AleaSoft Energy Forecasting, May 26, 2022. Interview of the Solar News magazine with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

The President of the Spanish Government proposed exceptional measures to lower energy prices. What other important measures are pending?

A measure that would have an immediate effect on the electricity bill would be the temporary reduction of VAT to 5%, and in the case of vulnerable consumers to 1%. Currently, until June 30 of this year, a 10% VAT is being applied to consumers with contracted power of up to 10 kW, provided that the pool price is greater than €45/MWh, except in the case of severe vulnerable consumers and at risk of exclusion for whom the VAT reduction is applied regardless of the market price.

On the other hand, both the European Union and the Spanish Government highlighted the importance of accelerating the development of renewable energies to reduce electricity markets prices and energy dependence on foreign sources. However, one of the obstacles to the development of renewable energies in Spain has to do with the slowness in administrative procedures. One of the measures included in Royal Decree‑Law 6/2022 is aimed at speeding up the procedures for projects that meet certain conditions, but we think that more work and resources should be put in place to speed up the development of all projects.

We also believe that measures to promote bilateral contracts or PPA with large consumers and retailers would be useful so that consumers are less exposed to electricity market prices. In Spain, the regulated tariff is indexed to pool prices and a high percentage of large consumers are direct consumers or their contracts are indexed to the market price. If bilateral contracts were promoted, the impact on consumers due to market volatility would be greatly reduced.

Renewable energy auctions also help finance projects. It is necessary that the electro‑intensive industry can benefit directly from these renewable energy auctions.

Another factor that caused the increase in electricity markets prices at a European level is the CO2 emission rights price, which has become more expensive since last year. Although it is a measure that would have to be taken beyond our borders, the Government could promote measures in Brussels to limit and control prices in this market. The CO2 emission rights market is a market created by the European Union and it has the necessary mechanisms to control the supply and demand of bonds and, effectively, control the price.

In addition, it is important to start thinking and planning in the longer term, designing a strategy at European level. In the future electricity system, based on renewable energies, stress situations may occur on days when wind, solar and hydroelectric production is not sufficient to cover the demand, which could cause very high prices or a lack of supply, especially in winter. The solution for these situations lies in short‑term storage and seasonal storage with green hydrogen or another alternative green fuel. It is necessary to plan investments in time to develop all necessary infrastructure, from the manufacture of green fuel, distribution grids, storage and even maritime transport to take advantage of the potential that Spain has as a future exporter of this energy.

How are the power plants that use fossil fuels going to be paid the difference between the €50/MWh that they will be allowed to offer and their real costs?

The details of this measure remain to be known, but what has transpired so far is that this difference will be paid by the agents that make the purchase offers in the market. Once the matched price is obtained, the extra cost of the plants that use gas will be calculated based on the gas price in the MIBGAS market and on the performance of each plant according to its technology (combined cycle gas turbines, cogeneration). This extra cost will be distributed among all the purchased MWh, so that the buyers will pay the matched market price plus this extra compensation to the gas power plants.

By paying this compensation only to the gas power plants, the final price to be paid by the buyers will be much lower than the prices that existed before the gas price was capped, because, without that cap, the cost of the gas power plants was paid to all technologies.

Given that CO2 emission rights prices are an important component in the energy price, what measures should be taken at this point?

CO2 prices are an important component of electricity market prices and went from around €30/t at the beginning of 2021 to around €80/t where they currently are, with maximums that exceeded €90/t. It is a market that emerged to encourage the development of renewable energies and penalise the use of fossil fuels, so it makes sense that prices have an upward trend and this attracted speculation in that market. However, this rise in prices, together with the rise in gas prices, is having a very negative effect on consumers, especially electro‑intensive consumers. At AleaSoft we repeatedly stated that it is important to regulate CO2 market prices so as not to affect European consumers, especially the industry, and even the possibility of applying a moratorium to temporarily exempt gas generation from paying these emission rights. As we always say, this should be a measure at European level, not national.

Are the solutions proposed for Spain and Portugal valid for other European markets?

The measure of capping the gas price in the Iberian electricity market is based on the exceptional nature of the Iberian Peninsula as an energy island, that is, it is a territory that is not sufficiently connected to the rest of Europe. However, if this measure works and there are no legal problems, it could be used in other countries on a temporary basis, although we believe that it is always better not to intervene in the markets and that the definitive solution is making mid‑ and long‑term contracts to mitigate the market price risk for consumers.

What consequences can the proposal to limit the gas price in the Iberian electricity market have?

Until the Royal Decree‑Law is approved, we will not know all the details, but it is clear that this measure will mean a reduction in what consumers whose bill is indexed to pool prices pay and it will be a great help, especially for large and electro‑intensive consumers. It was announced that, initially, the gas limit will be €40/MWh and that in the following months it will increase until the average price of the twelve months in which the measure will be applied is €50/MWh. If prices of a ton of CO2 continue around €80, electricity market prices will be a maximum of €120/MWh for a gas price capped at €40/MWh and €160/MWh when the cap is €60/MWh.

However, this measure may generate regulatory and legal insecurity because the historical market price reference, which is the underlying asset in the futures markets and is used as the basis for mid‑ and long‑term bilateral contracts, will be lost. A consequence of the legal and regulatory insecurity and the temporary intervention of the market might be the slowdown of the PPA market, because in the renewable energy projects financing, having a predictable and stable regulatory framework is very important.

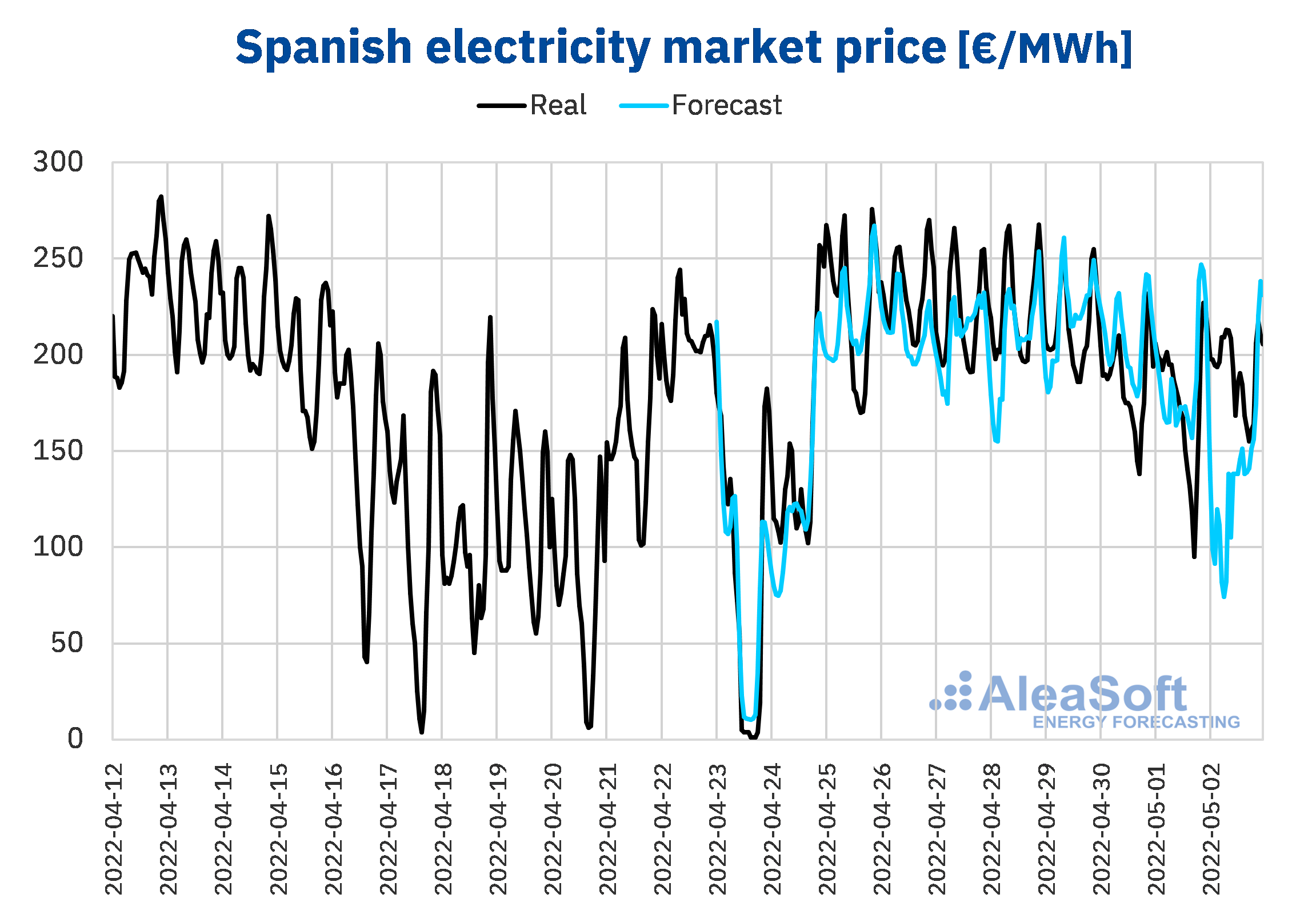

Source: Short term forecasts of the MIBEL daily market price (Spain) generated by AleaSoft Energy Forecasting.

Source: Short term forecasts of the MIBEL daily market price (Spain) generated by AleaSoft Energy Forecasting.

Taking into account the prospects for the energy markets in Europe, could the renewable energy projects financing be affected?

As we mentioned before, legal and regulatory insecurity can slow down the renewable energies financing due to lack of confidence. However, the lower availability of PPA projects that currently exists and the forecasts that indicate that market prices are not going to fall drastically are causing a change in perception about merchant projects. Banks and investment funds are more favourable to sign projects in this type of financing. This shows that there is still interest in renewable energy projects financing despite the unstable markets situation, which began with the COVID‑19 crisis and continued with the Russian invasion of Ukraine.

What role should renewable energies play in the necessary energy transition?

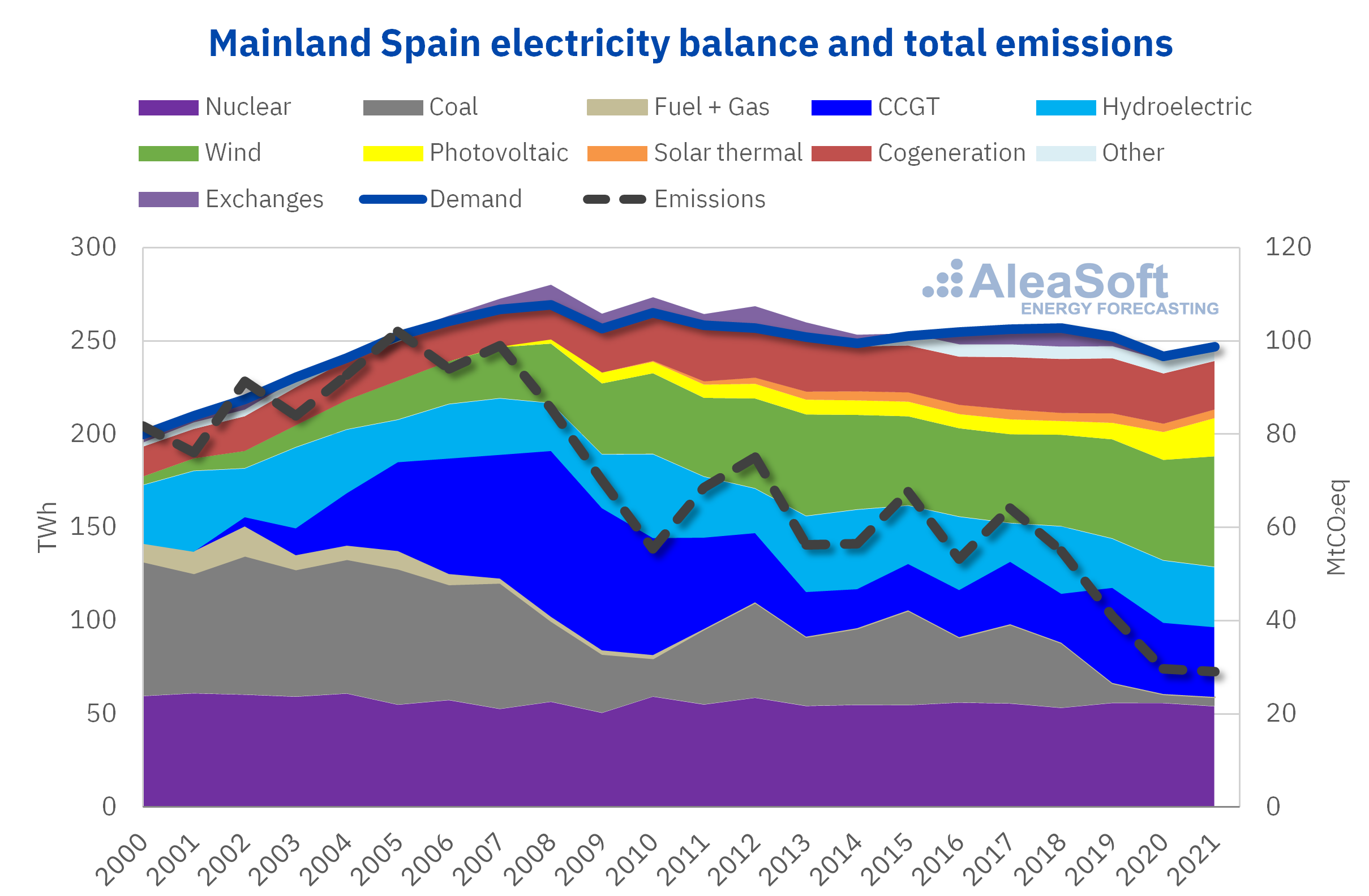

Renewable energies will be one of the protagonists during the energy transition, a role that they have already demonstrated since their emergence in the Spanish peninsular generation mix. The boom in wind energy first and later in solar photovoltaic energy managed to drastically reduce the presence of coal in the mix and helped reduce CO2 emissions from the electricity sector in Mainland Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

Source: Prepared by AleaSoft Energy Forecasting using data from REE.

The leading role of renewable energies in the coming years will be given by their essential role in achieving climate neutrality in 2050, as the European Union intends, and also by the need to achieve the energy independence from abroad, a need that became very evident after the Russian invasion of Ukraine. Throughout this transition process, renewable energies will be accompanied by other key players such as energy storage with batteries, green hydrogen and electric vehicles.

AleaSoft developed a Alea Energy Database (AleaApp), what market needs does it respond to?

The Alea Energy Database (AleaApp) is an updated database of energy markets, mainly European markets. The Alea Energy Database (AleaApp) compiles the data of a large number of variables of the energy markets, for example: European markets prices, electricity demand, wind energy production, photovoltaic energy production, hydraulic energy production, nuclear energy production, electricity and gas futures, meteorological data, economic data, among others. One advantage of the Alea Energy Database (AleaApp) is that it allows consulting the entire historical series of each variable, which is information that is often not available, or that is difficult to obtain as it is in different sources with different formats. The Alea Energy Database (AleaApp) also includes tools to visualise and analyse the data, convert them to other time periods, for example, convert the series of hourly prices to monthly to analyse the evolution. It also allows calculating moving averages, defining alerts that notify when a series crosses certain thresholds and comparing several series to detect causalities. In short, it is a database of information of the energy markets with all the tools to turn them into knowledge, intelligence, vision and opportunities.

Source: AleaSoft Energy Forecasting.