AleaSoft Energy Forecasting, October 9, 2023. In the first week of October, average prices in most European electricity markets were below €85/MWh and lower than the previous week in almost all markets. However, in some hours and markets, prices exceeded €200/MWh. In MIBEL, the highest hourly price since March was registered on the 9th. Wind energy production increased and in Germany on the 3rd it was the highest since March. Gas and CO2 prices fell, with CO2 reaching its lowest level since June on the 3rd.

Solar photovoltaic, solar thermoelectric and wind energy production

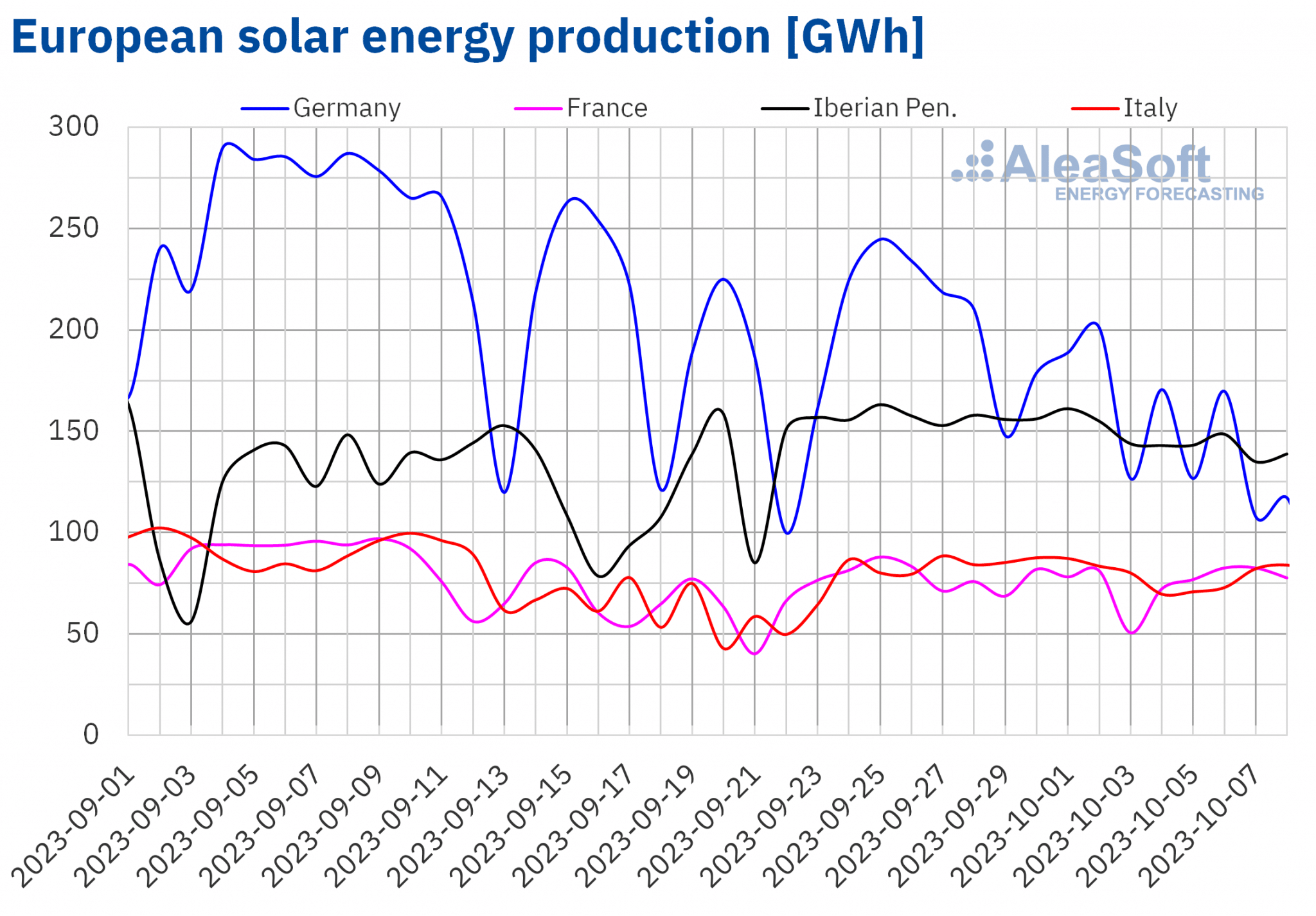

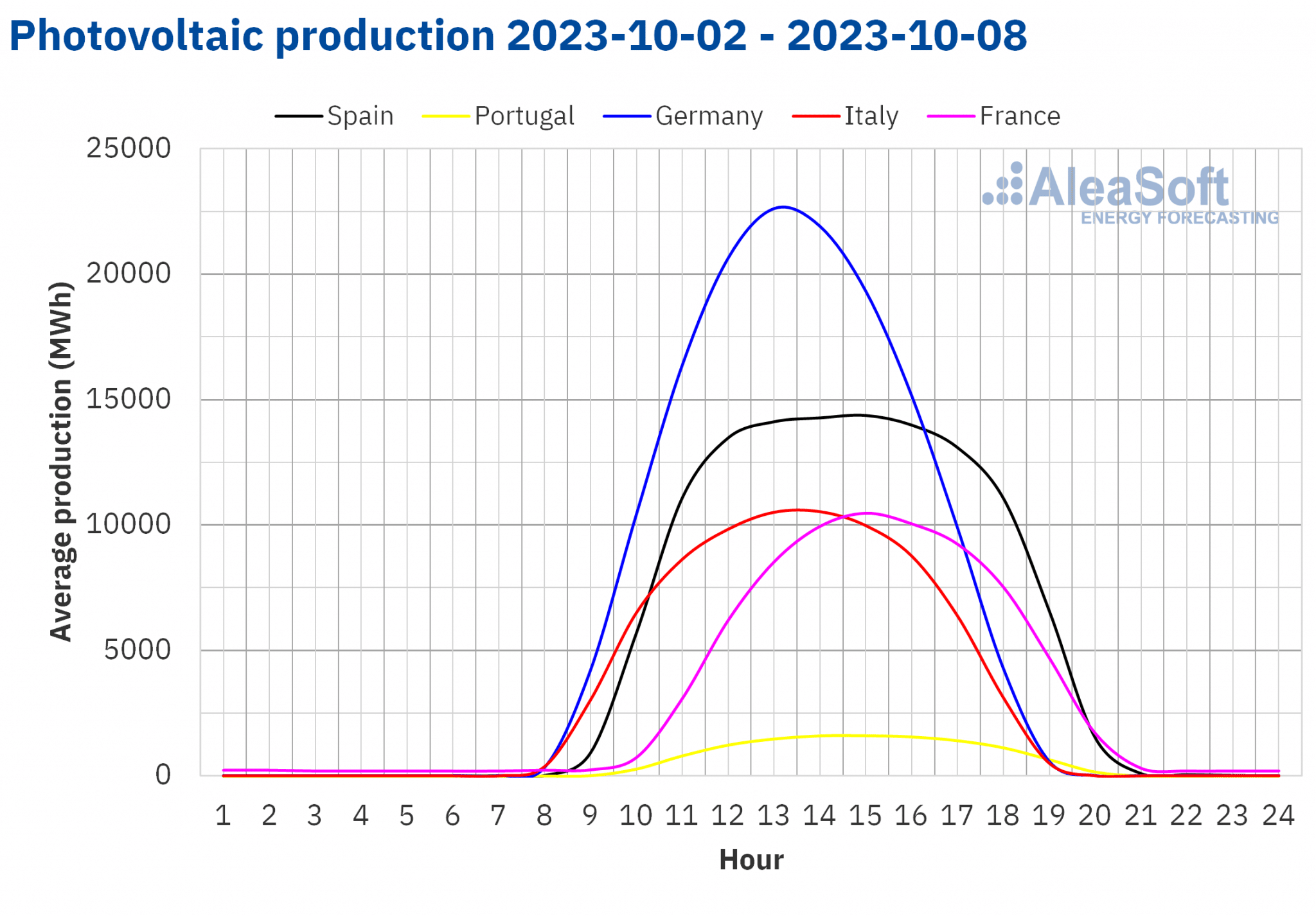

In the week of October 2, solar energy production decreased in all analyzed markets compared to the previous week. The German market registered the largest drop, 28%. In the other markets, the decrease in solar energy production ranged from 9.1% in Portugal to 4.3% in France.

According to AleaSoft Energy Forecasting’s solar energy production forecasts for the week of October 9, solar energy production is expected to decrease in all analyzed markets except the Spanish market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

The week of October 2 brought a week‑on‑week increase in wind energy production in most of the markets analyzed at AleaSoft Energy Forecasting. The largest increase, 108%, was registered in the German market. In this market, 753 GWh of wind energy was generated on Tuesday, October 3, the highest value since March 25. In the other markets, the increase ranged from 7.5% in France to 55% in Portugal. The exception was the Italian market, where wind energy production fell by 59% compared to the previous week.

For the week of October 9, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that wind energy production will decrease in all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

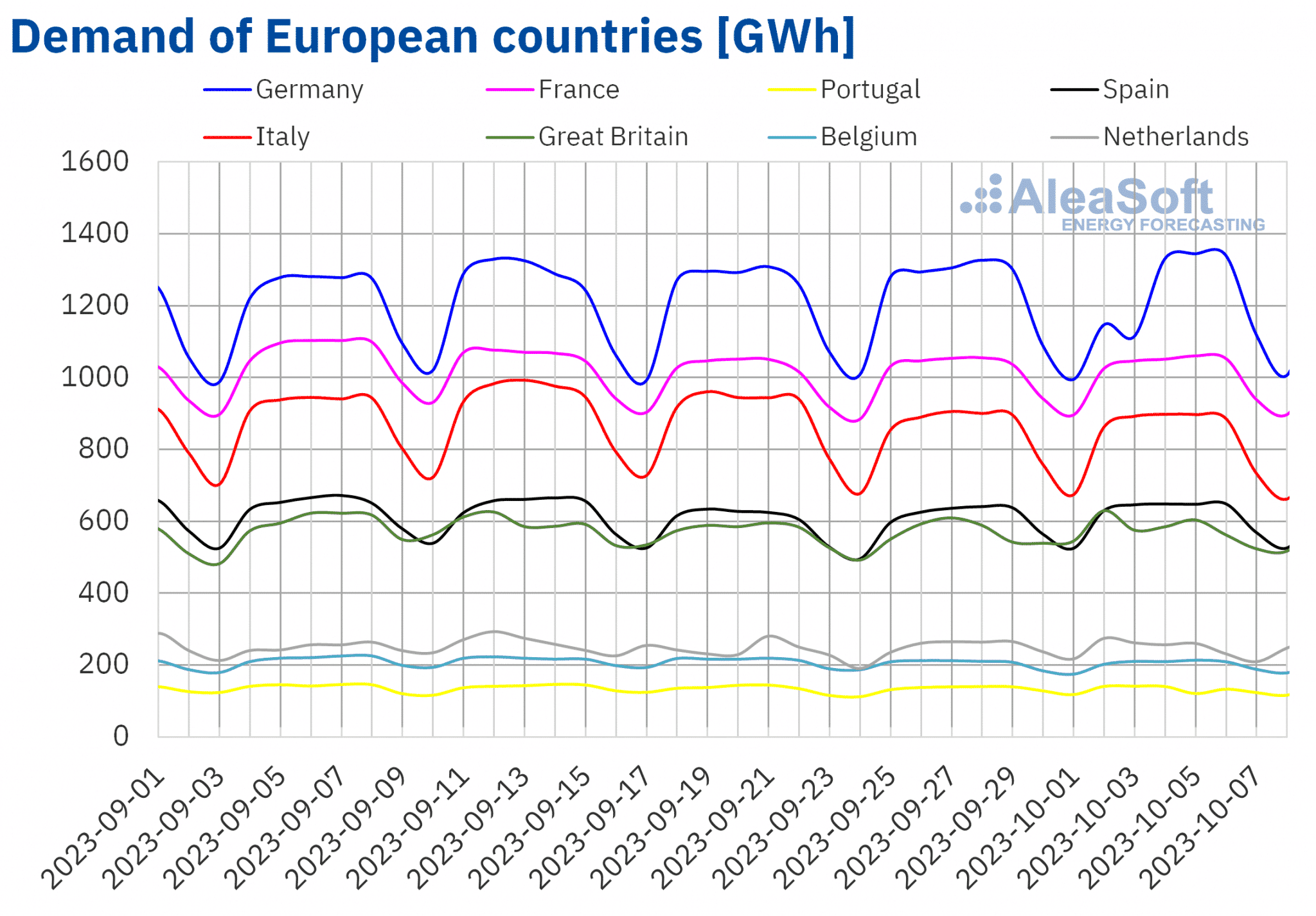

In the week of October 2, the evolution of electricity demand compared to the previous week did not show a common trend in the analyzed European markets. In some cases, demand increased compared to the previous week. The Spanish market registered the largest increase, 2.1%. It was followed by the British and French markets with the corresponding increases of 0.7% and 0.2%. In the Belgian market, demand remained similar to that of the previous week. In the other analyzed markets, demand decreased. The largest declines, 2.2% and 2.0%, were registered in Germany and Portugal, respectively. During the week, both countries celebrated national holidays: Germany’s Unity Day on October 3 and Portugal’s Republic Day on October 5. Italy and the Netherlands registered smaller declines, 0.8% and 0.2%, respectively.

During the same period, average temperatures decreased between 1.6 °C and 0.2 °C in most analyzed markets. The exception was Spain, where temperatures rose by 0.1 °C.

According to AleaSoft Energy Forecasting’s demand forecasts for the week of October 9, electricity demand is expected to increase in most analyzed European markets, with the exception of Spain, where the Spanish National Day will be celebrated on October 12.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

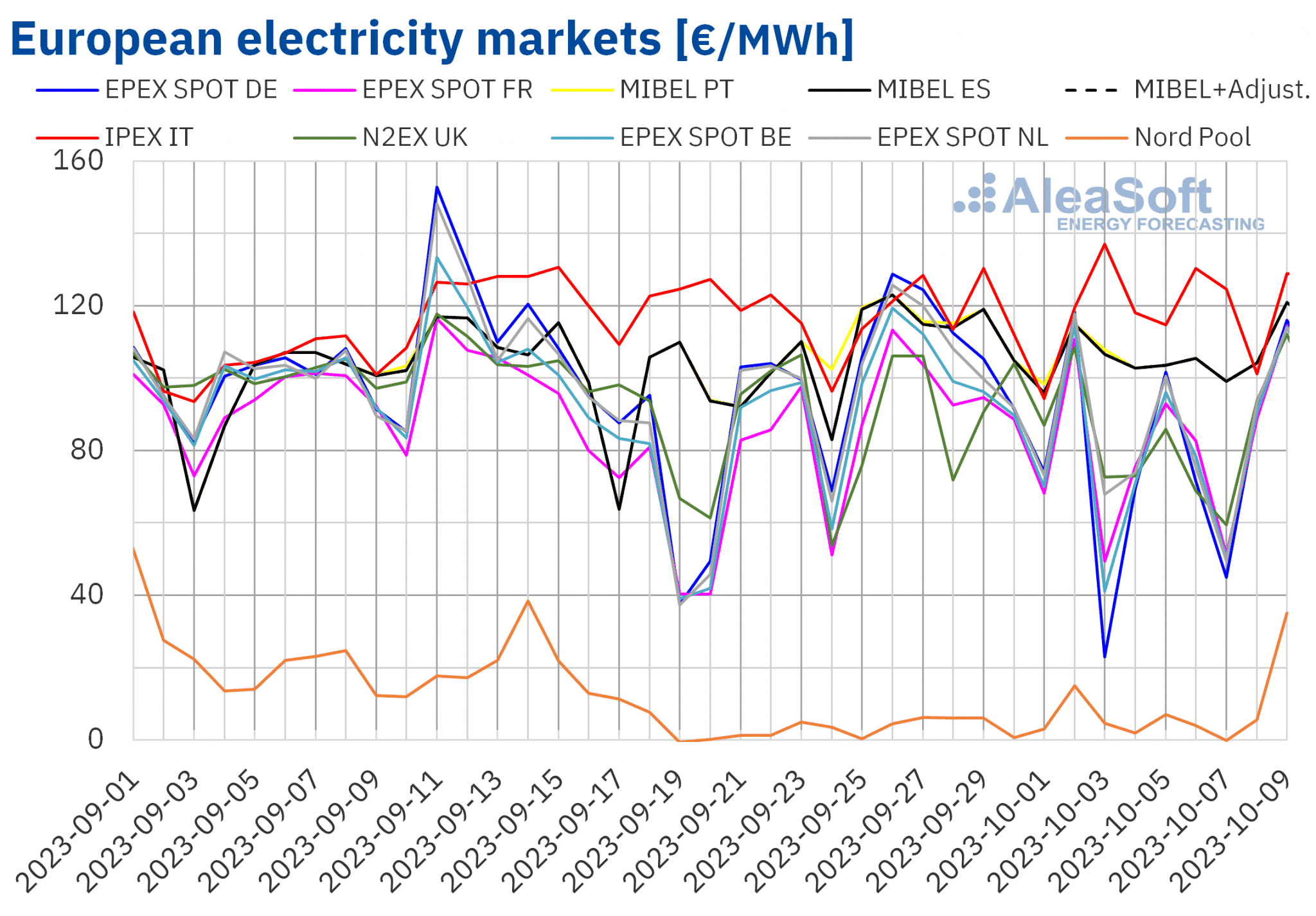

During the week of October 2, prices in most European electricity markets analyzed at AleaSoft Energy Forecasting decreased compared to the previous week. The exceptions were the IPEX market of Italy and the Nord Pool market of the Nordic countries, where the price increased by 3.9% and 43%, respectively. On the other hand, the EPEX SPOT market of Germany registered the largest decline, 30%. In the other markets, prices fell between 6.8% in the MIBEL market of Spain and 21% in the EPEX SPOT market of Belgium.

In the first week of October, weekly averages were below €85/MWh in most of the analyzed European electricity markets. The exceptions were the Spanish, Portuguese and Italian markets, where the averages were €105.23/MWh, €105.41/MWh and €120.79/MWh, respectively. On the other hand, the lowest average price, €5.45/MWh, was reached in the Nordic market. In the other analyzed markets, prices ranged from €74.20/MWh in the German market to €82.61/MWh in the Dutch market.

In terms of hourly prices, on October 3, negative prices were registered in the German, Belgian and French markets, while, on October 4, 5, 6 and 7, negative prices were registered in the Nordic market. The lowest hourly price, ‑€11.07/MWh, was reached in the German market on October 3, from 13:00 to 14:00. This was the lowest price in the German market since the first half of August.

On the other hand, in the first week of October, prices above €200/MWh were also registered in the German, Belgian, Italian and Dutch markets. The highest hourly price, €250.28/MWh, was reached in the German market on October 5, from 19:00 to 20:00. In addition, on Monday, October 9, hourly prices above €200/MWh were registered in the German, Belgian, French, Italian and Dutch markets. On that day, in the Spanish and Portuguese markets, from 20:00 to 21:00, a price of €184.50/MWh was reached, the highest price registered in these markets since March. In the case of the N2EX market of the United Kingdom, on Monday, October 9, from 19:00 to 20:00, a price of £184.24/MWh was registered, the highest since August.

During the week of October 2, the decrease in the average price of gas and CO2, as well as the increase in wind energy production in most markets, led to lower prices in European electricity markets. However, in the Italian market, wind energy production decreased, contributing to the price increase in that market.

AleaSoft Energy Forecasting’s price forecasts indicate that in the second week of October prices might increase in most of the analyzed European electricity markets, influenced by the general decline in wind energy production and the increase in demand in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

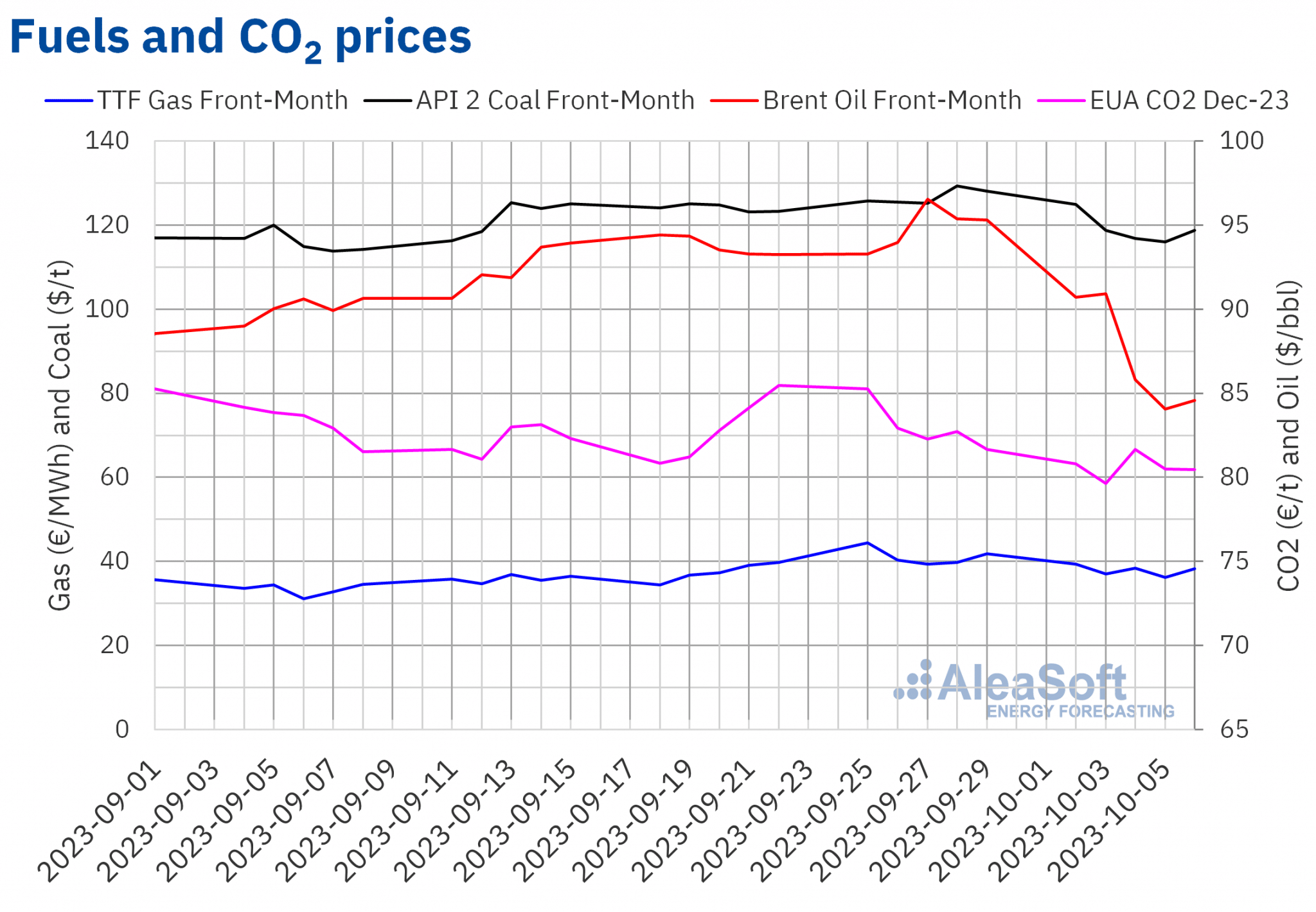

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market reached the weekly maximum settlement price, $90.92/bbl, on Tuesday, October 3. This price was 3.2% lower than the previous Tuesday. Subsequently, prices decreased and in the last two sessions of the first week of October settlement prices remained below $85/bbl. The weekly minimum settlement price, $84.07/bbl, was registered on Thursday, October 5. This price was 12% lower than the previous Thursday and the lowest since August.

In the first week of October, concerns about the evolution of the global economy and demand exerted their downward influence on Brent oil futures prices. However, fears of supply problems related to growing instability in the Middle East might exert an upward influence on prices in the second week of October.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, during the first week of October they remained below €40/MWh. On Monday, October 2, the weekly maximum settlement price, €39.33/MWh, was reached. This price was 11% lower than the previous Monday. The weekly minimum settlement price, €36.21/MWh, was registered on October 5 and it was 8.9% lower than the previous Thursday. But on Friday prices increased again until registering a settlement price of €38.23/MWh, which was still 8.7% lower than the previous Friday.

The high level of European reserves and the forecast of mild temperatures contributed to prices being below €40/MWh during the first week of October. But the possibility of strikes at Australian liquefied natural gas export facilities led to the price increase registered at the end of the week.

CO2 emission rights futures in the EEX market for the reference contract of December 2023 reached the weekly maximum settlement price, €81.67/t, on October 4. This price was 0.8% lower than the same day of the previous week. On the other hand, the weekly minimum settlement price, €79.65/t, was registered on Tuesday, October 3, and it was 4.0% lower than the previous Tuesday. Furthermore, this price was the lowest since the beginning of June.

The high level of renewable energy production reduced the demand for emission rights associated with fossil fuel electricity production and had a downward impact on prices in the first week of October.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

The next webinar in the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, October 19. Speakers from Deloitte will participate in the webinar for the fourth time, sharing their vision and experience on the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation. The webinar will also analyze the prospects for European energy markets for the winter 2023‑2024.

On the other hand, until October 15, AleaSoft Energy Forecasting is offering a promotion on long‑term price curve forecasts. This promotion includes a special discount for the fourth quarter report.