AleaSoft Energy Forecasting, June 6, 2022. Interview by Ramón Roca from El Periódico de la Energía with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

How do you assess the situation of the electricity market at AleaSoft? When will prices drop again? Will changing the marginalist market model be necessary?

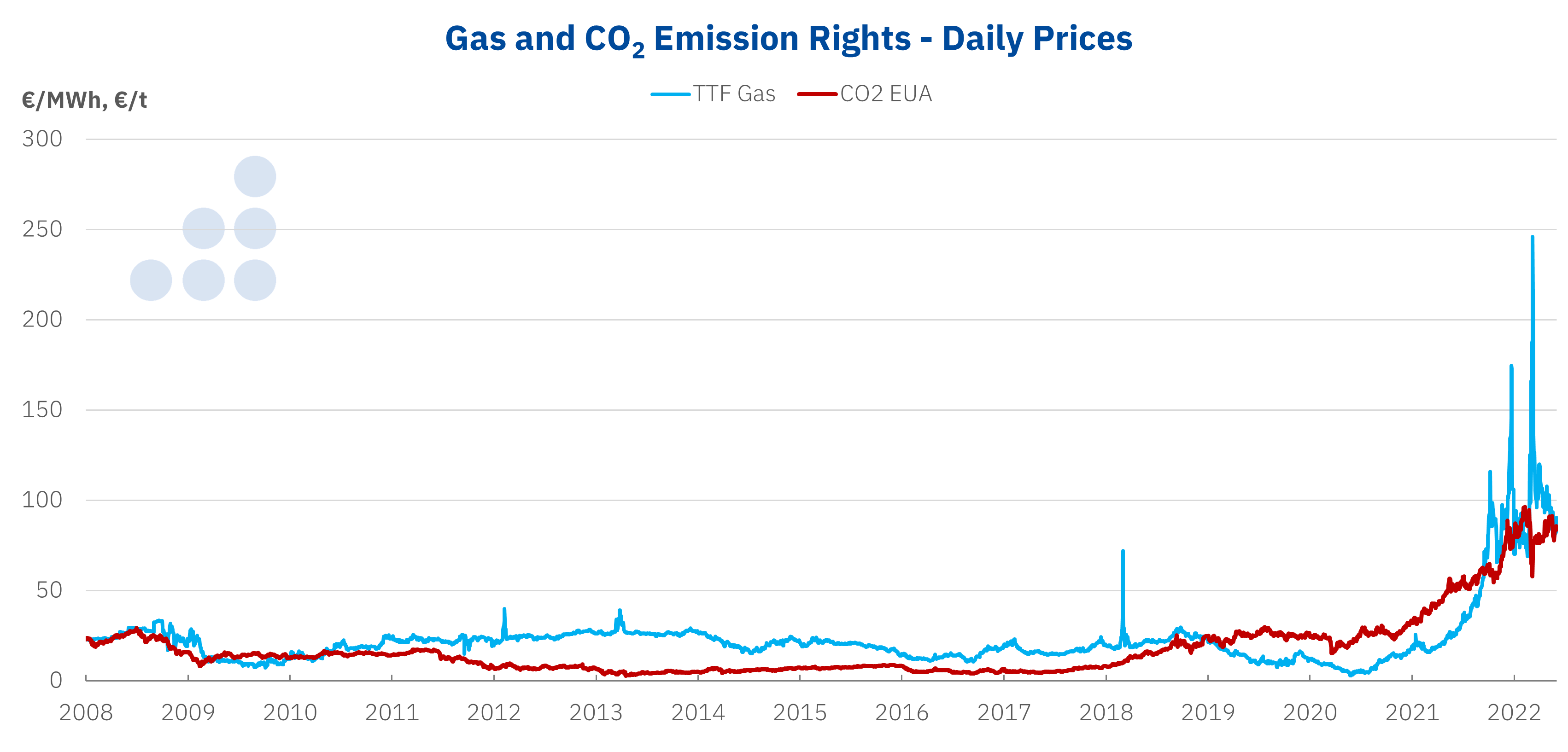

The situation is complex. Europe is at war and this put even more pressure on gas prices that came from a year 2021 in which they increased significantly. In spring and summer, with the decrease in demand and the increase in solar energy production, the situation is less critical, but in winter complicated situations can arise with the increase in demand, a scenario that would drastically worsen in the event that the gas supply from Russia to Europe is cut off, so everything indicates that we will be with high prices for a while.

At AleaSoft we believe that the marginalist market model should not be modified. The electricity market has worked efficiently for more than 20 years, offering a price signal in correspondence with supply and demand. Right now prices are high because gas prices are high. This shows the need to reduce dependence on energy from abroad and on fossil fuels, for which billions of Euros of investment in renewable energy, batteries and green hydrogen are needed, in which it is important to have a markets prices signal and stable and predictable regulation.

Do you see a moratorium on the payment of CO2 emission rights as necessary?

It is something that we proposed on several occasions at AleaSoft. Prices of this market are another of the factors that increased electricity markets prices throughout Europe. At a time when gas prices are so high, a temporary moratorium on CO2 prices would help lower electricity markets prices and bring some relief to consumers, especially the electro‑intensive industry.

And it is something that is in the hands of Europe, because it is a market created and regulated by the European Union. The product being negotiated is the right to emit CO2, which is important to help the energy transition, but is currently putting the competitiveness of European industry at risk.

Gas prices reached historically high levels this year. Can they go even higher? With the embargo on Russian fuels, do you think there may be a lack of gas supply in Europe?

The situation is very unsettled worldwide. The embargo on Russian fuels is reshaping all world trade. China and the United States will have a key role in this whole new situation. In principle, the gas supply is guaranteed in Europe during the winter with the reserves and the LNG that is arriving by ship. However, the situation with Russia may worsen and, in the worst case, we may have gas shortages in some European countries with restrictions on gas and electricity consumption.

As for prices, the current tension makes thinking that before spring next year prices may begin to fall difficult, and there is a certain probability that they will rise even more in winter. Even so, the current situation is quite critical and a new global crisis that sinks demand and consequently prices can not be entirely ruled out, just as it happened in 2020 with the COVID‑19 crisis.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

How do you value from AleaSoft the RDL that caps the gas price in the Iberian electricity market? Do you think there was any other better solution to lower prices paid by consumers?

The adjustment mechanism is controversial. On the one hand, it does not modify the operation of the marginalist market, but rather affects one of the external causes that cause the high prices in the market, such as gas prices.

It is a positive measure insofar as it will reduce prices paid by consumers, which will represent a relief for both consumers covered by the regulated tariff (PVPC) and electro‑intensive consumers who are purchasing part of their energy on the spot market.

But obviously, compensating gas power plants implies distorting the competition in the offers in the market and the collateral effects, for example, with the interconnections with France, and from there comes the necessary approval from Brussels for the measure. In addition, this measure affects the regulatory and legal confidence that is affected and is necessary for the large investment funds on which the future of renewable energies in Spain depends.

The best solution for consumers to have lower prices and not suffer the volatility of market prices is promoting PPA and long‑term contracts between consumers (retailers and electro‑intensive consumers) and renewable energy projects, combined with a larger reduction in taxes, such as VAT.

How would you reform the design of the current regulated tariff or PVPC?

Consumers need stable and predictable prices in the mid‑ and long‑term. What does not make sense is that the PVPC is tied to the hourly wholesale price, because that exposes it to all the volatility of market prices.

The most reasonable thing would be linking the price of the regulated rate to long‑term contracts with renewable energy projects. In this way, lower price levels would be achieved and, also very importantly, stable and predictable prices. It would also be a way of promoting new investments in renewable energies, because, for projects, having a PPA represents an advantage when it comes to obtaining financing.

From Europe they want more energy interconnections for Iberia. Do you think they are necessary? Are they viable or will they raise the bill? Which is more preferable, gas or electric?

They are very necessary. In fact, they are essential in order to achieve a completely decarbonised energy system. That energy flows freely without restrictions between the Iberian Peninsula and the rest of Europe is going to be necessary to import energy when the renewable energy production and the stored energy are not enough to cover the demand, and it is also going to be necessary to be able to export green energy from the peninsula to the rest of the continent.

Gas interconnections will also be necessary because Spain will become a major producer of green hydrogen thanks to the large amount of renewable resources (wind and solar) available on the peninsula. Part of this hydrogen will be exported to the rest of Europe and the world through gas pipelines and ships, so it will also be necessary to adapt gas interconnections to green hydrogen, which is more complicated to transport and store.

In the energy transition in which we are, does nuclear energy have a future?

Without a doubt, the current situation was unthinkable just a few months ago. This paradigm shift regarding the energy future and the need to achieve greater energy independence in Europe as soon as possible will make rethink the role that nuclear energy can play. Although the construction of new nuclear power plants does not make much sense to try to tackle the current crisis in the mid‑term, the maintenance of existing plants beyond the closures scheduled shortly, in countries like Spain, can play an important role when it comes to increasing independence from energy imports, but always prioritising the development of renewable energies and green hydrogen.

Another different case is that of France, where new nuclear developments may be justified by the powerful industrial infrastructure they have for nuclear energy and the positive response of the population.

Which is the main problem for the development of renewable energies in Spain?

From AleaGreen, the division of Alea Business Software S.L in charge of long‑term forecasting, we have a first‑hand view of the sector thanks to our clients, among who are the main renewable energy companies and some of the most important institutions in terms of financing of new renewable energy projects. What we find is that there is no lack of investment appetite in renewable energies in Spain, nor lack of financing, the main problem comes from the slowness and the obstacles of the administrative procedures that projects have that can take a long time.

It is urgent that from the European Union, as was already done from the REPowerEU program, pressure is made to facilitate and speed up the administrative procedures to the maximum when it comes to obtaining the necessary permits for the development of new renewable energy projects. Otherwise, there is a risk of discouraging investments and irreversibly delaying the achievement of the renewable energy generation capacity targets for 2030.

AleaSoft’s hybrid models have more than 20 years of trajectory in the energy markets. Which are their advantages over other providers of price curves forecasts?

The statistical nature of the Alea models allows energy markets to be treated and analysed as something dynamic that must maintain a balance in the long‑term. A balance between energy supply and demand, but also between the price that consumers are willing to pay and the price necessary for investments to be profitable.

The AleaSoft and AleaGreen forecasts present a dynamic future with a price level and confidence bands that are a numerical and scientific representation of the probability of future price fluctuations. We know that markets prices will continue to fluctuate due to the fluctuating nature of renewable energy generation and gas prices, so it does not make sense to present a forecast as a snapshot of the future with a couple of alternative scenarios that do not describe numerically and quantifiably the probabilities of price fluctuation in the future.

Another characteristic of AleaGreen’s forecasts, which those of other providers do not have, is the hourly granularity of prices over thirty years. These forecasts are necessary for PPA, renewable energy assets valuation, cogeneration and for the development of batteries.

An advantage of our service is the flexibility in updating long‑term forecasts, as we can provide long‑term price curves reports on demand for any European market within three or four days.

In very volatile and unstable contexts like the current one, does Artificial Intelligence work?

Artificial Intelligence is especially valuable in situations like the current one that have not occurred before in the energy markets. The Alea models do not simply try to reproduce what has happened so far, Artificial Intelligence analyses the past to understand how the markets work, how the variables are related to each other, what is the temporal structure of the price and demand series, where it is and how the equilibrium of each market evolves.

In this way, the models can react quickly to situations that have not occurred before, because they internalise the temporal dynamics of the markets and the relationship with their variables.

Based on your experience, what is the best recommendation for the renewable energy projects financing? Which is the health of PPA? Are there more merchant projects?

For the financing of a renewable energy project, the most important thing is to know and understand which the value of the project is, and for this, market prices forecasts that cover the entire lifetime of the projected plant are necessary, to estimate the value of the energy that will be produced. Our recommendation is having these forecasts with hourly granularity because it is the only way to estimate the income from the sale of energy based on the expected production profile.

The PPA market right now is very stagnant. The current situation of macrovolatility in the energy markets brought uncertainty, which reduces investor appetite. But the legal and regulatory insecurity generated by some government measures, such as the reduction in remuneration for inframarginal technologies of RDL 17/2021, the proposal to reduce remuneration for non‑emitting power plants or the adjustment mechanism of RDL 10/2022 that puts a cap on gas price and that has not yet come into operation, also had a very negative impact.

Given this situation of uncertainty, but also of high prices in the markets, banks and financial institutions focused on merchant projects and are now more willing to grant them financing.

Are renewable energy auctions recommended for electro‑intensive consumers? How can consumers protect themselves from daily market turmoil?

We think that the auctions of electro‑intensive consumers are going to be very positive. The electro‑intensive industry is very exposed to the high electricity markets prices since they buy part of the energy in the daily market. Therefore, signing a PPA can help them get more competitive prices.

The auction being organised by the AEGE, the Association of Companies with Large Energy Consumption, will have characteristics similar to those of the renewable energy auctions organised by the Ministry for the Ecological Transition and the Demographic Challenge. Wind and photovoltaic energy capacity will be auctioned and the energy will be delivered pay‑as‑produced for a period of twelve years. This energy contracted through a PPA will not be subject to the volatility of the daily market prices, which will protect the electro‑intensive consumer.

Developers will also benefit from signing a PPA with an electro‑intensive consumer, which has state guarantees through Cesce, the Spanish Export Credit Insurance Company, regulated by the Statute of Electro‑intensive Consumers, which will make obtaining financing for their projects easier for them.

You insisted that energy storage is going to be key in the energy transition. What recommendations do you make to developers and investors in storage projects? Is it an opportunity?

The increase in renewable energy generation is going to mean an opportunity in many ways. The low opportunity costs of wind and photovoltaic energy will push prices down during the hours of largest generation, and those hours with the most competitive prices will be an opportunity for the demand, for the production of green hydrogen and, obviously, for batteries and seasonal storage projects.

Like any generation or consumption project in the electricity market, energy storage projects need to have a long‑term vision of the market and its prices, with robust and coherent forecasts.

Is it necessary to have long‑term forecasts with hourly granularity to calculate the profitability of a battery?

It is essential. Based on forecasts or simulations of hourly prices, strategies for operating a battery can be defined that can be used to estimate its revenue throughout its lifetime. These strategies take into account the volatility of hourly prices to maximise the battery revenue. In the hours in which the market prices are expected to be lower, the battery charge is planned, to later pour the energy into the electricity grid in the hours with higher expected prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE.

Are batteries operating on the day‑ahead market profitable, or is it necessary to participate in ancillary services?

The volatility of prices will continue to be present in the daily and intraday markets and ensures the profitability of battery projects. The price arbitrage that batteries will be able to do in these markets will be very important and necessary, and a very well optimised battery project could become more profitable with these revenues. But the technical characteristics and flexibility of batteries make them especially suitable for their participation in ancillary services and they are markets that offer very attractive opportunities that must be taken advantage of.

On the other hand, capacity markets will be an important incentive when it comes to stimulating investment in storage systems.

And about green hydrogen, is it already a reality? What issues are pending for it to finally take off? What should the government do?

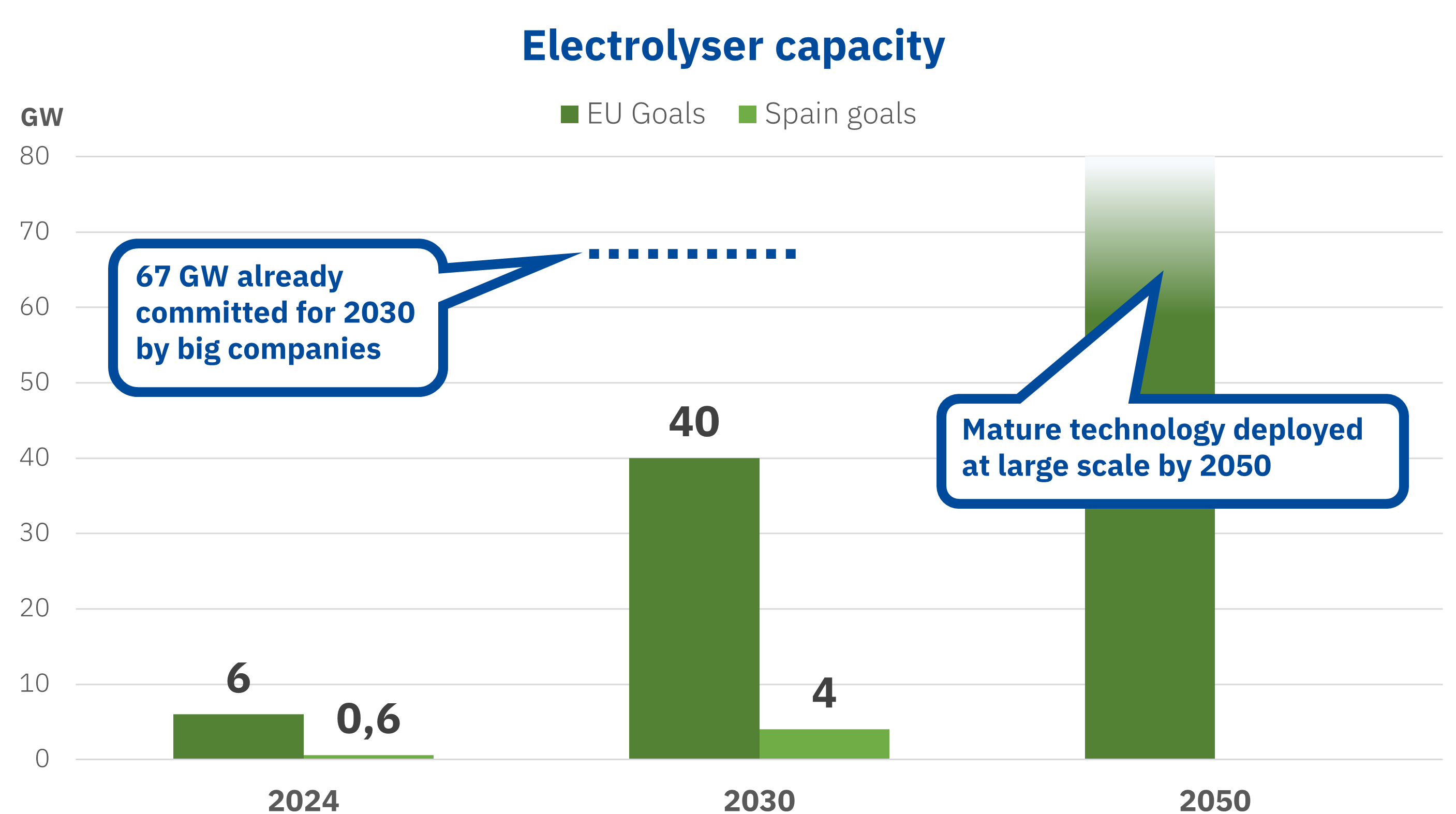

Currently, hardly anyone has any doubts about the importance that green hydrogen will have during the energy transition towards an economy with zero net emissions of polluting gases, and a sign of this is the tens of GW of electrolysers that are already planned throughout Europe. This renewable gas has great potential to replace the grey hydrogen used in many industries, also as a fuel for long‑distance transport and ships, as well as for seasonal energy storage, that is, producing hydrogen in periods when there is a lot of renewable energy production to transform it into electricity in periods of high demand and little renewable energy production. But for it to take off, it is necessary to start planning the investments of all the necessary infrastructure for its manufacture, distribution, storage and export through interconnections or by ship.

Source: Prepared by AleaSoft Energy Forecasting using data from the hydrogen roadmaps of Spain and the European Union.

Source: Prepared by AleaSoft Energy Forecasting using data from the hydrogen roadmaps of Spain and the European Union.

For some time we have been hearing about AleaGreen. What is AleaGreen and which are its prospects?

AleaGreen is the division of Alea Business Software S.L dedicated to the commercialisation of long‑term price curves forecasting reports for the energy markets in Europe and the rest of the world. AleaGreen was created in January of this year with the aim of becoming a hub capable of connecting the renewable energy sector with financial entities and investment funds, producers and large consumers, to explore synergies and opportunities that help to the achievement of a 100% renewable energy system.

AleaGreen offers long‑term price curves forecasting reports with a thirty‑year horizon and hourly granularity. These forecasts are necessary for the financing of renewable energy projects, risk management and hedging, negotiation and closing of PPA, portfolio valuation and audits, and for long‑term energy trading. These hourly forecasts are also necessary for monitoring a base load or fixed volume PPA, once signed, to estimate, for example, whether the energy produced will be sufficient to cover the contract and how much it would cost to acquire that lack of energy in the market, day by day, week by week or month by month, another of the services that AleaGreen offers.

Another AleaGreen service necessary for developers of renewable energy projects is the evaluation of the hourly photovoltaic and wind resource of any potential site in Europe and the rest of the world.

AleaGreen’s clients are a sample of the entire spectrum of actors of the energy sector: utilities, traders, retailers, large and electro‑intensive consumers, renewable energy developers, investment funds and banks.