AleaSoft Energy Forecasting, February 14, 2022. Interview by Ramón Roca from El Periódico de la Energía with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

The year 2021 was a year of records in the energy markets. In the first weeks of 2022, prices remained high. What evolution do you expect for this year? When do you forecast that electricity markets prices will begin to fall?

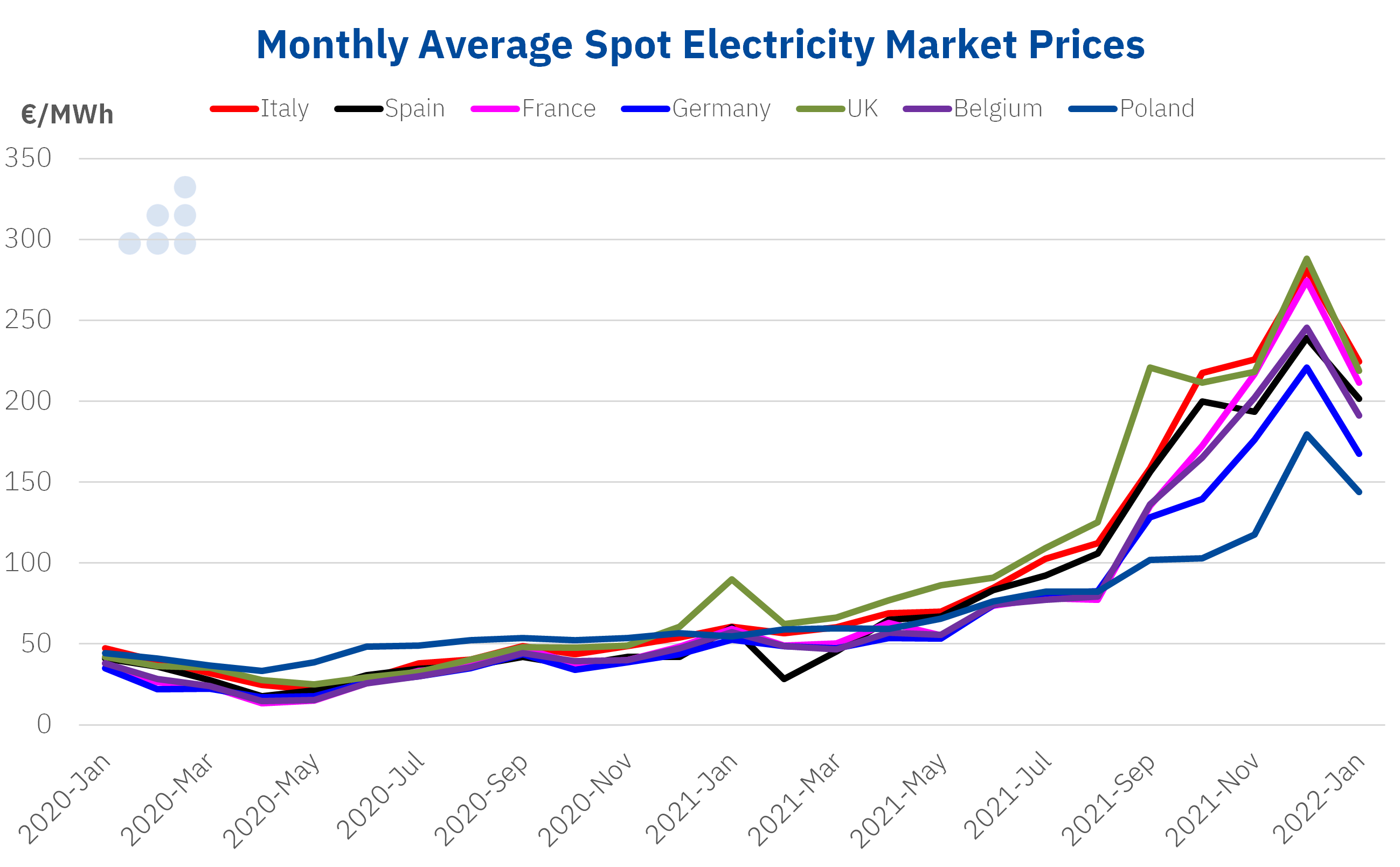

Indeed, the rise in gas and CO2 prices during 2021 led many European electricity markets to register the highest annual price in history, including the Spanish market. As you say, in 2022 prices are still high. Although in the Spanish market the average for January was lower than that registered in December 2021, until now the month with the highest prices in history, we expect that on average the price of 2022 will exceed that of 2021. Prices will relax a little when spring arrives, but they will still be high. We expect that in the spring of 2023 prices will fall, although without reaching the levels prior to the current escalation, something that we expect to happen towards the year 2025.

It is important to highlight that the evolution of prices will largely depend on the evolution of gas and CO2 prices.

Source: Prepared by AleaSoft Energy Forecasting using data from GME, OMIE, EPEX SPOT, Nord Pool and TGE.

Source: Prepared by AleaSoft Energy Forecasting using data from GME, OMIE, EPEX SPOT, Nord Pool and TGE.

As you say, one of the drivers for the price rises in the electricity markets are gas prices. How will prices of this fuel behave in 2022?

The gas markets were very stressed in recent months, what caused prices to increase significantly and they still remain high. On the one hand, there are the imbalances related to an increase in demand after the most critical period of the COVID‑19 pandemic crisis and insufficient reserve levels to cover this demand. The effects caused by this situation were expected to relax with the arrival of spring and with the entry into operation of the Nord Stream 2 gas pipeline, but geopolitical tensions between Russia and Ukraine caused a decrease in imports of Russian gas to Europe, it opened up the possibility that this route of gas entry to the continent will be completely cut off and generated uncertainty as to whether and when the new gas pipeline will come into operation. In recent weeks the European Union increased gas imports by ship from other countries, but we still expect prices to remain high through 2022, more likely to rise than fall.

In addition to the geopolitical dimension, the large gas purchasing companies do not want long‑term contracts with the usual suppliers with which Europe has gas pipelines, such as Algeria or Russia, and this also exacerbates the problem with no prospect of a short‑term solution.

And CO2 emission rights prices? Can we expect them to go down or at least not go up at the rate they did in 2021?

We see very little chance of CO2 prices going down unless the European Union intervenes, but considering that it has so far done nothing to stop the escalation of prices in the last year, everything seems to indicate that it is comfortable with this situation.

This market was created with the aim of discouraging the use of polluting technologies and thus stimulating the development of renewable energies, so it makes sense for their prices to rise. The expectations around these rising prices attracted speculators, which further favoured the upward trend in prices. In addition, this is a market that is quite sensitive to news that affects it in one way or another. For example, after the European Commission decided to consider nuclear and gas as green investments, the CO2 emission rights exceeded €93/t for the first time and €96/t a few days later.

Taking all these elements into account, everything seems to indicate that in 2022 prices will continue to be high.

It seems that the term macrovolatility, which you coined during the last Solar Forum, is taking hold to describe the current situation of the energy markets. How would you define macrovolatility? What implications does it have for electricity producers and consumers? How long do you expect this situation to continue?

In general, energy markets present volatility in their prices. However, in recent months the volatility increased. By macrovolatility I mean this great volatility currently present in the markets. For example, during December 2021, in the Spanish electricity market there were significant hourly price variations between the 26th and 27th. Prices went from €167.40/MWh in the last hour of the 26th to €52.64 /MWh in the first hour of the 27th, later they were between €2/MWh and €8/MWh between 1:00 and 6:00, to position themselves again above €100/MWh, specifically at €104.90/MWh, at 7:00 in the morning. At the weekly level there were also important variations in the last month of last year. The average for the week of December 13 reached €297.91/MWh after increasing by 44% compared to the previous week, the following week the daily market weekly price record, of €305.27/MWh, was registered, for a week later falling by 54% and standing at €140.38/MWh. That December was a month of records. To cite a few, the monthly average, of €239.16/MWh, is the highest in history to date, the absolute daily record was reached on the 23rd, when the average was €383.67/MWh and on a Sunday a daily price above €300/MWh was registered, specifically €319.63/MWh on the 19th.

Obviously, this uncertainty about the evolution of prices is very detrimental for large and electro‑intensive consumers, who find it increasingly difficult to assume spot and futures markets prices. In the case of producers, macrovolatility can be an opportunity to maximise their income, for example, through hybrid systems that combine renewable energy and storage technologies. In addition, high market prices can help renewable energy developers to obtain better financing conditions and can be an incentive for investments in new generation capacity.

As for the duration of this situation, we believe that it will continue as long as gas prices instability and high CO2 prices continue.

What do you recommend to large electricity consumers so that they can limit the impact of the high prices situation?

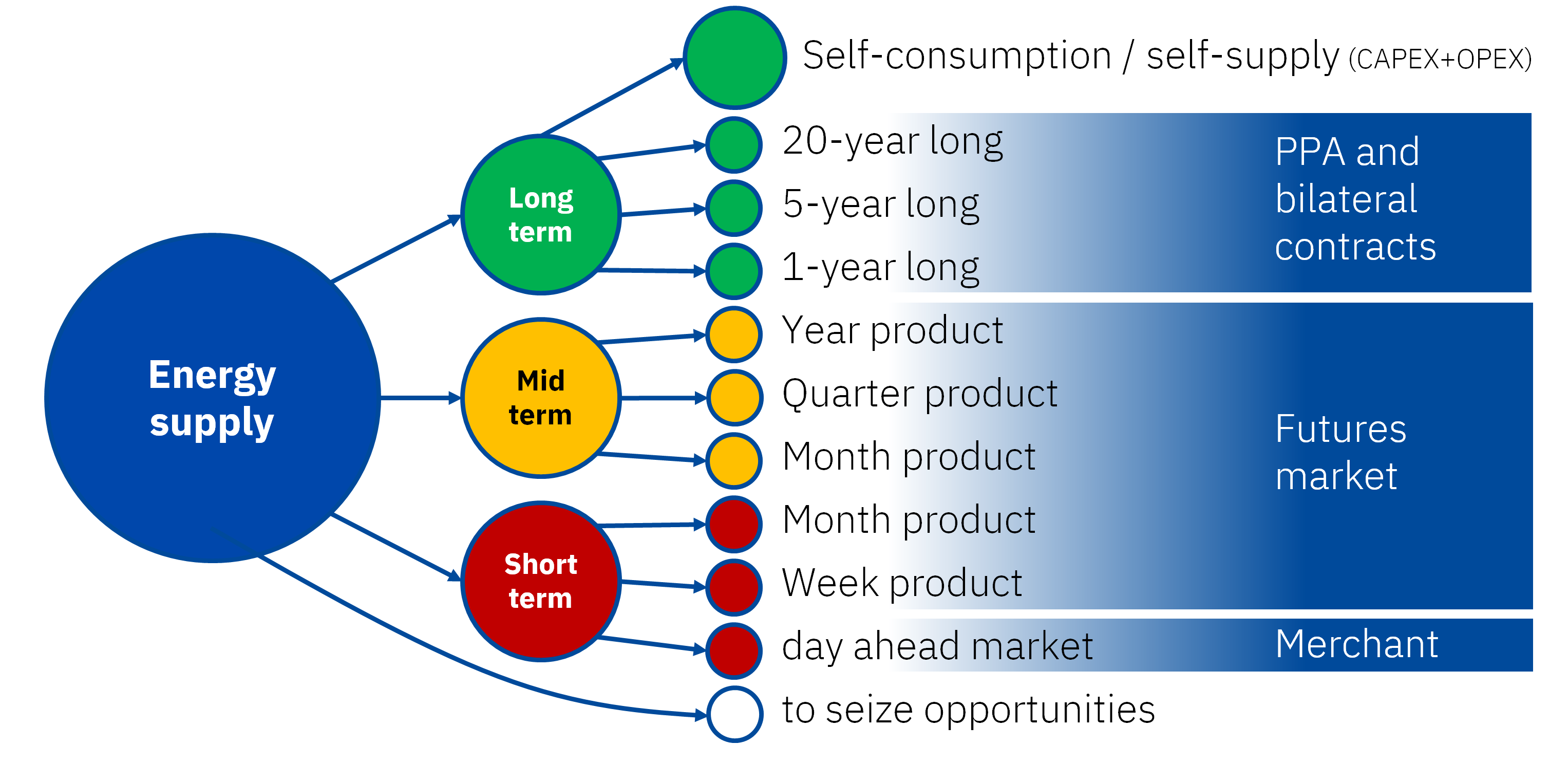

My recommendation for large consumers is that they define an energy purchasing strategy based on the diversification. But this recommendation is not only valid now that electricity markets prices are high, this is a good practice that we always recommend to minimise the intrinsic price risk of the market.

With a diversified purchasing strategy, I mean placing fractions of the energy to be consumed in different horizons and using different instruments. For example, covering a part of the energy through a long‑term bilateral contract (PPA) or self‑consumption, hedging another part of the energy at the mid‑term in the futures markets and leaving another fraction of the energy to buy at the short‑term in the spot market. Throughout this process it is very important to have reliable markets prices forecasts in the different horizons to assess and take advantage of the opportunities that arise.

One of the elements to define in the negotiation of a PPA is the price. Are electricity futures reliable as a forecast of the market price at the mid‑ and long‑term?

Electricity futures are not reliable as forecasts of the electricity market at the mid‑ and long‑term. The products beyond the next two years have no liquidity, they are synthetic prices, fundamentally nominations of bilateral contracts that normally already have a discount on the expected spot price. In addition, farther annual futures are influenced by traders’ perception of the effect that the expected increase in renewable energy production will have on market prices, making them low. Because of this, futures prices only provide a signal of the agents’ current estimate, which can change considerably, making them unreliable as price forecasts.

In addition, in the negotiation of a PPA, it may be important that the price forecasts have hourly granularity, in order to assess different price structures and make a more precise estimate of the income that the generation plant will receive.

You are specialists in price curves forecasting with a 30‑year horizon, with a distinctive feature that is the hourly granularity of the forecasts throughout the horizon. How important is this to analyse the storage and hybridisation, fundamentally with batteries?

In the operation of hybrid systems of renewable energy technologies with storage technologies, it is essential to have an estimate of the hourly prices in order to, depending on the price expected for each hour, plan whether it is more optimal to sell the energy that is produced or store it to sell it at a later time, when prices are higher. This is why, when designing a hybrid system, for example, to define the most appropriate energy storage technology, when seeking financing to develop it and when defining exploitation strategies, the hourly forecasts are an input in optimisation processes that maximise the income of the system from the sale of energy.

In 2021, the Spanish Government took some measures to reduce the impact of electricity prices on the bill paid by consumers, which caused great uncertainty in the sector. Did these measures have any impact on the development of PPA? Did the number of PPA deals drop during 2021 due to the high prices?

Indeed, some of the measures taken by the Spanish Government created a great regulatory instability that led to a paralysis of the PPA market, causing in turn the increase in PPA prices. Even so, Spain had a great growth in PPA contracts during 2021, so the increase in prices did not significantly affect the development of this market. According to BloombergNEF, Europe registered a record increase of 8.7 GW contracted in PPA in 2021, in which Spain and the Nordic countries had a large participation.

In December, the public insurance company Cesce approved the guarantee scheme for sellers of electricity in the framework of PPA at the mid‑ and long‑term with electro‑intensive consumers. What implications will this have for the PPA market?

This will be a boost for the PPA market in Spain. One of the most important difficulties in the negotiation of PPA lies precisely in the guarantees that offtakers must provide. If electro‑intensive consumers can provide State guarantees to the banks, in addition to their own, they will be in an advantageous position because they will attract more renewable energy projects and will be able to negotiate a reduction in the PPA price. The electro‑intensive consumers who already have sufficient financial capacity to provide the guarantees in a PPA, and who therefore already had more competitive PPA prices, may obtain an extra price reduction by having the State guarantees.

How do you think the starting of inframarginal energy auctions that the Government has in mind to launch this year would affect the wholesale market price?

Bearing in mind that the supplied energy and the demanded energy that will no longer participate in the market for this reason will be the same, we do not expect large variations in the price level, although as the traded volume decreases, the price volatility may increase.

Do you see the renewable energy auctions organised by AEGE as being efficient for the industrial sector?

Bearing in mind that the rules of the auctions organised by AEGE will be similar to those of the renewable energy auctions of the Renewable Energy Economic Regime (REER) organised by the Government and that electro‑intensive consumers will be able to count on the guarantees that Cesce will provide, we think that the resulting prices will be competitive, at least for part of the energy, for a sector that so badly needs stable and affordable electricity prices.

In general, long‑term energy purchase contracts are something that we consider very important for both consumers and producers and that still has a lot of room for growth in Spain. According to a survey that the AEGE carried out with its associates last year, only 9.5% of the energy of 2022 was contracted at a fixed price, the rest went directly to the market or had prices indexed to the market price, with what that supposes at this time of high prices.

Could the raw materials crisis affect the development of renewable energies, or at least make prices more expensive for a few years?

The raw materials crisis, along with other factors, is already affecting the development of renewable energies and may continue to do so in the coming years. This was one of the causes of the delays in some projects and of the increase in PPA prices, which is estimated to be between €4/MWh and €5/MWh.

However, the main problem is the administrative processing of the projects and this can affect the development of renewable energy development plans.

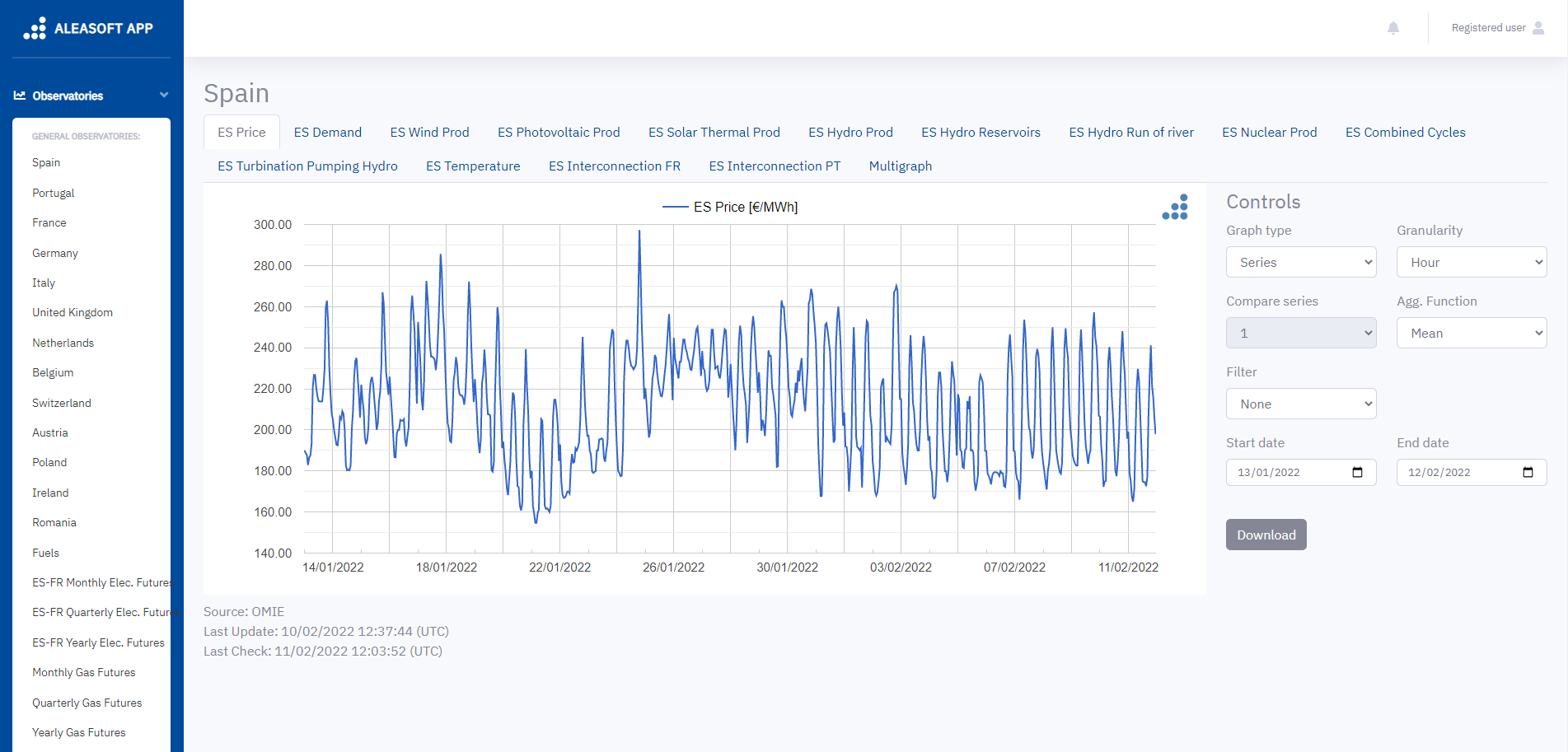

You developed a platform for the compilation, visualisation and analysis of energy markets data. How can this platform help all the actors of the energy sector?

The Alea Energy Database (AleaApp), the name of the platform, compiles data of a large number of variables from most European electricity markets, prices, demand, production by technology, fuels prices, CO2, macroeconomic data. Having all these data centralised, updated, with access to the entire historical series, with tools that allow analysing them, is of great value for agents of the energy sector who would otherwise have to consult different sources, with different formats and in many cases without options to visualise the data.

The tools included in the Alea Energy Database (AleaApp) allow analysing the evolution of the variables and detect trends, in the original series, as well as in the moving average or groupings of data, for example, weekly, monthly, annual. Different series can also be compared, which makes it possible to analyse causalities, analogies, etc. Alerts can be defined in the tool that warn when the values of a series or its moving average are greater or lower than an established value, something that can be useful for traders when operating in the markets.

To promote this data and information analysis tool, we are offering it as a trial to AleaSoft Energy Forecasting’s clients, collaborators and the media such as the one you lead, which is the main informative reference in our sector.

We started the interview talking about the prospects for the year 2022, but, since we are talking to someone used to making long‑term forecasts, we take the opportunity to ask you, how do you expect the energy sector to evolve in the next 30 years? Will we see more duck curves? When?

The electricity sector is called to undergo important transformations in the next 30 years. We will go from an electricity system that still has a large presence of fossil fuels generation technologies, to an electricity system where renewable energy technologies and the storage with batteries and green hydrogen prevail. Along this path, the market will regain the balance, but there will also be periods of instability with high or low prices. To the extent that renewable energy capacity increases, there will be days with the “duck curve” profile, but the development of the storage technologies and their hybridisation with the renewable energy technologies, the rise of electric vehicles, the electrification of the economy and the response of the demand will allow this not to become a structural problem. It will be an exciting period and our desire at AleaSoft Energy Forecasting is to continue being witnesses and participants in this entire process as we have been in the last 22 years, since the electricity market began to operate. Precisely at the beginning of 2022 we created AleaGreen, a new division of AleaSoft Energy Forecasting that offers long‑term forecasting reports of European electricity markets prices curves for PPA, long‑term risk management and assets and portfolio valuation. AleaGreen will act as a hub to connect the renewable energy sector with financial entities and investment funds, producers and large consumers, to explore synergies and opportunities that help achieve together the great purpose of having a totally clean and renewable electricity system.

Source: AleaSoft Energy Forecasting.