Interview with Antonio Delgado Rigal, PhD in Artificial Intelligence, Founding Partner and Director General of AleaSoft

We are in a period of high prices in the wholesale electricity market in Spain and there are indications that the upward trend could continue. What are the causes of this situation?

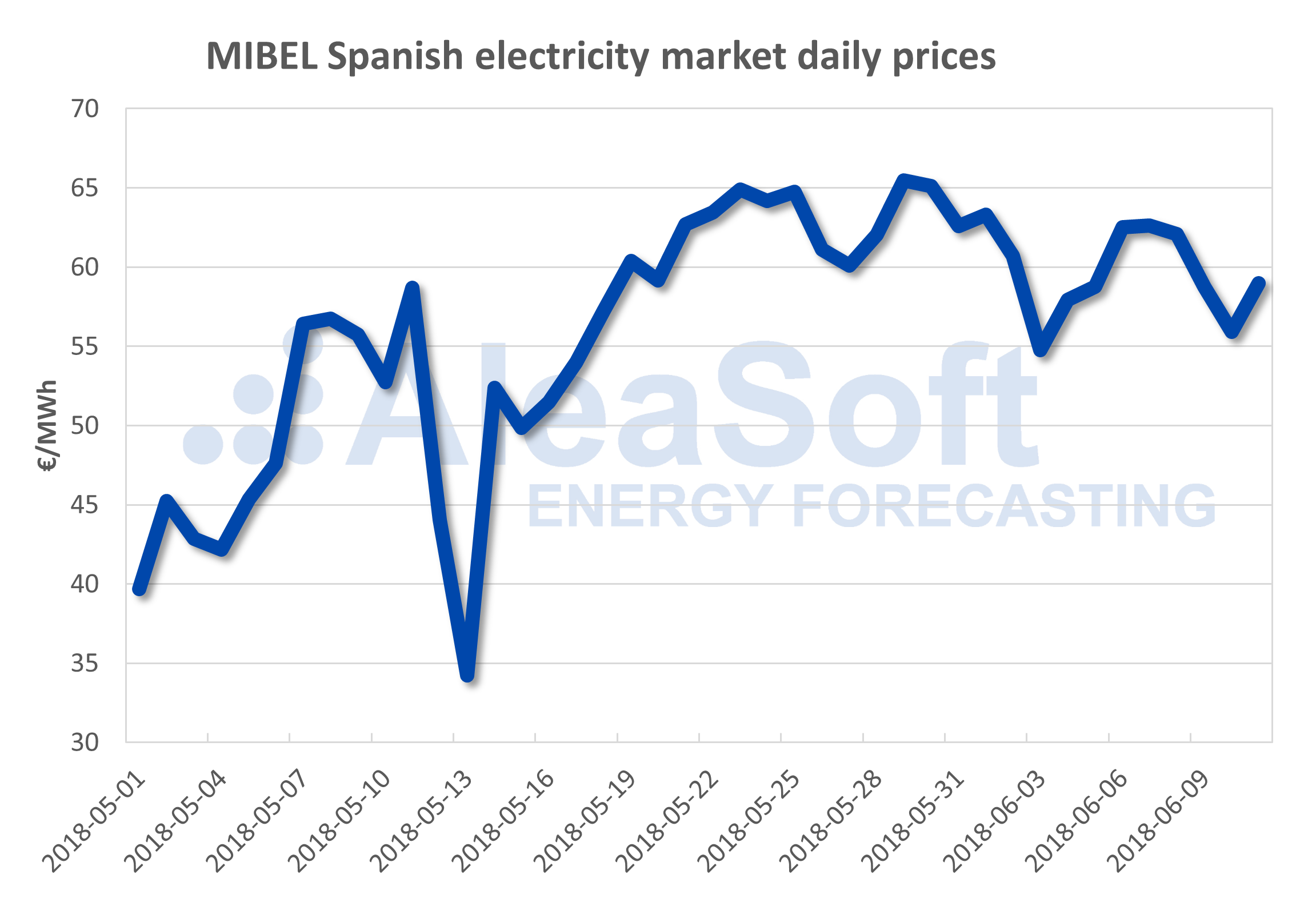

Yes, this May closed with an average price of the wholesale electricity market of 54.92 €/MWh, which places it as the second most expensive May in the history of MIBEL, the Iberian electricity market, only 1.36 €/MWh lower than May 2008, the most expensive so far.

Regarding the causes of these high prices, AleaSoft considers that the high prices of fuels (Brent, coal and gas) and CO2 emission rights (EUA), combined with a second half of the month with little wind production (45% of the typical values for this time of year) and three nuclear power plants shutdown at the end of the month. In June, everything seems to continue more or less the same way, although fuel prices have relaxed a bit.

The price of CO2 emission rights (EUA) has increased a lot in recent weeks. The month of May started below 13 €/t and closed at 16.27 €/t. There is no indication that the price will decrease drastically before the entry into force of the market stability reserve (MSR) next year, when the oversupply of allowances will be withdrawn, in order to maintain prices and thus stimulate the decarbonization of electricity production. The European Commission estimates that some 400 million EUA will be withdrawn from the market in 2019 to reduce the oversupply, although the final withdrawn amount will depend on the allowances in circulation at the end of 2018.

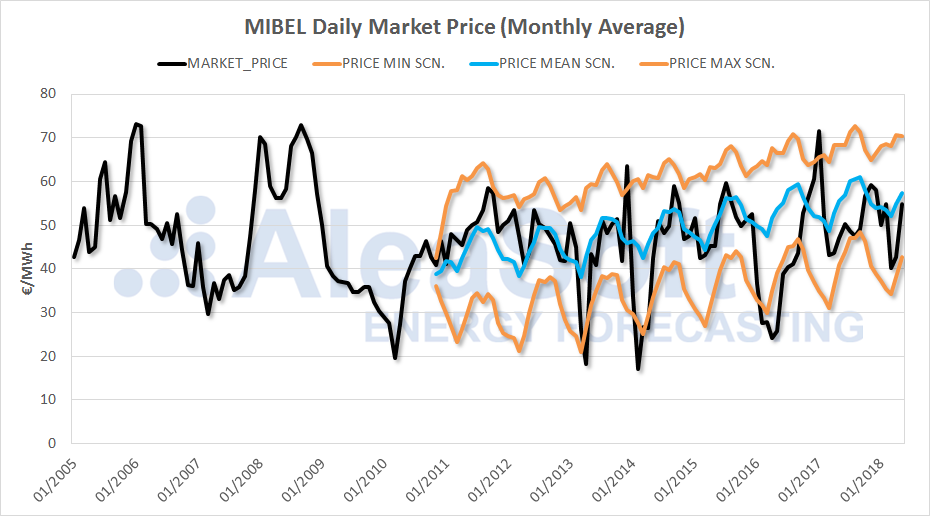

The price evolution will be conditioned by the Brent oil price. If Iran signs a new nuclear deal, Brent prices would fall below $60 a barrel. This would bring new scenarios downwards in the fuel prices and therefore the market price and futures. If on the contrary, Iran sharpens its aggressive policy, the Brent price could continue to rise with the consequences of higher fuel and electricity market prices.

Why, in recent months, the largest increases in the electricity prices in Europe occurred in the Iberian market (Spain and Portugal)?

All European markets to a greater or lesser extent are registering expensive prices, and all (except Switzerland) have closed May 2018 more expensive than, at least, the month of May of the last five years. The fuels and CO2 prices affect everyone in some way.

In Spain and Portugal, the price is determined by gas and coal with the corresponding CO2. Nuclear shutdowns and low wind energy production make the thermal gap, even if small, to be covered with gas or coal that set the marginal price competing with hydroelectric production. Water is optimized to the maximum for the summer months when there are fewer rainfalls. It is possible that with the reservoirs at full capacity, the price will relax a bit in Q3.

Spain and Portugal are countries that, from the electricity grid point of view, are quite isolated compared to the Central European countries that are connected with northern countries with a Nord Pool market with stable low prices all year round.

Another differentiating factor apart from the issue of the isolation from cheaper markets is related to taxes. The electric generation has, as a tax, the green cent and the electric tax that makes it more expensive, between 9 and 12 €/MWh compared to the same production in other European countries when the marginal price is set by gas or coal.

Traditionally, we have thought that greater hydro generation leads to lower pool prices, but in recent months this has not been the case. Why do you think this situation has occurred?

The price at which the hydroelectric power stations that use water reservoirs depends both on the level of the water reserves and on the need they have to dismantle flowing water. In March and April of this year, with many rainfall and floods of important rivers, hydro energy was offered at zero price in many hours.

As we stated earlier, Q3 is the quarter with less rainfall and the planning of hydroelectric production is optimized for the whole period until October 1, when the reservoir levels should be at their lowest point. In this optimization process the hydrothermal gap is not completely covered by hydroelectric production, always keeping a part for fossil fuels. From mid-April to the present, production from renewable energy sources has decreased to below-normal levels, leaving this hydrothermal gap “open” and favoring these higher prices.

Analyzing historical data, since 2012 hydroelectric technology has set the marginal price of the market in a very high percentage of hours (usually more than 40% of the hours of the month), either in months with a lot or little hydroelectric production, since their bids are adjusted to the price of gas and coal taking into account the CO2.

If in the next few years the generation with coal and natural gas in the mix were reduced and generation from renewable sources increased, what impact do you think it would have on the final price?

An increase in electricity production from renewable energy sources would reduce the thermal production with gas and coal, which would initially push down prices of the wholesale electricity market. However, the expected increase in the prices of CO2 emission rights would lead to higher peak prices, when thermal generation would enter to cover the lack of coverage to meet the demand by intermittent renewable energy sources, which would raise the average price of the electric pool.

It should also be taken into account that a too low price at the long term is not sustainable, because it would cause production to stop being profitable, including production from renewable sources, which would decrease supply and put upward pressure on prices. Also, low prices would stimulate the increase in electricity demand and even in many sectors, gas would be replaced by electricity or gasoline and diesel in land transport by the use of electric vehicles. It is the market balance between supply and demand.

What influence has the increase in the price of CO2 in the European market had on electricity prices?

The price of CO2 emission rights is an added cost of the thermal production, which undoubtedly makes the supply of thermal production more expensive.

In less than a year this price has multiplied by three and, combined with the increase in the prices of gas and coal, that have also grown significantly in the same period, have directly influenced the increase in electricity prices.

The production cost of a coal-fired plant, only due to CO2, not taking into account the fall of the exchange rate or the increase in the price of coal, increased 10 €/MWh compared to May 2017.

So far, no government has made a true reform of the ‘pool’ and the marginal pricing system, do you think it is necessary in view of the greater contribution of renewable energy sources in the future? In that case, how should this reform be approached?

It is plausible to think that the current marginalist system will be able to adapt itself to the expected significant increase in electricity production from renewable sources. It must be borne in mind that the current market mechanism has already experienced a significant increase in renewable capacity since it began operating twenty years ago when renewable capacity was practically non-existent.

There are other opinions that predict that a marginalist system like the current one will not survive and should disappear and start working with other market mechanisms.

And there are other opinions halfway, which suggest that the current marginal system works only for manageable technologies to meet the residual demand not covered by renewable sources. While the latter should be governed by other mechanisms.

The marginal price must be maintained as a sign of an efficient dispatch, that is, that the cheapest technology matches the demand. However, it may lose its meaning as a signal to make investments, in renewable and conventional backup, that could be awarded in another way, for example, through capacity payments or capacity auctions.

A fundamental thing in any market is legal security and stability. The current electricity market is twenty years old and has functioned correctly integrated with the rest of the European markets. To guarantee investments, a message must be sent that the basic principles of liberalized markets will continue to be fulfilled and that the rules will not change.

Do you think we will see a rapid growth in PPAs related to renewable plants in Spain?

Definitely. Right now, PPAs are an option for renewable plant projects to ensure a purchase price that allows them to obtain bank financing.

Let’s talk about AleaSoft now. What has been the trajectory of the company since its creation as specialists in forecasting in the energy sector?

AleaSoft was founded in Barcelona in 1999, in the context of the liberalization of the European electricity markets and as a result of scientific research projects carried out at the UPC (Polytechnic University of Catalonia), in the field of Artificial Intelligence associated with the energy forecasting. The UPC has been a fundamental part of AleaSoft, as a founding member and as a technological partner, and has always left a strong R&D character in the DNA of the company.

The combination of classical statistical techniques, SARIMA models and Machine Learning, specifically Recurrent Neural Networks, gave rise to a set of scientific novelties in the field of Artificial Intelligence applied to forecasting in the energy sector. Based on this scientific advance, a forecasting platform and a new model called AleaModel were created.

Taking the new scientific advances as a basis, AleaSoft has continued with the uninterrupted development of research projects in the field of energy forecasting, including demand, renewable energy production and market prices, applied mainly in the electricity sector but also in the gas sector and other fuels.

At this time, we want to position ourselves as leaders in Europe in long-term price forecasting for PPA and mid-term price forecasting with associated probabilities for risk management. Our solutions have satisfied the needs of all the agents involved in the European energy market and continue to do so. The ambition of AleaSoft is to expand our reach globally, reaching the markets of America and Asia.

How has the forecasting capacity evolved in fields such as photovoltaics or wind energy?

In the field of forecasting, the key factors are the quantity and the quality of the data, as well as the experience. As installed renewable power has increased, all three factors have increased over time. The more power and renewable production there is, the more and better the data will exist to make better and better forecasts. Also, the experience will increase. In this sense, our company has the privilege of having been analyzing data and developing forecasting models since technologies such as wind and photovoltaics began to be implemented in Europe.

What role will digitalization and the use of Big Data play in a sector like yours?

For a company like AleaSoft, data is its most important raw material. Digitization is improving and boosting the registration, validation and automated filtering of data which leads to an exponential increase in the amount of quality data available.

This is an unbeatable opportunity to improve the forecasting quality, but also a challenge to know how to properly manage the volume of Big Data, and how to find the keys among so much information.

We are also fully automating the process of modeling, forecasting, validation and self-correction of the results. At the moment we have more than 350 active models for almost all European markets.

What kind of clients use AleaSoft services?

Any agent of the electricity sector, at some point will need forecasting services, either production, demand or market prices, in addition to the forecasting of the necessary explanatory variables such as weather, fuel prices and socio-economic variables that we also provide.

Our first client was Endesa in 1999 and we are currently still working for five Departments / Directions of this company. Subsequently, the most important companies in the sector such as Unión Fenosa, Iberdrola, Viesgo, Gas Natural, REE, Fortia, BBE, Siemens Gamesa and the rest of the important companies in the sector in Spain entered our portfolio of clients. In the same way, our platform and services were used by large European companies such as Enel, Terna, EDF, EOn, Elia, Statnett, BP, Shell, Electrabel – Suez Group – GFD, HSE, Statkraft or EP Produzione among the most important companies of the energy sector, in addition to many companies that are retailers and large consumers of electricity that need to optimize purchases.

AleaSoft currently provides forecasting services to all kind of agents in the energy sector in Europe: utilities, System Operators (TSO), traders, retailers, distributors, large consumers, all types of manufacturers and managers of electricity generation assets, especially renewable, and also to consultancies, banking entities and investment funds.