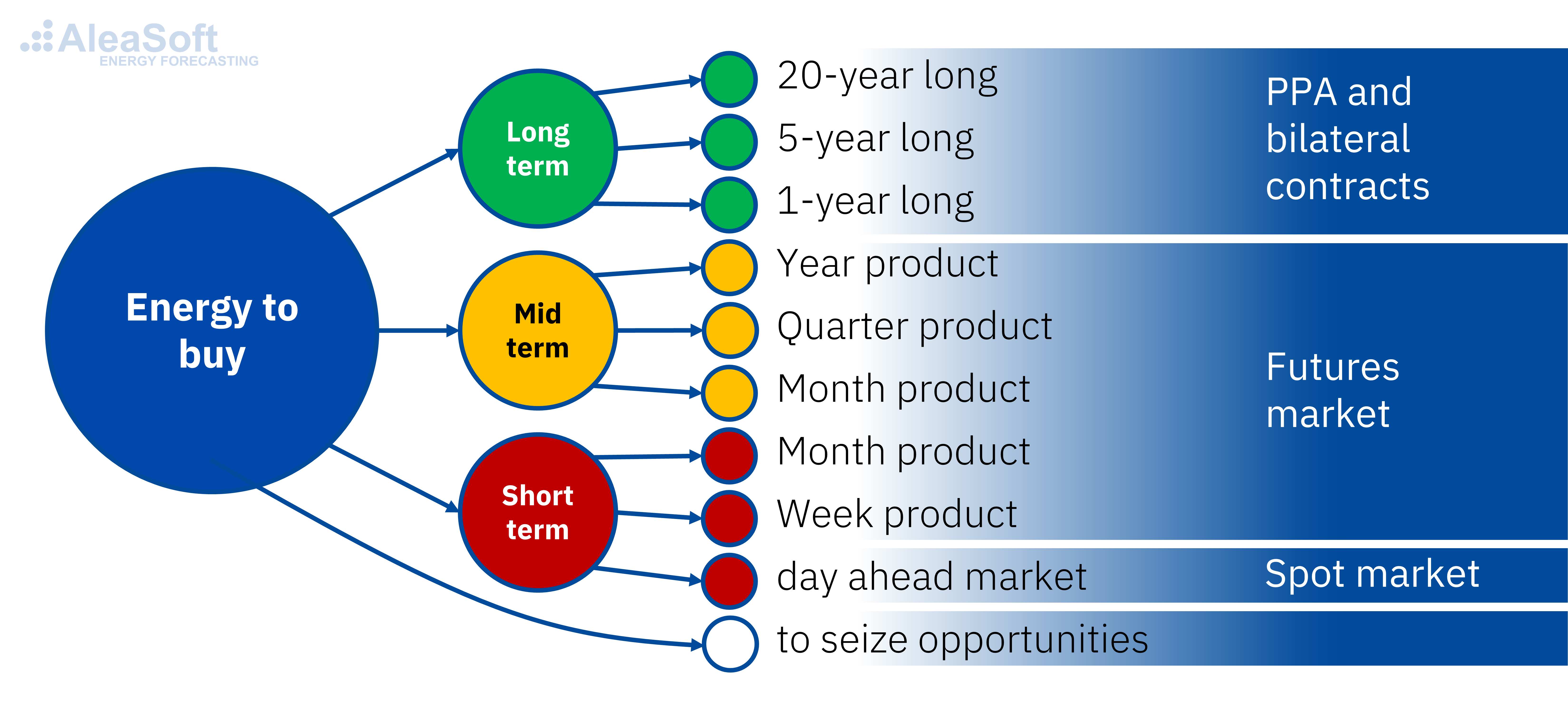

The options to choose from are multiple. On the one hand, there is the duration of the contract, which can be from months, to one year, to long‑term multi‑year contracts in the PPA modality. On the other hand, there is the price structure. The most basic classification is fixed price or indexed price. But the number of possible price structures is very wide, with floor prices or ceiling prices, with prices indexed with premiums, etc. The most important thing when choosing one or the other option is to have a proper vision of the market prices in the future based on a reliable price forecasting.

The best strategy: the diversification

From the consultancy in energy markets, AleaSoft, the recommendation is to design a strategy based on the diversification of the electricity supply that allows part of the energy to be placed at different terms with the most advantageous conditions in each situation. A good strategy must be able to ensure an adequate price in the mid and long term for most of the energy, protect against market price rises and take advantage of times when the prices are low.

Source: AleaSoft.

Source: AleaSoft.

For the energy acquisition strategy to be robust, it must be based on a vision of the market prices in all horizons, short, mid and long term, that is reliable, scientifically based and with a probabilistic metric.

The probabilistic metric of the confidence bands or of the distributions of possible future prices is essential to be able to responsibly assess the risk associated with the price of each purchase transaction, either the closing or opening of positions in the futures markets or the signing of bilateral contracts or PPA.

Source: AleaSoft.

Source: AleaSoft.

The AleaSoft‘s mid‑term forecasting reports provide probability distributions for all monthly, quarterly and yearly periods for the next three to five years that provide a scientific metric that allows a robust risk management to reliably assess each energy acquisition transaction.

Next AleaSoft’s webinar

Continuing with the series of public webinars during the economic crisis, at AleaSoft a next webinar is being prepared that will be held on November 26. This webinar will be the first part of a new series “Prospects for the energy markets in Europe from 2021” that will have, at least, a second part in January 2021. On this occasion the following speakers from Vector Renewables will participate: Javier Asensio Marín, CEO, Hugo Alvarez López, Global Head of Technical Advisory and Carlos Almodóvar Almaraz, Principal M&A and Financial Advisory.

In addition to analysing the behaviour of the energy markets since the economic crisis began, the prospects from 2021 will be discussed. The central topics of this webinar will revolve around the design of the new renewable energy auctions and their effect on the market, as well as the technical Due Diligence and its importance for the projects financing.

Source: AleaSoft Energy Forecasting.