AleaSoft Energy Forecasting, November 11, 2025. Interview by Antonio Barrero, from Energías Renovables magazine, with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

There was a time when it almost sounded like science fiction, but today AI is all the rage. AleaSoft, however, has been working with it for more than a quarter of a century. “We are experts -says its slogan- in energy market intelligence solutions powered by Artificial Intelligence”. Is AleaSoft the pioneer, the Nikola Tesla, of AI for the markets?

Curiously, I completed my PhD in AI in 1998, one year before we founded AleaSoft. I have always been convinced that AI is the future.

At AleaSoft, we have been applying artificial intelligence and advanced statistics to the energy sector for 26 years, long before “AI” became a buzzword. At AleaSoft, AI is not a slogan but a scientific tool serving predictability and decision‑making. Our approach combines recurrent neural networks belonging to the machine learning branch of AI, econometric models and probabilistic techniques in a rigorous methodology validated over the years. If there is something “Teslian” about our story, it is that we embraced artificial intelligence in the late 1990s as a technological cornerstone when hardly anyone in the sector was talking about it, and we turned it into a reliable, transparent and bankable system now used by utilities, IPPs, retailers, large consumers, financiers and industries across Europe.

Forecasts for the energy market. AleaSoft produces long‑, mid‑ and short‑term forecasts for prices, demand…. What does AleaSoft have that its competitors do not? What is its distinguishing feature, its unique hallmark?

Our main differentiator is the rigour and global coherence of our forecasts. AleaSoft has its own database, the Alea Energy DataBase (AleaApp), which integrates and harmonises decades of historical data on demand, prices, fuels, CO₂ and renewable energy generation across Europe. On that foundation we apply hybrid AI and econometric models with a multi‑horizon probabilistic approach, generating forecasts and confidence bands that allow every result to be explained. Another key feature is that our forecasts are bankable: they are used in project financing, PPA, due diligence and portfolio valuation processes. Furthermore, we do not just deliver data, but also expert analysis and support, enabling each client to translate forecasts into strategic, investment or hedging decisions. That combination of technology, expertise and guidance is the true AleaSoft hallmark.

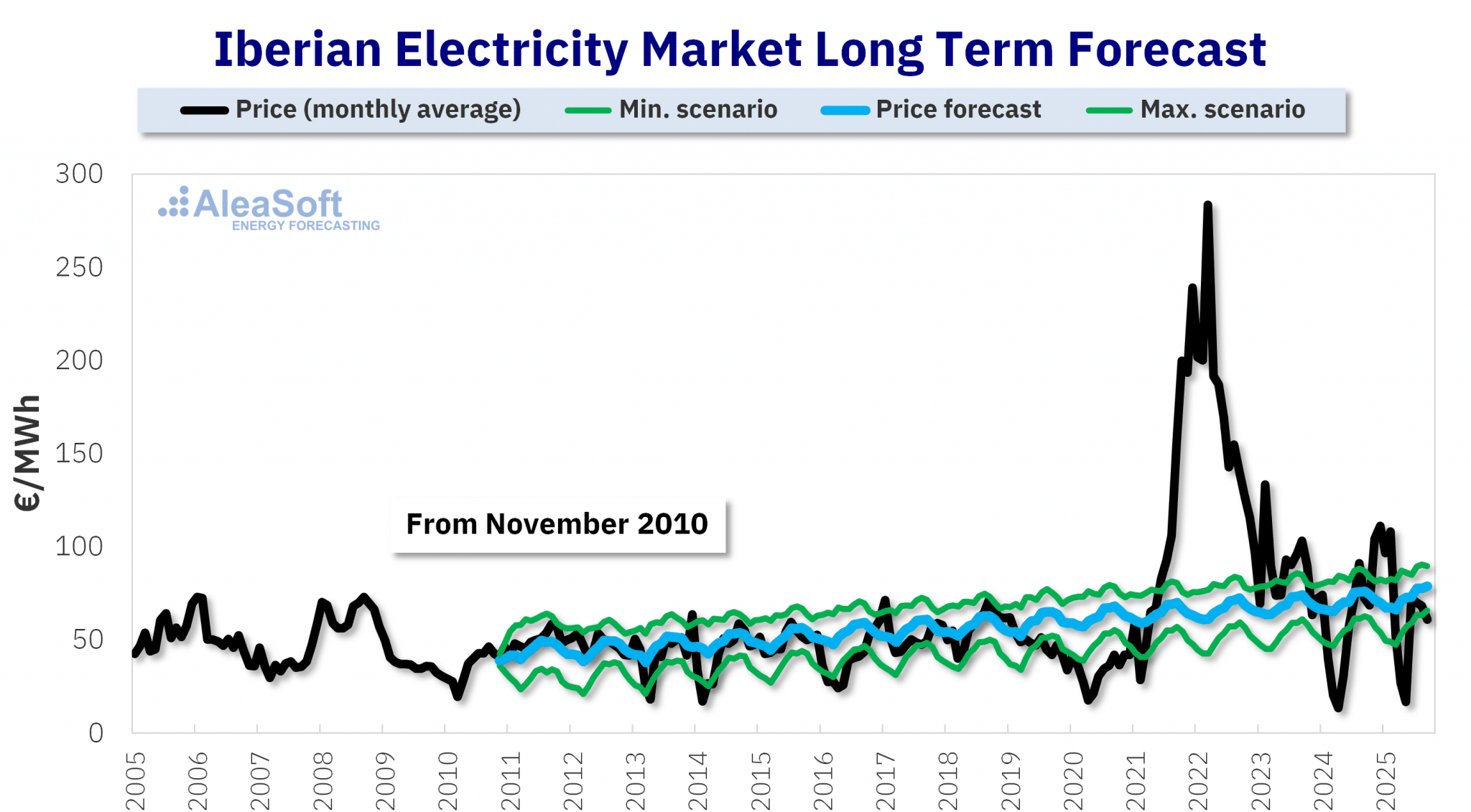

Long term price forecast for the Iberian MIBEL electricity market made by AleaSoft in late October 2010.

Long term price forecast for the Iberian MIBEL electricity market made by AleaSoft in late October 2010.Source: AleaSoft Energy Forecasting.

Developers, funds, banks, industries, electro‑intensive consumers, data centres, generators, retailers… and grid operators. I understand AleaSoft has clients everywhere. But right now, is your portfolio of grid operators the one growing the most? The reason I ask is because grid operators seem to be struggling to integrate all the new generation and demand coming their way. Has AleaSoft’s client base grown more in that area recently, or am I mistaken?

Indeed, in recent years we have seen growing interest from grid operators, TSOs and DSOs in our solutions. The electricity system faces a dual challenge: integrating increasingly distributed renewable energy generation and absorbing new types of demand such as data centres, electric mobility and electrified industrial processes. In this context, AleaSoft provides demand and generation forecasts with high temporal and spatial resolution, as well as analyses of congestion, flexibility, voltage and stability, and mid‑ and long‑term scenarios for network planning. Other sectors such as retailers, generators and large consumers are also growing, but grid management is undoubtedly undergoing a transformation and our models are an essential tool to plan ahead.

Zero and negative prices are becoming increasingly common, and concern in the sector seems to be growing. Or at least among some players in the sector. I say ‘seems’ because the truth is that never before have so many photovoltaic plants been installed in Spain as in the last two years. How is it possible that there is so much fear (or uncertainty) and, at the same time, so many new megawatts?

That apparent contradiction is typical of a transition phase. Low or negative hourly prices at certain times of day reflect the temporary abundance of renewable energy generation, but they do not undermine the structural attractiveness of photovoltaic energy. Its LCOE remains the most competitive. The “fear” or uncertainty stems from market volatility and the adjustment to a new paradigm where value lies in managing when and how energy is delivered, not merely in producing it. That is why there is so much interest in hybridisation with storage, optimised dispatch and long‑term hedging strategies. Investment continues because, with proper revenue and risk management, the economic case for hybrid solar remains very strong. In hybridisation studies of PV with batteries, revenues can increase by up to 40% if the optimal configuration is found, something we also do at AleaSoft.

Storage is the answer to curtailments, zero prices, and those uncertainties and “fears”. Question for a privileged market observatory, like AleaSoft: has the time for storage arrived in Spain, or does this technology still need a bit more time to mature?

Yes, storage has arrived, particularly in its hybridised form with photovoltaic and wind energy, and the stand‑alone segment is rapidly gaining traction. Its value goes far beyond arbitrage between cheap and expensive hours: storage provides system stability, avoids curtailments, improves congestion management, and delivers flexibility, capacity and voltage support services. What is still lacking is for the regulatory and market framework to evolve so that all these services are properly remunerated. As the capacity market and flexibility mechanisms consolidate, BESS projects will become fully bankable. At AleaSoft, we see it clearly: storage is no longer a promise, it is a necessity and a strategic opportunity for the Spanish and European electricity systems.

For some time now, I’ve ended all my interviews with the same question, and I won’t resist asking it again: who was to blame for the blackout? How was it possible? Did no one foresee it?

Blackouts rarely have a single cause. They usually result from a chain of simultaneous events: failures in grid elements, automatic generation disconnections, low system inertia, interconnection stress or delays in protection systems. What matters is to analyse the lessons learned from the event. In this case, operators reacted swiftly and professionally, restoring service in record time. The lesson is not to seek an individual culprit but to strengthen planning, flexibility, digitalisation and predictive tools to prevent a chain of small events from escalating into a major incident. And that is precisely where AleaSoft contributes: anticipating risk scenarios and providing foresight to the system.

And finally, directed at -I insist- one of the most privileged observatories in the national market and in any case an expert in forecasts: will the lights go out again?

In increasingly electrified, digital and renewable electricity systems, zero risk does not exist. But we can make incidents less likely and less severe through greater interconnection, storage, demand response, flexibility services and robust forecasts. The future will be more complex, but also more manageable if we have the right tools. At AleaSoft, that is exactly what we work for: to anticipate, plan and reduce uncertainty. So, will the lights go out again? There may be occasional events, but if we learn and plan properly, it will become ever harder for them to leave us in the dark.