AleaSoft, May 21, 2021. The need for a renewable energy generation facility to have market prices forecasts may seem logical because of the simple reasoning that having a vision of the future prices provides a competitive advantage. But how does this need materialise when designing an energy sales strategy? The AleaSoft’s experts discussed this issue in a #WindEnergyWebinar organised by the AEE.

Last Thursday, May 20, a new edition of the #WindEnergyWebinars organised by the Asociación Empresarial Eólica (AEE) took place. On this occasion, the session was moderated by Heikki Willstedt, Director of Energy Policy and Climate Change of AEE, and included the participation of two AleaSoft’s speakers: Antonio Delgado Rigal, CEO, and Oriol Saltó i Bauzà, Head of Data Analysis and Modelling. During the webinar, and with subsequent questions from the attendees, the current situation and perspectives of the renewable energies and the energy markets were analysed, the needs and benefits of the price forecasts for the electricity generation plants were explained and the vision of the future of the energy system in the whole of the European continent was discussed.

The energy sales strategy

In a market with prices as volatile as the electricity market, having a strategy for the sale of the energy produced by a generation plant is an unavoidable necessity for not being at the expense of the price fluctuations and, consequently, of the incomes. A robust strategy should allow mitigating this market prices risk to a large extent and allow stability and predictability of the income.

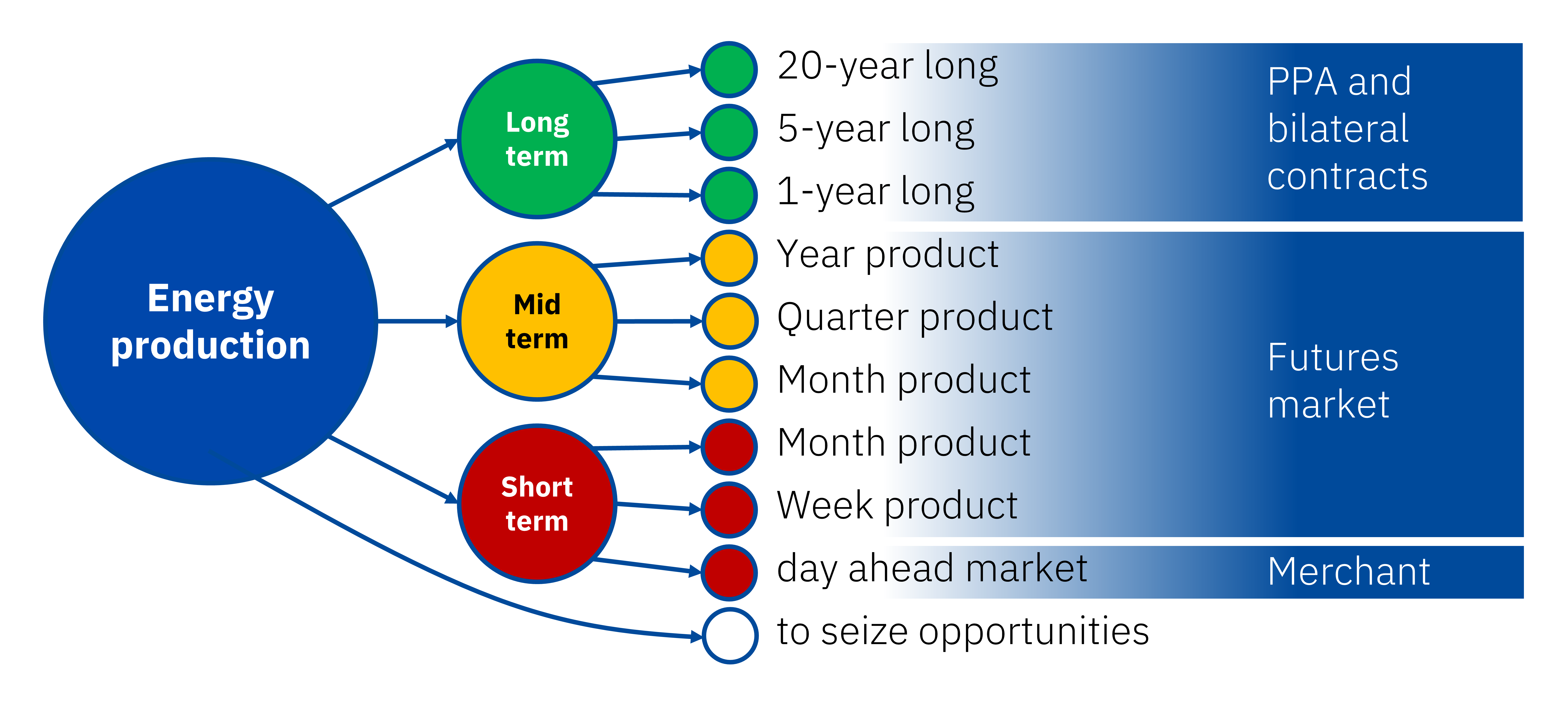

In the webinar, AleaSoft showed a simple, but illustrative, example of a sales strategy based on the diversification. The idea is dividing the total production into several pieces and place and sell them in different time horizons. For this, and any, sales strategy it is necessary to have a vision of the market in all horizons based on reliable forecasts of market prices.

Energy sales strategy based on the diversification. Source: AleaSoft

Energy sales strategy based on the diversification. Source: AleaSoft

Long term

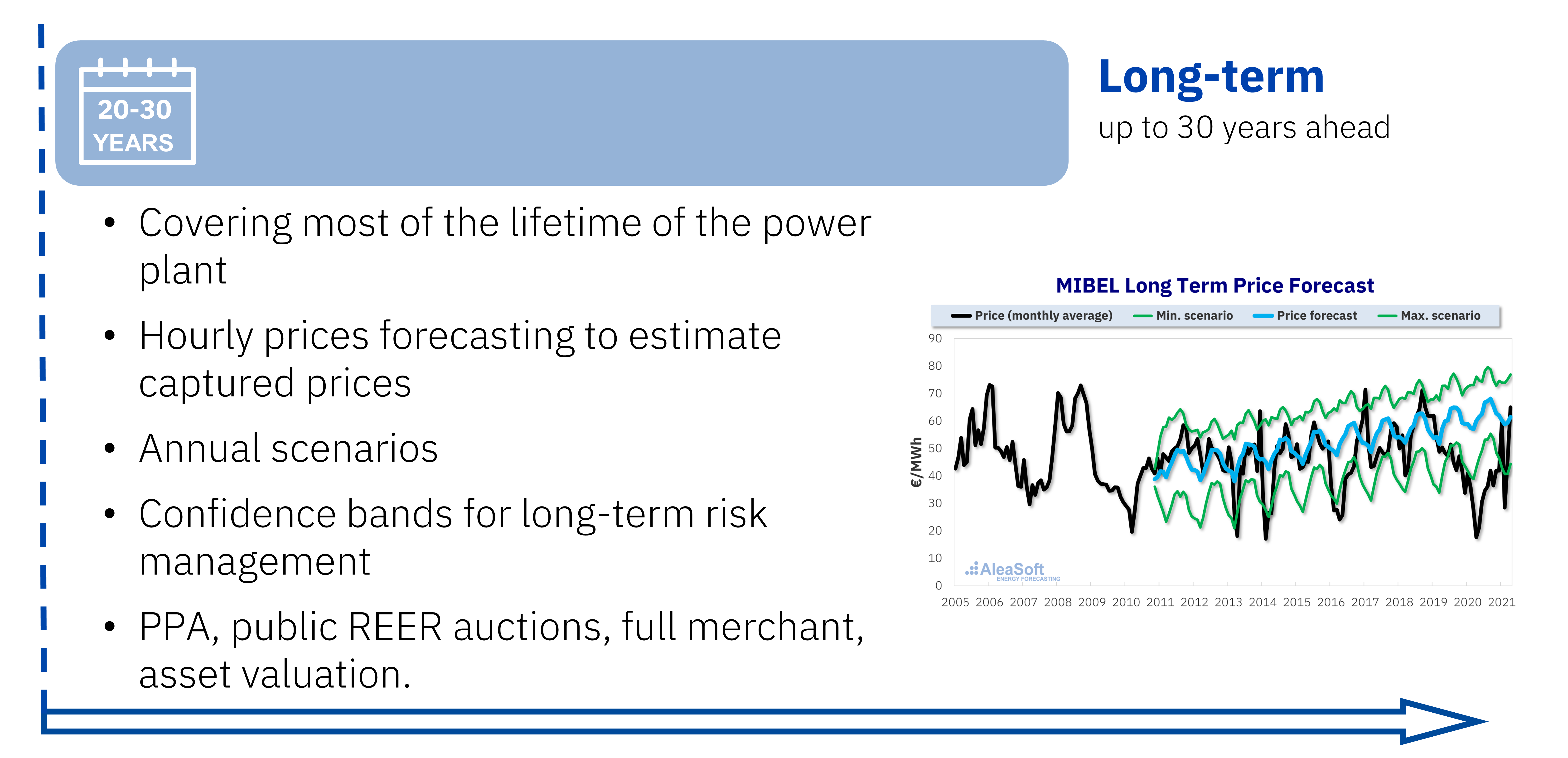

To sell energy in the long term, the possibility of signing a PPA or of participating in a public auction of renewable energy capacity can be considered. For this, it is necessary to have price forecasts that cover most of the lifetime of the generation plant. It is important not to simply stay with the market vision for the duration of the PPA or the economic regime of the auctions, because, once the PPA or the auction fee is finished, the generation plant will be exposed to the market prices, and, according to the market prices forecasts, the decision on what prices to offer in the auction or to propose in the PPA negotiation may change.

It is necessary to have hourly prices forecasts for the entire forecast horizon in order, given the plant’s production profile, to be able to estimate the captured price and the income. The confidence bands of the forecasting will be necessary to be able to carry out a long‑term risk management and as input to the financial model.

Source: AleaSoft.

Source: AleaSoft.

Medium term

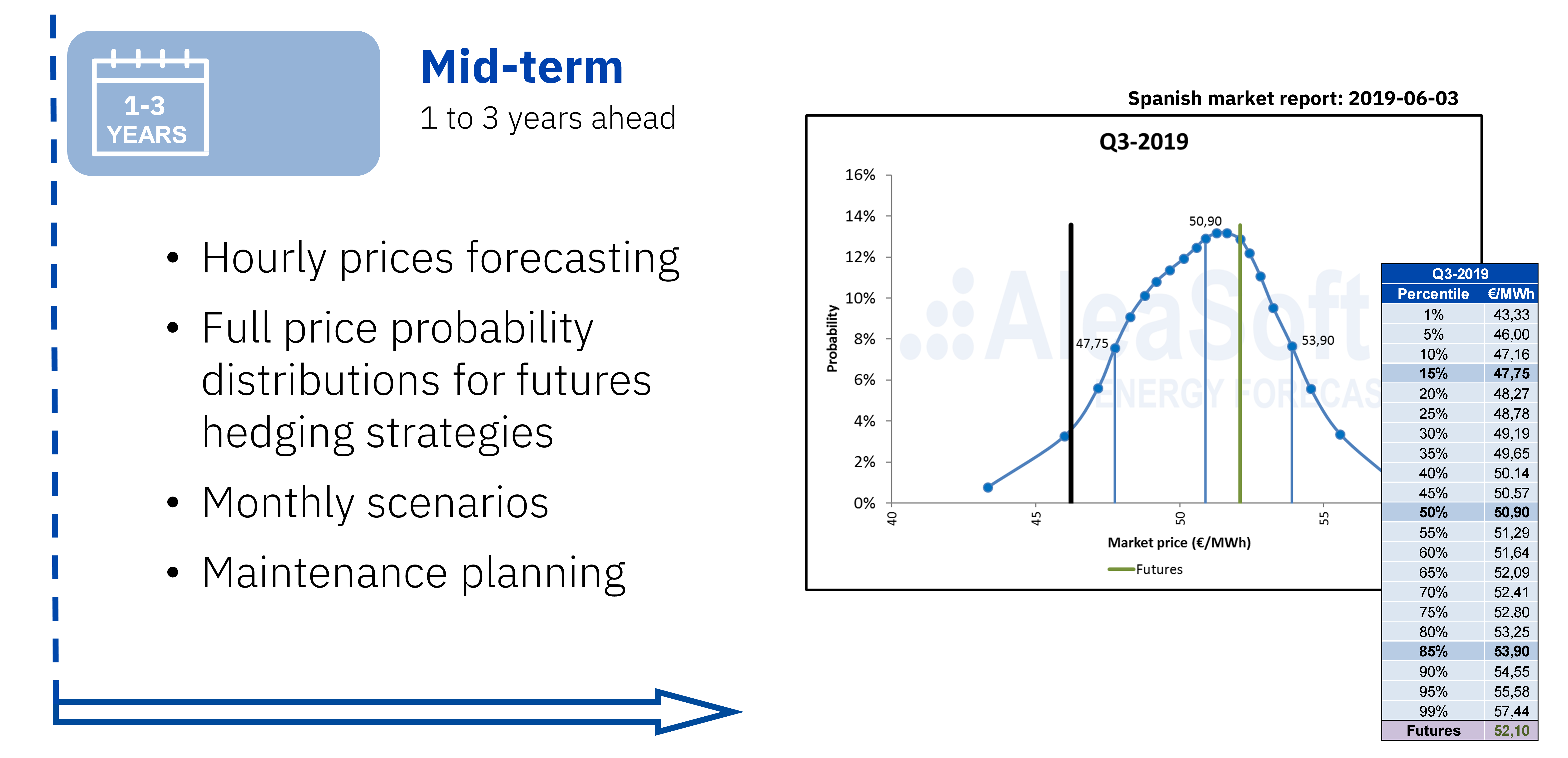

The mid‑term price forecasts will serve to hedge positions in the futures markets in the most favourable way. For this, it is necessary to have complete probability distributions of the prices in the future. For example, the probability distribution of the price for the next quarter will allow quantifying the risk that the market price is above or below a certain value, and thus determining the opportunity to cover our production given the price of the product for the next quarter in the futures market.

The forecasts for several months are also necessary when planning maintenance at the facilities. If these tasks will mean a stop or a decrease in power, with a vision of the future they can be planned in such a way that their impact on the income is the minimum possible.

Source: AleaSoft.

Source: AleaSoft.

Short term

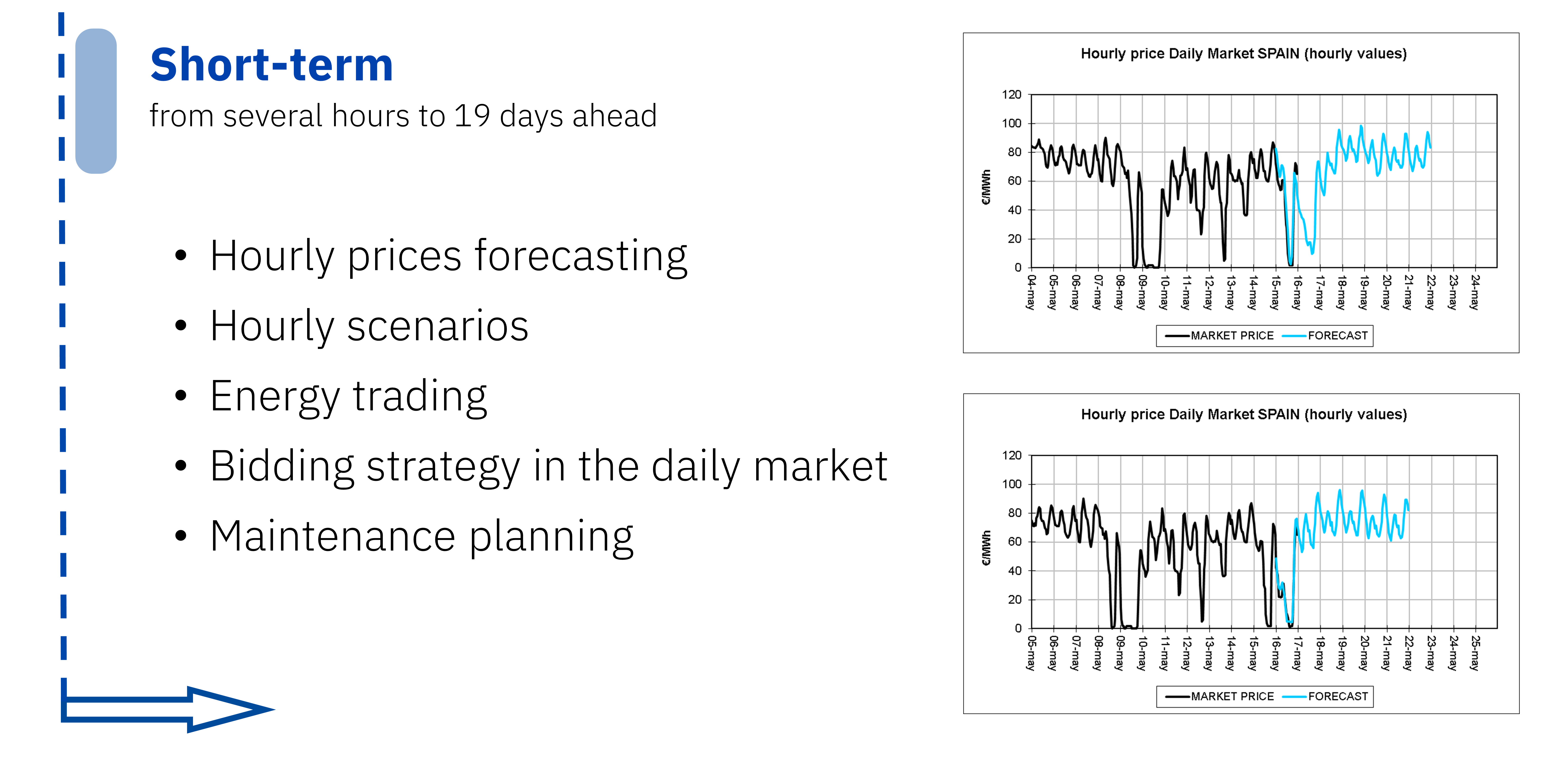

The short‑term forecasts are those that allow optimising the offers in the daily market. Knowing in advance the hours with maximum or minimum prices is a competitive advantage that allows maximising the income.

Also noteworthy is the source of additional income represented by the auxiliary services after the daily market. Intraday markets, technical restrictions, secondary and tertiary regulation band or deviation management. All these services will gain relevance in the future with the increase in renewable energy generation, the introduction of the batteries and the demand response.

Source: AleaSoft.

Source: AleaSoft.

The price forecasts for large consumers, the industry decarbonisation and the role of the green hydrogen

The market prices forecasts are not only important for the electricity generation plants. They are also important for large and electro‑intensive consumers. It is precisely on this subject that the following webinar organised by AleaSoft for June 10 will mainly deal, in addition to the usual analysis of the evolution of the energy markets. The part of the vision of the future will focus on the decarbonisation of the industrial sector and the role that the green hydrogen will play in the energy transition.

Source: AleaSoft Energy Forecasting.