AleaSoft, June 21, 2021. Interview of Ramón Roca from El Periódico de la Energía with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft.

What is happening to the electricity price in the wholesale market? Did you expect these record prices?

Since the beginning of spring, the Spanish wholesale market prices increased considerably, reaching daily values that are among the highest in the historical series. These increases are due to the increase in CO2 emission rights and gas prices. The price of a ton of CO2, which in 2020 was between 20 and 30 Euros most of the time, in 2021 has not stopped increasing until reaching values above 50 Euros. Gas prices were also increasing and are currently among all‑time highs. With this panorama of high CO2 and gas prices and with the approach of summer, the increase in demand, the reduction in wind and hydroelectric energy production typical of this time of year, the increases in wholesale market prices were to be expected.

What was not expected at the end of winter was the rise in CO2 and fuels in the proportion that they did.

The main protagonist of the increases in the electricity markets was CO2. After exceeding €56/t in mid‑May, now it seems that a breather was taken, do you consider that it could fall below €40/t again?

It is a possibility, even below €30/t. Behind the rise in CO2 there is a large speculative component, which was also enhanced by the fact that in April the deadline for companies that generate emissions to comply with the obligations corresponding to the year 2020 was reached and by the entry into operation of the UK emission allowance market after Brexit. If Europe made use of the Market Stability Reserve (MSR), it could increase the supply of rights in order to curb the price escalation and make the cost of electricity affordable for consumers. In this case, prices could drop below €40/t without problem. However, so far Europe said that it has no plans to intervene in the market, so in the short term we expect prices per ton to remain at high but stable levels between 50 and 55 Euros, although the uncertainty is great in a market as volatile as that of CO2.

What can the government do? The high price of these rights hurts all European consumers, especially electro‑intensive consumers. The Government must insist in Europe to end speculation, prohibiting or limiting these activities and also, making use of the stability reserve.

Similarly, gas, Brent and coal prices are having an upward trend that also had an impact on the European electricity markets prices. What evolution do you expect in the coming months?

The rate of vaccination against COVID‑19 is generating optimism regarding the recovery of the economy in the most developed countries, so it is expected that the demand for these raw materials will increase. In fact, according to the latest report from the International Energy Agency, it is expected that, by the end of 2022, oil demand levels will exceed those before the start of the pandemic. Therefore, we do not rule out that prices will continue to rise in the coming months, although in the longer term they will regain the market equilibrium.

Although in the most developed countries the pandemic is being controlled, in the rest of the world the situation continues to be dramatic, with an economic crisis that has no end in the short term. If to this is added that fuels prices rise, the situation of the energy markets can be critical if prices do not drop considerably at some point.

Do you have any recommendations for large and electro‑intensive consumers in situations of high prices in the market like the current one?

Large consumers and the electro‑intensive industry are among the most affected by the rise in prices, a situation that, by the way, is not exceptional in the market. Periods of high prices occurred in the past and will occur in the market in the future, just like periods of low prices. Our recommendation is that they define a long‑term purchase strategy based on diversification, which allows them to mitigate the market prices risks. For example, buying a part of the energy they need through one or more PPA, in the long term, with competitive prices that also give them visibility on the costs of energy in the coming years, and leave another part to take advantage of the opportunities that arise in the futures markets and in the spot market.

It must be borne in mind that in this long‑term strategy, self‑consumption and self‑generation must also be present, in addition to cogeneration, which, of course, will not be with gas in the future.

Do you consider it a good strategy for a large consumer signing a PPA if market prices are expected to fall with the increase in renewable energy capacity?

The increase in renewable energy capacity will effectively cause periods of low prices in the market. But, the fact that the photovoltaic and wind energy generation depends on the sun and wind, will make it necessary, in times of low renewable energy production and high demand, to resort to more expensive technologies to generate electricity and, therefore, prices will increase. The planned shutdown of nuclear power plants and the increase in demand as the economy is electrified are elements that will also prevent prices from falling systematically. In other words, the risk of periods of high prices will remain, so we consider that signing a PPA is a good and necessary strategy for large consumers. Thanks to PPA, in addition to mitigating markets prices risk and having visibility over their energy costs, they will be able to meet their environmental commitments and help in the decarbonisation of the economy.

Another element in favour of PPA is that the Statute of Electro‑intensive Consumers published in December 2020 provides the opportunity to the electro‑intensive industry to obtain advantageous conditions in PPA by having the endorsement of the State as a guarantee.

You that dominate the issue of PPA, do you see electro‑intensive consumers wanting to sign PPA as required by the Statute of Electro‑intensive Consumers? Or will they simply meet the minimum requirements?

If they get a price that allows them to compete with the industries of other neighbouring countries, they do find the option of PPA interesting, even covering a percentage of consumption higher than the 10% required by the Statute. Speaking to our clients that are large consumers, the issue of price is what made signing PPA uninteresting for them so far. Even though Spain is one of the countries with the most attractive PPA prices, due to the amount of renewable energy resource and the large number of projects, the prices offered to electro‑intensive consumers were not competitive for them. Therefore, the opportunity to obtain lower prices by having the State guarantee is eagerly awaited.

Precisely on this subject we were talking in depth with Fernando Soto, Director‑General of the Asociación de Empresas con Gran Consumo de Energía (AEGE) in the webinar that we held at AleaSoft on June 10. If someone is interested in the recording, they can request it through this link.

So do you consider that PPA are still necessary in Spain even when there is a planned calendar of renewable energy auctions?

We think so. PPA and auctions are two different alternatives to obtain financing for renewable energy projects that will coexist in the coming years. On the one hand, we already commented on the importance of PPA for consumers. On the other hand, renewable energy developers that do not win in the auctions have the path of PPA to ensure a flow of income that allows them to obtain financing for the projects. European emissions reduction targets are ambitious and a lot of funding is needed to install all the new renewable energy capacity that will be needed in the coming years.

Some of the renewable energy sector companies that had planned to go public during the first half of this year delayed it due to the instability in the markets. Acciona recently confirmed its IPO. Do you think that other companies can resume their plans in the coming months?

It will depend on how Acciona Energía opens on the stock market. The CNMC approved the registration document, which is the previous step to the IPO, which allowed presentations to investors before the actual placement of the shares. After testing investors, the valuation with which the company will make its debut on the stock market will be between 8800 and 9800 million Euros, when it was initially expected to be in a range of between 10 and 12 billion Euros. However, the start‑up of the company is expected to be successful.

An interesting event recently occurred when the shares of all listed renewable energy companies rose as a result of the Swedish fund EQT’s takeover bid for Solarpack, reinforcing the interest in companies of the sector in the stock market.

What is clear is that renewable energy projects continue to be profitable, so that in the future other companies with solid projects could consider going public.

Lately there were some days, mainly during the weekends, when the “duck curve” began to be noticed when there is a lot of renewable energy production and less demand. Do you think that this effect will become more acute in the coming years when renewable energy capacity increases? Should renewable energy developers and producers care?

In the energy transition process, in addition to the increase in renewable energy capacity, other actors will come into play that will help to soften the effect of the “duck curve”. We are referring to batteries and hydrogen, which will allow storing energy at times of low prices so that it can be consumed at times of high prices, thereby flattening the curve. There is also the demand response. Consumers will move their consumption to those hours when prices are cheaper. The increasingly massive introduction of electric vehicles is also expected, the charge of which could be shifted towards lower price hours.

Will we see many hours with negative or very high prices in the MIBEL market as of July 6 when the minimum and maximum limits of the offers change?

Negative prices are possible, although we do not expect them to be very frequent in the short and mid term. At AleaSoft we also see it unlikely that hours with very high prices will be reached. In fact, in the entire history of the Spanish market the current maximum of €180.3/MWh has never been reached. We do not expect the behaviour of market agents to change significantly with the change in price limits, so we do not expect it to affect prices resulting from the market.

Are there opportunities for renewable energy producers in the adjustment markets?

Yes there are. Renewable energies offer some flexibility, especially to lower, and in fact they are already participating in auxiliary services. With the hybridisation of the plants with batteries or with green hydrogen production stations, their flexibility will increase even more and the adjustment markets can lead to additional turnover.

What do you think of the Draft Law with which they want to cut the income of non‑emitting plants prior to 2005, which mainly affects nuclear, hydroelectric and some wind power plants?

It seems to us a bad sign for investors in renewable energies, something that we cannot afford at this time when trillions of Euros in investments will be needed to achieve the objectives of the NECP and of emission neutrality in 2050. The regulatory uncertainty discourages investment. In addition, revenues from technologies that do not emit CO2 and that will be essential for the decarbonisation of the economy are being cut. Hydropower is a renewable energy that has the characteristic of being completely manageable, something that does not happen with wind and solar energy, for example. This measure could also lead to the early closure of nuclear power plants, which would be very negative for the energy transition. The closure of nuclear power plants must be orderly and staggered as renewable energy capacity increases so that CO2 emissions do not increase. If they are closed early, it will be necessary to cover the demand with the combined cycle gas turbines production, which use gas and emit CO2 and are therefore exposed to the prices of these commodities. That is, market prices will also increase.

A collateral problem that already caused the announcement of this law was the fall on the stock market of the Spanish companies that own the affected hydroelectric and nuclear power plants, which reflects the legal and regulatory uncertainty caused by such a measure.

If this law is finally approved, legal proceedings may take place over many years, affecting the image of the country, with an uncertain end for everyone and causing direct damage to the affected companies.

A measure that could help lower the cost of electricity without harming producers is the elimination of the 7% tax on the sale of electricity, the IVPEE, which, in addition to making generators offers more expensive, puts them at a disadvantage compared to their competitors in other European electricity markets. Recently, the Minister for the Ecological Transition, Teresa Ribera, announced that some of the fiscal elements that tax electricity would be reviewed, on an exceptional and provisional basis, and hinted that the temporary suspension of the 7% tax was being considered, as it was already made for six months starting in October 2018, in the middle of another episode of high prices in the markets. However, at AleaSoft we always defended that this tax should be permanently eliminated due to the damage it causes to both consumers and generators. Some sources also point out that the Government is studying lowering the VAT on electricity, which is currently 21%, which would also significantly relieve consumers without affecting generators.

And about the new electricity bill, what do you think?

At AleaSoft, we think it is positive that a more efficient consumption of electricity is encouraged. It is important that consumers become aware and move their consumption to the hours when the electricity price is lower. This flexibility will be very important in the future, when we have hours with a lot of renewable energy production and lower prices, for example, during the hours with more sun. Precisely, our long‑term models are based on the demand being flexible and adapting to the lower prices hours so that, thus, the market balance is maintained.

It is also positive that the cost of the fixed part of the invoice decreases and that of the variable part increases. In this way, those who consume less will pay less, encouraging efficiency and savings.

Another advantage that we see in the new electricity tariff is that it is simplified. For example, in the case of domestic consumers, the six existing tolls, 2.0 A, 2.0 DHA, 2.0 DHS, 2.1 A, 2.1 DHA and 2.1 DHS, were grouped into a single toll, 2.0 TD.

Despite the positive part that we see, the negative part of the law is that it affects consumers who cannot move consumption to other hours and do so when prices are higher. In this case, they will see the electric bill increased. Perhaps the moment of entry into force was not the most fortunate considering that the economy is beginning to reactivate after the stoppage caused by the COVID‑19 pandemic and that also coincides with a moment of high prices in the wholesale market. But, in general, it seems to us a measure that goes in the direction that the energy transition needs.

On July 1, the moratorium for renewable energies to request access and connection permits ends. How do you expect the market to react?

This will mean a flood of requests for access and connection points and a new impetus for the development of new renewable energy capacity. The changes in the regulations, to require that projects have a greater solidity to obtain these permits, will make it possible to stop speculation and reduce the number of rejected applications. According to REE data of the end of April 2021, the permit was denied to 20 880 MW of wind energy and 93 067 MW of photovoltaic energy.

At AleaSoft we work with almost all the renewable energy generation development companies in the country and we see great enthusiasm to present the new projects.

The government is working on creating a capacity market to support renewable energies that can be an incentive for the development of technologies such as battery and green hydrogen storage. What role will these technologies play in the energy transition?

As we commented before, storage with batteries and green hydrogen will be essential to counteract the downward effect that the increase in renewable energy generation will have on prices. Furthermore, storing energy with these technologies will allow minimising curtailments when the renewable energy generation exceeds the demand. At AleaSoft we consider that green hydrogen will be the fuel of the future given its great potential, not only for seasonal storage, but also as a substitute for fossil fuels in the production of heat in industry, and in transportation, mainly in long‑term distances, maritime and aviation transport. Also as a main component in the production of new energy vectors of a decarbonised economy such as green ammonia.

On the AleaSoft website you have observatories to monitor the main energy markets in Europe. Do you have a version for companies?

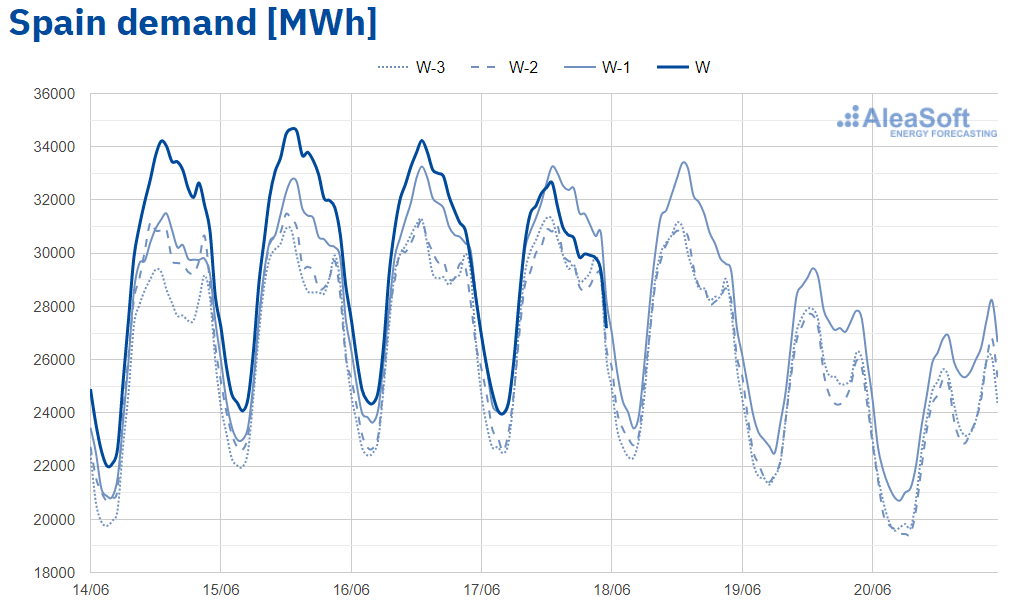

Indeed, the observatories that we have on the web allow monitoring updated data of prices, demand, production by technologies and temperatures of the main European markets. The data are shown in hourly, daily and weekly graphs where the last weeks are compared. These days with the changes in demand and prices, the observatories have a lot of follow‑up.

Image of the Spanish electricity demand observatory from the AleaSoft website (18.06.2021)

Image of the Spanish electricity demand observatory from the AleaSoft website (18.06.2021)

We also developed the Alea Energy Database (AleaApp) platform, aimed at companies, in which it is possible to visualise and analyse the entire updated historical series of the data that we show in the web observatories, but also of data of fuels, CO2, of the products that are being negotiated in the futures markets, of the macroeconomic data, among others. The tool includes functionalities that allow analysing different periods, with different granularities and aggregations, comparing several series to detect causalities, calculating the moving average, etc.

For many years you have been absolute leaders in Spain making forecasts for the energy sector. In the short‑ and mid‑term price forecasting services AleaSoft is the main reference. Can the same be said for the long‑term price forecasting, which is essential for the financing and development of renewable energies? Is there something that differentiates you from the competition?

In the last three years, at AleaSoft we developed more than 200 long‑term market price forecasting projects, not only for the Iberian market, but also for the majority of European electricity markets. Our forecasts use a scientific methodology that takes into account the market equilibrium that makes them coherence and robust. One characteristic that differentiates us from the competition is that we estimate prices with hourly detail, that is, they are price forecasts for each hour of the next 30 years. This is essential to quantify the income of an electricity generation plant hour by hour throughout the forecast horizon based on its production profile, which allows estimating the profitability of investments in the new renewable energy technologies. The hourly forecasting is also essential to assess whether a base load or pay‑as‑produced PPA is better. Our forecasts include confidence bands that, unlike those of other providers, are calculated with a probabilistic metric, so they are a scientific measure of the risk or probability that the price will fluctuate above or below a certain value.

The following graph shows a long‑term forecasting that we generated in 2010, which is an example of the quality, coherency and robustness of our forecasts. In the graph it is possible to see how, from data that could seem chaotic, the models were able to determine the equilibrium point around which the market works and project it into the future. Since then, prices continued to fluctuate, but always around the central forecast, as expected from our model in October 2010.

Long term price forecast made in October 2010

The shown forecast shows monthly data from November 2010 to May 2021

The webinars that AleaSoft organises monthly are becoming a reference in the sector. How was the experience? Anything especially interesting to comment on?

For us it was a very enriching experience that also helped us to learn from all the guests who accompanied us. We were fortunate to have speakers from important companies and associations of the European and global energy sector, consulting and service companies and financial entities, such as Deloitte, PwC Spain, EY, JLL, Vector Renewables, Engie, Axpo, Banco Sabadell, Triodos Bank, Powertis and AEGE. Due to the feedback we are receiving from the attendees, the webinars are a way to keep up to date with the evolution of the energy markets and to learn about the most current topics in the sector, and they became for many a regular appointment each month. They also value that the webinars are monthly and, according to their general opinion, are the best in our sector. The companies that participated in them are also evaluating it very positively and some repeat as speakers, such as Deloitte, who will accompany us again in the webinar that we will hold on October 7, one year after their first participation.

There are many changes that are being experienced in the electricity market. How can AleaSoft help all the actors in these times of change?

We try that all our actions are aimed at helping, guiding and training the companies in the energy sector. As we commented, the long‑term forecasting is a fundamental input to obtain the necessary financing to build all the new renewable energy capacity that is expected in the coming years. Our short‑ and mid‑term forecasts are also useful for the operation of the plants once they are in operation and participating in the wholesale and futures markets. The webinars, workshops, the Alea Energy Database (AleaApp) platform and the observatories on our website aim to disseminate the most interesting topics in the sector, offer our strategic vision of the future, which is moving towards a world without greenhouse gas emissions, in addition to provide tools and information that help detect opportunities and make decisions. That is, we transform the information of the energy markets into knowledge, intelligence, vision and opportunities.

AleaSoft will soon turn 22 years making forecasts for the European energy sector. What do you think of the future that is looming today?

Thrilling. If we think about it, the European Union’s goal of bringing net emissions of polluting and greenhouse gases to zero by 2050 will require a paradigm shift, a revolution in the way of producing energy, in used fuels in the processes, in the way of moving and in the way of consuming, which will have to be more efficient and respectful with the environment. In our day to day all will be protagonists in this change in one way or another, but that our objectives as a company are also oriented to help in this entire process makes us feel responsible and, above all, excited. We are fortunate to be in a revolutionary sector, which was able to continue active in the worst crisis for many decades, and with a future with ambitious goals and many projects to carry out.