AleaSoft, January 28, 2021. Interview of the magazine Solar News with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft.

You have been in the Spanish electricity market for more than 21 years making forecasts with a new methodology. What can you tell us? Does the artificial intelligence really work?

The Alea methodology, widely used for the forecasting in the energy sector, combines the artificial intelligence with classical statistical techniques such as the regression, the time series and the econometric models. The fact that the methodology has been providing forecasts for 21 years for the main companies of the sector in Europe already indicates that it is a robust technology with reliable results.

How will the MIBEL end the year in the Spanish electricity market?

It was an exceptional year. The COVID‑19 pandemic brought the confinement with the fall in demand to 2002 levels. The gas, oil and coal prices also plummeted at the end of the first quarter of the year. And all this brought low prices in the electricity market, in Spain as well in the rest of the European markets.

The Spanish electricity market will end the year with an average price of around €34/MWh. This is the lowest price since 2004, before the Iberian MIBEL market was created in 2007.

The fall in demand due to the COVID‑19 led to an increase in demand coverage by the renewable energy. Can this reality be repeated in the next exercise? Is this an advance of those that we will find when we have all the renewable capacity that the NECP promises?

The high coverage by the renewable energy came from a sudden and unexpected drop in demand. This caused a very significant drop in electricity market prices, but these prices would not have been possible without the low gas prices registered in March and April.

The demand coverage by the renewable energy will increase as the renewable capacity grows. But it will do so gradually and, in addition, for the demand there will also be changes, both in volume and in flexibility, which will make it possible for this to respond to price signals. Therefore, the future situation of demand coverage by the renewable energy is not comparable with the exceptional situation of this year. It does not make sense to predict very low prices in the future based on the exceptional and unexpected situation of this year 2020.

The health and economic crisis are impacting practically all sectors. Will the financing of new renewable energy projects continue active in 2021?

The energy sector in Spain and in Europe proved to be very resilient and during the critical moments of the pandemic it managed to maintain the pace of investments, obviously with some setbacks in the parks that are under construction. The outlook for investments in renewable energy in the mid and long term continues at levels similar to those before the crisis.

Is it possible to make a forecasting of the electricity prices for the year 2021?

The prices in the energy markets are recovering across Europe and in 2021 the prices will recover. However, the level to which they end up recovering will be determined by multiple factors: how will the economy evolve?, will there be a third or fourth wave of COVID‑19?, will it be a rainy or dry year? how will the gas and oil price behave worldwide?

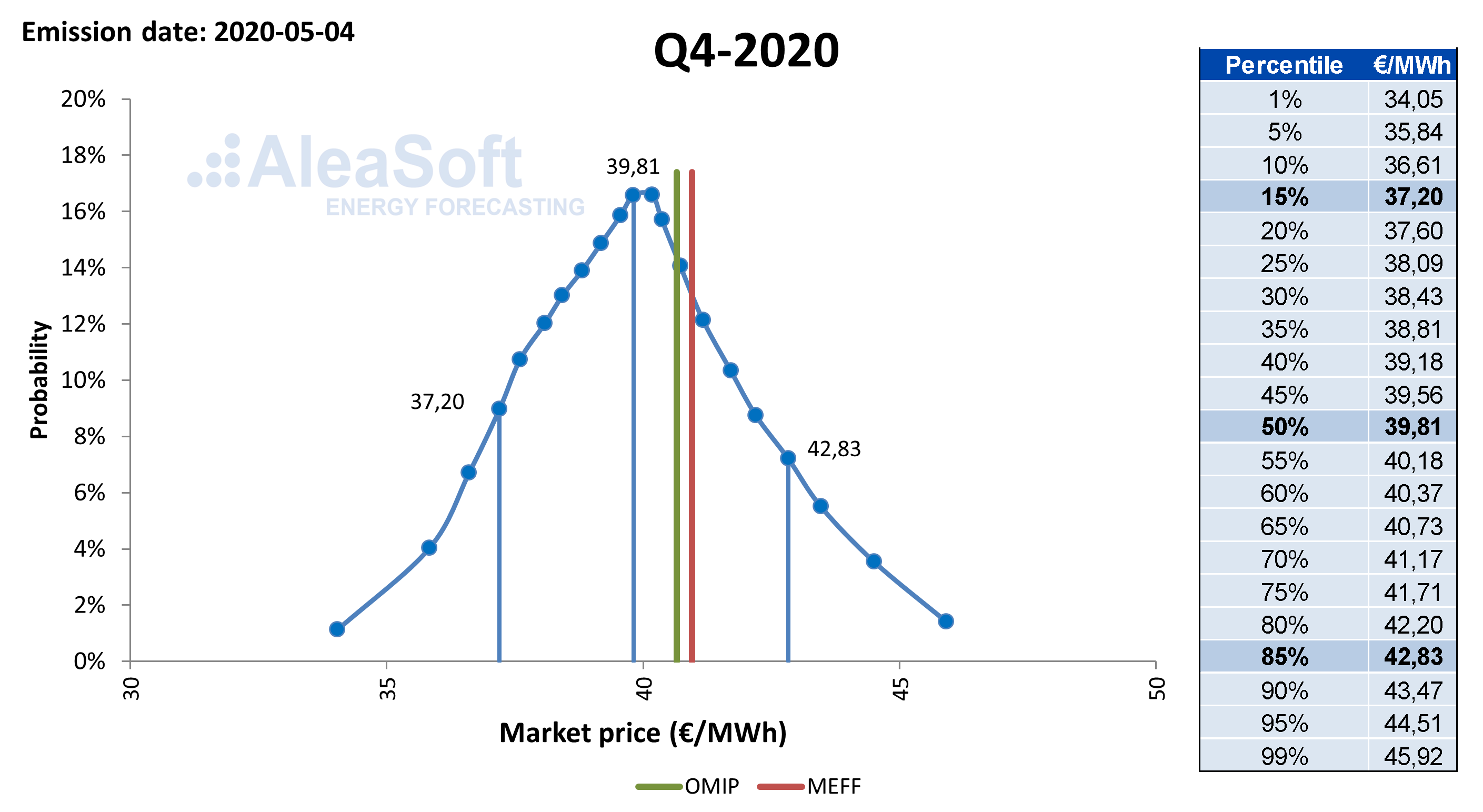

All these factors mean that, beyond a deterministic forecasting of the price that provides a number, the most appropriate is a probabilistic forecasting that describes all the possible prices that may occur and that assigns to each one of them a probability of occurrence. In this way, both buyers and generators of electricity will be able to quantify the risk associated with each price forecasting.

How will they influence the PPA contracts prices?

The PPAs prices are determined mainly by the characteristics and specific needs of both the renewable energy generation plant and the offtaker. Beyond this, they are effectively influenced by the electricity markets prices, and as these recover, so will the PPAs prices.

If the PPAs prices follow a downward trend, what will it represent for the wind and photovoltaic energy parks looking to sign a long‑term agreement?

Each park and situation is specific. Obviously, no generator will sign a PPA that does not mean that it will make its investment profitable, and an offtaker cannot expect to obtain a price for the electricity lower than the return of any plant, because those prices will not be found in the market either.

So the returns on investments in renewable energies may adjust a bit, but there is a floor from which the PPAs prices cannot fall.

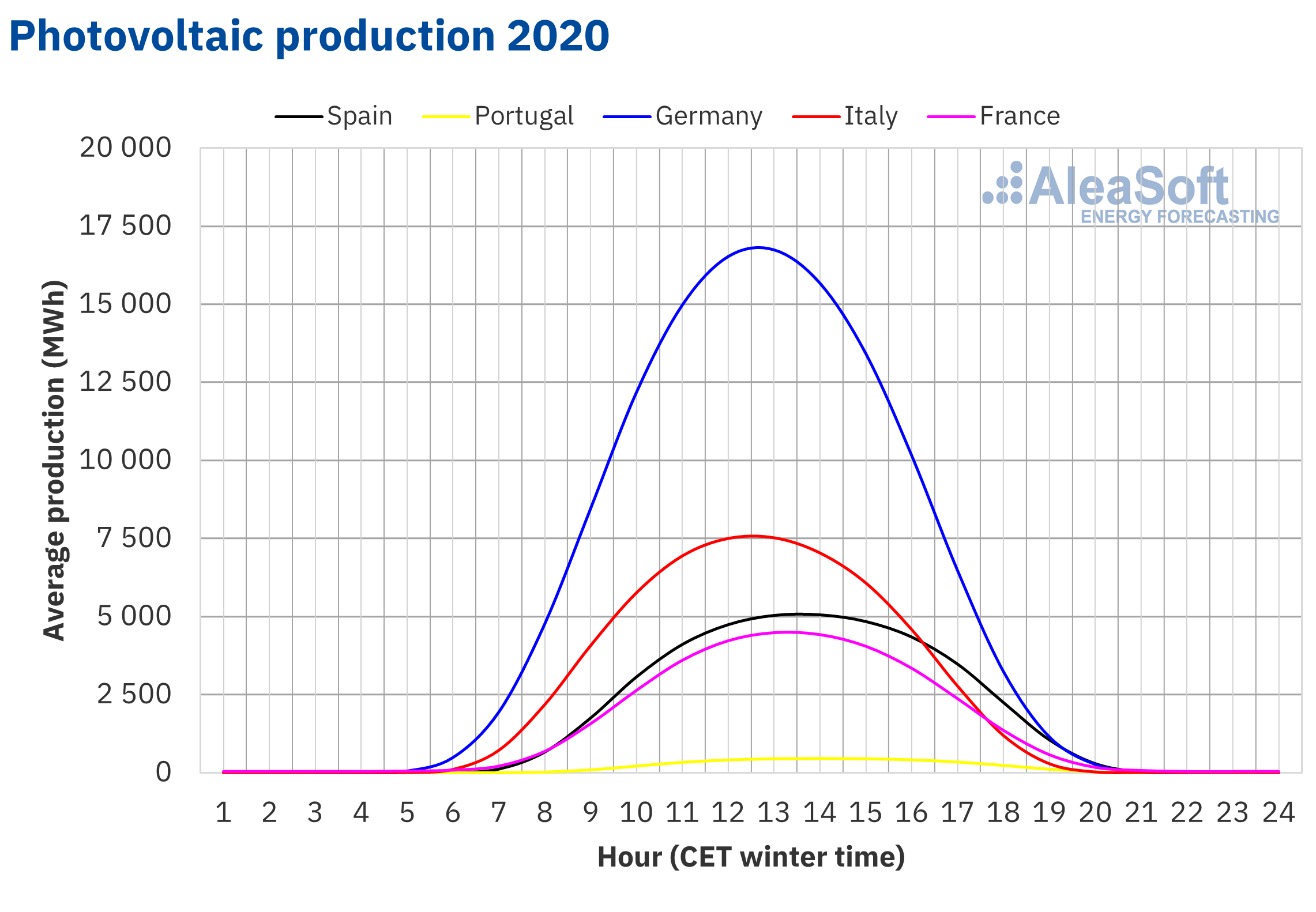

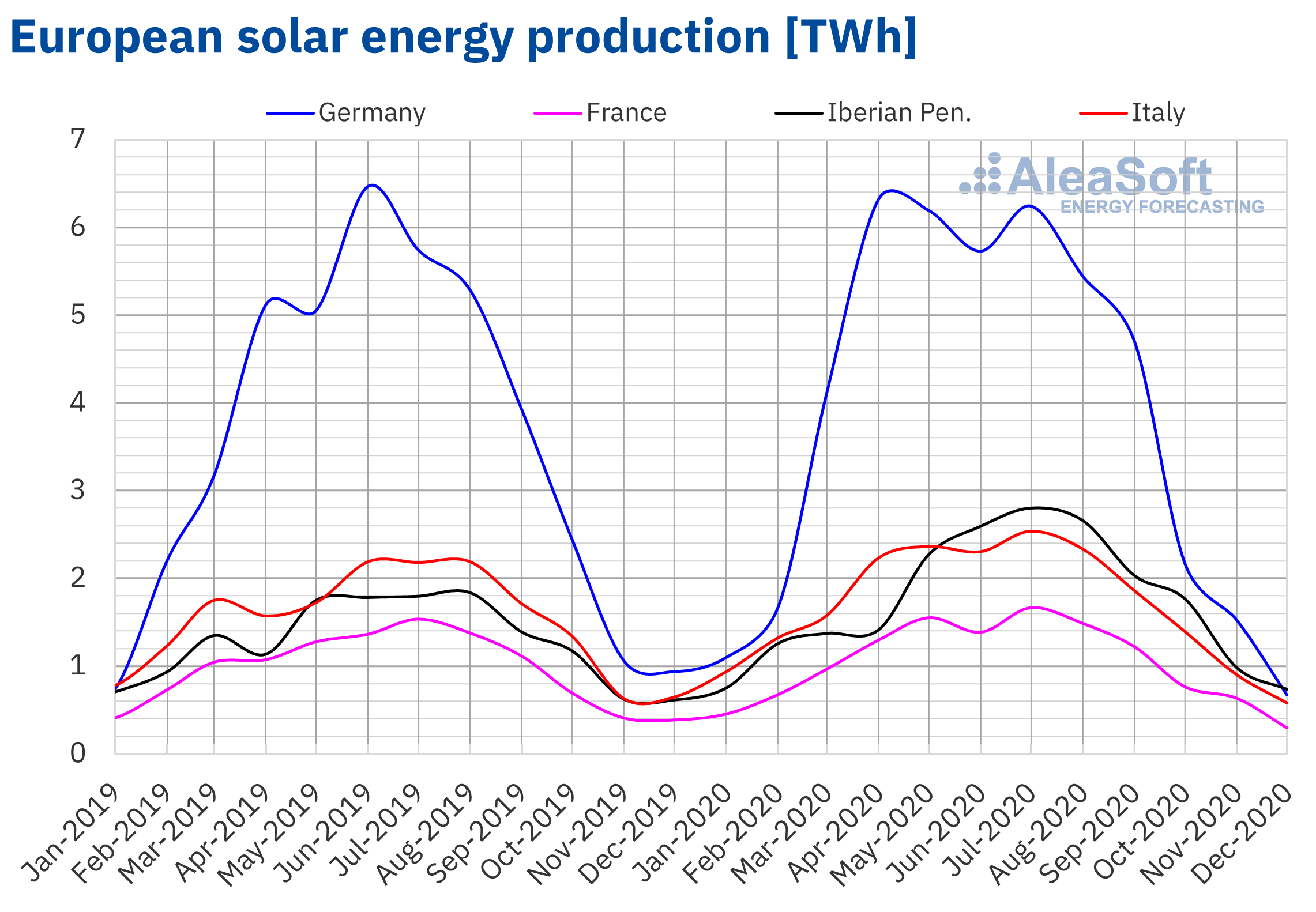

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

The new auction regime sets the calendar for holding them, which will comprise a minimum period of five years, and in them the participants will bid by offering the price. How will it influence the market?

The renewable capacity auctions introduce uncertainty into a self‑regulating market. As there are auctions, generation facilities without any help will be competing in the market with facilities that will have a different remuneration system outside the market. This distorts the market, does not create robust price signals and creates mistrust in the investors.

AleaSoft also organises webinars that provide useful information and knowledge to the professionals of the energy sector. Could you tell us the most outstanding topic for 2021?

We are very satisfied with the success and acceptance of the webinars that we carried out this year.

This year we will continue to monitor the evolution of the energy markets and together with other important companies of the sector at a European and global level, we will continue to analyse interesting aspects for the professionals of the energy sector, such as the PPAs, the auctions, the financing of the renewable energy projects, the risk management and the regulatory aspects among others.

Recent news highlighted the need to have 30‑year hourly forecasts. Why are these forecasts essential for an investment in renewable energy or for a PPA?

A 30‑year hourly price forecasting allows estimating the long‑term hour‑by‑hour revenue from the production profile of a plant. This estimate is essential when determining the risk associated with the decision of an investment or of the signing of a PPA.

The audits also require having forecasts that support the decisions taken in each moment, both in the present and in the past.

Are the forecasts with probabilities necessary for the risk management?

They are essential. Without forecasts that have bands with an associated probabilistic metric, it is not possible to quantify the risk of going to the market or opening or closing a position in the futures markets.

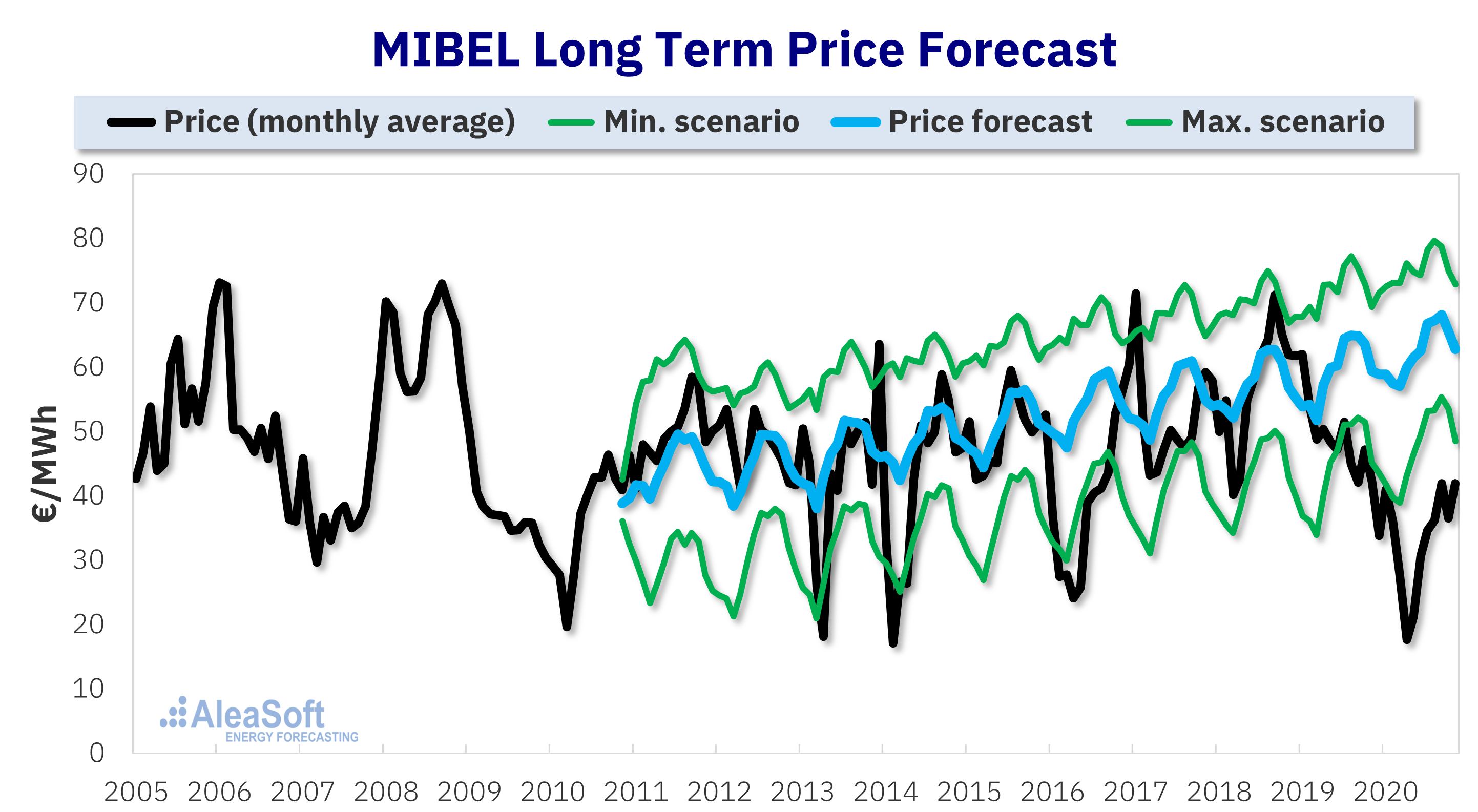

Long term price forecast for the Iberian electricity market made in November 2010.

Long term price forecast for the Iberian electricity market made in November 2010.

Probability distribution of the average price of the Iberian electricity market OMIE Spain for the fourth quarter of 2020 made on May 4, 2020.

Probability distribution of the average price of the Iberian electricity market OMIE Spain for the fourth quarter of 2020 made on May 4, 2020.

In your opinion, what awaits the renewable energies in 2021?

The renewable energies are the future. This renewable future has already started and will continue in 2021.

The auctions, the NECP targets for 2030, the European emission reduction targets of 2040 and 2050, all these are long‑term goals that will be achieved step by step, and 2021 will be one more step in that direction, and an important step after the exceptionality in all senses of 2020.

The year 2021 will be decisive and we hope it will be the first year without pandemic. For Spain, the most important thing now is attracting the international investors that are those who will contribute the billions of Euros necessary for the transformation of the energy sector as a whole to reach the full decarbonisation within 30 years.

Source: AleaSoft Energy Forecasting