AleaSoft Energy Forecasting, February 7, 2022. The prices of almost all European electricity markets fell during the first week of February, favoured by the decrease in gas prices, lower demand and an increase in wind and solar energy production. Even so, the weekly averages were above €160/MWh in most markets. CO2 prices registered a new historical high, standing above €96/t and Brent prices continued to rise, reaching values not seen since 2014.

Photovoltaic and solar thermal energy production and wind energy production

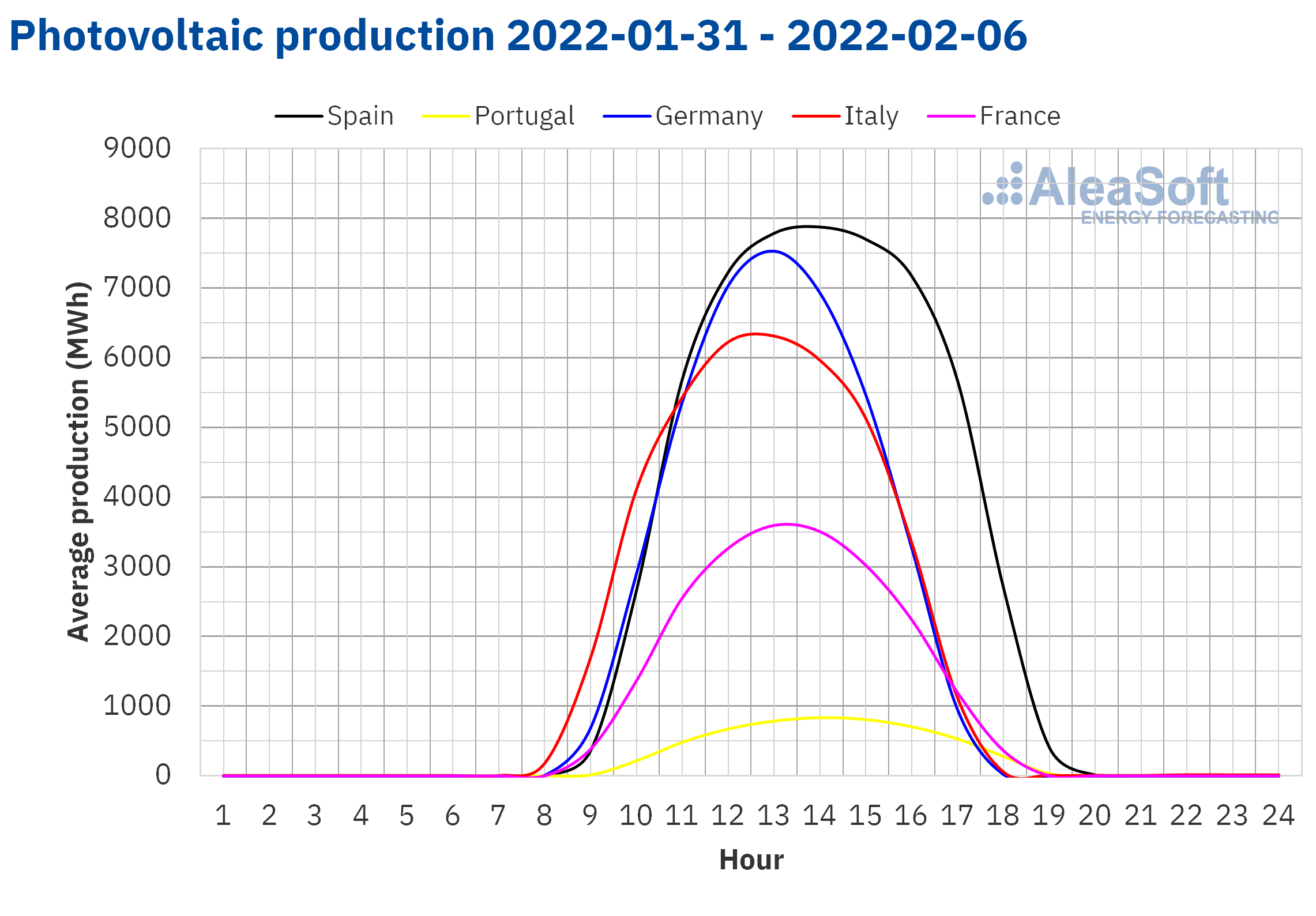

During the first week of February, the solar energy production increased in most of the markets analysed at AleaSoft Energy Forecasting, compared to the last week of January. In the Spanish market, the production with this technology increased by 13%, followed by increases in Germany and Italy, of 5.7% and 4.9%, respectively. On the contrary, in the French market there was a reduction of 18% and in the Portuguese market the drop was 6.8%.

For the week of February 7, the AleaSoft Energy Forecasting’s forecasts indicate that there will be an increase in solar energy production in the German and Italian markets. However, a decrease in production is expected in the Spanish market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

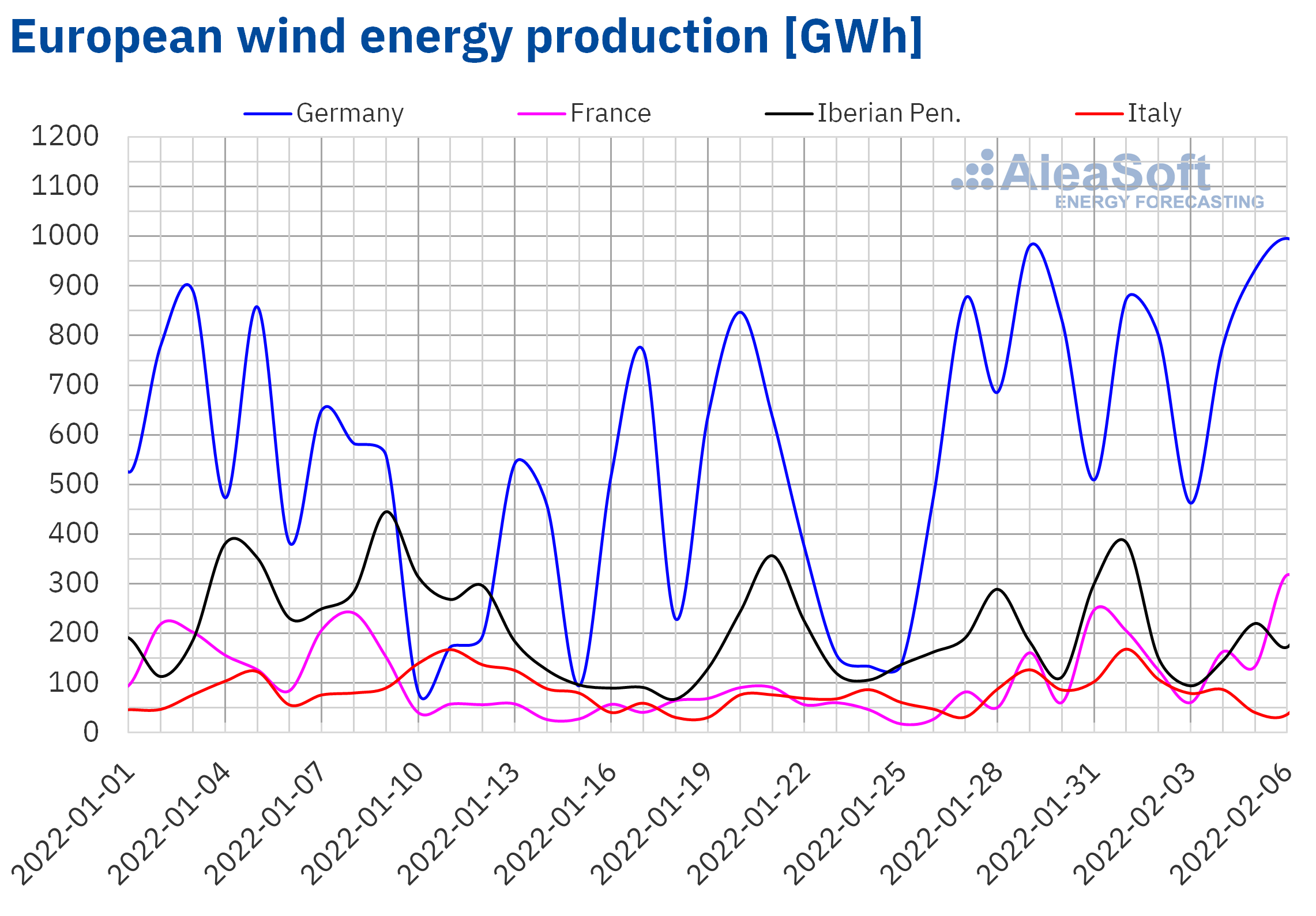

The wind energy production increased in most of the analysed markets during the week that began on January 31, compared to the previous week. The largest increase was registered in the French market, exceeding the production of the previous week by 181%. In the markets of Spain, Germany and Italy the increases were 36%, 30% and 18% respectively. The exception was the Portuguese market, where the production with this technology fell by 16%.

For the second week of February, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a drop in production with this technology in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

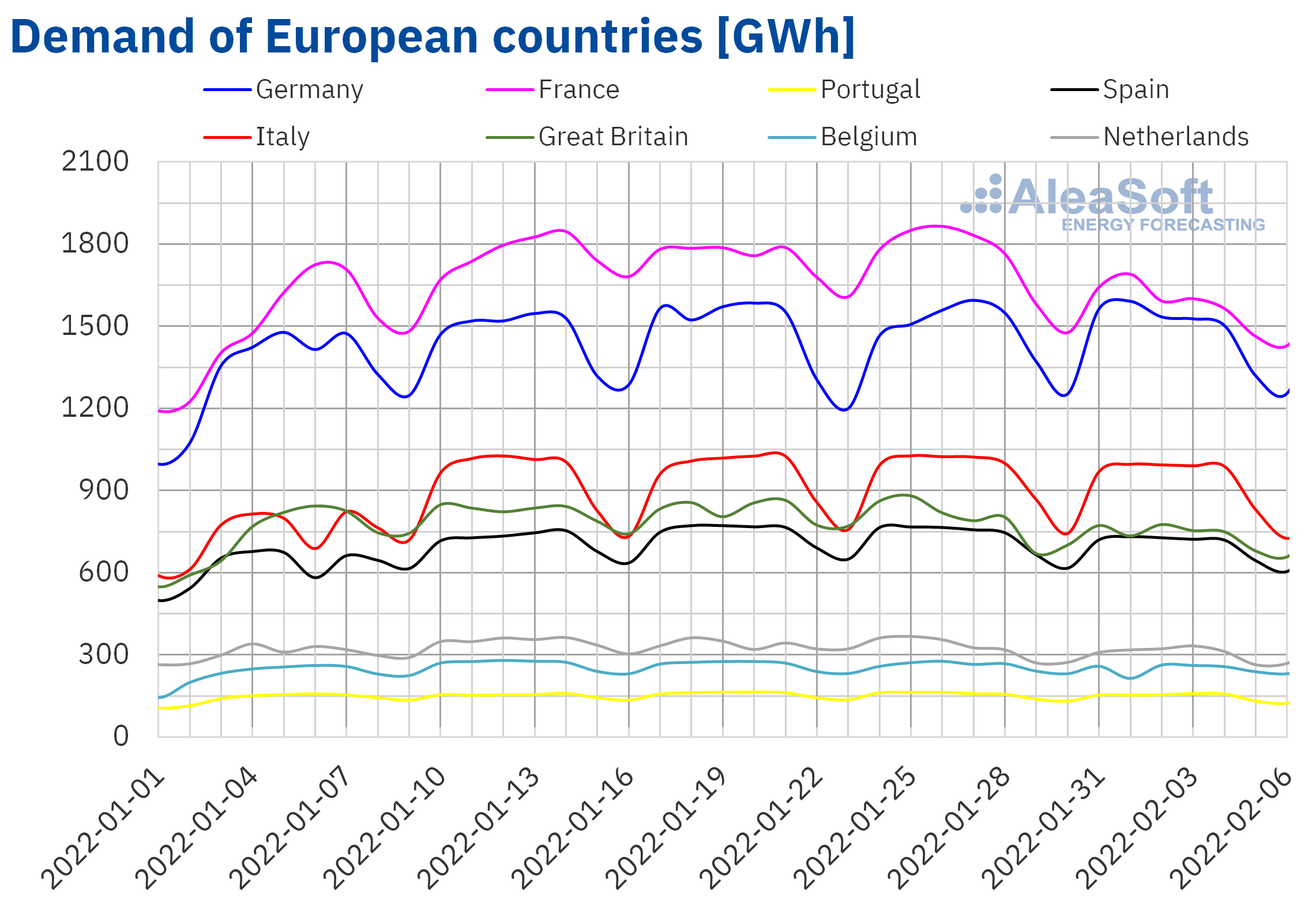

The electricity demand fell in a general way in all European markets during the week of January 31 compared to the previous week. The main cause of this fall was the increase in average temperatures of more than 1 °C in all markets. In particular, the markets of France and Great Britain registered the most significant drops in demand, with drops of 9.6% and 7.3%, respectively. On the other hand, in the Dutch market a decrease in demand of 6.4% was registered. The markets of the Iberian Peninsula had decreases of around 4.0%, while in the rest of the markets the falls were lower than that value.

For the week of February 7, the AleaSoft Energy Forecasting’s demand forecasting indicates that it will recover in most European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

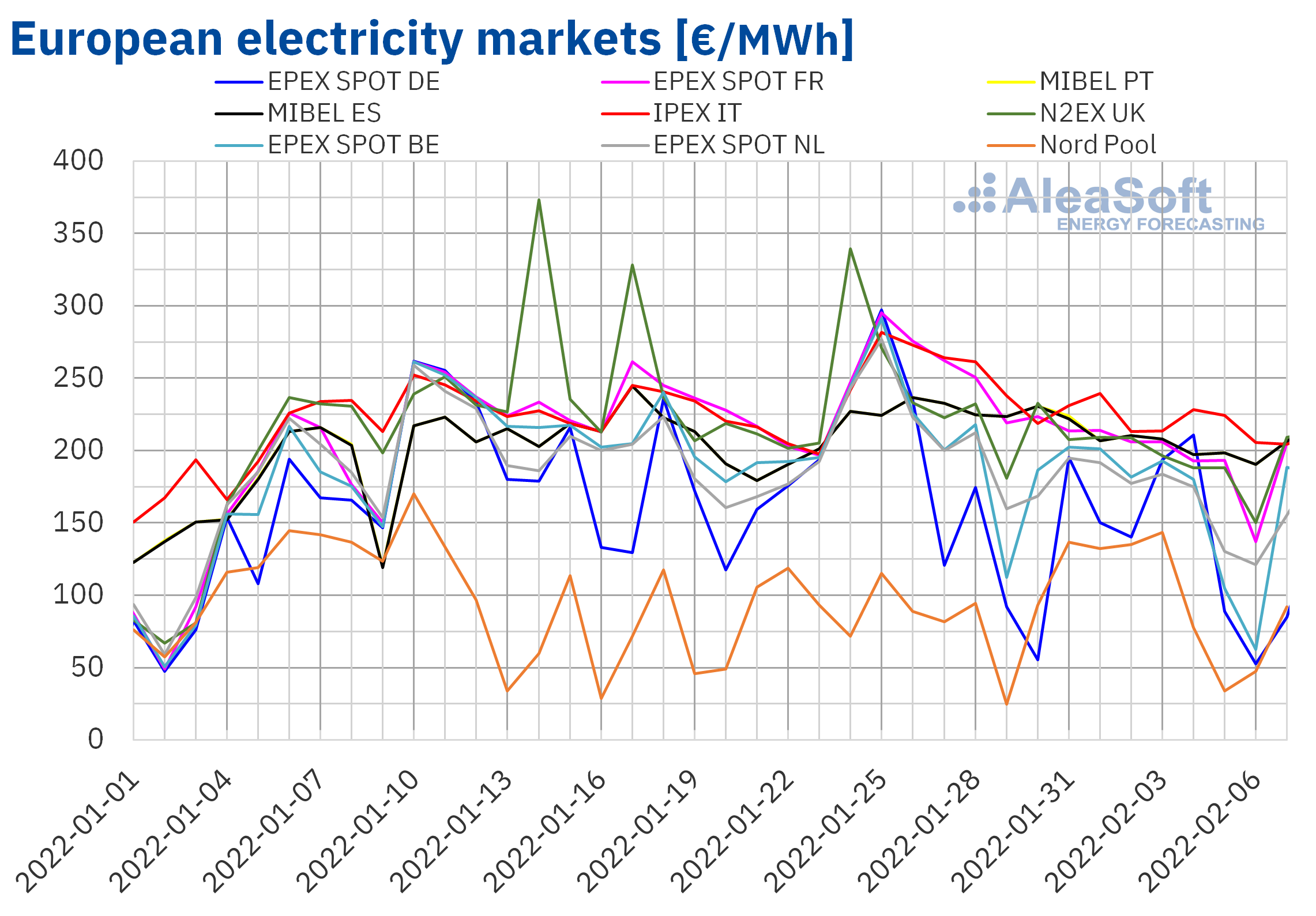

In the week of January 31, the prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with a price rise of 24%. On the other hand, the largest drop in prices was that of the EPEX SPOT market of Belgium, of 24%. In contrast, the smallest decreases were those of the MIBEL market of Spain and Portugal, of 10% in both cases. In the rest of the markets, the price decreases were between 13% of the IPEX market of Italy and 23% of the EPEX SPOT market of France.

Despite the price drops, in the first week of February, almost all the analysed markets reached weekly average prices above €160/MWh. The exceptions were the Nord Pool market and the German market, with averages of €100.90/MWh and €147.40/MWh, respectively. On the other hand, the highest weekly average price, of €222.21/MWh, was that of the Italian market. In the rest of the markets, prices were between €160.68/MWh of the Belgian market and €204.92/MWh of the Portuguese market.

On the other hand, in some European markets, low hourly prices were registered in the early hours of February 6. Among these, the Belgian market should be highlighted. Negative hourly prices were registered in this market on February 5 and 6. The lowest hourly price so far this year in this market, of ‑€30.00/MWh, was reached for two hours of February 6. This contrasts with the price of €293.00/MWh reached in this market on Monday, February 7.

During the week of January 31, the general decrease in demand, the increase in wind and solar energy production in most markets and the drop in gas prices favoured the decrease in prices, despite the increase in CO2 emission rights prices.

The AleaSoft Energy Forecasting’s price forecasting indicates that the week of February 7, prices might increase in most European electricity markets, favoured by the increase in demand and the general decrease in wind energy production. The evolution of gas and CO2 emission rights prices might also contribute to the price increases.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

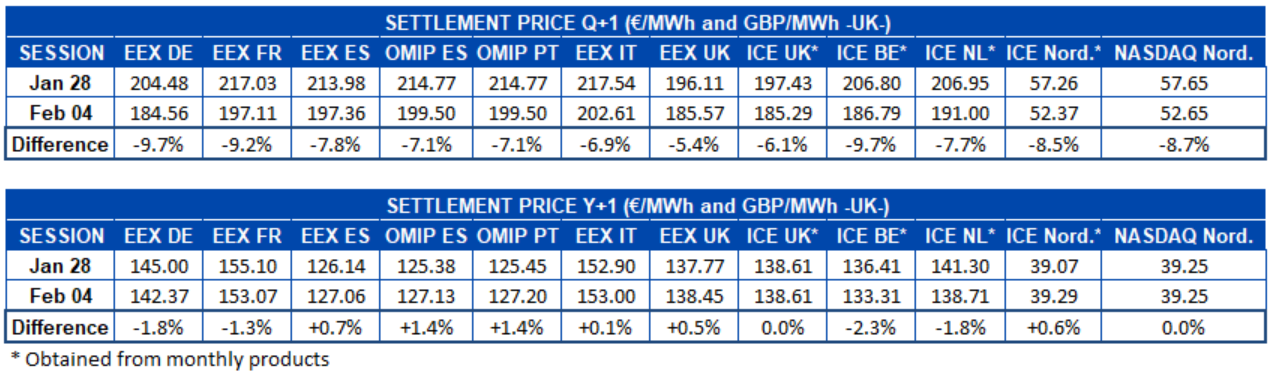

Electricity futures

In the first week of February, the electricity futures prices for the next quarter registered decreases in all European markets analysed at AleaSoft Energy Forecasting, taking into account the settlement prices of the sessions of January 28 and February 4. The EEX market of Germany and the ICE market of Belgium were the markets that registered the greatest decreases, with a drop of 9.7% in both cases. On the other hand, the ICE market of the United Kingdom was the one in which prices varied the least, by 6.1%.

As for the futures prices for the calendar year 2023, the behaviour was different. Prices fell in the EEX market of Germany and France and in the ICE market of Belgium and the Netherlands. On the other hand, in the OMIP market of Spain and Portugal, the EEX market of Spain, Italy and the United Kingdom and the ICE market of the Nordic countries, prices rose. In the case of the ICE market of the United Kingdom and the NASDAQ market of the Nordic countries, the settlement prices of the sessions of January 28 and February 4 were the same, so the variation at the end of the week was nil.

Brent, fuels and CO2

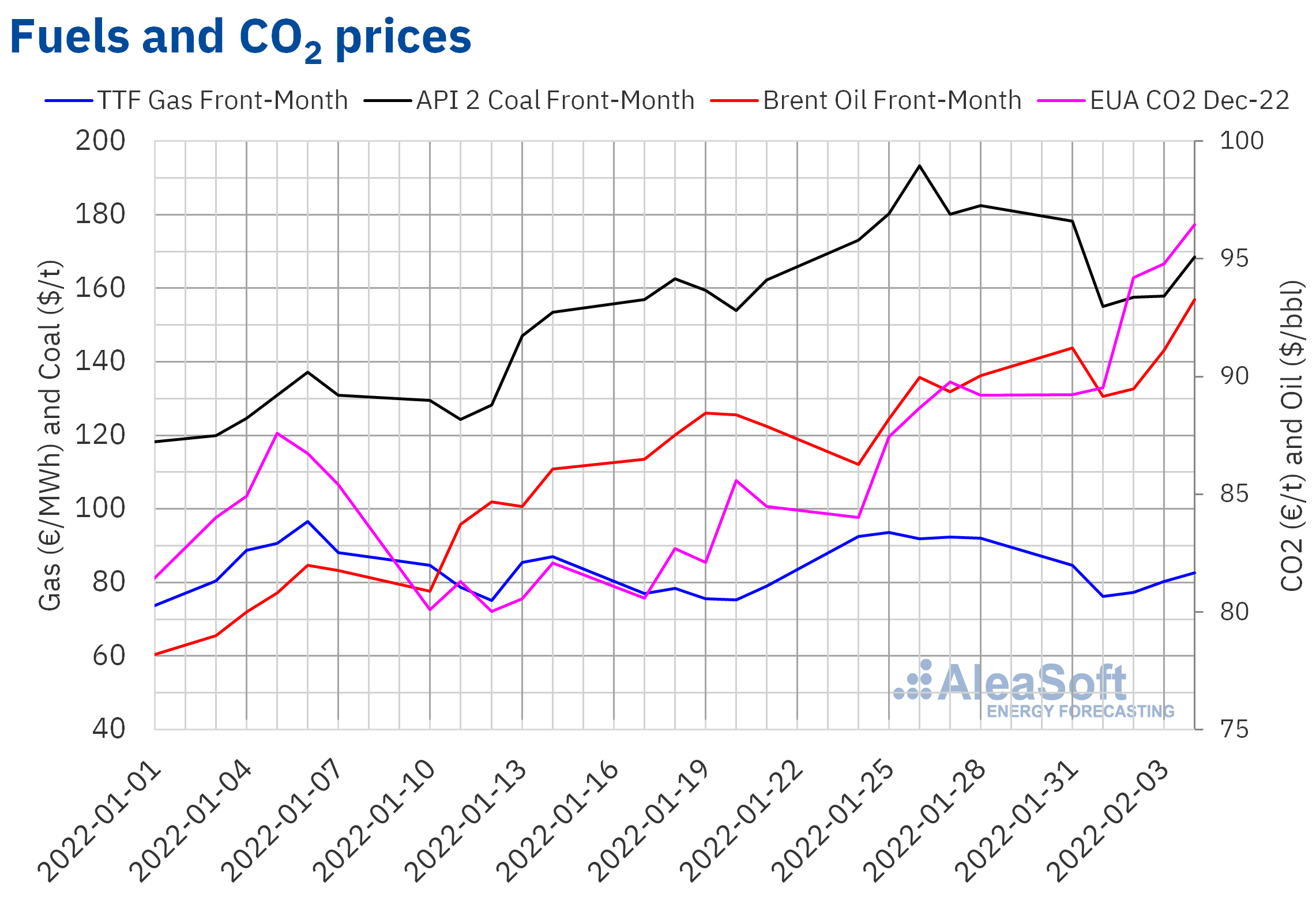

Brent oil futures prices for the Front‑Month in the ICE market remained above $89/bbl during the first week of February. Most of the week prices increased. As a consequence, on Friday, February 4, a settlement price of $93.27/bbl was reached. This price was 3.6% higher than that of the previous Friday and the highest since October 2014.

The OPEC+ agreed at the meeting of February 2 to maintain the previously agreed production increases for the month of March, despite the pressure to further increase its production. This favoured the upward trend in prices. Furthermore, fears that some OPEC+ member states may not be able to meet the established quotas and tensions between Russia and Ukraine also contributed to the concerns about the supply levels. On the other hand, the levels of the demand remain high, also favouring the increase in prices.

As for TTF gas futures prices in the ICE market for the Front‑Month, during the first week of February they remained below €85/MWh. The minimum settlement price of the week, of €76.17/MWh, was registered on Tuesday, February 1. This price was 19% lower than that of the same day of the previous week. However, as of Wednesday, prices began to recover. In the last session of the week, on February 4, a settlement price of €82.65/MWh was reached, which was still 10% lower than that of the previous Friday.

The tension between Russia and Ukraine continues to affect the evolution of prices. However, the European Union is looking for alternatives to gas from Russia to avoid shortage problems.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2022, during the first week of February, they maintained a growing trend. As of Wednesday, the settlement prices exceeded €94/t and on Friday, February 4, a record price of €96.45/t was reached. The European Commission’s intention of considering gas as “green” favoured these increases.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Next Thursday, February 10, the AleaSoft Energy Forecasting’s webinar “The macrovolatility of energy markets in Europe. Benefits of PPA for large and electro‑intensive consumers” will be held, in which Fernando Soto, Director‑General of AEGE, and Juan Puyol, Deputy Director at Cesce, will participate in the analysis table of the Spanish version of the webinar. The meeting will be an opportunity to analyse the guarantees that Cesce is offering in the contracting of renewable energy PPA with electro‑intensive consumers, within the framework of the Statute of Electro‑intensive Consumers.

AleaSoft Energy Forecasting developed a Web platform for the compilation of energy markets data called Alea Energy DataBase (AleaApp), which has tools that facilitate data visualisation and analysis. The data are updated daily and include prices, demand and production by technologies of the main European electricity markets in addition to fuels and CO2 prices and macroeconomic data. A trial period is currently being offered until March 31 to AleaSoft Energy Forecasting’s clients and collaborators.